Preview text:

lOMoAR cPSD| 58511332

1. Company Overview (1)

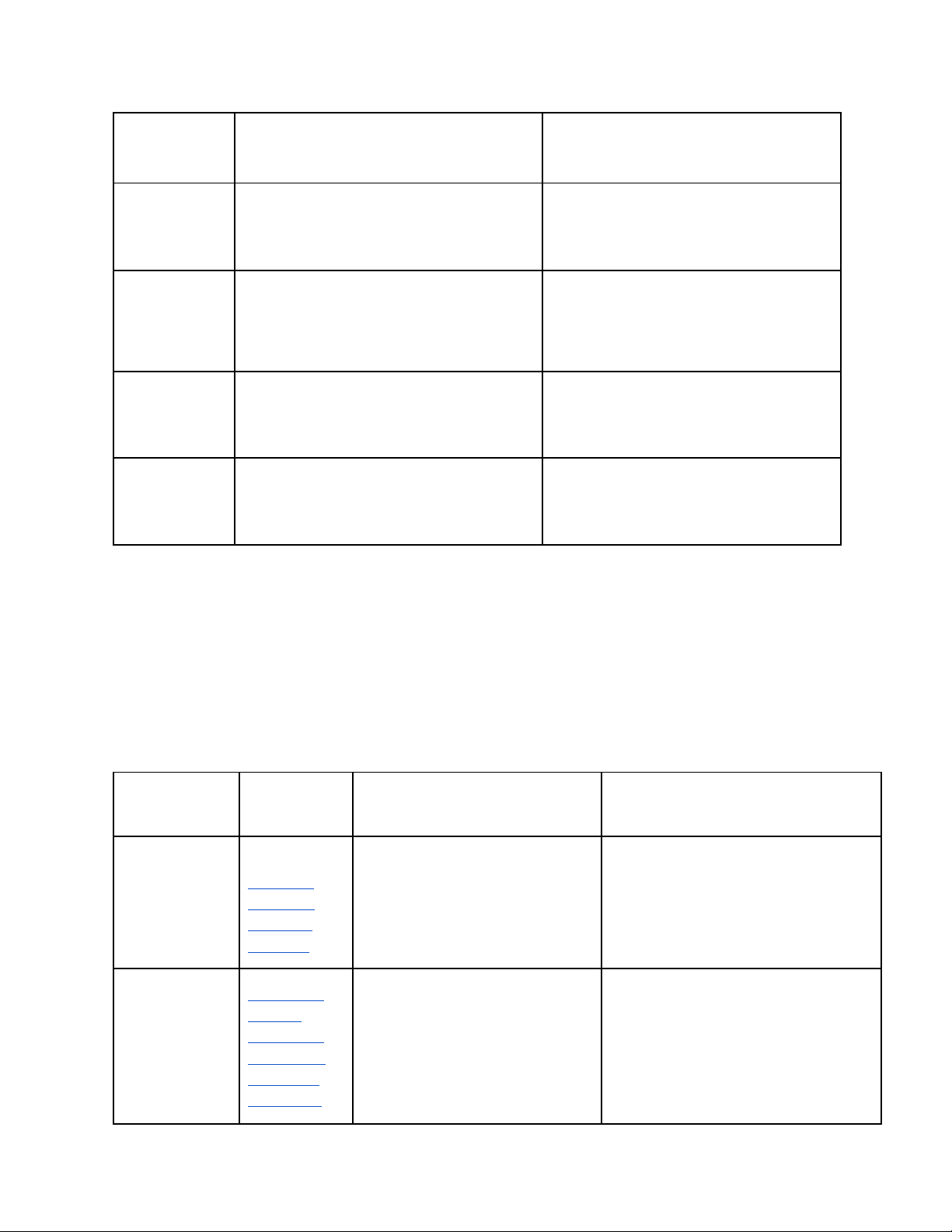

(Source: Sea, 2025; MercadoLibre, 2025) Aspect

Sea Limited (NYSE: SE)

MercadoLibre (NASDAQ: MELI)

Origin country Singapore-based tech conglomerate

Argentine-founded e-commerce and fintech giant Founding Year 2009 1999

We transform the lives of millions of people in Latin

To better the lives of consumers and small Mission

America by democratizing commerce and financial businesses with technology services.

To become the leading digital economy platform

To be the most successful and respected commerce Vision

in the region, driving sustainable growth and

and financial services company in Latin America prosperity - MercadoLibre (E-commerce)

● MercadoLibre, Mercado Shops: E-commerce marketplace -

Garena (Digital entertainment/gaming

● Mercado Vehicles, Real Estate and Services platform with Free Fire)

● Mercado Envíos: Shipping Management Main Products - Shopee (E-commerce)

● Mercado Ads: Advertising Platform - -

Monee (Digital financial services, formerly

MercadoPago (Digital financial services) SeaMoney)

● Digital Account, Savings and Investments, Insurance ● Mercado Crédito (Loans) Headquarters: Singapore Primary

Headquarters: Buenos Aires, Argentina

Operations: Southeast Asia, Latin America, Locations

Operations: 18 Latin American countries Taiwan

Leading e-commerce platform in Southeast AÁia

Commands approximately 30% of Latin American e-

with strong presence in Singapore, Malaysia, Market Share

commerce market by 2026 forecast (Market

Thailand, Philippines, Vietnam, and Indonesia

Leader) (Source: Statista, Yahoo Finance) (Source: MarketScreener)

=> Conclusion: Both companies demonstrate strong strategic positioning within their respective markets,

with Sea Limited showing exceptional growth momentum in the diverse Southeast Asian market while

MercadoLibre maintains dominant market leadership in Latin America. lOMoAR cPSD| 58511332

