Preview text:

RISK & RETURN Problem 1 (15 points)

Suppose you have invested in three stocks: A, B and C. You expect that returns on the

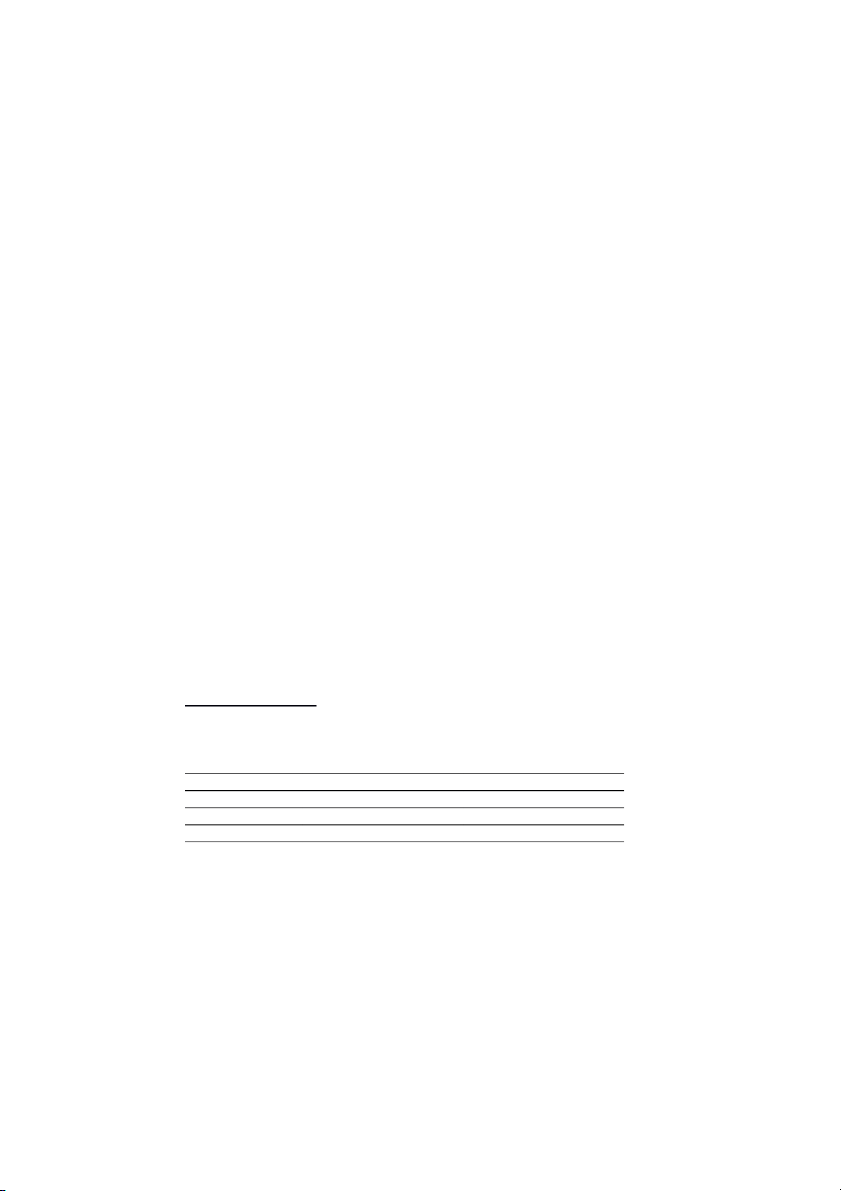

stocks depend on the following two states of the economy, with the probabilities to happen given below. State of Probability of Return on Return on Return on Economy State Occurrence stock A stock B stock C Boom 0.70 7% 15% 33% Bust 0.30 3% 3% -6%

a. (5 points) What is the expected return of an equally weighted portfolio of these three stocks?

b. (5 points) What is the expected return of a portfolio invested 20 percent each in A and

B, and 60 percent in C?

c. (5 points) What is the standard deviation of a portfolio invested 20 percent each in A

and B, and 60 percent in ? C

………………………………………………………………………………………… ….

………………………………………………………………………………………… ….

………………………………………………………………………………………… ….

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

………………………………………………………………………………… ..

………………………………………………………………………………………

..…………………………………………………………………………………………….

..……………………………………………………………………………………………. Solution:

a) To find the expected return of the portfolio, we need to find the return of the portfolio

in each state of the economy. This portfolio is a special case since all three assets have the same weight.

Boom: E(Rp) = (0.07 +0.15 +0 .33)/3 = 0.1833 or 18.33%

Bust: E(Rp) = (0.03 + 0.03 -0.06)/3 = 0.000 or 0.00%

And the expected return of the portfolio is:

E(Rp) = 0.70(0.1833) + 0.30(0.00) = 0.1283 or 12.83%

b)This portfolio does not have equal weight in each asset. We still need to find the return

of the portfolio in each state of the economy.

