Preview text:

lOMoAR cPSD| 59691467

BỘ GIÁO DỤC VÀ ĐÀO TẠO

TRƯỜNG ĐẠI HỌC KINH TẾ QUỐC DÂN

INTERNATIONAL MARKETING

TOPIC 1 : Develop a country/product brief to highlight the

opportunities that exist for market entry, and specify product entry

issues, and strategies for a given country. Instructor:

Mr. Nguyen Huu Dang Khoa Class:

Quản trị Marketing CLC 64D Hà Nội, tháng 09/2024 lOMoAR cPSD| 59691467 Group members Name ID 1. Nguyễn Trần Minh Trang 11226474 2. Nguyễn Ngọc Linh Nhi 11224937 3. Nguyễn Minh Tâm 11225682 4. Nguyễn Minh Anh 11220375 5. Đỗ Quốc Cường 11221151 6. Nguyễn Minh Quang 11225441 7. Nguyễn Hồng Sơn 11225633 lOMoAR cPSD| 59691467

I. Introduction................................................................................................................................................... ..

1. About Singapore:........................................................................................................................................

2. About Bamboo products from Ocean Republic:.........................................................................................

II. Macro environment analysis

(PESTLE)......................................................................................................

1. Political environment..................................................................................................................................

2. Economic environment...............................................................................................................................

3. Sociological environment........................................................................................................................... 4. Technological

environment......................................................................................................................... 5. Legal

environment...................................................................................................................................... 6. Environmental

environment........................................................................................................................ III. Category

market analysis............................................................................................................................

1. Competitor strength.....................................................................................................................................

2. Consumer habits and attitudes....................................................................................................................

3. Market.........................................................................................................................................................

IV. Company competitive advantage relative to in-market

competition.......................................................

1. Bamboo product..........................................................................................................................................

2. Factory........................................................................................................................................................

3. Certification................................................................................................................................................ V. Opportunities and

issues................................................................................................................................

1. Opportunities...............................................................................................................................................

2. Issues...........................................................................................................................................................

VI. References..................................................................................................................................................... . I. Introduction 1. About Singapore:

- The Republic of Singapore is an island country and city-state in maritime Southeast Asia - Area: 735.6 km2

- Population: 5,920,000 (2023) - Economics:

+ GDP Per capita: $84,734 (2023) (5th) +

Ease of doing business: ranked 2nd globally - Culture:

+ Ethnic groups: Chinese (74%), Malay (13%), Indian (9%), and others (4%)

+ Official languages: English, Malay, Mandarin, and Tamil

+ Religious practices: Buddhism, Islam, Christianity, Hinduism, Taoism - Lifestyle: lOMoAR cPSD| 59691467

+ Online shopping: 83% of online consumers in Singapore shop via mobile phones

+ Health & Wellness: pay a premium for healthy food options, organic products,

and fitness-related products and services

+ Food culture: 22% of Singaporeans cook at home daily.

+ Eco-friendly products: acknowledging the sustainability of the product made

Singaporeans increase their willingness to pay level

2. About Bamboo products from Ocean Republic:

- Oceans Republic was founded in 2020 by Mrs. Nguyen Huong Xuan and Mr.

Swarnendu Sarkar to create sustainable bamboo products that would positively impact the environment. [1]

- Core Value: Responsibility, People & Society

- Mission: To reduce the use of plastic and produce eco-friendly products for the

sustainability of our environment.

- Vision: To collaborate with green distributors, wholesalers, and retailers worldwide and

supply businesses with biodegradable and eco-friendly products to replace singleuse

plastic and help keep our oceans clean.

- Products: toothbrushes, cutlery sets, straws, bamboo kitchenware, tableware, office

furniture, and various hotel amenity products.

- Oceans Republic uses responsibly sourced materials, uses recycled packaging, and

ensures a carbon-neutral production process.

