Preview text:

1.2.1 Concept

A portfolio is a form of investment structure that consists of a combination of

many different kinds of assets. The goal of this structure is to maximize investment

returns while simultaneously minimizing investment risks.

Each investor should diversify their holdings over a variety of asset classes and

investment vehicles, including gold, foreign currency, real estate, bonds, equities, open-ended funds, and so on.

If you just invest in one type of asset class, it is important to diversify your

holdings across that one asset class.

Have a clear and simple understanding of the set of channels through which you assign your assets. 1.2.2 Role Profit maximization

Making a profit is the primary objective of any and all investments. Investors will

be better able to evaluate the potential expansion of a variety of sectors and fields

by building investment portfolios, which will allow them to assign a higher priority

to the distribution of their investment portfolios to various fields and businesses.

From that point on, investors are presented with a plethora of chances to increase

their profits and the effectiveness of their investments. The mitigation of danger

The majority of investors choose to mitigate risk by constructing diversified investment portfolios.

The diversification of the portfolio will assist investors in offsetting risks between

asset classes in the event that certain industries experience a decline or that certain

types of investments experience fluctuations. As a result, the repercussions of

financial risks will be reduced. the most reduced.

1.2.3 The Principle of Diversification

Diversifying your portfolio is an investment strategy that involves dividing your

investment assets across a range of asset classes. The goal of this strategy is to

lower risk while simultaneously increasing the potential for profit. Diversifying

your portfolio allows you to hold a number of assets, such as stocks, bonds, and

other assets. Rather than placing your entire investment in a single stock, bond, or

investment channel, diversifying your portfolio enables you to own a variety of

assets, such as cash, real estate, gold, or other products.

When you diversify your holdings in the market, you bring the level of risk

associated with your investments back into balance. When something impacts one

area of investment, it is still possible for other areas to help compensate for the

loss. This serves to lower the overall risk that is associated with your portfolio,

which, in turn, boosts your portfolio's profitability over the long term.

Diversification of your holdings, on the other hand, does not in and of itself

guarantee your portfolio's ultimate safety. There are still a number of factors that

could have an effect on the market as a whole or on the various asset classes that

make up your portfolio. Therefore, diversification of investment portfolios is

merely one of the numerous techniques to lessen the risk of investing. 1.2.4 Portfolio management Actively:

Active portfolio management is a form of investment management that makes use

of the active participation of humans. When determining whether to buy or sell a

company or how to build the portfolio, proactive administrators will rely on

analytical and forecasting information as well as the judgment and experience of

the portfolio manager or management team.

These active portfolio managers are not going to subscribe to the efficient market

hypothesis. They are of the opinion that it is feasible to make money on the stock

market by locating stocks that are mispriced. Passive:

Index investing is another name for passive portfolio management, which is also used sometimes.

The goal here is to amass earnings, reduce risks, and keep fees to a bare minimum

by way of establishing a diversified portfolio.

As a consequence of this, investors who adopt the passive portfolio management

strategy will buy stocks that are included in prominent indices. Such as the TCBF

bond fund or the TCBS TCEF stock fund, and keep it in your investment portfolio

for an extended period of time.

When it comes to having success as an investor, one of the most important things

to do is keep a portfolio that is adequately diversified. Moreover, one of the most

efficient ways to achieve this diversification is by constructing a portfolio

comprised of fund certificates. By holding all or representative shares of a fund,

fund certificates disperse the risk across a large area and spare investors the need to

make frequent purchases and sales of securities. Because of this, the fees and

operational costs associated with these funds are far lower than those associated with actively managed funds.

Passive portfolio managers, as opposed to active portfolio managers, do not

attempt to profit from short-term price swings or attempt to time the market. The

