Preview text:

lOMoAR cPSD| 61630929

TOPIC 1: INTRODUCTION TO INTERNATIONAL TRADE AND BUSINESS LAW I. History - Ancient time:

o 3500 before chris in mesopotamia o 1000 – 2000 bc in china

o 1000 – 2000 tcn before chirs in america - Modern time: o 14 – 18: trade in europe

o 19 – 1945: multinational corporations - Comtemporary time:

1945 – now o Global economic

integration o Regional economic integration o Protectionism come bac II.

The concept of international trade and ITBL - ITNL:

o International trade: trade relation between nations or organizations o

Internaitonal business transactions: business man

o Can be understood in the broadest sense including international trade law

with the main participantion of states and public trade law annd

international business law with participation of business III. Persons of ITBL - Natural person - Legal person - State

o Sign or participate in internatioinal agrrments: muti and bilateral o Participate

in business transasctions: natural or legal persons o Special persons: Take the priority in chosing law Sovereign immunuty in theory: In theory: in reality: freedom of in reality: principles of state contract priority equality immunity

o State’s sovereign immunity:

No institutions oe persons can judge a state

State’s property can not be on mortgafe for a suit

Foreifn court’s judgments against a state are not binding

o Waive sovereign immunity: method of implementation: Regulate in domestic law Sign international agreements

Provide in a contract between state and non-state actor - International organization:

o Global: wto, world bank, international menetary funds lOMoAR cPSD| 61630929 o Regional: EU, Asean

- Others o Regions, custom territory, economic unions: Hongong, macao, eu la thanh

vien cua wto, cac tam giac tu giac phat trien IV. Sources of ITBL 1. National law - Legal documents

- National precedents - Others - Mutual agreements:

o Each party’s law or third country o The tribunal refuse to apply o Illegal

agreement o For public interst or order - Conflict law: o Nationality o Residence

o Place of object of the contract o Place of formation of contract o Place of performance of contract 2. International law

- Căn cứ vào số lượng chủ thể của điều ước quốc tế, có thể chia làm 2 loại:

o Bilateral agreement (tay đôi) o Multilateral agreement (nhiều bên)

- Trong khuôn khổ WTO, các hiệp định đa phương được chia thành 2 laoij:

o Multilateral agreement: hiệp định đa phương o Plurilateral agreement: hiệp định nhiều bên/đa bên

- Customs refer to principles arisen from actions. Behaviors of businessmen, which are

regarded as “law” bound by themselves incoterms 3. International precedents:

- International precedents refers to a court decision that is considered an authority for

deciding subsequent cases involving identicla ỏ similar facts, or similar legal issues

LECTURE 2: Introduction to Basic principles of WTO Law 1.

Trade without Discrimination (MFN & NT) (Thương mại không phân biệt đối xử (MFN & NT) 1.1.

Most-favored-nation – đối xử tối huệ quốc (MFN – non-discriminatory treatment

between products of WTO members): “treating other people equally” -

Under the WTO agreements, countries cannot normally discriminate between their trading partners -

Eg: if a WTO member grants another member a special favour (such as a lower

customs duty rate for one of their products) it must do the same for all other WTO members

a. MFN treatment under GATT – general agreement on tariffs and trade: hiệp ước chung

về thuế quan và mậu dịch -

Legal provision GATT Art I.1 (quy định pháp lý)

o Scope of measures (phạm vi): With respect to customs duties and charges of any kind

imposed on or in connection with importation or exportation or imposed on the international

transfer of payments for imports or exports, and with respect to the method of levying such

duties and charges, and with respect to all rules and formalities in connection with importation lOMoAR cPSD| 61630929

and exportation, and with respect to all matters referred to in paragraphs 2 and 4 of Article III

o Obligation (nghĩa vụ): any advantage, favour, privilege or immunity granted by any

contracting party to any product originating in or destined for any other country shall be

accorded immediately and unconditionally to the like product originating in or destined for

the territories of all other contracting parties. -

Purpose: to protect the equality of competitive opportunities for imports

from/exports to all WTO members (mục đích bảo vệ sự bình đẳng về cơ hội cạnh tranh cho

hàng nhập khẩu từ/xuất khẩu đến tất cả các thành viên WTO) -

Scope of application: phạm vi áp dụng (Canada-Autos, AB reports) o

De jure (in law) discrimination: origin-based measures (phân biệt biết sử theo luật

định) o De facto (in law) discrimination: origin-neutral measures but discriminatory in

application (các biện pháp trung lập về xuất xứ nhưng phân biệt đối xử trong ứng dụng) - The Three – Tier Test: o

Advantage, favor, privilege or immunity covered by GATT (Ưu đãi, ưu đãi, đặc quyền

hoặc quyền miễn trừ được GATT bảo vệ) o Granted immediately and unconditionally

(Được cấp ngay lập tức và vô điều kiện) o Like products (Sản phẩm tương tự) o

A measure that creates a more favorable competitive opportunity for some WT

members causes violation of MFN (Một biện pháp tạo ra cơ hội cạnh tranh thuận lợi hơn

cho một số thành viên WT gây ra vi phạm MFN) - (i) Measueres covered by Art.1: 02 types o

Borderd mesures: custom duties, charges on export/import, quota, tariff quota, import,

customs formalities (thue quan, phi xuat khau/nhap khau, han ngach, han ngach thue quan,

nhap khau, thu tuc hai quan) o Internal measures: internal taxes, internal regulations affecting

sales/distribution/use of products: (thuế nội bộ, quy định nội bộ ảnh hưởng đến việc bán/phân

phối/sử dụng sản phẩm)

“advantage”: not only those granted by WTO members to other members. But also those

granted by WTO members to non-WTO members - (ii) Like products

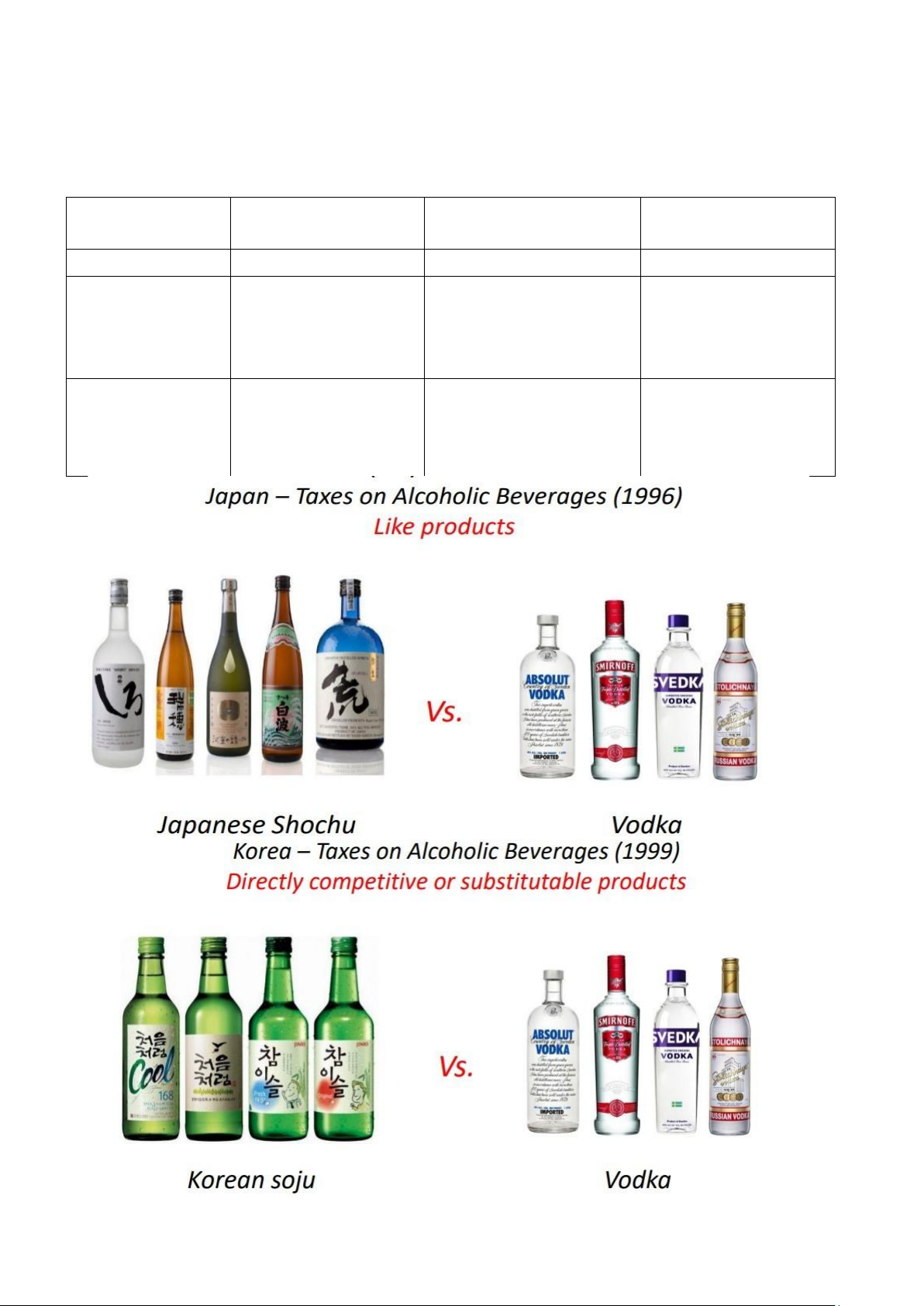

o EC-Bananas III, AB report: like products should be treated qually (i.e. unlike products may be treated differently) o Not defined in GATT

o But clarified in GATT/WTO case law: eg: Japan -a alcoholic beverages II o

Product’s phusical characteristics o Product’s end uses o Consumers’tastes and

habits o Tariff classification -

(iii) Immediate and unconditional granting of advantage to like products

o Immerdiate: without delay, no time lapses between granting advantage to a prodict and

all like products o Unconditional: without any conditions/criteria unrealted to the product imprted

(indonesia – autos, panel report) -

Irrelebant factors in determining MFN violation: lOMoAR cPSD| 61630929 o Actual trade effects o Discrimatory intent -

General exceptions to all provisions (including MFN)

o General exceptions (Art XX GATT 1944) o Security exceptions (Art XXI GATT 1994)

o Balance of payment exceptions and temporary applicatikon of quakntikktative

restrictions in a discrikmiknatory manner (Art XII, SVIII.B and XIV GATT1994)

o Waivers (Art IX3. Marrakesh Agreement) o Special and differential

treatment provisions in WTO agreements - Particular exceptions to MFN:

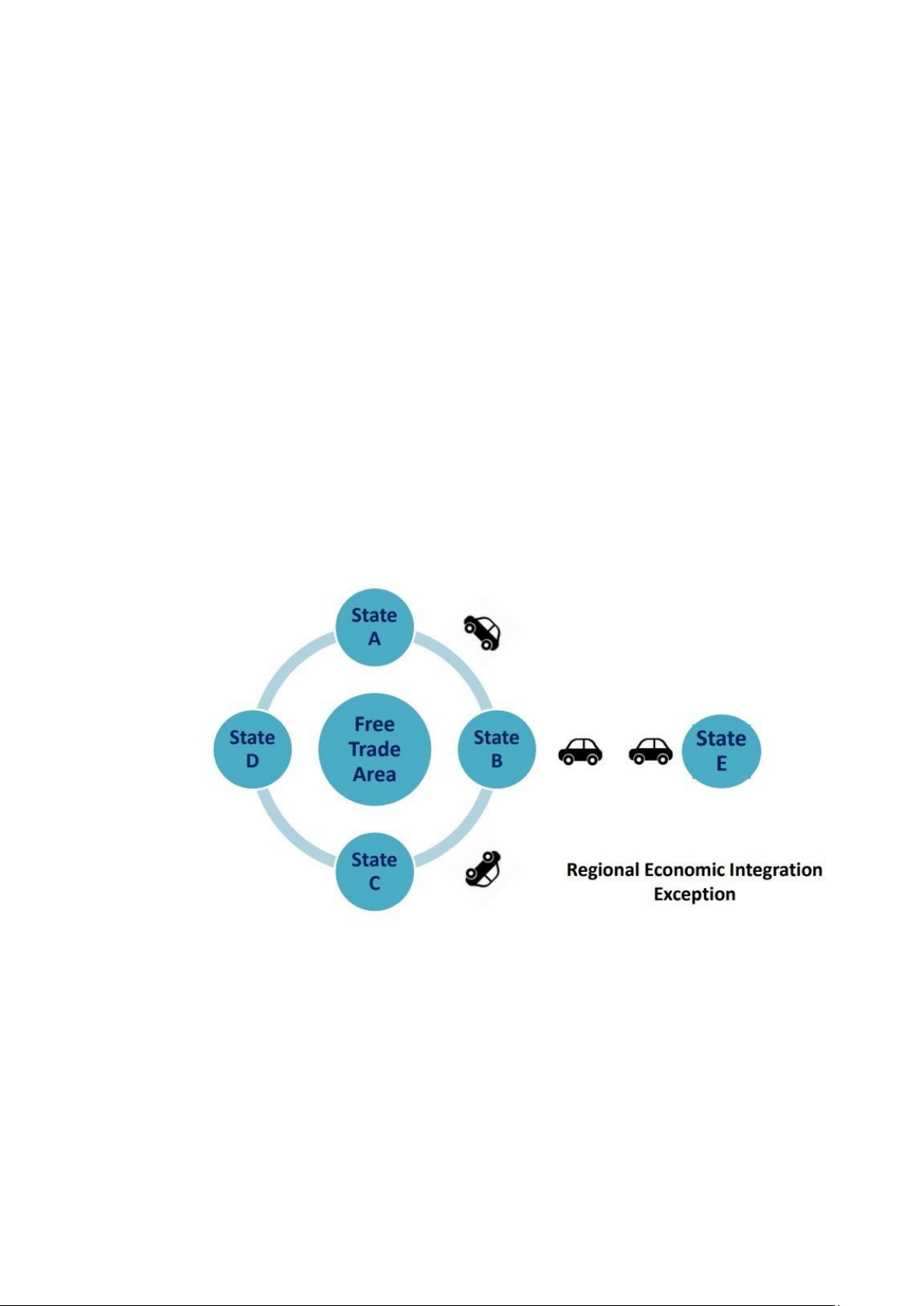

o Regional intergration (Art XXIV GATT 1994): more favorable treatment to trading

partners within a FTA/CU o Enabling clause (1970 decision on differential and more

favorable treatment reciprocity and fuller participantion of developing countries): preferential

tariffs by developed members to imports from developing members only (eg: generalized

system to preferences – GSP Schemes) o Historical preferences (Art I.2 – Art I.4 GATT

1994): tariff preferences among some

members of GATT 1947 only o Frontier traffic (Art XXIV.3 GATT 1994): advantages

accorded to adjacent countries to facilitate frontier transactions

b. MFN treatment under GATS – general agreement on trade in services: hiệp định

chung về thương mại dịch vụ -

Legal provision: Art II.1 GATS: with respect to any measure covered by this

agreement, each member shall accord immediately and unconditionally to services and

service suppliers to any other member treatment no less favourable than that it accords to

like servives and services and service suppliers of any other country -

Purpose: to ensure equality of opportunity for services and service suppliers from all WTO members -

Scope of application: de jure and de facto discrimination (EC-Bananas III) - The Three-Tier Test lOMoAR cPSD| 61630929 - (i) Measures covered:

o Measures taken by central/regional/minicipal governments and authorities or taken by

non-governmental bodies in exercise of state power o

Measures affecting trade in services -

(ii) Like services/service suppliers o No definition in FATS/GATS case law o But some resonable criteria

1. Characteristics of service/service suppliers

2. Classification and description of service in UN’s CPC system (central product classification)

3. Consumer habits and preferences -

(iii) Treatment no less favorable

o Definition in FATS Art XVII (NT): less favorable treatment modifies the conditions of competition - Exceptions:

o Annexes on some service sectors (finance, maritime Transport,..)

o Annex on Art II (MFN) Exemptions o Regional Integration (Art V)

o Government procurement (Art XIII)

c. MFN treatment under TRIPS – agreement on trade – related aspects of intellectual

property rights: Điều ước quốc tế đa phương về sở hữu trí tuệ thương mại trong lĩnh vực sở hữu trí tuệ - Legal provision: Art IV TRIPS

With regard to the protection of intellectual property, any advantagde, favour, priviledfe or

immunity granted by a Member to the national of any other country shall be accorded

immediately and unconditionally to the nationals of all other Members 1.2.

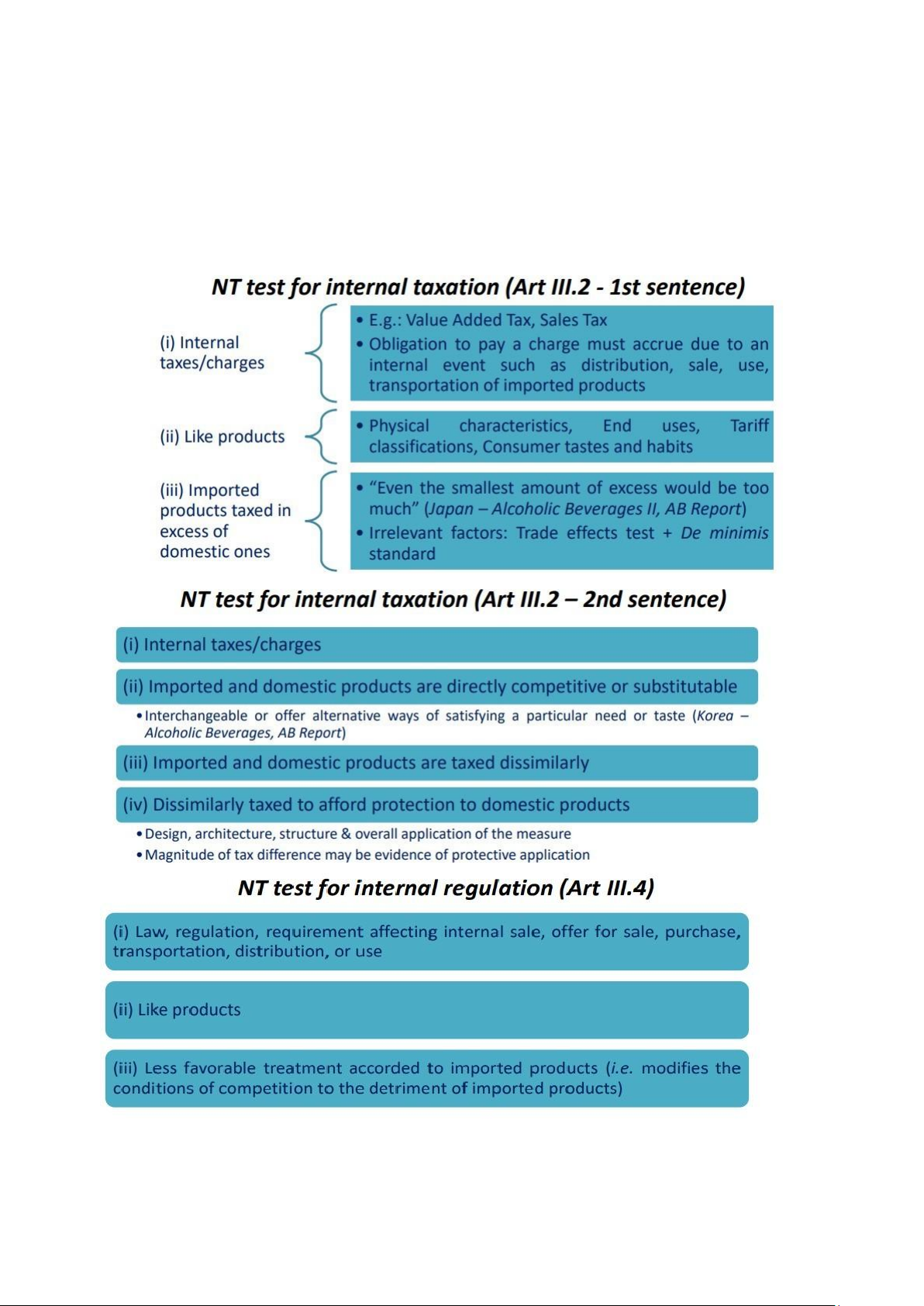

National treatment (NT – non – discriminatory treatment between imported and

domestic products): “treating foreigners anf locals equally” a. NT under GATT -

Legal provision: Art III GATT o General principle (Para. 1)

1. The contracting parties recognize that internal taxes and other internal charges, and

laws, regulations and requirements affecting the internal sale, offering for sale, purchase,

transportation, distribution or use of products, and internal quantitative regulations requiring

the mixture, processing or use of products in specified amounts or proportions, should not be

applied to imported or domestic products so as to afford protection to domestic production. o Internal taxation (Para. 2) 2.

The products of the territory of any contracting party imported into the territory of

any other contracting party shall not be subject, directly or indirectly, to internal taxes or other

internal charges of any kind in excess of those applied, directly or indirectly, to like domestic

products. Moreover, no contracting party shall otherwise apply internal taxes or other internal

charges to imported or domestic products in a manner contrary to the principles set forth in

paragraph 1 o Ad Note to Art III.2, second sentence o Internal provision (Para. 4) lOMoAR cPSD| 61630929

4. The products of the territory of any contracting party imported into the territory of any

other contracting party shall be accorded treatment no less favourable than that

accorded to like products of national origin in respect of all laws, regulations and

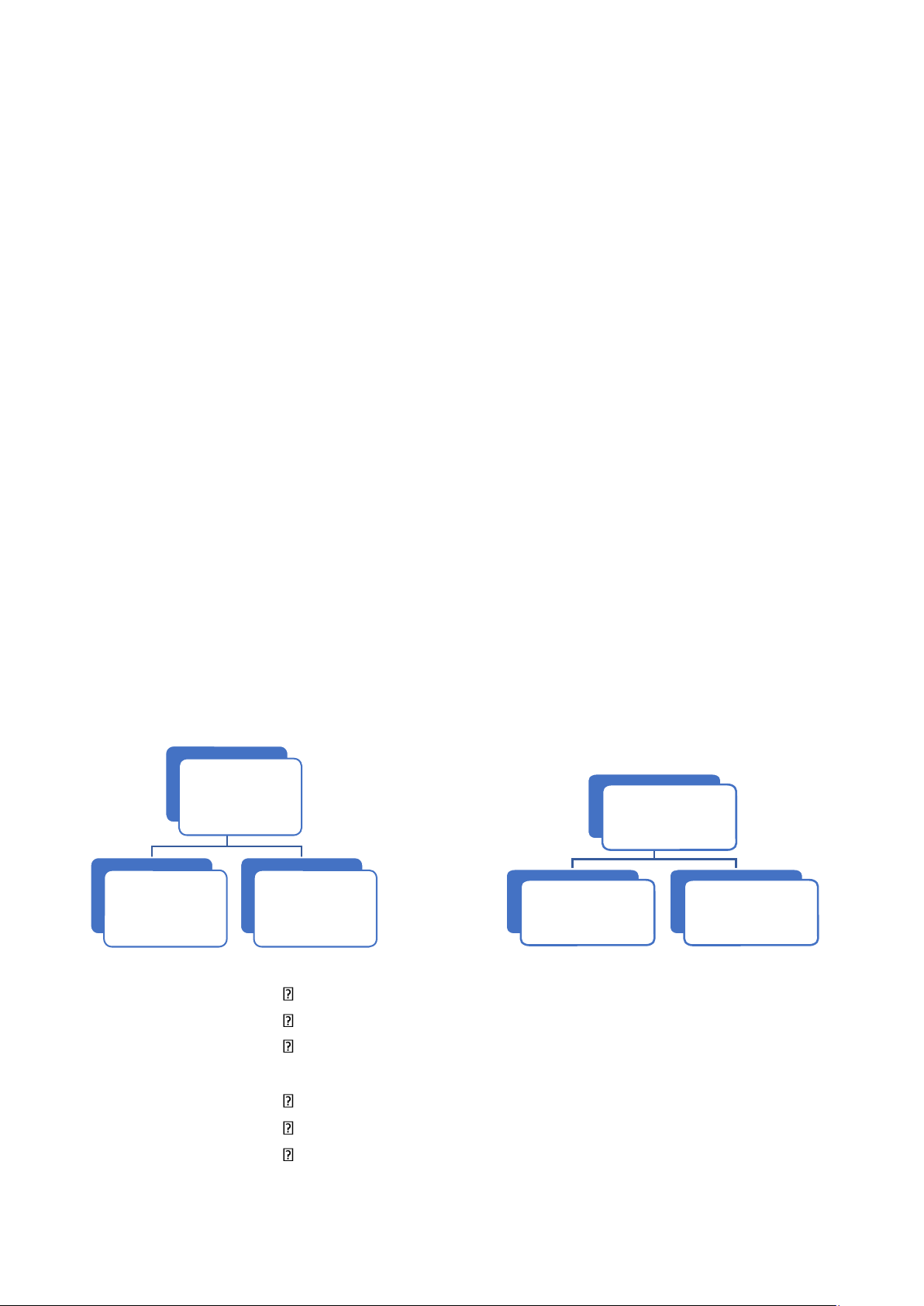

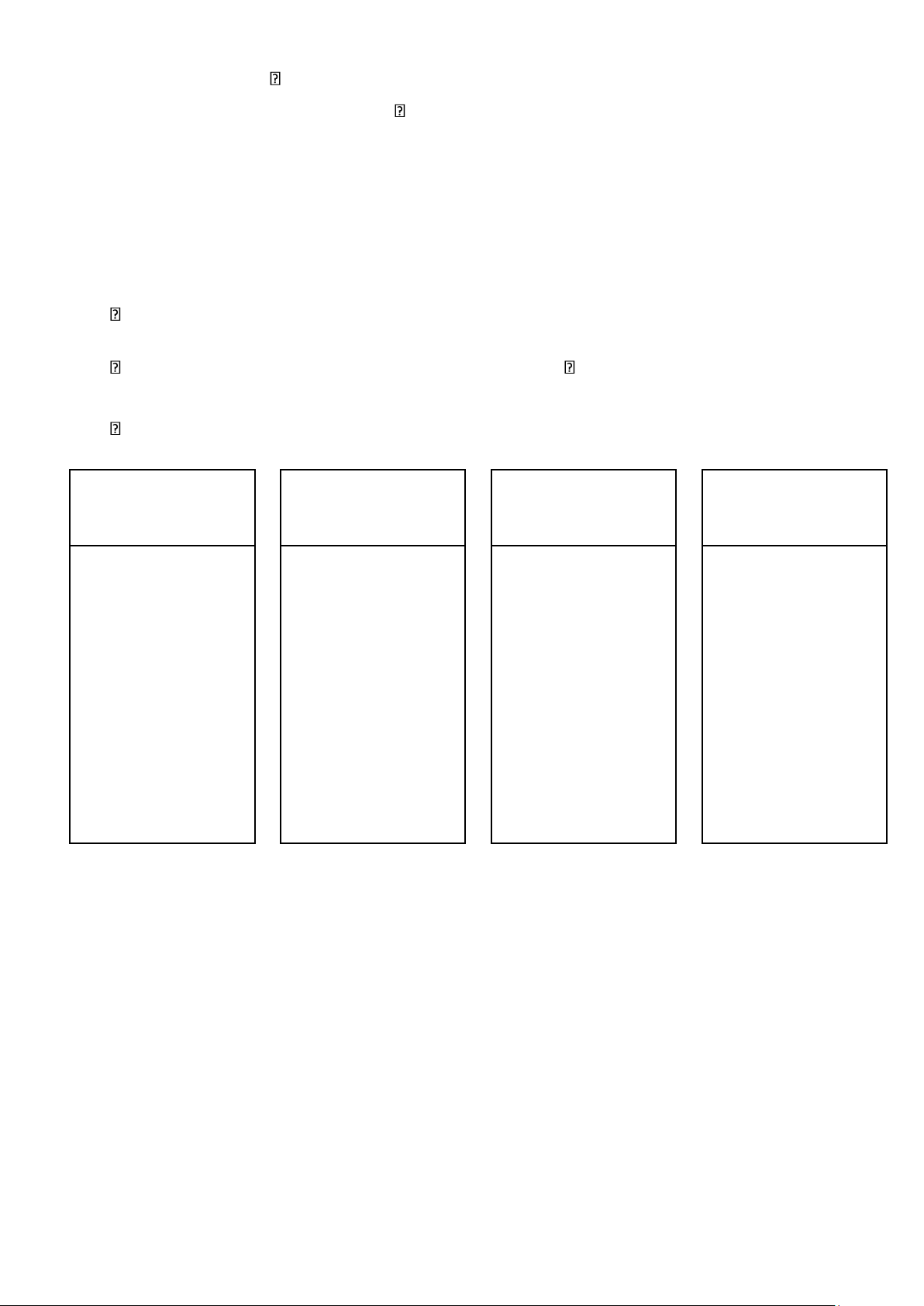

requirements affecting their internal sale, offering for sale, purchase, transportation, distribution or use… Legal basis Art III.2 First Art III.2 Seconf Art III.4 sentence sentence Coverage Internal taxation Internal Taxation Internal regulations Imported and Like products Directly competitve or Like products domestic substitutable producrs products relationship Obligations Imported products Dissimilar taxatikon Imported products cannot be taxed “in cannot be applied “so as caknnot be treated excess of” domestic

to afford protection” to “less favorably” than products domestic production domestic products - Purpose: lOMoAR cPSD| 61630929

o Avoiding protectionism in application of internal taxes/regulatkions

o Requiring equalikty of competitve relationships -

Scope of application o De jure discrimination o De facto discrimination (Japan

– alcoholic Beverages II, koreakk – alcohoic Beveragkes, Chile – alcoholic Beverages) -

Measures covered o Internal measures only (NOT border measures) o Art III is

not limited to products under tariff concessions, but applies generally to other products even not bound to reduce tariffs -

General exceptions to all provisions (including NT) o General exceptions (Art

XX GATT 1994) o Security exceptions (Art XXI GATT 1994)

o Balance of payment exceptions and temporary application of quantitative restrictions lOMoAR cPSD| 61630929

in a discriminatory manner (Art XII, XVIII.B and XIV GATT 1994)

o Waivers (Art IX.3 Marrakesh Agreement) o Special and

differential provisions in WTO agreements

- Particular exceptions to NT: o

Government procurement (Art III.8A GATT 1994): domestic products may be

granted advantages over imported ones in government purchase o

Subsidies to domestic producers (Art III.8B GATT 1994): subsidies may be provided

exclusively to domestic producers o Cinematography films (Art III.10 and IV GATT 1994): Products of national movie

industry may be granted more preferential “screen quotas” b. NT under GATS

- Legal provision: Art XVII GATS

1. In the sectors inscribed in its Schedule, and subject to any conditions and qualifications

set out therein, each Member shall accord to services and service suppliers of any other

Member, inrespect of all measures affecting the supply of services, treatment no less

favourable than that it accords to its own like services and service suppliers. - Scope of application:

o De jure and de facto discrimination covered

o NT does not have general application to all trade in services

o NT just applies to specific service sectors which a WTO member has explicitly

committed itself to grant NT (in Schedule of Commitments on Services) - The Three-Tier Test

(i)Measures affecting trade in services

(ii) Like services/service suppliers

(iii) Treatment no less favorable

- Less favorable treatment: only if such treatment modifies conditions of competition in

favor of domestic services/service suppliers c. NT under TRIPS

- Legal provision: Art II TRIPS

o Each Member shall accord to the nationals of other Members treatment no less

favourable than that it accords to its own nationals with regard to the protection of intellectual property…

2. Freer trade: gradually, through Negotiation (Thương mại tự do hơn: dần dần, thông qua đàm phán)

- Other name: Principle of Market Access (MA)

2.1.MA in trade in goods

- Market access for goods inWTO stands for the totality of government-imposed conditions

under which a product may enter a country under non-discrimination conditions

- Two main categories of barriers to market access o Tariffs o Non-tariff barriers (NTBs) lOMoAR cPSD| 61630929

- Principle of market access in trade in goods includes: o The progressive reduction and

binding of tariffs o The elimination of quantitive restrictions o The reduction of other non- tariff barriers to trade

2.1.1. The progressive reduction and binding of tariffs

- Tariff (or custom duty) is a financial charge or tax on goods upon exportation/importation

- Legal provision: Art II, XXVIII, XXVIIIbis GATT 1994

- GATT recognizes customs duties (tariffs) as an obstacle to international trade but not

prohibit the imposition of customs duties A lawful instrument of protection - Tariff negotiations: o

Principles: Reciprocal and mutually advantageous basis (Art XVIIIbis GATT) + MFN

(Art I.1 GATT) o Outcome: Tariff concessions/tariff bindings (in Schedule of Concessions)

form an integral part of GATT (Art II.7 GATT) A commitment not to raise customs duty on

a given product beyond the agreed level - Modification of Schedules: o

Requesting a waiver to suspend the tariff concessions on a temporary basis (Art

IX.3 Marrakesh Agreement), or o Renegotiating with other WTO members to withdraw or modify tariff concessions on

a permanent basis (Art XXVIII GATT)

2.1.2. The elimination of quantitative restrictions - What is a quantitative restriction (QR)

o No explicit definition in WTO Agreements o But implicit definition in Art XI.1: all

measures prohibiting or restricting importation of

exportation/sale for export of any products other than duties, taxes, charges, e.g.:

import/export ban, import/export quota, licensing procedures

o A tariff quota (TRQ) is NOT a quantitative restriction and not prohibited under Art XI

GATT (since it takes the form of varying customs duties on specific quantities of imports and

Art XI excludes customs duties, taxes or other charges…)

- Legal basis: Art XI GATT 1994

1. No prohibitions or restrictions other than duties, taxes or other charges, whether made

effective through quotas, import or export licences or other measures, shall be instituted or

maintained by any contracting party on the importation of any product of the territory of any

other contracting party or on the exportation of sale for export of any product destined for the

territory of any other contracting party - General prohibition on the use of QRs o Preference

for tariffs over QRs o Reasons: QRs are more trade-distorting (absolute limits) and less transparent - Exceptions:

o General exceptions, Security exceptions, Safeguard measures, Balance-of-Payment exceptions, Waivers…

o Particular exceptions to general prohibition of QRs (Art XI.2 GATT), e.g.:

Prevent shortage of foodstuff or other essential products (Art XI.2.a)

Remove a temporary surplus of the like domestic product (Art XI.2.c.ii) lOMoAR cPSD| 61630929

- Administration of QRs (Art XIII GATT 1994) o Non-discriminatory basis (Para.1) o

Allocation of quotas should correspond closely to the expected market shares that would

have existed in the absence of quotas (Para.2)

o Provision of information relating to import licensing procedures (Para.3)

2.1.3. The reduction of other hon-tariff barriers

- Other non-tariff barriers: Lack of transparency in trade regulations, unfair and arbitrary

application of trade regulations, customs formalities, technical barriers to trade, arbitrary

practive of customs valuation…

The largest and most diverse sub-category of NTBs - Legal provisions:

o Trade in goods agreements, e.g. TBT, SPS, PSI, CVA, ILP, TRIMS… o Art VIII GATT

(Fees and Formalities connected with Importation and Exportation), Art X GATT (Publication

and Administration of Trade Regulations) 2.2. MA in trade in services

- Trade in services are subject to domestic regulations, rather than border measures (as for trade in goods)

- WTO Members are required to submit a Schedule of Specific Commitments for trade in services

o A Member guarantees other Members minium conditions of access on an MFN basis

(the same as a tariff binding under GATT) o A Member at its discretion decides the level of

market access (service sectors/modes of

supply/limitations on market access)

o Schedules may only be withdrawn or modified after negotiations and agreement on

compensatory adjustment with affected Members

- Article XVI.2 GATS 1994 provides an exhaustive list of six categories of restrictions that

must NOT be maintained, unless scheduled as a market access limitation including:

a. The number of service suppliers

b. The value of service transactions or assets

c. The number of operations or quantity of output

d. The number of natural persons supplyiing a service

e. The type of legal entity or joint venture

f. The participation of foreign capital

No general prohibition of MA barriers (such as the case of QRs for trade in goods)

Requirements relating to quality of services/qualifications of service suppliers are not

market access barriers under Art XVI

- Other MA barriers o Lack of transparency o Unfair or arbitrary application of

measures affecting trade in services o Lack of recognition of diplomas and

professional certificates o Other domestic regulations (e.g. licensing,

qualification and technical standards)

3. Predictability: through Binding and Transparency (Khả năng dự đoán: thông qua ràng buộc và minh bạch)

- How to enhance the predictability of trade policies lOMoAR cPSD| 61630929

o Tariff bindings to increase certainty as to the maximum level of custom duties to be

imposed o Transparency mechanism to increase awareness of a particular Member’s trade policies

- Legal basis: Most WTO Agreements include transparency obligations:

o Art X GATT o Art III GATS o Art 63 TRIPS

o Other provisions in WTO Agreements

- How to enhance transparency in international trade o Internal transparency: Keeping the WTO informed

Review of Members’ national trade policies through the Trade Policy Review Mechanism (TPRM)

Domestic publication of Members’ trade regulations Notification of Members’ trade

measures to the WTO o External transparency: Keeping the public informed

Initiatives and programs aimed at informing the general public about WTO activities -

The Trade Policy Review Mechanism Why Whom When How To achieve greater All WTO Frequency Two reports transparency of Members are depends on share submitted to Members' trade reviewed of world trade TPRB: (every 3/5/7 policies and (i) An years) independent report practices Vietnam (two by WTO times: 2013, 2021) Secretariat (ii) A policy statement by the Member reviewed

4. Promoting fair competition (Thúc đẩy cạnh tranh công bằng) -

Other name: Principle of Fair Trade (FT) -

WTO is not about “free trade”, it cares about “fair trade” also -

Fair trade is violated in case of practices of dumping, subsidies, IPR-infringing goods… - Legal basis:

o WTO rules on trade remedies establish what is unfair trade practice and how

governments can respond to that (e.g. ADA. SCM) o Other WTO Agreements also support

fair competition: GATS, AoA, TRIPS, GPA, ILP, TBT, SPS…

5. Encouraging development and economic reform (Khuyến khích phát triển và cải cách kinh tế) -

Other name: Principle of Special and Differential Treatment (S&D) -

Why S&D? Developing countries (DCs) and least-developed countries (LDCs)

face difficuties in benefiting from trade liberlization lOMoAR cPSD| 61630929 -

Who enjoys S&D? DCs and LDCs (additional rights), small economies,

transitional economies from central planning to market economies - How to provide S&D?

o Special and differential treatment: in the form of special flexibilities or rights

provided in WTO Agreements and decisions

o Technical assistance and training o

Capacity building programs - Legal basis: o

Part IV GATT (Trade and Development) o

Enabling Clause (e.g. GSP Schemes) o Other

provisions in WTO Agreements - Differents categories (6) of S&D provisions o

Provisions aimed at expanding trade

opportunities of DCs o Provisions requiring to

safeguard interests of DCs o Provisions giving

flexibility in using trade policy instruments o

Provisions giving longer transitional periods to comply

o Provisions giving technical assistance o Special provisions for LDCs [THẢO LUẬN]

1. The transparency obligation implies that Members:

a. Make public all measures that affect services trade

b. Allow other Members to comment on all proposed new measures affecting trade

c. Create online access to a database of all their measures affecting trade 2. Most-

favoured-nation treatment must be ensured:

a. Only for services subject to specific commitments

b. For all services covered by GATS

c. For governmental services and all services covered by GATS 3. Market access

limitations that need to be scheduled include:

a. Restrictions on the total number of service operations

b. Restrictions on the eligibility of foreigners for domestic subsidies

c. Restrictions on the composition of the board of directors 4. National treatment under the GATS is:

a. Granted unconditionally once market access conditions are met

b. Granted only on a sector – and mode-specific basis

c. Granted only to specific trading partners

5. The Most-Favoured-Nation principle requires a Member to treat services and

service suppliers from any other Member no less favorably than:

a. Like services and service suppliers of national origin

b. Like services and service suppliers from any other WTO Member

c. Like services and service suppliers from any other country lOMoAR cPSD| 61630929

6. Under GATT, which countries can give the more favoured treatment to others without

violating of Article I: a. US, Canada, Mexico

b. US, Canada, Vietnam, China

c. Japan, US, Canada, Vietnam

7. Economic integration agreements are permissible:

a. Only if they provide for substantial sectoral coverage and the elimination of

substantially all discrimination

b. Only if other Members are afforded an opportunity to join

8. Discriminatory licensing requirements would need to be scheduled under: a. Market access b. National treatment c. Additional commitments

d. None of these provisions

9. Equity ceilings for foreign investors, individually and as group, would be scheduled as:

a. Market Access limitation

b. National Treatment limitation

c. Exemption from MFN treatment

d. None of these provisions

10. A non-discriminatory licensing requirement for doctors must be scheduled under: a. Market Access b. National Treatment c. Additional commitments d. None of these provisions

11. If a country that maintains sales and advertising bans for arms wants to undertake

commitments on retail trade and on advertising services, it needs to schedule these bans:

a. Under advertising services - market access

b. Under retail distribution services - market access c. In both sectors d. In neither sector

12. Existing specific commitments can be modified only:

a. In new rounds of services negotiations

b. At any time, after three years from their date of entry into force, against

compensation of affected trading partners

c. If approved by the Council for Trade in Services

13. WTO Members have to inform other members about modification, change, and

cancellation of any domestic laws, this is the spirit of which principle? a. Market access b. National treatment c. Additional commitments d. Transperancy

14. The main objectives of the TPRM are: lOMoAR cPSD| 61630929

a. the smoother functioning of the MTS by achieving greater transparency and

understanding of Members' trade policies and practices

b. contribute to improved adherence by all Members to rules, disciplines and

commitments made under the WTO Agreements

c. enable the collective appreciation and evaluation of the full range of individual

Members' trade policies and practices and their impact on the MTS

d. All the answers above

15. Primary principles under consideration by the Working Party on Domestic

Regulation for a framework for regulatory development are:

a. Objective criteria and technological neutrality

b. Necessity, transparency, equivalency and international standards

c. Transparency, impartial application, regular review process lOMoAR cPSD| 61630929

Lecture 3: WTO Multilateral trade agreements - GATT, AoA, TBT, AND SPS

1. The general Agreement on Tariffs and Trade (GATT) 1.1.Overview

- Original GATT (GATT 1947) provided rules of multilateral trading system from 1 Jan

1948 until WTO entered into forcw on 1 jan 1995

- GATT 1947 is no longer in force and has been replaced by GATT 1994 - GATT 1994 consits of

o Provisions of GATT 1947, as amended or modified up to 1 January 1995 (date of entry

into force of the Agreement Establishung the WTO) o Protocols and Certicications

realting to Tariff Concessions o Protocols of accession (to the GATT up to 31 December

1994) o Decisions on Waivers still in force on 1 Jan 1995 o Understanding on the

interpretarion of various GATT provisions o Other decisions of the contracting Parties

to GATT 1947 o Marrakesh Protocol to GATT 1994 1.2.Tariffs -

Definiftion of tariff/customs duty:

o Not defined in GATT 1994 or any other multilateral agreemenrs on trade in goods o A

tarikss is a financial charge in the form of a tax, imposed on goods transported from

one customs area to another (often from one country to another) -

Tariff is he most commonly used and visible measure to determine maret access for

goods o Import tariffs afre more popular and main focus of GATT/WTO o Export tariffs

are largely unbound in GATT/WTO -

Classification of tariff/customs duty (by manner of calculation) Customs duty Ad v alorem Specific Mi xed Compound -

Ad volorem: a percentage of the value of the good -

Specific: an amount of money based on a unit of quantity such as weight (kg),

length m, area m2, volume (m2/litre), numer (items, pairs, dozen, packs) -

Mixed: An alternative between ad valorem duty and specifuc duty, whicherver duty is the higher/lower -

Compound: An ad valorem duty to which a specific duty is added or less frequently, subtracted -

Difference between tariffs and other charges that may levied at the border

o Tariff is not an internal tax (eg value added tac): internal taxes are regulated by

Art III.2 GATT on National Treatment. Whether a charge is a customs duty or

an internal charges?k the obligaktion to pay that charge accures due to

importation or due to an internal event (distribution, sales, transportation…)? o lOMoAR cPSD| 61630929

Tariff iks not a free or charge associated with import service (regulated by art

VIII GATT on fees and formalities connected with importation and exportation) -

Purposes of customs duty on imports o Source of government revenue (now less

importantkk) o Protectkion of domestic industries -

Tariffs represent a lawful instrument of protection allowed by GATT 1994 (cf. QRS are generally prohibited -

Tariffs are subject to negotiatons on reduction (Art XXVIIIbis GATT) o 8 rounds

of trade negotiations under GATT 1947 reduced average custims duties of developed

countries on industrial products from 40% to less than 4% ad valorem -

Tariffs remain a significant barrier to international trade for several reasons:

o Developing countries (DCs) maintain relatively high tariffs

o High taridds remain on certain sensitive products (“tariff peask”), e.g. textile

leatherk, agricultural products

o Tariff increase with the level of processong that products have undergonr (tariff

escaltion), i.e non – processed and raw materials v. processed and

semiprocessed products, eg EU’sk tariff on cotoon (o%) cotton yarkkkn (4k-

5%) woven fabric of cotton (8%) shirts of cotton (12%) -

Basic rules governing tariff negotiations:

o Reciprocity and mutual advantage (Art XXVIIIbis GATTT) o MFN treatment (Art I.1 GATT)

o Predictability on tariff concessions/tariff bindings (Art II GATT) -

Bound tariff: A tariff for which there is a legal commitment not to raise it above a

certain level (the maximum level of customs dutykk to be levied on products imported)

o Results of tariff negotiations

o Set out in Schedule of Concessions on goods

o Can be changed, only after negotiation and trade compensation -

Applied tariff: A duty that is actually charged on imports on a MFN basis. Applied

tariffd, as specified in WTO Members’ nationa tariff schedules, can be below but not higher than the bound tariffs - Schedule of concessions:

o Schedule of concessions consists of a list of products for which a “bounf tariff”

has been agreed by the Member concerned

o Concessions are granted on a MFN basis

o Art II:1(b) GATT: requires a Member to refrain from imposing ordinary

customs duties in excess of those provided for in that Member’s Schedule

o Schedules are based on the Harmonized commodity description and coding

system (harmonixed System (HS) – HS Convetion) the HS constitues an

international classificaion system which provides for the systematic and

uniform classification of goods

o Structure of a Schedule of concessions

o A schedule contains the following information for each product subject to tariff concessions lOMoAR cPSD| 61630929 (1) HS tariff item member

(2) Description of the product

(3) Base rate of duty (intial bound rate)

(4) Bound rate of duty (final bound rate) (5) Implementation period

(6) Intitial negotiating rights (IRN) (7) Other duties and charges

(8) For agricultural products only, special safeguards

1. 3.Quantitative Restrictions

- Definition and classification:

o A measure that limits the quantity of a product that may be imported or exported o Different types: A prohibition/ban

A quota (but not tariff quota) Import/export licensing Other measures - Rules onQRS

o Art XI GATT: General Prohibition on the use of QRs (para. 1) + Exceptions (para. 2)

o An illustrative list of QRs → See 2012 WTO Decision on Notification

Procedures for Quantitative Restrictions – De jure QRs v. De facto QRs → So

far, in GATT/WTO Case Law: Art XI may apply to, e.g: ✓

Minimum price requirements (EEC – Minimum Import Prices 1978 / China – Raw Materials 2012) ✓

Non-automatic licensing system (India – Quantitative Restrictions 1999) ✓

Trade balancing requirement (India – Autos 2002) ✓

Restriction on ports of entry (Colombia – Ports of Entry 2009) ✓

Data collection and monitoring requirements (Japan – Trade in SemiConductors 1988) ✓

Import prohibition due to processing methods (US – Shrimp 1998) – Art XIII

GATT (Administration of QRs) → Non-discrimination (p

2. The Agreement on Agricultural (AoA) 2.1.Overview -

Why a separate agreement on agricultural products? → Agricultural products are

“sensitive” in the sense that:

– Agriculture remains in many countries an important part of overall economic

activityand employment (especially for low-income populations)

– Every country would like to ensure food security in times of world market instability lOMoAR cPSD| 61630929 -

Objectives of AoA: Reforming trade in agriculture, envisaging a fair and

marketoriented system, improving predictability and stability for both importing and exporting countries -

Scope of application: Annex 1 of AoA lists “agricultural products”: – Basic

agricultural products (e.g.: wheat, live animals)

– Products derived from them (e.g.: flour, meat) – Processed agricultural products (e.g.:

chocolate, sausages, wine, spirits, tobacco products, fibres) – Fishery and forestry products are NOT included 2.2.Market access

- General rules regulating market access on agricultural products include: –

Tariffication – transform non-tariff border measures into tariffs,

reflectingsubstantially the same level of protection (Article 4.2); –

Commitments on tariffs and tariff quotas - maintain existing import access levels

andensure minimum-access opportunities (Schedule of tariff concessions); –

Special safeguard – allows the imposition of an additional duty under

certaincircumstances (available for those Members that reserved the right to use the safeguard

measure in their Schedules) (Article 5); –

Special treatment – allows certain Members to maintain non-tariff border

measureson certain products in exceptional circumstances (Annex 5) 2.3.Domestic support

- Not all subsidies distort trade to the same extent → AoA distinguishes 2 categories of

domestic support (Art 6 and Annex 2)

o Domestic support with no, or minimal, distorting effects on trade - NOT subject to

reduction commitments o Domestic support with distorting effects on trade - subject to limits and reduction commitments

- Domestic support with no, or minimal distorting effects on trade – NOT subject to

reduction commitments o "Green Box" measures (Art 7 and Annex 2): they must be

provided through a publicly-funded government programme, not involving transfers

from consumers, and price support. E.g.: government services such as research, disease

control, infrastructure and food security o "Blue Box" measures (Art 6.5): certain direct

payments to farmers where farmers are lOMoAR cPSD| 61630929

required to limit production o Developmental category (Art 6.2): measures of assistance

adopted by developing countries to encourage agricultural and rural development that are an

integral part of the development programmes of developing countries o Domestic support

de minimis (Art 6.4): Any domestic support not covered by the exempted categories above

must be maintained within the de minimis levels (5% of agricultural production value for

developed Members, 10% for developing Members)

- Domestic support with distorting effects on trade – subject to reduction commitments o

"Amber Box" measures (Art 3.1, 3.2 and 6): all other domestic support measures

considered to distort production and trade in favor of domestic producers o E.g.: measures

to support prices, input subsidies or subsidies directly related to

production quantities o Domestic support measures falling into this category should not

exceed the commitment levels recorded in Members‘ Schedules and were subject to reduction

commitments specified therein (Article 3.2) 2.4.Export competition

• Definition of “subsidy”: not in AoA, but in SCM (Agreement on Subsidies andCountervailing Measures)

• Export subsidies are subsidies contingent upon export performance

• Export subsidies allow exporters to sell below the cost of production and unfairly

competewith exporters in other countries, therefore:

– Art 3.3 and 8 (General prohibition): AoA prohibits the use of export subsidies

foragricultural products, UNLESS a Member has reserved the right to use export subsidies in

its WTO Schedules of Concessions

– Art 3.3 and 9.1 (Reduction commitments): When the right to use export subsidies

isscheduled, AoA requires Members to cut both the amount of money they spend on export

subsidies and the quantities of exports that receive subsidies

3. The Agreement on Technical Barriers to Trade (TBT)

3.1. Overview and scope of application

Why TBT Agreement? Technical regulations and standards are important, but differ from

country to country. In the absence of international disciplines, TBT measures could be used

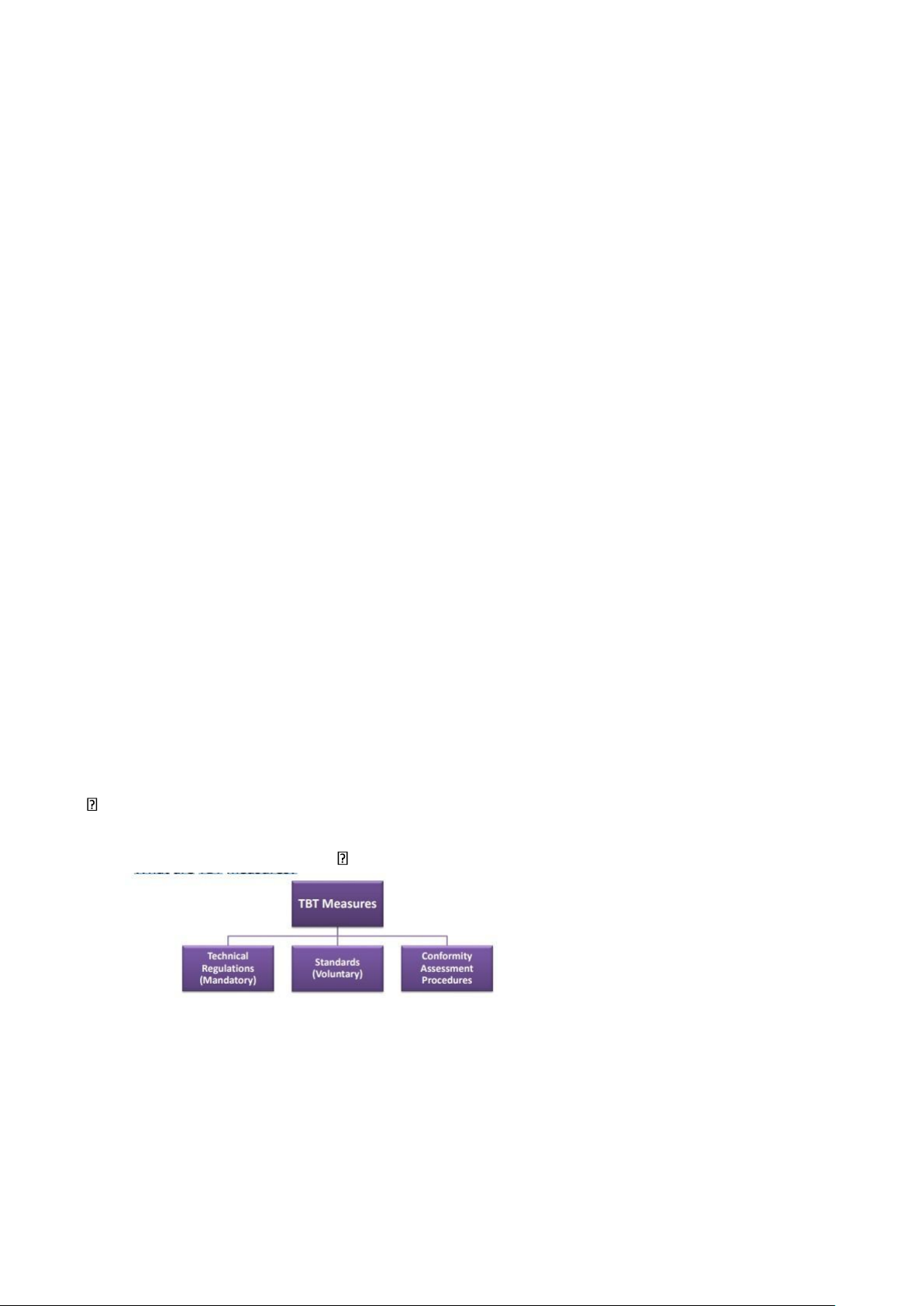

as an excuse for protectionism What are TBT measures? • Art 1 and Annex 1 of TBT:

– Technical Regulations: document which lays down product characteristics or their

relatedprocesses and production methods, with which compliance is mandatory.

→ E.g: A law requiring that batteries be rechargeable, wine be sold in green glass bottles, furniture be fire-resistant

– Standards: document approved by a Recognised Body that provides, for common

andrepeated use, rules, guidelines or characteristics for products or related processes and

production methods, with which compliance is voluntary. lOMoAR cPSD| 61630929

→ E.g: Standards for construction materials, mobile phones, electric toothbrushes

– Conformity Assessment Procedures: procedures used, directly or indirectly, to

determinethe fulfilment of relevant requirements contained in technical regulations or standards

→ E.g: Procedures for sampling, testing, inspection

3.2. Main disciplines on TBT Measures

• Non-discrimination (MFN, NT) (Art 2.1, Annex 3(D), Art 5.1.1)

• Avoidance of unnecessary obstacles to international trade (Art 2.2)

− Necessity requirement: A TBT measure shall not be more traderestrictive than necessary to

fulfill a legitimate objective (E.g.: national security, protection of public health, environment,

prevention of deceptive practices)

− “Necessary” meaning: No alternative measures that are (i) less traderestrictive and (ii)

reasonably available to (iii) achieve the objective pursued (US – Tuna II (Mexico) 2012)

Harmonization and Recognition of Equivalence

− Why to harmonize? To minimize the variety of requirements that exporters have to meet in

different exporting markets − How to harmonize?

✓ WTO Members base their measures on relevant international standards, guidelines andrecommendations (Art 2.4)

✓ WTO Members recognize each other’s measures as equivalent (Art 2.7) • Transparency

and Notification (Art 2.9 – 2.12)

• Special and Differential Treatment, including technical assistance to DCs and LDCs (Art 12)

4. The Agreement on Sanitary and Phytosanitary Measures (SPS)

4.1.Overview and Scope of application

4.2.Main disciplines on SPS Measures

• To be applied only to the extent necessary to protect human, animal or plant life or health(Art 2.2)

• To be based on scientific evidence (and international standards unless otherwise

justifiedbased on risk assessment) (Art 2.2, 3.3)

→ Two options to show that measures are based on science:

✓ Base their measures on international standards, or

✓ Base their measures on scientific risk assessment

• Shall not arbitrarily or unjustifiably discriminate between Members where identical

orsimilar conditions prevail (Art 2.3)

• Harmonization (Art 3), Recognition of Equivalence (Art 4), Transparency and Notification(Art 7)

• Precautionary approach which allows the application of a SPS measure without

sufficientscientific evidence (e.g., emergency response to a sudden outbreak of animal disease

suspected or linked to imports, new food processing techniques whose evidence regarding

safety is not yet available) (Art 5.7) Seminar

1. Country A imposes a 20% income tax on the income of teachers with the nationality of

Country B. Meanwhile teachers with the nationality of Country C are not levied with this tax