- Their team is made up of experienced and passionate professionals dedicated to

providing excellent customer service, so Oceans Republic can deliver a product that meets high standards.

- Oceans Republic believes in offering competitive prices without sacrificing quality or sustainability.

→ Oceans Republic creates bamboo products with minimal environmental impact,

blending sustainability with aesthetics. Proud to combat plastic pollution, they work

to preserve oceans and rivers for future generations. Committed to developing stylish,

practical solutions, Oceans Republic empowers others to make a positive difference

and strives for a greener future with every bamboo product produced.

II. Macro environment analysis (PESTLE) 1. Political environment - Policies Supporting

Businesses and International Trade

+ Free Trade: Singapore's free trade policies and low tax rates create favorable

conditions for Oceans Republic to export bamboo products without significant tariffs or trade barriers.[2]

+ Free Trade Agreements (FTAs): Singapore's extensive FTAs with countries like

Vietnam and ASEAN reduce export tariffs and simplify customs, making

market access easier for Oceans Republic. lOMoAR cPSD| 59691467

- Environmental and Sustainability Policies

+ Commitment to Sustainable Development: Singapore's policies promoting

environmentally friendly products create opportunities for Oceans Republic, as

their bamboo products align with these sustainability initiatives.

+ Green Programs and CSR Initiatives: Singapore's numerous CSR and green

programs focused on reducing environmental impact offer Oceans Republic the

chance to collaborate and market their products as part of the country's sustainability efforts.

- Transparent Legal System and Political Stability

+ Political and Legal Stability: Singapore is known for its transparent legal system

and stable business environment, reducing political risks for foreign businesses

like Oceans Republic when exporting and operating in the country.

+ Intellectual Property Protection Regulations: Singapore has strong regulations

protecting intellectual property rights, allowing Oceans Republic to safeguard

its unique bamboo designs and products as it expands into this market.

- Bilateral Relations between Vietnam and Singapore: Vietnam and Singapore enjoy

strong diplomatic relations, especially in the economic sector, creating numerous

opportunities for trade and cooperation for Vietnamese businesses like Oceans

Republic. Singapore is a major investor in Vietnam, while Vietnamese businesses are

encouraged to expand and invest in Singapore, further enhancing Oceans Republic's growth potential.

- SME Business Support Policies: Singapore has many programs supporting SMEs,

including financial aid, consulting, and collaboration with foreign businesses. Oceans

Republic can use these opportunities to enter and expand in the Singaporean market.

2. Economic environment a. Economic situation in Singapore

- Economic Freedom: Singapore consistently ranks as the world's freest economy, with

a 2023 score of 83.9, thanks to strong property rights, low corruption, and an open trade regime.[3]

- Business-Friendly Environment: Known for its supportive regulatory landscape,

Singapore fosters innovation and economic growth, creating a favorable setting for entrepreneurs.

- Sustainable Development: The "Singapore Green Plan 2030" aims to drive national

sustainability efforts, with goals to achieve net zero emissions by 2050, aligning with global environmental targets.

- Global Competitiveness: Singapore's efficient infrastructure, skilled workforce, and

strong financial sectors make it one of the most competitive economies globally.

- Openness to Global Trade: With no tariffs on imports and an open trade regime,

Singapore supports a thriving trading environment that facilitates the seamless flow of goods and services.

→ Singapore's economic landscape is characterized by stability and prosperity,

achieving high levels of economic freedom, competitiveness, and growth. The

government's dedication to fostering innovation, embracing global trade, and lOMoAR cPSD| 59691467

maintaining a business-friendly environment has cemented Singapore's position as a

leading global economic powerhouse.

→ Potential opportunity for overseas eco-friendly products

b. Singapore’s key industries

- Singapore is well-positioned to face the challenges and reap the benefits of Industry

4.0. As an established regional powerhouse for advanced manufacturing, the country

has already embraced Industry 4.0 and is steadily moving its production base up the

value chain in various sectors.

- Singapore’s largest industry is manufacturing, contributing between 20 and 25 percent

to the country’s annual GDP. Electronics manufacturing is the bedrock of Singapore’s

manufacturing sector, contributing approximately 8 percent of the GDP and 20 percent of total manufacturing jobs.

c. Ratio of products imported into Singapore

- Ratio: Singapore consistently imports more than it exports, reflecting its status as a

highly urbanized and trade-focused economy. In 2019, imports totaled approximately

$385 billion, while exports were around $370 billion.[4]

- Import Characteristics: Singapore's imports include a diverse range of products such

as machinery, electronics, mineral fuels, chemicals, and food. The country’s strategic

location, advanced infrastructure, and pro-business environment make it a key hub for international trade.

- Factors Contributing to High Import Ratio: Limited natural resources, a need for

essential commodities, and its role as a global financial center drive Singapore's high

import levels. Its favorable trade conditions and access to the Southeast Asian market further boost import volumes.

→ Singapore’s high import ratio underscores its open, trade-driven economy and its

reliance on foreign goods to support domestic demand, contributing to its success as

a major regional and global trade hub.

3. Sociological environment a. Customer behavior: [5]

- Singapore is a developed country with a high-income population and an increasing

consumer focus on sustainability and environmental protection. Bamboo products can

attract Singaporean consumers due to their eco-friendliness and ability to replace

unsustainable materials. The demand for green and organic products is on the rise,

creating opportunities for Vietnamese businesses to export bamboo products such as

household items, interior decorations, and personal goods. b. Demographics:

- As of June 2023, Singapore’s population is 5.92 million, a 3% increase from the

previous year. The working-age population (20-60 years) is 4.147 million, with the

largest age group being 30-34 years old (323,000 individuals). The elderly (aged 60 and lOMoAR cPSD| 59691467

older) number 1.01 million, making up 19% of the total population, with a 6% increase from the previous year.

- Younger individuals (16-24 years) are more inclined to adopt new imported products,

while the elderly tend to stick with familiar products. This preference may pose a

challenge to the adoption of bamboo products in Singapore’s aging population. c. Religion:

- Singapore has a diverse religious culture with five main religions: Buddhism,

Christianity, Islam, Taoism, and Hinduism. Buddhism has the largest proportion, with

31%. Notably, 80% of Singaporeans have a religion, while 20% of the total population has no religious affiliation.

- Religion in Singapore will not significantly hinder the exporting of bamboo products

from Vietnam. Bamboo is a natural, eco-friendly material, which aligns with the values of most religions.

→ Singaporean consumers' attitudes towards products with natural and sustainable

origins are positive. Consumers here tend to prioritize eco-friendly and responsibly

produced products. Other cultural factors, such as religion, do not pose a barrier to exporting bamboo products.

→ However, attention should be given to the aging population and marketing

strategies targeting older customers.

4. Technological environment

a. Technology development [6]

- The IT infrastructure in Singapore is praise-worthy. The penetration rate for household

broadband internet is over 70%. E-commerce and eB2Cmodels have flourished in turn.

More than 10Mbps of broadband internet service is available. The widespread IT

infrastructure has encouraged multinational companies to establish regional operations in Singapore.

- Singapore is also often regarded as the Asian technology capital. Global tech giants

such as Amazon, IBM, and many others use Singapore to pilot ground-breaking new

projects before they are commercialized worldwide. Likewise, 80 of the top 100 tech

firms in the world have a presence in Singapore (EDB Singapore, 2023).

b. Technical and logistic resources [7]

- Singapore has a strategic geographic location among the main commercial routes of

Asia and has a developed system of roads, waterways, and air transport. The

Singaporean government has heavily invested in developing seaports, airports,

railways, and road systems to improve connectivity and transportation of goods.

