Preview text:

lOMoAR cPSD| 49431889 CHAPTER 2 Q1

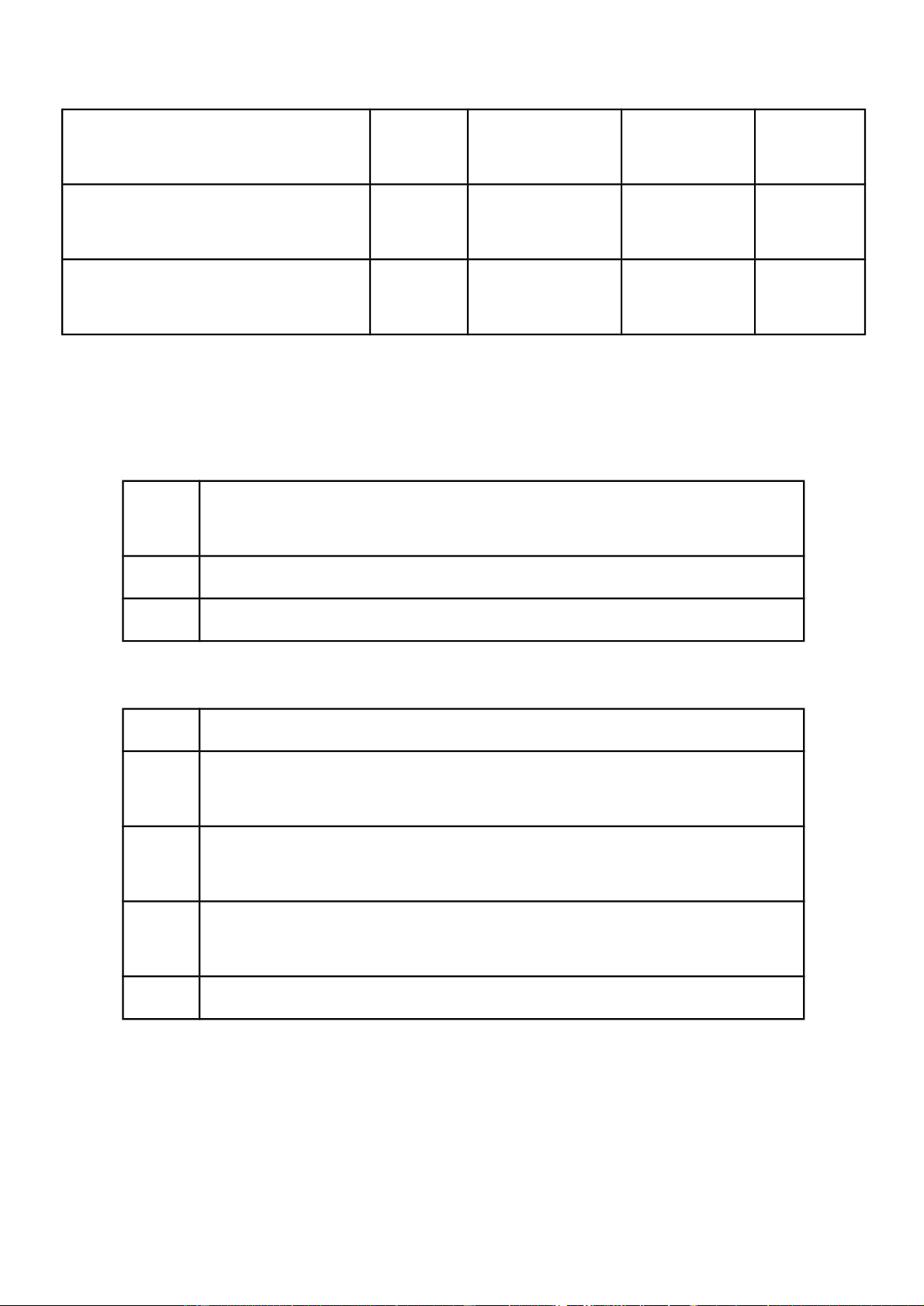

Typical statement of financial position classifications are as follows: a.

Long Term Investments f. Share Capital

b. Plant Assets g. Share Premium c. Intangible Assets h. Retained

Earnings d. Non - Current Assets i. Non-Current Liabilities e. Current Assets j Current Liabilities

Indicate by use of the above letters how each of the following items would be

classified on a statement of financial position prepared at December 31st, 2019. If a

contra account, or any amount that is negative or opposite the normal balance, put

parentheses around the letter selected. A letter may be used more than once or not at all. 1. Accrued salaries and wages

2. Rental revenues for 3 months collected in advance 3. Land used as plant site

4. Equity securities classified as trading 5. Cash

6. Accrued interest payable due in 30 days

7. Share premium–preference shares 9. Petty cash fund 10. Ordinary shares

11. Allowance for doubtful accounts: 12. Accumulated depreciation: 13. Goodwill: 14. 90 day notes payable

15. Investment in bonds of another company; will be held to 2023 maturity 1

16. Current maturity of bonds payable 17. Trade accounts payable

18. Preference shares ($10 par) lOMoAR cPSD| 49431889

19. Prepaid rent for next 12 months 20. Copyright

21. Accumulated amortization, patents

22. Earnings not distributed to shareholders Q2

1- Let’s have a look at a business where capital at the end of 2019 was $20,000.

During 2020, there have been no drawings, and no contributions from the owner.

At the end of 2020, the capital was $30,000. Required: a.

Determine net income (loss) for business for year 2020. b.

Determine net income (loss) for business for year 2020 if drawings had been $7,000.

2- ABC company has got following information on 3stQuarter of 2019.Unit: $ 1 /7/2019 30 / 9/2019 Cash 1 ,000 1,200 A/R 1 ,800 2,400 Goods 5 ,100 4,000 Equipment 1 ,000 1,000 Accumulated depreciation (400) (600) Receive in advance 200 100 A/P 1 ,000 800

During 3rd Quarter of 2019, owner withdrew by cash $300. no contribution. 2 Determine:

A - Changes of the owner’s equity during 3rd Quarter of 2019. lOMoAR cPSD| 49431889

B - Net income (net loss) for 3rd Quarter of 2019?

3 – XYZ coporation has got following information on Quarter 1st, 2020 Openning Closing balance balance Assets 3 ,200 5,100 Liabilies 2 ,300 2,900

During 1st Quarter of 2020, XYZ coporation issued shares and received cash of $1,000. No drawings.

Require: Determine net income (net loss) for business for 1st Quarter of 2020? Q3

Lee started a business on 1st January 2002 with $35,000 in a bank account.

Unfortunately, he did not keep proper books of account.

He must submit a calculation of profit for the year ending 31st Dec 2002 to the

inspector of Taxes. At 31 st December 2002, he had inventory valued at cost of $6,200,

a van which had cost $6,400 during the year and which had depreciated during the

year by $1,600, A/R of $15,200, expense prepaid $310, a bank balance of $33,490, a

cash balance $270, A/P $7,100 and expenses owing $640. His drawings were: cash

$400 per week for 50 weeks, cheque payment $870 Required:

Draw up statements to show the profit or loss for the year. Q4

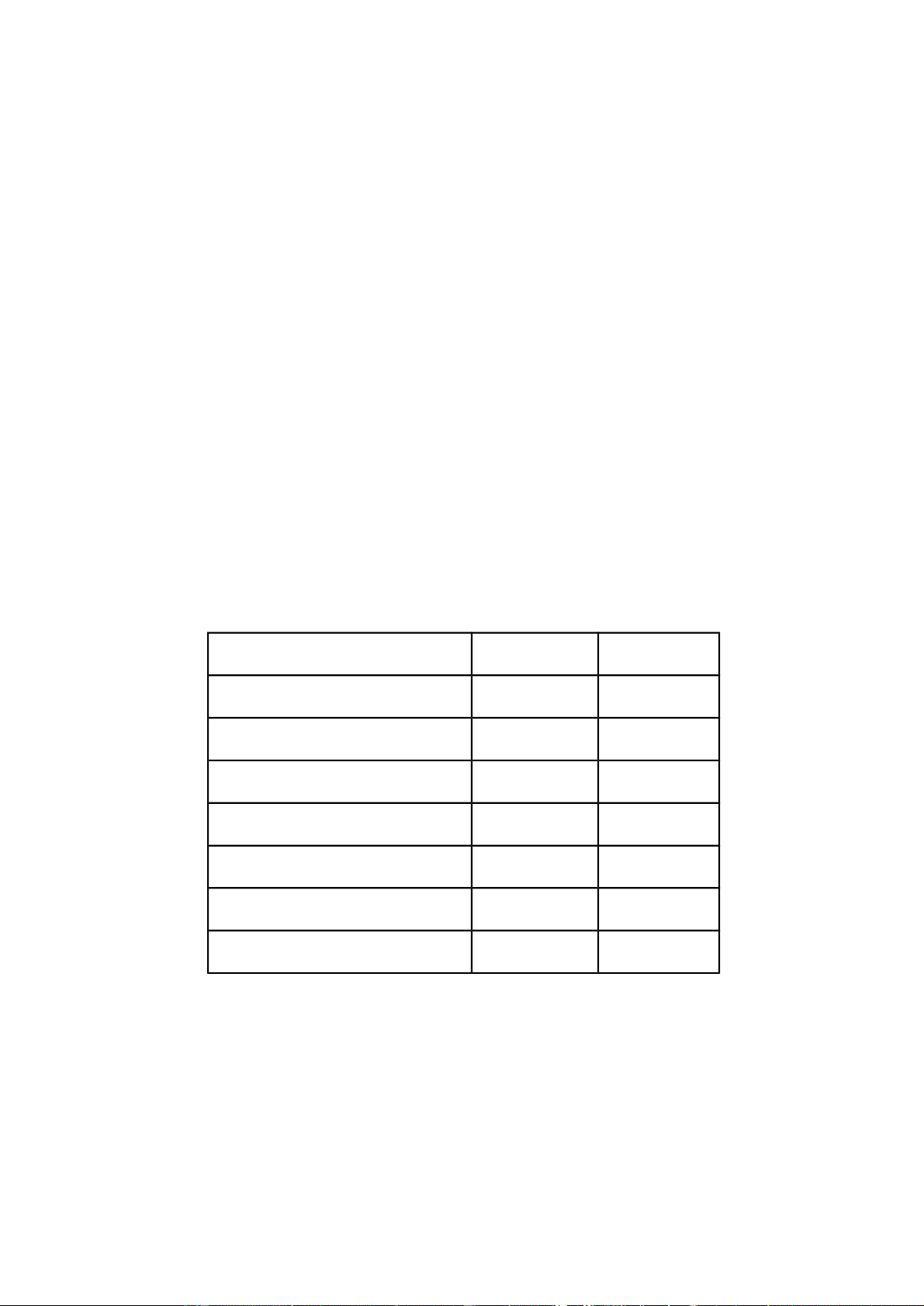

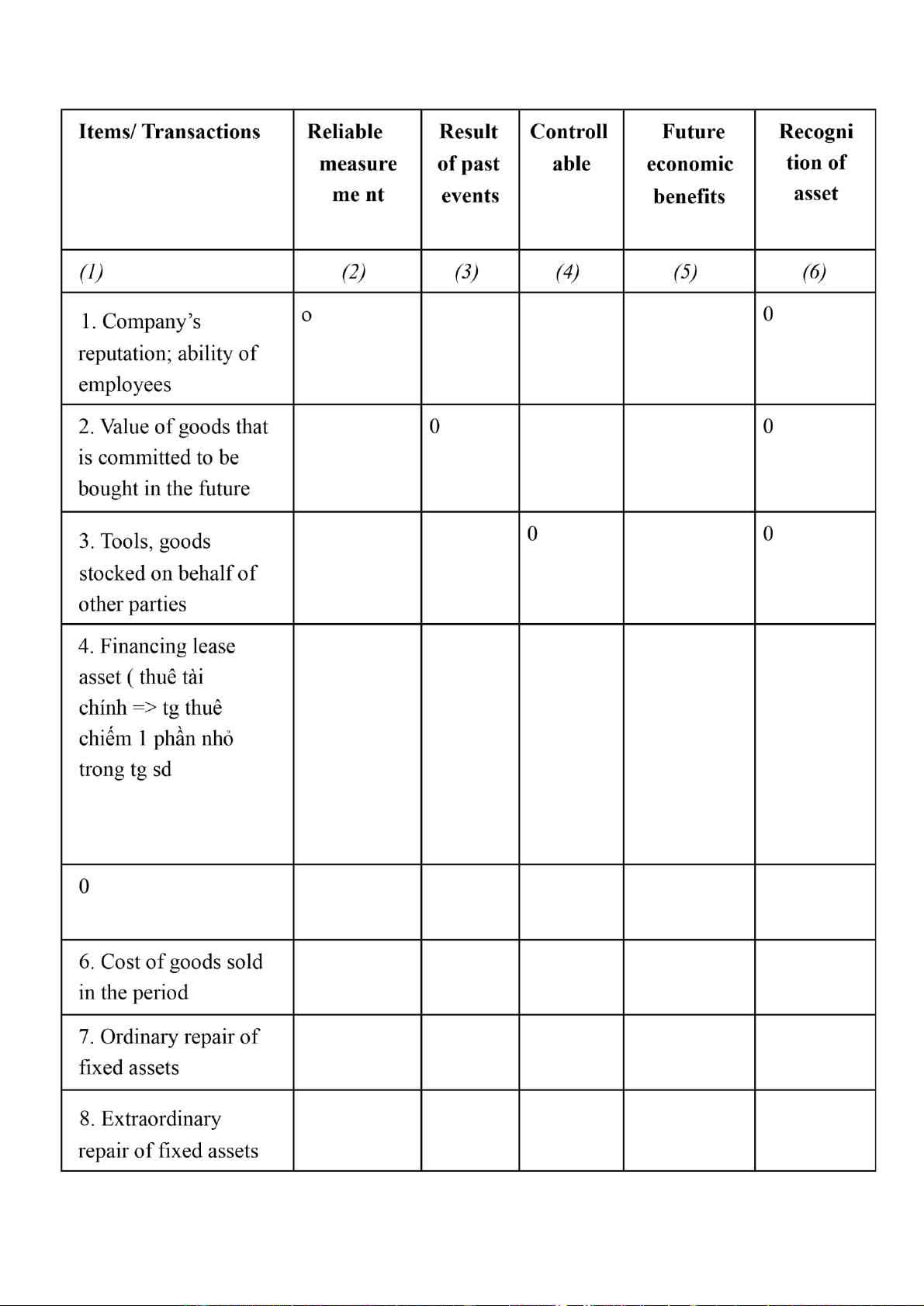

Which of the following transactions meet the recognition criteria of FS’s elements?

+ Meet all the criteria – recognize: √

+ Does not meet any criteria – does not recognize: 0 3

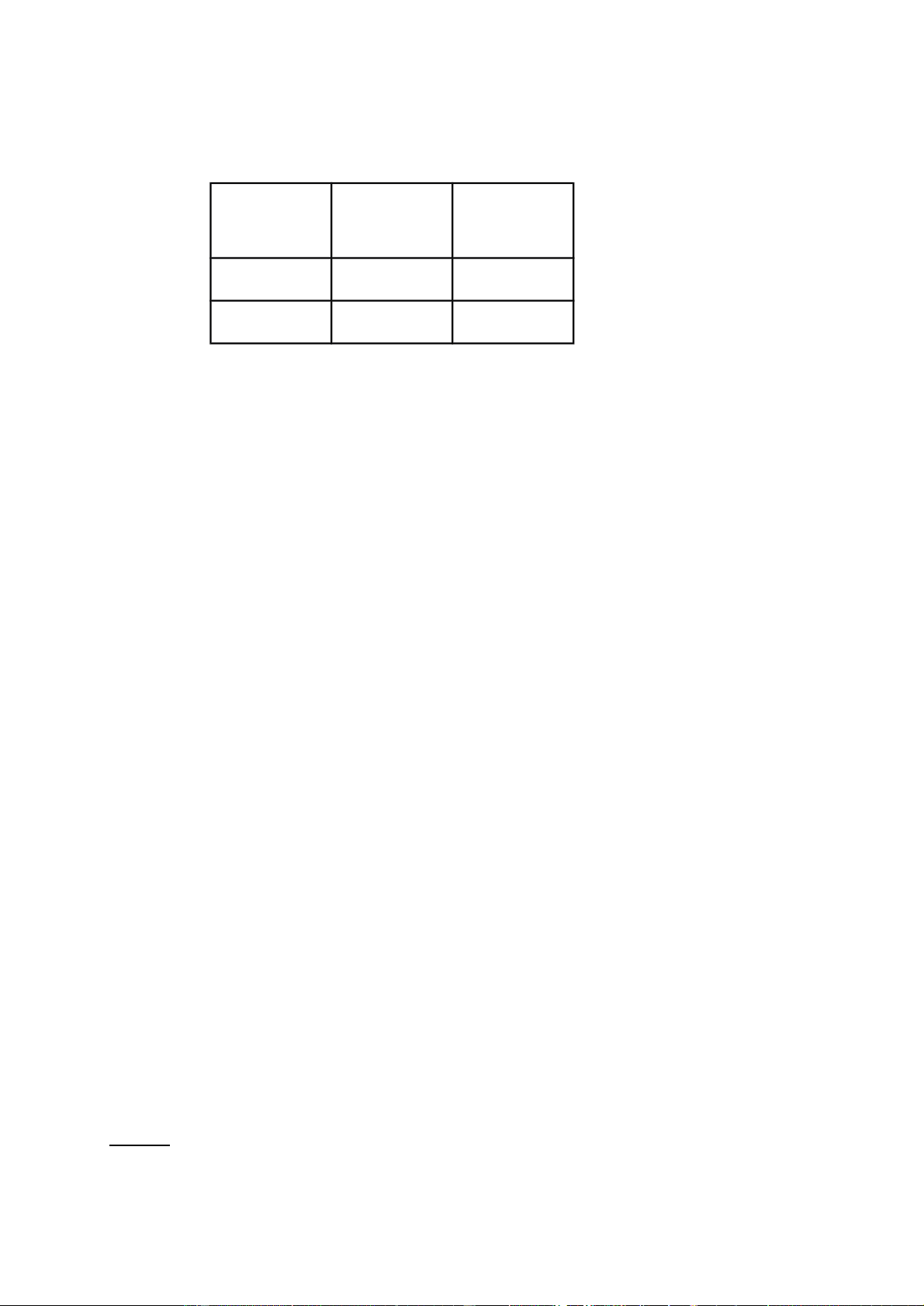

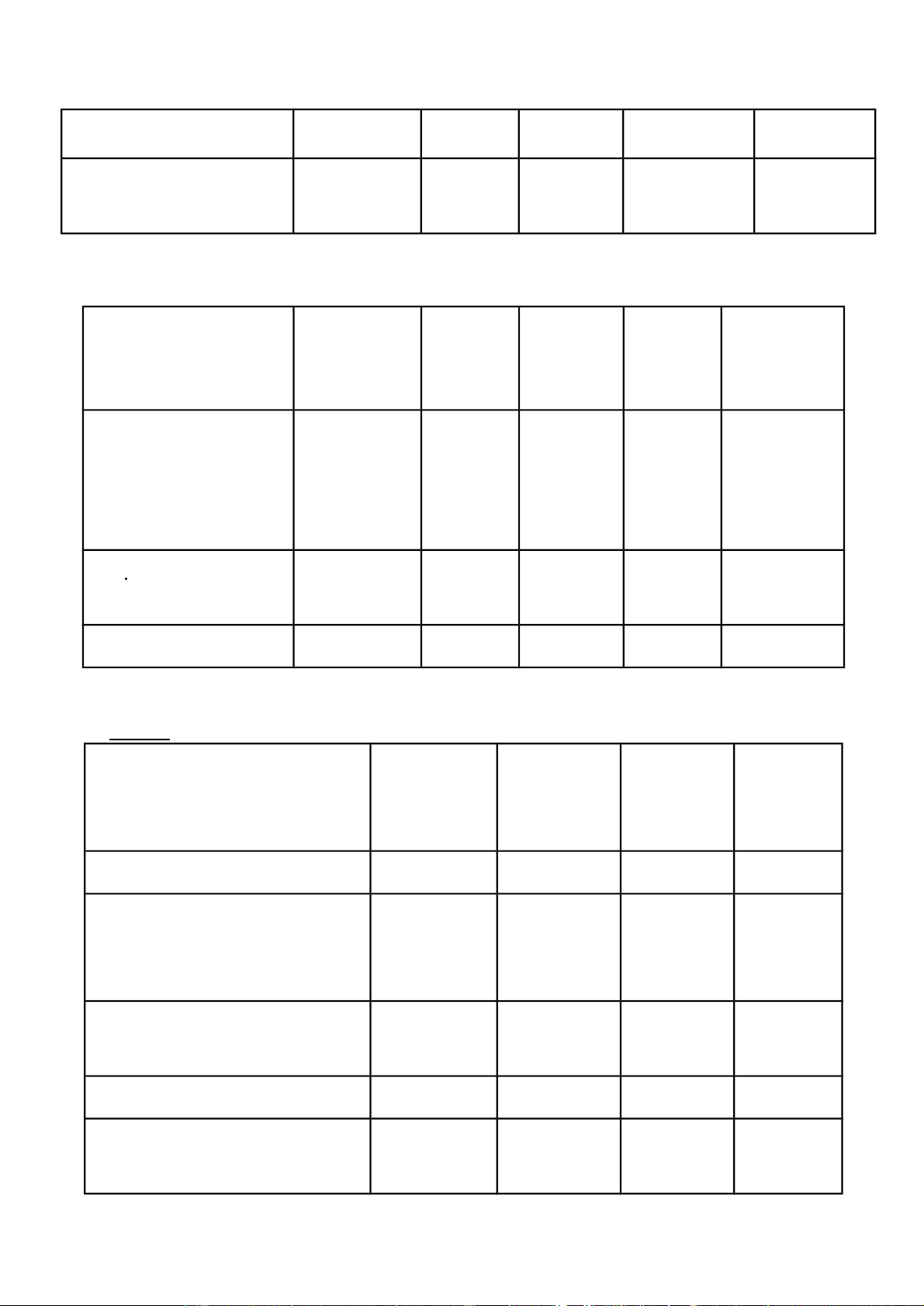

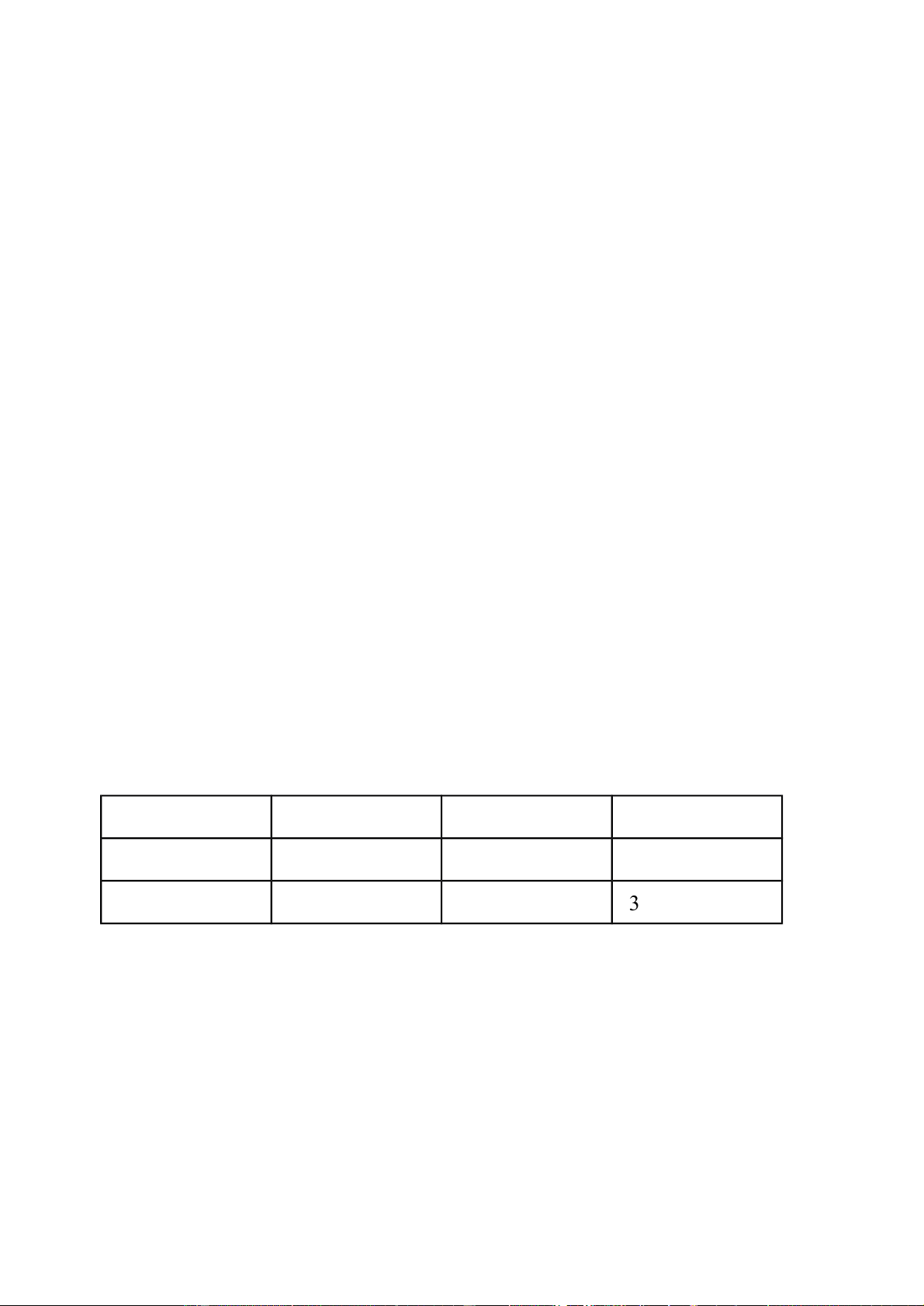

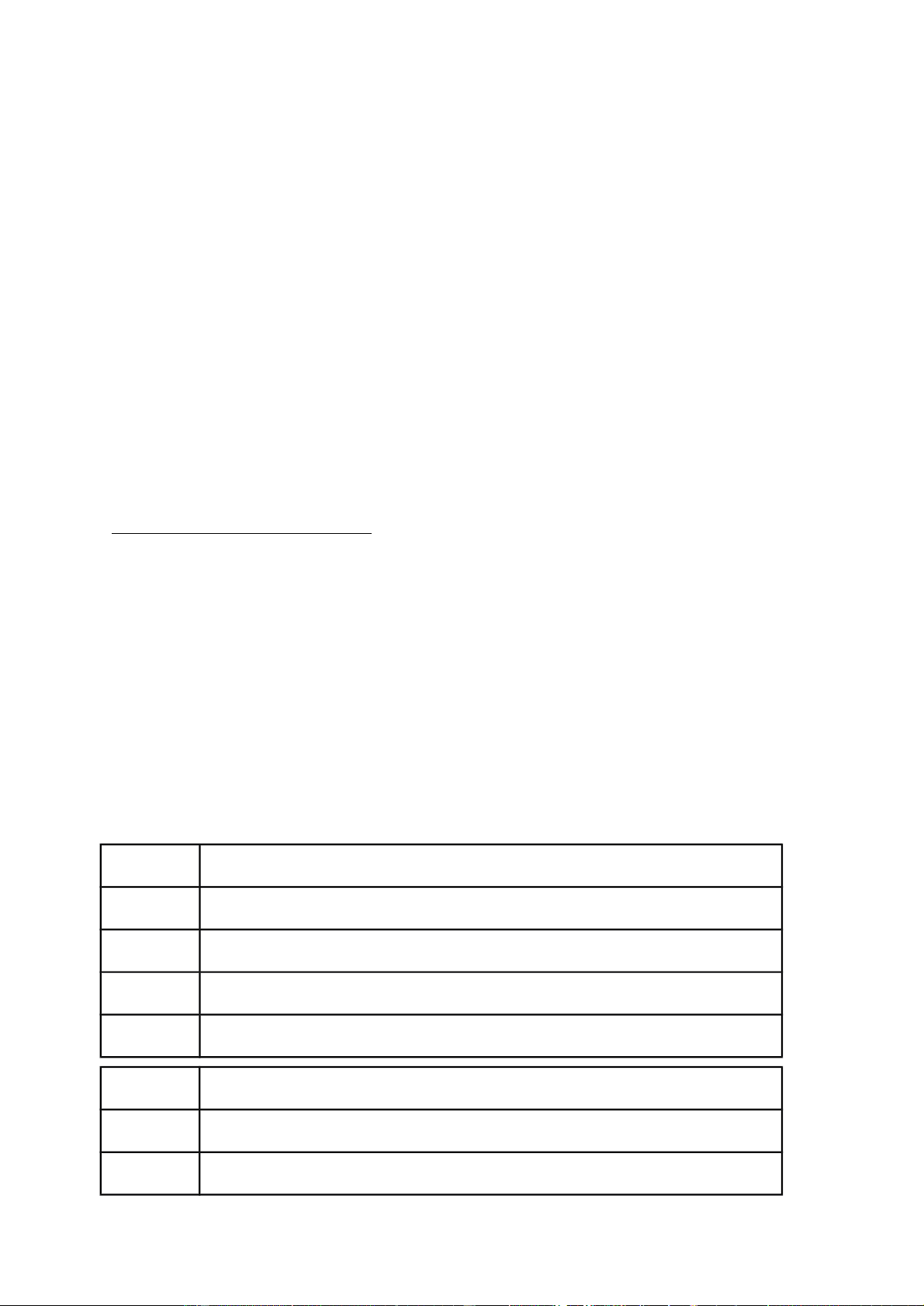

Part A: Which items/transactions satisfy asset recognition criteria? lOMoAR cPSD| 49431889 lOMoAR cPSD| 49431889 ( Overhauls ) 9 . Obsolete goods cannot be sold 4 10 . Goods from trial test cannot be sold 11 .Prepayment of leased assets for future accounting period . 12 Stolen technology secret ...

Part B: Which items/transactions satisfy liability recognition criteria? Items/Transactions Reliable Past Present Recog measure transacti obligation niz ed me nt on s liability (1) (2) (3) (5) (6) 1 . Share dividend (stock dividend) declared, not yet issued 2 . Cash dividend declared, not yet paid 3 . Bonds/ debentures 4 . Receipt in advance from customers lOMoAR cPSD| 49431889

5 . Interest received in advance 6 . Lease payment received in advance from lessee 7 . Provision for warranty 5

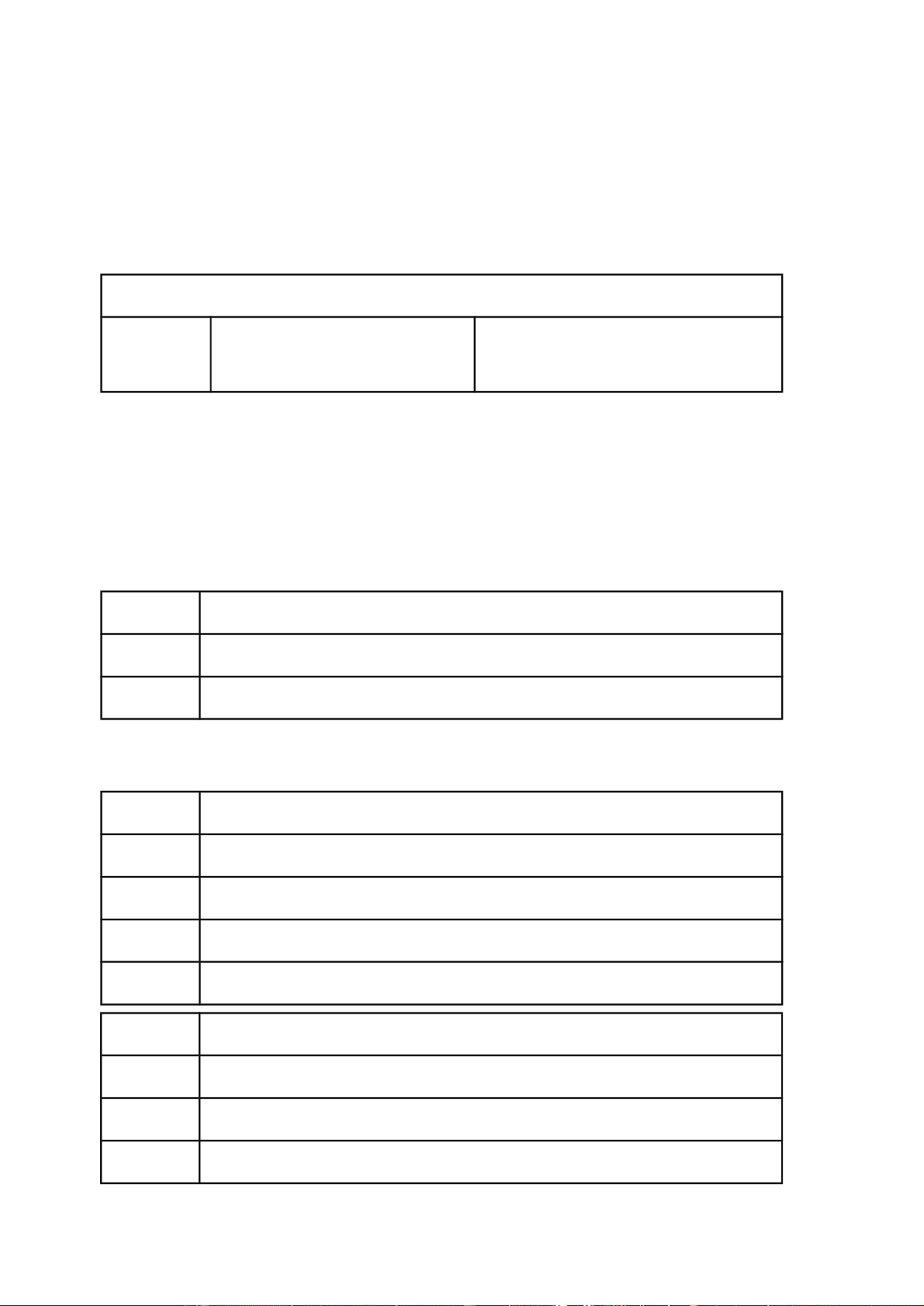

Part C: Which items/transactions satisfy revenue recognition according to accrual basis? Items/Transactions Reliabl Increase Complete Income e equity d recognit measu ( indirect) obligatio io n re n for ment income transacti on s (1) (2) (3) (4) (5) 1 . Contributions from owners or liabilities reclassification 2 . Receipt in advance

3 . Interest/ lease payment, etc received in advance 4 . Revenue from delivering goods/rendering services on credit

5 . Interest, dividend earned, not yet received.

Part D: Which items/transactions satisfy income recognition criteria in

accordance with cash basis? lOMoAR cPSD| 49431889 Items/ Transactions Reliable Equity Received Income measure increase cash from recognit ment ( indirect) the io n transaction (1) (2) (3) (4) (5) 1 . Contributions from owners by assets or liabilities reclassification 2 . Receipt in advance 6 3 . Selling goods on credit 4 . Interest, dividend on due date but not received 5 . Interest/ asset lease payment received in advance

Part E: Which items/transactions satisfy expense recognition criteria in

accordance with accrual basis? Items/transactions Reliab Equity Match Expense le decrease in g recognit measu (i ndirect) with io n re current period (1) (2) (3) (4 ) (5) 1. Equity withdrawal from owners: Distribution to owners Payments utilized from lOMoAR cPSD| 49431889 funds (e.g Bonus and Welfare Fund..) 2 . Goods available for sale 3 . Cost of goods sold in the period

4 . Obsolete goods cannot sell 5 . Revenue in the period 6 . Salary payable to employees 7

Part F: Which items/transactions satisfy expense recognition criteria in

accordance with cash basis? Items/transactions Reliabl Equity Cash paid Expense e decrease out from recognit measu ( indirect) the io n re transactio ment ns (1) (2) (3) (4 ) (5) . 1 Equity withdrawal of owners Profit distribution to owners Payments utilized from funds ( e.g Bonus and Welfare Fund, etc) 2 . Goods decrease due to unknown reason 3 . Purchase goods on credit, sold in the period lOMoAR cPSD| 49431889

4 . Interest/ asset lease paid in advance

5 . Salary paid in cash during the period

6 . Salary payable for employees during the period Q5

Caren Smith Corporation, supplies a medical practice. During July 2020, the first

month of operation, the business experienced the following events: Jul 6

Caren Smith received $55,000 cash from shareholders and issued common stock 9 Paid $46,000 cash for land. 12

Purchased medical supplies of $1,800 on account 8 15

Officially opened for business 15-

During the rest of the month, Caren Smith treated patients and 31

earned service revenue $ 8,000, receiving cash. 29

Paid cash expense employees’ salaries, $1,600; office rent, $900, utilities, $100 30

Returned supplies purchased on the 12th for the cost of those supplies, $700 31 Paid $1,100 on account Required:

Analyze the effects of these events on the accounting equation of business of Caren Smith Corporation. lOMoAR cPSD| 49431889 Q6

Indicate the effects of the following business transactions on the accounting

equation of Video Store Corporation. Transaction (a) is answer as a guide. a.

Received cash of $8,000 and issued common stock. Answer: increase asset (Cash)

Increase stockholders’ equity (Common stock)

b. Earned video rental revenue on account, $1,800

c. Purchased office furniture on account, $400.

d. Received cash on account, $100 e. Paid cash on account, $100

f. Rented videos and received cash of $100

g. Paid monthly office rent expense of $900.

h. Paid $200 cash to purchase supplies that will be used in the future Q7

Hongha Corporation has got following information on August 31, 2013. 9 Unit: $ Cash 2 ,300 Land 14,000 A/R 1 ,800 A/P 8,000 RE 7 ,100 Common stock 3,000

During Sept 2013, the business completed the following transaction:

a. Issued common stock and received cash of $13,000. b. Performed

service for client and received cash of $900.

c. Paid off the beginning balance of accounts payable.

d. Purchased supplies on account, $600.

e. Collected cash from customer on account, $700. lOMoAR cPSD| 49431889

f. Received cash of $1,600 and issued common stock.

g. Consulted and billed the client for service rendered, $3,500. h. Recorded the

following business expenses for the month: 1. Paid office rent, $1,200. 2. Paid advertising, $600

i. Paid cash dividends of $2,000 Required:

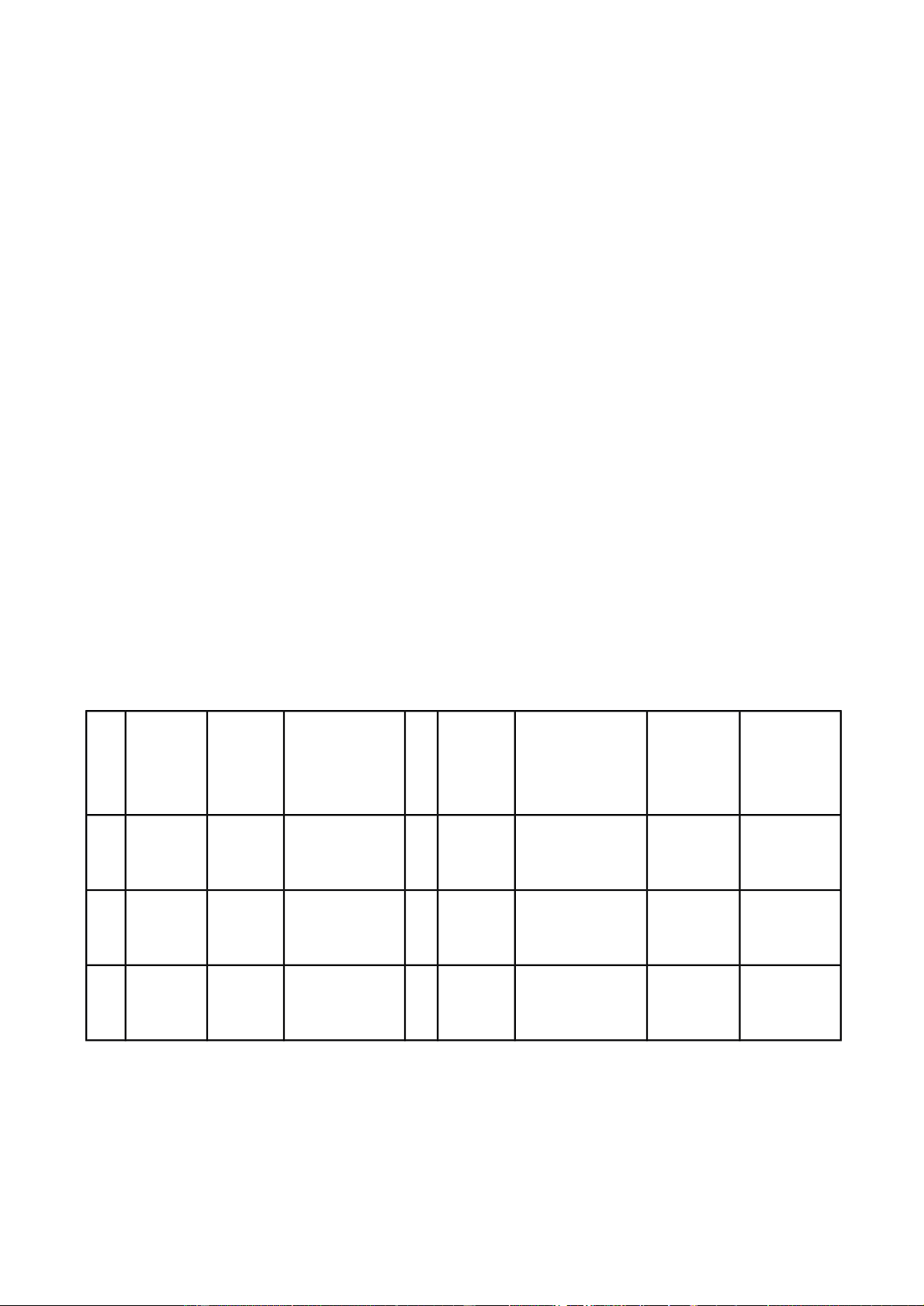

1. Analyze the effects of these events on the accounting equation of business of Hongha Corporation.

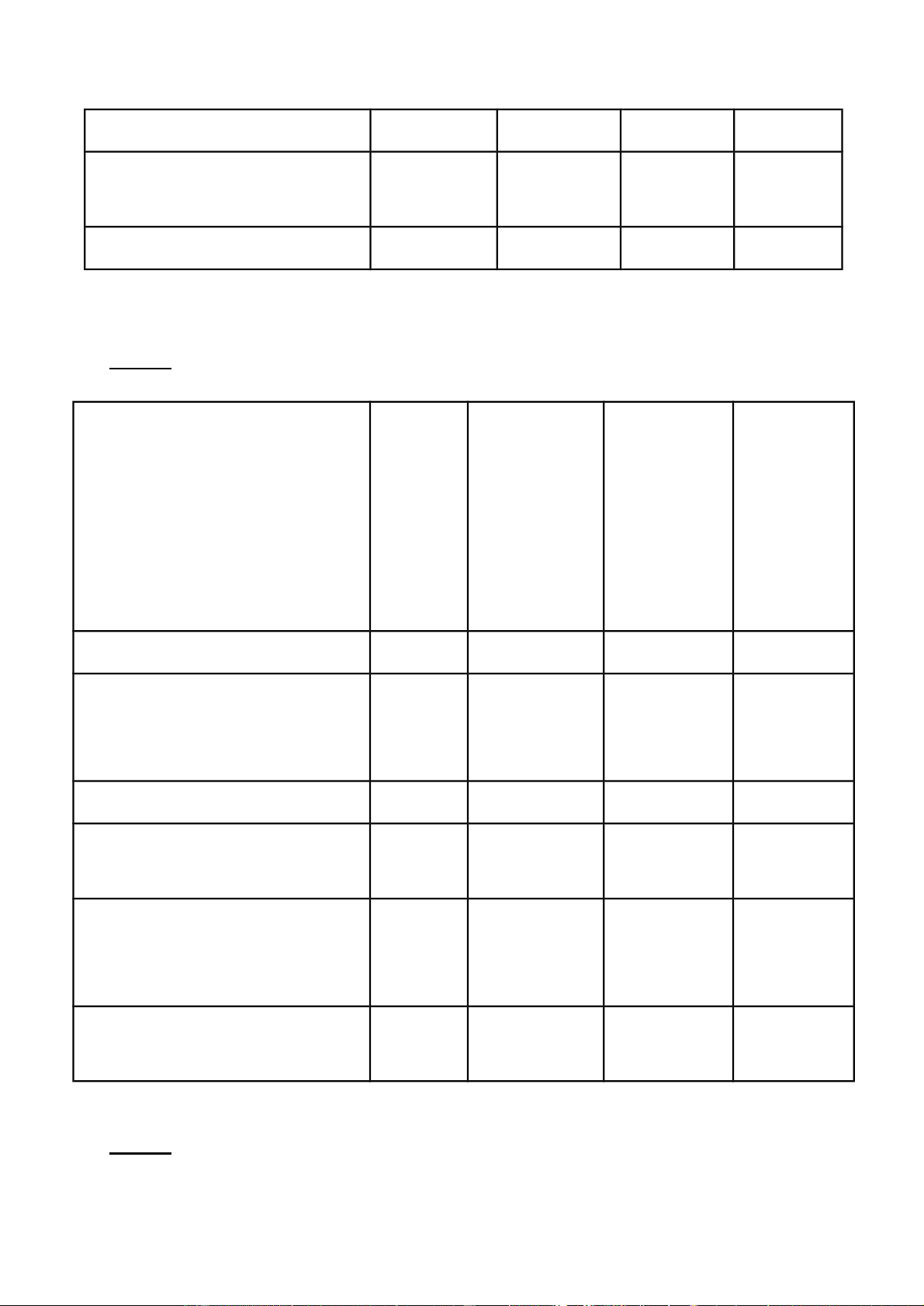

2. Prepare the following financial statements for the month ended 30 Sept 2013: a. Income statement b. Statement of RE c. Balance sheet 10 Q8 Cash + + A/P + + - A/R Equipment = Common Revenu Expense Stock e 31,000 1 31 ,000 2 3 ,800 3 ,800 13,400 13 , 40 3 0 lOMoAR cPSD| 49431889 - 4 190 190 - 5 41 0 410 - - 6 8 ,000 8 ,000 - - 7 1 ,500 1 ,500 Required : Describe each transaction. Q9

On 1/1/Y, Company X signed a contract to supply products ordered by Company Y

with the total contract value of $ 3,000 and received in advance $1,000 by cash in

bank. On 1/5/Y, Company X delivered finished goods to Company Y with total

production cost was $2,500. After finished goods were delivered, the remaining

amount of the contract will be paid in the following period. Required:

With the given transactions, please identify: 11

A/ How does X record for elements of financial statement if the accrual basis is applied?

- At the time of receiving in advance.

- At the time of delivery to customer;

- At the time of receiving the remaining amount.

B/ How does Y record for elements of financial statement if the accrual basis is applied?

- At the time of advance payment; lOMoAR cPSD| 49431889

- At the time of receiving goods;

- At the time of paying the remaining amount Q10

On January 1/Year, Company P gave a loan of VND 500 million in two-year term

and at 12%/year interest to Company Q. On January 4th, the borrower prepaid the full

interest of VND120 million in two years. On 1/04/Y + 1 the borrower paid the

principal to Company P, the interest received for the last 3 quarters of year (Y + 1)

was repaid by the Company P by deducting from the principal.

Required: With the given transactions, please identify:

A/ How does P’s accountant record for elements of financial statement if the accrual

basis is applied and the accounting period is quarterly?

- At the time of transfering to the borrower;

- At the time of receiving 02-year interest;

- By the end of each quarter in year Y;

- At the time of receiving the principal

B/ How does Q’s accountant record for elements of financial statement if the accrual

basis is applied and the accounting period is quarterly?

- At the time of receiving from the lender - At the time of paying 02-year interest; 12

- By the end of each quarter in year Y; - At the time of paying the principal. Q11

In January/Y, A Company sold and handed over to B Company a batch of products

for total VND 900 million and received by cash on hand VND 500 million, the

remaining amount will be received in May/Y. Free warranty service was provided for

02 years since the products were delivered to customer. Based on historical data, the

cost of warranty coverage was about 2% of revenue. Accordingly, A Company

extracted a product warranty amount for Jan/Y over of the products sold in this month which was VND 18 million.

Required: With given transactions, please identify: A / Company A’s Accountant: lOMoAR cPSD| 49431889

A1- How does she/he record elements of financial statement if accrual basis is

applied with the accounting period of month?

- At the time of delivery and receipt the first payment;

- At the time of receipt of the second payment; - At the time of deducting warranty costs.

A2- How to record sales and expenses of January Y from the above events if the cash basis is applied?

A3-It is assumed that the accounting period is quarterly. In Q1/Y, A Company applied

the money accounting method, quarter 2/Y changed to accrual accounting and did

not conduct retroaction. Whether sales of the above product batch were omitted or duplicated? how much?

B/ Company B’s Accountant: How to record the financial statement elements if

accrual principle is applied with the accounting period of month?

- At the time of receiving goods and making the first payment; - At the second payment;

- At the time the seller extracted warranty cost. 13 Q 12

ABC Catering Company, completed the following selected transactions during May, 2019. May 1

Prepaid rent for three months since 1/May, $1,500 5

Paid electricity expense, $400 9

Received cash for meals served to customers, $2,600 14

Paid cash for kitchen equipment, $2,400 23

Served a banquet on account, $3,000 31

Determine rent expense for May 31 Accrued expense, $1,400 31

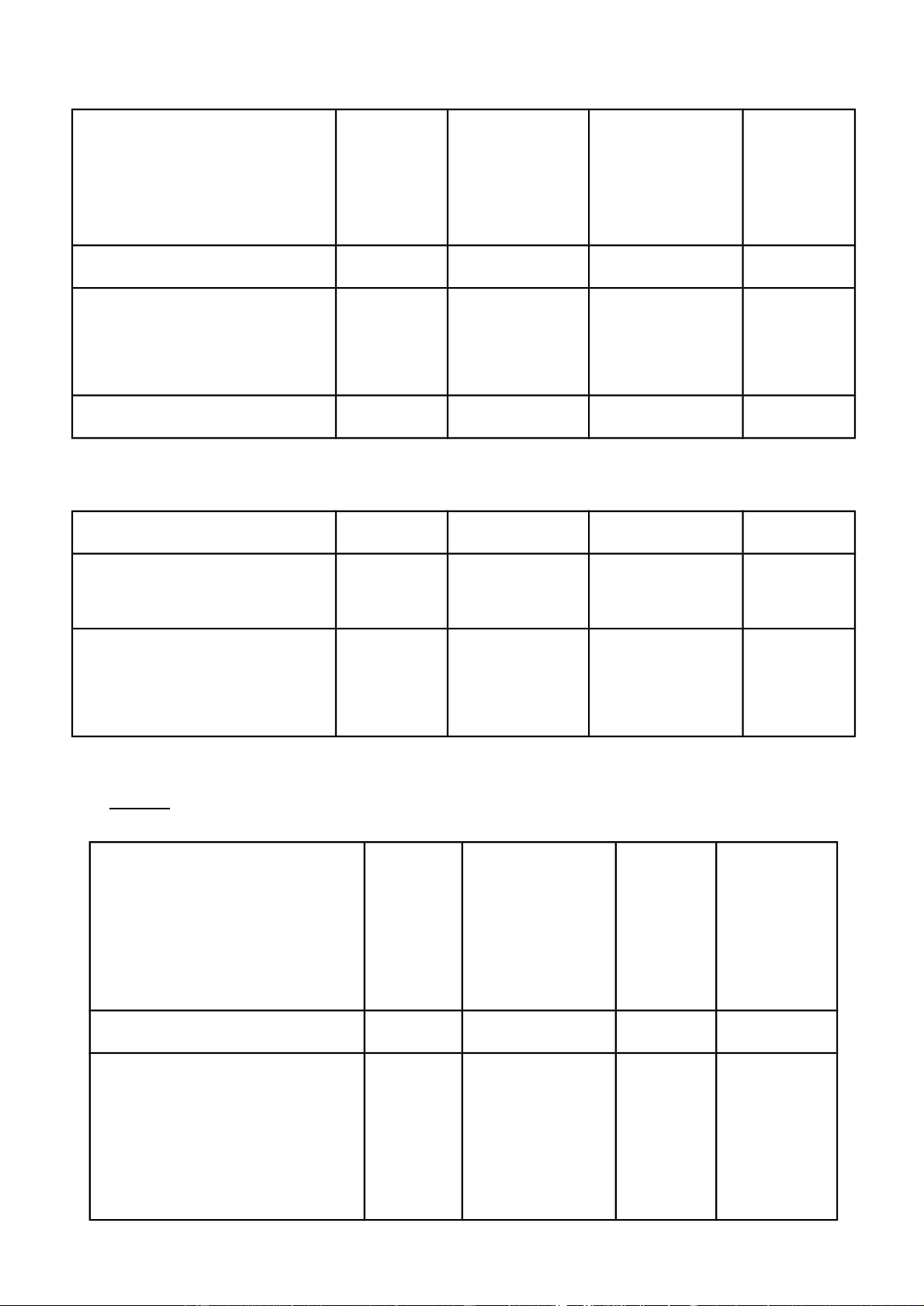

Recorded depreciation for May on kitchen equipment, $40 lOMoAR cPSD| 49431889 Required a.

Indicate which accounts were increased or decreased and by what amounts

from the transactions above, according the accrual basis accounting. b.

Show whether each transaction would be handled as a revenue or an expense

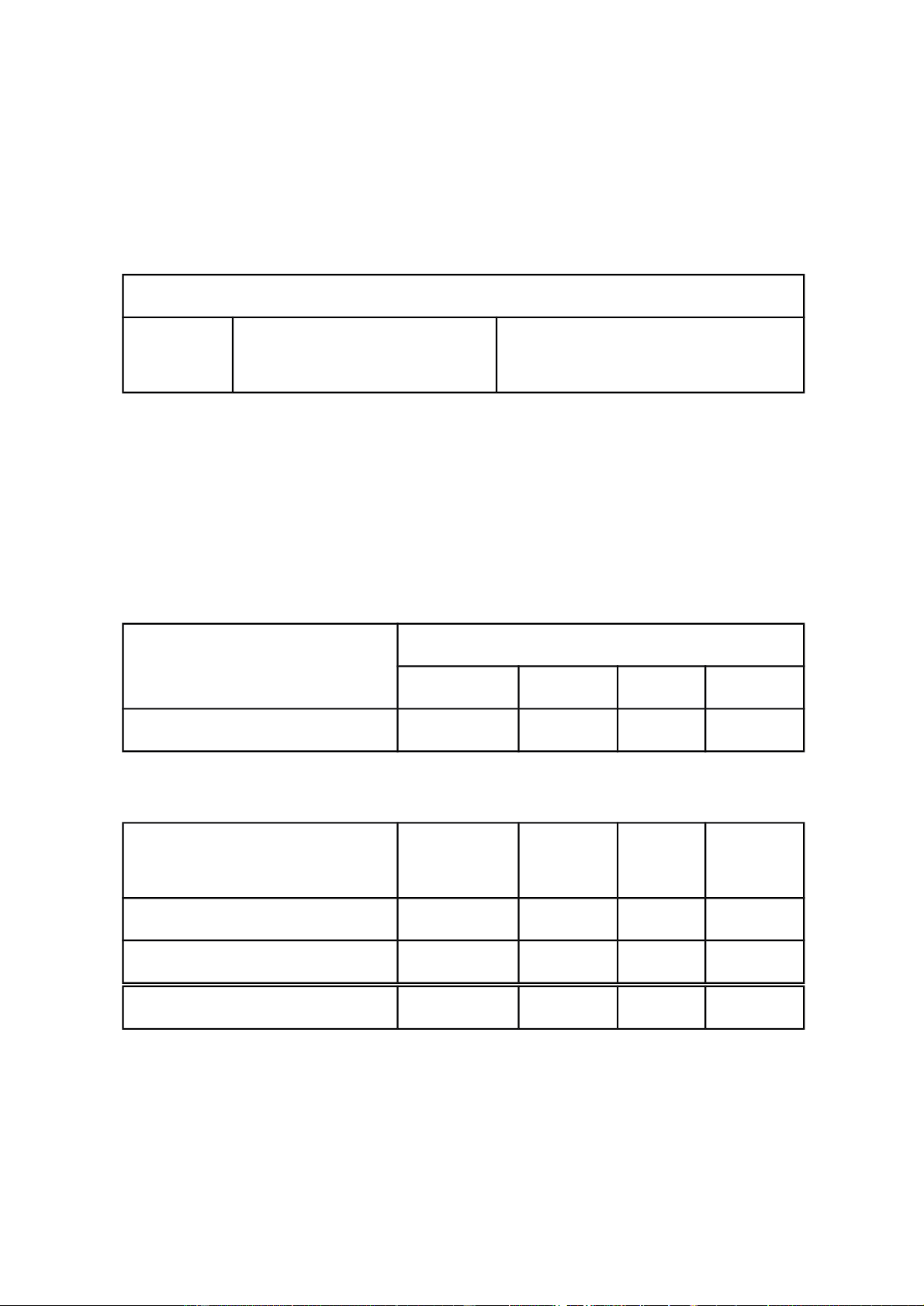

using both the accrual basic and cash basic by completing the following table:

Amount of Revenue (Expense) for May

Date Cash basic amount of Accrual basic amount of Revenue (Expense) Revenue (Expense) c.

Calculate the amount of net income or net loss for ABC Catering Company

undercash basic and accrual basis. Q13

Quoc Viet Company completed the following transaction during June, 2020: June

1 Prepaid rent for June through September, $3,600 2

Purchased computer for cash, $900 3

Performed catering service on account, $2,300 14 5

Paid internet service provider invoice, $100 6

Catered wedding event for customer and received cash, $1,500 8

Purchased $150 of supplies on account. 10 Collected $1,200 on account 14

Paid account payable from June 8 15 Paid salary expense, $1,200 30

Calculate rent expense (see June 1) 30

Depreciation expense for June, $25 30

There are $40 of supplies still on hand lOMoAR cPSD| 49431889 Required a.

Indicate which accounts were increased or decreased and by what amounts

from the transactions above, according the accrual basic accounting. b.

Show whether each transaction would be handled as a revenue or an expense

using both the accrual basic and cash basic by completing the following table:

Amount of Revenue (Expense) for June

Date Cash basic amount of Accrual basic amount of Revenue (Expense) Revenue (Expense) c.

Calculate the amount of net income or net loss for Quoc Viet Company under cash basic and accrual basis. Q14

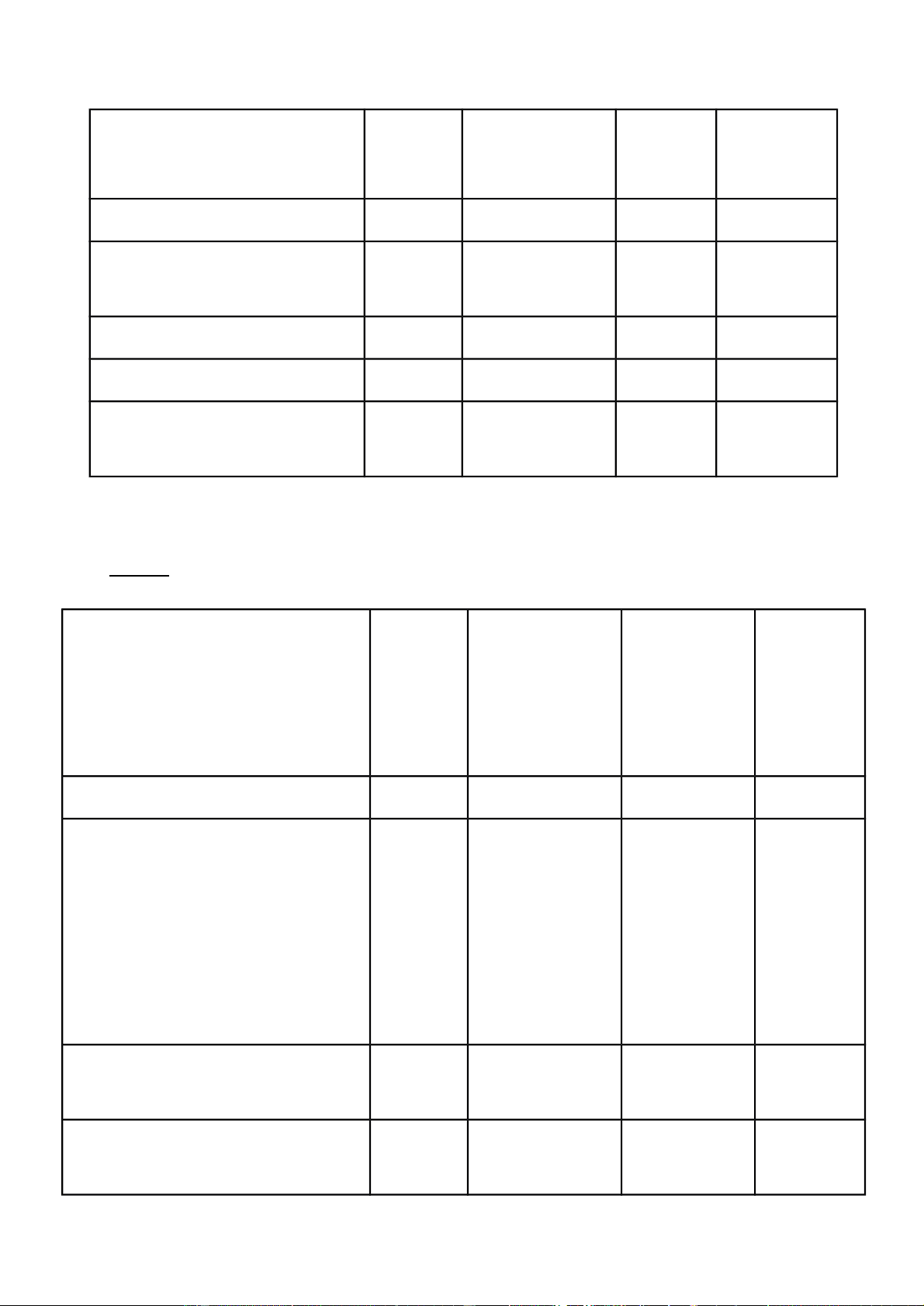

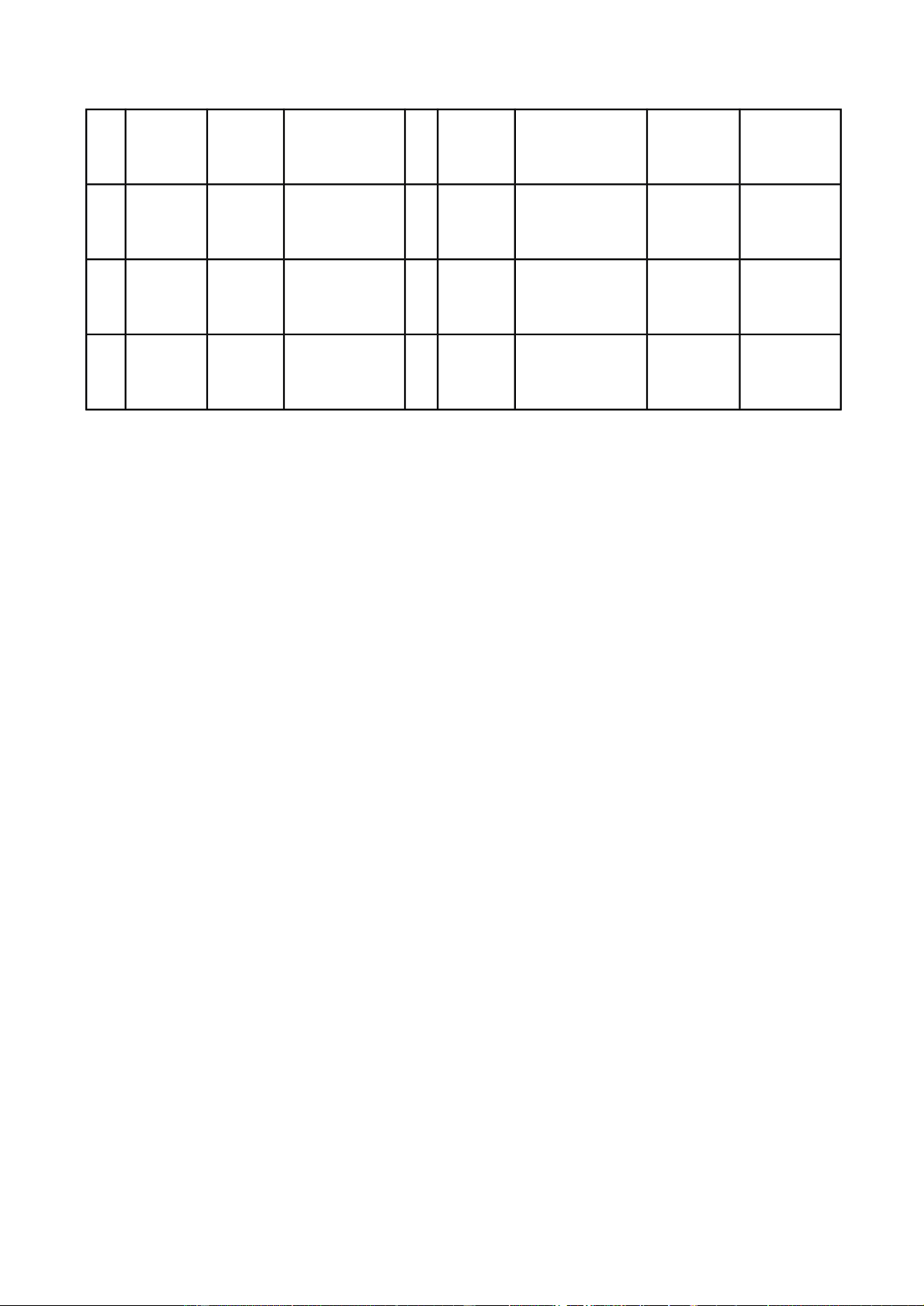

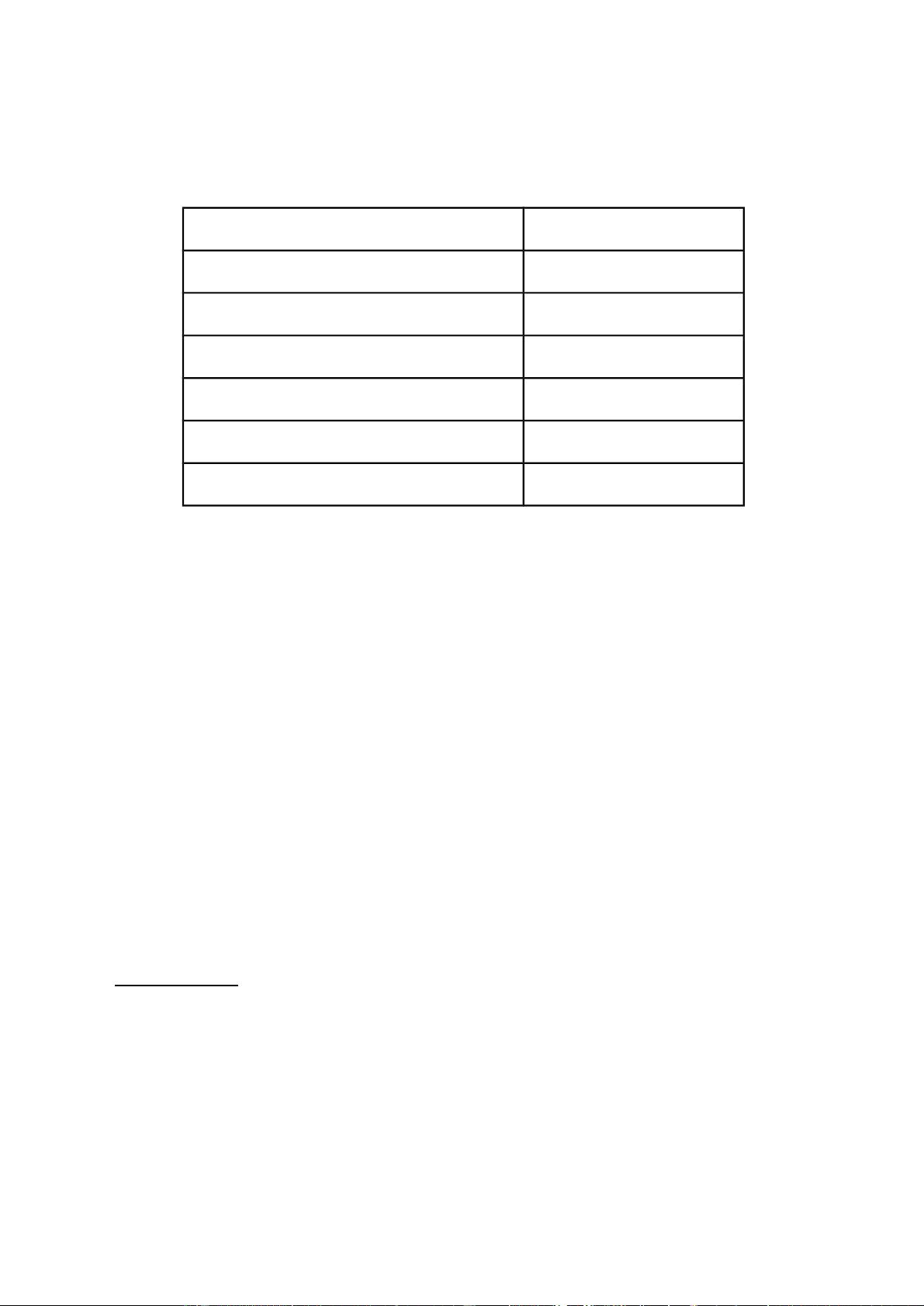

Tropical View Company applies accrual basic accounting. Consider the facts

presented in the following table for the company: Situation A B C D Beg prepaid rent $1,200 $900 $200 $700 15 Payments for prepaid rent 1 ,400 b 1,800 d during the year Total amount to account for 2 ,600 1 ,400 ? ? Subtract: ending prepaid rent 600 500 c 400 Rent expense $ a $900 $1,900 $1,100 Required

Complete the table by filling in the missing values. lOMoAR cPSD| 49431889 Q15

The following are changes in all account balances of XYZ Furniture Co. During the

current year, except for retained earnings. Increase (Decrease) Cash $69,000 Account receivables 45,000 Inventory 127,000 Investments (47,000) Account Payables (51,000) Share capital 138,000 Required

Compute the net income for the current year, assuming that there were no entries in

the RE account except for net income and a dividend declaration of $24,000 which was paid in the current year. Q16

Case 1: Sales salaries paid during 2019 were €70,000. Sales salaries accrued were

€1,360 on January 1, 2019, and €1,380 on December 31, 2019. Show the computation

of sales salaries on an accrual basis for 2019. Case 2: 16

The records for Todd Inc. showed the following for 2019: Jan. 1 Dec. 31

Accrued expenses R$1,800 R$2,150 Prepaid expenses 720 870 Cash paid

during the year for expenses, R$55,500

Show the computation of the amount of expense on accrual basic 2019. Case 3: lOMoAR cPSD| 49431889

The records for Kiley Company showed the following for 2019: Jan. 1 Dec. 31

Accrued revenue HK$1,260 HK$920 Cash collected during the year for revenue, HK$75,000

Show the computation of the amount of revenue that should be reported on the income statement. Case 4

The records for Kiley Company showed the following for 2019: Jan. 1 Dec. 31

Unearned revenue HK$1,600 HK$2,160 Cash collected during the year for revenue, HK$75,000

Show the computation of the amount of revenue that should be reported on the income statement. Case 5

Revenue for the year on accrual basic was €135,800. Account receivable were

€4,500 on January 1 and €3,540 on December 31.

Show the computation of revenue for the year on a cash basis. 17

REVIEW CHAPTER 2 Question 1 1.

Resources owned by a company (such as cash, accounts receivable, vehicles)

arereported on the balance sheet and are referred to as __________ 2.

Obligations (amounts owed) are reported on the balance sheet and are referred toas __________ 3.

Which of the following characteristics does not describe an asset? Requires the

payment of cash or Controlled by an entity? 4.

Which of the following characteristics does not describe a liability? Present

obligation or must be legally enforceable? lOMoAR cPSD| 49431889 5.

If you receive a telephone bill, is your expense increasing or decreasing? 6. If

you purchase a motor vehicle, is your asset value increasing or decreasing? 7.

If you are informed that your last insurance bill was overstated and that you

will receive a credit, is your expense increasing or decreasing 8.

If you receive notification from the bank that you have been charged bank fees,

is your asset (the bank account) increasing or decreasing? Question 2

Business transactions during December of XYZ Company are presented as follows:

1. The owner invested $30,000 cash in the corporation

2. Purchased $5,500 of equipment with cash

3. Purchased a new truck for $8,500 cash

4. Purchased $500 in supplies on account

5. Paid $300 for supplies previously purchased/

6. Paid February and March Rent in advance for $1,800

7. Performed work for customers and received $50,000 cash 8. Performed work for

customers and billed them $10,000 18

9. Received $5,000 from customers from work previously billed 10. Paid office salaries $900 11. Paid utility bill $1,200

Required: Prepare a tabular analysis which shows the effects of these transactions

on the expanded accounting equation lOMoAR cPSD| 49431889 19