Preview text:

lOMoAR cPSD| 59085392 BANKING ACADEMY ADVANCED PROGRAM

GROUP ASSIGNMENT: COMMERCIAL BANKING MODULE CODE : FIN09H TOPIC:

‘THE ROLE OF COMMERCIAL BANKS IN PROMOTING SUSTAINABLE

DEVELOPMENT OF ECONOMY’

Group 2 - Class K24CLCTCB

Instructor : Ts. Nguyen Thi Diem Huong Group members:

Vu Thu Thao ( leader) 23A4010609

Pham Thuy Nhung 24A4012965

Tran Thi Hong Nhung 24A4013122

Nguyen Nhat Minh 24A4010767

Huynh Ngoc Mai 24A4013111 lOMoAR cPSD| 59085392 Ha Noi, 2023 lOMoAR cPSD| 59085392 TABLE OF CONTENT

1. Liturature review ............................................................................................... 1

1.1. Definition and frameworks to calculate sustainable development of economy ... 1

1.2. Role of commercial banks in promoting sustainable development (NCKH) ...... 2

2. Liturature Sustainable developed activites of Vietnam commercial banks ............... 4

2.1. Green banks development ............................................................................ 4

2.1.1 Environmental policy in credit appraisal ................................................... 5

2.1.2. Green credit........................................................................................... 6

2.1.3. Green bond............................................................................................ 9

2.1.4. Community social activities .................................................................. 11

2.2. Digital banks development ......................................................................... 12

2.2.1 Payment ............................................................................................... 12

2.2.2 Lending ............................................................................................... 13

2.2.3 Saving ................................................................................................. 16

2.2.4 Blockchain ........................................................................................... 17

3. Assessment of the activity of Commercial Bank ................................................. 18

3.1. Assessment of the activity of Green Bank .................................................... 18

3.1.1. Achievements ...................................................................................... 18

3.1.2 Limitations ........................................................................................... 19

3.1.3 Solution ............................................................................................... 20

3.2. Assessment of the activity of Digital Bank ................................................... 21

3.2.1. Achievements ...................................................................................... 21

3.2.2. Limitations .......................................................................................... 22

3.2.3. Solution .............................................................................................. 23

4. References ....................................................................................................... 25 lOMoAR cPSD| 59085392 1. Liturature review

1.1. Definition and frameworks to calculate sustainable development of economy

There are different definitions of sustainable development of the economy,

depending on the perspective and context of research. (1) Economic sustainability is a

broad set of decision-making principles and business practices aimed at achieving

economic growth without engaging in the harmful environmental trade-offs that

historically accompany growth. Ideally, sustainable development creates operational

systems that consume natural capital (also known as natural resources) slowly enough that

future generations can also use those resources) (MasterClass, 2022). (2) Sustainable

development of the economy is a concept that aims to balance the economic, social and

environmental aspects of human activity, while ensuring that the needs of the present

generation are met without compromising the ability of future generations to meet their

own needs. (Barbie, E., 1987). It is based on the recognition that natural resources are finite

and that human activities have impacts on the environment that need to be managed and

minimized. (Kieren Mayers, Tom Davis, Luk N. Van Wassenhove, 2021).

There are various frameworks and indicators that can be used to assess and compare

the environmental, social, and governance performance of different entities. Some of the

most widely used frameworks and indicators are the ESG Metrics, the Global Reporting

Initiative (GRI), and The Sustainable Development Goals (SDGs). The E in ESG,

environmental criteria, includes the energy your company takes in and the waste it

discharges, the resources it needs, and the consequences for living beings as a result. Not

least, E encompasses carbon emissions and climate change. Every company uses energy

and resources; every company affects, and is affected by, the environment. S, social criteria,

addresses the relationships your company has and the reputation it fosters with people and

institutions in the communities where you do business. S includes labor relations and

diversity and inclusion. Every company operates within a broader, diverse society. G,

governance, is the internal system of practices, controls, and procedures your company

adopts in order to govern itself, make effective decisions, comply with the law, and meet

the needs of external stakeholders. Every company, which is itself a legal creation, requires

governance. (Witold Henisz, Tim Koller, and Robin Nuttal, 2019). lOMoAR cPSD| 59085392

GRI Standards are based on a Triple Bottom Line, disclosing information about the

achievement of specific economic, social and environmental results.Sustainable

development indicators are combined into three thematic standards: economic standard –

6 indices, environmental standard – 8 indices and social standard – 19 ones (Vera Samarina,

Tatiana Skufina, and Aleksandr Samarin, 2020)

To sum up, this research would consider that sustainable economic development

involves balancing economic growth with social and environmental considerations, while

ensuring intergenerational equity.

1.2. Role of commercial banks in promoting sustainable development (NCKH)

Lala, Stone (2023) states that commercial banks can help promoting sustainable development in four methods:

Financing renewable energy projects: invest in renewable energy projects, such as wind

and solar power, as a result reduce reliance on fossil fuels and support the growth of the renewable energy sector.

Green loans: make loans to businesses and individuals who have investment in sustainable

technologies, such as energy-efficient buildings and electric vehicles. Risk management:

identify and assess climate change risks, therefore banks can take steps to mitigate these

risks and ensure the long-term sustainability of their lending and investment activities.

Innovation: develop new financial products and services such as green bonds and other

financial instruments to finance sustainable projects.

Nguyễn Khánh Duyên (2018) indicates banks may create sustainable business

development through their credit policies, such as providing capital and encouraging

environmentally friendly projects, making an impact through service activities like

investment consulting. Moreover, commercial banks can offer "green" or "sustainable"

loans not only for large infrastructure projects but also in various sectors of the economy,

such as projects aimed at energy efficiency. Adhering to industry sustainability standards

can help banks better assess and manage environmental and social risks in projects and

avoid negative impacts on the environment. Additionally, banks contribute to sustainable

development by promoting comprehensive finance. Comprehensive finance involves

providing suitable and convenient financial services to all individuals and organizations,

especially those with low incomes and vulnerabilities, to enhance access to financial

resources, contribute to livelihood opportunities, circulate investment capital, and savings lOMoAR cPSD| 59085392

in society, thereby driving economic growth. Therefore, banks play a specific role in

achieving the Sustainable Development Goals (SDGs) as outlined in the tasks assigned to

the banking sector in the National Action Plan for Implementing the 2030 Agenda for Sustainable Development.

Ryszawska (2018) emphasizes the importance of digital banks in promoting a

sustainable economy. Thanks to technology development such as climate finance, green

finance, carbon finance, banks support sustainability transitions. It may be observed that

traditional banks are changing to adjust digital innovation, decentralized and sustainable

production and consumption. Moreover, banks play an important role in financing

production of energy from renewable sources, waste recycling, reduction of greenhouse

gas emission, modern products and technologies with improved energy efficiency,

sustainable transportation, sustainable supply chains, and sustainable consumption.

It was revealed by Khaliun’s research (2015) that when commercial banks invest in

environmentally oriented projects, they may effectively manage their resources as well as

fulfill social responsibility and thereby build confidence in present and future customers..

For the effective development of the investment credit organizations need to balance the

supply and demand of the real sector. Commercial banks fulfill their social responsibility

as well as solve the problem of cash flow balance when sending their financial resources

to environmentally oriented investment projects.

Standard Bank Limited has categorized green banking products into several items

to emphasize diversification and promote sustainable development. 1. Renewable energy

a. Solar energy: solar home system, solar micro/mini grid, solar iIrrigation pumping

system, surface water purification plant using solar pump, solar photovoltaic (PV) assembly plant, …

b. Bio-gas: organic manure from slurry, mid range bio-gas plant, biomass based large

scale bio-gas plant, poultry & dairy based large scale bio-gas Plant

c. Hydro-power: hydropower (Pico, Micro & Mini)

d. Wind-power: wind energy driven power plant

2. Energy efficiency: substitution of conventional lighting system, electronic material,

boiler with energy efficient alternatives on the basis of Energy Audit; auto sensor

power switch assembly plant, energy efficient Improved Cook Stove (ICS)/ICS lOMoAR cPSD| 59085392

Renewable/Hybrid Cook Stove Assembly Plant

3. Recycling & Recyclable Initiatives: PET Bottle Recycling Plant, Plastic Waste

Recycling Plant (PVC/PP/LDPE/HDPE,PS), Wastage Paper Recycling Plant for

Production of recycled paper, plate, mug, glass, Recyclable Baggage Manufacturing Plant

In addition, there are some outstanding digital banking products to pursue the goal of

sustainable development:(Sayan Das, 2022): (1)Savings accounts: easy access to banking

services and preserve money's purchasing power with interest; (2)Current accounts: make

multiple transactions daily; (3)Cash withdrawals and deposits: withdraw from or deposit

cash into these accounts. (4)Fund Transfers: users can transfer money between bank

accounts, e-commerce services, or other business transactions. (5)Bank statements:

generate bank statements online using the bank's mobile application or website; (6)Loans:

give loans to their users through digital means only.

In conclusion, many researchers conclude that commercial banks have a positive

influence on sustainable development. Banks promote economy’s sustainable development

by enhancing comprehensive finance, offering green loans and mobilizing fund for economic development.

2. Liturature Sustainable developed activites of Vietnam commercial banks

Recently, the Vietnamese government has actively participated in implementing

international commitments to reduce greenhouse gas emissions, minimize the impact of

climate change, towards sustainable development goals as committed to implementing the

2030 Agenda for the sustainable development at the United Nations Summit. In particular,

the banking industry is always identified with its roles in "greening" investment capital

flows for sustainable development goals. Within the framework of the green banking and

green growth development plan proposed by the Government, commercial banks have also

made changes to suit the new market.

2.1. Green banks development

Within the framework of promoting and developing green banking, commercial

banks have been researching and proposing new policies to promote sustainable

development, including: Environmental policy in credit appraisal, green credit, green bond

and community social activities. lOMoAR cPSD| 59085392

2.1.1 Environmental policy in credit appraisal

According to an assessment by PanNature, before 2015, Vietnam had not issued any

environmental safety policies for credit granting activities, and a number of banks had

developed environmental and social risk management policies. The association is still

relatively small. However, recognizing the importance of environmental risk management

in credit granting, the State Bank of Vietnam has taken many different steps to promote

sustainable finance, and at the same time, provide directions. guidelines to promote green

credit growth and manage environmental and social risks in credit granting activities.

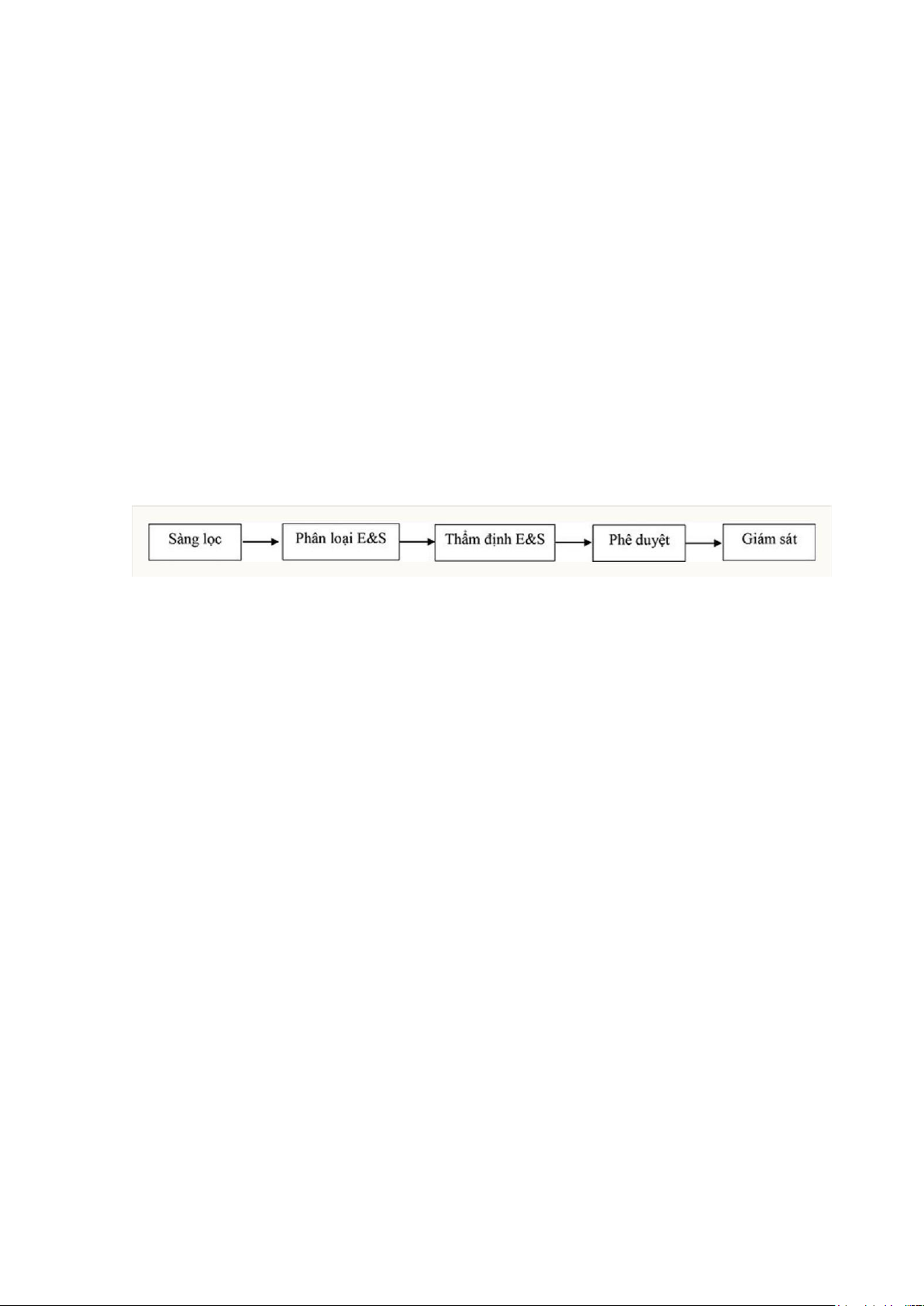

Currently, some commercial banks have basically built and completed their internal

Environmental and Social Management System (ESMS) to serve the assessment of

environmental and social impacts during the appraisal process. determining and granting

credit, usually includes the following steps:

Source: author's compilation

In 2012, Sacombank was the first bank to deploy the ESMS system with a

combination of the following elements: Strategy, governance model, environmental and

social policy (E&S) integrated into the credit granting process. application, an Excel toolkit

including a questionnaire to assess E&S impacts on customers, establishing an ESMS team

at the Head Office.to conduct training for personnel to directly perform the assessment and

participate in the appraisal process, environmental and social impacts on customers. By

2016, the Credit Department (State Bank) said that two more banks had built internal

environmental risk management systems: Vietnam Technological and Commercial Bank

(TechcomBank) and Vietnam Bank for Industry and Trade. (VietinBank). Up to now, many

commercial banks have paid more attention and partly integrated environmental and social

risks in the appraisal of loan projects. For example, BIDV does not approve credit for

unplanned projects, professionalizing environmental and social risk management in the

credit granting process; promulgate a sustainable loan framework to provide green loans

and sustainable linked loans for businesses. Vietcombank only approves credit for projects

that have been approved for environmental impact assessment and requires project owners

to provide information related to technology and environment in the loan application. At

VPBank, since 2016, the bank has issued policies on environmental and social risk lOMoAR cPSD| 59085392

management, by 2018 it has completed the environmental and social risk management

system (ESMS) and in 2022, the ESMS system credit granting became part of the bank- wide ESG policy.

Additionally, in February 2023, BIDV was the first bank to successfully develop a

sustainable loan framework based on advice from the Carbon Trust, designed to provide

the most popular sustainable loan products on the market. The global market today includes

thematic loans and sustainability-linked loans. This sustainable loan framework includes

Green Loan Principles, Social Loan Principles, and Sustainability-Linked Loan Principles.

The promulgation of the Sustainable Loan Framework helps position BIDV as a reputable

bank, with an active role in implementing the Sustainable Development Strategy of the Government of Vietnam.

However, the actual implementation of the environmental and social risk assessment

system in credit granting activities of most banks only stops at integrating requirements on

projects that have been approved for assessment. In addition, the sustainable development

reports of commercial banks show that there are no significant actual or potential negative

environmental impacts on the banks' product supply chains, nor are there any complaints.

Complaints about environmental impacts, no loan case has been closed due to

environmental issues of the project. This practice shows that many banks have not fully

assessed environmental and social risks in granting credit and monitoring E&S risks after

capital transactions with customers. 2.1.2. Green credit

In Vietnam, there are many different definitions of green credit, but in general, green

credit can be understood as credits supported by the banking industry for production and

business projects that do not cause environmental risks. environment, or for the purpose of

protecting the environment, contributing to protecting the general ecology.For example,

Techcombank has signed a credit cooperation contract with IFC to sponsor energy saving

and clean production projects of small and medium-sized enterprises in Vietnam.

Accordingly, Techcombank and IFC will finance businesses to change equipment, upgrade

technology and systems to improve energy saving efficiency, expand production, cut costs,

and reduce gas emissions. waste. In addition, Techcombank, along with ACB and VIB, also

plays a role in supporting financial appraisal and providing credit at the Green Credit Trust

Fund established by the Swiss Federal Economic Department (SECO). The fund's lOMoAR cPSD| 59085392

operating purpose is to provide financial support for clean technology investment projects

of domestic enterprises, and at the same time, encourage customers to develop investment

products that bring environmental benefits to the community. copper.

Survey results on the application of "green credit" in the banking industry by the

State Bank show that 19 credit institutions have developed environmental and social risk

management strategies, of which 13 credit institutions have integrated risk management

content. environmental and social risks into the green credit operating process, 10 credit

institutions have built banking credit products for green credit, 17 credit institutions have

used environmental and social risk assessment handbooks for 10 Economics. Along with

that, preferential/support policies for banks lending to environmentally and

climatesensitive fields (providing preferential loans or applying low interest rates or

compensating for interest rate differences) …) has also been done. In addition, commercial

banks with a high proportion of green credit loans are also given priority in accessing

preferential loans from international organizations and development partners.

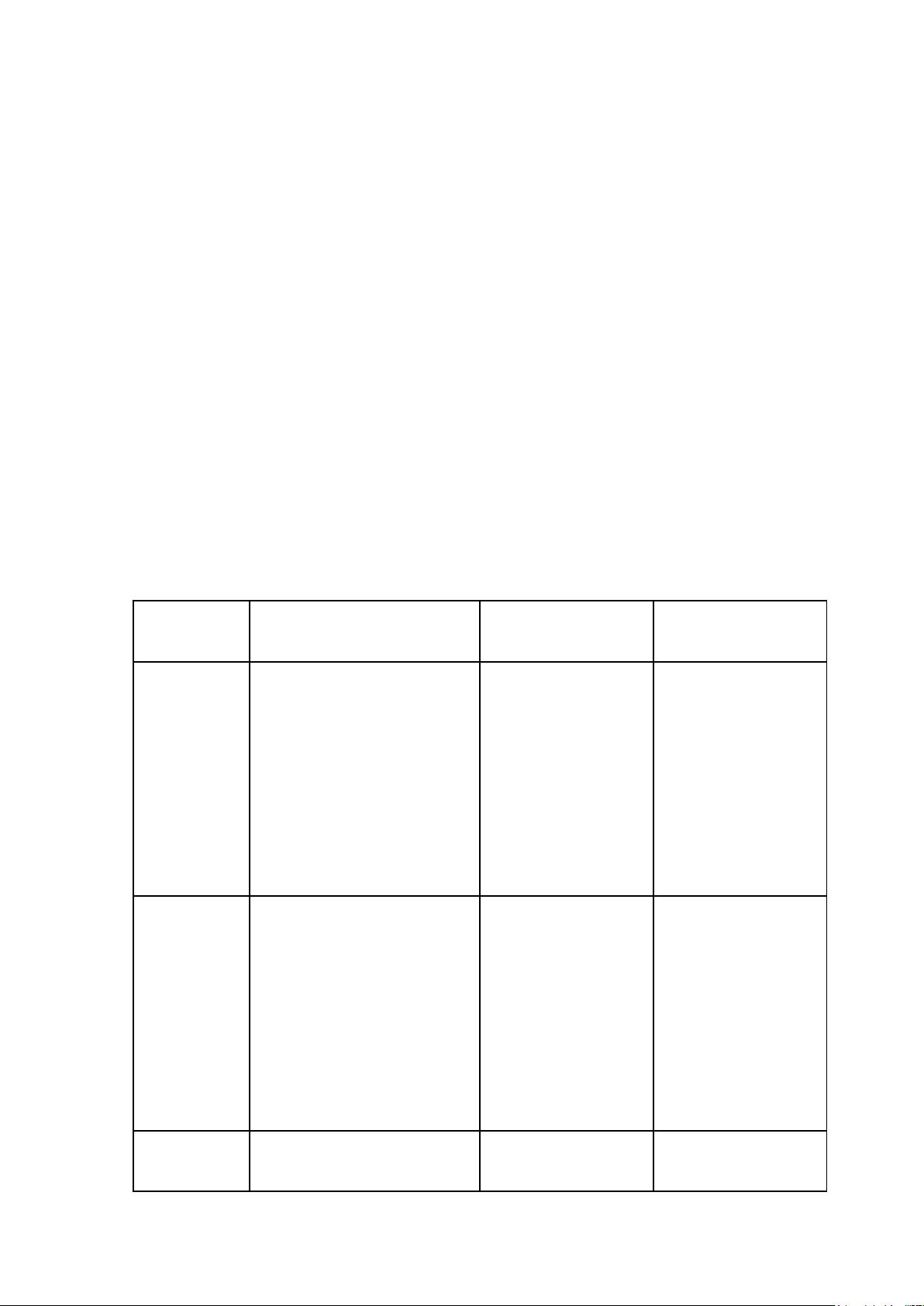

Green credits lending incentives of some Commercial Banks Banks Loan purposes Loan rate Tenor BIDV and Clean energy, green Medium and long Minimum 2 years Agribank

agriculture and projects to term: 8,7%/year in reduce pollution and treat the first 3 years waste From 4th year: 12 months saving + 4% margin VietinBank Energy saving and Medium and long Minimum 2 years efficiency projects under term: 8,1%/year EIB environmental credit program, GCPF credit program, REDP renewable energy projects Sacombank Development strategies, Medium and long Maximum 8 years lOMoAR cPSD| 59085392 production processes or term: 8,5%/year in loan use purposes that no the 1st year risk to environment, From the contributing to protect the following years: common ecosystem 9,5% Nam A Environment friendly Short term: Maximum 2 years Bank investment. The projects 7%/year promote reduction of CO2 Medium term: emissions, and save 20% 8,8%/year in the energy first 24 months Incentive package: 7,7%/year MBBank Renewable energy

Medium and long Maximum 15 years industry, green building term: Apply loan products, lending for margin 2,8%/year projects on waste (normally margin treatment 3%/year) HDBank Renewable energy and

Approval depends Maximum 10 years high tech agriculture on each case projects SHB Projects for renewable Preferential Maximum 10 - 15 energy and clean energy interest rates from years 1% - 1,5% compared to market interest rates

Sources: Banking Magazine lOMoAR cPSD| 59085392

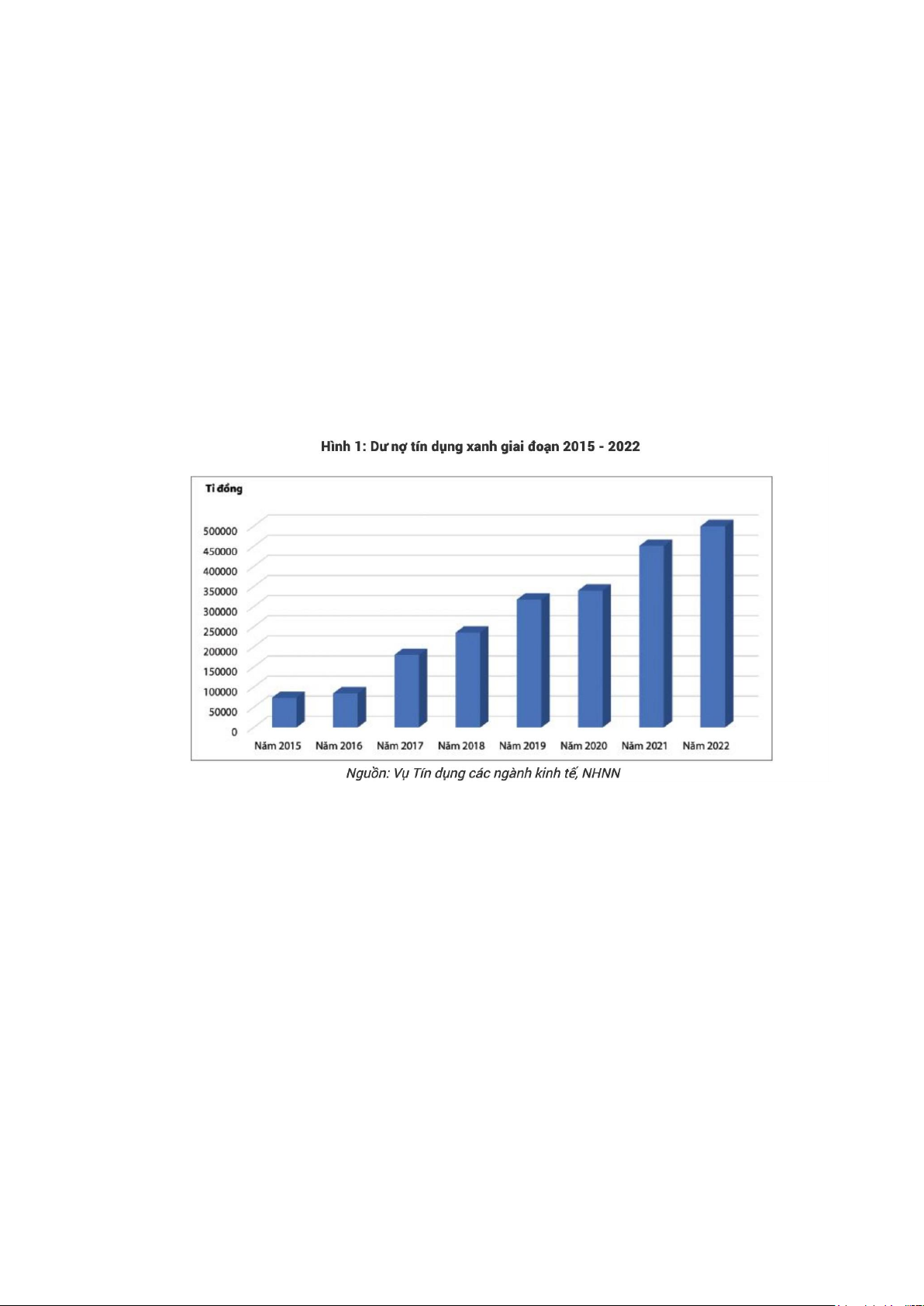

Commercial banks actively complete the development of internal regulations on

environmental and social risk management in credit granting activities, which has brought

encouraging results. By the end of 2022, outstanding credit for green projects (12 green

projects built and issued by the State Bank since 2015) reached nearly 500,000 billion VND

(accounting for about 4.2% of the total outstanding debt of the economy). economy),

focusing on areas such as renewable energy, clean energy (accounting for the highest

proportion of 47%), followed by green agriculture (accounting for over 30%). Credit

institutions actively evaluate environmental and social risks in credit granting activities

with outstanding loans reaching more than 2.2 million billion VND with more than 1.1 million loans.

Green credit loans are mainly focused on green agriculture (accounting for about

46%), sustainable water management (accounting for about 13%), and recently tend to shift

to a number of fields. other such as renewable energy and clean energy (Tran The Anh,

2022). Many important fields in environmental protection and response to climate change

such as waste management, transportation and sustainable construction... are still very limited. 2.1.3. Green bond

Compared to other countries in the world, the green bond market in Vietnam is being

implemented more slowly. However, in recent years, there have been a number of green

bond-financed projects implemented in Vietnam. Domestic banks have only issued 216

million USD in green bonds in the past 5 years, although there are many environmental,

social and governance (ESG) projects that are looking for capital and investors looking for lOMoAR cPSD| 59085392

them. investment opportunities. The majority of proceeds from bond issuance (57%) are

used for renewable energy - the main industry of interest to Vietnam, in addition to the

water, waste and agriculture sectors (MOF, 2021).

The overall picture of the green bond market in Vietnam is currently assessed to be

in its early form, undeveloped, the scale, type and foundation of supply and demand for

green bonds are all uncertain, in particular, the system The information system, propaganda

and understanding of investors in particular and the market in general about green bonds

are still very limited. In terms of structure, green bonds in Vietnam today are mainly local

government bonds financing green projects, Vietnamese commercial banks are only in the

early stages of developing products and services. green bond projects, 40% of Vietnamese

banks do not have green investment projects in their investment portfolio.

In October 2023, BIDV successfully became the first bank to issue green bonds

worth VND 2,500 billion according to the Green Bond Principles of the International

Capital Market Association (ICMA) in the domestic market. Accordingly, BIDV has

achieved Moody's rating for the Green Bond Framework of credit institutions, confirming

compliance and high-level transparency in project selection, appraisal, lending,

management and reporting regimes. Proceeds from bond issuance will be used to finance

green projects, save energy, reduce emissions, and protect the environment. BIDV's bond

issuance is also the first green bond issuance in Vietnam with a no-collateral structure, no

secondary debt and no need for payment guarantees, demonstrating a high level of

credibility. capacity and reputation of the issuing organization. All investors participating

in the transaction are insurance companies and fund management companies belonging to

the world's leading insurance groups. BIDV's Green Bond framework is highly rated by

Moody's Credit Rating Organization with the SQS2 (very good - very good) rating being

the second highest in a total of five rating levels.

BIDV's successful issuance of green bonds according to ICMA standards not only

has good meaning, contributing to the operations and reputation of the business but also

inspires other corporations and commercial banks to do the same. efforts to green the economy. lOMoAR cPSD| 59085392

2.1.4. Community social activities

In addition to continuously building, innovating and providing modern and digital

financial products and services, green banking is also demonstrated through socially responsible investing.

Currently, most commercial banks in Vietnam have a separate fund serving community

activities. Among investments in social security, investments in improving the quality of

education and health care receive the most attention and investment from banks. In

addition, banks also sponsor volunteer and charity activities with the goal of sharing

difficulties and improving the quality of life of the community.

For example, Vietcombank said that community contribution is a core goal in the

bank's development strategy, focusing on the fields of health, education, supporting the

construction of charity houses, and giving gifts to the poor and families. policy families,

wounded and sick soldiers... The implementation of these activities spans all parts of the

country, from urban to rural areas, with a focus on mountainous areas, ethnic minorities,

and islands. Some welfare and charity activities that Vietcombank supports include Hoang

Tru primary school (Kim Lien, Nghe An) with a budget of 8 billion VND, Vang Anh

kindergarten (Ca Mau) with a cost of 13 billion VND, charity houses for the poor Quang

Ngai province worth 5 billion VND,... Besides sponsoring the construction of schools and

classrooms, the bank also focuses on supporting health insurance and social insurance

payments for the poor. At the end of November 2022, the bank transferred 1,000 social

insurance cards and 9,968 health insurance cards, with a total value of 5 billion VND, to

give to people in difficult circumstances.

In the period 2017 - 2022, in addition to implementing financial and monetary tasks

to serve the country's economic development programs, BIDV has also pioneered and

proactively allocated funding from the bank's operations. as well as mobilize employees to

contribute to implementing social security programs. The total cost of BIDV implementing

social security programs in the past 5 years is nearly 1,500 billion VND. Funding areas

focus mainly on education, health care, eliminating temporary housing for the poor, and

overcoming the consequences of natural disasters...

In addition, as of June 2023, Agribank has donated 215 billion VND for social

security activities in localities across the country, of which, separate funds are for building

charity houses and charity houses. for the poor, the great solidarity house is 56 billion VND, lOMoAR cPSD| 59085392

the budget for educational activities is 69 billion VND, and nearly 55 billion VND for health care.

In general, community activities for social security are one of the activities that have

long been promoted in the tradition of commercial banks and have brought many benefits

not only to the environment but also to the people. contributing to social stability and

development background terrible international.

2.2. Digital banks development

With the strong development of the new technology era, applying technology to

banking services not only increases convenience for customers but also promotes

sustainable development by contributing to reducing printed documents, as well as

reducing the number of vehicles having to travel to the bank building. Those developments

can be mentioned such as online banking, online lending, saving and blockchain. 2.2.1 Payment

Vietnam has welcomed the e-banking trend since the mid-2000s. Although there are

still many shortcomings in banking service supervision, the Government is also trying to

create conditions for banks to exploit their potential and develop the above services. A sign

that the e-banking trend is gaining a foothold in Vietnam is the explosion of digital

payments. Vietnamese people increasingly prefer this payment service instead of using

cash. Especially in the early stages of the Covid-19 pandemic, in the first months of 2020,

digital payment figures skyrocketed. Compared to the same period in 2019, the value of

payment channels via the Internet increased by nearly 50%, payments via smartphones

increased by nearly 160%. During the period of social isolation, electronic payment

activities increased in number. quantity, price and transactions. volume also increased.

Since then, people have gradually become accustomed to the convenience that digital

payments bring. Even after the epidemic passed, the proportion of cash payments still decreased significantly.

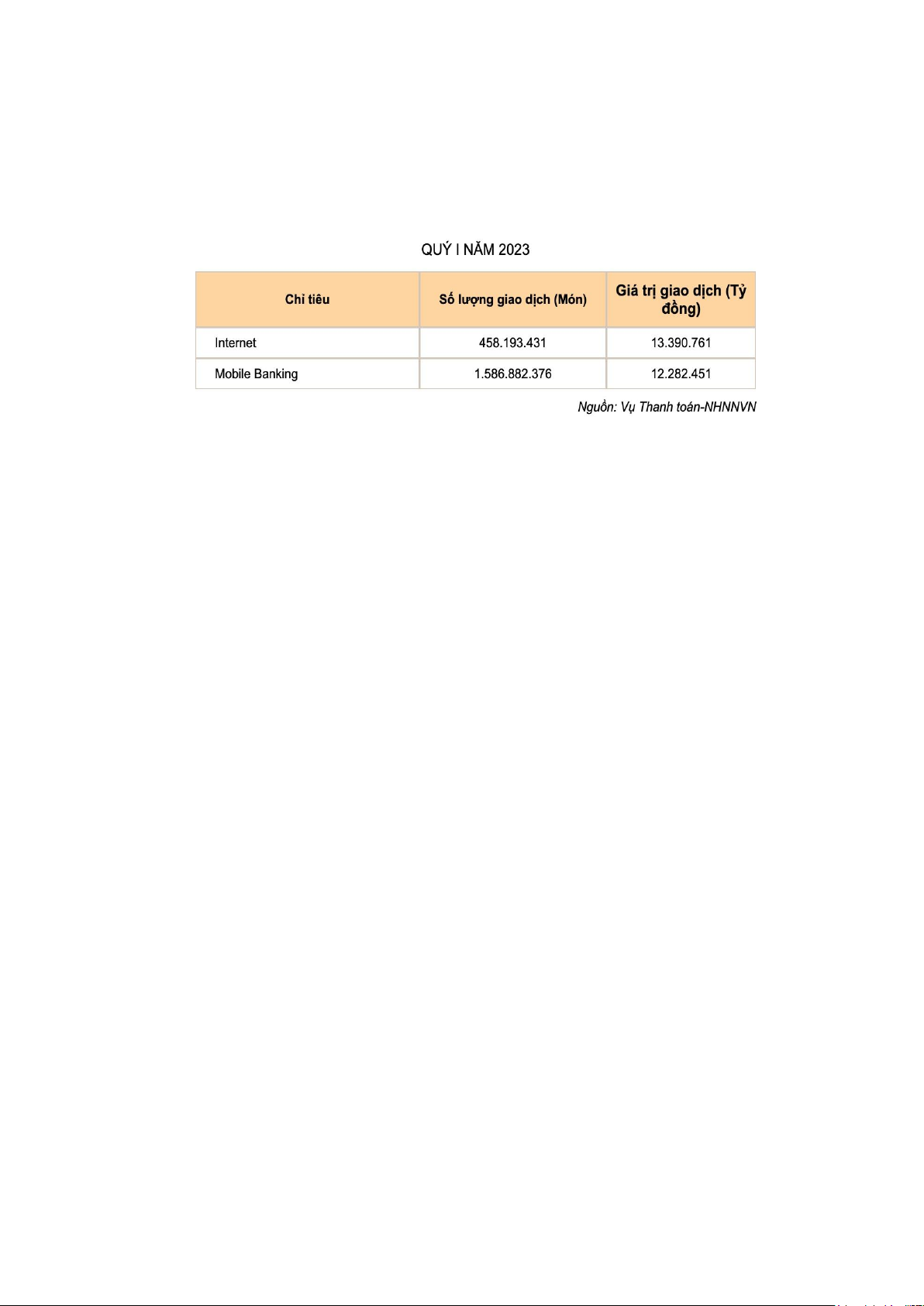

According to data published by the Payment Department - State Bank of Vietnam,

in the first 7 months of 2023 compared to the same period in 2022, non-cash payments

increased by 51.14% in quantity, via Internet channels increased by 66.46%. % in quantity,

via mobile phone channel increased by 63.09% in quantity; via QR Code increased by

124.15% in quantity. Online account opening will be carried out from the end of March

2021. As of June 2023, there were nearly 27 million accounts opened using the eKYC lOMoAR cPSD| 59085392

electronic method. There are 10.8 million cards in circulation using the eKYC method.

This is the result of the banking digital transformation process that has changed customers'

behavior in using banking services, contributing to accelerating the banking digitization process.

The increasing demand for digital payment makes the race between banks more

exciting than ever as the goal of digital transformation and cashless payment is being

promoted. According to a report by the State Bank, currently 94% of commercial banks

have initially researched and implemented digital transformation strategies. Of these, more

than 50% of banks have been implementing this strategy in practice. Many commercial

banks have identified digital banking as an inevitable trend in future business activities.

Commercial banks in Vietnam are increasingly making changes to keep up with the

market, most banks have developed their own digital banking applications. For example,

Vietcombank and BIDV have replaced the previous Internet Banking and Mobile Banking

services with digital banking applications VCB Digibank and BIDV Smart banking. With

this application, customers can easily track transactions, bank account balances as well as

online savings on digital banking applications. In addition, commercial banks also

strengthen cooperation with Fintech to provide digital products and services based on

multi-channel platforms to ensure a rich experience for customers (the combination of

Techcombank Joint Stock Commercial Bank Vietnam

(Techcombank) and Fastcash Company, VIB and Vietnam Company Weezi Digital,

VietinBank and ON Company (UK), BE GROUP (Sweden)...). Thanks to the support of

Fintech, many digital models and products have appeared such as: Mobile Wallet, PeerTo-

Peer Transfer, mobile payment (Mobile Payment). ), Mobile Banking. 2.2.2 Lending

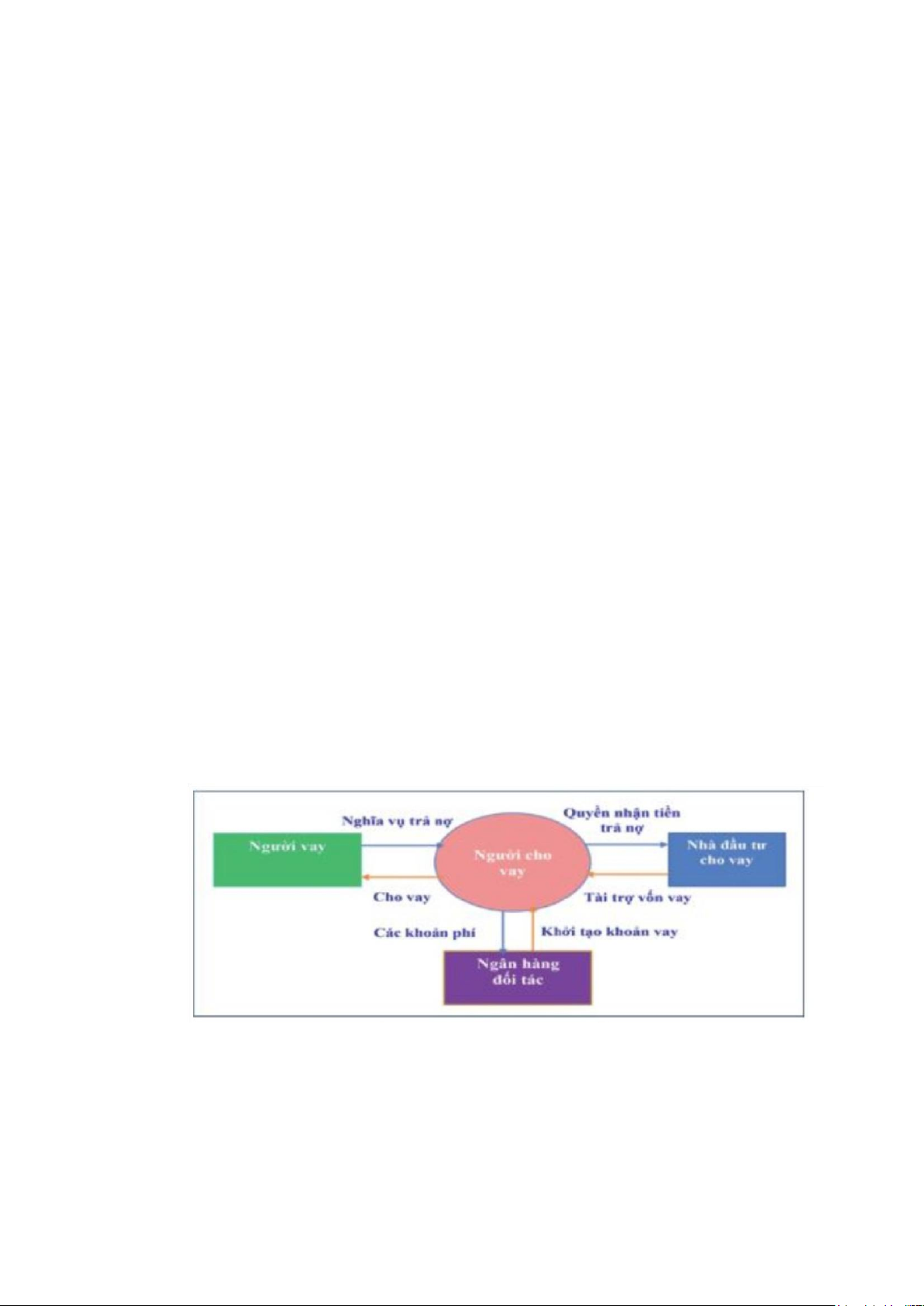

With the development of digital technology, a new online lending method has

appeared: peer-to-peer lending (P2P Lending). P2P Lending is an activity designed and lOMoAR cPSD| 59085392

built on a digital technology application platform to directly connect borrowers with

lenders without going through financial intermediaries. Thanks to the application of digital

technology platforms, loan and disbursement procedures and processes are also simplified,

saving time. In Vietnam, a company operating like the P2P Lending model began to appear

in 2016 with the website huydong.com. Since then, many other P2P Lending companies

have gradually come into operation, such as Tima, SHA, Mobivi, Vaymuon.vn, etc. Among

more than 100 licensed Fintech companies, there are up to 40 companies with P2P Lending

services. . Some are operating quite effectively, especially lending companies targeting the

small and medium-sized enterprise segment, gradually helping this market become a

potential capital mobilization channel for businesses which are the target group. Capital

needs for production and business activities change greatly during operations and often

have to mobilize capital from unofficial sources.

P2P Lending development models in Vietnam are also quite diverse. In addition to

direct models from companies directly providing peer-to-peer lending services, indirect

models have also been deployed. According to this model, P2P Lending companies will

transfer the loan request of the person in need to an affiliated commercial bank. If the loan

proposal is approved, the bank will issue a debt receipt to the P2P Lending company so

that customers can receive disbursement at commercial banks using this debt receipt. Then,

when a lender is found, the P2P Lending company will pay this debt to the bank with the

lender's money and issue a loan certificate to the lender.

With the indirect lending model, P2P Lending companies cooperate with banks and

credit institutions to lend to customers. Accordingly, some banks combine with technology

companies to lend to small business and individual customers such as Dragon Bank, The

Bank, Gobear are three joint stock companies that cooperate and connect with banks in

finding customers. Cooperative banks are very diverse. Dragon Bank Joint Stock Company lOMoAR cPSD| 59085392

cooperates with banks: OCB, Shinhan Bank, HDBank, ACB, UOB, VPBank, TPBank,

MSB. Gobear Joint Stock Company connects with BaovietBank, Citibank, DongA Bank,

Eximbank, HD Bank. The Bank has financial partners: FE Credit, Techcombank, Manulife,

VPBank, UOB, Shinhan Bank, BIDV, ABBank, Sacombank,... In general, P2P Lending

companies connected to banks will cooperate with many financial institutions.

In addition, a technological development that has been successfully applied in

lending activities is the application of blockchain in the documentary credit (L/C) method.

Blockchain technology acts as a ledger for all transactions, with the ability to share data

information transparently in real time, save storage space and be highly secure. To limit the

risks of late payment or refusal of payment, letters of credit can be modeled as smart

contracts capable of self-processing on the blockchain. This type of contract automatically

checks and determines the compatibility of delivery information with contract terms. This

approach increases the possibility of quick payment for sellers by preventing disputes

arising due to ambiguity in payment contracts.

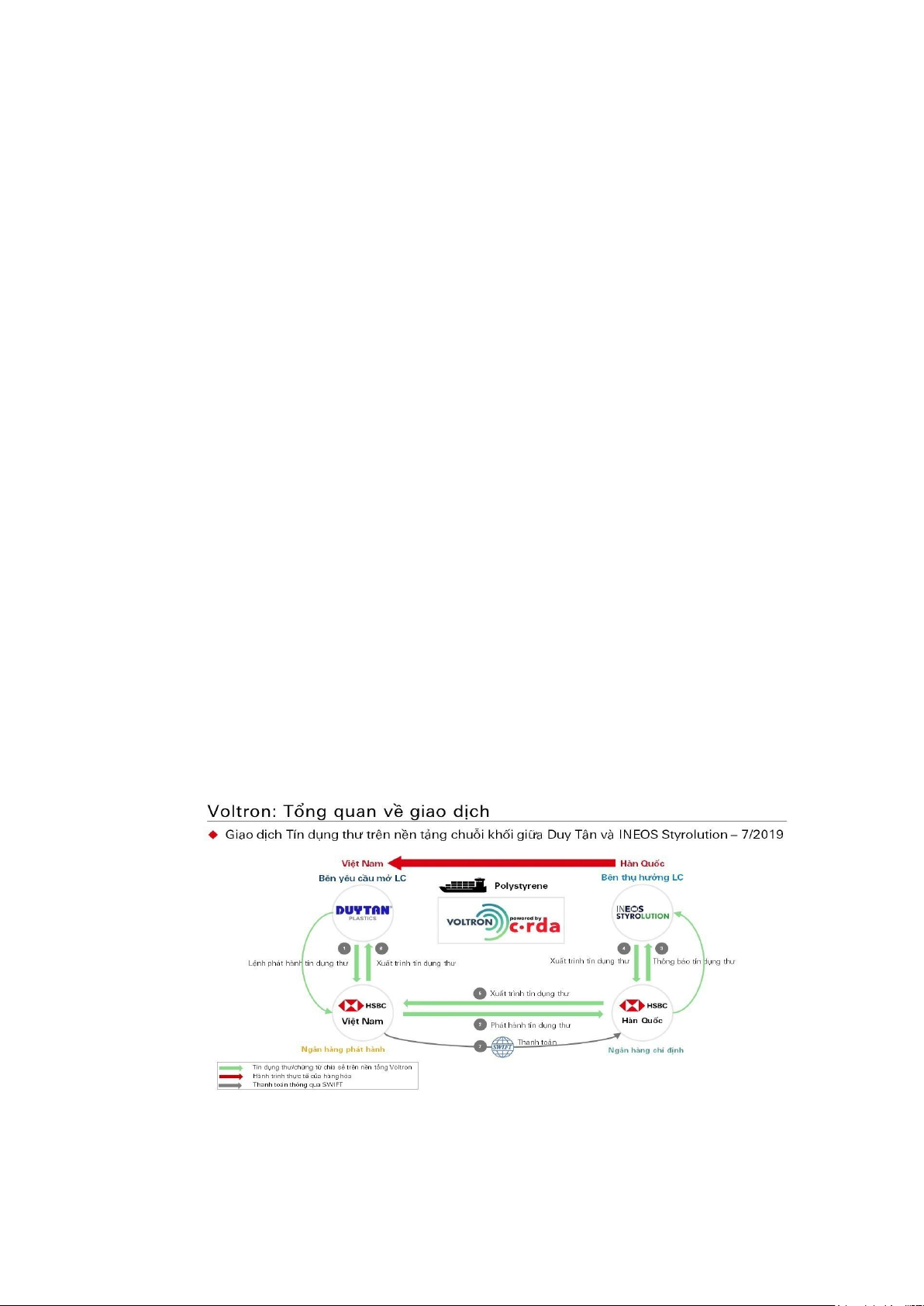

HSBC is the first bank to successfully have a letter of credit transaction on the

blockchain platform in 2019 between Duy Tan Plastic Manufacturing Joint Stock Company

of Vietnam and INEOS Styrolution Korea Company of Korea. Transactions are conducted

from start to finish on a single shared application, Voltron, the goal of this platform is to

provide a single, simplified channel to support the digitalization of trade finance, from L/C

issuance until presentation/exchange of documents. lOMoAR cPSD| 59085392 2.2.3 Saving

According to the General Statistics Office, Vietnam has a large population, reaching

98.51 million people in 2021, with a relatively high young population (50.5 million people

aged 15 and over). However, about half of the population currently does not have access to

financial services through banks. With these potentials, developing personal financial

services is becoming one of the strategic directions of commercial banks. The strong

development of the consumer loan market is considered a good signal in the financial

market, especially microfinance and personal finance. To develop personal financial

services, commercial banks often promote consumer lending to improve quality and

diversify types of personal credit products. Personal financial management (PFM): is a tool

that helps build personal financial plans through managing financial data on software and

phone applications. PFM allows customers to manage their deposits in different banks or

loans from different lenders in the same application.

For example: Personal Finance Management (PFM) feature is integrated on the

MBBank App: Supports users to compile personal financial situation statistics, provide

financial advice and investment instructions. Effective investment to help customers

achieve their goals in life, with a modern, user-friendly interface. Fintech offers

customization tools and savings performance tracking. Users can set savings goals, receive

notifications, and track progress automatically. Fintechs can provide smart suggestions

based on customers' data and savings behavior, helping them optimize their savings and

investment strategies. Integration with other services: Fintechs often have integration

capabilities with other services such as electronic payments, loans, or investments, creating

a comprehensive financial ecosystem. Reduce costs and Increase competition: Using

fintech can reduce operating costs for banks, which in turn can provide higher benefits to

users through higher interest rates or other incentives.