- Singapore invested heavily in new technologies to improve logistics processes. For

example, they have deployed automation systems and robots to increase productivity

and reduce costs. They built modern logistics centers, with intelligent cargo monitoring and management systems. lOMoAR cPSD| 59691467

- Singapore has used information technology to optimize logistics processes and improve

operational efficiency. They have applied technologies such as artificial intelligence,

blockchain, and IoT to manage and monitor goods and warehouse systems.

c. The level of expertise

- There is a severe lack of STEM (science, technology, engineering, and mathematics)

talents in the country. According to some surveys, many employers find difficulties in

recruiting IT and engineering staff due to the booming of technology in Singapore.

- The workforce in Singapore is known for its high level of professionalism and expertise.

The city-state attracts global talent, and there is a strong presence of professionals in

finance, technology, healthcare, and engineering.

- Exporting to Singapore offers significant opportunities due to its advanced

technological infrastructure, strategic location, skilled workforce, and businessfriendly

environment. However, exporters must be prepared to face challenges such as intense

competition, and high operational costs. 5. Legal environment

- Import Regulations: Singapore enforces strict import regulations requiring

comprehensive documentation, including commercial invoices, packing lists, and

import permits via the TradeNet system. Importers must pay Goods and Services Tax

(GST) at 3%, customs duties, and other fees automatically deducted from their bank

accounts. For bamboo materials, import duties apply based on product categories. [8]

- Standards for Goods and Services: The Singapore government promotes adherence

to standards such as ISO 14001 for environmental management and ISO 9001 for

quality. Companies like Ocean Republic should prioritize these standards for easier market entry. [9]

- Bamboo Regulations: Businesses must provide complete documentation, including an

exploitation license and compliance with both Vietnamese and Singaporean regulations.

Quality standards set by agencies like the National Environment Agency and the Agri-

Food & Veterinary Authority must also be met. [10] - Suppliers / Channels of Entry:

+ Shipping Mark: Ensure packages have shipping marks for smooth transportation and customs clearance.

+ Certificate of Origin: Although Vietnam doesn’t require it, buyers may ask for a

certificate of origin, especially if free trade agreements are involved, to benefit from reduced import taxes.

- Tax System: Singapore offers competitive income tax rates (up to 22% for individuals

and 17% for companies) and has over 70 double taxation agreements, which reduce

withholding tax rates on foreign income.

6. Environmental environment a. Singapore’s climate

- Climate: Singapore, located near the equator, has a tropical climate with high

temperatures, high humidity, and abundant rainfall year-round. Temperature variations

are minimal between seasons. [11] lOMoAR cPSD| 59691467

- Rainfall: The city experiences significant rainfall throughout the year, with the heaviest

precipitation from November to January, accompanied by frequent thunderstorms.

February is typically the driest month.

- Temperature: Temperatures remain high throughout the year. The warmest months are

May and June (mean temperature of 27.8°C), while December and January are the

coolest (mean temperature of 26.0°C).

- Humidity: Relative humidity is consistently high, often reaching 100%.

- Seasons: Singapore has two monsoon seasons: the Northeast Monsoon from December

to early March and the Southwest Monsoon from June to September, separated by inter- monsoonal periods.

b. Environmental challenges

- Singapore, as a low-lying island state, faces significant environmental challenges

including sea level rise, coastal erosion, industrial pollution, and limited freshwater

resources. Climate change exacerbates these issues by impacting water management,

biodiversity, public health, the urban heat island effect, and food security.

- Despite early efforts to address pollution, Singapore's high population density and

urbanization present ongoing challenges. Climate change also affects businesses,

disrupting supply chains and causing volatile food prices due to heavy reliance on imported food.

- Regulators, banks, and financial institutions in Singapore are increasingly

implementing measures to manage carbon emissions and adhere to global climate

standards. Businesses not improving their carbon footprint risk losing support from

financial institutions and facing regulatory challenges. Additionally, there is a growing

preference among retail investors for sustainable and eco-conscious companies, which

could significantly impact businesses not aligning with the global Environmental,

Social, and Governance (ESG) movement.