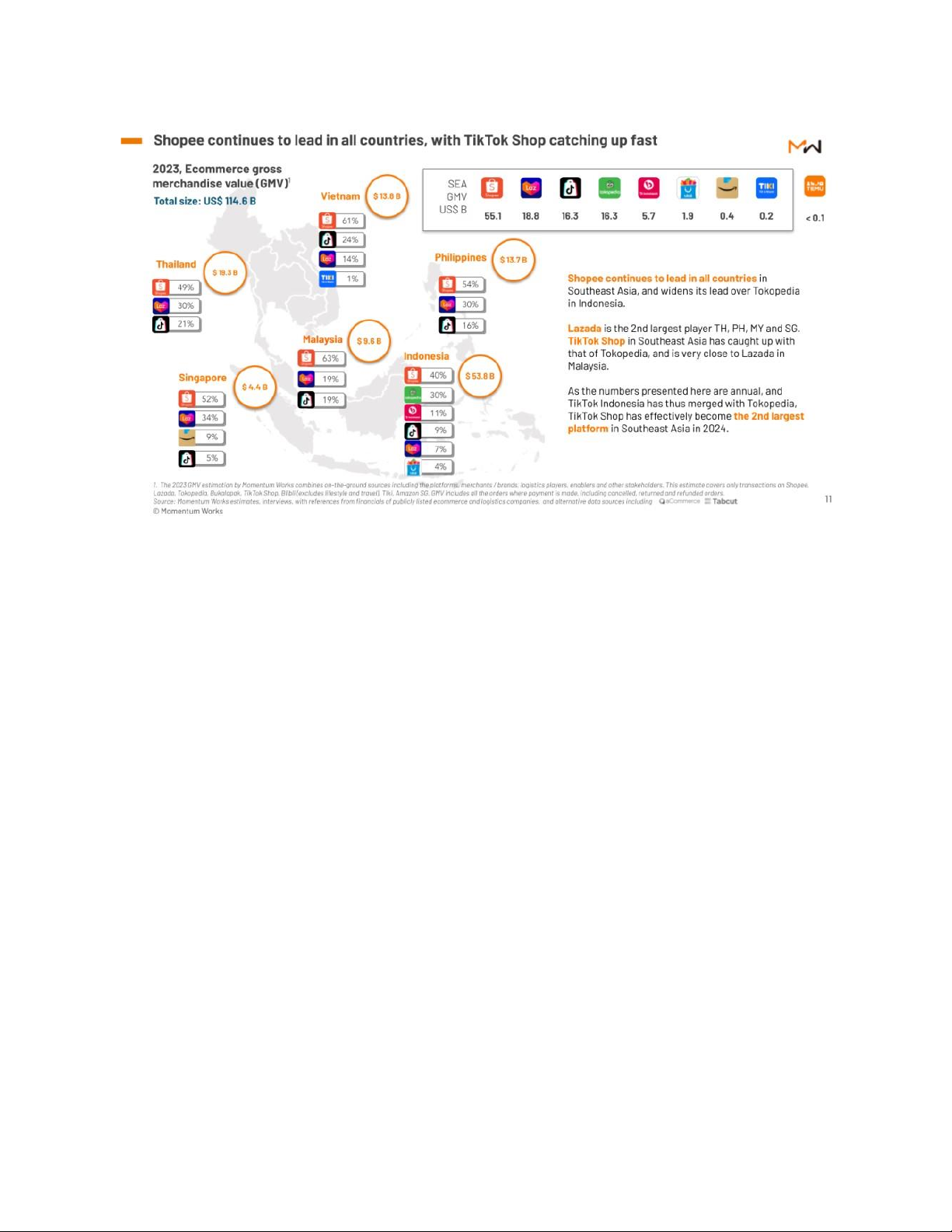

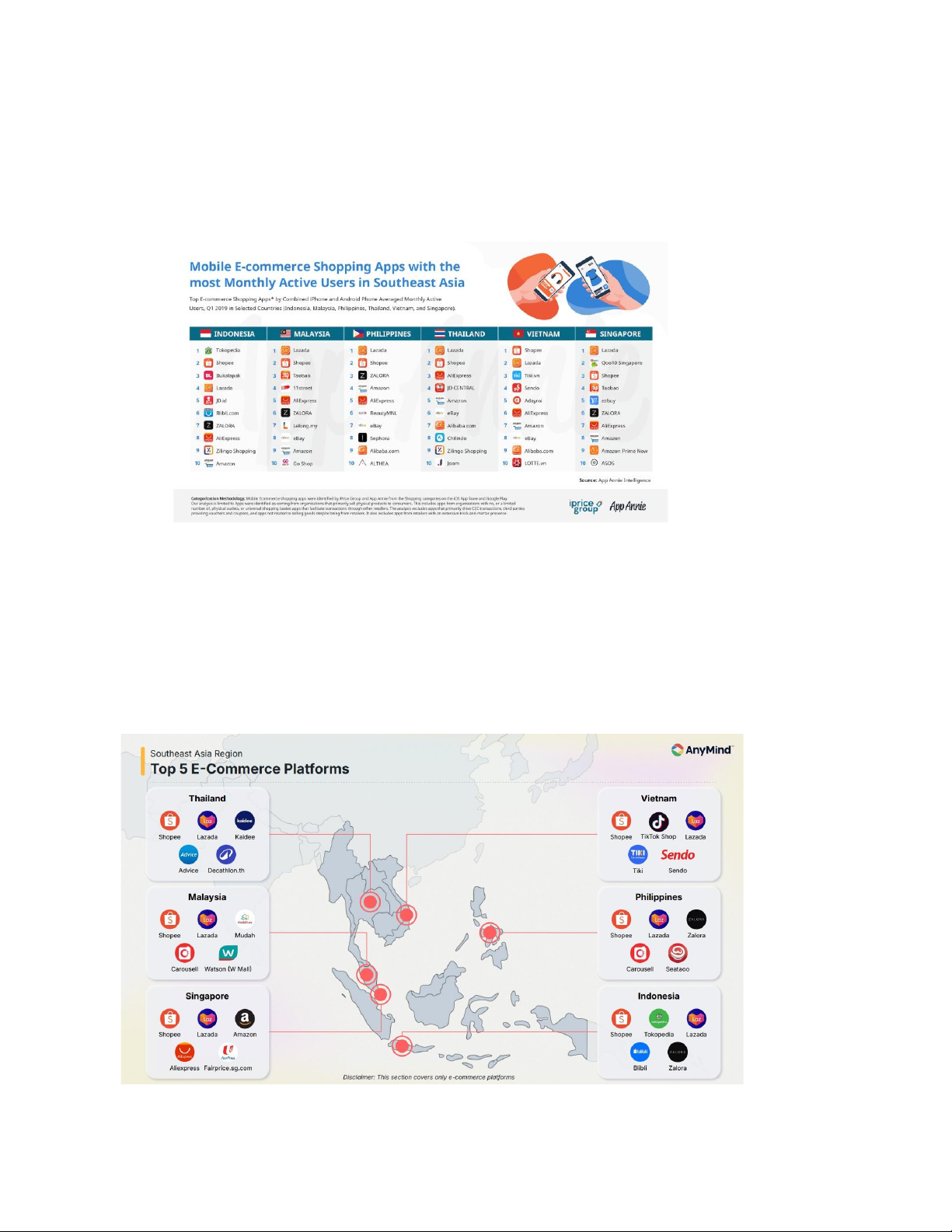

Source: Momentum Works “Ecommerce in SEA 2024” lOMoAR cPSD| 58511332 lOMoAR cPSD| 58511332

2. Industry Analysis (2) 2.1. Industry Overview

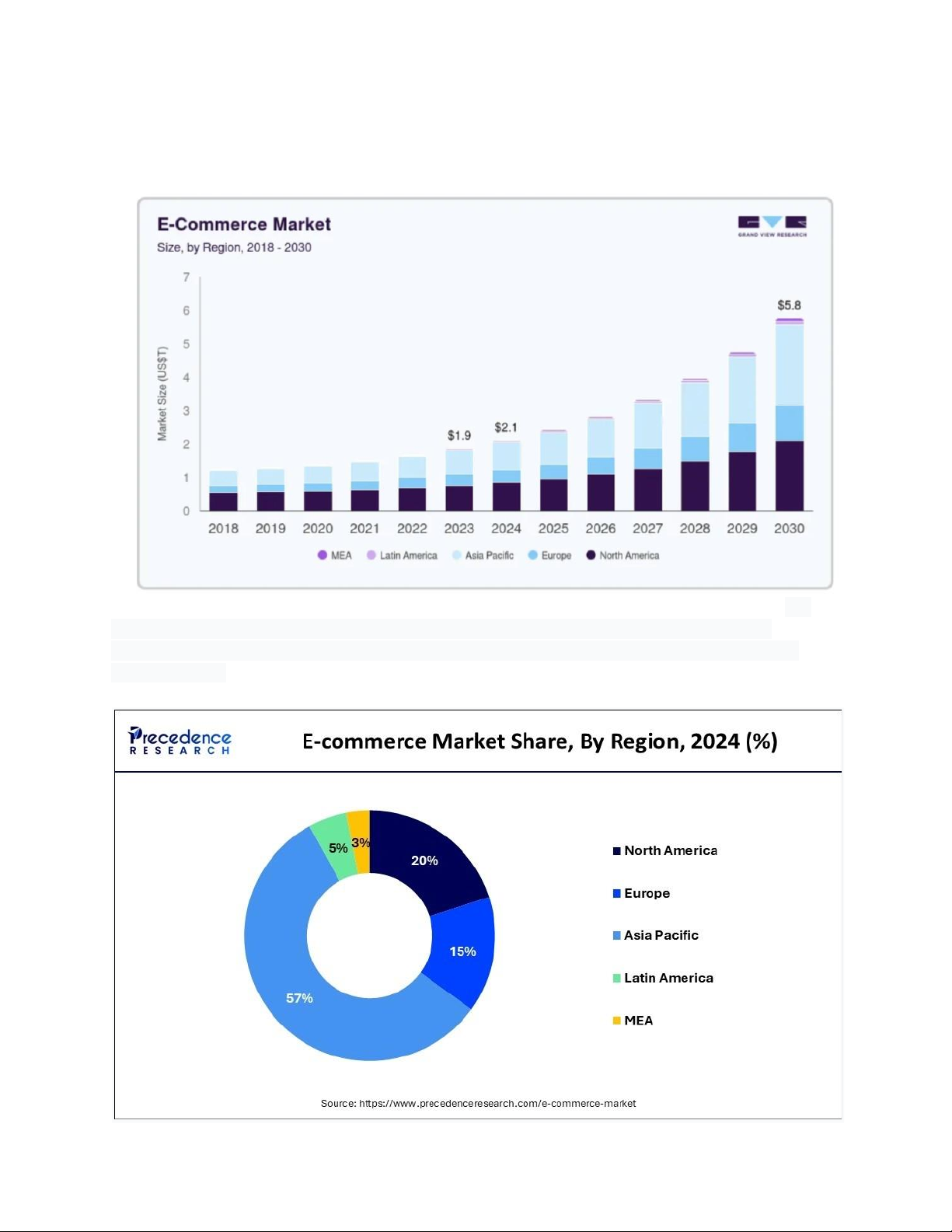

Figure: E-Commerce Market Size from 2018-2030 (Source: Grand View Research, 2023) The

global e-commerce market size was estimated at USD 25.93 trillion in 2023 and is projected to

reach USD 83.26 trillion by 2030, growing at a CAGR of 18.9% from 2024 to 2030. (Grand View Research, 2023) lOMoAR cPSD| 58511332

