Preview text:

VIETNAM NATIONAL UNIVERSITY INTERNATIONAL UNIVERSITY SCHOOL OF BUSINESS SUBMISSION COVER SHEET

BUSINESS ANALYSIS & EVALUATION COMPANY RESEARCH PROJECT

Course coordinator: Dr. Tien Nguyen Group members: Team Member Student ID Full Name Signatures Contribution (max 100%)

1. BAFNIU19007 Nguyễn Đức Duy 100%

2. BAFNIU19011 Trịnh Gia Hân 100%

3. BAFNIU19012 Trương Thanh Hoa 100% 4. BAFNIU19016 Bùi Tú Lan 100%

5. BAFNIU19028 Lê Đỗ Mai Oanh 100%

We declare that this assessment item is the own work of our group, except where acknowledgem

has not been submitted for academic credit elsewhere.

Signed: ………………………………………. Date: ……………………………………………

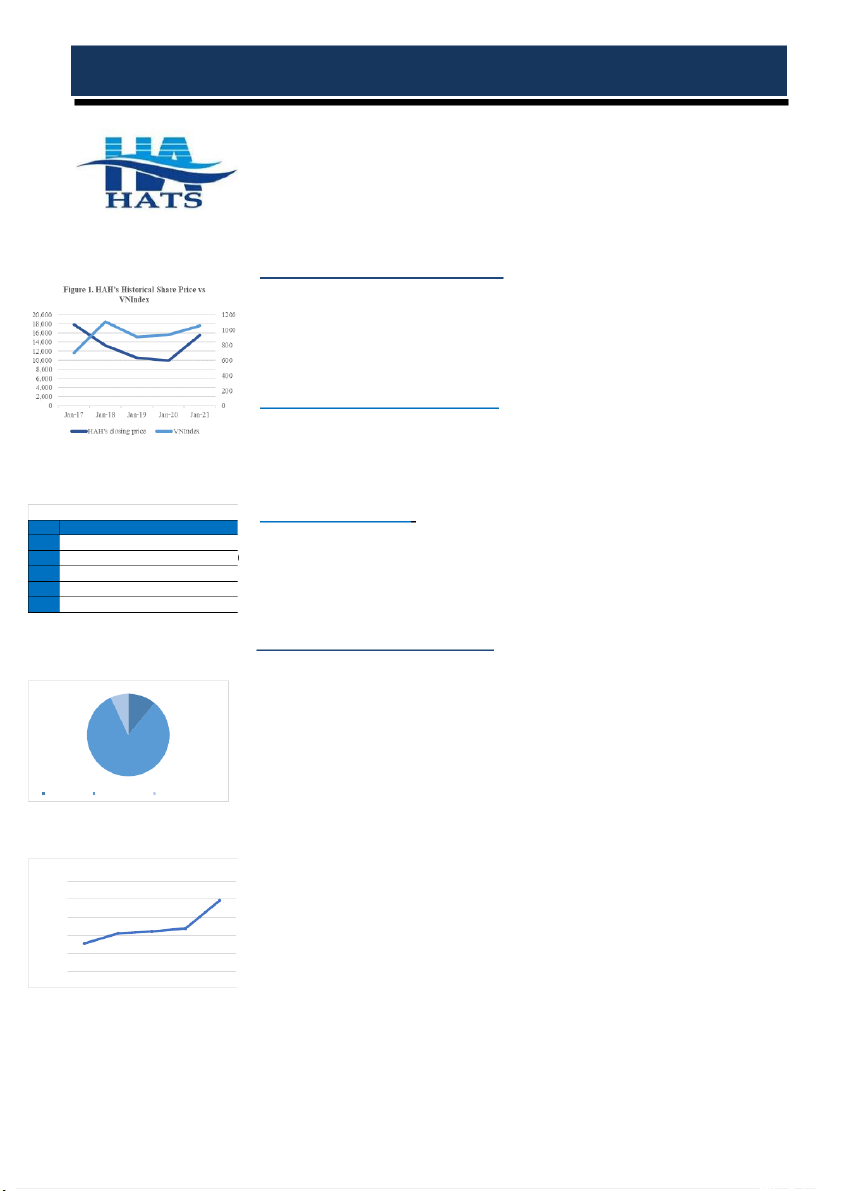

HAI AN TRANSPORT AND STEVEDORING JSC. Ticker: HAH Recommendation: BUY Date: 31/12/2021 (Upside: 50%) Current Price: VND67,800 Price Target: VND102,017 INVESTMENT SUMMARY

We recommend a BUY option for Hai An Logistics JSC., at a target price of VND 102,017.

This price represents a 50% increase over the stock's previous closing price on December

31st, 2021. HAH's stock price is in a period of strong growth. From 2015 to January 2021,

HAH stock price fluctuated at a lower level, then from the beginning of February 2021, HAH

stock price increased with a big slope (Figure 1). Up to now, the share price of HAH has

increased 9 times compared to the previous period. Our recommendation is based on the fol owing key points:

Investment in ships and port upgrades: The company wil continue to invest in its fleet

over the next 3 years. Specifical y, the company wil buy 2 more used container ships of

1,600 - 1,700 TEUs and build 4 new 1,800-TEU container ships of the type “SDARI

Source: Investing.com, Team estimate

Bangkok Mark IV”. Regarding ports and logistics, the company will continue to implement

investment projects in ports and depots in Ho Chi Minh City, Vung Tau, and the Central

region when there are opportunities. Moreover, the company wil invest in upgrading Hai