III. Category market analysis 1. Competitor strength a. Overview

- Size and Growth: The market for eco-friendly products in Singapore has seen

significant growth, driven by increased awareness of sustainability and environmental

issues. The demand is strong across various sectors, including food and beverage,

fashion, personal care, and household products.

- Consumer Trends: Singaporean consumers are increasingly looking for products that

are not only effective but also environmentally friendly. This includes items made from

sustainable materials, organic products, and those with minimal environmental impact. [12] b. Key Segments

- Personal Care and Cosmetics: There is a rising demand for organic and natural

skincare products, free from harmful chemicals and synthetic ingredients.

- Food and Beverages: Organic, locally sourced, and sustainably produced food items

are becoming more popular, with a particular focus on plant-based and vegan options. lOMoAR cPSD| 59691467

- Household Products: Eco-friendly cleaning supplies, reusable containers, and energy-

efficient appliances are in demand as consumers seek to reduce their environmental footprint.

- Fashion and Textiles: Sustainable fashion, including clothing made from organic

cotton, recycled materials, and ethical production practices, is gaining traction. [13] c. Key Players

- Green Collective: A multi-brand store offering a wide range of sustainable and

ecofriendly products. The Green Collective SG is an ecosystem of Sustainable Brand

Owners (SMEs), conscious consumers, and businesses. Working together on a principle

of sharing, we are building a community of change-makers who collaborate to simplify

the adoption of a sustainable lifestyle. Distribution of unique sustainable products from

Vietnam(Equo). Vendors are largely based in Singapore (92.54%) and in SouthEast Asia(7.46%)

- Zero Waste SG: An NGO that also promotes and supports businesses that offer

ecofriendly products. On 16 April 2024, Zero Waste SG received its status as an

Institution of Public Character (IPC), having grown to become a recognized charity that

has reached over 55,000 people and engaged more than 220 companies through its campaigns and services.

→ Make collaboration to advertise products since this is not a competitor.

- Scoop WholeFoods: A store that focuses on sustainable, organic, and eco-friendly

products, emphasizing packaging-free shopping. Originating in Australia, now they

have 8 stores located in Singapore since the first one was opened in 2019, selling

products at a premium price. Scoop Wholefoods in Singapore has made a significant

impact on the eco-friendly market by promoting sustainable living through its product

offerings. The store emphasizes organic, plastic-free, and ethically sourced products,

catering to environmentally conscious consumers. It has become a key player in

promoting zero-waste shopping in Singapore, encouraging customers to bring their

containers and reduce packaging waste.

2. Consumer habits and attitudes

- A study by Accenture and WWF Singapore reveals that while Singaporean consumers

are increasingly interested in environmentally friendly products, more than sustainable

options are needed to ensure consistent green choices. The government's Green Plan

has boosted awareness, with 90% of consumers caring about the environment and one-

third making purchasing decisions based on sustainability.

- The survey highlights that nearly 90% of Singaporeans are reducing single-use plastics,

and a significant proportion is engaged in recycling, with 51% of young people and

70% of those over 55 participating. About 37% prefer items with sustainable packaging

and are avoiding plastic-wrapped products. Many consumers are willing to pay up to

80% more for eco-labeled products, especially for household appliances.

- Despite this, trust issues persist, with 30% of consumers finding competing

sustainability claims confusing and 23% not trusting businesses' sustainability claims.

However, for truly eco-friendly products like bamboo, these trust issues are lessened,

which could drive strong growth in this market segment. lOMoAR cPSD| 59691467 3. Market

- The eco-products industry in Singapore is experiencing significant growth, driven by

increasing environmental awareness, government support, and changing consumer preferences.

- Market Overview: The eco-products market in Singapore is growing rapidly, though

it remains a niche segment compared to conventional products.

- Consumer power: The latest UOB ASEAN Consumer Sentiment study conducted in

June 2022 shows that 34 percent of millennials and Gen Zs in Singapore are willing to

pay more for sustainable products. Among older consumers, it is 24 percent. But the

older generation of consumers are catching up. In the UOB study, 64 percent of baby

boomers (aged 56 and above) cited a greater availability of sustainable products as the lOMoAR cPSD| 59691467

core reason for buying sustainable products – a 21 percent rise from a year ago. This

increase in awareness is the largest among all age groups.

- Government Support and Regulations: The Singaporean government has launched

several initiatives to promote sustainability, such as the Green Plan 2030. Policies like

carbon tax, waste management regulations, and incentives for green buildings further

encourage the adoption of eco-products. Singapore also has established various

ecocertifications like the Singapore Green Label, which helps consumers identify

environmentally friendly products. - Key Segments + Eco-friendly Packaging + Sustainable Fashion

+ Organic and Natural Products

+ Green Building Materials - Entry barrier:

+ Regulatory compliance: Singapore has strict environmental standards, and

obtaining necessary certifications like the Singapore Green Labeling Scheme

(SGLS) can be costly and time-consuming.

+ Consumer awareness: Many consumers are still price-sensitive and may lack

awareness about the benefits of eco-products, requiring significant investment in education and marketing.

+ Market competition: Established brands dominate the market, making it difficult

for new entrants to gain traction.

+ Consumer loyalty: Building credibility and loyalty in a market wary of

greenwashing takes time and effort.

- Communication channel:

+ Digital marketing: Online platforms: e-commerce (Shopee, Lazada), social

media (Facebook, Instagram, Tiktok, Whatsapp), websites.

+ Retail partnerships: Collaborations with established eco-friendly stores and retail chains

+ Events and exhibitions: Sustainability-themed events, trade shows, and popup

markets can help build brand awareness and connect with target customers.

+ Influencer marketing: Leveraging local influencers who advocate for

sustainability can be effective in reaching a wider audience. [14]

IV. Company competitive advantage relative to in-market competition 1. Bamboo product

- The leading Vietnamese Bamboo Products Supplier is The Bamboo & Rattan Industry

of Vietnam is highly developed. With more than 720 handicraft villages that make

bamboo products and over 1,000 bamboo and rattan production and trading

establishments and companies, Vietnam is currently the third-largest Bamboo Products exporter in the world.

- Oceans Republic bamboo factory in Vietnam is committed to providing a variety of

quality bamboo products for B2B customers. By using the latest technologies, strong

R&D, and applying strict quality control procedures, we’ve become well-known for

having the best bamboo products in the industry. lOMoAR cPSD| 59691467

- Our most exported products are Bamboo cups, Bamboo Cutlery, Natural Bamboo

Straws, Bamboo Canisters, Bamboo Bowls, Bamboo Bottles, Bamboo boxes, Bamboo Toothbrushes, and many more. 2. Factory

- Oceans Republic’s bamboo factory in Hanoi benefits from proximity to bamboo forests,

allowing easy access to raw materials and quality control throughout production. The

factory is known for high-quality, eco-friendly bamboo products, utilizing advanced

technology like CNC machines to maintain exceptional standards while prioritizing sustainability.

- OEM and ODM Services: Oceans Republic offers both Original Equipment

Manufacturer (OEM) and Original Design Manufacturer (ODM) services. OEM

services enable customers to produce bamboo items to their specifications, while ODM

services allow customers to customize existing designs to align with their brand.

- Sustainability: Bamboo is a highly sustainable resource, and Oceans Republic is

committed to using sustainably sourced materials. Their sustainable practices extend to

marketing, including eco-branding, sustainable content, packaging consultation, and

green SEO strategies. This focus on sustainability provides a competitive edge in markets like Singapore.