Asia Pacific is dominating the e-commerce market ● Market Drivers Political Economic

● Government support for digital economies

● Rising middle classes & disposable and fintech incomes in emerging markets

● Cross-border trade agreements (RCEP, EU

● SME digitalization and lower barriers to regulations, etc.) entry

● Data privacy and taxation frameworks

● Post-COVID online shift: Pandemic

(e.g., EU’s Digital Services Act)

restrictions accelerated digital

adoption—e-commerce now dominates offline across categories. Social Technological

● Growth of mobile-first generations (Gen

● AI/ML for search, recommendation, Z, Millennials) dynamic pricing

● Increasing consumer trust in online

● Logistics automation, drone delivery, and payments smart warehouses

● Shift to convenience, instant delivery, and

● Embedded finance growth—Buy Now personalization

Pay Later, e-wallets, seamless payments

● Rise of mobile, social, and live commerce channels ● Market trends

Social & Live commerce: Social media isn’t just where shoppers discover products – it’s where they increasingly buy them.

- Social commerce generated an estimated 571 billion U.S. dollars in 2023. This figure is expected

to grow in the coming years, and is forecast to exceed one trillion U.S. dollars by the end of 2028. (Statista, 2025)

- 7 in 10 shoppers have made a purchase on social media (DHL, 2025)

Cross‑border expansion: Consumers want more choice, better prices and unique products – and they’re

looking beyond borders to find them.

- The value of the global cross-border e-commerce market is expected to reach 4.81 trillion U.S.

dollars by 2032. (Coherent Market Insights, 2025)

- 3 in 5 shoppers buy from retailers outside their home country (DHL, 2025)

- 1 in 3 shoppers buy from other countries at least once a month AI-driven e-commerce lOMoAR cPSD| 58511332

- The estimated value of the AI-enabled e-commerce market in 2024 was 7.25 U.S. billion dollars –

and it’s predicted to reach around 64.03 billion U.S. dollars by 2034. (Precedence Research, 2024)

- 7 in 10 shoppers want retailers to offer AI-powered shopping features (DHL, 2025) lOMoAR cPSD| 58511332

2.2. Competitive Landscape --> Industry Attractiveness 1. Level of Competitiveness:

Main Competitors

Southeast Asia (for Sea Limited): The market is dynamic, unpredictable, and fragmented. The

competition is a battle for every percentage point of market share against strong local and regional players. .

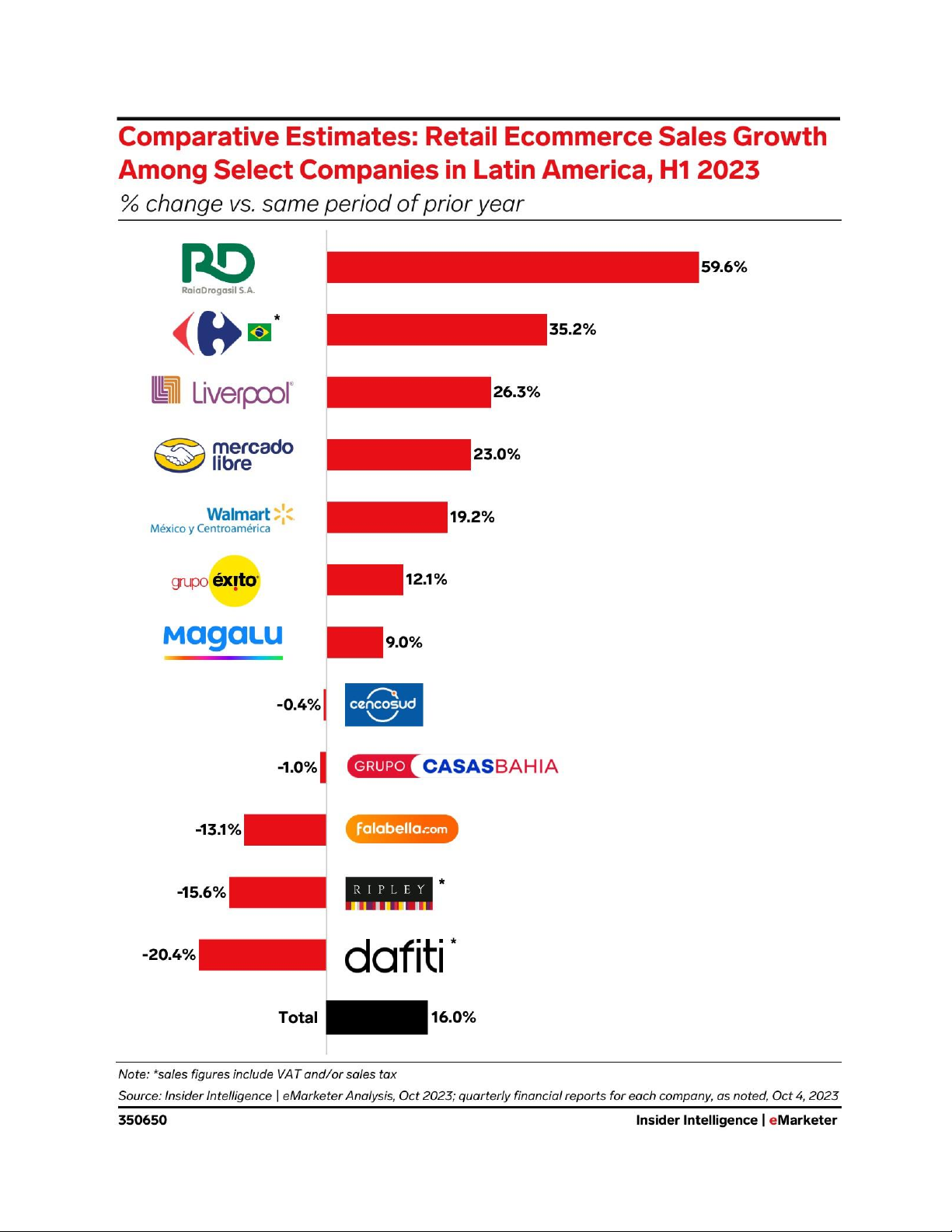

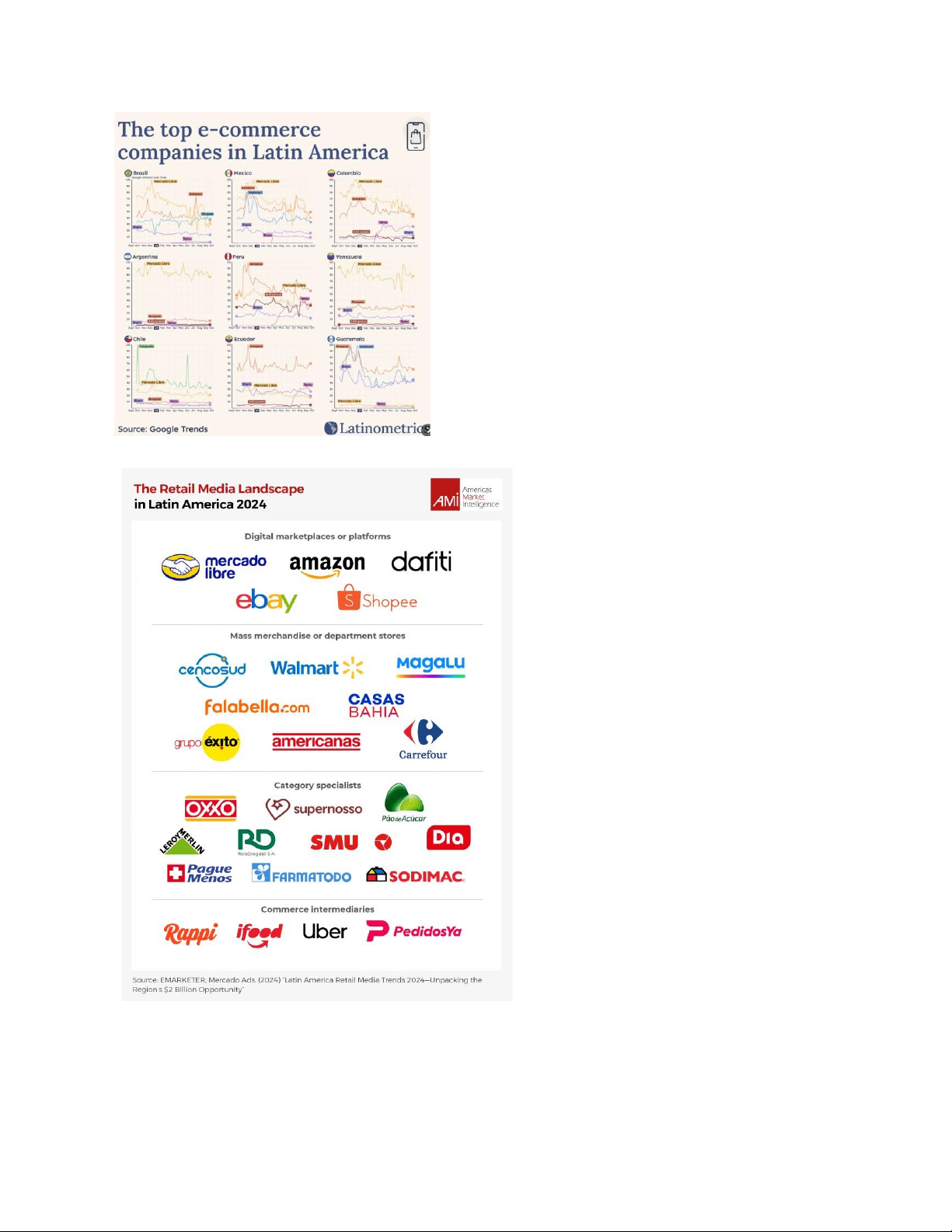

Latin America (for MercadoLibre): The competition is a "battle of giants," but with a clear,

dominant leader. MercadoLibre has already established an overwhelming lead. The competition is not

about who is number one; it is about powerful challengers (like Amazon) trying to take market share from the established champion lOMoAR cPSD| 58511332 lOMoAR cPSD| 58511332

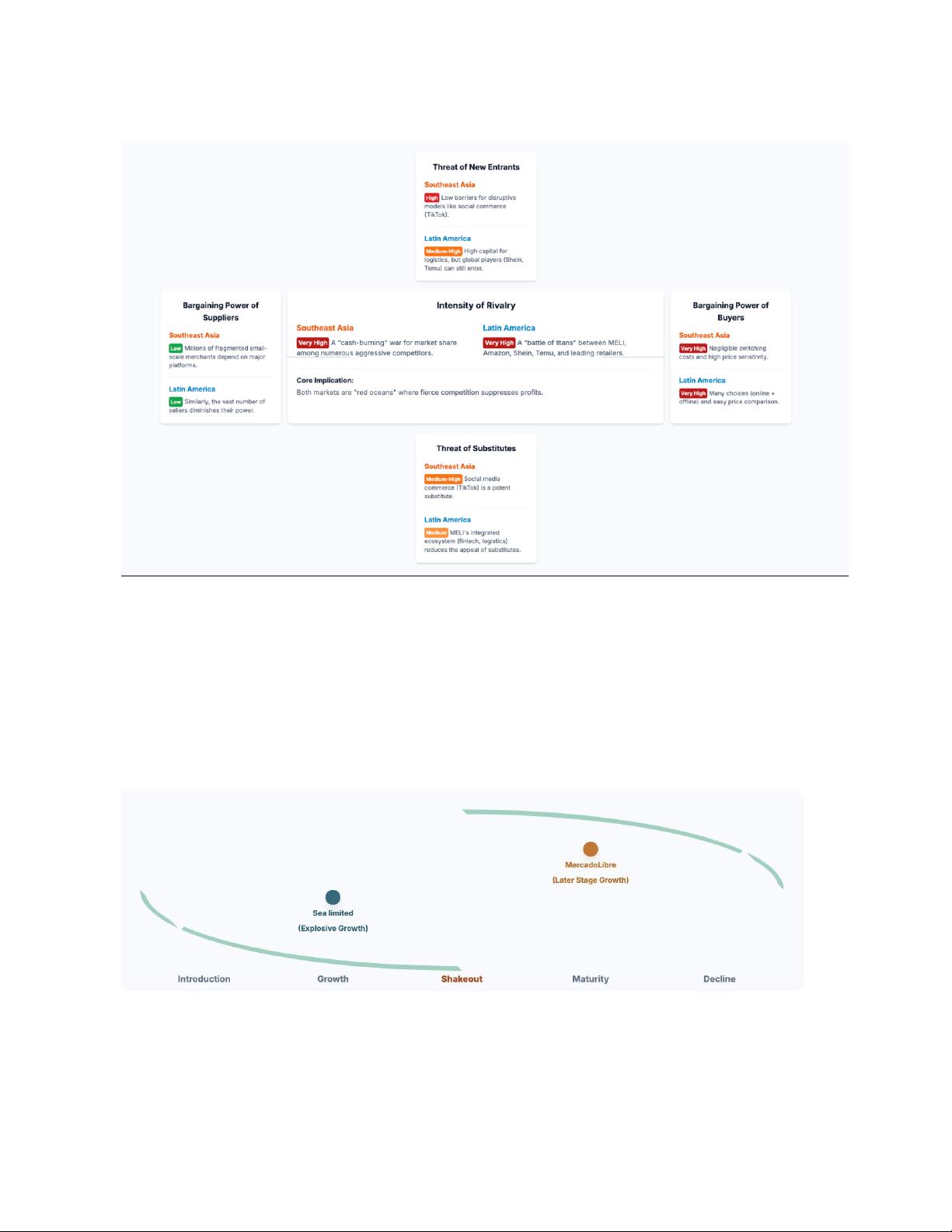

2. Industry attractiveness: A Porter's five forces analysis in e-commerce

Sea Limited (Southeast Asia): The market is highly volatile and unpredictable, primarily

threatened by asset-light, disruptive new business models like social commerce which lower entry barriers significantly.

MercadoLibre (Latin America): The market structure is more stable but intensely competitive.

The main threats come from large, well-funded global giants and sophisticated omnichannel retailers.

3. Evolution of the Competitive Structure: A Competitive Life Cycle Perspective

Southeast Asia faces a shakeout of disruptive innovation, where agility wins.

Latin America faces a shakeout of operational scale, where efficiency and resources win. Conclusion: lOMoAR cPSD| 58511332 Criterion

Sea Limited (Southeast Asia)

MercadoLibre (Latin America)

Dynamic and unpredictable, defined by

More structurally stable, yet fiercely Market disruptive new entrants.

contested in a "battle of giants." Environment Strategic

Requires extreme agility to survive a

Fortify its powerful logistics and fintech Imperative "multi-front war."

ecosystem to win a long-term war of attrition.

Higher-risk, hyper-growth potential. Investment

A more resilient foundation for long- Profile

term value creation and durability. The Bottom

A high-risk, high-reward growth

Superior strategic potential on a risk- Line opportunity. adjusted basis.

3. Company Analysis (3)

3.1. Customer Segmentation

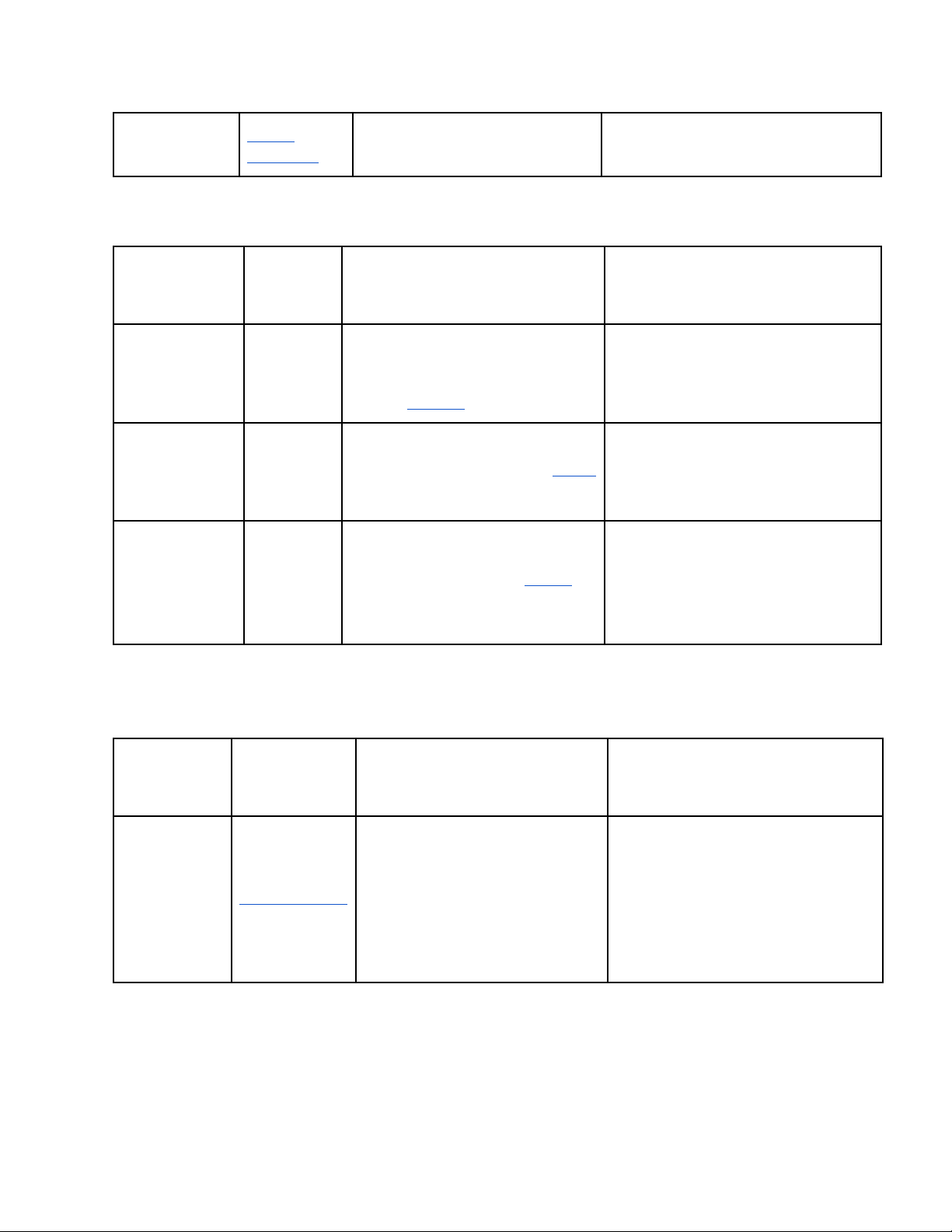

1. Sea Limited Holdings B2C

Segment Name Business Description Key Traits Unit Smart Everyday users who shop for

Price-sensitive, mobile-first, Shopee with Shoppers deals, convenience, and

promotion-driven, loves vouchers & Monee as entertainment gamification consumer financing solution) New-to-Digital

First-time e-commerce shoppers

Low digital literacy, price-sensitive, Onboarded Users gaining trust in platform. appreciate pay-later options through ShopeePay wallets and SPayLater loans from lOMoAR cPSD| 58511332 Monee ecosystem B2B Segment Name Description Business Key Traits Unit Aspiring Shopee

Low capital, needs guidance, uses

Individuals or micro-entrepreneurs Sellers

basic tools, learning the platform

starting their online selling journey through SPinjam Growth SME Shopee

Small businesses looking to scale ROI-driven, uses ads/logistics, seeks

with Shopee tools and Monee credit working capital, digitally maturing Omni-Channel Shopee

Require integrated payments, quick

Multi-channel merchants expanding Merchants

cash flow, multi-channel presence

online via Shopee, using Monee for

payments, disbursement, and cash flow management. 2. Mercado Libre B2C Business Unit Segment Description Key Traits Name Everyday Individuals and

households Price-sensitive, convenience-seeking, Mercado Libre Explorers shopping online for

daily trust-focused (Shopee Guarantee, (Using

convenience, price, and variety. reviews). Mercado Pago for in-store payment and financing tools) lOMoAR cPSD| 58511332 Financial

First-time users of formal digital Previously unbanked or underbanked, Mercado Libre Newcomers

financial tools in Latin America.

prefers mobile wallets and benefits (Using from micro-credit. Mercado Pago for in-store payment and financing tools) Value

Mercado Libre Customers engaging heavily in Promotion-driven, impulse buyers, Hunters

seasonal promos (e.g. Hot Sale, strong response to free shipping and Black Friday). rewards. B2B Segment Description Key Traits Business Name Unit Rising Sellers Mercado

Individual or informal sellers Low capital, need logistics Libre

starting to monetize via online + financial onboarding, channels. often previously offline. Empowered

Small to medium businesses using Use ads, fulfillment (MELI Mercado SMEs

platform tools to scale their Fulfillment), working capital loans, Libre (Using commerce. omnichannel tools. Mercado Pago for in-store payment and financing tools) Digitalized

Offline sellers integrating digital Seeks frictionless payments, omni- Mercado Merchants

payments and later expanding into payment processing, and consumer Libre (Using e-commerce. finance tools. Mercado Pago’s offline payment data to offer loans and transition them into online selling) lOMoAR cPSD| 58511332 Institutional Mercado

Growth at scale, data-driven strategy,

Large brands using Mercado Ads Partners Libre

brand protection features, logistics and Mercado Envíos for optimization. performance marketing and fulfillment.

=> Similarities: Both companies target underserved individuals and small businesses, especially those new

to digital commerce and financial services. They use their fintech and platform ecosystems to onboard and

grow both consumers and merchants.

Differences: Sea Limited is stronger in tech-driven user engagement, while Mercado Libre excels at

infrastructure and ecosystem integration (payments, delivery, ads) across a diverse merchant base.

3.2. Value Proposition

1. Sea Limited Holdings

Providing a vertically-integrated experience through its different core businesses: entertainment, e-

commerce, digital financial service

B2C: Shopee creates value for consumers in Southeast Asia by:

● Providing a mobile-first shopping experience tailored to price-sensitive, young consumers.

● Offering convenient digital payment and installment options (ShopeePay, SPayLater) for first- time e-commerce users.

● Building trust through buyer protection programs and free shipping thresholds.

B2B: Shopee enables small and mid-sized businesses to grow by:

● Providing a plug-and-play digital storefront with tools for inventory, order, and customer management.

● Offering Shopee Ads, affiliate tools, and built-in promotions to increase visibility for new or growing sellers.

● Supporting financial access through working capital loans (SPinjam) and instant settlements via ShopeePay. 2. Mercado Libre

Democratizing commerce and financial services to transform the lives of millions of people across Latin America.

B2C: Mercado Libre supports buyers by:

● Providing a trusted and efficient online marketplace with massive product variety, fast delivery, and buyer protection.

● Enabling financial inclusion via Mercado Pago’s e-wallets, QR payments, and Buy Now Pay Later options.

● Enhancing engagement through promotional events (e.g., Hot Sale) and free shipping incentives.

B2B: Mercado Libre enables business growth by:

● Offering free e-commerce storefronts via Mercado Shops, especially for first-time digital sellers. lOMoAR cPSD| 58511332

● Providing ads (Mercado Ads) and logistics (Mercado Envíos) to boost traffic and fulfillment capabilities.

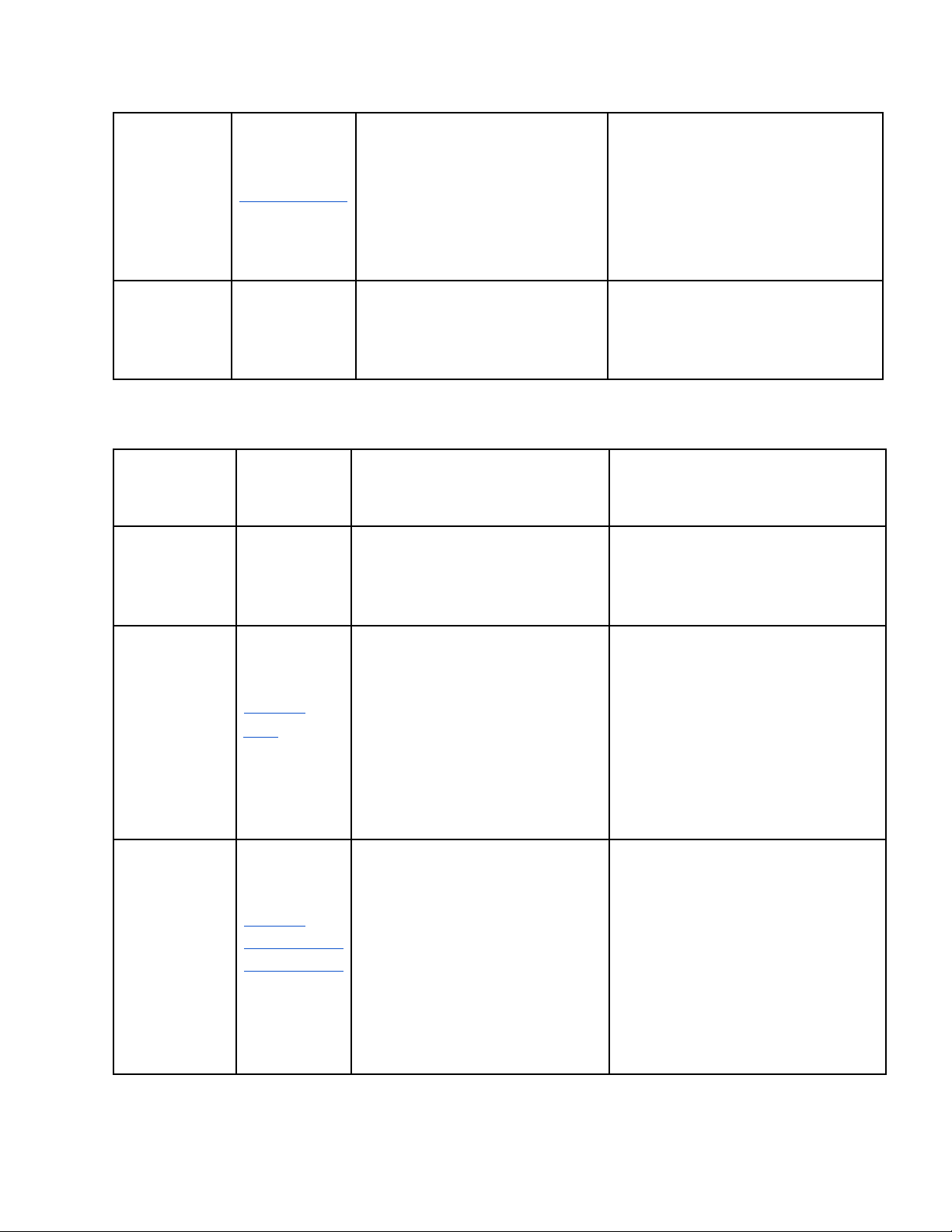

● Delivering cash-flow-based credit via Mercado Pago, helping sellers invest in inventory and campaigns. 3.3. Revenue Stream Sea Limited Mercado Libre

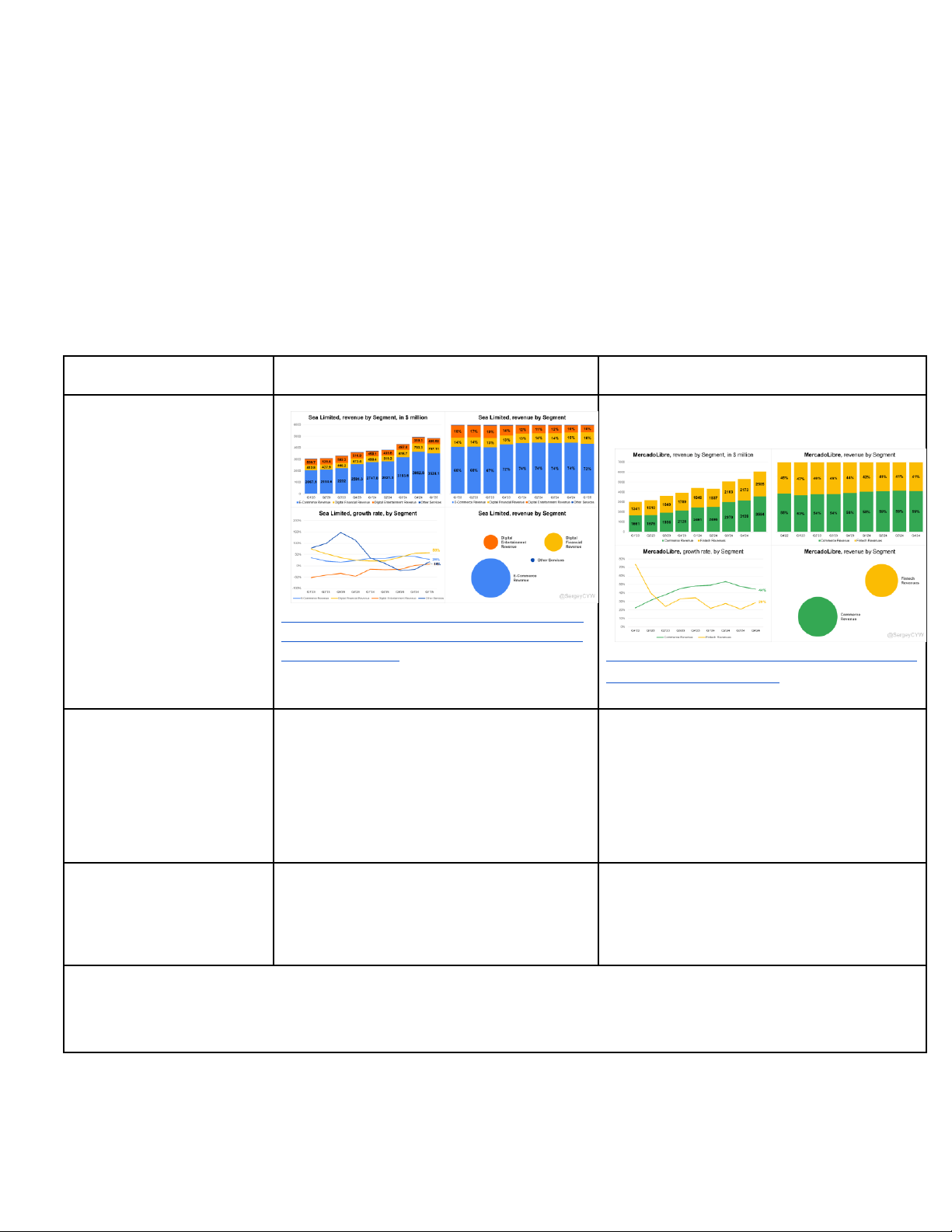

https://sergeycyw.substack.com/p/sea-limite

d-q1-2025-earnings-analysis?utm_source=p ublication-search

https://sergeycyw.substack.com/p/mercadolib re-dominant-e-commerce

Revenue by segmentation

- grew from $2,067.1M in Q1'23 to (E-commerce)

$3,524.1M in Q1'25, maintaining

- Increased from $1,661M (Q1'23) to over 68% of total revenue.

$3,554M (Q4'24), share dropped from 55% to 41%. Growth rate by

- grew 58% in Q1'24, showing strong segmentation (E-

and sustained expansion into Q1'25 - Decreased from 70% (Q4'22) to 44% commerce) (Q4'24), lower than Fintech

=> Sea Limited has a better revenue stream, maintaining a higher proportion (over 68%) of total revenue from E-

commerce, along with stronger growth at 58% in Q1'24. lOMoAR cPSD| 58511332

3.4. Value Chain Analysis --> Cost Structure - Sea limited Support Firm infrastructure

Headquarters: Singapore, NYSE-listed, regional offices (Vietnam, Indonesia, activities Philippines) Human resource management Competitive pay, tech talent Technology development

Sea AI Lab, AI (gaming, e-commerce, ads) Procurement

Asset-light, logistics/payment/IT vendors Primary Inbound logistics

3PL partnerships, cost-efficient activities Operations

Diversified (Shopee, Garena, SeaMoney) Outbound logistics

Hybrid (Shopee Express, external couriers), fast delivery Marketing and sales

Gamification, live-streaming, vouchers, e-sports Service

Chatbots, coins, cashback, stable servers, Garena

=> Conclusion: Sea Limited focuses on its diversified business model, integrating e-commerce,

gaming, and fintech to drive cross-sector synergies and growth.

- Efficient logistics: The 3PL model and Shopee Xpress help reduce costs, drive rapid growth, but

need to maintain consistency when expanding.

- Integrated digital finance: SeaMoney enhances the shopping experience and increases revenue.

- Creative marketing: Gamification, livestreaming, and collaboration with influencers help

Shopee stand out in the market.

- App-based services: Chatbots, coins, and cashback strengthen customer loyalty. - Mercado Libre Support Firm infrastructure

Headquarters: Argentina, strong LATAM presence, NASDAQ-listed activities Human resource management

Local hiring, leadership development in LATAM lOMoAR cPSD| 58511332 Technology development

Machine learning, fraud detection, credit scoring, logistics Procurement

Delivery vans, warehouse systems, POS terminals Primary Inbound logistics

Fulfillment network, sorting centers, warehouses, hubs activities Operations

Integrated, end-to-end process Outbound logistics

MercadoEnvios, its own fleet and partners Marketing and sales

MercadoAds, SEO, SEM, loyalty programs Service

Integrated support, MercadoPago, order tracking, communication tools

= > Conclusion: Mercado Libre focuses on vertical integration within e-commerce and financial

services, leveraging its strong logistics network to provide end-to-end solutions

1. Strong logistics integration: Utilizing MercadoEnvios with dedicated fulfillment centers and a

private fleet, along with expansion in Brazil and Mexico, optimizes fast delivery and reduces reliance on third parties.

2. Seamless operations: High integration from listing to delivery and payment via MercadoPago

ensures consistency and efficiency in the customer experience.

3. Effective marketing strategy: Leveraging MercadoAds, email marketing, SEO/SEM, and the

"Mercado Puntos" loyalty program boosts visibility and retains users.

4. Integrated support services: Support through MercadoPago, order tracking, and communication

tools create a seamless user experience, enhancing customer satisfaction. Sea Limited Mercado Libre lOMoAR cPSD| 58511332

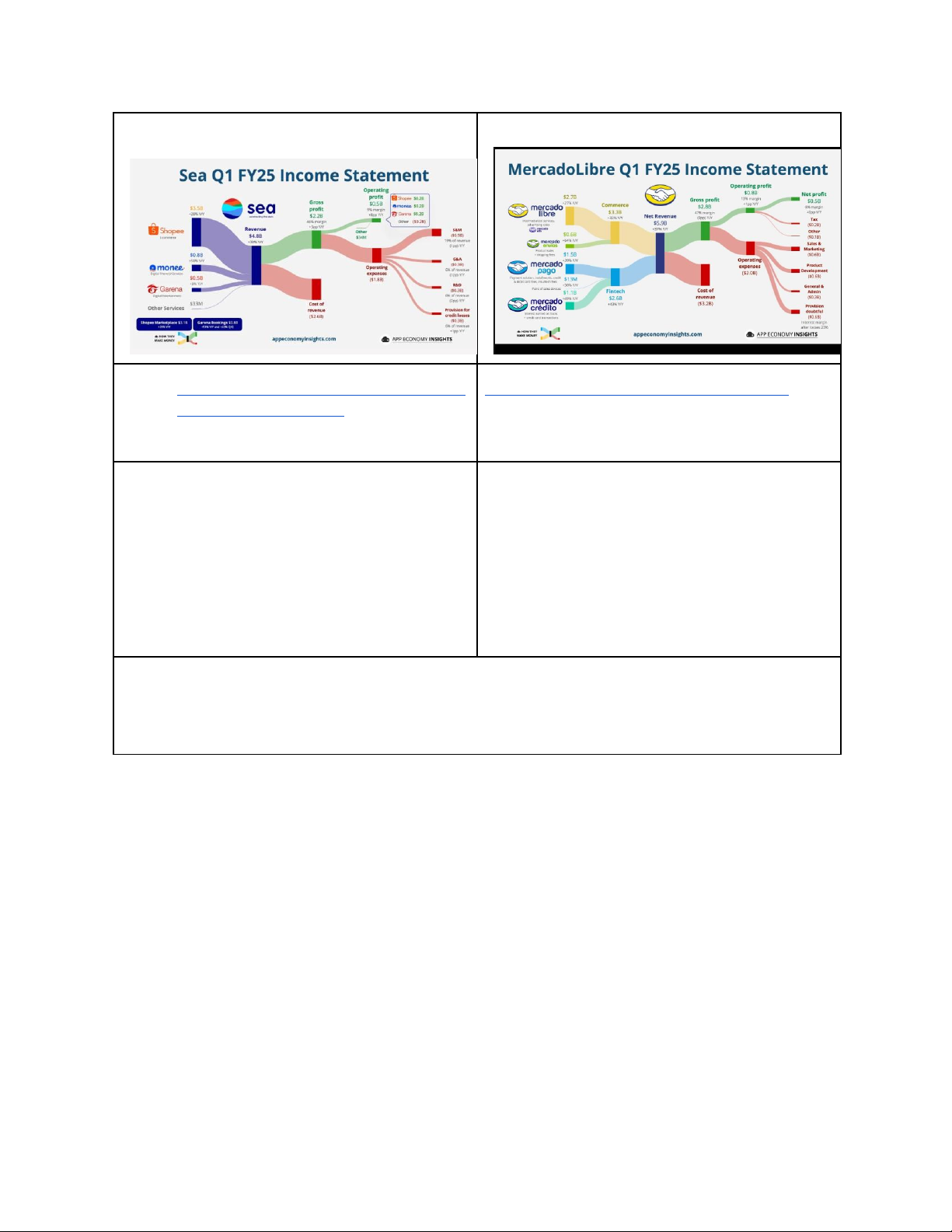

https://www.appeconomyinsights.com/p/n https://www.instagram.com/p/DJeniqGJaTe/ intendo-is-overwhelmed

Net Revenue: $5.9B (+37% YoY)

Net Revenue: $4.8B (+30% YoY) Cost

Cost of Revenue: $3.2B (54% of revenue)

of Revenue: $2.6B (54% of revenue)

Operating Expenses: $2.0B

Operating Expenses: $1.8B (38% of revenue)

Operating Profit: $0.8B (+19% YoY)

Operating Profit: $0.5B (+88% YoY, 9% Net Profit: $0.5B (+30% YoY) margin) Net Profit: $0.2B

MercadoLibre has a better cost structure due to its 13% operating profit margin and

more efficient spending on product development, compared to Sea Limited's 9%

operating profit margin and higher focus on sales & marketing. 3.5. Competitive Advantage Sea Limited

● Geographic Market Focus:

➔ Strong presence in Southeast Asia (home region)

➔ Significant expansion in Latin America (Brazil particularly) ➔ Limited presence in other

major markets (North America, Europe) ● Business Model Diversification:

➔ Highly diversified with three pillars—Shopee (e-commerce), Monee (fintech), and Garena (gaming).

➔ Cross-platform synergies between gaming and e-commerce user acquisition: gaming

revenues subsidize e-commerce expansion; fintech integrated with Shopee for payments and credit.

➔ Gaming provides cash flow for aggressive e-commerce expansion lOMoAR cPSD| 58511332

● Market Leadership / Scale: Shopee holds ~50% market share in Southeast Asia e-commerce;

Garena leads in regional gaming.

● Revenue Growth & Profitability: Shopee’s revenue grew ~28% YoY; SeaMoney revenue up

57.6%, now profitable; Garena stable but smaller share.

● Logistics & Fulfillment Capability: Improving logistics network but still behind MercadoLibre

in Latin America; logistics is a key challenge in SEA and Brazil.

=> Broad Differentiation Strategy: targeting diverse customer segments across Southeast Asia, Taiwan,

and Latin America through its multi-platform ecosystem. Its unique approach uses gaming revenues to

fuel e-commerce growth, creating cross-platform synergies that boost engagement and loyalty. By

offering distinct, integrated digital services to a broad market, Sea Limited fits Porter’s Broad Differentiation quadrant

MercadoLibre (MELI)

● Geographic Market Focus:

➔ Focusing on growing the business in the key markets of Brazil, Mexico, Argentina and increasingly Chile

➔ No significant presence outside Latin America ● Business Model Diversification:

➔ Highly integrated e-commerce and fintech ecosystem: marketplace (commerce), fintech

(MercadoPago), logistics (MercadoEnvios), advertising (MercadoAds), and merchant tools (MercadoShops)

➔ Vertical integration from marketplace to payments to logistics to lending

➔ Strong control over entire customer journey

● Market Leadership / Scale:MercadoLibre is the dominant e-commerce player in Latin America,

with approximately 30% market share of e-commerce sales in the region and the highest gross merchandise volume (GMV).

● Revenue Growth & Profitability: MercadoLibre has demonstrated strong revenue growth and

improving profitability, driven by e-commerce expansion and fintech adoption. Revenue hit $5.9

billion in Q1 2025, with net income of $494 million, reflecting 37% YoY revenue growth

● Logistics & Fulfillment Capability: MercadoLibre operates the leading logistics network in

Latin America, handling 95% of deliveries through MercadoEnvios, critical for overcoming

regional infrastructure challenges.

=> Focused Differentiation Strategy: concentrating solely on Latin America’s complex and diverse

market. It leverages deep regional expertise to offer tailored payments, credit, logistics, and marketplace

solutions designed for local needs. Its specialized value proposition includes local payment methods,

currency handling, and logistics adapted to the region’s infrastructure and regulations. This aligns with

Porter’s Focused Differentiation quadrant, as it serves a specific geographic niche with highly specialized offerings. lOMoAR cPSD| 58511332 3.6. Growth Strategy Growth Strategy Sea Limited MercadoLibre Product

- Introduced "instant delivery"

- Logistics Control: 95% of Development

allowing customers to receive Shopee packages self-delivered (Q3

orders in just a few hours, and 2024)

launched VIP memberships offering - Digital Advertising: 55.6%

perks like unlimited free shipping and market share in LATAM retail

priority customer service for a fixed media monthly fee - AI-Powered: Enhanced

- Garena continues to be a major recommendation and seller revenue contributor and analytics

cross-platform user acquisition tool Strategic Alliances

- NUS Partnership: Sea Building &

- Forms partnerships with local Sea Connect opened (Jan 2025) banks, fintech firms, and

- Collaborates with regional regulators logistics providers to expand

and banks to obtain digital banking MercadoPago and

licenses (e.g., Bank BKE acquisition MercadoEnvios. in Indonesia). - Global Expansion

- 2021: Raised $6 billion for strategic - Latest deal: Windsurf in AI by M&A investments power for modern engineering - 2022: Ceased new equity team

investments, discontinued investment

- Recent acquisitions: Redelcom, division Kangu Technology, Lagash

- Current: 100% ownership of direct

- Investment plan: $4.6 billion subsidiaries for Brazil (2024)

- Focus on internal capability building

- Acquisition focus: 43% internet and market penetration software, 29% software services

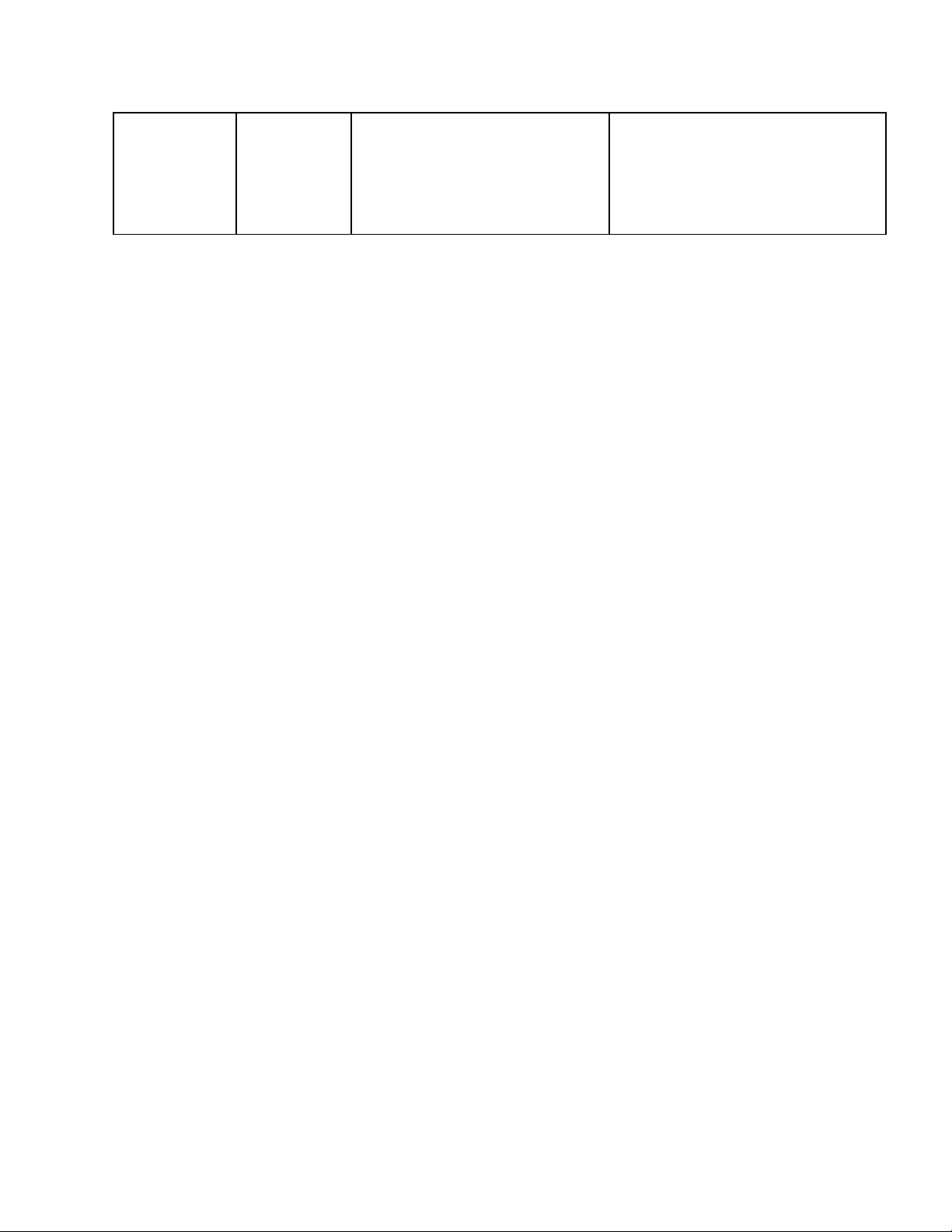

3.7. Financial Performance Financial Ratio

Sea Limited (SE) - Q1 2025 /

MercadoLibre (MELI) - Q1 2024 Estimate 2025 / 2024 Estimate Operating Profit Margin ~12.7% (2024), Q1 2025 ~9.4% (TTM), Q1 2025 estimate ~10-12% operating margin ~19% (quarterly) lOMoAR cPSD| 58511332 Net Profit Margin ~4.9% (TTM), Q1 2025 net ~9.2% (2024), Q1 2025 net margin ~8.6% margin ~8.4% Debt-to-Equity Ratio Approx. 0.4-0.5 (2024) Estimated ~0.3 (2024-2025 forecast) Approx. 1.5 (Q1 2025 Current Ratio Approx. 1.3-1.4 (2024) estimate) Price-Earnings (P/E) Ratio ~113x (May 2025 TTM) ; ~30x (2025 forecast) adjusted estimates ~35x (2025 forecast)

=> Sea Limited is transitioning from rapid growth with losses to a more mature phase of profitability and

sustainable growth, supported by improved margins, strong liquidity, and controlled leverage.

=> MercadoLibre demonstrates consistent profitability and strong growth within a focused regional market.

Its financial ratios reflect a mature, well-managed company with solid operational efficiency and investment capacity. 4. Conclusion (1)

4.1. Company Overall Evaluation

Using “The Representative Weighted Competitive Strength Assessment” (Textbook p.117), the

criteria and importance weight are chosen due to competitive advantages of the E-commerce sector and both companies. Key Success Importance Sea MercadoLibr Limited e Factor/Strength Weight Measure Strength Weighted Strength Weighted Rating Score Rating Score Market 0.15 7 1.05 9 1.35 Share/Dominance