fundamental presumption underlying this approach is that a dynamic market will,

as time passes, result in rising levels of profitability. 1.2.5. CAPM Model

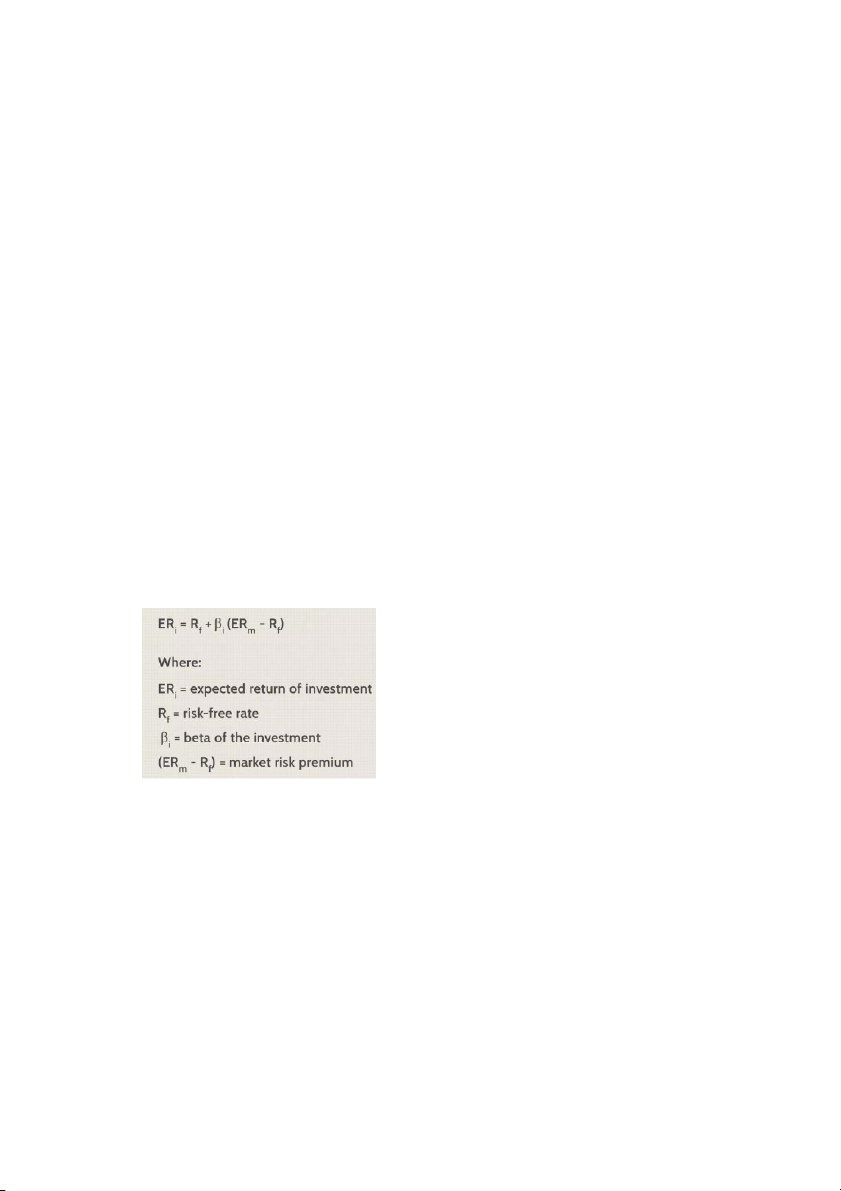

The capital asset pricing model, also known as the CAPM model, is a model that

defines the relationship between risk and expected return and is used to value high- risk securities.

The CAPM demonstrates that the expected return of a security or portfolio will be

equal to that of risk-free securities plus the risk premium. If the anticipated income

does not meet the required minimum income, then the investor will not make the investment. Formula: Advantages:

Simple and straightforward to implement. Disavantages:

Using only the most recent beta does not reveal the complete scope of stability over time.

In actuality, there are not a large number of such assumptions upon which to rely.

Systemic risk is not entirely disregarded by investors.

1.2.6. Portfolio management according to the Markowitz model.

1.2.6.1. Introduction to the Markowitz model.

More than forty years ago, a graduate student in economics from the University of

Chicago, in quest of a thesis topic, ran to a stockbroker who promised to research

the stock market. Harry Markowitz accepted the suggestion and developed a theory

that became a cornerstone of financial economics and changed investment practice.

That earned him part of the 1990 Nobel Prize in Economics. A fundamental

concept of economics is that due to the shortage of resources, all economic

decisions are made in response to the scarcity of resources. confront trade-offs.

Markowitz recognizes investors who confront a trade-off between risk and

expected reward. Investment decisions are not only about owning stocks but also

how to divide the number of shares. It was a question of "Portfolio Selection", the

title of which was a feature article published in the March 1952 issue of the

Financial Review. Markowitz developed critical line algorithms by extending the

methods of linear programming in both the paper and his following work. The

critical line algorithms determine all potential portfolios that simultaneously reduce

risk (as defined by variance or standard deviation) while maintaining the same

level of expected return and maximizing expected return for a given level of

investment. risk level. The efficient limit is formed by these portfolios whenever

the expected return space is graphed within standard deviations of that space.