Boom: E(Rp) = 0.20(.07) + 0.20(0.15) + 0.60(0.33) = 0.2420 or 24.20%

Bust: E(Rp) = 0.20(.03) + 0.20(0.03) + 0.60(-0.06) = -0.024 or – 2.4%

And the expected return of the portfolio is:

(Rp) = 0.70(0.2420) + 0.30(-0.024) =0.1622 or 16.22%

c)To calculate the standard deviation, we first need to calculate the variance. To find the

variance, we find the squared deviations from the expected (mean) return. σ 2 2 2

p = 0.70(0.2420 - 0.1622) + 0.30(-0.0240 - 0.1622) = 0.01486 σ 1/2 p = (0.01486) = 0.12189 or 12.189% Problem 2 (15 points)

Based on the following information, calculate the expected return and standard deviation

of each of the following stock. Assume each state of the economy is equally likely to

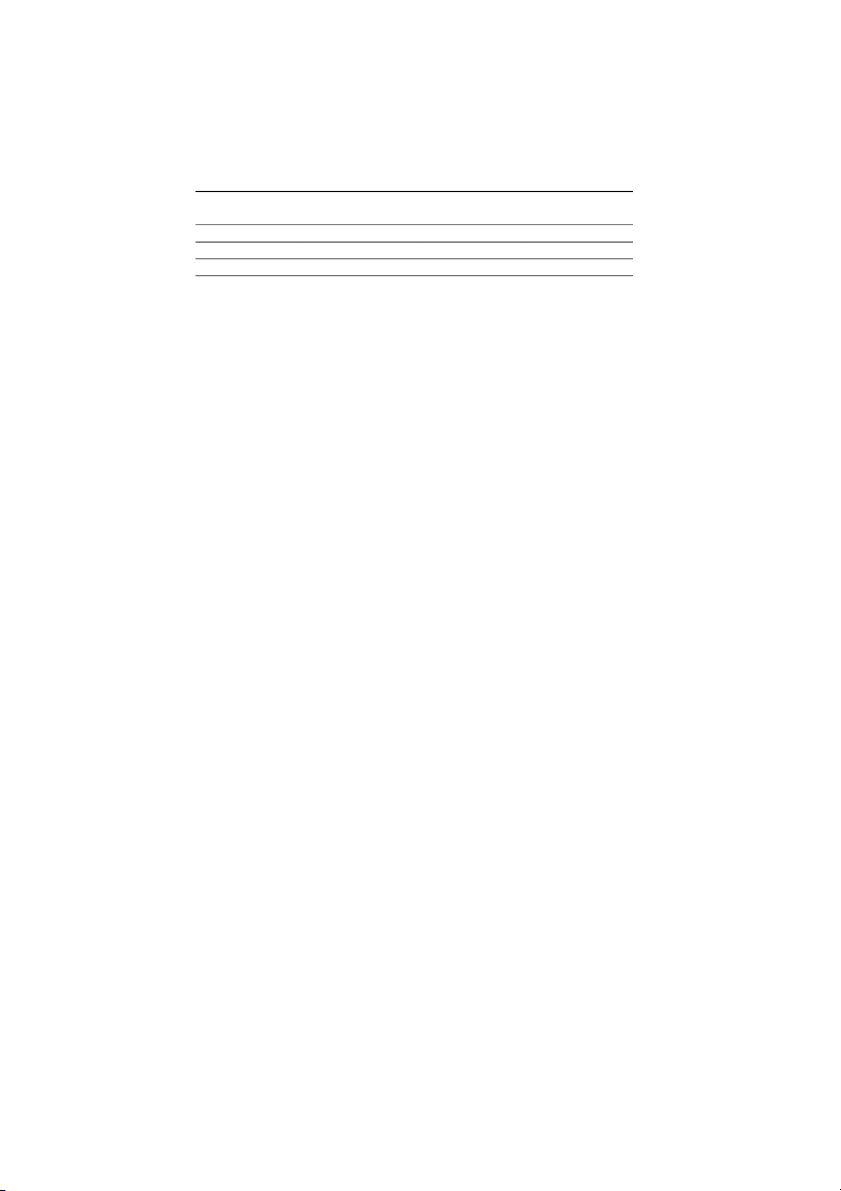

happen. What are the covariance and correlation between the returns of the two stocks? State of Economy

Rate of Return on stock A Rate of Return on stock B Bear 6.3% -3.7% Normal 10.5% 6.4% Bull 15.6% 25.3%

a. (5 points) What is the expected return on stock A and stock B?

b. (5 points) What is the variance and standard deviation for stock A and stock B?

c. (5 points) What are the covariance and correlation between the returns of the two stocks?

…………………………………………………………………………………………….

…………………………………………………………………………………………….

…………………………………………………………………………………………….