- Market Potential: With Singapore’s growing investment in sustainable tourism,

including hotels and resorts, Oceans Republic is well-positioned to expand its market

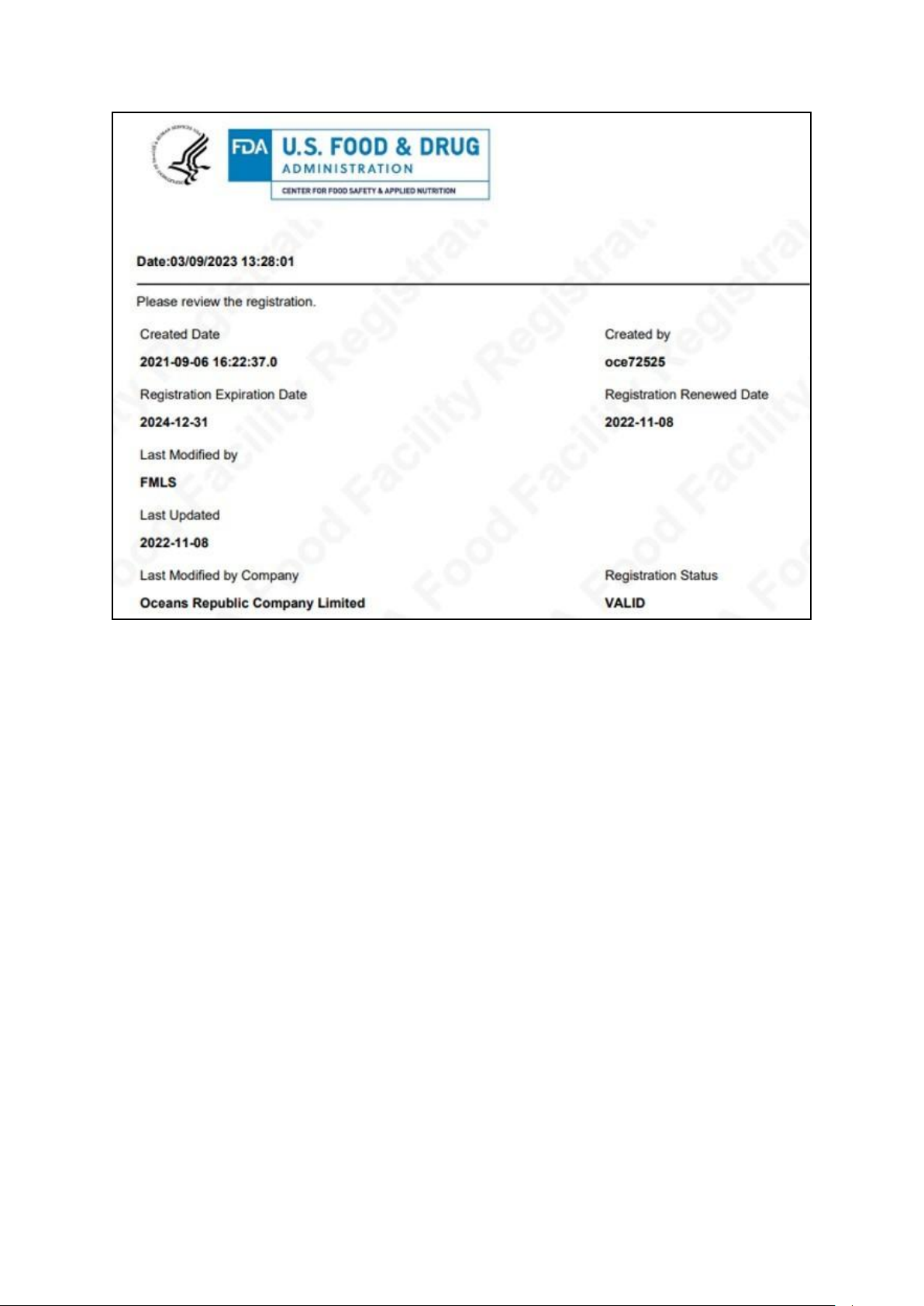

by offering eco-friendly bamboo products. 3. Certification

- Expanding into the Singapore market, Oceans Republic benefits from its bamboo

products being tested and certified by SGS Lab Vietnam according to European and

American food-grade standards. Singapore's strict regulations on food safety and

environmental standards make these international certifications, including SGS and FDA, a significant advantage.

- Consumer Trust: Singaporean consumers prioritize product quality and safety,

particularly for imports. SGS and FDA certifications enhance trust and brand credibility,

helping Oceans Republic establish itself in the market.

- Import and Customs: Singapore’s stringent quality control and food safety standards

are eased by these certifications, simplifying inspection and import processes and

reducing administrative barriers.

- Support for Sustainability: With Singapore’s focus on sustainability and responsible

consumption, eco-friendly bamboo products with international certifications are likely to be welcomed and supported.

- Marketing Advantage: SGS and FDA certifications can be leveraged as a powerful

marketing tool, attracting Singaporean consumers who value eco-friendly and safe products.

- Overall, these certifications ensure safety and quality while providing Oceans Republic

with significant opportunities for market penetration and growth in Singapore. lOMoAR cPSD| 59691467

V. Opportunities and issues 1. Opportunities - Consumer Behavior:

+ Rising Awareness: Younger generations and well-educated individuals are

increasingly aware of environmental concerns and are actively seeking out sustainable options.

+ Willingness to Pay: Singapore's high-income population is willing to invest in

products that align with their environmental values, even if they come at a premium. - Government Support:

+ Incentives: The Singapore government actively promotes sustainable

consumption through tax incentives and financial support for businesses

producing green products. There is ample room for companies to innovate in

product design and packaging, minimizing waste and enhancing sustainability

+ Policy Framework: A favorable policy environment encourages innovation and

investment in sustainable practices.

- Infrastructure and Logistics:

+ Efficient Systems: Singapore's well-developed infrastructure and logistics

networks facilitate the smooth flow of goods, reducing environmental impact.

+ Global Connectivity: Strong international connections enable access to a wider

range of sustainable products and services. lOMoAR cPSD| 59691467 2. Issues

- High Competition: The market for green products in Singapore is highly competitive,

with a wide range of options available from both large and small brands around the

world. This makes it challenging for new entrants to differentiate themselves and gain market share.

- High-Quality Standards: Consumers in Singapore have high expectations for product

quality and often look for products with green certifications or international

environmental standards. Meeting these standards can be costly and time-consuming for businesses.

- Consumer Education: Despite growing environmental awareness, there is still a need

to educate consumers about the benefits of green products and how to identify them.

This includes providing clear information about product features, certifications, and environmental impacts. VI. References

[1] Ocean Republic, Ecofriendly products in Vietnam, 2024

[2] Credit Agricole Group, Economic and political of Singapore overview, 2024

[3] Singapore Department of Statistics, Performance of the Singapore Economy in 2024,2024

[4] World Bank Group, The World Bank in Singapore, 2024

[5] Frederic c. Deyo, sociology in Singapore: a Western social science in a non-western environment, 2022

[6] Tejasolani, PESTLE Analysis on Singapore, 2022

[7] Van Tam, 10 experiences in developing logistics of Singapore, 2023

[8] Civil Service College, Sustainable Development: Challenges and Opportunities, 2010

[9] GasHub, Impacts of Climate Change on Businesses in Singapore, 2022

[10] M. Raman, PESTEL analysis of Singapore, 2023

[11] Trung tâm WTO và Hội nhập Liên đoàn Thương mại và Công nghiệp Việt Nam,

Những quy định về kinh doanh tại Singapore, 2010

[12] SG Green Plan, What is the Singapore Green Plan 2030?, 2024

[13] The Straits Times, Younger consumers want to go green urgently. How can financial institutions help?, 2024

[14] R. Hirschmann, Sustainable consumer habits in Singapore - statistics & facts, 2023