Preview text:

lOMoAR cPSD| 59691467

N ATIO N AL ECO N OMIC U N IVERSITY

SCHOOL OF ADVA N CED EDUCATIO N AL PROGRAMME

- - - - - - - - - - * * * - - - - - - - - - -

GROUP 6 - MARKETI N G MA N AGEME N T 63E

I N TER N ATIO N AL MARKETI N G

PRODUCT EXPORT PLA N FOR DH FOODS COMPA N Y Member ID

Tr ầ n Ánh D ươ ng 11211643

N guy ễ n H ươ ng Trà 11215696

Đỗ Thu Huy ề n 11212674 Hoàng Khánh Linh 11213145

N guy ễ n Võ Kim Th ị nh 11215517

L ụ c Minh H ạ nh 11212104

Lecturer: Mr. Tr ầ n Vi ệ t An Hanoi, Oct/2023 lOMoAR cPSD| 59691467 TABLE OF CONTENT CHAPTER I 5

GENERAL INTRODUCTION ABOUT DH FOODS, VIETNAMESE

ENVIRONMENT & PRODUCT PORTFOLIO 5 1. Dh Foods 5 1.1. Company Overview 5 1.2. Missions & Goals 5

1.3. Company's business activities 5 1.4. Resources 7 1.4.1.Human Resources 7 1.4.2.Financial resources 7 1.4.3.Physical resources 8 1.4.4.Brand Reputation 8 1.5. Suppliers 8 2. Vietnamese environment 8 3. SWOT 10 4. Product Portfolio 10

4.1. Product Portfolio of Dh Foods 10

4.2. Product lines that have been exported 11 4.3. The chosen product line 11 CHAPTER II 12

INTERNATIONAL MARKET SELECTION 12

1. A look at Dh Foods' current markets 12 2. First Screening 13 3. Second Screening 13

4. Comparison between Polish market and Canadian market 13

5. Marketing attractiveness evaluation 16 6. Conclusion 17 7. Region 17 CHAPTER III 18 lOMoAR cPSD| 59691467

GENERAL POLISH ENVIRONMENT & SPICES MARKET 18 1. General Polish Environment 18

1.1. Introduction of the Polish Market 18 1.2. Demographic Environment 19 1.3. Economic Environment 19

1.3.1.Overview of Poland’s Economic 19

1.3.2.The stability in the exchange rate between Vietnam Dong and currencies used in Poland (EURO) 20

1.4. Sociocultural Environment 21

1.5. Technological Environment 21 1.6. Political Environment 22 1.6.1.EU 22 1.6.1.1.Food Safety 22

1.6.1.2.Tax Policies and Tax Rate 22 1.6.1.3.EVFTA 23 1.6.1.4.Custom Procedures 24 2. Polish Spices Market 25

2.1. Market Size & Potential 25 2.2. Competitors 26 2.3. Target Customers 28 2.3.1.Demography 28

2.3.2.Psychology and Buying Behavior 28 CHAPTER IV 29 MARKET ENTRY MODES 29

1. Choosing Market Entry Modes 29 1.1. Internal Factor 29 1.2. External Factor 29

1.3. Direct and indirect trade barriers 30

1.4. Transaction-specific factors 30 1.5. Conclusion 30 lOMoAR cPSD| 59691467 2. Direct Export Modes 30

2.1. Current partner of Dh Foods in EU markets 30

2.2. International Partner Matrix 31

2.2.1.The performance of the distributor partner 31

2.2.2.The general attractiveness of the market where the partner operates 31 CHAPTER V 31 MARKETING MIX 31 1. Product 31

1.1. Product design in current markets 31

1.2. Labelling & Packaging 32 1.2.1.EU Regulation 32 1.2.2.Adjust Packaging 32 2. Price 33

2.1.Factors influencing international pricing decisions 33

2.2.Price of Dh Foods’ product in other European markets & Price of similar products from competitors 34 2.3.Pricing Strategies 35 3. Place 35

3.1.Factors influencing channel width 35 3.2.Retail channels in Poland 36 4. Promotion 36

4.1.Factors affecting promotion activities 36 4.2.Communication tools 37 5. Marketing Mix Plan 37 CHAPTER VI 41 BUDGET & CONTROL 41

1. International Marketing Budget 41 2. Marketing Control 43 CONCLUSION 43 REFERENCES 45 lOMoAR cPSD| 59691467 MEMBER CONTRIBUTION 45 CHAPTER I

GENERAL INTRODUCTION ABOUT DH FOODS, VIETNAMESE

ENVIRONMENT & PRODUCT PORTFOLIO 1. Dh Foods 1.1. Company Overview

CEO Nguyen Trung Dung started DH Foods Co Ltd. in 2012. In its 11 years of business,

DH Foods has established itself as the premier, esteemed company specializing in regional

spice specialties from Vietnam. Its primary offerings are authentic, traditional Vietnamese

spices and sauces, including dipping sauces, salt, and spices for cooking and marinating.

Dh Foods believes that using high-quality spices would enhance the flavor of food and

make people happier. The spices from Dh Foods are also regional delicacies that showcase

some of Vietnam's most notable cultural characteristics.

With its current 9 product lines and 170 goods, DH Foods is generating a lot of buzz and

holding a dominant position in the home market. The products of DH Foods are specifically

categorized to fit each specialty in various places.

Since 2016, DH Foods has successfully exported to Japan, beginning a journey to deliver

Vietnamese spices to 98 nations with demanding requirements: Korea, Japan, the

Netherlands, Australia, the United States, the United Kingdom, Germany, Russia, France and others on many continents.

1.2. Missions & Goals

• DH Foods is acutely aware of the negative impact artificial substances have on public

health. As a result, DH Foods strives to produce goods that maintain the original hue and flavor of each ingredient.

• DH Foods works to educate customers on the value of thoroughly checking the

ingredients before buying any product in order to choose those that are safe.

• Every single DH Foods product is 100 percent pure.

• As a result of consistently adhering to the standards of "No Artificial Color, No

Preservatives, No Foreign Matter" since its inception, Dh Foods has emerged as the

consumer's top option for quality and safety.

1.3. Company's business activities

Although business activities were greatly affected during the Covid pandemic, Dh Foods'

operations still achieved many achievements:

• Dh Foods experienced good business outcomes in 2021. In the context of the Covid-

19 epidemic, the company generated income of 144.2 billion VND, up 51.6% from 2020

and 14.5% more than anticipated. lOMoAR cPSD| 59691467

• A partnership agreement between Dh Foods Joint Stock Company and Heritage

Beverage was inked in the early months of 2022, opening the US market to Vietnamese regional specialty spices. lOMoAR cPSD| 59691467 •

Dh Foods had the distinction of taking part at VietFood, the 26th International Food and

Beverage Exhibition, in 2022. Additionally in 2022, DH Foods organizes the Shareholders'

Meeting with much-needed future direction. to revamp the business strategy in order to dominate the global market.

• DH Foods began its journey to the great ocean in 2016 with problems and difficulties,

but the company has gradually demonstrated its potential to introduce Vietnamese products

to the rest of the world. After passing the "test" from the European market on procedure,

manufacturing, factory, and so on, DH Foods obtained the order in 2017; first with a 12,000 USD value.

• By 2018, DH Foods had continued to pass the stringent "test" imposed by the Japanese

market, which threatened to cancel the contract if DH Foods did not satisfy the product

quality requirements to which they had pledged to conclude.

• DH Foods expanded its journey to many more nations after acquiring the trust of

demanding markets, including the United States, Australia, Russia, the United Kingdom,

Korea, Japan, France and Germany. DH Foods consolidates its resources and continues to

prepare for the internationalization of Vietnamese products from 2020 to 2021. 1.4. Resources 1.4.1.Human Resources

• As of 2023, Dh Foods has a team of over 400 employees, including production

workers, quality control inspectors, marketing and sales staff, and administrative personnel.

• The company has a strong commitment to employee training and development, and

offers a variety of programs to help employees learn new skills and advance their careers.

• The company also has a number of initiatives in place to promote a healthy and

productive work environment. Instead of managing human resources with discipline

through KPIs, Mr. Dung experimented with the 'heart-warming' management style:

training, guidance and inspiration.

1.4.2. Financial resources

In 2022, Dh Foods had a revenue of $12 million and a net profit of $2 million. The

company has a strong financial foundation, with over $10 million in cash and cash

equivalents, as well as a good track record of profitability, and has been able to reinvest its

profits in new products, technologies, and marketing initiatives. Dh Foods is also debt-free,

which gives it more financial flexibility to invest in its future growth.

Dh Foods financial performance in 2021: lOMoAR cPSD| 59691467 • •

Total revenue: 144.2 billion VND (about 6.4 million USD), an increase of 51.6% from 2020. •

Net profit: 10.8 billion VND (about 450,000 USD), an increase of 21.9% from 2020.

Dh Foods has set a target of achieving total revenue of 190-215 billion VND (about 8-9

million USD) and net profit of 16-18 billion VND (about 650,000-720,000 USD) in 2022.

1.4.3. Physical resources

• Dh Foods has a modern production factory - Le Minh Xuan Factory in Ho Chi Minh

City. The facility is equipped with state-of-the-art machinery, including a high-speed

bottling line and a warehouse with a capacity of 1,500 tons.

• The company also has a network of distribution partners in 8 countries.

• The company is in the process of expanding its production capacity to meet the

growing demand for its products.

1.4.4. Brand Reputation •

Dh Foods has a relatively positive brand reputation in Vietnam and in export markets. •

The company is known for their high-quality products, their commitment to safety and

quality, and innovative marketing campaigns. For example, the company has been featured

in televisions, magazines and newspapers, actively participated in fairs and exhibitions in

Vietnam and in other countries, and won several awards for their products and business practices. 1.5. Suppliers

Dh Foods' spices are specialties with typical cultural features of Vietnam's regions. The

Company's raw material sources are mainly cooperated with typical agricultural products

from the North region to the South region in Vietnam such as pepper from Pleiku, chilli from

the Central region, salt from the Central region… So, their suppliers are mainly the farmers

in each region. Moreover, the company has cooperated with farmers to establish a granary of

raw materials that benefits both farmers and Dh Foods to ensure the quality of the ingredients and the price.

2. Vietnamese environment

Export incentives are understood as measures, policies, and financial assistance from the

government to domestic companies to promote exports and support the country's balance of

payments. Measures to encourage exports may include direct subsidies to reduce the price of

exported goods (export subsidies), tax incentives (tax exemption on profits earned from lOMoAR cPSD| 59691467 •

exports), and provision of credit (exemption of profits from exports). using preferential

exports, low interest rates) and financial guarantees.

Currently, the Vietnamese government has many policies to promote the export of goods

abroad by domestic companies. Some notable policies include the following:

• The imposition of low or 0% tax rates on Vietnamese goods as agreed in a total of 17

FTAs that Vietnam has been negotiating, signing, and implementing is a driving force to

boost export activities of businesses.

Export Promotion Programs: Vietnam still maintains several forms of export subsidy

under Government programs such as reducing or exempting taxes; providing direct

financial support (especially for new exporters) to the export of goods to new markets or to

goods affected by price fluctuations; and granting export rewards (under Trade Ministry

Decision No. 02/2002/QD-BTM). The Export Support Fund is maintained to support, encourage and promote export.

• Export Credit and Finance Support: The government, through institutions like the

Vietnam Export-Import Bank (Eximbank) and Agribank, provides export credit and

financing support to help businesses access the necessary capital to expand their export activities.

• Investment in Infrastructure: Infrastructure development, such as the expansion and

improvement of ports, transportation networks, and logistics facilities, is a key part of

facilitating efficient export processes. Vietnam has a lot of infrastructure constantly being

built, including road systems, seaports, airports,...

• Trade Promotion Agencies: Vietnam has several trade promotion agencies that assist

businesses with export-related activities. These agencies help with market research, trade

missions, and participation in international trade fairs and exhibitions.

• Customs Simplification: Streamlining customs procedures and reducing red tape make

it easier for companies to export their products. The Vietnamese government has made

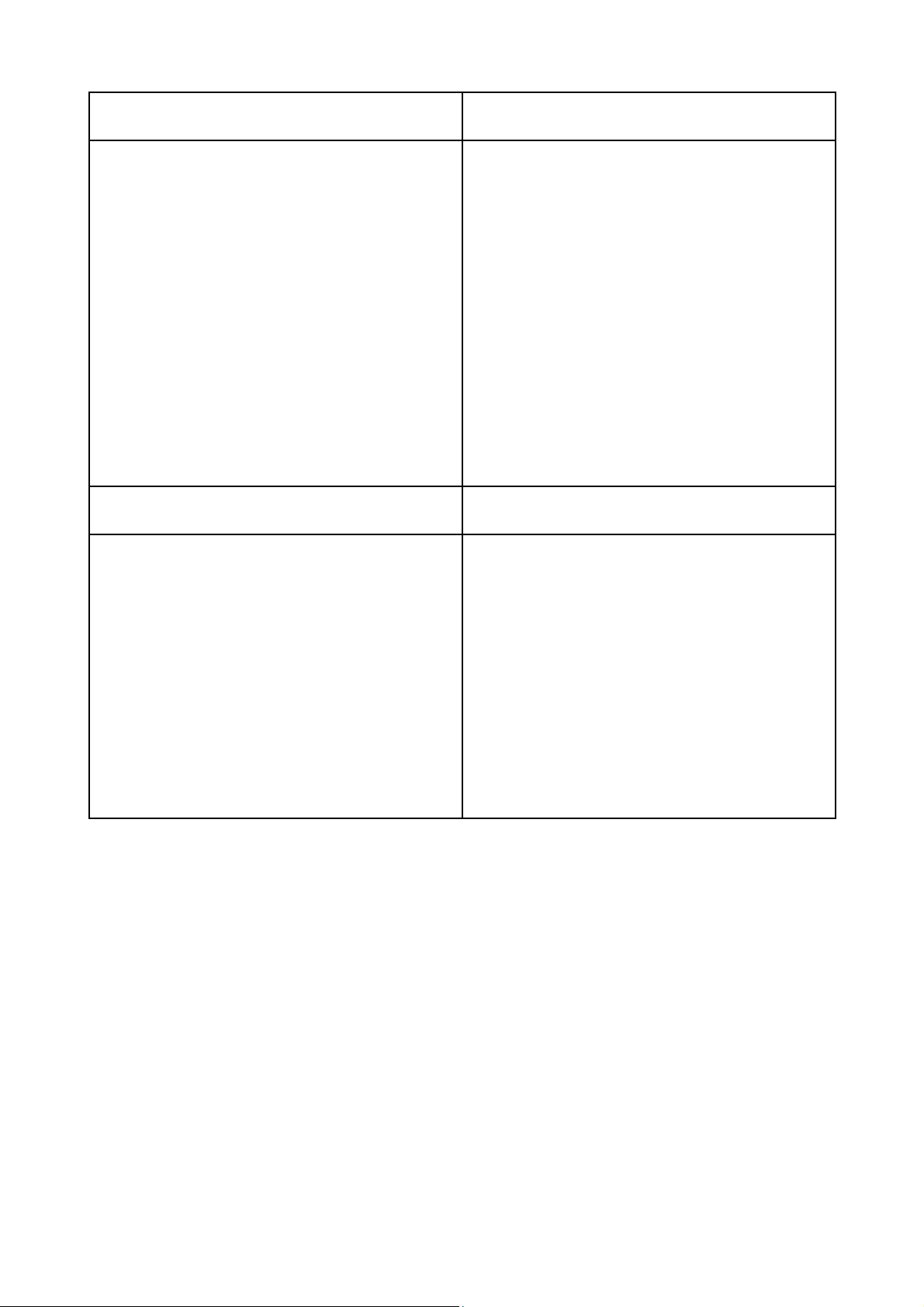

efforts to simplify and modernize customs processes. lOMoAR cPSD| 59691467 3. SWOT Strengths Weaknesses •

Dh Foods has a relatively stable •

The quality and selling price of the financial foundation.

