Preview text:

lOMoAR cPSD| 59691467

Chương 6: The political and economic environment Political: 1.

BRIC: Giải thích + Có ảnh hưởng thế nào

- BRIC stands for Brazil, Russia, India, China (and South Africa). The economic growth and emerging middle

class in these countries will probably have enormous influence on the rest of the world. Two countries are

manufacturing-based economies and big importers (China and India), and two are huge exporters of natural

resources (Brazil and Russia). 2.

BOP: Giải thích + Thị trường này bán những sản phẩm gì -

The poor people’s market has been seen as a gold mine for reaping business profits and it has been

called the ‘bottom of the pyramid’ (BOP) market. According to Prahalad, focus on the BOP market

should be a part of core business and not just corporate social responsibility (CSR) initiatives: catering

to the BOP market (by satisfying unmet social needs and new consumer preferences), business

organizations can create market opportunities of substantial value, other parties have to get involved -

mainly local and central government, financial institutions and non-governmental organizations (NGOs) -

Sản phẩm ví dụ: Microfinance is a banking service that is provided to low-income individuals who

have no other means of gaining financial services. Có thể áp dụng trickle-down/ waterfall approach. -

Giải thích 1 số thuật ngữ:

+ Trickle-down/ waterfall approach/effect: Đầu tư kinh doanh sản phẩm tại 1 market phát triển trước (thường

là developed countries) thị trường suy thoái => bê mặt hàng đó kinh doanh xuống cấp dưới developing

countries => các nước kém phát triển cuối cùng (under-develope). Ví dụ: Xà phòng Cleopatra (Francê).

+ Trickle-up: Kinh doanh loại sp mang tính bình dân, chỉ phù hợp với 1 nhóm người trong xã hội => nâng cấp

làm loại sp đó phổ biến cho các tầng lớp khác. Ví dụ: fashion - quần jeans.

+ Showering approach: cùng 1 lúc đầu tư kinh doanh tại nhiều thị trường khác nhau (k phân biệt nước phát

triển hay kém phát triển) - high risk nhưng high reward. Ví dụ: fast food. 3.

European Monetary Union: Liên minh tiền tệ

- The Maastricht Treaty (hiệp ước M) resulted in the European Economic and Monetary Union (EMU), which

also included the new common European currency, the euro (introduced on 1 January 1999). The euro involves

the extension of the ‘law of one price’ across a market comprising more than 320 million consumers,

representing one-fifth of the world economy, which should promote increased trade and stimulate greater

competition. Consequently, the development of this ‘new’ Europe has an importance beyond the relatively

small group of nations currently involved in its creation. Today, the euro is one of the world’s most powerful

currencies, used by more than 320 million Europeans in 23 countries. 4.

Yếu tố ảnh hưởng đến lý do đi ra nước ngoài kinh doanh -

Promotional activities (sponsored by governmental organizations) lOMoAR cPSD| 59691467 - Financial activities -

Information services: các cty dịch vụ cung cấp thông tin cho những cty cần ra nước ngoài. -

Export-facilitating activities -

Promotion by private organizations (NGOs) - State trading 5.

Trong yếu tố chính trị, khi công ty sang host country gặp những rủi ro nào -

Three major types of political risk can be encountered: +

ownership risk, which exposes property and life; +

operating risk, which refers to interference with the ongoing operations of a firm; +

transfer risk, which is mainly encountered when companies want to transfer capital between countries.

Ví dụ 1 số actions và effects: Import/ Labour restrictions, Local-content laws, Exchange/ Market/ Price/ Tax

controls, Change of government party, Nationalization, Domestication. 6.

Host country sử dụng hình thức tariff, non-tariff để ngăn cản quốc gia thâm nhập

- Tariffs are direct taxes and charges imposed on imports. They are generally simple, straightforward and easy

for the country to administer. While they are a barrier to trade, they are a visible and known quantity and so

can be accounted for by companies when developing their marketing strategies. (Thường được dùng bởi những

nước host nghèo hơn nước home) Common forms: +

Specific: thuế phí phụ thuộc loại sản phẩm cụ thể. +

Ad valorem: đánh thuế % của giá xuất khẩu. +

Discriminatory: đánh thuế tùy quốc gia cụ thể (trừ các thành viên WTO thì phải công bằng với nhau). -

Non-tariff (thuế quan phi tiền tệ): Non-monetary barriers to foreign products, such as biases against a

foreign company’s bids, or product standards that go against a foreign company’s product features.

+ Quotas: A restriction on the amount (measured in units or weight) of a good that can enter or leave a country

during a certain period of time.

+ Embargoes: A complete ban on trade (imports and exports) in one or more products with a particular country.

+ Administrative delays: Regulatory controls or bureaucratic rules designed to impair the rapid flow of imports into a country. +

Local-content requirements: Laws stipulating that a specified amount of a good or service be supplied

by producers in the domestic market. Economic: 1.

Exchange rates: Giải thích

- Exchange rates affect demand for a company’s products in the global marketplace. Ví dụ: rate giảm => giá

export giảm, giá import tăng (more appealing on world market); công ty nước ngoài rate cao trả lượng cho

công nhân nước có rate thấp => profit.

+ Law of one price: The law of one price stipulates that an identical product must have an identical price in

all countries when price is expressed in a COMMON-DENOMINATOR currency. For this principle to apply, lOMoAR cPSD| 59691467

products must be identical in quality and content in all countries, and must be entirely produced within each particular country.

+ BigMacCurrencies (purchasing power parity - sức mua tương đương): The underlying assumption is that

the price of a Big Mac in any world currency should, after being converted to dollars, equal the price of a Big Mac in the US. 2. GDP:

- Khái niệm: the value of all goods and services produced by a country during a one-year period. This figure

includes income generated both by domestic production and by the country’s international activities. 3. GNP: -

Khái niệm: the value of all goods and services produced by the domestic economy over a one-year period. Thuật ngữ viết tắt: -

LDCs: less developed countries - trên các nước đang phát triển nhưng dưới các nước đã phát triển. VD: Columbia, Cuba -

NICs: Newly industrialized countries - countries with an emerging industrial base, one that is capable

of exporting. Examples of NICs are the ‘tigers’ of South-east Asia: Hong Kong, Singapore, South Korea

and Taiwan. Brazil and Mexico are examples of NICs in South America.

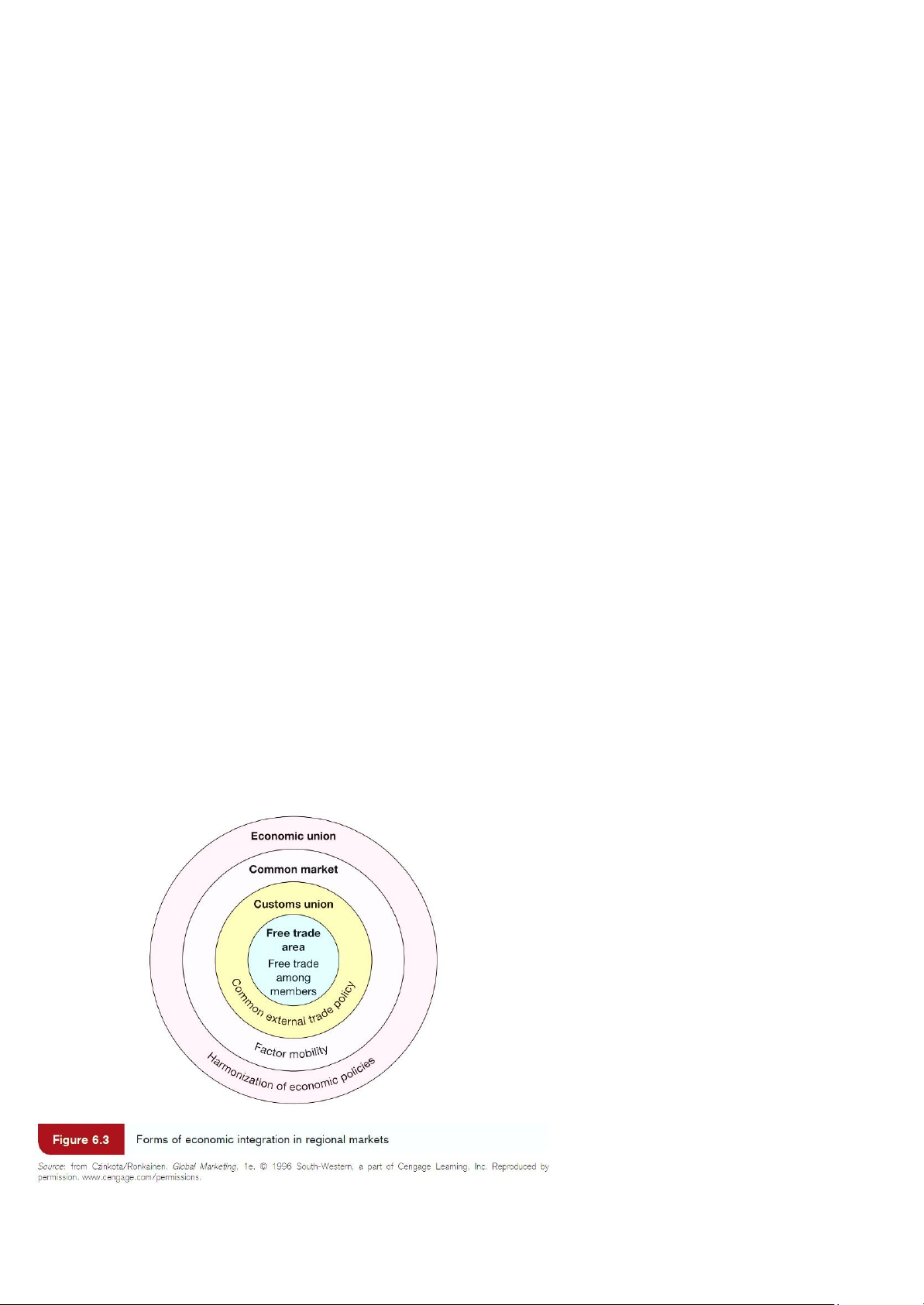

Fig 6.3: Regional economic integration (Liên kết kinh tế khu vực) - Economic integration has been one of the

main economic developments affecting world markets since World War II. Countries have wanted to engage

in economic cooperation to use their respective resources more effectively and to provide large markets for member country producers.

Hình mô tả các dạng liên kết sau (chữ đậm là tên dạng, chữ nhạt là mô tả): lOMoAR cPSD| 59691467

Chương 7: The sociocultural environment

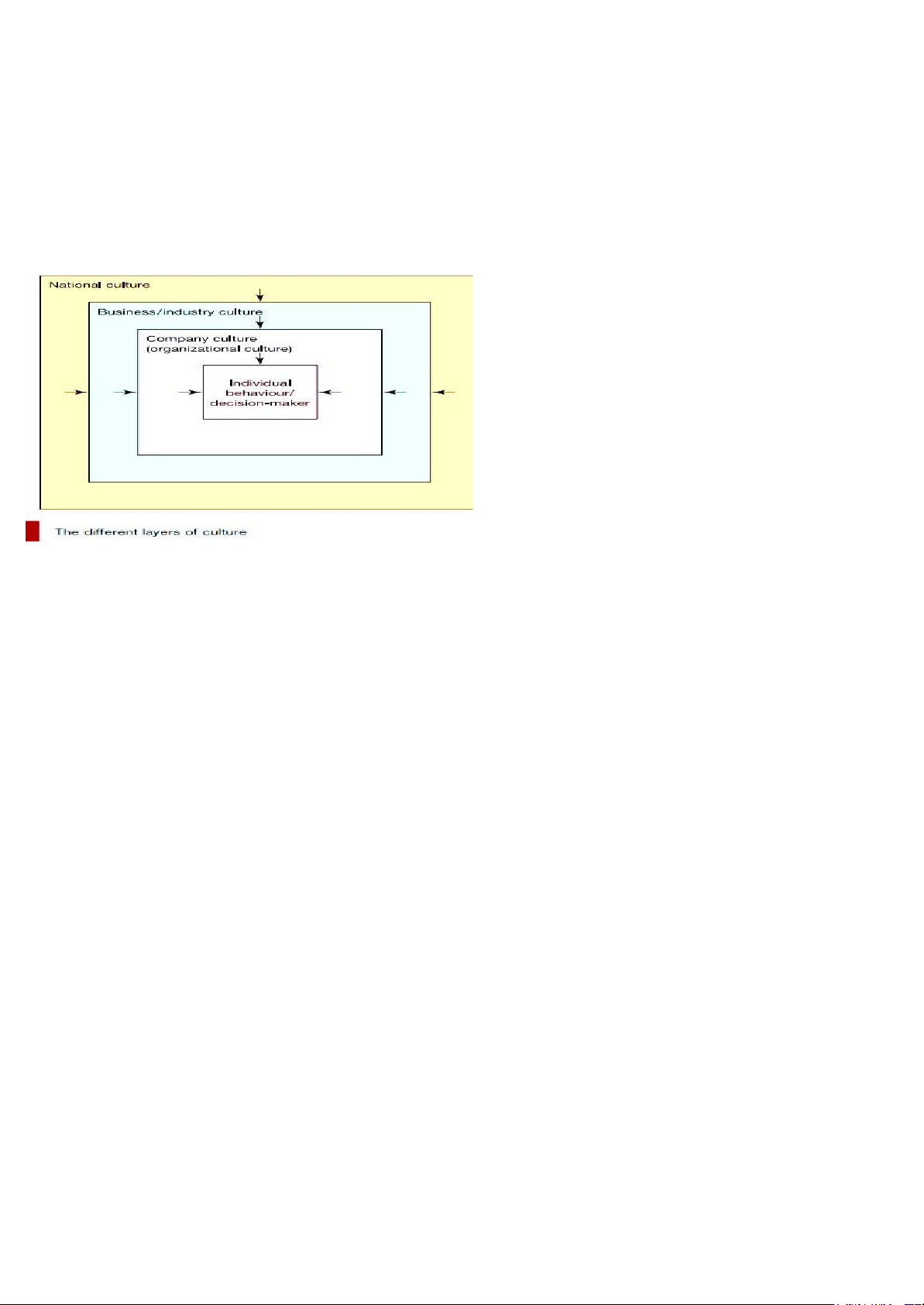

Layers of culture: phân tích thì phải so sánh các layers (Nếu chỉ nêu: nêu + Ví dụ)

The behaviour of the individual person is influenced by different layers of culture. The national culture

determines the values that influence business/industry culture, which then determine the culture of the individual company. ●

National culture: This gives the overall framework of cultural concepts and legislation for business activities. ●

Business/industry culture: Every business is conducted within a certain competitive framework and

within a specific industry (or service sector). This level has its own cultural roots and history, and the

players within this level know the rules of the game. Industry culture is very much related to a branch

of industry, and this culture of business behaviour and ethics is similar across borders. For example,

shipping, the oil business, international trading and electronics have similar characteristics across national borders. ●

Company culture (organizational culture): [the culture that makes it distinctive from competitors

and non-competitors. Organizational cultures are often referred to as “corporate cultures” and reflect

the beliefs, values, and assumptions of an organization. For example, the culture of one school in a

school district can be different than the culture of another school located in the same district simply

because of what the people in one school culture adhere and react to.] ●

Individual behaviour: The individual is affected by the other cultural levels. In the interaction

environment, the individual becomes the core person who ‘interacts’ with the other actors in industrial

marketing settings. The individual is seen as important because there are individual differences in

perceiving the world. Culture is learned; it is not innate. The learning process creates individuals due

to different environments in learning and different individual characteristics.

Example: Electrolux is adapting its vacuum cleaner for the Japanese market. ●

National culture: Japanese customers are also very careful about cleanliness in their homes and thus clean them regularly. lOMoAR cPSD| 59691467 ●

Business/industry culture: Vacuum cleaners are suitable for ‘globalization’, as the shipping costs per

unit are relatively low. Japanese homes are relatively small and vacuum cleaners need to be quiet in

order not to disturb family members and neighbors. ●

Company culture: Thay đổi tính năng của sản phẩm và cách phân phối khác nhau giữa các nước để phù

hợp với nhiều thị trường quốc tế khác nhau. ● Individual behaviour: - Social culture:

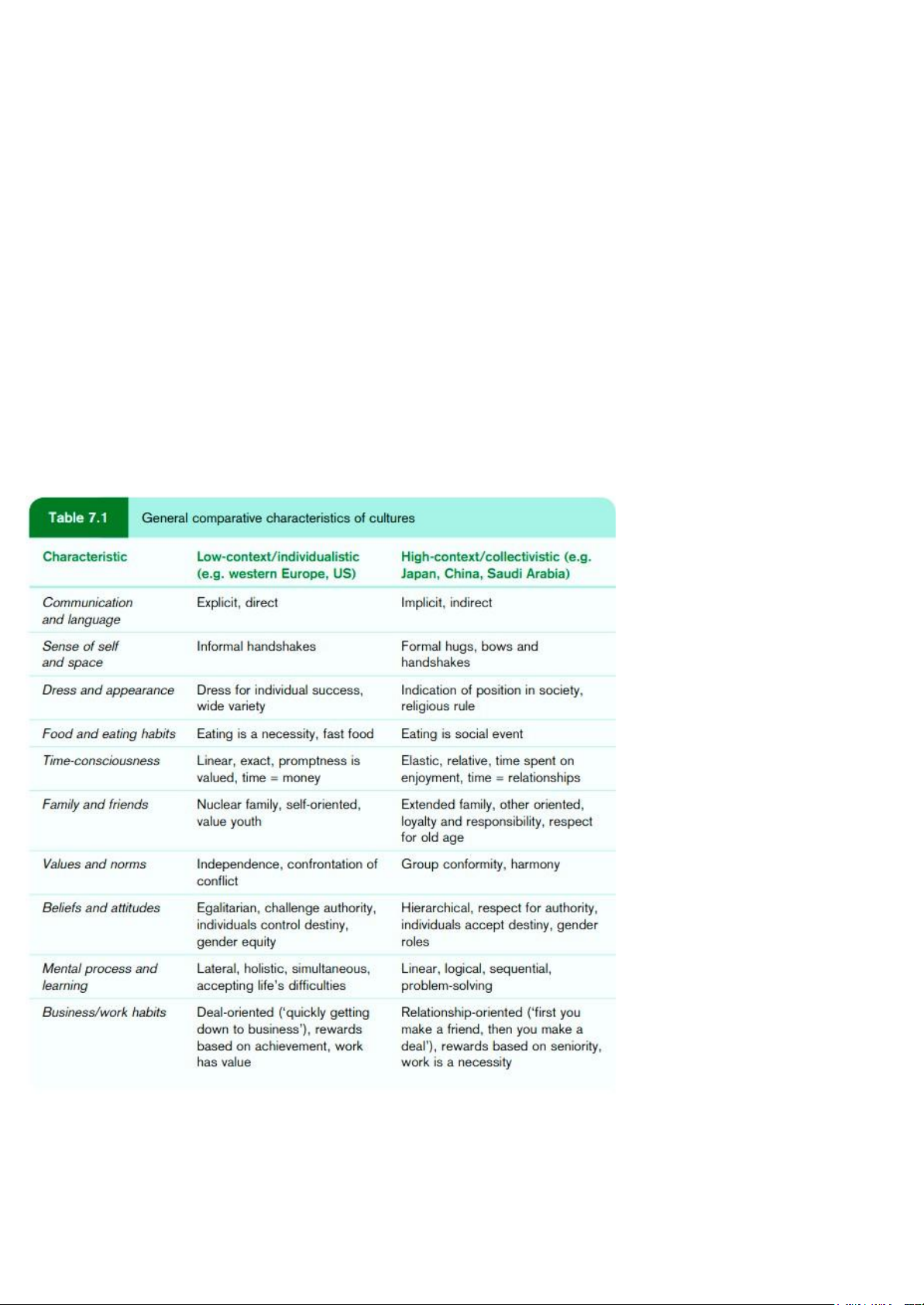

High/low context: for example, Asian (high-context) and Western (low-context) styles are so different, and

why Asians prefer indirect verbal communication and symbolism over the direct assertive communication approaches used by Westerners

+ High context: Use more elements surrounding the message. The cultural context in which the message is

communicated has a lot to say. High degree of complexity in communication. +

Low context: Rely only on spoken and written language. Low degree of complexity in communication.

+ Elements of culture: Chỉ ra 3 trong các elements về vhoa: Language, Technology and material culture, Education. lOMoAR cPSD| 59691467

*Language: Language gains complexity when a country has more than one officially recognized language.

The choice between verbal and non-verbal communication needs to be balanced based on whether the national

culture is a high-context culture or a low-context culture. In countries like Australia what is said is what is

meant and spoken language carries the emphasis of communication – low context culture. Whereas in

countries like Japan and some Arabic nations what is said may not be what is meant and the communication

tends not to carry a direct message in it – high context culture. So the researchers need to make sure the

marketing reaches out to the customers in the exact way it was meant to be communicated. *Manners and

customs (phong tục tập quán): Changes occurring in manners and customs must be carefully monitored,

especially in cases that seem to indicate a narrowing of cultural differences between peoples. Phenomena such

as McDonald’s and Coca-Cola have met with success around the world. Understanding manners and customs

is especially important in negotiations because interpretations based on one’s own frame of reference may

lead to a totally incorrect conclusion. To negotiate effectively abroad, one needs to read all types of

communication correctly. In many cultures, certain basic customs must be observed by the foreign

businessperson. One of them concerns the use of the right and left hands. In so-called right-hand societies, the

left hand is the ‘toilet hand’ and using it to eat, for example, is considered impolite.

*Education: The level of education in a country has a direct impact on the sophistication of the target

customer. A simple example will be the degree of literacy. In developed countries, main forms of

communication are advertising and printing methods. In developing countries, they rely on training and

verbally based educational programs to get their message across.

- Religion: ít trọng tâm: Christianity is the most widely practiced. Islam has been a recent rise in Islamic

fundamentalism in Iran, Pakistan, Algeria, and elsewhere. Hinduism is most common in India. Beliefs

emphasize the spiritual progress of each person’s soul rather than hard work and wealth creation. Buddhism

has adherents in Central and Southeast Asia, China, Korea, and Japan. Like Hinduism, it stresses spiritual

achievement rather than wealth, although the continuing development of these regions shows that it does not

necessarily impede economic activity. Confucianism has an emphasis on loyalty and obligation between

superiors and subordinates has influenced the development of family companies in these regions. - Hofstede:

(the ‘4 + 1’ dimensions model) không trọng tâm: According to Hofstede, the way people in different countries

perceive and interpret their world varies along four dimensions: power distance, uncertainty avoidance,

individualism, and masculinity. lOMoAR cPSD| 59691467

Chương 8: The IMS process

Phân biệt IMS process trong 2 loại công ty SMEs (small and medium-sized enterprises) và LSE (large-scale enterprised): SMEs:

- IMS is simply a reaction to a stimulus provided by a change agent, in the form of an unsolicited order. -

decision-making based on incrementalism where the firm is predicted to start the internationalization by

moving into those markets they can most easily understand.

- IMS có xu hướng: based on intuition and pragmatism (chủ nghĩa thực dụng).

- In real life, the decision about IMS is made by the partner obtaining the main contract (main contractor –

nhà thầu chính), từ đó SMEs mới có thể tham gia được vào thị trường quốc tế.

- SMEs are often selling to global customers (so-called global accounts) who have a global scope of operation

and they expect delivery of the SME’s product and services at multiple country sites.

- SMEs with already established global distribution networks and production sites in more business hubs are

often better positioned to supply these global account customers, VD: automotive sector (ngành công nghiệp ô tô). LSEs:

- LSEs with existing operations in many countries have to decide which of them to introduce new products into.

- By drawing on existing operations, LSEs have easier access to product-specific data that is more accurate

than any secondary database => the LSEs can be more proactive.

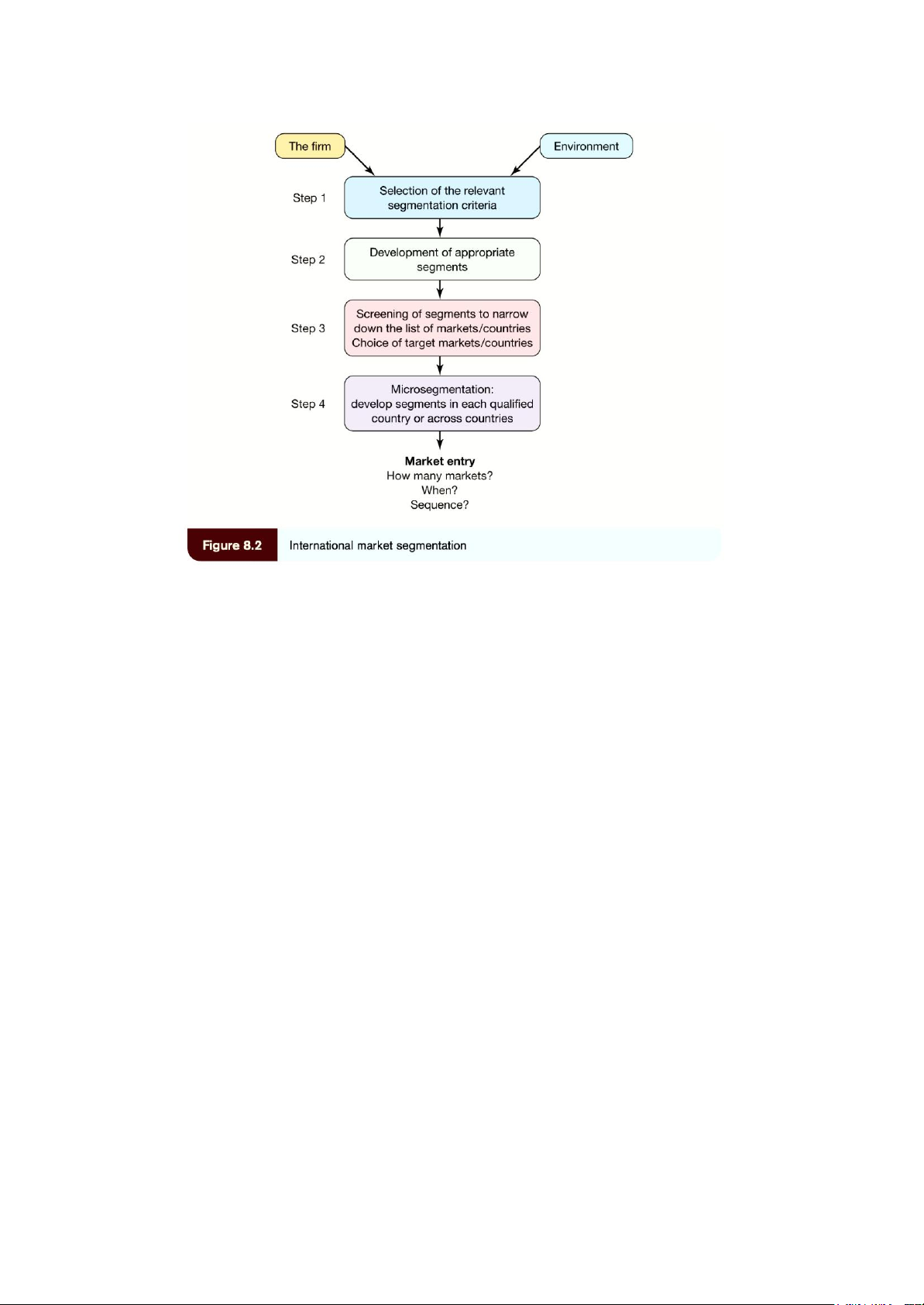

- IMS có xu hướng: more proactive, organized in a systematic way with step-by-step analysis. lOMoAR cPSD| 59691467 Fig.8.2: IMS step

Step 1 & 2: Defining criteria & developing segments

Criteria gồm general characteristics + specific characteristics. -

General characteristics gồm: geographic, language, political factors, demography, economy, industrial

structure, technology, social organization, religion, education. -

Specific characteristics gồm: cultural characteristics, lifestyle, personality, attitudes and tastes. Step 3: Screening of segments

Divided into 2 stages: preliminary screening and fine-grained screening. -

Preliminary screening: This is where markets/countries are screened primarily accord- ing to external

screening criteria (the state of the market). In the case of SMEs, considering the limited internal

resources (e.g. financial resources) => Using knocked-out criteria to exclude unsuitable countries. -

Fine-grained screening: comparing the firm’s competitive strength in different markets.

Step 4: Microsegmentation => using the MACS model (market attractiveness and competitive strength model).

Fig 8.17 tr.307: global product portfolio

The corporate portfolio analysis provides an important tool to assess how to allocate resources, not only across

geographic areas but also across different product business. The global corporate portfolio represents the most

aggregate level of analysis and it might consist of operations by product businesses or by geographic areas.

the further analysis of single corporate product business can be carried out in a product or geographic

dimension, or a combination of the two. lOMoAR cPSD| 59691467

The global corporate portfolio can be characterized by high market attractiveness and high competitive

strengths => phục vụ cho market-planning decisions. Waterfall vs shower approach

Chương 9: Some approaches to the choice of entry mode

*Entry mode: An institutional arrangement for the entry of a company’s products and services into a new

foreign market. The main types are export, intermediate, and hierarchical modes.

There are three different rules: naive rule (the decision-maker uses the same entry mode for all foreign

markets), pragmatic rule (The decision-maker uses a workable entry mode for each foreign market), and

strategy rules (This approach requires that all alternative entry modes are systematically compared and

evaluated before any choice is made).

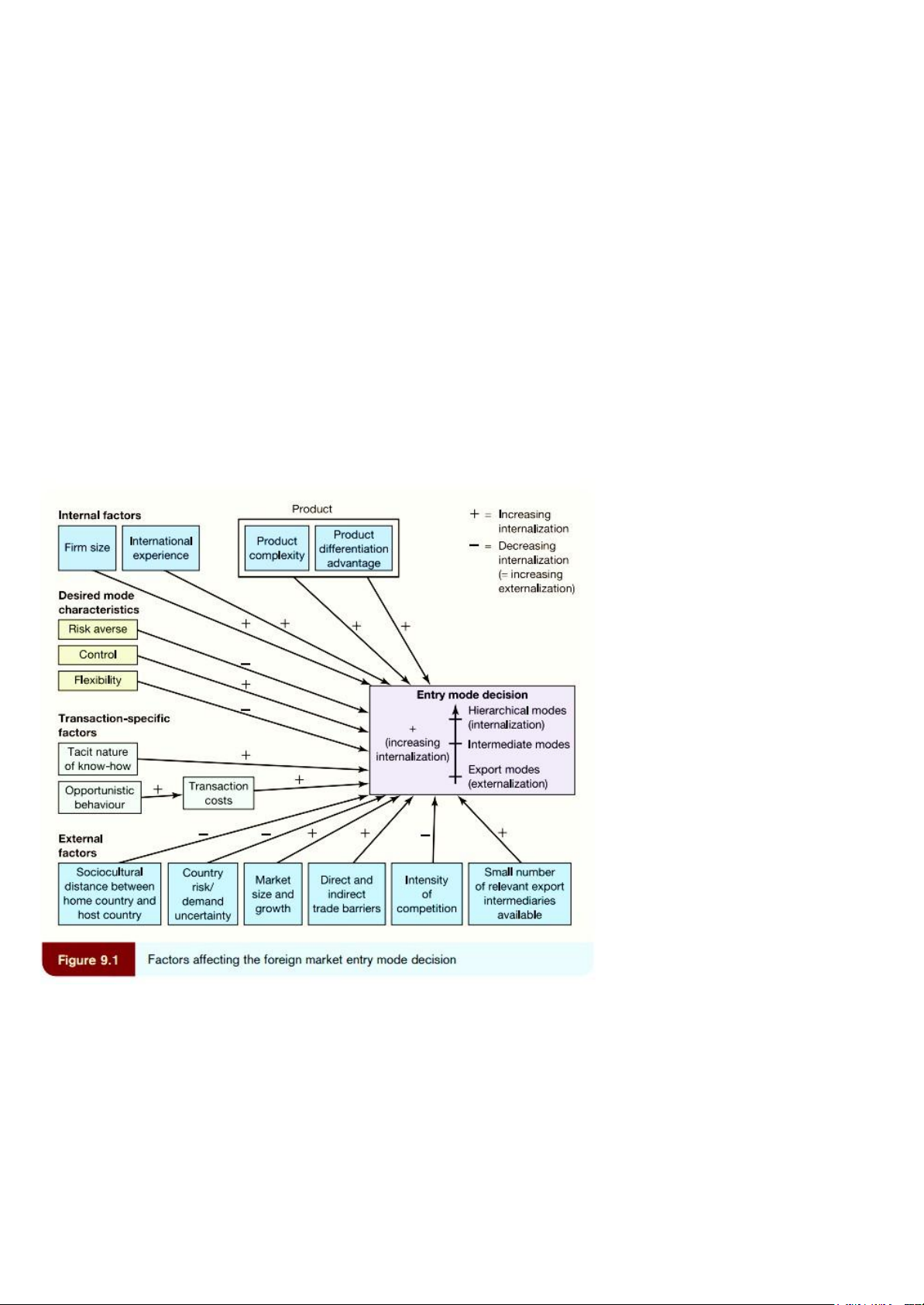

- P352: Fig 9.1: Factors influencing the choice of entry mode: internal factors, external factors, desired mode

characteristics, transaction-specific behavior.

-> Các yếu tố đánh giá, với các yếu tố tác động mang dấu +: với từng thị trường, các yếu tố đó càng cao thì

phương án lựa chọn sẽ tăng dần và cao nhất sẽ là internalization, để có thể dễ control hoạt động kinh doanh của doanh nghiệp.

Với các yếu tố mang dấu -: dấu - càng nhiều thì sẽ ngược lại với ý trên, phương án lựa chọn sẽ giảm dần xuống

intermidiate mode và xuống thấp nhất là export mode (phương án an toàn và low risk). lOMoAR cPSD| 59691467 ●

Hierarchical mode (direct investment: resulting in full ownership of the stores): Zara: Those markets

where the hierarchical model is used are characterized by high growth potential and relatively low

sociocultural distance (low country risk) between Spain and target market: high control, high risk, low

flexibility, the most costly, most difficult to change in the short run. ●

The intermediate modes (contractual modes) (usually joint venture and franchising): used in

countries where the sociocultural distance is relatively high. [Joint ventures: This particular mode is used in

large, competitive markets where it is difficult to acquire property to set up retail outlets or where there are

other kinds of obstacles that require cooperation with a local company]; [Franchising: for high-risk countries

that are socioculturally distant or have small markets with a low sales forecast: shared control and risk, split ownership ●

Export modes: exporting is appropriate when there is a low trade barrier, home location has and

advantage on costs, and when customization is not crucial.; minimal resource commitment: low control, low

risk, high flexibility 1. Internal factors a. Firm size -

As the firm grows, it will increasingly use the hierarchical model. -

Export entry modes, with their lower resource commitment, may therefore be more suitable for SMEs. b. International experience

- Reduces the cost and uncertainty of serving a market, increases the probability of firms committing resources

to foreign markets, which favours direct investment in the form of wholly owned subsidiaries (hierarchical modes).

-> Đúng nếu chọn đất nước là điểm đến tiếp theo có nét tương đồng với quốc gia mà doanh nghiệp đã có

kinh nghiệm gia nhập thị trường trước đó. Nét tương đồng giữa quốc gia đã thâm nhập với quốc gia mới

càng cao thì lựa chọn hình thức thâm nhập càng cao và cao nhất là hierarchical mode. c. Product/service

The physical characteristics of the product or service, such as its value/weight ratio, perishability and

composition, are important in determining where production is located

+ For instance, the technical nature of a product (high complexity) may require service both before and after

sale. In many foreign market areas, marketing intermediaries may not be able to handle such work. Instead

firms will use one of the hierarchical modes.

+ Products with high value/weight ratios, such as expensive watches, are typically used for direct exporting,

especially where there are significant production economies of scale, or if management wishes to retain control over production. 2. External factors a.

Sociocultural distance between home country and host country

- To summarize, other things being equal, when the perceived distance between the home and host country is

great, firms will favour entry modes that involve relatively low resource commitments and high flexibility. b.

Country risk/demand uncertainty lOMoAR cPSD| 59691467 -

When country risk is high, a firm would do well to limit its exposure to such risk by restricting its

resource commitments in that particular national domain. That is, other things being equal, when country risk

is high, firms will favour entry modes that involve relatively low resource commitments (export modes). c. Market size and growth -

The larger the country and the size of its market, and the higher the growth rate, the more likely

management will be to commit resources to its development, and to consider establishing a wholly-owned

sales subsidiary or to participate in a majority-owned joint venture. -

Small markets may not warrant significant attention or resources. Consequently, they may be best

supplied via exporting or a licensing agreement. d. Direct and indirect trade barriers e. Intensity of competition -

The greater the intensity of competition in the host market, the more the firm will favour entry modes

(export modes) that involve low resource commitments. f.

Small number of relevant intermediaries available 3.

Desired mode characteristics a. Risk-averse

If decision-makers are risk-averse they will prefer export modes (e.g. indirect and direct exporting) or

licensing (an intermediate mode), because these typically entail low levels of financial and management resource commitment b. Control -

Control is often closely linked to the level of resource commitment. Modes of entry with minimal

resource commitment, such as indirect exporting, provide little or no control over the conditions under which

the product or service is marketed abroad. c. Flexibility -

The hierarchical modes are typically the most costly, but they are the least flexible and most difficult to change in the short run. -

Export modes provide the company with higher flexibility because the company can terminate an agent

contract on a relatively short time horizon.

4. Transaction-specific factor Chương 10: Export mode

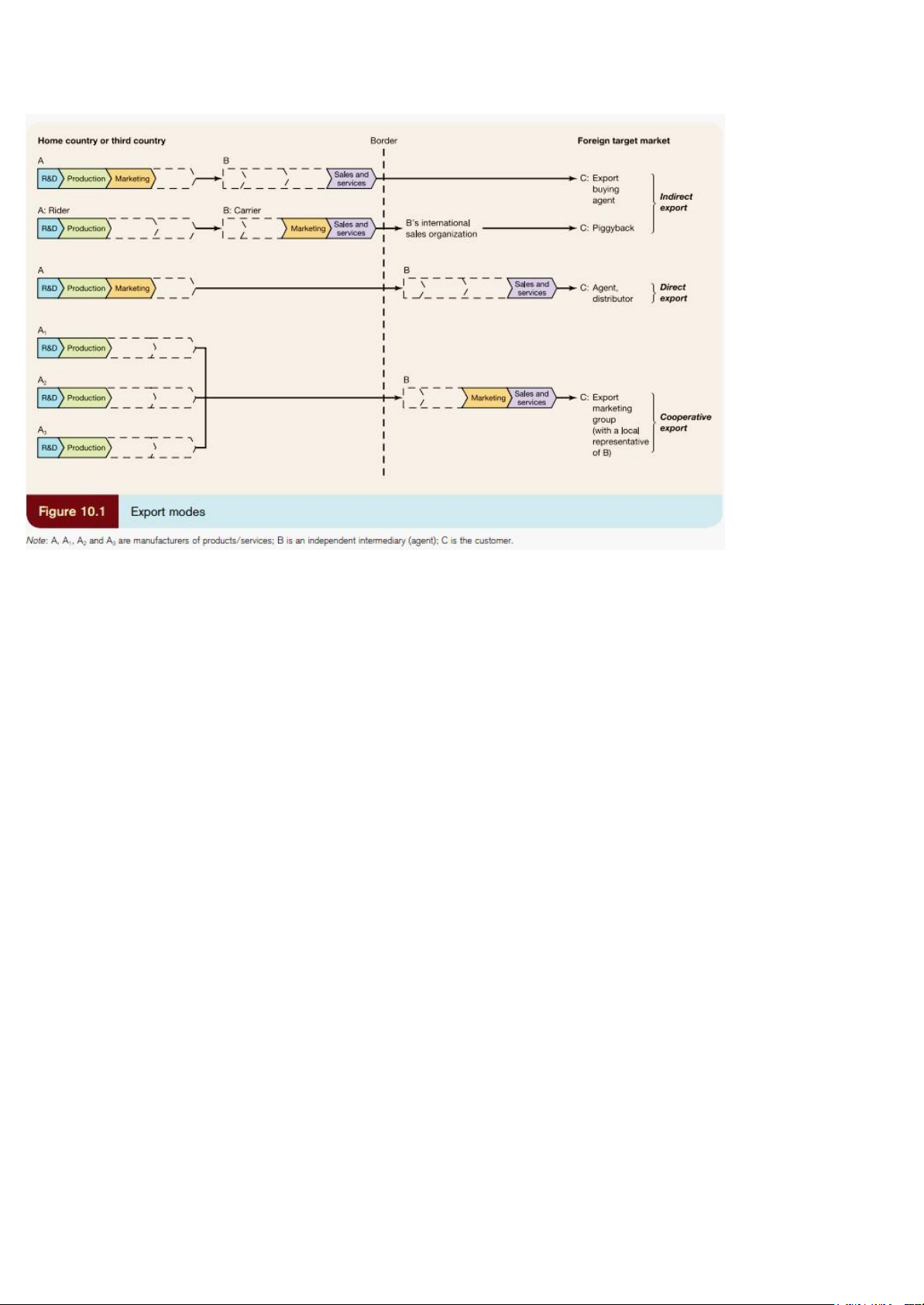

- Figure 10.1: Giải thích về export mode pg 367 lOMoAR cPSD| 59691467

3 modes: Indirect export, direct export, cooperative export

1. Indirect export modes: A manufacturer uses independent export organizations located in its own country

(or third country). Is used when:

- International sales are viewed primarily as a means of disposing of surplus production, or as a marginal -

Adopted by a firm with minimal resources to devote to international expansion which wants to enter

international markets gradually, testing out markets before committing major resources and effort to

developing an export organization. Disadvantages:

- The firm has little or no control over the way the product or service is marketed in other countries. - The firm

has limited information about foreign market potential, and obtains little input to develop a plan for

international expansion. The firm will have no means to identify potential sales agents or distributors for its products. Advantages:

- The least cost and risk of any entry method

- Through indirect export modes the SME is able to utilize the resources of other experienced exporters and

to expand its business to many countries.

5 main entry modes of indirect exporting: export buying agent, broker, export management company/export

house, trading company, piggyback -

Export buying agent: A representative of foreign buyers who is located in the exporter’s home country.

The agent offers services to the foreign buyers, such as identifying potential sellers and negotiating prices. lOMoAR cPSD| 59691467 -

Broker: bring a buyer and a seller together, they may act as the agent for either the seller or the buyer.

Does not actually handle the products sold or bought. -

Export management company/export house: (EMCs) are specialist companies set up to act as the

‘export department’ for a range of non-competing companies. + Advantages: ●

EMCs can spread their selling and administration costs over more products and companies, as well as reducing transport costs ●

EMCs deal with the necessary documentation, and their knowledge of local purchasing practices and

government regulations is particularly useful in markets that might prove difficult to penetrate ●

Allows individual companies to gain far wider exposure of their products in foreign markets at much

lower overall costs than they could achieve on their own + Disadvantages: ●

The selection of markets may be made on the basis of what is best for the EMC rather than for the manufacturer ●

They might be tempted to concentrate upon products with immediate sales potential, rather than those

that might require greater customer education and sustained marketing effort to achieve success in the longer term ●

The manufacturer’s products may not be given the necessary attention from salespeople ●

EMCs may carry competitive products that they may promote to the disadvantage of a particular firm

- Trading company: They offer a wide range of financial services

- Piggyback: the export-inexperienced SME, the ‘rider’, deals with a larger company (the carrier) which

already operates in certain foreign markets and is willing to act on behalf of the rider that wishes to export

to those markets. It is about the rider’s use of the carrier’s international distribution organization. + Advantages: ●

Carriers: a low-cost way to get the product because the carrier firm does not have to invest in R&D,

production facilities or market testing for the new product. ●

Riders: export conveniently without having to establish their own distribution systems, also they can

observe carefully how the carrier handles the goods and hence learn from the carrier’s experience + Disadvantages: ●

Carriers: Will the rider maintain the quality of the products sold by another firm? Will the rider firm

develop its production capacity, if necessary? ●

Riders: this type of agreement means giving up control over the marketing of its products and lack of

commitment on the part of the carrier and the loss of lucrative sales opportunities in regions not covered by

the carrier are further disadvantages.

2. Direct export mode: The manufacturer sells directly to an importer, agent or distributor located in the foreign target market. lOMoAR cPSD| 59691467 -

Distributors (importers): Independent companies that stock the manufacturer’s product. They will have

substantial freedom to choose their own customers and price. They profit from the difference between their

selling price and the buying price from the manufacturer. -

Agents: An independent company that sells to customers on behalf of the manufacturer (exporter).

Usually it will not see or stock the product. It profits from a commission (typically 5–10 per cent) paid by the

manufacturer on a pre-agreed basis.

3. Cooperative export modes/export marketing groups: Figure 10.1 shows an export marketing group with

manufacturers A1, A2 and A3, each having separate upstream functions but cooperating on the downstream

functions through a common, foreign-based agent. lOMoAR cPSD| 59691467

CHƯƠNG 11: Intermediate entry modes : trung gian ● Differences:

- Intermediate # export: they are primarily vehicles for the transfer of knowledge and skills between partners,

in order to create foreign sales.

- Intermediate # hierarchical: there is no full ownership (by the parent firm) involved, but ownership and

control can be shared between the parent firm and a local partner

- CAGR = compound annual growth rate = tỉ lệ tăng tưởng kép ●

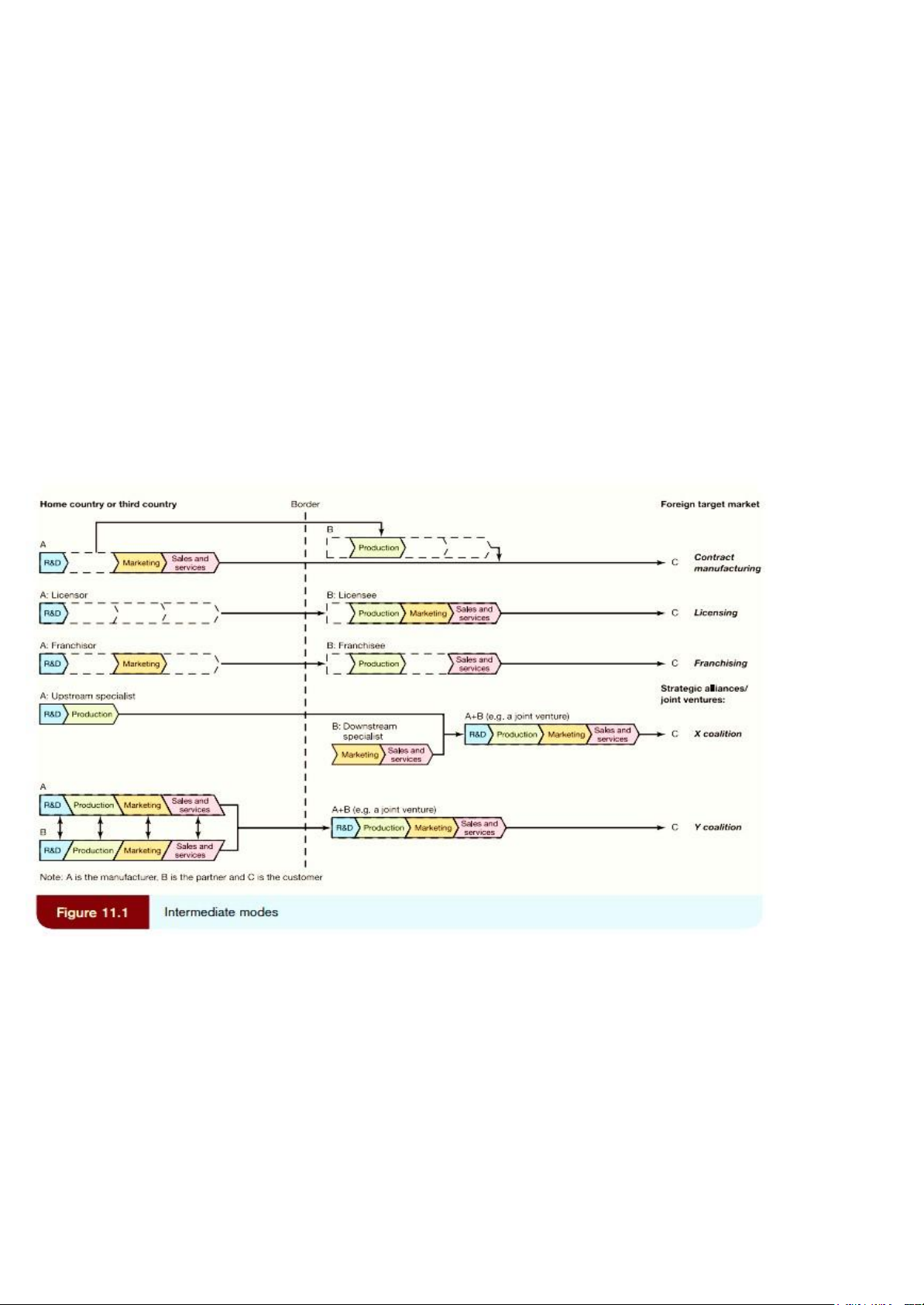

Intermediate entry modes include a variety of arrangements, such as licensing, franchising,

management contracts, turnkey contracts, joint ventures, and technical know-how or co-production arrangements.

=> Figure 11.1 shows that the most relevant intermediate modes are shown in the usual value chain perspective.

=> contractual arrangements take place when firms possessing some sort of competitive advantage are unable

to exploit this advantage because of resource constraints, for instance, but are able to transfer the advantage

to another party. The arrangements often entail long-term relationships between partner firms and are typically

designed to transfer intermediate goods, such as knowledge and/or skills, between firms in different countries. lOMoAR cPSD| 59691467

11.2 Contract Manufacturing: Hợp đồng sản xuất/ chế tạo

(Là sự hợp tác hoặc chế tạo lắp ráp sản phẩm do nhà sản xuất thực hiện hiện theo đặt hàng của khách nước ngoài) ● Contract manufacturing: -

Manufacturing is outsourced to an external partner, specializes in production and production technology. -

Contract manufacturing is a strategy that allows companies to produce their products in foreign markets

without having to make a long-term commitment to investing in manufacturing facilities and infrastructure.

This can be beneficial for companies that lack the resources or are unwilling to risk the capital required to

establish their own foreign operations. Contract manufacturing also allows companies to focus on their core

competencies of research and development, marketing, distribution, and sales, while outsourcing the

production of their products to a local firm.

=> This approach is particularly popular in industries where quality and specification requirements are critical.

The contractor is responsible for selling the product, while the manufacturer is responsible for producing it

according to the contractor's specifications. ●

Benefits of manufacturing in foreign markets: -

Desirability of being close to foreign customers. Local production allows better interaction with local

customer needs concerning product design, delivery and service. -

Foreign production costs (e.g. labour) are low. -

Transportation costs may render heavy or bulky products non-competitive. -

Tariffs or quotas can prevent entry of an exporter’s products. -

In some countries there is government preference for national suppliers.

11.3 Licensing: Cấp phép

(Hình thức thâm nhập thị trường nước ngoài, trong đó một công ty (bên mua giấy phép) quyền được sử

dụng các tài sản vô hình (thương hiệu, kiểu dáng công nghiệp,..) mà họ đàn sở hữu trong 1 time nhất định,

bên mua giấy phép phải trả bản quyền cho bên bán giấy phép.) ● Licensing: -

The licensor gives a right to the licensee against payment, e.g. a right to manufacture a certain product

based on a patent against some agreed royalty. -

Licensing is an alternative strategy for companies to establish local production in foreign markets

without making a capital investment.

=> Unlike contract manufacturing, licensing typically involves a longer-term commitment and transfers more

value chain functions to the licensee, giving them greater control over production. ●

Two main approaches to licensing: lOMoAR cPSD| 59691467 -

Stand-alone licensing agreement (Hợp đồng sử dụng giấy phép độc quyền): This type of agreement

focuses on the legal transfer of rights and the payment of royalties or other compensation to the licensor. The

royalties earned can be used to fund the licensor's ongoing research and development activities. -

"Licensing plus" licensing agreement: This type of agreement goes beyond simply granting a license.

It also includes provisions for R&D collaboration and/or equity exchange, creating a more strategic

partnership between the licensor and licensee. The licensor may need to adapt its research agenda to align

with the licensee's priorities.

11.4 Franchising: Nhượng quyền

(Phương thức thâm nhập thị trường nước ngoài trong đó 1 doanh nghiệp (nsx độc quyền) cung cấp cho 1

doanh nghiệp khác (đại lý đặc quyền) tài sản vô hình cùng với sự hỗ trợ trong 1 thời gian dài và nhận lại

được chi phí nhượng quyền kinh doanh)

Franchisor: bên nhượng quyền

Franchisee: bên nhận quyền ●

The franchisor gives a right to the franchisee against payment, e.g. a right to use a total business

concept/system, including use of trademarks (brands), against some agreed royalty. ●

Factors have contributed to the rapid growth rate of franchising: -

the general worldwide decline of traditional manufacturing industry and its replacement by service-

sector activities has encouraged franchising. It is especially well suited to service and people-intensive

economic activities, particularly where these require a large number of geographically dispersed outlets serving local markets. -

the growth in popularity of self-employment is a contributory factor to the growth of franchising.

Government policies in many countries have improved the whole climate for small businesses as a means of stimulating employment.

● Franchising is a marketing-oriented method of selling a business service, often to small independent

investors who have working capital but little or no prior business experience. -

Product and trade name franchising (Nhượng quyền sử dụng tên sản phẩm và thương mại) -

Business format ‘package’ franchising (Nhượng quyền mô hình kinh doanh “trọn gói”)

=> Trong sách ghi tập trung vào cái t2

+ International business format franchising is a market entry mode that involves a relationship between the

entrant (the franchisor) and a host country entity, in which the former transfers, under contract, a business

package (or format) that it has developed and owns, to the latter. The franchise system can be set up as a direct or indirect system.

_The direct system: the franchisor is controlling and coordinating the activities of the franchisees directly. ->

Advantages: access to local resources and knowledge, more adaptation and the possibility of developing a lOMoAR cPSD| 59691467

successful master franchisee (subfranchisor) as a tool for selling the concept to other prospective franchisees within the country

_The indirect system: a master franchisee (sub-franchisor) is appointed to establish and service its own

subsystem of franchisees within its territory. => Disadvantage: monitoring issues because of loss of control

11.5 Joint ventures/strategic alliances: Liên doanh/ Liên minh chiến lược

(Joint ventures - liên doanh: công ty chia sẻ quyền sở hữu và trách nhiệm kinh doanh với 1 đối tác khác ở

nước sở tại trong hoạt động kinh doanh thông qua việc thành lập 1 công ty riêng biệt được sở hữu bởi ít nhất

2 pháp nhân độc lập để đạt được những mục tiêu kinh doanh chung)

(Stragic alliances - liên minh chiến lược: sự hợp tác giữa các doanh nghiệp nhằm sử dụng các nguồn lực và

tiềm năng cơ bản của các bên để tạo ra những lợi ích chung) ●

A joint venture or a strategic alliance is a partnership between two or more parties. In international joint

ventures these parties will be based in different countries, and this obviously complicates the

management of such an arrangement. ●

Reasons are given for setting up joint ventures -

Complementary technology or management skills provided by the partners can lead to new

opportunities in existing sectors (e.g. multimedia, in which information processing, communications, and the media are merging). -

Many firms find that partners in the host country can increase the speed of market entry. Past research

(Kuo et al., 2012) has found evidence that a joint-venture arrangement can compensate for the lack of

international experience. Joint ventures allow the partners to share the responsibility of management and,

consequently, lower overall operation and administrative costs. -

Many less-developed countries, such as China and South Korea, try to restrict foreign ownership. -

Global operations in R&D and production are prohibitively expensive but are necessary to achieve competitive advantage. ●

The formal difference between a joint venture and a strategic alliance is that a strategic alliance is

typically a non-equity cooperation, meaning that the partners do not commit equity into or invest in the alliance.

=> In a contractual joint venture, no joint enterprise with a separate personality is formed. Two or more

companies form a partnership to share the cost of investment, the risks, and the long-term profits. An equity

joint venture involves the creation of a new company in which foreign and local investors share ownership and control. ●

Three different types of value chain partnerships appear: lOMoAR cPSD| 59691467 -

Upstream-based collaboration: A and B collaborate on R&D and/or production. -

Downstream-based collaboration. A and B collaborate on marketing, distribution, sales, and/or service. -

Upstream/downstream-based collaboration. A and B have different but complementary competences at each end of the value chain. ●

Y coalition - liên minh Y

Each partner in the alliance/joint venture contributes with complementary product lines or services. Each

partner takes care of all value chain activities within its product line. Another example is a joint marketing

agreement where complementary product lines of two firms are sold together through existing or new

distribution channels, and thus broaden the market coverage of both firms. ●

X coalition - liên minh X => liên minh này thì t nghĩ là cty A có lợi thế về R&D + sản xuất, B

thiên về mkt + sales

Forming X coalitions involves identifying the value chain activities where the firm is well positioned and has

its core competences. Take the case where A has its core competences in upstream functions but is weak in

downstream functions. A wants to enter a foreign market but lacks local market knowledge and does not know

how to get access to foreign distribution channels for its products. Therefore A seeks and finds a partner, B,

which has its core competences in the downstream functions but is weak in the upstream functions. In this

way A and B can form a coalition where B can help A with distribution and selling in a foreign market, and A

can help B with R&D or production.

11.6 Other Intermediate Entry Modes lOMoAR cPSD| 59691467

Chương 12: Hierarchical modes

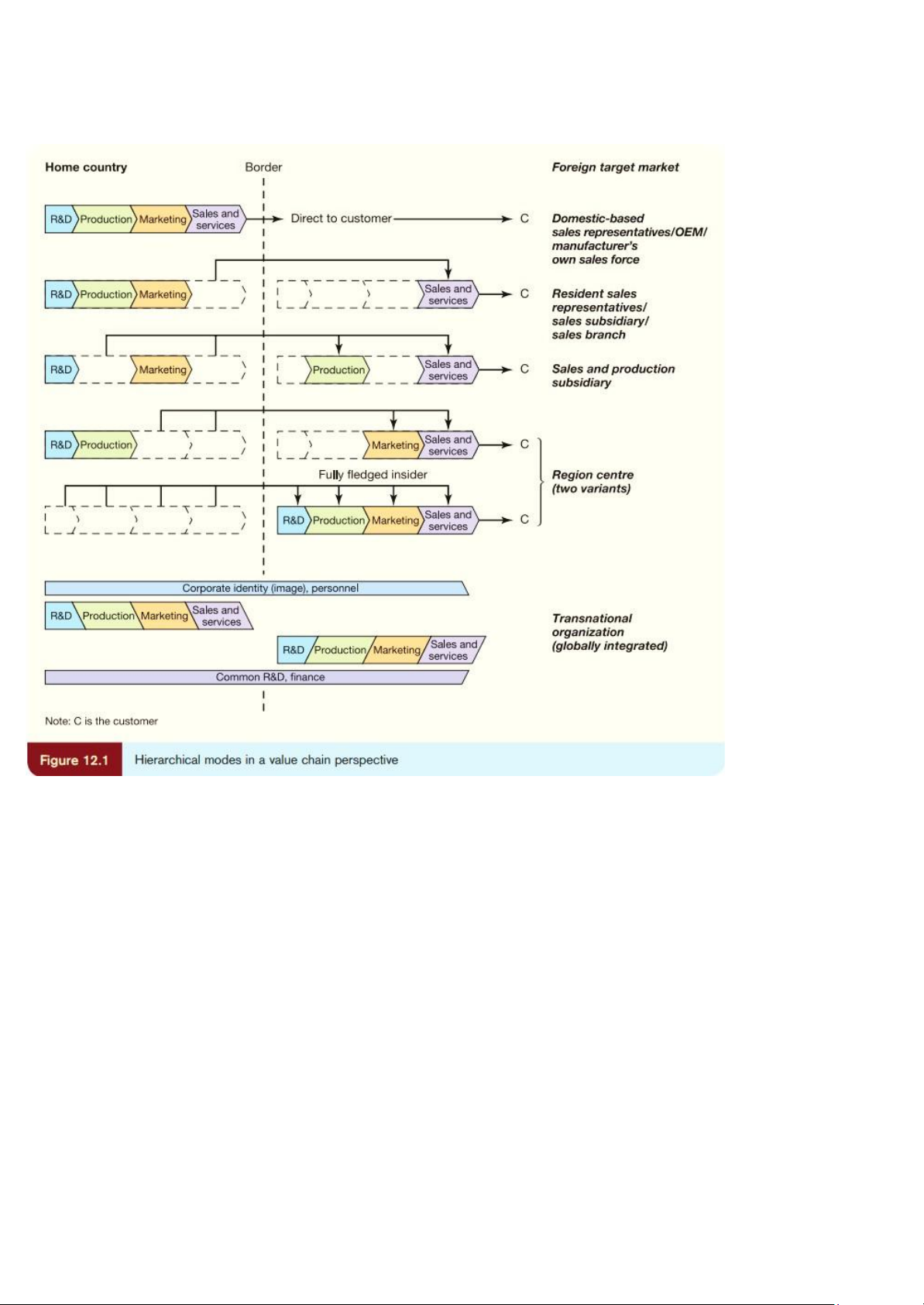

Hierarchical mode: The firm owns and controls the foreign entry mode/organization.

As a firm goes through Figure 12.1 , it chooses to decentralize more and more of its activities to the main

foreign markets. In other words, it transfers the responsibility of performing the value chain functions to the

local management in the different countries.

Internationalization stages:

- Ethnocentric orientation: represented by the domestic-based sales representatives. This orientation

represents an extension of the marketing methods used in the home country to foreign markets.

- Polycentric orientation: represented by country subsidiaries. This orientation is based on the assumption that

markets/countries around the world are so different that the only way to succeed internationally is to manage

each country as a separate market with its own subsidiary and adapted marketing mix.

- Regiocentric orientation: represented by a region of the world

- Geocentric orientation: represented by the transnational organization. This orientation is based on the

assumption that the markets around the world consist of similarities and differences and that it is possible to