An's port yard and drainage system. Ta T b a lbe e 1. 1 Fo F u o n u d n idng n g me m mb m e b rs r

Increase in freight rates: In 2021, the COVID-19 epidemic disrupted the global supply No. Company name

chain, which pushed container freight rates to increase by 5-6 times on average compared to 1 Ha H n a o n i o Ma M r a irtime m e JS J C S

pre-pandemic rates. As for the shipping industry, due to high international freight rates, 2 Ma M r a irtime m e Te T c e h c n h inca c l a Se S r e v r i v ce c s e an a d n d Su S p u p p l p y y JS J C S

many domestic shipping lines have taken advantage of the opportunity to lease ships to 3 Ha H i a Mi M nh n h JS J C S C

foreign markets. At the same time, domestic rates have been gradual y adjusted to suit the 4 Ha H i a An A n Sh S i h pb p u b i u ldi d ng n g JS J C S

general trend. Therefore, the operations of shipping and logistics enterprises stil achieved 5 Ha H i a Ha H a Tr T a r n a s n p s o p r o tr an a d n d Inv n e v s e t s me m n e t n JS J C S

good results. The operations of Hai An Logistics JSC also benefit from this general situation. So S u o r u c r e c : e : Co C m o p m a p n a y n ’ y s ’ s we w b e s b i s t i e t e BUSINESS DESCRIPTION

Hai An Logistics was established on May 8th, 2009 in Ha Noi with 5 founding members with Fi F gu g r u e r e 2 . 2 .HA H H A ’ H s ’ 2 0 2 2 0 1 2 1 br b e r a e k a k d o d w o n n r e r v e e v n e u n e u e

a charter capital of 150 bil ion VND (Table 1). The company focused on main business line

categorization including Seaport Transport Services (accounting for 11% and 14.48% of total 7.01% 10.93%

revenues in 2021 and 2020, respectively) and Marine Transport Services (accounting for 82%

and 79.28% of total revenues in 2021 and 2020, respectively) (Figure 2). In 2017, in order to

diversify services, the company signed a joint venture contract with Pantos Holding 82.05%

Incorporation (Korea) to establish the first joint venture company with a foreign enterprise:

Pan Hai An Co., Ltd (PANHAIAN) to build a Logistics Center in Hai Phong, providing

warehousing services. On March 11th, 2015, the company listed al 23,196,232 shares on the Port service revenues Marine Shipping revenues Revenues from other servi ce So S u o r u c r e c : e :C o C m o p m a p n a y n y da d t a a t , a ,T e T a e m a m e s e titma m t a e t e

Ho Chi Minh Stock Exchange with the stock code HAH.

Taking advantage of high international freight rates during the COVID-19 period last year,

Hai An Transport and Handling Joint Stock Company recorded impressive growth.

Figure 3. HAH’s Net Revenue

According to the consolidated financial statements for 2020 and 2021, total net revenue HAH's Net Revenue

reached VND1,191 bil ion in 2020 and VND1,283 bil ion for the first 9 months of 2021 2,500

(Figure 3). After-tax profit accounted for VND147 bil ion in 2020 and VND284 bil ion for ilions B 2,000 the first 9 months of 2021. 1,500

With the strategy to focus on accelerating investment in transport capacity, in addition to the 1,000

domestic market, the company also intends to expand to the Asian market, especial y 500

Southeast Asia and Northeast Asia, to serve Vietnam's import and export goods. The

company's output of seaport and marine transport services wil decrease this year. Thus, the 0 2017 2018 2019 2020

202 revenue and profit growth prospects wil mainly come from the increase in freight rates.

Source: Company data, Team estimate CORPORATE GOVERNANCE

Organizational model: HAH's corporate governance has a wel -defined organizational

model for conducting business, which consists of:

Table 2. HAH’s Board of management

Board of Management (BOM): The Board of Management includes 7 individuals (al of

them are Vietnamese people (Table 2).

HAH's management team has many years of seasoned experience and expertise in th

company's business fields. As a result, the management team is expected to be able to com

up with appropriate strategies and take timely response measures to the rapid fluctuations o

the Vietnamese economy as wel as the seaport industry, in particular.

Board of Director (BOD) structure: There are 6 members in the Board of Director structure

and al of them are Vietnamese : Vũ Ngc Sơn – Chairman ; Vũ Thanh Hi – Member ; Trần

Quang Tiến – Member ; Nguyễn Ngc Tun – Member ; Trần Thị Hi Yến - Independent

member ; Nguyễn Thị Vân - Independent member. Al members of the BOD attended all

Source: HAH’s annual report 2021 meetings before 2021.

Shareholders structure: Vietnam shareholders invest in Hai An more than foreign

Figure 4. HAH’s shareholder structure

shareholders (Figure 4). Large funds and corporations are shareholders of the company suc

as Sao A D.C Investment JSC, CTBC Vietnam Equity Fund, America LLC, etc. Hai Ha

Transport and Investment JSC owns the highest shares of HAH (11.41% of the capital with

7,794,500 shares). These show that Hai An has been an attractive corporation to invest in and

could potential y develop in the future. INDUSTRY OVERVIEW

1. Advantages of the maritime industry Geographical location

The Vietnamese marine logistics industry has been benefiting from Vietnam’s strategic

construction of numerous ship docks as wel as easy access for ships from far and wide.

Source: HAH’s annual report 2021

Transportation infrastructure construction and development

During the COVID-19 pandemic, the construction of transportation infrastructure was

extremely stagnant due to unexpected lockdowns. By contrast, after the pandemic has been

wel control ed, the process has been continued again using enormous funds from the

Government's supporting packages and even urged to finish soon. This contributes to the

effective connection among different types of routes including road, river, and maritime

routes, hence increased transport efficiency for the marine logistics industry.

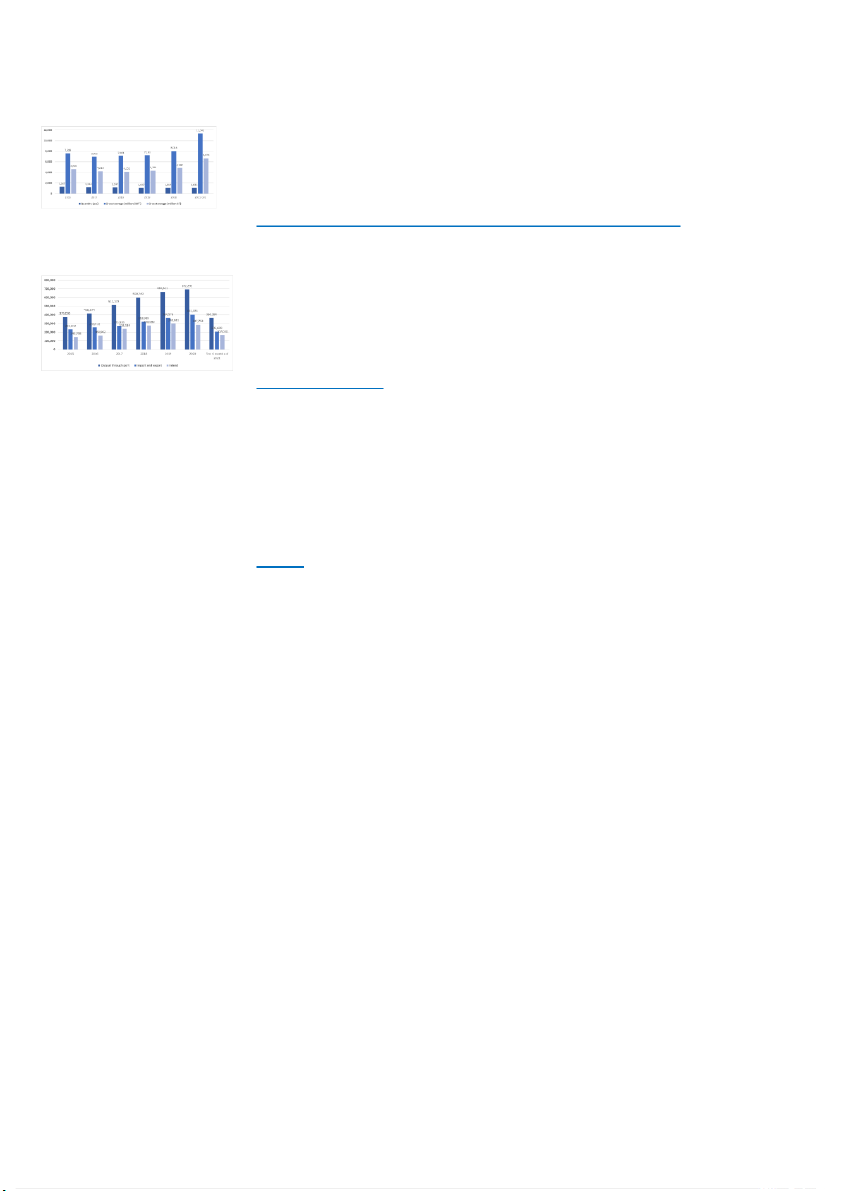

2. Market share and transportation volumes

Vietnam has been a large logistics market with increasing volumes of imports and exports

compared to other ASEAN countries despite the negative impacts of the Covid-19 pandemic.

This helped the total marine cargo transportation loads through Vietnamese docks increase

over time. However, the market share that the Vietnamese fleet has regarding imports and

exports has been decreasing compared to that of others. This is because 800 out of 1,04

Figure 5: The size of Vietnam's shipping fleet

Vietnamese specialized ships are smal - and medium-sized whose capacities are no more tha

in the period 2016 - Oct 2021 (includes only

10,000 GT, while the number of above-30,000-GT ships is just 13. There has been a trend

specialized cargo ships, excluding other ships/vehicles)

towards investment in container ships and other upper-size ones in Vietnam, but no

breakthrough has been recorded in the trend until now. Also, the Vietnamese fleet is stil

fal ing behind other countries regarding techniques, expertise, and experience while the

international logistics supply chain requires higher and higher transport quality.

Consequently, foreign fleets whose conditions above are satisfactorily met easily outperform

the Vietnamese one in terms of marine logistics market share.

Soure: Vietnam Maritime Administration

International Marine Logistics Supply Chain and Transportation Fees

During the Covid-19 pandemic, many countries had to implement lockdown and reduced

production policies. This caused the docks in developed countries including America, Figure 6: Q

uantity of goods through Vietnam seaport

European nations, and China to suffer great jams, which inevitably results in a shortage of

international supply chains of marine logistics services. Consequently, inadequacy in ship and

container supplies arises, causing container transportation fees to increase by 5 - 6 times o

average compared to the period before the pandemic. The shortage of marine logistics supply

chains is expected to be long-lasting in the future, especial y regarding container transport

capacity, so firms focusing on their investment in containers and transport capacity may

sustain wel under such a circumstance.

Source: Vietnam Maritime Administration Industry Constraints

Limited transport productivity

The Vietnamese fleet requires lower investment capital and is easier to operate compared to

other developed countries’ fleets, meaning that it has not generated optimal productivity and

may find it difficult to compete with other rivals in international marine logistics markets. Resource shortage

It is difficult to recruit competent captains and crew members for the marine logistics industry

as such staff are required to have enough technical proficiency and experience to ensure saf

transportation. In addition, Vietnamese captains and crew members stil have a limited

understanding of international regulations on marine transportation, so it is difficult to enable

the Vietnamese fleet to operate in developed countries with rigorous legislation. Threats

Large foreign marine logistics brands have been through considerable M&A and

reorganization ventures, granting them significant competitiveness regarding quality, prices,

and chal enging Vietnamese firms in terms of acquiring international market share.

Container ship utilization requires significant experience, network, and financial support,

which hardly any Vietnamese ship lords have been able to acquire. Hence, it is stil

chal enging for Vietnamese logistics firms to make use of international container ship route.

COMPETITIVE ADVANTAGES AND POSITIONING

Figure 7: Container ships count

Leading position in domestic container transportation capacity

In the first half of 2022, Hai An successful y received the 10th container ship named 12

HAIAN CITY. With the presence of HAIAN CITY, HAH currently possesses the highest 10 10

number of container ships in Vietnam with 10 container ships, accounting for 20.83% of 8

the total 48 container ships in Vietnam (Figure 7). This makes the total tonnage of the 7 6 6

HAH’s fleet increase to 14,263 TEU. In addition, the average capacity of Hai An ships 5 4 4

also beats that of its competitors (Figure 8). With this strong container fleet, Hai An now 4 3 3

has a higher market share over competitors in the container shipping sector and is 2 2 2 2

expected to expand in the years to come when Hai An Group's management has planned 0

to continue investing in 4 new ships, scheduled to be delivered in 2023 - 2024.

Ful -service logistics is a highlight of Hai An in the industry

Source: Cuc dang kiem Vietnam, companies’

With the col aboration of 9 member companies and branches operating throughout the websites Figure 8: Q

uantity of goods through Vietnam

country, the synchronous implementation of package logistics services, from seaport

warehousing, wharf, loading and unloading, container clearance and repair to water and 1,400

road transport in 2 main regions of the country: Hai Phong - Ha Noi and Vung Tau - 1,237 1,200

HCMC, transportation service from port to port, from warehouse to warehouse by al 1,000 956

types of transport, along with the putting into operation of the PAN Hai An cargo 770 800 719 719

distribution center, has made Hai An a complete and prestigious logistics center in 585 600 588 600 560 555

Vietnam. Convenience, time-saving, and simplicity in the procedure are what Hai An’s 444 400

customers can benefit from. As a result, this is a driver for customers to choose Hai An 200

services rather than other competitors. 0

One of few domestic transport firms possessing alternating harbors and important cargo alternating centers

Source: Cuc dang kiem Vietnam, companies’

Hai An runs the Hai An harbor on the Cam river, Hai Phong, with a lifting and parking websites

capacity of up to 250,000 TEU per year and 20,000DWT, respectively. This enables

HAH to become one of the few inland waterway transport firms to have alternative

harbors for its business operations. As a result, Hai An takes advantage of the ability to

gather goods col ectively, to reduce transport waiting time and fleet turnover.

Furthermore, domestic rivers are being increasingly used for transporting goods to

harbors, reducing logistics expenses and attracting customers’ demand. Hai An

corporation has enhanced the position of deep-water harbors, including important cargo

alternating centers, helping raise the demand for feeder fleet services regarding cargo col ection.

Benefits from large-size vessels

HAH controls 51% of Hai An Container Transportation Co. Ltd (HACT), the company

with the largest fleet, capacity, and market share in domestic container transportation.

Since 2015, HAH has taken advantage of the downturn cycle and invested extensively in

large size vessels at a low cost. This provides a significant advantage for HAH because

large-size vessels operate at a lower cost per container compared to its competitors in the

sector and always maintain a timely schedule for clients because they do not have to stop

due to a storm like smal -size vessels. Furthermore, establishing a schedule would attract

corporate clients, whose logistic supply chain is the most significant component. As a

result, the largest part is always assigned to companies that can provide the service.

Catching 4.0 trends with technology application

The company is implementing the warehouse operation management system on PL-TOS

RTC software and online networking, including 10 modules for ship planning and

operation, port operation, trade, EDI Port management, Container receipt, Container

repair inspection, refrigerated container management, Forklift management, Tonnage

management. This system helps identify and manage goods easily, convenient for

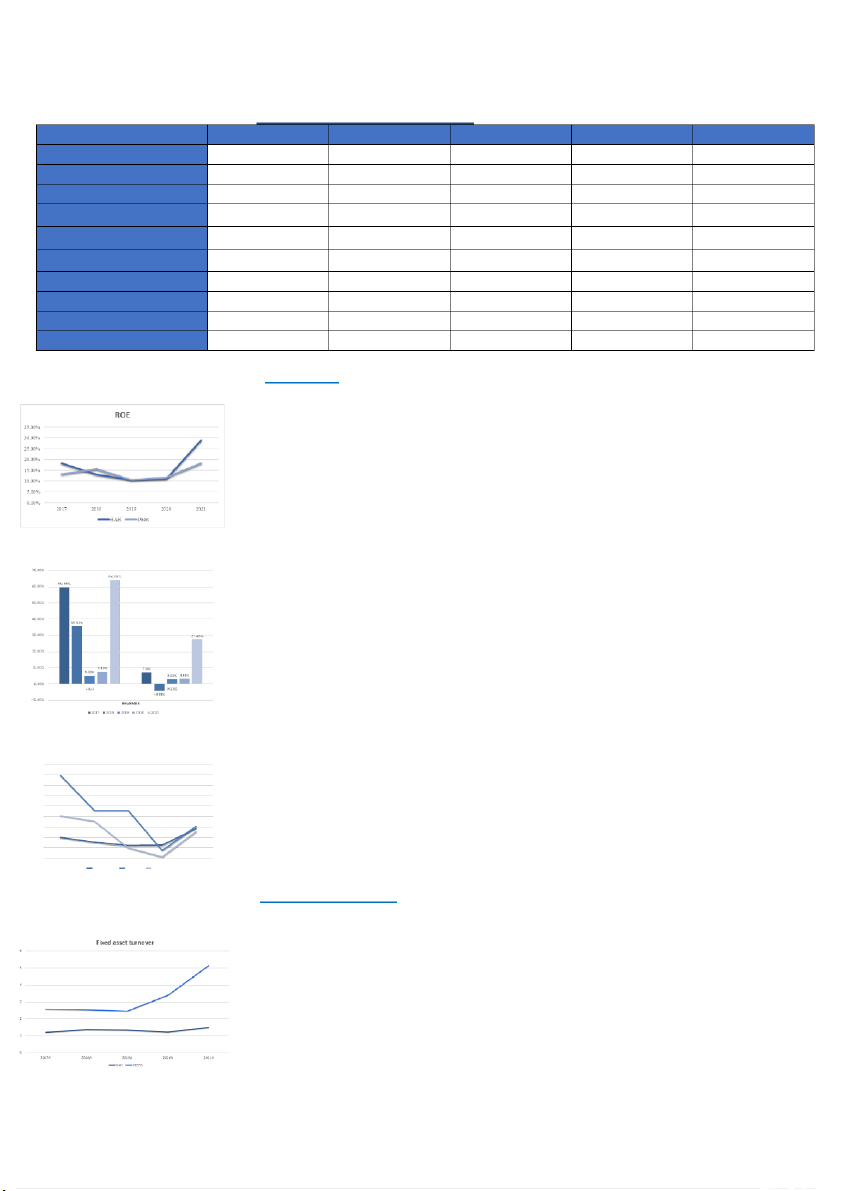

transportation, loading and unloading, improving service quality at Hai An port. FINANCIAL ANALYSIS 2017 2018 2019 2020 2021 Net Sales 59.55% 35.52% 5.18% 7.46% 64.08% Cost of Sales 79.00% 45.39% 6.55% 7.04% 30.32% SG&A expense 40.22% 35.05% 9.63% 1.01% 25.25% ROE 18.25% 13.04% 10.58% 10.97% 28.95% P/E 4.21 5.06 4.18 8.54 10.18 Net Profit Margin 19.61% 15.07% 11.97% 12.30% 28.16% Fixed Assets Turnover 1.20 1.35 1.33 1.22 1.48 WC Turnover 6.81 4.93 3.08 3.16 3.76 Debt / Equity 56.55% 35.88% 45.66% 56.80% 69.94% Interest Coverage 30.04 27.36 10.16 8.26 21.61 1. Profitability

Firgure 9. Hai An’s ROE from 2017 to 2021

HAH’s ROE remained stable in 2019 and 2020 at 10.58% and 10.97%, respectively,

before suddenly rising to 28.95% in 2021. This was primarily because the transport

and ship leasing fees significantly rose during the year, and the firm also succeeded in

taking part in two new ship leasing contracts for Haian West and Haian Mind.

HAH’s revenue growth reached 35.52% in 2018 but significantly decreased to

5.18% in 2019. Then it rose slightly in the next year, before rocketing to 64.08% in

2021. The slowdown in 2019’s revenue growth resulted mainly from decreases in the

Source: Company data, Team estimate

volume of goods transferred through the firm’s ports located in Hai Phong and in the

transport fees for one of HAH’s domestic routes. By contrast, a considerable surge in

Firgure 10: Revenue from 2017 to 2021

HAH’s revenue growth in 2021 resulted mainly from an approximate double in shipping

revenues. Despite the negative effects of the COVID-19 pandemic, the volume of goods

transported through Vietnamese port systems stil managed to increase, which

considerably benefited Hai An thanks to its large market share (nearly 30%) in the

domestic transport market. Also, the increase in shipping revenues came from a

significant rise in ship leasing and transportation fees owing to a shortage in the

container ship supply chain, while the demand for container transport strongly rose after

the COVID-19 had been wel -control ed. The revenue of Hai An has been higher than

the industry average’s revenue.

Source: Company data, Team estimate

Figure 11: Net profit margin from 2017 to

HAH’s Net Profit Margin (NPM) decreased over time from 2017 to 2019 (from 2021

19.61% to 11.97%), then slightly rose to 12.30% in 2020, before surging more than NET PROFIT MARGIN 90.00% 80.00%

twofold to 28.16% in 2021. Also, the firm’s NPM outperformed that of the industry in 70.00%

2021 after consecutive 4 years of underperforming, which is regarded as a positive signal 60.00% 50.00%

of HAH’s business as it operates in a capital-intensive industry, whose ROE depends 40.00%

mostly on the NPM. The increase in HAH’s NPM came mainly from its considerable 30.00% 20.00%

revenue growth thanks to increasing ship leasing and transport fees, while it stil 10.00%

managed to keep its SG&A expenses and Cost of Sales wel -control ed relative to 0.00% 2017A 2018A 2019A 2020A 2021A Net profit margin Cost of sales SG&A HAH’s revenue growth.

Source: Company data, Team estimate 2. Efficiency (Turnovers)

Hai An’s Fixed Asset Turnover (FAT) from 2017 to 2021 remained below the

Firgure 12: Fixed asset turnover from 2017 to 2021

industry's average turnover, but in general experienced an uptrend from 1.20 to

1.48, despite a slight fal in 2020. The inferiority of HAH’s FAT to that of other

competitors in the industry was because of the firm’s continuous investment in its fixed

assets, including the Haian West and Haian East container ships in Q2/2021, the PAN

Hai An Logistics Center in Q3/2020, etc. This, in the short term, appears to be

unfavorable for HAH’s earnings, but brings the firm considerable benefits in the long

term, which has partly been illustrated by a strong increase in HAH’s 2021’s revenue

growth rate thanks to its container ship availability during the period of the ship supply

chain shortage. Also, the steady increase in HAH’s FAT has reflected the firm’s

Source: Company data, Team estimate

efficiency in its fixed asset utilization.

The working capital turnover of HAH has gradual y risen from 2019 to 2021, which was

from 3.08 in 2019 to 3.76 in 2021, despite the downtrend before. This implies that the

company has been able to generate a higher volume of sales. The years from 2020 to

2021 are the period that Vietnam’s economy was seriously impacted by the COVID-19

pandemic; however, the increase in working capital turnover of HAH is a good signal for

the effective operation of the company. 3. Solvency

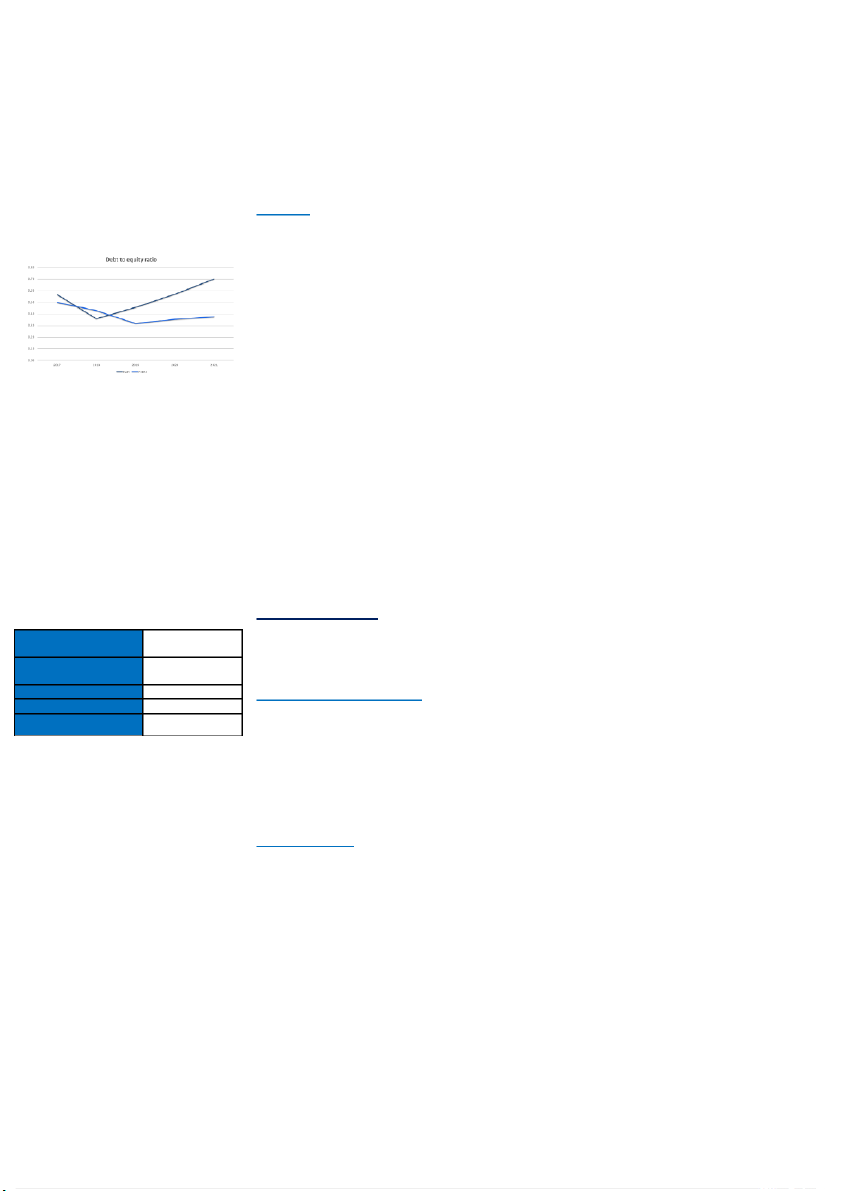

From the figures stated on the Balance Sheet, the calculated ratios imply that HAH’s

financing sources mainly come from equity rather than debt. To be more specific, during

Figure 13: Debt to equity ratio from 2017 to 2021

the last 5 years, HAH’s debt to equity ratio (D/E ratio) was lower than 1. However, an

uptrend pattern is witnessed for four years where the proportion of debt over equity

increased from 0.36 (2018) to 0.7 (2021), which has been higher than the industry’s

average ratio. On the other hand, considering 2017 and 2018, there was a considerable change when the debt-t -

o equity ratio was cut from 0.56 (2017) down to 0.36 (2018). It is

because from 2017 to 2018, equity increased nearly 46% while total debt experienced a

drop of approximately 8%. It is possible that the company issued shares to pay the due debt.

Source: Company data, Team estimate

Regarding the ability to cover interest payments, the calculated interest coverage ratio

for the last 5 years is al much higher than 2 times, which is primarily less risky since the

earnings of the company exceed the interest liability amount, so there is a lot of money

left. Taking a deeper look into the interest coverage ratio, we notice that the ability to

pay interest declined nearly four times from 2017 to 2020. The interest coverage

significantly decreased from 27.35 times in 2018 to slightly over 10 times in 2019. This

resulted from the high increase in interest expense together with a decrease in EBIT in

the period 2018-2019, which might have come from the additional debt HAH took in

2019. The decline occurred for two years before its remarkable increase to 21.6 in 2021.

This is because in 2021, even though the interest expense went up over 32 bil ion VND,

the revenue experienced an extreme increase of approximately 260% compared to 2020.

This is consistent with the above analysis when HAH took advantage of an increase in

freight rates and got a huge gain during the Covid-19 period. VALUATION

Table 3. Final HAH’s Target Share Price

We determined HAH’s target price at VND102,017, which was computed as the Share price from FCFF

weighted average of the firm’s intrinsic and relative valuation methodologies. They Valuation VND 85,931

include the Discounted Free Cash Flow Model (DCF Model) (70%) and Relative Share price from VND 139,549.72 Relative Valuation Valuation (30%) (Table 3 ) Estimated Share price VND 102,017 Discounted Free Cash Flow Current share price VND 67,800

We adopted the Three-stage H Model for HAH, in which we divide the firm’s Upside / (Downside) 50%

development into three phases: growth phase (2022 - 2026), transitional phase (2026 -

2036), and maturity phase (2036 onwards). We expect the firm to grow strongly during

2022 - 2026 thanks to its continuous investment in its fleet expansion, significantly

raising transport capacity, while there exist short-term and long-term factors maintaining

transport fees at high levels, supporting HAH’s revenues. In the transitional phase,

HAH’s revenues witness a gradual slowdown in its growth and then remain stable forever in the maturity phase. Discount Factor

We adopt the CAPM Model to compute HAH’s Cost of Equity. Our risk-free rate (RFR)

is the Vietnamese 5-year Government Bond obtained from World Government Bonds.

The market return is computed from the daily VN Index returns from 2017 - 2021, and

then combined with the RFR to determine the Market risk premium of 15.3%. The beta is

computed using a regression model of 1,248 daily values of VN Index during the chosen

5-year period. Hai An borrows both short- and long-term debts at 11.76% per annum, and

its tax rate is 14%, which is the average of its actual rates of taxes paid compared to its

Earnings before tax each year from 2017 to 2021. The components of HAH’s WACCs

are shown in the table below, from which we determine the discount rates for its

forecasted free cash flows. The WACC tends to increase over the period as the increase

in Owners’ Equity is greater than that of Total Debt, which is explained in the Key

Assumptions for Projections section. Return on Equity (ROE)

Figure 14: Hai An’s ROE

In the following years, HAH’s ROE is not expected to maintain at the level in 2021 (2017 - 2026)

(28.95%), but gradual y decline and reach 13.62% in 2026 (Figure 14). Though ROE (%)

decreasing, we stil expect the ROE to remain at higher levels than that before the Covid- 35.00

19 breakout thanks to long-term factors keeping the transport fees at high levels. The 30.00 25.00

reason for the decrease comes from a slowdown in the firm’s forecasted revenues 20.00

throughout the period, and the rising Equity of HAH. Al those factors are explained in 15.00

the Key Assumptions for Projections. 10.00 5.00

Key Assumptions for Projections 0.00 Net Revenues

2017A 2018A 2019A 2020A 2021A 2022F 2023F 2024F 2025F 2026F

We forecast HAH’s total revenues by breaking it down to 3 components: Sales from Port,

Source: Company data, Team estimate

Marine Shipping, and Other Services.

(1) Marine Shipping Services: The contribution of Marine Shipping services to HAH’s

total revenues steadily increased throughout 2017 – 2021 from 62.25% (2017) to 82.05%

(2021), showing the firm has been focusing more on the proportion of this sector (Figure

Figure 15: Hai An’s Revenue Breakdown

15). We expect the proportion to remain stable from 2022 to 2026, meaning HAH wil (2017 - 2026)

focus mainly on this sector over the period. During the Covid-19 pandemic, its negative

impacts caused the transport stagnation at worldwide seaports and breakage of the

container ship supply chain, resulting in a tremendous rise in transportation and ship

leasing fees. This is only regarded temporary and expected to weaken after more ships

have been supplied and come into operation from the second half of 2022 to the end of

2023, there emerge some factors maintaining the transport and ship leasing fees at a

higher level in the long run than that before the pandemic, including:

+ The reinforcement of the supply and fee controls of marine shipping lines thanks to Source: Team estimate

the rising number of M&A ventures wil raise their reputation. This is a new milestone in

the marine shipping industry's development, making it hard for the long-term transport

fees to return to the level before the COVID-19 pandemic.

+ The regulations by the IMO in 2020 on vessels’ exhaust fumes curtailment aiming

to cut CO2 emissions by 40% by 2030, causing shipping lines to adopt different

approaches to comply with them. Among the methods is the reduction in vessels’ moving

speed to save energy, causing a slowdown in container transport and rising transport fees.