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

………………………………………………………………………………………………

……………………………………………………… …………………………………….. Solution:

a) The expected return of an asset is the sum of the probability of each return occurring

times the probability of that return occurring. So, the expected return of each stock is:

E(RA) = .3333(.063) + .3333(.105) + .3333(.156) = .1080 or 10.80%

E(RB) = .3333(–.037) + .3333(.064) + .3333(.253) = .0933 or 9.33%

b) To calculate the standard deviation, we first need to calculate the variance. To find the

variance, we find the squared deviations from the expected return. We then multiply

each possible squared deviation by its probability, and then add all of these up. The

result is the variance. So, standard deviation of stock A is:

2A =.3333(.063 – .1080)^2 + .3333(.105 – .1080)^2 + .3333(.156 – .1080)^2 = . 001446

A = (.001446)^(1/2) = .0380 or 3.80%

And the standard deviation of stock B is:

2B =.3333(–.037 – .0933)^2 + .3333(.064 – .0933)^2 + .3333(.253 – .0933)^2 = . 014446

B = (.01445)^(1/2) = .1202 or 12.02%

c) To find the covariance, we multiply each possible state times the product of each

assets’ deviation from the mean in that state. The sum of these products is the

covariance. So, the covariance is:

Cov(A,B) = .3333(.063 – .1080)(–.037 – .0933) + .3333(.105 – .1080)(.064 – .0933)

+ .3333(.156 – .1080)(.253 – .0933) Covariance = .004539

And the correlation coefficient is: A,B = Cov(A,B)/( A

B) = .004539/(.0380)(.1202) A,B = .9937 Problem 3 (15 points)

Based on the following information calculate the expected return and the standard deviation for the two stocks. State of Probability of Rate of Return Rate of Return Economy State of Economy on stock A on stock B Recession 0.10 6% -20% Normal 0.60 7% 13% Boom 0.30 11% 33%

a. (5 points) What is the expected return on stock A and stock B?

b. (5 points) What is the variance and standard deviation for stock A and stock B?

c. (5 points) What is of the standard deviation of an equally weighted portfolio of these

two stocks if the correlation is 0.2?

………………………………………………………………………………………… ….

………………………………………………………………………………………… ….

………………………………………………………………………………………… ….

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

………………………………………………………………………………… ..

……………………………………………………………………………………… ..

…………………………………………………………………………………………

………………………………………………………………………………………….. ..

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

………………………………………………………………………………………….. Solution:

a) The expected return of an asset is the sum of the probability of each return occurring

times the probability of that return occurring. So, the expected return of each stock asset is:

E(RA) = .10(.06) + .60(.07) + .30(.11) = .0810 or 8.10%

E(RB) = .10(-.2) + .60(.13) + .30(.33) = .1570 or 15.70%

b) To calculate the standard deviation, we first need to calculate the variance. To find the

variance, we find the squared deviations from the expected return. We then multiply

each possible squared deviation by its probability, and then add all of these up. The

result is the variance. So, the variance and standard deviation of each stock are: 2

A = .10(.06 - .0810)^2 + .60(.07 - .0810)^2 + .30(.11 - .0810)^2 = .000369

A = (.00037)^(1/2) = .01921 or 1.921% 2

B = .10(.-2 - .1570)^2 + .60(.13 - .1570)^2 + .30(.33 - .1570)^2 = .022161 1/2 B = (.02216) = .14886 or 14.89%

c) To calculate the portfolio standard deviation, we first need to calculate the variance.

To find the variance we use the formula based on the individual stocks’ variances and

the covariance between the two stocks. So, the portfolio variance is: 2 2 2 2 2 p = wA A + wB B + 2wAwB A B AB 2

p = (0.5^2)(0.01923^2) + (0.5^2)(0.1489^2) + 2(0.5)(0.5)(0.2)( 0.0192)( 0.1489) 2 p = 0.0059183

P = (0.0059183)^(1/2) = 0.076930, or 7.6930% Problem 4 (15 points)

Consider the possible rates of return that you might obtain over the next year. You can

invest in stock U or stock V. State of Probability of Rate of Return Rate of Return Economy State of Economy on stock U on stock V Recession 0.20 7.0% -5.00% Normal 0.50 7.0% 10.0% Boom 0.30 7.0% 25.0%

a. (5 points) Determine the expected return, variance, and the standard deviation for stock U and V.

b. (5 points) Determine the covariance and correlation between the returns of stock U and stock V.

c. (5 points) Determine the expected return and standard deviation of an equally

weighted portfolio of stock U and stock V.

…………………………………………………………………………………………….

………………………………………………………………………………………… ….

………………………………………………………………………………………… ….

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………………………………………………………

………………………………………………………………………………….. ..

………………………………………………………………………………………

..…………………………………………………………………………………………….

..……………………………………………………………………………………………. Solution:

b) The expected return of an asset is the sum of the probability of each return occurring

times the probability of that return occurring. So, the expected return of each stock is: