Preview text:

TESTING AND FORECASTING THE VNINDEX OF HOSTC

IN THE WEAK-FORM MARKET EFFICIENCY

In Partial Fulfillment of the Requirements of the Degree of

MASTER OF BUSINESS ADMINISTRATION In Finance By Ms: Au Tuong Vi ID: MBAIU13094

International University – Vietnam National University HCMC January 2016

TESTING AND FORECASTING THE VNINDEX OF HOSTC

IN THE WEAK-FORM MARKET EFFICIENCY

In Partial Fulfillment of the Requirements of the Degree of

MASTER OF BUSINESS ADMINISTRATION In Finance By Ms: Au Tuong Vi ID: MBAIU13094

International University – Vietnam National University HCMC March 2016

Under the guidance and approval of the committee, and approved by all its members, this

thesis has been accepted in partial fulfillment of the requirements for the degree. Approved:

Advisor: Assoc. Prof. Ho Thanh Phong Committee member

Chairperson: Assoc. Prof. Vo Thi Quy Committee member Committee member Acknowledge

I dedicate this thesis to my advisor, Assoc. Prof. Ho Thanh Phong – Rector of International

University – VNU HCMC, whom I keep calling Prof. Dumbledore for his resemblance to

this headmaster character in the Harry Potter book series: enthusiasm, understanding,

clemency and unconditional love for his students.

I would give my sincerest gratitude to my parents and sister for their support and

encouragement during not only the journey of master degree but also the journey of my

entire life. I would like to extend my special thanks to all my teachers, friends and

colleagues for their fellowship. Especially to those who have shared my Potterhead

worldview, without you, the completion of this thesis would not have been equipped with so much joy and laughter.

Finally, I would like to thank Novelist Joanne Kathleen Rowling for her genius in building

book characters so typically and in describing human psychology so deeply that I feel like

I can borrow her exact words to express my gratitude to a person I know resembling one

of her Harry Potter book series characters, Prof. Albus Dumbledore: his strictness and

caring have “filled me with the same balm as phoenix song”.

Plagiarism Statements

I would like to declare that, apart from the acknowledged references, this thesis either

does not use language, ideas, or other original material from anyone; or has not been

previously submitted to any other educational and research programs or institutions.

I fully understand that any writings in this thesis contradicted to the above statement

will automatically lead to the rejection from the MBA program at the International

University – Vietnam National University Ho Chi Minh City. Copyright Statement

This copy of the thesis has been supplied on condition that anyone who consults it

is understood to recognize that its copyright rests with its author and that no quotation

from the thesis and no information derived from it may be published without the author’s prior consent.

© Au Tuong Vi/ MBAIU13094/ 2015-2016 Table of Contents

Chapter 1 - INTRODUCTION ............................................................................... 1 1.

Business context ........................................................................................... 1 2.

Problem statements ...................................................................................... 4 3.

Objectives ..................................................................................................... 4 4.

Research questions ....................................................................................... 5 5.

Scope and limitations ................................................................................... 5 5.1.

Time scope ............................................................................................ 5 5.2.

Location scope ...................................................................................... 5 6.

Organization of the study ............................................................................ 6

Chapter 2 - LITERATURE REVIEW .................................................................... 7 1.

Weak-form market efficiency test ............................................................... 9 1.1. Random walk

model ............................................................................. 9 1.2. Submartingale

model.......................................................................... 17 2.

Semi-strong form market efficiency test ................................................... 21 2.1. Event

analysis ..................................................................................... 21 2.2. Correlation & simple linear

regression ............................................. 25 3. Vietnamese researches on weak-form

efficient market hypothesis .......... 26 Chapter 3 - RESEARCH

METHODOLOGY ...................................................... 28 1.

Data and logarithm transformation .......................................................... 27 2.

Weak-form market efficiency testing process ........................................... 28 3.

Tests of normality ...................................................................................... 31

3.1. Analysis of mean, standard deviation, skewness and kurtosis ......... 31

3.2. Jarque-Bera test ................................................................................. 32 4.

Tests of stationarity .................................................................................... 33

4.1. Augmented Dickey-Fuller test ........................................................... 33

4.2. Information criterions ........................................................................ 33

4.2.1. Akaike Information Criterion ................................................ 33

4.2.2. Schwarz Information Criterion .............................................. 34 4.2.3. Adjusted

............................................................................. 34

4.3. Variance ratio test .............................................................................. 35 5.

Tests of serial dependence.......................................................................... 35

5.1. Autocorrelation function and partial autocorrelation

function ............................................................................................... 35

5.2. Ljung-Box test .................................................................................... 37 6.

Autoregressive Integrated Moving Average forecasting .......................... 37

6.1. Definition of terms .............................................................................. 37

6.1.1. Stationary stochastic process .................................................. 37

6.1.2. Autoregressive model - AR(p)................................................. 37

6.1.3. Moving average (MA) ............................................................. 38

6.1.4. Mixed autoregressive moving average (ARMA) .................... 38

6.1.5. Autoregressive integrated moving average (ARIMA) ........... 39

6.1.5.1. Integration ................................................................... 39

6.1.5.2. ARIMA ........................................................................ 39

6.2. Box-Jenkins methodology................................................................... 40

6.2.1. Model identification ................................................................ 41

6.2.1.1. Identification of the degree of differencing d ............. 41

6.2.1.2. Identification of the autoregressive order p ............... 41

6.2.1.3. Identification of the moving average order q............. 42

6.2.2. Model estimation ..................................................................... 42

6.2.3. Diagnostic checking ................................................................. 42

6.2.4. Forecasting .............................................................................. 42 7.

ARCH effect and ARCH forecasting ......................................................... 43 8.

GARCH forecasting ................................................................................... 44

Chapter 4 - RESULTS & DISCUSSIONS ............................................................ 46 1.

Descriptive statistics and histogram .......................................................... 46 2.

Test of stationarity ..................................................................................... 47

2.1. Augmented Dickey-Fuller test ............................................................ 47

2.2. Variance ratio test ............................................................................... 50 3.

Serial dependence ....................................................................................... 51 4.

Weak-form market inefficiency ................................................................. 52 5.

ARIMA forecasting .................................................................................... 52

5.1. Model identification, estimation and forecasting .............................. 52

5.2. Residuals checking .............................................................................. 55

5.2.1. Residuals descriptive statistics and histogram ....................... 55

5.2.2. Residuals serial dependence .................................................... 56 6.

ARCH effect and forecasting ..................................................................... 58 7.

GARCH ...................................................................................................... 60

Chapter 5 - CONCLUSION AND RECOMMENDATIONS ............................... 62 1.

Conclusion .................................................................................................. 62 2.

Recommendations ...................................................................................... 63

REFERENCES ...................................................................................................... 64

APPENDIX ............................................................................................................ 67 List of Tables

Table 4.1 ..................................................................................................... 47

Table 4.2 ..................................................................................................... 50

Table 4.3 ..................................................................................................... 51

Table 4.4 ..................................................................................................... 53

Table 4.5 ..................................................................................................... 57

Table 4.6 ..................................................................................................... 59

Table 4.7 ..................................................................................................... 60 List of figures

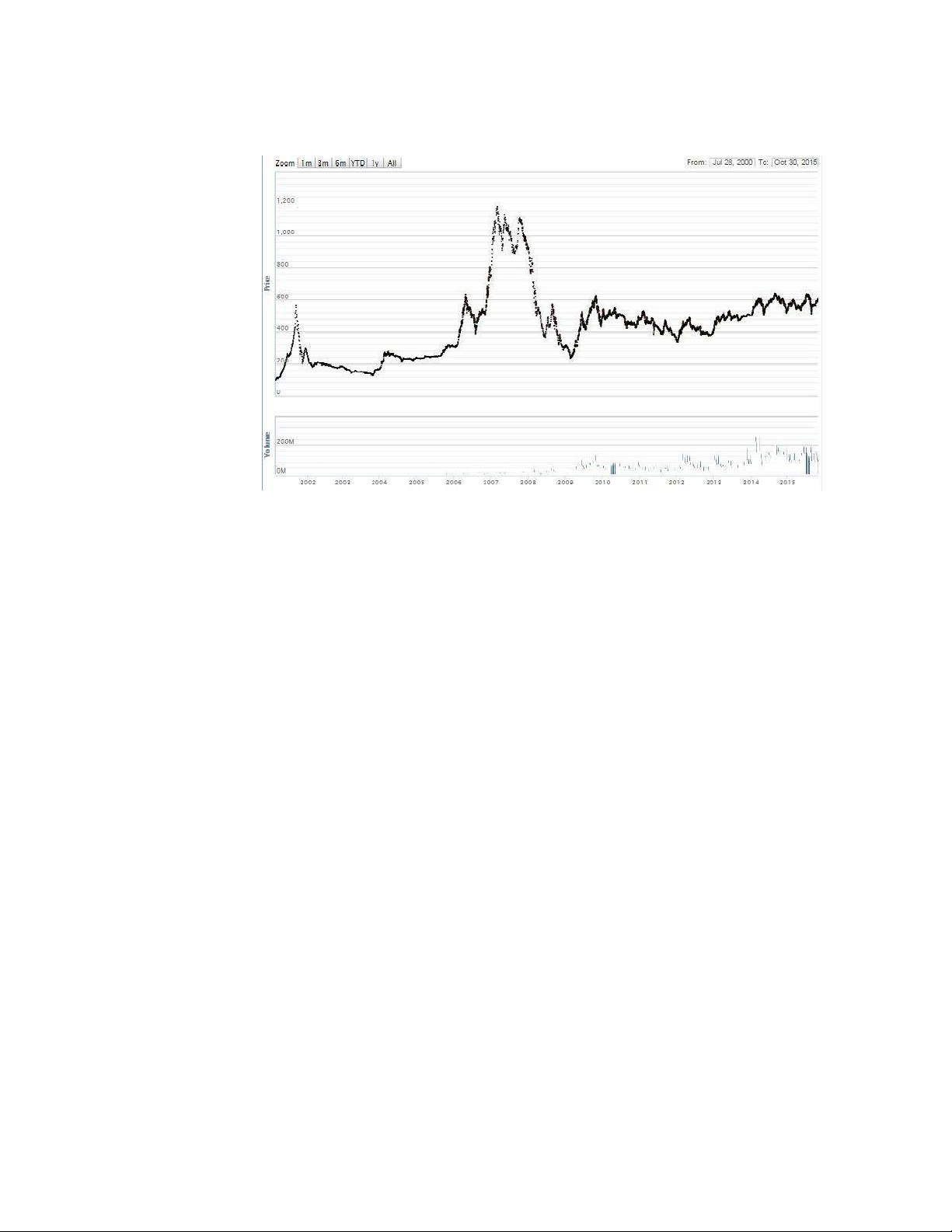

Figure 1.1: VNINDEX from July, 2000 to October, 2015 ........................... 2 Figure

3.1: VNINDEX daily returns from March, 2002 to

October 2015 .............................................................................................. 43

Figure 4.1: Distribution of VNINDEX returns ......................................... 46

Figure 4.2: Distribution of ARIMA (11, 0, 10) residuals .......................... 56

Figure 4.3: Actual and Forecast of VNINDEX returns ............................ 58 Abstract

This study tests the weak-form efficient market hypothesis for the case of VNINDEX, the

stock index of Ho Chi Minh Securities Trading Center. The stock market is found to be

weak-form inefficient, which means prices are predictable. Therefore, forecasting models

ARIMA, ARCH and GARCH of are applied into the data series. Goodness of fit of those

models shall be subject to further analysis.

Keywords: Efficient market, weak-form, ARIMA, ARCH, GARCH Comments: 1)

Bad points: lack of background & importance of the study

(reasons to conduct the study of the Vietnam stock market?), no

theory or model mentioned, the results of the study are unkown,

recommendations or contribution of the study is not clear, and the

abstract is too short with over 60 words. 2)

Good points: Easy to read and understand what the author is going to do in this study.

This page is intentionally left blank

Chapter 1 – INTRODUCTION 1. Business context

Vietnam’s economy has experienced the Reform Era for almost thirty years.Since 1986,

many important changes have been made to turn the economy into a marketoriented such as

reforming the whole banking system with more financial instruments,corporatizing the State

Owned Enterprises, enhancing the international trade via thenational participation in

Association of Southeast Asian Nations (ASEAN) and WorldTrade Organization (WTO), etc.

Among those changes, the most remarkable one was theestablishment of the first two security

markets: Ho Chi Minh Securities Trading Center(HoSTC) and Ha Noi Securities Trading Center

(HaSTC) (Farber, Nguyen, and Vuong,2006). According to Farber et al. (2006), these changes

signaled a bold move ofVietnam’s economy into a market driven financial one.

Comments: lack of citations and macro analysis (talk about capital markets => stock

markets => VN stock markets ).

VNINDEX is a capitalization weighted index of all listed companies on HoSTC.Ho

officially operated its first stock trading session on July 28

th, 2000 with only twocompanies listed

and SAM. After 15 years of operation, there are totally 324companies currently

on HoSTC. Highlights in the history of the VNINDEX arepresented as follows: 1

Figure 1.1: VNINDEX from July, 2000 to October, 2015 Source: VnDirect

• 2000-2005: HoSTC started its first official trading session on July 28th, 2000 and

the starting point of VNINDEX was 100. The index reached its peak of 571 points

in June 25th, 2001. The number of companies listed on the stock market was

finger countable then. The dramatic increase of the index within one year created

a stock market bubble and the index decreased almost 400 points within not yet

a year later. Trading regulation then limited the number of holding stocks and

required investors to hold the stocks for a particular time period. Investors lose

their interests and left the stock markets. Correspondingly, the index reached its

lowest record of around 130 points in 2003.

• 2006-2007: This period was signaled by the dramatic increase of VNINDEX to

its peak of 1,170 points on March 12th, 2007. Companies racing to be listed

created more investment alternatives for investors. Belief on a continuous 2

increase of the stock market brought investors from every background to

continuous participation in the market.

• 2008-2009: Dramatic decrease of VNINDEX from the peak of 2007 to the level

of less than 300 points recognized in December of 2008. The world financial

crisis was blamed to affect on the Vietnamese stock market at that time and

VNINDEX reached its bottom of 235 points on February 24th, 2009. The year

2009 was also signaled by an adjustment of prime interest rate and USD/VND

exchange rate made by the State Bank of Vietnam. Withdrawal of numerous

investors to move capital from the stock market to other assets’ markets was

blamed for dramatic decline of the VNINDEX.

• 2010-2015: Increases and decrease of VNINDEX during this period was not as

dramatic as previous periods. Widespread decreases was recognized

aroundevents related to the banking system such as the arrest of Vice Chairman ofAsia

Commercial Bank in August 21st, 2012 and Dong A Bank being put undera special

control of the Bank of Investment and Development of Vietnam inAugust 2015.

Comments: no use of bullets, lack of citations, and unclear graph.

Investors have long concerned about the stability of VNINDEX and its ability to

function as a barometer of Vietnamese economy and to provide a fair environment for

firms to generate capital to make production and investment decisions and for investors

to select securities representing ownership of firms’ activities. Manipulation problem has

undermined the transparency of stock prices for they do not reflect the firms’ activities 3

anymore. Manipulation in HoSTC occurs when an investor or a group of investors hold

most of the outstanding stocks of a listed firm to push the price dramatically up and wait

until the market goes thirst of the stock to sell at a significantly higher price level compared

to the real value of that stock. Manipulation has been so popular in the stock market that

there has been investors’ comment that only a few stocks in the market being real traded

based on their value. Therefore, many investors choose to trade on the basis of following

the manipulators’ activities. The efficiency of the stock market in reflecting real

information on firms’ activities into the stock prices has become a serious problem

according to investors trading on VNINDEX. Comments : lack of citations. 2. Problem statements

The initial problem inspiring the establishment of this research is the concern of

investors on the efficiency of the stock market, or say, on whether the stock market truly

reflect the operational and financial health of listed companies in order for investors to

make right investment decisions because a stock market is expected to function as a fair capital resources allocation.

The second problem arises from investors’ concern of what should be done in case

of inefficiency occurring in the stock market for the ultimate purpose of investors

regarding their participation in a capital market is to make profits.

Comments: weak rationale: broad problem is unclear => lead to

unclear specific problem of the study, lack of lots of previous studies, figures

& theories to highlight 'research gap', no definition of stock

market found, and weak connections among each paragraph. 3. Objectives

The intention of this thesis is establishing the model to reflect the 4

current efficiency condition of VNINDEX. lOMoARcPSD|47231818 4. Research questions

• Is VNINDEX efficient in the weak-form according to the theory of efficient market?

• What can be inferred about market efficiency condition from forecasting models?

Comments: no use of bullets, and the number of objectives isnot aligned

with the number of research questions, 'weak-form','market efficiency',

and 'forecasting models' are not defined well =>confused to understand.

5. Scope and limitation 5.1. Time scope

Due to the problems of a newly established stock market, VNINDEX’s data inthe early years

shall not be concerned. Particularly, during the time period from July28th, 2000

to February 27th, 2002, stocks listed on VNINDEX were only traded in 3sections per week, not in

5 sections as they are traded today. In order to ensure the

significance of the statistical tests,

data collected from July 28th, 2000 to February 27th,2002 shall be removed.

Comments: add citations for 'a newly established stock market', and give reasons

to choose VN-Index but not others. 5.2. Location scope

The stock market index to be concerned in this research is VNINDEX - the stocks market index of Ho

Chi Minh Securities Trading Center. The HNX of Hanoi

Securities Stock Exchange, the UPCOM and the OTC shall be considered to be out ofscope.

Comments : give reasons to study HOSE but not UPCOM or HNX. 5 lOMoARcPSD|47231818

6. Organization of the study

This study is organized as follows: • Chapter 1: Introduction

• Chapter 2: Literature reviews

• Chapter 3: Research methodology

• Chapter 4: Results and Discussions

• Chapter 5: Conclusion and Recommendations

Comments: no use of bullets, and each chapter needs to be briefly described. Summary:

Most critical errors: lack of citations, key definitions, experts' studies, macro analysis, figures, theories,

and forecasting techniques => unclear broad problem => the specific problem is unclear too => weak

rationale of conducting the study.

Critical errors: lack of 'Overview of Methodology', 'Significance of Study', 'Structure of Study', 'Key

Terms', and 'Chapter 1 Summary'.

Minor errors: spelling & grammar mistakes, illogical arrangements among sections, low coherence &

cohesion among paragraphs, use of bullets when listing, unclear figures, and less persuasive arguments.

Comments: Chapter 2 should firstly start with 'Definition of Key Concepts' => order of section is not logic.

Chapter 2 – LITERATURE REVIEWS

Comments: lack of titles.

An efficient market was defined by Fama (1970) as a market in which prices fully

reflected available information and provided accurate signals for assets allocation.

Therefore, firms could efficiently make production and investment decisions whereas

investors could select among securities representing ownership of firms’ activities there.

Lack of sources Empirical literatures on the theory of efficient markets model considered the adjustment

of security prices in accordance to the variables contained in the relevant information 6 lOMoARcPSD|47231818 Lack of Definition

set. If only historical prices were comprised in the information set, weak form test of

efficient market hypothesis shall be carried out; if the information set was expanded to

include all publicly available information such as announcement of annual earnings, Lack of Definition

stock splits, dividends, etc., semi-strong form test of efficient market hypothesis shall be Lack of Definition

considered; and finally, market efficiency in the strong form shall be tested if all public

and private information were included in the information set (Fama, 1970; Timmermann

& Granger, 2004). Comments: lack of related theories. Lack of Sources

Scholars have long put attempts to develop the phrase “fully reflect” regarding the

behavior of prices toward available information set in an efficient market into empirically

testable implications by specifying the process of price formation. Fama (1970) mentioned

a popular assumption of market equilibrium prices being expressed in terms of expected

returns which could be notationally described as follows: E p, ϕ = [1 + E r, ϕ ]p, (Equation 2.1)

Where pj,t is the price of security j at time t; Φt is the information available at time

t and assumed to be reflected in pj,t+1; and rj,t+1 is one period percentage return, calculated as follows: r, = p ,p,− p, (Equation 2.2)

The assumption of expected market equilibrium being formed on the basis of a fully

reflected information set Φt had a major empirical implication in ruling out the possibility 7 lOMoARcPSD|47231818

of a trading system basing only on the information set Φt to make profits. This was

basically the idea of a “fair game” for investors and firms in the capital market in which

no party could make abnormal trading returns based on knowledge of any particular

information set Φt. Let xj,t+1 be the profits in excess of equilibrium expected returns at time

point t+1, expressed as follows: x, = p, − E(p,|ϕ ) (Equation 2.3)

Fama (1970) defined the sequence {xj,t} as a “fair game” which respected to the

information set Φt when E x,|ϕ = 0.

Or equivalently, let zj,t+1 be the profits in excess of equilibrium expected percentage

returns at time point t+1, expressed as follows: z, = r, − E r,|ϕ (Equation 2.4)

Fama (1970) defined the sequence {zj,t} as a “fair game” which respected to the

information set Φt when E z,|ϕ = 0.

Jensen (1978) expressed the above definition of an efficient market which respect to

the information set Φt as follows: “A market is efficient with respect to information set Φ

if it is impossible to make economic profits1 by trading on the basis of information set Φt.”

1. Weak-form market efficiency test

1 Jensen (1978) defined economic profits as the risk adjusted returns net of all costs. 8 lOMoARcPSD|47231818

1.1. Random walk model

Hagerman & Richmond (1973) recalled the definition of an efficient market of Fama

(1970) as a market within which, the current price of a security was an unbiased estimator

of its intrinsic value, or say, the information relevant to the value of the security was

reflected in the current security prices. Fama (1970) limited the scope of available

information relevant to the value of the security in a weak-form efficient market to its

historical price movements. Based on that definition, Hagerman & Richmond (1973)

expressed a testable weak-form efficient market model as a “fair game” model as follows:

E(pj,t+k|pj,t; pj,t-1; pj,t-2,…, pj,t-n) = E(pj,t+k|pj,t) (Equation 2.5)

This was a random walk model which assumed that successive price changes were

independent and identically distributed (Fama, 1970) and the information set Φt in this

case, included a time series of past prices. The existence of a random walk model has

therefore, become the main concern in researches on the weak-form efficient market for

it supported confirming the presence of weak-form market efficiency. Literatures to be

reviewed as follows test the existence of a random walk model in various stock markets

worldwide in order to support conclusion on market efficiency:

The author published this paper in 2016 => the previous studies should be from 2011 to 2016

=> the below study is too old. (1)

Worthington, Andrew and Higgs, Helen (2004) tested for random walks and

weak-form market efficiency in European sixteen developed market as well as four

emerging markets. Employed methods included a combination of serial correlation

coefficient, run test, Augmented Dickey-Fuller, Phillip-Perron, KPSS unit root test and

multiple variance ratio test. The emerging markets were found to be inefficient in

weakform with the exception of Hungary; and among the developed markets, only Germany, 9 lOMoARcPSD|47231818

Ireland, Portugal, Sweden and The U.K complied with random walk criteria.

Descriptions of this study’s methods shall be presented as follows: 1. Test of normality:

1.1. Analysis of mean, standard deviation, skewness and kurtosis

(Aczel & Sounderpandian, 2002): 1 r − r̅ S = N σ (Equation 2.6) 1 r − r̅ K = N σ (Equation 2.7)

1.2.Jacque-Bera test (Gujarati, 2004): H0 : S

= 0 and K = 3 which means JB = 0

H1 : S ≠ 0 and K ≠ 3 which means JB ≠ 0 S (K − 3) JB = N + 6 24 (Equation 2.8)

Not rejecting H0 means the residuals are normally distributed 2. Tests for random walk: 2.1.

Dickey-Fuller test: statistic, testing for stationary (Gujarati, 2004):

+ Dickey Fuller test: ∆Yt = Yt-1 + ut (Equation 2.9)

+ Augmented Dickey Fuller test: ∆Y = β + β t + δY + ∑ α ∆Y + ε (Equation 2.10) 10