When an investor is putting together their portfolio, they will have to make a

choice between the amount of risk they are willing to take and the amount of return

they anticipate receiving. The majority of limits represent the optimal level of

diversification for a portfolio. This is due to the fact that diversification is an

effective method for accomplishing the goal of reducing risk.

In the process of selecting a portfolio consisting of common stocks, Harry

Markowitz established the "mean-variance" concept. In the course of the last

twenty years, mean-variance analysis has become more prevalent in the process of

asset allocation. The process of selecting an investment portfolio in which each

component is an asset class rather than a single stock is referred to as asset

allocation. When compared to the selection of portfolios, asset allocation is often

seen as a more fruitful use of mean-variance analysis for a number of reasons.

Analysis using the "mean-variance" method involves knowledge not only of the

expected returns and standard deviations for each asset but also of the correlation

of returns for each asset pair. Unlike the challenge of selecting stocks for a stock

portfolio, which involves hundreds of stocks (and, consequently, thousands of

correlations), the problem of selecting asset classes often involves only a few asset

classes (such as a small number of asset classes). Gold, real estate, cash, stocks,

and bonds are included in this category. In addition, the absence of correlation

across assets presents a chance to cut down on the total risk posed by the portfolio.

The benefits of diversifying a stock portfolio are somewhat limited due to the fact

that stocks frequently go together. On the other hand, correlations across different

asset classes are often rather modest and, in some instances, even negative. As a

result, "mean-variance" is an effective technique in asset allocation for locating big

risk reduction possibilities via diversification. 1.2.6.2. Assumptions

As with any model, it is vital to understand the assumptions of mean-variance

analysis in order to utilize it successfully. First, mean-variance analysis is based on

an individual phase model of the investment. At the beginning of this time,

investors divide their funds across several asset classes, assigning a non-negative weight to each.

During the period, each asset created a random rate of return thus at the conclusion

of the term his assets were altered by the weighted average of the returns. In asset

volume selection, investors are faced with linear limitations, one of which is that

the weights must sum up to one. Based on the game theory work of Von Neumann and Morgenstern:

The investor attempts to maximize the expected return on total assets.

All investors have the same estimated single-period investment.

All investors are risk-averse; that is, they are willing to take greater risk if

they are compensated by a higher expected return.Investment decisions are

made based on expected return and risk.

All markets are totally efficient (e.g., no taxes and no “transaction costs”).

Investors base their decisions on expected return and risk; therefore, the

efficient frontier is an equation of the expected rate of return and the

variance (or standard deviation) of the rate. profit margins.”

1.2.6.3. Optimal Portfolio Selection

Markowitz demonstrates that the correlation (variance) of asset returns, in addition

to the weight of the assets and the standard rate of return, is a crucial factor in

determining the risk of an asset investment. The link between the potential

advantages of a DM and its risks (fluctuations) is described by its effective margin

lines. It could be represented by a boundary line on a risk-to-expected-return graph

for DMIs. The lowest degree of risk or risk necessary to meet the desired rate of

return can be predicted to yield the highest profitable margin lines. For the theory

of DMD construction and valuation, effective boundary lines are crucial. To

demonstrate the advantages of diversification, use the idea of an effective boundary line.

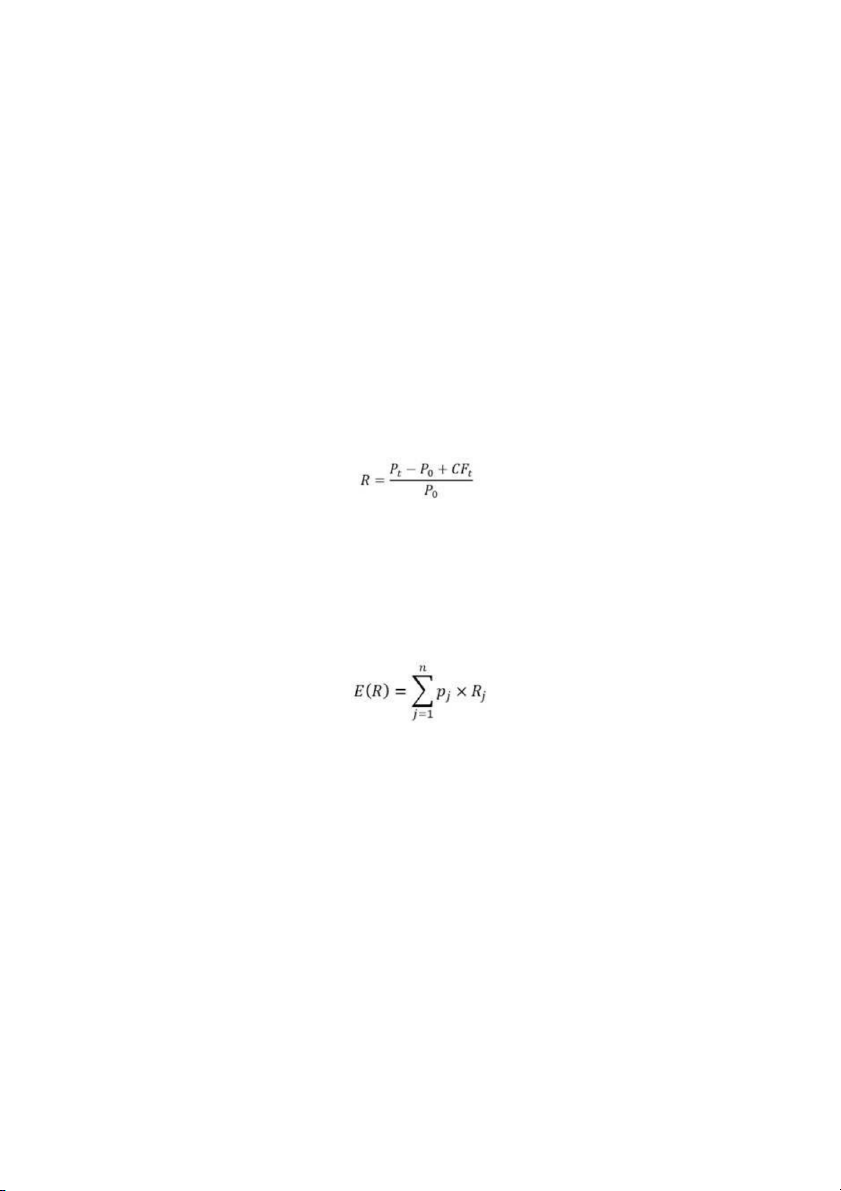

1.2.6.4. Formula of Markowitz Model Yielding:

Where: P : The price of the asset in the period t

Po : The price of the asset in the period 0

CFo : Dividend cash flow during the period from to t Expected rate of return:

With Ry : The rate of return of the risky asset in the situation j.

Pj : Likelihood of the rate of return Rj.

Variance, standard deviation of return for a risky asset: Variance: Standard deviation:

The variance values, however, will be derived from a sample of N observations and

will be based on the standard deviation of the empirical return values.

As a result, below is the formula for an N-observation sample: If N ≥ 30: If N < 30:

• Expected rate of return of a portfolio: With: Where:

: Expected rate of return of the portfolio

: The weight of i item in the portfolio

: The expected rate of return of the security i.

n : Number of securities in the portfolio

Variance and standard deviation of return on portfolio: Vairiance: Standard deviation:

Standard deviation of the return on the portfolio

The share of the i (or j) asset in the portfolio

Standard deviation of the rate of return on the i asset

The covariance between the return on the i asset and the j asset in the portfolio. Correlation Coefficient: Where:

: Correlation coefficient between the return on asset A and asset B.

The value of is in the range [-1;+1] The standard deviation of Standard Deviation of

1.2.6.5. Benefit and Drawback of Markowitz model: Advantages:

Optimize your portfolio such that you get the highest possible projected rate of

return while taking the fewest possible risks. - Disavantages:

In order to obtain the exact formula, an excessive number of data points with a

regularly distributed distribution are required; however, the documents and

financial statements do not yet fulfill this criteria. Risk-free assets have not yet

been accounted for in the Markowitz model. SOME STOCKS SELECTION METHODS

1.3.1. CANSLIM stock selection method

One of the most successful stock investors in the United States is William J. Oneil,

who founded CANSLIM stock selection. When he first began out, he focused a lot

of his limited study time on learning about the performance and experience of

"high money" in the stock market. After much work and investigation, he was

successful in developing a strategy that may be used to select high-quality stocks.

For this study, the "Wall Street man," or one of the 13 persons who helped him

achieve recognition and fortune, made millions of dollars in earnings from stocks

each year and started the investment research firm William J. O'Neil & Company.

7 elements in the CANSLIM model:

C − Current Quarterly Earnings Per Share

A − Annual Earnings Increases

N − New products (New management, New highs, new tops) S − Supply and demand

L − Leader and laggard I − Institutional sponsorship M − Market direction