Dh Foods products depend entirely on the •

Dh Foods has a certain number of Le Minh Xuan factory. loyal customers. •

Product quality depends on many •

Dh Foods' product coverage in the

different raw material sources, which can

Vietnamese market and foreign markets is

be affected by factors such as weather, increasingly expanding. crops, diseases,... •

Dh Foods has a diverse product •

Promoting activities of Dh Foods

portfolio and the product quality meets

are not as effective as major competitors international standards.

such as Cholimex, Ajinomoto, Knorr,... •

Dh Foods has been effectively and

stably conducting business operations in

Vietnam and 9 other countries. Oppoturnities Threats •

The spice market in Vietnam is • Nowadays, competitors appear

vibrant and Vietnamese families have a

more and more and new product types are

great need to use spices in meals. The increasingly diverse.

average annual growth rate of this industry •

The large and rapidly changing

is forecast to continue to increase in the

spice market like Vietnam requires Dh coming years.

Foods to adjust and be more active in •

In recent years, the Vietnamese

promoting activities to avoid being kicked government has been promoting out of the spice market.

businesses participating in exporting the

seasoning industry to maintain its position

as the leading exporting country.

=> Although promoting activities of Dh Foods are not effective compared to experienced

competitors in the markets, the company's business activities at this time have shown the

position of the brand in Vietnam and other nations. Thereby, the company is strong enough

and should seize the opportunity by continuing to introduce its products to the international market. 4. Product Portfolio

4.1. Product Portfolio of Dh Foods.

Dh Foods have a wide range of product lines. The current product lines of Dh Foods include:

• Tay Ninh Dipping Salt speciality

• Sauce speciality and Chili sauce • NATURAL Spices specialty lOMoAR cPSD| 59691467

• NATURAL Cooking & Marinade spice

• NATURAL Dipping Salt speciality • Sate Sauce • Soup Base for cooking

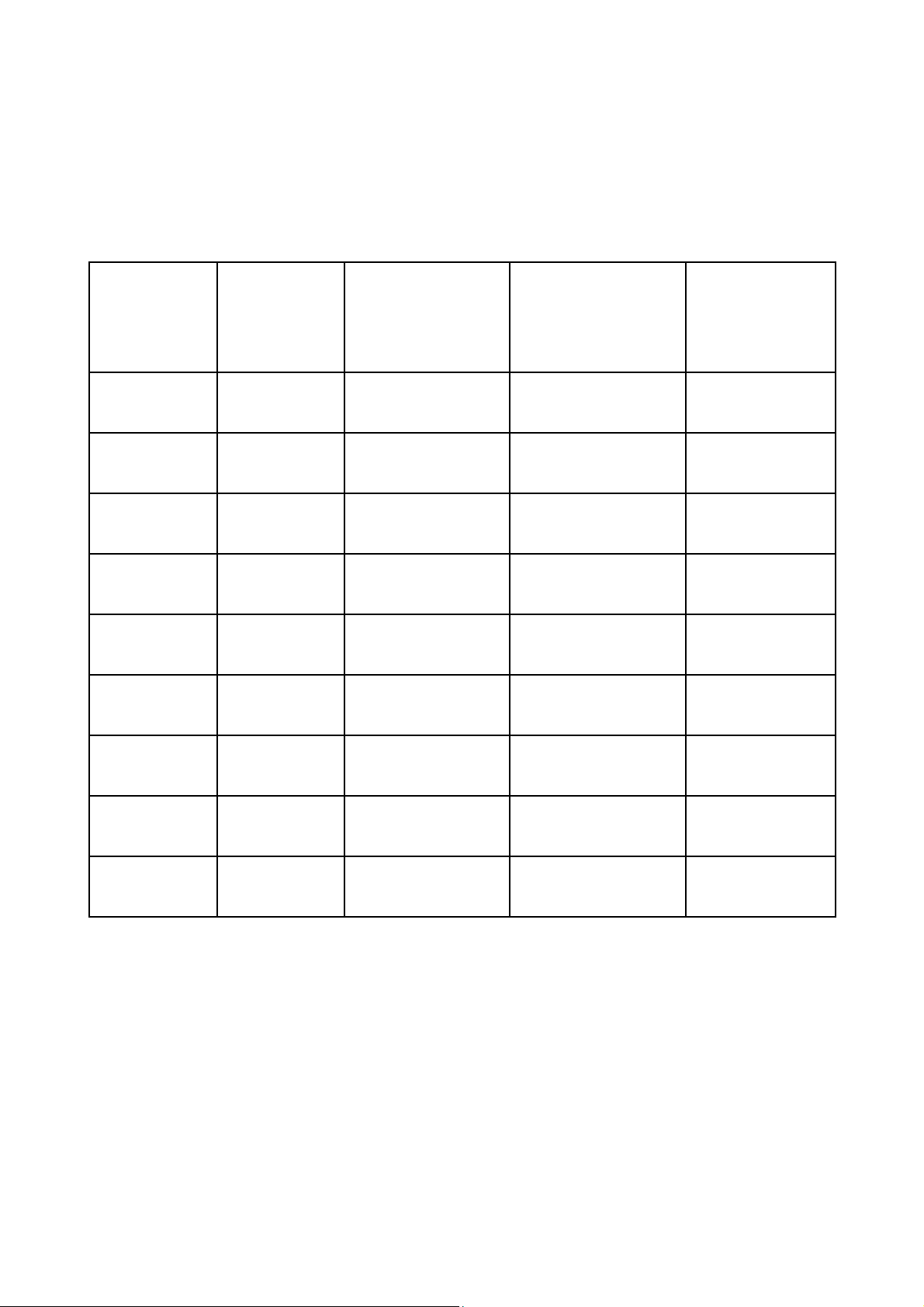

4.2. Product lines that have been exported

Currently, there are 4 product lines exported by Dh Foods to foreign countries. Specific

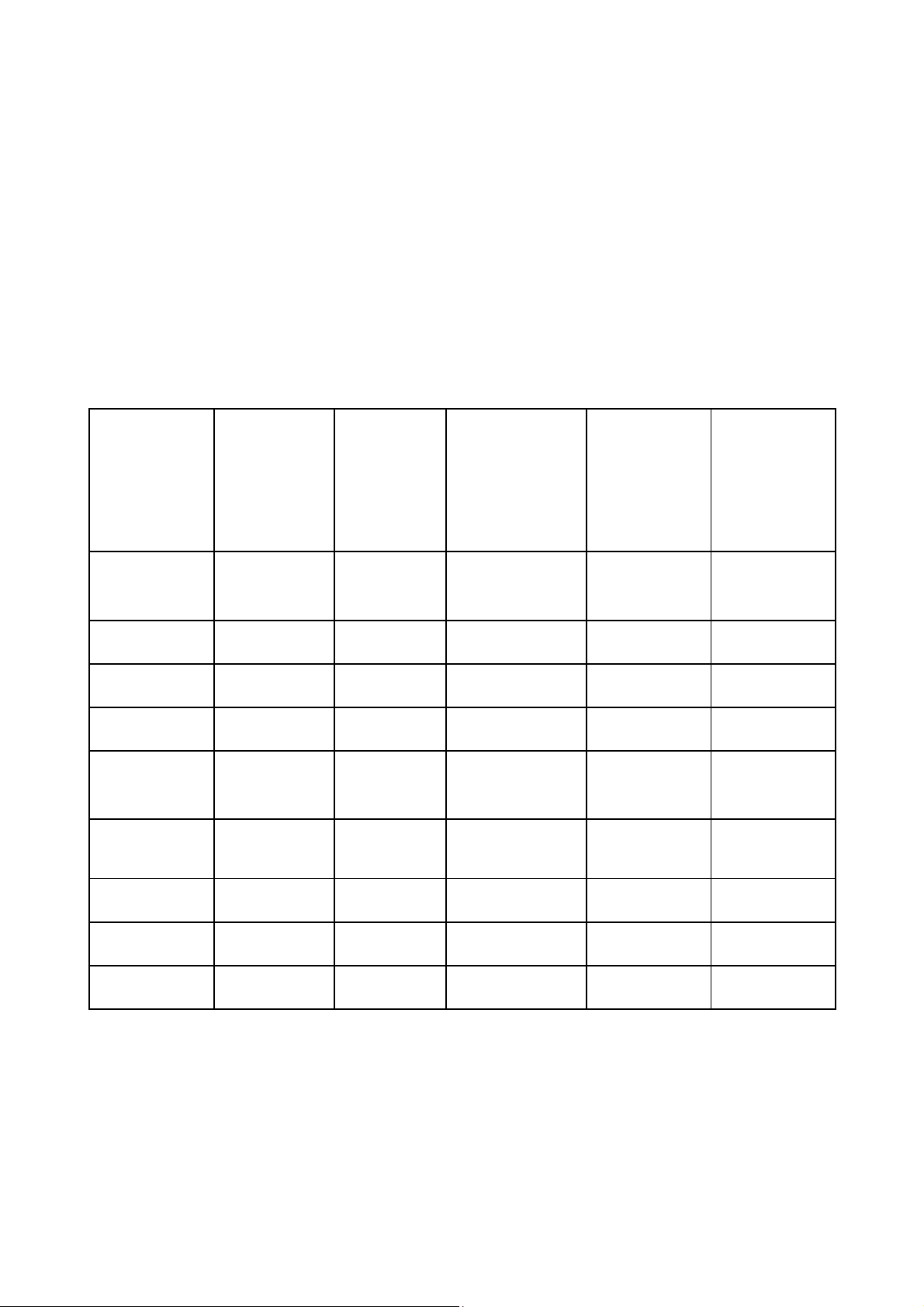

information is given in the following table: Tay Ninh Sauce speciality NATURAL Spices NATURAL Dipping Salt and Chili sauce specialty Cooking & speciality Marinade spice Germany x x x Korea x x Australia x x x Russia x x x x US x x x Japan x x x France x x x Netherlands x x x UK x x x

4.3. The chosen product line

As illustrated in the table, Dh Foods mainly exported 2 types of their product lines

including: Sauce speciality and Chili sauce, and Tay Ninh Dipping Salt speciality. These 2

spice lines of Dh foods have received good feedback in the countries where Dh foods exports.

Furthermore, this is the most prominent product line of Dh Foods and is also the product line that makes the brand famous.

Our group suggested choosing the Sauce Speciality and Chili sauce line of Dh Foods to

export. This product line is suitable for many cuisines around the world, including Asian

cuisine and European cuisine. The Sauce Speciality line includes 19 different sauces such as: lOMoAR cPSD| 59691467

pineapple sauce, mango sauce, orange sauce, salted egg yolk sauce, cheese sauce, kumquat

sauce, black pepper sauce,... With Dh Foods dipping sauce, customers can use it instantly or

use it as a marinade for grilled dishes and vegetables in the simplest and most convenient way. CHAPTER II

INTERNATIONAL MARKET SELECTION

1. A look at Dh Foods' current markets

Currently, Dh Foods products have appeared in nine markets: US, UK, Germany,

Netherlands, France, Russia, Japan, Korea, Australia.

It can be seen that Dh Foods tends to export its products to European, American or East

Asian countries that have high incomes, large enough populations, and have signed trade

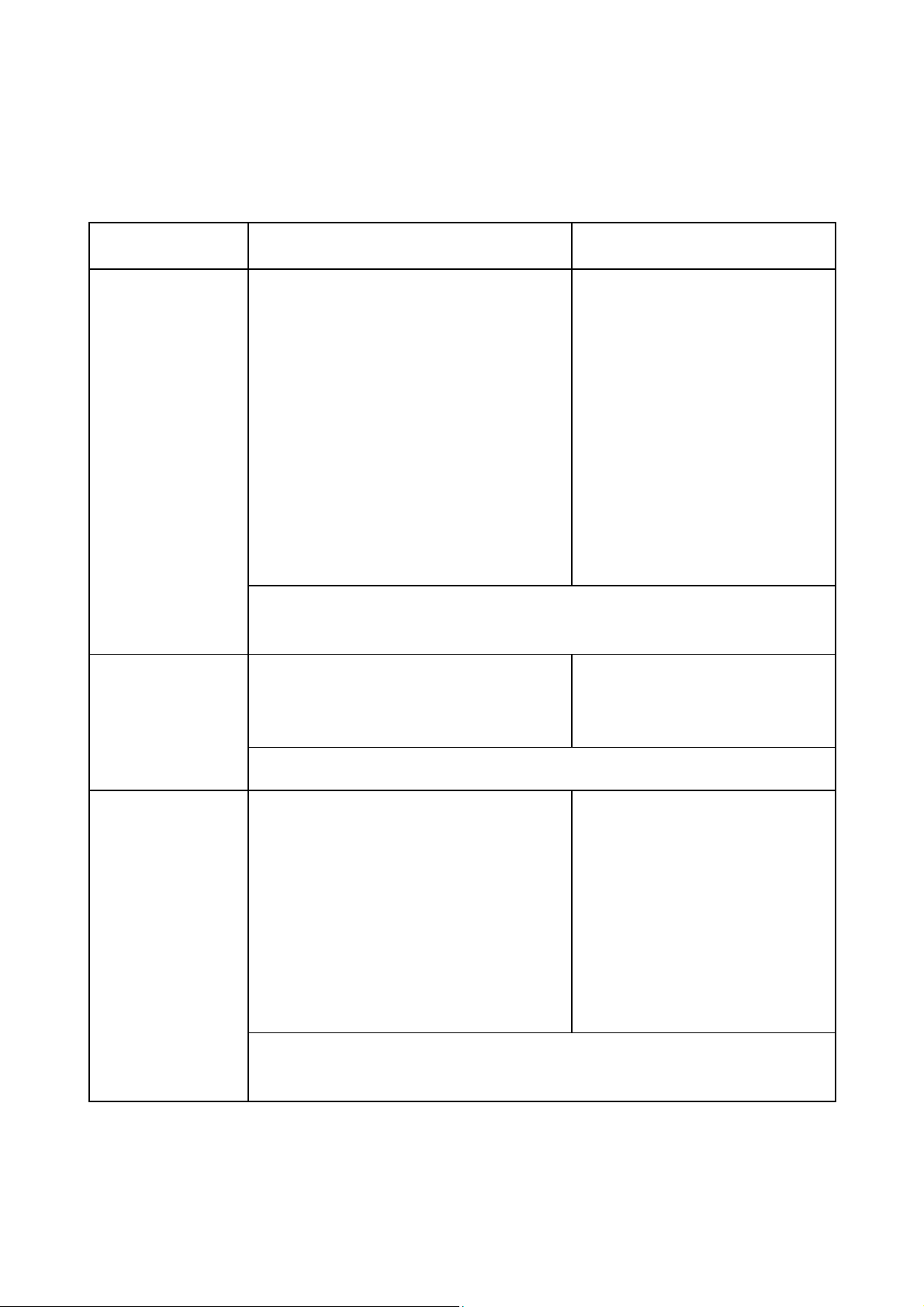

agreements with Vietnam. The following table offers some detailed information about the above markets: 2023 Sauces & Annual Condiments Has at least Vietnamese Wages in one FTA Population Revenue (in Community 2022 (in billion US with Population US dollars) dollars) Vietnam On US 335,533,000 77,463 29.90 2.183.000 negotiating Russia 146,424,729 14,771 5.24 150.000 V Japan 124,450,000 41,509 21.83 432.934 V Germany 84,482,267 58,940 6.53 188.000 V 300.000 – France 67,794,293 31,294 4.79 350.000 V 90.000. – UK 67,026,292 53,985 4.85 100.000 V Korea 51,439,038 48,922 5.42 208.000 V Australia 26,807,000 59,408 1.91 294.798 V

Netherlands 17,942,700 63,225 1.04 24.594 V

From the table above, we can see that Dh Foods has only exported products to markets that

have signed at least FTA with Vietnam, with the only exception being the United States, but

with whom an FTA is being negotiated. The reason is that US has an extremely large spice

market and holds the largest overseas Vietnamese community.

In addition, by taking the smallest figure of each factor, we can set minimum norm for each factor as follows: lOMoAR cPSD| 59691467

- Has the population of at least 17,942,700 people.

- Has the annual wages of at least $14,771.

- Has the revenue in sauces & condiments of $1.04 billion.

- Has the Vietnamese community population of at least 24,594 people. (1) 2. First Screening

We start with the global scale of 195 countries. After excluding 9 markets Dh Foods has

exported products to, there remains 186 countries.

As mentioned in the above section, Dh Foods mainly focuses on markets that have

concluded at least one FTA agreement with Vietnam. Therefore, we continue to filter out

markets that satisfy this requirement, and as a result, qualified countries fall into the following groups: - ASEAN (10 countries)

- South Asian & East Asian (2 countries, including China and India + 1 territory, including Hong Kong) - Central Asian (3 countries) - EU (24 countries)

- South American (2 countries) - North American (2 countries) - Oceanian (1 country)

- Middle East (1 country) These adds up to 46 countries. 3. Second Screening

We continue to filter out countries that satisfy all four requirements in (1).

- Out of 46 countries obtained after first screening, 14 of them has a population of at least

17,942,700 people, including China, India, Indonesia, Mexico, Philippines, Thailand,

Italy, Myanmar, Spain, Canada, Poland, Malaysia, Chile, and Kazakhstan - Out of these

14 countries, 6 of them has an annual wages exceeding $14,771, including Canada, Italy, Spain, Poland, Chile, Mexico.

- 4 of them has the revenue in sauces & condiments of at least of $1.04 billion, including

Canada, Poland, Mexico, Italy.

- The only two countries that satisfy all four requirements are Poland and Canada.

4. Comparison between Polish market and Canadian market

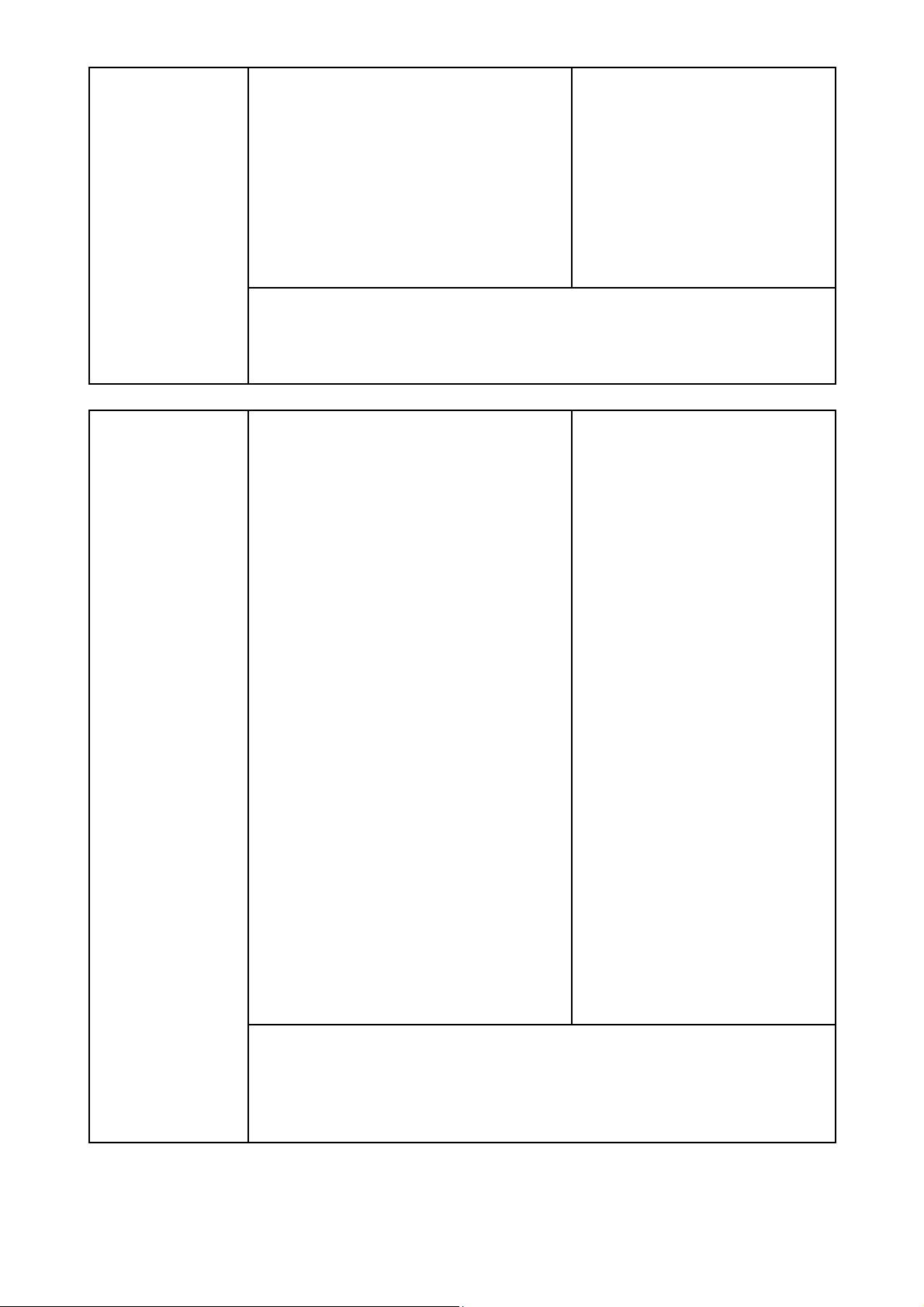

The following table gives an overview of the spice market in Poland and Canada. The 7

factors used for comparison here include: - Market size. - Market growth. - Buying power. lOMoAR cPSD| 59691467 - Strength of FTA. - Market Access. - Competitive intensity. - Political/Economic risk. Country Canada Poland

Revenue in the Sauces & Condiments Revenue in the Sauces &

market amounts to US$5.02bn in Condiments market amounts to 2023. US$1.64bn in 2023.

In relation to total population figures, In relation to total population

per person revenues of US$129.80 are figures, per person revenues of generated in 2023. US$43.63 are generated in

The average volume per person in the 2023. Market Size

Sauces & Condiments market is The average volume per

expected to amount to 18.7kg in 2023. person in the Sauces & Condiments market is expected to amount to 10.4kg in 2023.

In general, it can be seen that in terms of market size, Canada is the better choice.

The market is expected to grow Revenue is expected to show annually by 6.63% (CAGR 2023- an annual growth rate (CAGR Market Growth 2028). 2023-2027) of 9.68%.

Poland market is growing with a faster rate.

The average salary of Canadians is The average income of Polish

about 59,300 dollars a year, among people is approximately

the highest in the world. This enables 32,527 US dollars a year. This

people to invest more in their food, places Poland in the group of with demand for organic foods

developed countries. The rapid increasing. growth in average income also Buying Power gives Polish people more options in choosing food and spices.

Canadians, with the higher incomes and diverse immigrant

communities, have a greater buying power. lOMoAR cPSD| 59691467

CPTPP: CPTPP facilitates the export EVFTA: Poland is a member

of spices from Vietnam to Canada by of the European Union (EU),

reducing or eliminating tariffs on so exports to Poland can

many types of items. This helps benefit from the EU's free reduce export costs and makes trade agreements with other

Vietnamese spice products more

countries. This could reduce or FTA

competitive in the Canadian market. eliminate tariffs on spices from Vietnam.

Both countries have signed FTAs with Vietnam, however, for

agricultural or food products EVFTA has great advantages for exports

to Europe, while CPTPP can be useful for other industrial products .

Technical standards and food

EU food safety and technical

safety: Canada has strict standards for standards: Poland, as part of

food safety and product quality. Spice the EU, sets strict food safety

exports need to comply with these and technical standards.

standards, including food safety However, with exports to a

testing, quality management and number of other EU markets,

compliance with production and

the quality of the product has packaging standards. been certified by the EU.

Certificates and documents: To

import spices into Canada, it is

necessary to provide certificates of

origin, food safety certificates and

other related documents. Product

testing and quality assurance:

Market Access Before export, spice products may

need to undergo quality assurance

and testing to ensure that they meet

Canadian standards. Labeling and

packaging: Label design and product

packaging must comply with special

Canadian regulations. This includes

information about ingredients, origin,

expiration date, and other important information.

Exporting to the Polish market is currently more favorable, with the

support of trade agreements between Vietnam and the EU, as well as

the quality of Dh Foods products having been verified in a number of

markets in other members of this alliance lOMoAR cPSD| 59691467

The spice market, especially Asian Market competition is not too

spices in Poland today, is extremely fierce. In fact, most Asian

competitive. Immigrants from China

spices sold in Poland are often

and India are two large groups among imported individually, or

the immigrant communities here. With imported indirectly through

a rapidly growing population, they

countries in the region such as

brought cooking ingredients as well as Germany or France, instead of

spices from their homeland to Canada. imported directly in large

Supermarkets here also provide a full quantities. .

range of spices imported from Asia to

meet the growing culinary diversity in Competitive this country. intensity

It can be seen that, in terms of competition, the Polish market is the

least fierce market, when compared to a market that already has

imported products, and a market that has a rich amount of domestic spices with low price.

The latest value from 2021 is 0.94 The latest value from 2021 is points. 0.51 points. Political/

Economic risks Canada is of a better favor. However, it should be noted that this is not

a key factor, as the world average is -0.07, and any country with this

index greater than 0 is considered quite stable.

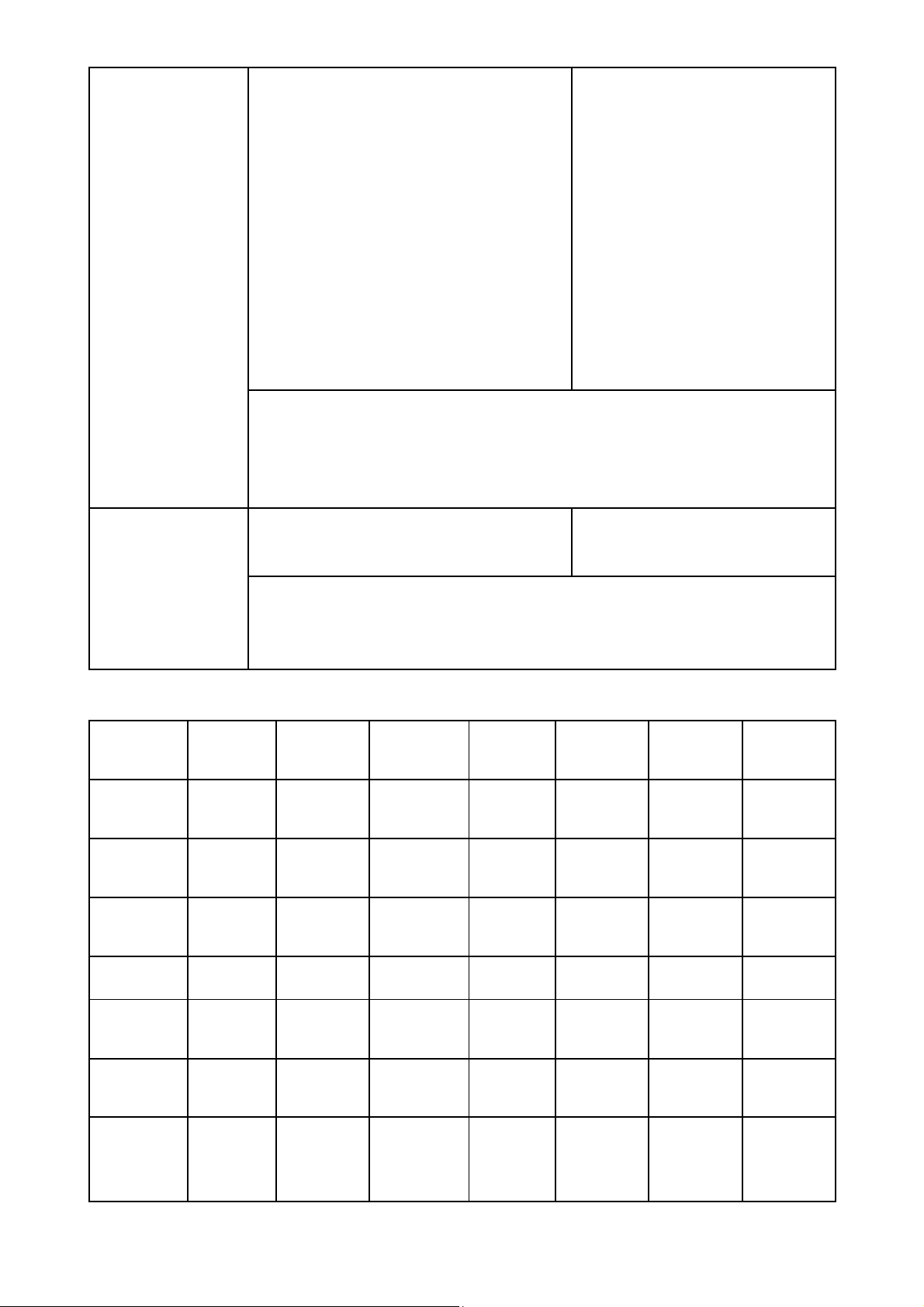

5. Marketing attractiveness evaluation * Poland Very Poor Acceptable Good Very Weight Criteria Poor (1) (2) (3) (4) Good (5) Factor Result Market size X 20% 0.6 Market growth X 10% 0.4 Buying power X 20% 0.6 FTA X 10% 0.4 Market access X 10% 0.4 Competitiv e intensity X 20% 0.8 Political/ economic X 10% 0.4 risks lOMoAR cPSD| 59691467 To tal 100% 3.6 * Canada Very Poor Acceptable Good Very Weight Criteria Poor (1) (2) (3) (4) Good (5) Factor Result Market size X 20% 0.8 Market growth X 10% 0.3 Buying power X 20% 1 FTA X 10% 0.3 Market access X 10% 0.2 Competitiv e intensity X 20% 0.4 Political/ economic X 10% 0.4 risks To tal 100% 3.4 6. Conclusion

Based on the evaluation and comparison table above, the team concluded that DH Foods

should export its dipping sauce products to the country with the higher result, which is Poland.

As demonstrated by the criteria listed in the table, it is possible to infer that Poland is a

promising market for DH Foods to develop in the long run. 7. Region

The Vietnamese community in Poland is the third largest Vietnamese community in

Europe, after that in France and Germany.

Studies show that, as a result of labor exports and student-exchanging activities in the past,

the Vietnamese community is mainly concentrated in large cities of this country. Therefore,

in the first phase of exporting products to Poland, our group will focus on big cities.

Specifically, cities with populations greater than 500,000 people, including Warsaw, Kraków, Wrocław, Łódź, Poznań lOMoAR cPSD| 59691467

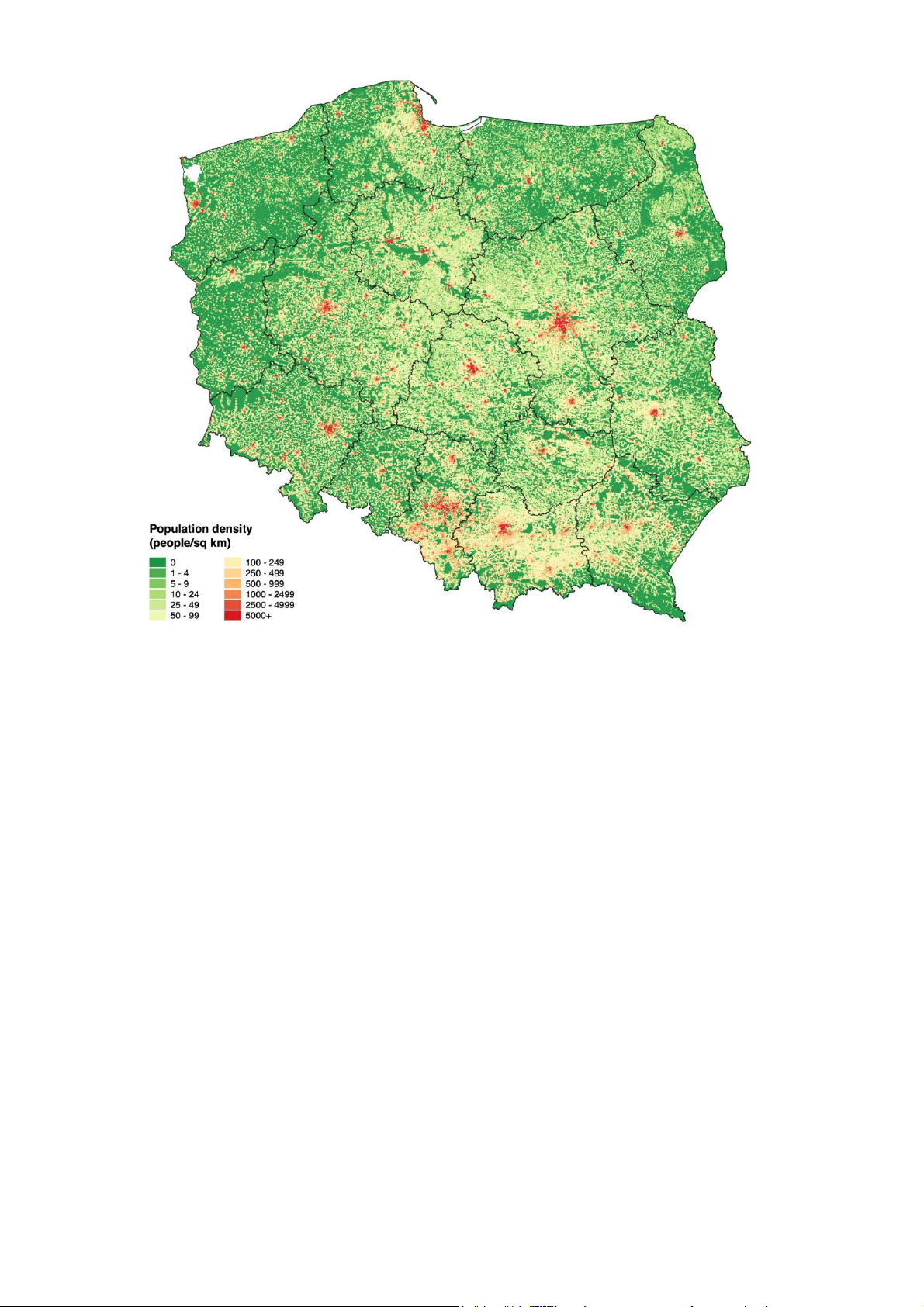

Population density chart in Poland. It can be seen that the 5 points with the largest population

density include the cities of Warsaw, Kraków, Wrocław, Łódź, Poznań CHAPTER III

GENERAL POLISH ENVIRONMENT & SPICES MARKET

1. General Polish Environment

1.1. Introduction of the Polish Market

With a population of over 40 million people, Poland is one of the most populous countries in Europe.

The country has a profound historical legacy, with a timeline that spans over a thousand

years. Having gained its independence in 1918 after World War I, the 20th century brought

significant challenges to Poland, including the devastation of World War II and the imposition

of communist rule by the Soviet Union. Nevertheless, Poland emerged from communism in

1989 and rapidly transitioned into a democratic republic, joining the European Union in 2004.

This history is the foundation for Poland to receive a large number of immigrants from Asian

countries, of which Vietnamese are the largest group here.

Today, Poland is a dynamic and economically developed nation with a diverse and growing

economy. Its prosperous economy and sound policies make Poland a remarkable market for

companies looking to import their goods into the country. lOMoAR cPSD| 59691467

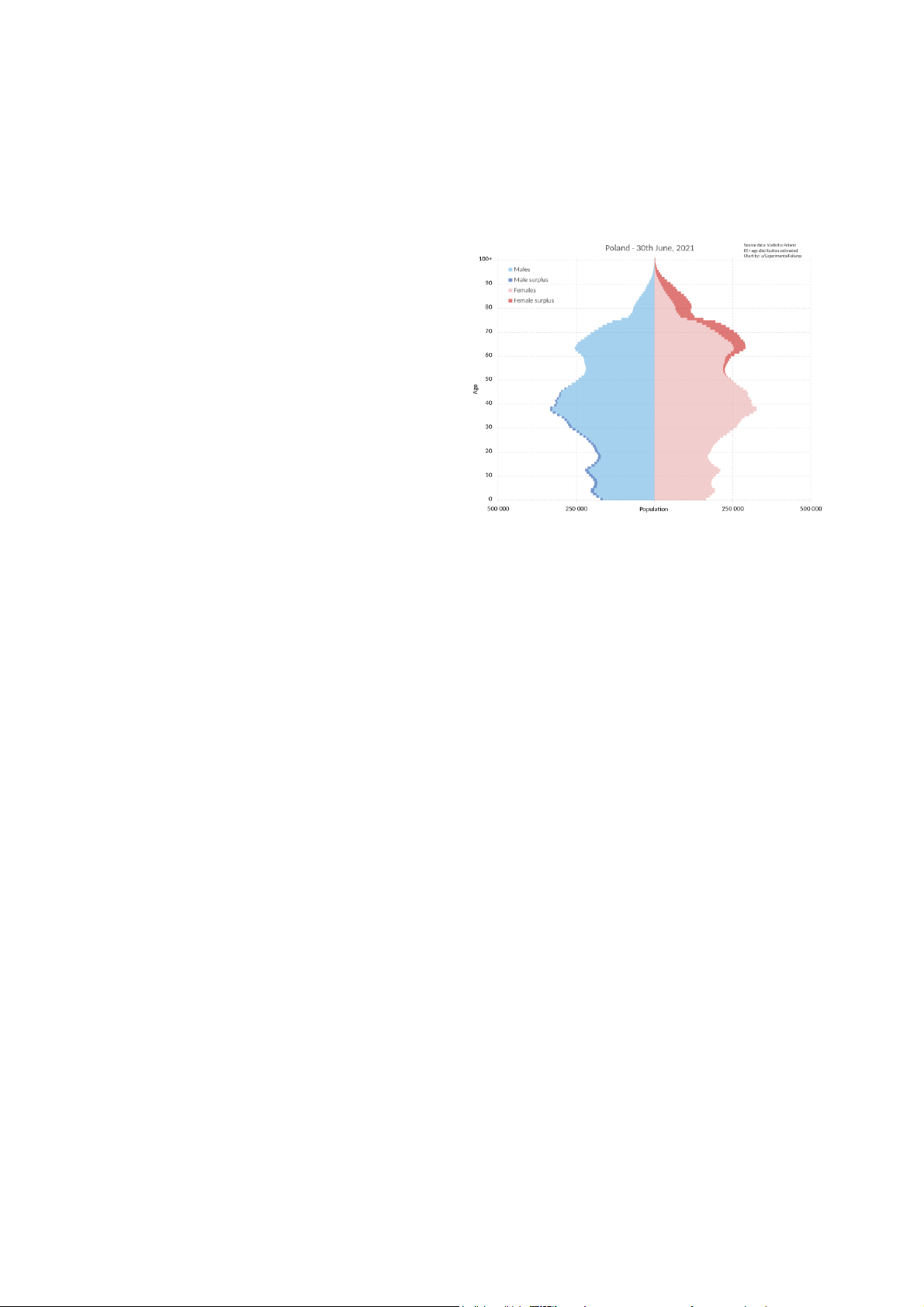

1.2. Demographic Environment

The demographic of Polish customers using spices can vary widely, but there are some

general trends and preferences that can be observed:

• Population: The current population of Poland is 40,761,232 as of Saturday, October

28, 2023, based on Worldometer elaboration of the latest United Nations data. 55.2 % of

the population is urban.

• The median age in Poland is 40.0

years. This means this is a country with an

aging population. Spice usage is prevalent

across all age groups in Poland. However,

younger generations might be more open to

experimenting with international cuisines

and exotic spices. In addition, the high median age also affects

Dh Foods' promotion method when entering this market.

• Gender: There's generally no significant gender bias when it comes to spice

consumption in Poland. Both men and women use spices in their cooking.

• Income Level: Polish people earn USD 32,527 per year on average. This means they

are in the group of high-income countries as defined by the World Bank. Higher-income

households might be more likely to afford a wider variety of spices, including exotic and

imported ones, while lower-income households might stick to more basic and affordable options.

• Ethnicity: European and other immigrant communities, including Vietnamese community. 1.3. Economic Environment

1.3.1.Overview of Poland’s Economic

The economy of Poland is an industrialized, mixed economy with a developed market that

serves as the sixth-largest in the European Union by nominal GDP and fifth-largest by GDP

(PPP).Poland boasts the extensive public services characteristic of most developed economies.

Since 1988, Poland has pursued a policy of economic liberalization but retained an

advanced public welfare system. This includes universal free public healthcare and education

(including tertiary), extensive provisions of free public childcare and parental leave. The

country is considered by many to be a successful post-communist state.

Polish people earn USD 32 527 per year on average, less than the OECD average of USD

49 165. Nevertheless, it is still classified as a high-income economy by the World Bank, lOMoAR cPSD| 59691467

ranking 21st worldwide in terms of GDP (PPP), 21st in terms of GDP (nominal), and 21st in

the 2023 Economic Complexity Index. Poland's economy is considered the strongest economy

among countries in Eastern Europe (after Russia), with an annual economic growth rate of over 6.0%.

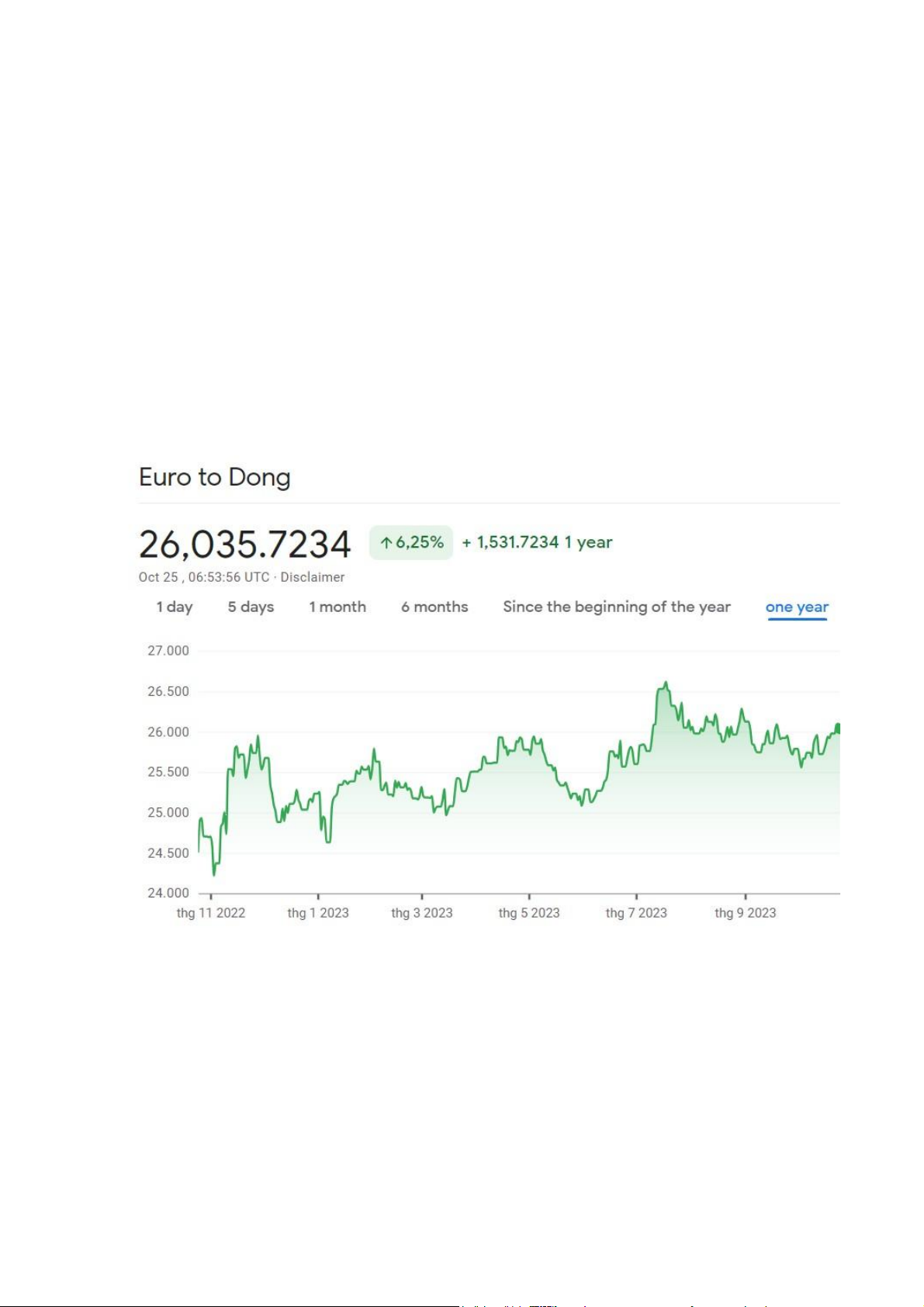

1.3.2. The stability in the exchange rate between Vietnam Dong and currencies

used in Poland (EURO)

The falling EUR affects many exporters to Europe. Accordingly, all customers in Europe

pay in Euro, and Vietnamese businesses that receive money back home must change it to US

dollars. Besides, the local currency zloty is also used. The Euro affects the zloty in a

proportional manner. Therefore, the fact that the Euro falling almost equal to the USD means

that the export value of each shipment decreases accordingly. Meanwhile, profits fall as they

are affected by input costs such as gasoline, raw material prices, and labor costs that have all increased.