Preview text:

lOMoAR cPSD| 59691467

Chapter 1: Global marketing: Comparison of SMEs and LSEs; Economies of scope/scale;

Globalization/ deglobalization; Internationalization; Glocalization; The four orientations of global marketing; Value chain.

1. Comparison of SMEs and LSEs SMEs (small-medium sized LSEs (Large scale enterprises) enterprises) definition - Small: fewer than 50 Firms with more than 250 employees employees - Medium: fewer than 250 Resources Limited resources Many resources Externalization of

resources Internalization of resources (outsourcing of resources) Coordination of: - Personnel - Financing - Marketing knowledge etc organization Informal Formal/hierarchical

The owner/entrepreneur usually has Independent of one person the power/charisma to

inspire/control a total organization Risk-taking Sometimes risk-taking/ Mainly risk-averse sometimes risk-averse Focus on long term

Focus on short term opportunities opportunities Flexibity High Low

Take advantage of Only limited Yes economies of scale and economies of scope

Use of information Information gathering in an informal Use of advanced techniques sources

manner and an inexpensive way: - Databases - Internal sources - External consultancy - Face-to-face communication - Internet

2. Economies of scope/scale

- Economies of scope: Accumulated volume in production, resulting in lower cost price per unit + Definition: lOMoAR cPSD| 59691467

Economies of scope refer to the cost advantage a company achieves by producing

multiple products or services using shared resources, infrastructure, or processes. + Key Characteristics:

● Focus on diversifying product lines or services.

● Achieved by sharing resources like facilities, marketing, or R&D across multiple products.

● Suitable for companies looking to expand into related markets.

● Cost savings come from leveraging synergies and resource utilization. Examples:

+ A dairy company produces milk, cheese, and yogurt using the same processing plant and distribution network.

+ A tech company develops both software and hardware, sharing R&D and marketing efforts.

- Economies of scale: Reusing a resources from one business/country in additional

businesses/countries + Definition: Economies of scale refer to the cost advantage a company achieves

when increasing the production of a single product

or service, resulting in a reduction in the average cost per unit + Key Characteristics:

● Focus on producing more of the same product.

● Achieved by spreading fixed costs (e.g., machinery, rent) over a larger number of units.

● Suitable for industries that produce standardized goods or services in large quantities.

● Cost savings come from higher efficiency in production processes. Examples:

● A car manufacturer reduces the cost per car by increasing production from 1,000 to 10,000 units.

● A factory installs a new assembly line that increases output while keeping operational costs constant. lOMoAR cPSD| 59691467

3. Globalization/ deglobalization -

Globalization: Reflects the trend of firms buying, developing, producing and selling

products and services in most countries and regions of thư world. -

Deglobalization: Moving away from the globalization trends and regarding each market

as special, with its own economy, culture and religion. -

Internationalization: Doing business in many countries of the world, but often limited to a certain region -

The nine strategic windows:

+ Industry globalism: Local, Potentially global, Global

+ Preparedness for internationalization: Mature, Adolescent, Immature -

Global marketing Stagies: Think globally, act locally (glocal) -

Glocalization:The development and selling of products or services intended for the global

market, but adapt to suit local culture and behaviour - Globalization (Standardization): lOMoAR cPSD| 59691467

● Global low-cost production and selling

● Global roll-out of concepts/high speed ● Low complexity -

Localization (Differentiation)

● Culturally close to consumer

● Flexible response to local customer needs

● Regional and local market penetration -

The four orientations of global marketing

+ Ethnocentric: the home country is superior and the needs of the home country are

most relevant. Essentially the headquarters extends its ways of doing business to

its foreign affiliates. Controls are highly centralized and the organization and

technology implemented in foreign locations will be largely the same as in the home country.

+ Polycentric (multidomestic): each country is unique and should therefore be targeted

in a different way. The polycentric enterprise recognizes that there are different

conditions for production and marketing in different locations and tries to adapt to

those different conditions in order to maximize profits in each location. The control

is highly decentralized among affiliates, and communication between headquarters and affiliates is limited.

+ Regiocentric: the world consists of regions (e.g. Europe, Asia, the Middle East). The

firm tries to integrate and coordinate its marketing programme within regions, but not across them.

+ Geocentric (global): the world is getting smaller and smaller. The firm may offer

global product concepts but with local adaptation (‘think global, act local’). 4. Value chain

- A categorization of the firm's activities providing value for the customers and the profits for the company lOMoAR cPSD| 59691467 Primary:

- Inbound logistics: storing and distributing

- Operations: machining, packaging

- Outbound logistics: distribution to consumers

- Marketing and sales: to create awareness

- Services: this covers all which enhance or maintain the value of the product / service Supportive:

- Procurement: acquiring of resource inputs - Technological development: - Human resource management

- Infrastructure: planning, finance & quality

In order to assess how they contribute to cost reduction or value added, there are two kinds of linkage:

- Internal linkage: between activities within the same value chain

- External linkage: between different value chains, “owned” by different actors in the total value chain system

- Downstream activities create competitive advantages that are largely country specific. For example a firms reputation. lOMoAR cPSD| 59691467

- In industries where downstream activities or other buyer-tied activities are vital to competitive

advantage, there tends to be a more multi-domestic (domestic = inside your country) pattern of international competition.

- Upstream: focus on activities that relevant to materials and production

- Downstream: focus on distribution and create values for customers Chapter 2: Internationalization initiation: Motives; Triggers; Barriers; De-internationalization.

1. Motives for firms to go international: The fundamental reason for companies to export is to

make money, but like most business activities, one factor rarely accounts for any given action.

Usually a mixture of factors is at hand.

- Pro active motives: These represent stimuli to attempt a strategy change, bases on a

companies interest to in exploiting a unique competences (special technological

knowledge) or market possibilities

+ Profit and growth goals: they can grow by exporting

+ Managerial urge: enthusiasm form the board of directors. Managers’commitment and

motivation that reflect the desire and enthusiasm to drive internationalization forward.

+ Technological competence / unique product: the company produces goods that are not widely available

+ Foreign market opportunities / market information: a firm has the necessary resources

to respond to foreign opportunities

+ Economies of scale: increasing sales by exporting can dramatically cut down your production costs

+ Tax benefits: taxes are lower in other countries

- Reactive motives: These motives indicate that the firm reacts to pressures or threats in it’s

home market or foreign markets, and adjusts passively to them by changing it’s activities in time.

+ Competitive pressures: fear from your competitors

+ Domestic market: small and saturated: home market is to small

+ Overproduction: loose your products abroad

+ Unsolicited foreign orders: enquiries form abroad that make company’s aware

+ Extend sales of seasonable products: for example agricultural products

+ Proximity of international customers / psychological distance: if your close to the

border, why net sell over it to

2. The triggers of export initiation: A trigger factor is usually foreign travel during which new

business opportunities are discovered, or where information is received that makes the

management believe that such opportunities exist. The triggers in of export marketing are:

- Internal: Internal triggers are coming from the company itself

+ Perceptive management: make it your business to become knowledgeable of other markets.

+ Specific internal event: for example a new bright employee lOMoAR cPSD| 59691467

+ Importing as inward internationalisation: importing often results in exporting as well.

Imports (inward) as a preceding activity for the later market entries (outward) in foreign market

- External: External triggers come from influences outside the company.

+ Market demand: demand of your product in other countries

+ Competing firms: if they can do it, the why not us to

+ Trade associations: contact made on international market seminars +

Outside experts: for example: export agents, chambers of commerce, etc.. + Financing:

+ Network partners: Access to external network partners may encourage the company

to use this as a key source of knowledge in triggering the internationalization

process. For example, the company network partners can provide access to

international sales through their distribution and sales networks abroad

3. Internationalization barriers/risks

- Factors hindering export initiation

A wide variety of barriers can be given. Some problems mainly affect the export start; others affect

the entire process. These factors are mainly internal. Some examples are: - Insufficient finances - Insufficient knowledge - Lack of connections - Lack of capital - Lack of production capacity

- Lack of foreign distribution channels

- Cost escalations: chi phí leo thang

Critical barriers: These can be divided into three groups:

+ General market risks: competition, differences in cultural usage of products

+ Commercial risks: delays, exchange rates

+ Political risks: interventions by home or host country governments.

4. De-internationalization: A process, determined by internal and external factors, where the

multinational companies shift to a strategic configuration that has a lower international presence

Chapter 3: Internationalization theories: The difference between cultural distance and psychic

distance; Models: Uppsala internationalization; The transaction cost analysis (TCA); The network model; Born globals

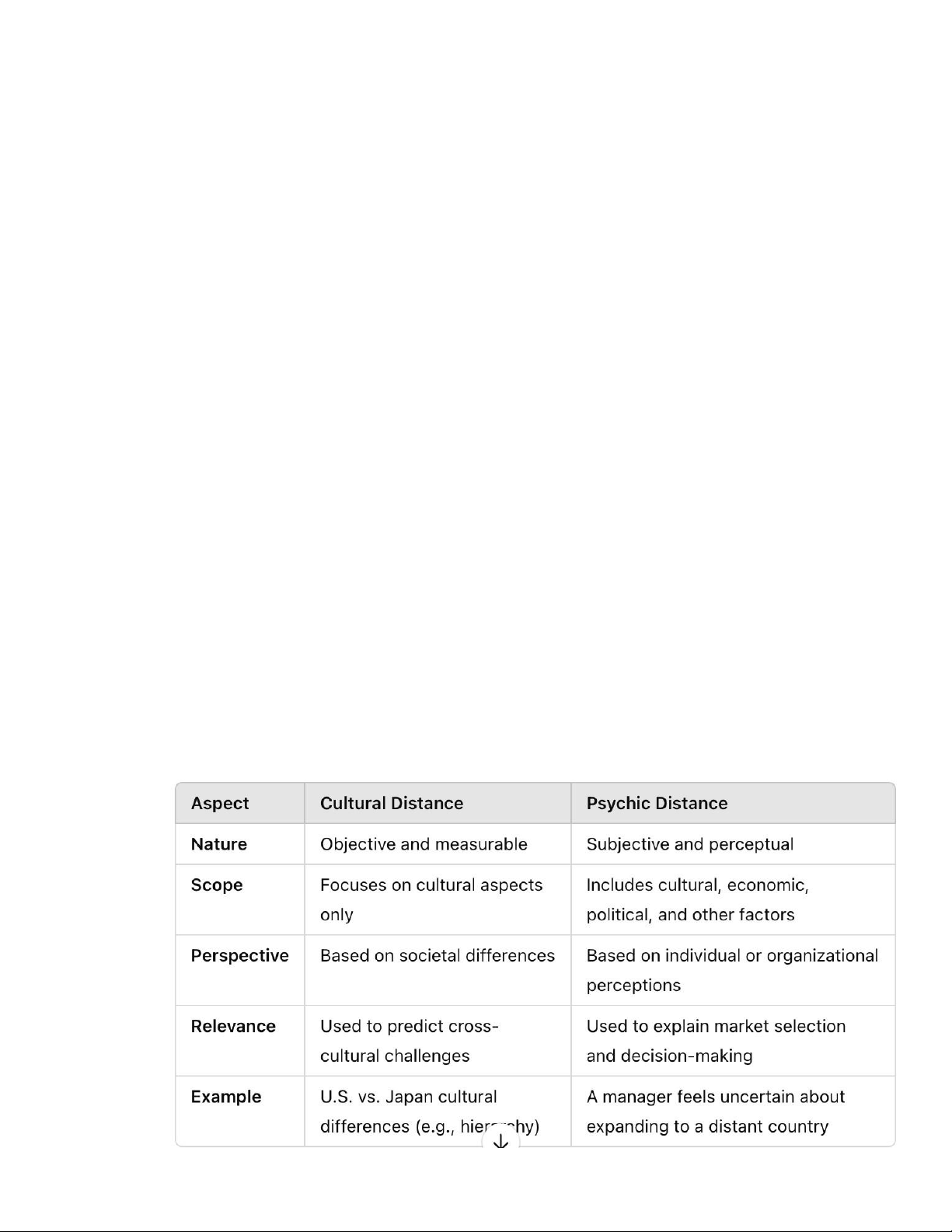

1. The difference between cultural distance and psychic distance

- Cultural distance: Cultural distance refers to the differences in cultural values, norms, and

practices between two societies or countries. It is an objective measure based on established

cultural frameworks, such as Hofstede's cultural dimensions or the GLOBE study. lOMoAR cPSD| 59691467 + Focus: It

focuseson observable and measurable differences in culture, including: ● Language ● Religion ● Social norms

● Individualism vs. collectivism ● Power distance

+ Application: Often used in international business and management to assess

challenges in cross-cultural interactions, such as entering a new market or managing multicultural teams.

+ Example: A company from the U.S. may face cultural distance when entering Japan

because of differences in hierarchy (high power distance in Japan vs. low power distance in the U.S.).

2. Psychic distance: The individual's perception of differences between two markets, in

term of differences in country and people characteristics, which disturbs the flow of

information, goods, and services between the firm and the market

+ Focus: It emphasizes subjective perceptions and how individuals or businesses feel

about operating in a foreign market. ● Perceived uncertainty

● Familiarity with foreign markets

● Stereotypes or assumptions

+ Application: Common in international marketing and trade to explain how

perceptions of distance affect decisions, such as choosing markets for expansion.

+ Example: Even though the U.K. and Australia share similar languages and cultural

roots (low cultural distance), an entrepreneur from the U.K. may perceive high

psychic distance due to Australia's geographic remoteness and different business practices. lOMoAR cPSD| 59691467

2. Models: Uppsala internationalization; The transaction cost analysis (TCA); The

network model; Born globals Uppsala

Transaction cost analysis Network model Born Globals internationalization model model Definitions This is a model for the Transaction costs: The

Business networks: Actors are Born Globals: A firm that choice for market, and

friction between the buyer autonomous and linked to each from its ‘birth’ globalizes form of entry when going and seller, which is other through relationships, rapidly without any abroad. The main

explained by opportunistic which are flexible and may preceding long term

consequence of this model behaviour = ex ante costs alter accordingly to rapid ỉnternationalization period is that firms tend to + ex post costs changes in the environment.

Born again global: A firm intensify their The’glue’ that keeps the Opportunistic that previously focused on commitment towards

relationships together is based its domestic markets but foreign markets as their

Behaviour: self-interest on technical, economic, legal that suddenly embraces experience grows. The with guile misleading,

and, in particular, personal ties rapid and dedicated model distinguish distortion, disguise and Network model: the internationalization. The between four different confusion relationships of a firm in a internationalization can be a modes or entering a Transaction costs domestic network can be used

result of critical events, such foreign market. The four

analysis: Include that if as bridges to others networks as a change in ownership successive stages the friction between the in others countries and management or a represent higher degrees buyer and seller is higher takeover by another of international than through an internal company. In this way, the involvement / market hierarchical system, then acquired firm can gain commitment. the firm should internalize access to more financial

Stage 1. No regular export Externalization: Doing resources, managerial activities (sporadic business through an capability and international export) Stage 2. Export external partner (importer, market knowledge Born via independent agent, distributor) regional: A firm that representatives Internalization: Integration Stage 3. Establishment of of an external partner into

starts international activities a foreign sales subsidiary one's own organization early and with significant Stage 4. Foreign international shares, but its production / international activities are manufacturing units only in its home region The common complaint is that the model is to deterministic. Meaning that the model does not take in account the differences of country markets. Unit of analysis The firm The transaction or set of - Multiple inter- The firm transactions organizational relationships between firms - Relationships between one group of firms and other groups of firms lOMoAR cPSD| 59691467 Basic The model is based on In the real world there are The’glue’ that keeps the Born Globals operate under assumptions behavioural theories and ‘friction’/transaction

relationships together is based

the assumption of rapid about firm' an incremental decision-

difficulties between buyer on technical, economic, legal

international expansion, behaviour making process with little and seller. This friction is

and, in particular, personal ties. bypassing the traditional influence from mainly caused by

Managers’ personal influence incremental approaches competitive market opportunistic behaviour:

on relationships is strongest in seen in the Uppsala model.

factors. A gradual learning the self-conscious the early phases of the Unlike the transaction cost by doing process from attention of the single

establishment of relationships. analysis model, Born simple export to foreign manager

Later in the process, routines

Globals rely on dynamic direct investment (FDI) and systems will become more

capabilities, leveraging important. networks and resources efficiently to enter multiple markets quickly. Their behavior often aligns with the network model, emphasizing relationship- building and resource- sharing across borders. Explanatory The firm's knowledge/ Transaction difficulties The individual firms are

Knowledge intensity: These variables marketing commitment and transaction costs autonomous. The individual firms often possess unique, affecting the Psychic distance between increase when firms is dependent on high-value knowledge (e.g., development home country and the transactions are

resources controlled by others technological innovations). process firm's international characterized by asset firms Entrepreneurial markets specificity, uncertainly,

Business networks will emerge orientation: Founders of frequency of transaction in fields where there is Born Globals have a global frequent coordination between mindset, seeing the world as specific actors and where one market. conditions are changing

Global networks: Similar to rapidly the network model, Born Globals depend heavily on

strategic partnerships to overcome resource limitations.

Market opportunity: They identify and exploit international market gaps quickly, irrespective of psychic distance. lOMoAR cPSD| 59691467 Normative Additional market Under the above

The relationships of a firm in a Develop international implications for commitments should be mentioned conditions domestic network can be used

networks early to secure international

made in small incremental (prohibitively high

as bridges to other networks in market access and resources. marketers steps: transaction costs), firms

other countries. Such direct or

Focus on high-value niches - Choose new

should seek internalization indirect bridges to different where they can leverage geographic markets with of activities (implement country networks can be their unique competencies small psychic distances

important in the initial steps the global marketing globally. from existing markets abroad and in the subsequent

Embrace risk and flexibility -

Choose an ‘entry strategy in wholly owned entry of new markets. to adapt to varying market mode’ with few marginal subsidiaries). Overall the Sometimes an SME can be conditions, resembling risks firm should select the forced to enter foreign elements of both the entry mode for which networks, e.g. if a customer network and transaction cost transaction costs are requires that the subsupplier models. minimized (an SME) follows it abroad. Implement digital

marketing and technology- driven strategies to overcome traditional barriers to internationalization.

Chapter 4: International Competitiveness: National competitiveness; Porter’s five-forces

model; Sharing economy; Corporate social responsibility (CSR); Blue/Red ocean strategy.

1. National competitiveness

National competitiveness refers to the ability of a country to create and sustain an environment

in which businesses can compete effectively in international markets while improving the standard

of living for its citizens. It encompasses economic, social, political, and environmental factors that

collectively influence the productivity and growth potential of a nation.

Porter's diamond: the characteristics of the home base play a central role in explaining the

international competitiveness of the firm - the explaining elements consist of factor conditions,

demands conditions, related and supporting industries, firm strategy - structure and rivalry, government and chance

2. Porter’s five-forces model: The state of competition and profit potential in an industry

depends on five basic competitive forces: new entrants, suppliers, buyers, substitutes, and market competitors.

- There are six factors that can be identified that influence the location of global industries: 1. Factors of production 2. Home demand

3. Location of supporting industries

4. The internal structure of the domestic industry 5. Chance lOMoAR cPSD| 59691467 6. Government

- The five forces of Porter are: 1.

Market competitors: Measures competition among existing firms. Intense rivalry occurs

inslow-growing industries with many competitors or undifferentiated products. 2.

Suppliers: Assesses suppliers’ ability to influence prices or terms. Fewer suppliers or

uniqueinputs increase their power. 3.

Buyers: Looks at customers’ influence on prices and quality. Buyers with many options or

lowswitching costs have more power. 4.

Substitutes: Evaluates the risk of customers switching to alternative products. More

substitutesor lower switching costs increase this threat. 5.

New entrants: Measures how easily new competitors can enter the market. High entry

barriers(e.g., costs, brand loyalty) reduce this threat.

These factors are interconnected.

- The collaborative five forces model

Porters original idea is based on that the competitive advantage of a firm is best developed in a

very competitive market with intense rivalry. The five forces model provides an analysis for

considering how to squeeze maximum competitive gain out of the context in which the company

is located, or how to minimize being squeezed by it. Over the last decade, an idea has emerged

which explains a positive roll of cooperative arrangements between industry participants. This has

been termed a “collaborating advantage”. lOMoAR cPSD| 59691467

3. Sharing economy: The sharing economy refers to a socio-economic model where

individuals and organizations share access to goods, services, or resources, often

facilitated by digital platforms. It focuses on collaborative consumption,

emphasizing the use of underutilized assets to maximize efficiency, reduce waste, and lower costs. lOMoAR cPSD| 59691467

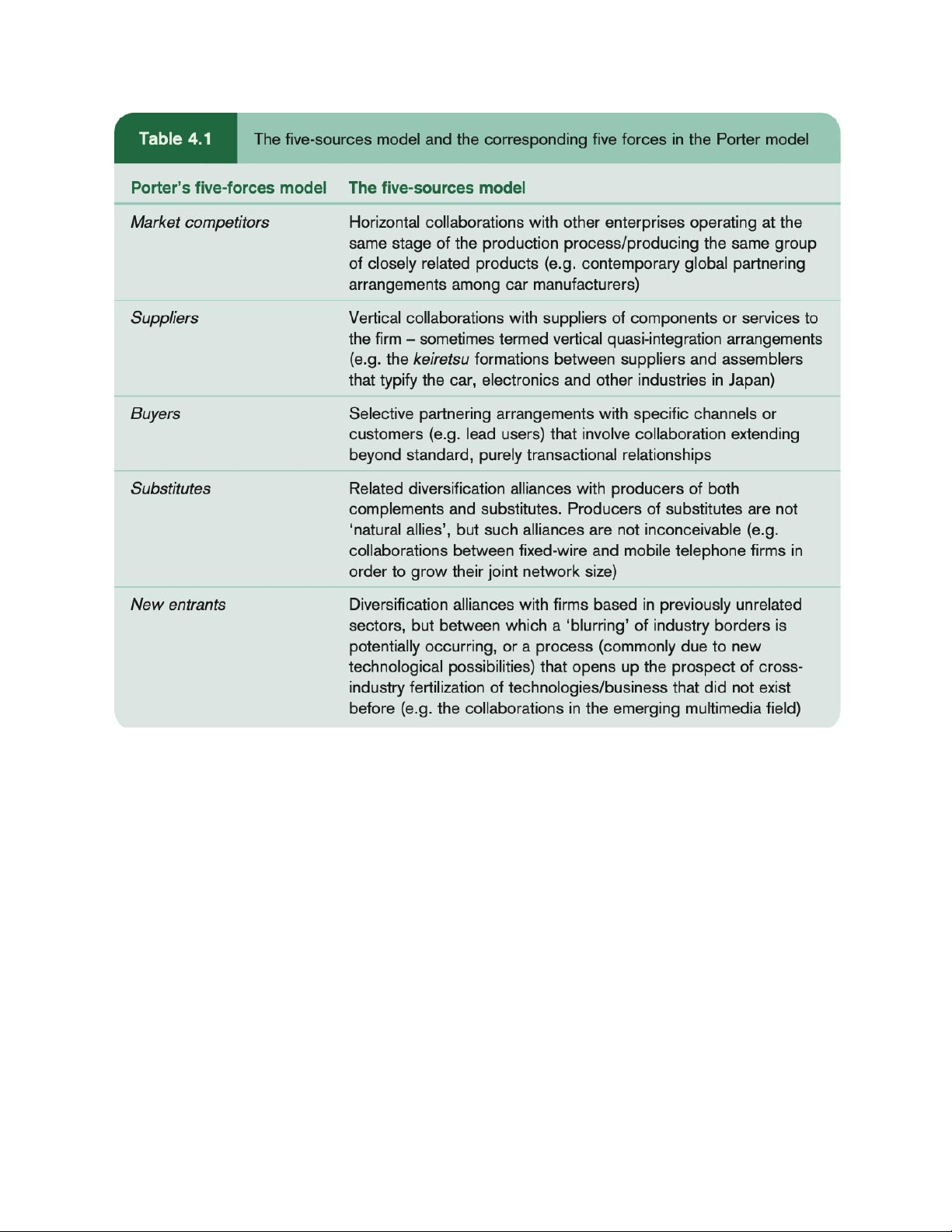

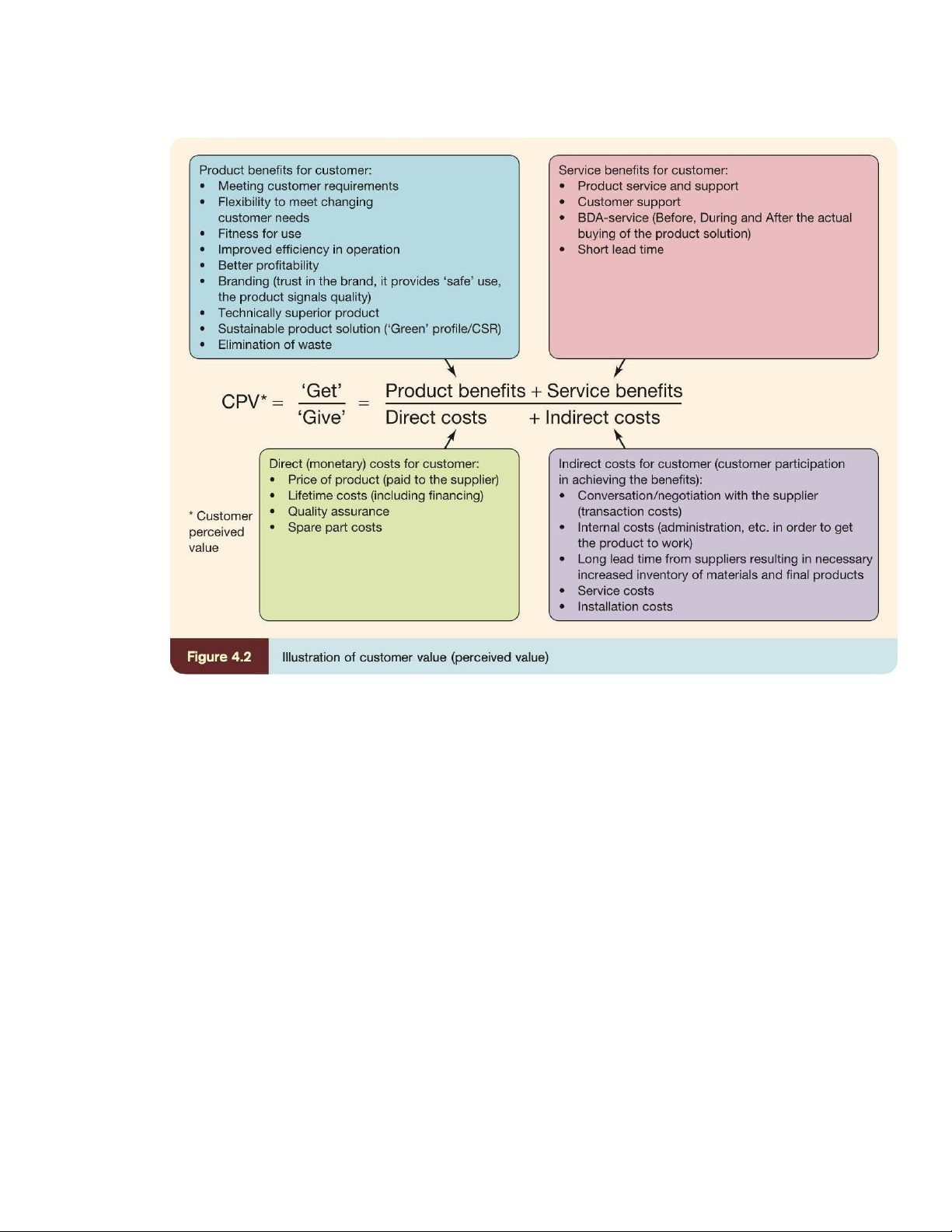

- Customers perceived value -

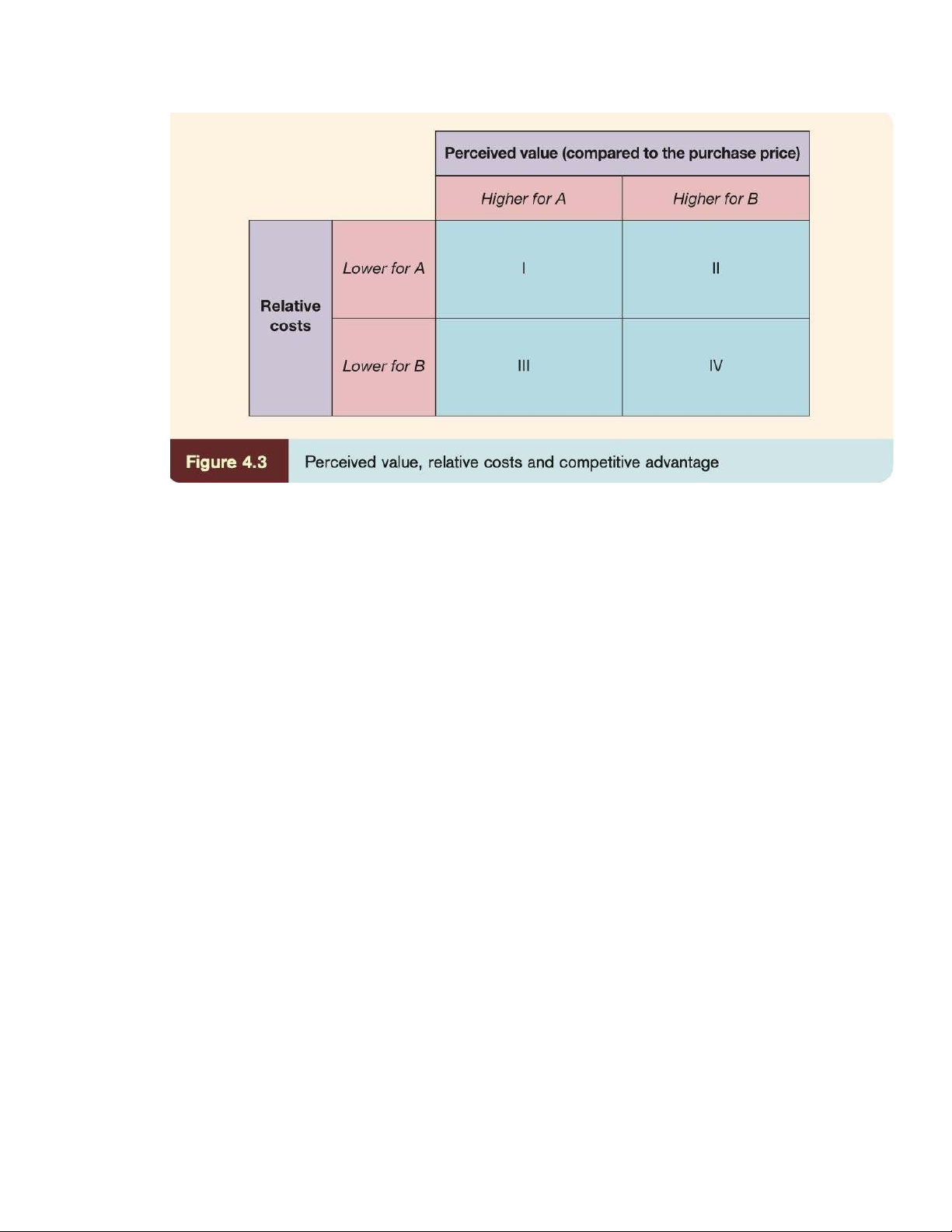

Competitive triangle: Consists of a customer, the firm and a competitor (the ‘triangle’).

The firm or competitor ‘winning’ the customer’s favour depends on perceived value

offered to the customer compared with the relative costs between the firm and the competitor. - Value chain

+ Success in the market is dependent not only on identifying and responding to

customer needs, but also on our ability to ensure that our response is judged by

customers as superior to our competitor. The cause of these differences between

companies can be reduced to two factors:

● The perceived value of the product offered ●

The firm related costs that perceive this value - Note that:

+ Customers do not buy products, they buy benefits.

+ Perceived value is the customers overall evaluation of the product/service offered.

+ The rules of the game can be described as: providing the highest possible perceived

value to the customer, at the lowest possible cost. -

Perceived value: The customer’s overall evaluation of the product/service offered by a firm. lOMoAR cPSD| 59691467 -

Perceived value advantage: People, Physical aspects, process -

Relative cost advantage: A firm’s cost position depends on the configuration of the

activities in its value chain versus that of its competitors. -

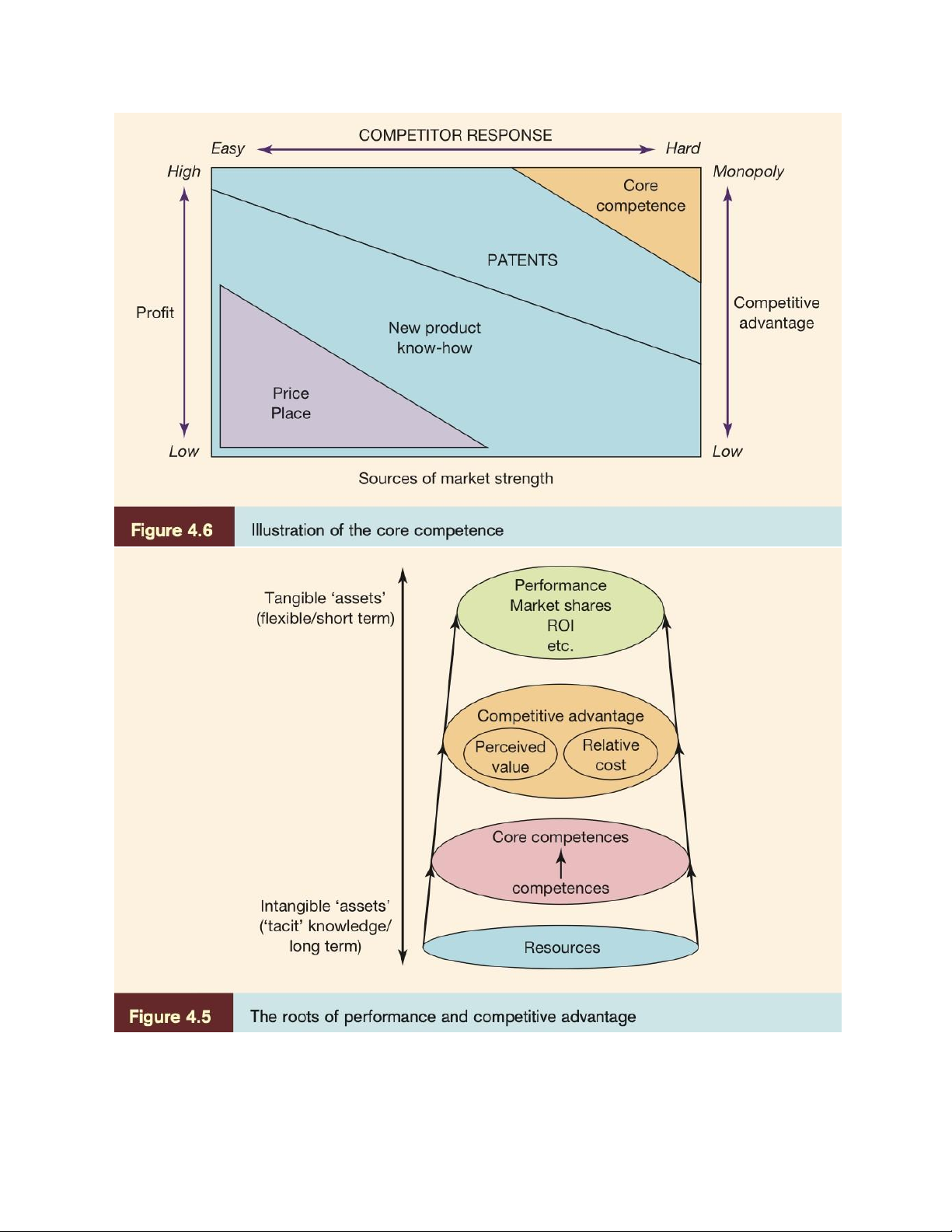

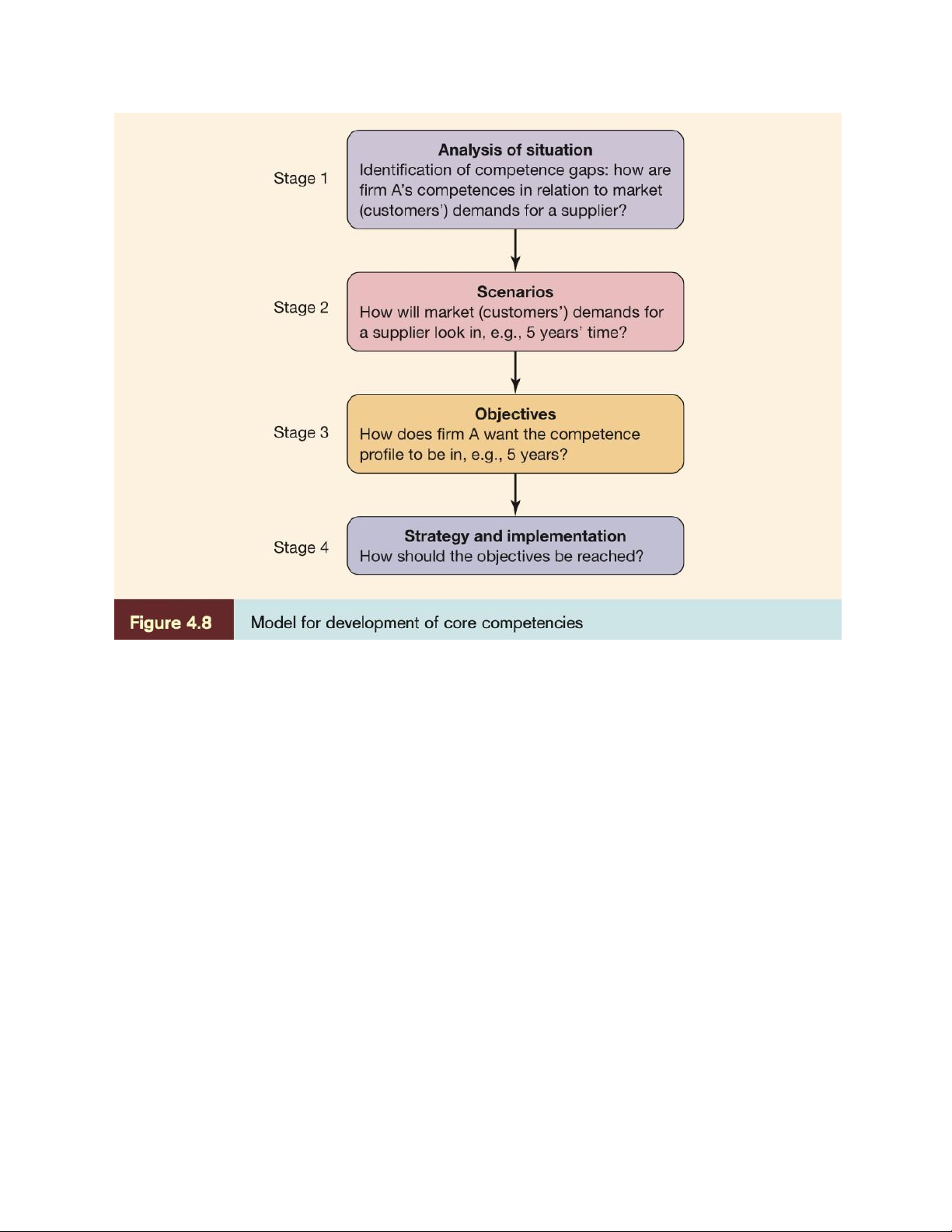

The basic sources of competitive advantage: The perceived value created and the costs

will depend on the firms resources and competences. Resources are the basics units of

analysis. They include all inputs into business processes. Financial, technological, human

etc.. Competences result from a combination of the various resources.

+ Resources: Basic units of analysis – financial, technological, human and

organizational resources – found in the firm’s different departments.

+ Competences: Combination of different resources into capabilities and later

competences – being something that the firm is really good at.

+ Core competences: Value chain activities in which the firm is regarded as better than its competitors.

+ Competitive benchmarking: A technique for assessing relative marketplace

performance compared with main competitors.The ultimate test of the efficiency of

any marketing strategy had to be in terms of profit. Those companies that strive for

market share, but measure this in terms of volume sales might be deluding their

selves. Volume is bought at the expense of profit. Because market share is measured

“after event, we will need to use continuing indicators of competitive performance.

This will highlight the areas where improvements in the marketing mix can be

made. Originally, the idea of benchmarking was literally taking apart a components

product, and compare it’s components performance to your own products. The

concept of benchmarking is similar to what Porter calls operational effectiveness. lOMoAR cPSD| 59691467

- Development of a dynamic benchmarking model: lOMoAR cPSD| 59691467

4. The sustainable global value chain

- Shared Value: A company’s strategies and operating practices that globally enhance the

competitiveness of the company, while simultaneously advancing the social conditions in

the international communities in which it operates.

5. Corporate social responsibility (CSR)

- Corporate social responsibility (CSR): A number of corporate activities that focus on the

welfare of stakeholder groups other than investors, such as charitable and community

organizations, employees, suppliers, customers and future generations. - CSR benefits: + Revenue Increases:

CSR boosts revenue through additional sales from higher quantities, prices, or margins.

Key drivers include cause-related marketing, eco-friendly product lines, winning public

tenders, and CSR grants. Sales growth stems from: ● Improved brand value

● Better customer attraction and retention

● Enhanced employer appeal and hiring rates

● Increased employee motivation and retention + Cost Savings: CSR reduces costs via: ● Efficiency improvements

● Collaborations with NGOs for expertise and stakeholder access lOMoAR cPSD| 59691467

● Tax concessions for eco-friendly initiatives - CSR costs + One-Time Costs:

- One-time donations (e.g., disaster relief).

- Investments (e.g., installing smoke filters exceeding legal requirements). + Continuous Costs:

- Recurring donations and license fees (e.g., for labels or patents).

- Personnel and material costs (e.g., CSR project managers, marketing materials).

+ Challenges in Assessment:

Conventional cost systems struggle to separate CSR from non-CSR costs. + Opportunities:

CSR can address social issues like poverty and environmental degradation, which also

present business opportunities (e.g., ‘green’ markets).

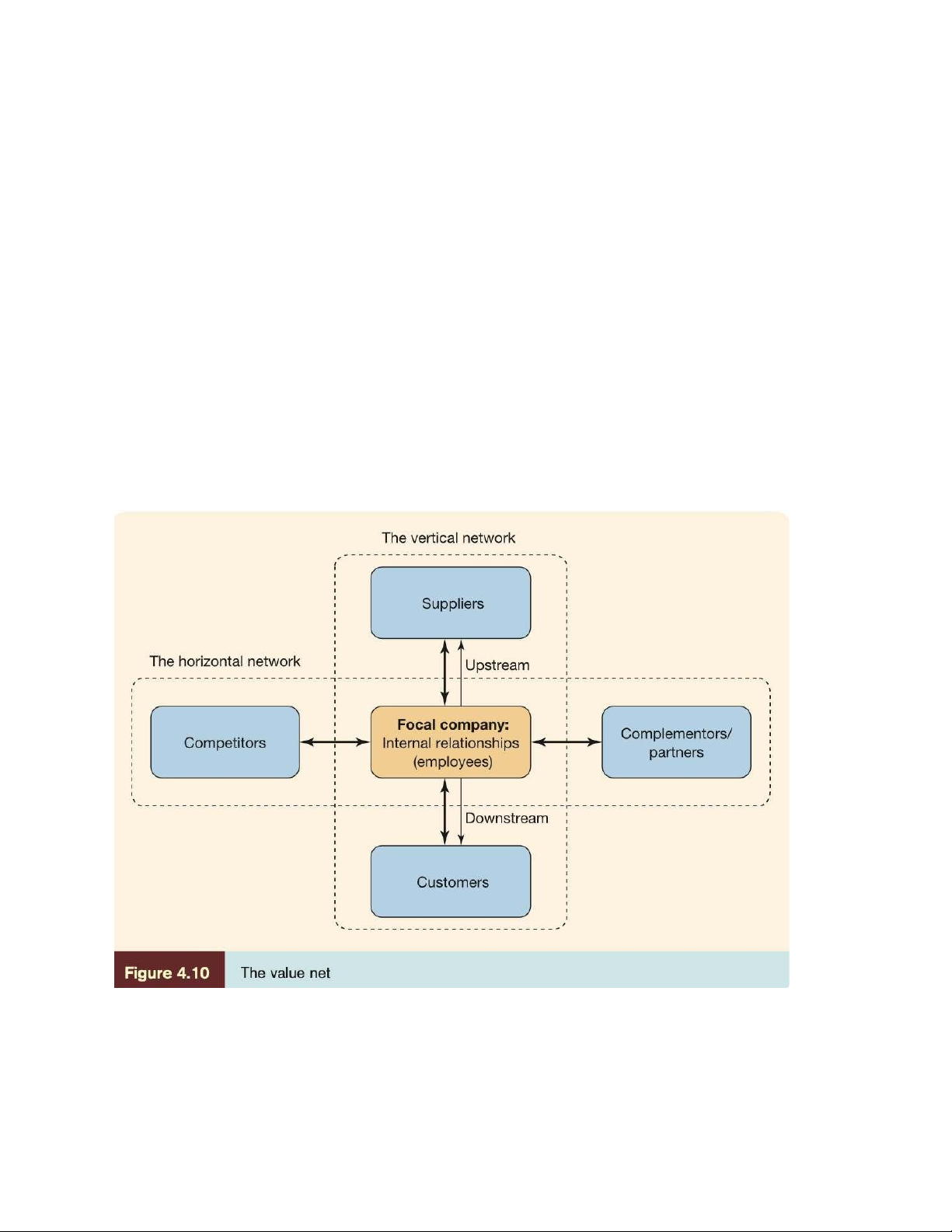

6. Value net: A company’s value creation in collaboration with suppliers and customers

(vertical network partners) and complementors and competitors (horizontal network partners).

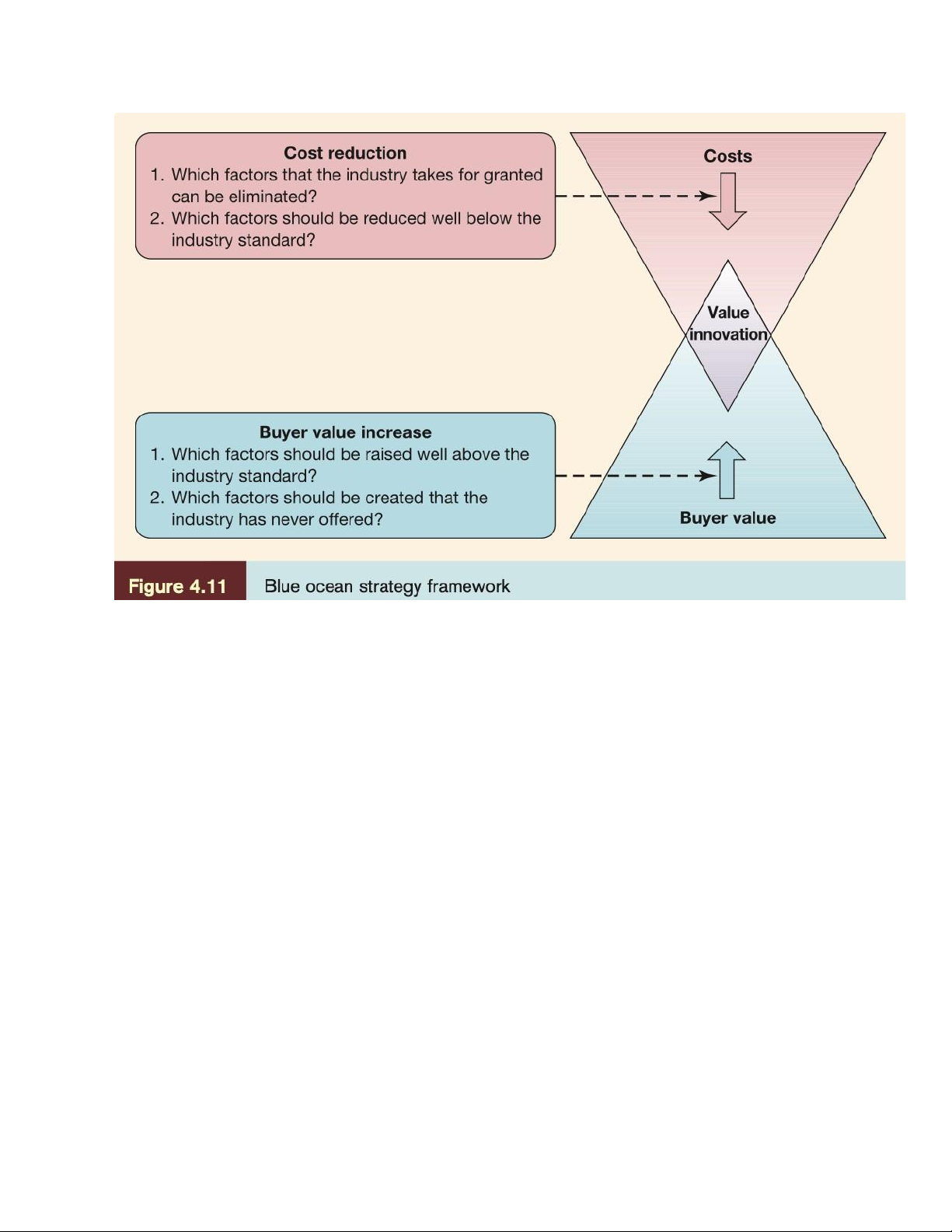

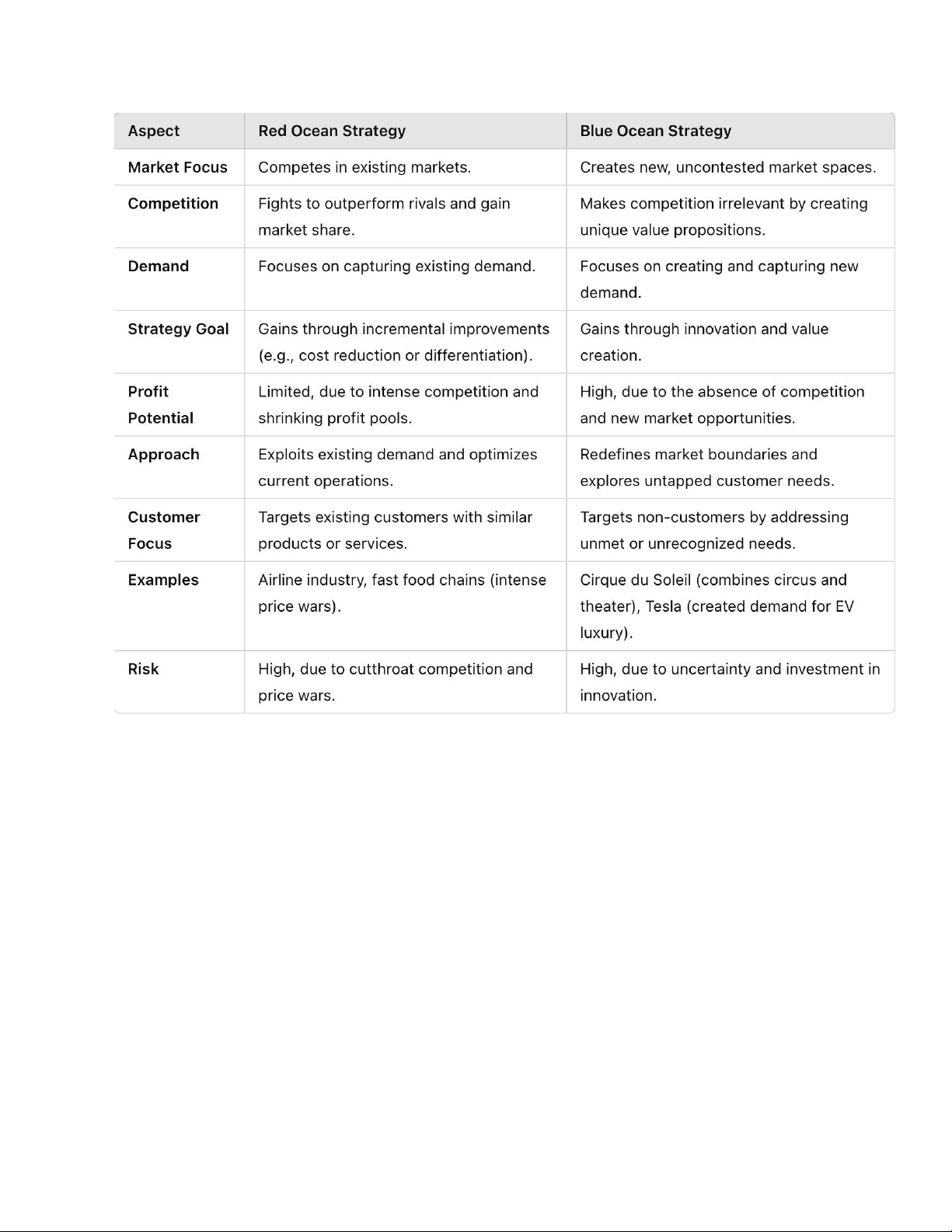

7. Red Ocean: Tough head-to-head competition in mature industries often results in nothing

but a bloody red ocean of rivals fighting over a shrinking profit pool.

8. Blue Ocean: The unserved market, where competitors are not yet structured and the market

is relatively unknown. Here it is about avoiding head-to-head competition. - Value innovation: lOMoAR cPSD| 59691467 lOMoAR cPSD| 59691467

Chapter 5: Political/legal environment (Nationalization, Trade barriers, Tariffs, Non-tariff

barriers); The economic environment (Exchange rates, Law of one price, The levels of economic

integration, Bottom of pyramid); 1. Nationalization

- Nationalization is the process by which a government takes ownership and control of

private assets, industries, or resources, converting them into public ownership. It is often

done to serve national interests, improve public access, or protect key sectors.

- Ownership Transfer: Assets move from private (individual or corporate) ownership to state control.

- Compensation: Governments may compensate previous owners, but the terms can vary widely. - Purpose:

+ Ensure control over critical industries (e.g., energy, transportation).

+ Redistribute wealth and reduce inequality.

+ Safeguard national security.

+ Prevent exploitation of resources or workers. -

Examples of Nationalized Sectors: