Preview text:

09:10, 28/01/2026

Mock Exam 2020 - TCH 302 Principles of Finance Review - Studocu Student’s name: Student’s ID:

TCH 302 – PRINCIPLES OF FINANCE

A. Multiple Choices

1 Markets in which funds are transferred from

2. A problem for equity contracts is a particular example of _________

those who have excess funds available to those called the _____ problem.

who have a shortage of available funds are a.

adverse selection; principal-agent called b. moral hazard; free-rider a. commodity markets. c. adverse selection; free-rider b. fund-available markets.

d. moral hazard; costly state verification c. derivative exchange markets. e. moral hazard; principal-agent d. financial markets.

3. Investors buy and sell bonds in ………….

4. Solutions to the moral hazard problem include Markets. a. high net worth. a. Equity

b. monitoring and enforcement of restrictive covenants. b. Debt c.

greater reliance on debt contracts and less on equity contracts. c. Derivatives d. all of the above. d. Foreign exchange e. only (A) and (B) of the above.

5. The market in which the initial buyer of a stock

6. You have purchased a savings bond that will pay $16,000 for your

or bond may choose to resell the asset to another

newborn child in fifteen years. If the bank discounts this bound at a rate

party is known as the ………. market.

of 4.307% per year, what is today’s price for this bond? a. Primary a. $8,417 b. Money b. $8,500 c. Secondary c. $ 5,654 d. Dealer d. $10,000

7. The process by which a company managers its

8. You have an annuity of equal annual end-of-the year cash flows of

day-to-day operating needs through its current

$750 that begin two years from today and last for a total of ten cash

assets and current liabilities is known as……….

flows. With a discount rate of 5%, what are those cash flows worth in a. Capital budgeting today’s dollars? b. Capital structure a. $3,899.47 c. Accounts receivable management b. $ 5,515.55 d. Working capital management c. $ 4,380.24 d. $5,000

9. The owners’ wealth in a company is represented

10. A credit card that charges a monthly interest rate of 1.5% has an by………..

effective annual interest rate of: a.

The equity value of the company a. 18.0%

b. The value of assets of the company b. 19.6% c.

The numbers of owners of the company d. The bond value c. 15.0% d. 17.50%

11. In agency theory, the owners of the business

12. Average U.S wages in 1990 were $28,960 far higher than

are………. And the managers are………………

the average in 1930 of $1,970. What was the average annual increase in a. Bondholders, principals

wages over this sixty year period? b. Stockholders, bondholders a. 3.31% c. Agents, principals b. 2.45% 1 09:10, 28/01/2026

Mock Exam 2020 - TCH 302 Principles of Finance Review - Studocu Student’s name: Student’s ID: d. Principals, agents c. 24,50% d. 4.58%

13.A company selling a bond is………..money

14. With ____finance, borrowers obtain funds from lenders a. Borrowing

by selling them securities in the financial markets. b. Lending a. active c. spending b. determined d. Reinvesting c. indirect d. direct

15. Financial institutions that accept deposits and

16. Which transaction(s) increases/increase equity of entity?

make business loans are called . a. issuing bonds a. insurance companies b. issuing common stock b. commercial banks

c. addition to retained earning c. investment banks

d. only (b) and (c) of the above d. mutual funds e. all of the above

17. A share of common stock is a claim on a

18. An insurance company is an example of a financial institution that: corporation s ………… ʹ a. Transfers risk. a. debt. b. acts as a broker. b. liabilities. c. expenses. c.

serves as a depository institution. d. earnings and assets

d. sells derivative securities. 19. Financial intermediaries

20. The problem created by asymmetric information before the a.

provide a channel for linking those who transaction occurs is called

want to save with those who want to

, while the problem created after the transaction occurs is invest. called ………………

b. produce nothing of value and are a.

adverse selection; moral hazard therefore a drain on society s ʹ resources.

b. moral hazard; adverse selection c.

can hurt the performance of the c.

costly state verification; free-riding economy.

d. free-riding; costly state verification

d. hold very little of the average American s wealth. ʹ 2 09:10, 28/01/2026

Mock Exam 2020 - TCH 302 Principles of Finance Review - Studocu Student’s name: Student’s ID:

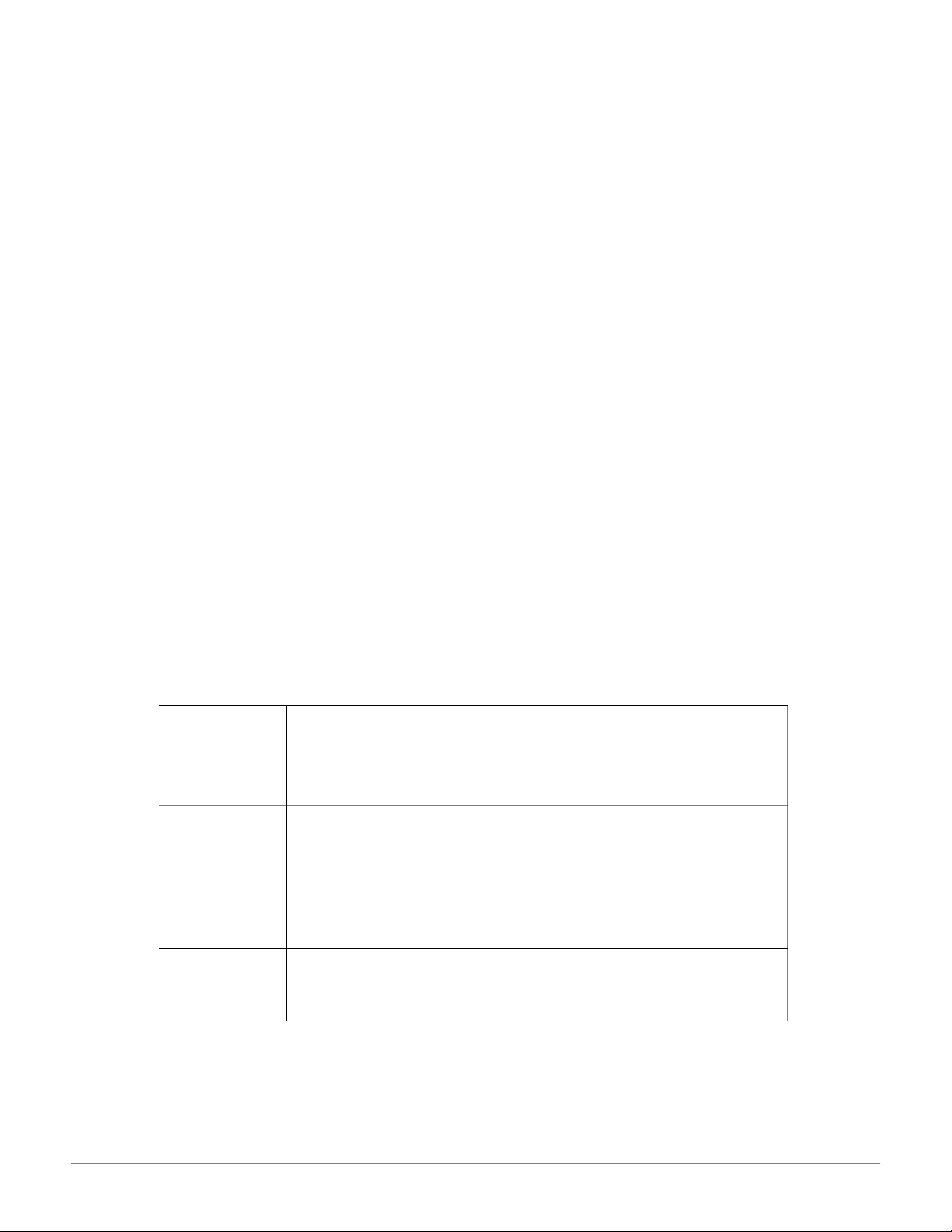

B. Short answer question

1. What kind of moral hazard problems do banks worry about?

2. There are two companies in the hospitality business. One company operates hotels and

residential complexes. Rather than owning the hotels, this firm chooses to manage or franchise

its hotels. The company receives its revenues each moth based on long term contracts with the

hotels owners, who pay a percentage of the hotel revenues as a management fee or franchise fee.

Much of this company’s growth is inorganic-the company buys the rights to manager existing

hotel chains and also the rights to use the hotel’s brand name. This company has also pursued a

strategy of repurchasing a significant percentage of the shares of its own common stock.

The other company owns and operates several chains of upscale, full service hotels and resorts.

The firm’s strategy is to maintain market presence by owning all of its properties, which

contributes to the high recognition of its industry-leading brands.

By comparing the financial statements of these companies, what do you think about these following items? Company One Company Two Net PPE Goodwill and intangible assets Equity Asset turnover 3 09:10, 28/01/2026

Mock Exam 2020 - TCH 302 Principles of Finance Review - Studocu Student’s name: Student’s ID: ROE 4 09:10, 28/01/2026

Mock Exam 2020 - TCH 302 Principles of Finance Review - Studocu