Hai An has realized the potential for future growth soon, so it has been investing in the

expansion of its own fleet to significantly enhance its transport capacity. Specifical y,

during the first half of 2022, the firm has invested in 2 additional used ships with the

capacity of 1,577 and 1,708 TEUs and plans to acquire 4 more ships from 2023 to 2024,

each of which has a capacity of approximately 1,800 TEUs.

Based on the information above, we expect HAH’s Marine Shipping revenues to grow

by 45%, 20%, and 10% in 2022, 2023, and 2024, respectively. After this period, the

growth is expected to slow down, at 7% and 10% in 2025 and 2026, respectively.

(2) Port Services: The contribution of Port services to HAH’s revenues witnessed a

downtrend from 32.86% in 2017 to 10.93% in 2021, indicating the firm’s switching from

providing Port services to Marine shipping ones. However, this downtrend is not

expected to continue, as the significant benefits for the firm’s Marine shipping factors are

just temporary. In 2022, HAH is planning investment in its seaports, Depot in Ho Chi

Minh City, Vung Tau, and the Middle of Vietnam, as wel as the renovation of the front

area of Hai An Port. Despite the negative impacts of the COVID-19 pandemic, the

growth rate of the total volume of container goods transported through the Vietnamese

seaport system rose from 6% (2019) to 13% (2020) and stil maintained at 8% in 2021,

higher than that before the pandemic and is expected to remain at 6% on average from

2021 – 2030, maintaining the average port revenue growth rate at 9% per year during the

period. Also, the growth rate in HAH’s port service revenues experienced an acceleration

over the period 2018 – 2021, up to nearly 24% in 2021, which came from HAH’s port

system capacity maximization during the period. Based on those trends, we forecast

HAH’s Port services revenue growth to be 20% during 2022 – 2024, and slightly slow down to 16% in 2026.

(3) Other Services: these services are not the core operating activities of HAH, and the

revenues generated from them do not significantly contribute to the Total Revenues. We

forecast HAH’s Other services revenue growth to be 10% in 2022, 5% in 2023, and

then gradual y rise to 17% in 2026. Cost of Goods Sold (COGS)

From 2017 to 2020, Hai An’s COGS maintained at around 80% of its net sales, while in

2021, the proportion suddenly fell to 63.47% only, benefiting the firm’s Gross profit.

This is not expected to last long, especial y because there have emerged risks of inflation

from the Government’s loosening monetary policy to support corporations subject to the

negative impacts of the Covid-19 pandemic and a rise in the global oil prices due to the

political tension between Russia and Ukraine. As a result, HAH’s COGS is expected to

rise in our forecasted period, up to 80% of its net sales in 2026.

Debt Schedule, Retained Earnings, and Debt-to-Capital ratio

We expect HAH’s revenues to increase favorably from 2022 to 2024 thanks to the factors

maintaining high transport and ship leasing fees as mentioned above, hence abundance of

the firm’s Net income after tax and Cash flows generated. As a result, HAH is expected

to be able to finance its own capital without borrowing too much debt and even to repay

its historical debt amounts. This explains why the firm stil borrows both Short- and

Table 4 Discounted Free Cash Flows Valuation

Long-term debts from 2022 to 2026, but the year-end balances of such debts stil remain Model

stable over the years. Also, thanks to the large amounts of forecasted Net Income after PV of FCFFs &

tax each year, HAH’s Retained Earnings are expected to rise favorably during the period, Terminal value (VND) 5,084,483,410,927

mainly contributing to the rise of the firm’s Owners’ Equity without issuing additional Less: Market Value of

shares. As a result, HAH’s Debt-to-Capital ratio is expected to decline over the years, Debt (VND) 892,520,825,773

causing the firm’s WACC to rise.

Transitional phase: 2026 - 2036 Number of shares outstanding 48,782,751

HAH’s FCFF growth rate in 2026 is forecasted to be 16%, and then gradual y decline to HAH’s Target Share 4% in 2036. price (VND) 85,931 Mature phase: 2036 onwards Upside 26.742%

In this phase, HAH’s FCFF is expected to grow at 4% forever, given that the firm no

longer carry out any expansion or M&A projects. Share price on Dec 31, 2021 (VND) 67,800 Valuation Models

Discounted Free Cash Flows Valuation: We forecast HAH’s FCFFs from 2022 to 2026

using our forecasted CFOs, Interest expenses, and Capital Expenditures. Then, HAH’s

Table 5: Relative valuation method using P/B forward

terminal value in 2026 is computed using the formula of the Three-stage H Model with

the sustainable growth rate of 4%. Then we compute the Present Values of al those Share price on Dec 31, 67,800

figures by scaling them with the discount factors. After combining al the results, we 2021 (VND) Current BVPS (VND) 31,808.82

deduct the Market Value of Debt for HAH’s intrinsic value, which is divided by the Current P/B 2.92

current number of shares outstanding for the target share price (Table 4) BVPS forward (VND)

Relative Valuation: We determine HAH’s Target Share Price by multiplying the Book 66,200.06

value per share (BVPS) and P/B forward together. The BVPS forward is determined by P/B forward 2.108

the average of HAH’s Owners’ Equity during 2022 - 2026 divided by the current number HAH’s Target Share

139,549.72 of shares outstanding, while the P/B forward is computed by taking the average of price (VND)

HAH’s industry peers’ P/B ratios in 2021 (Table 5)

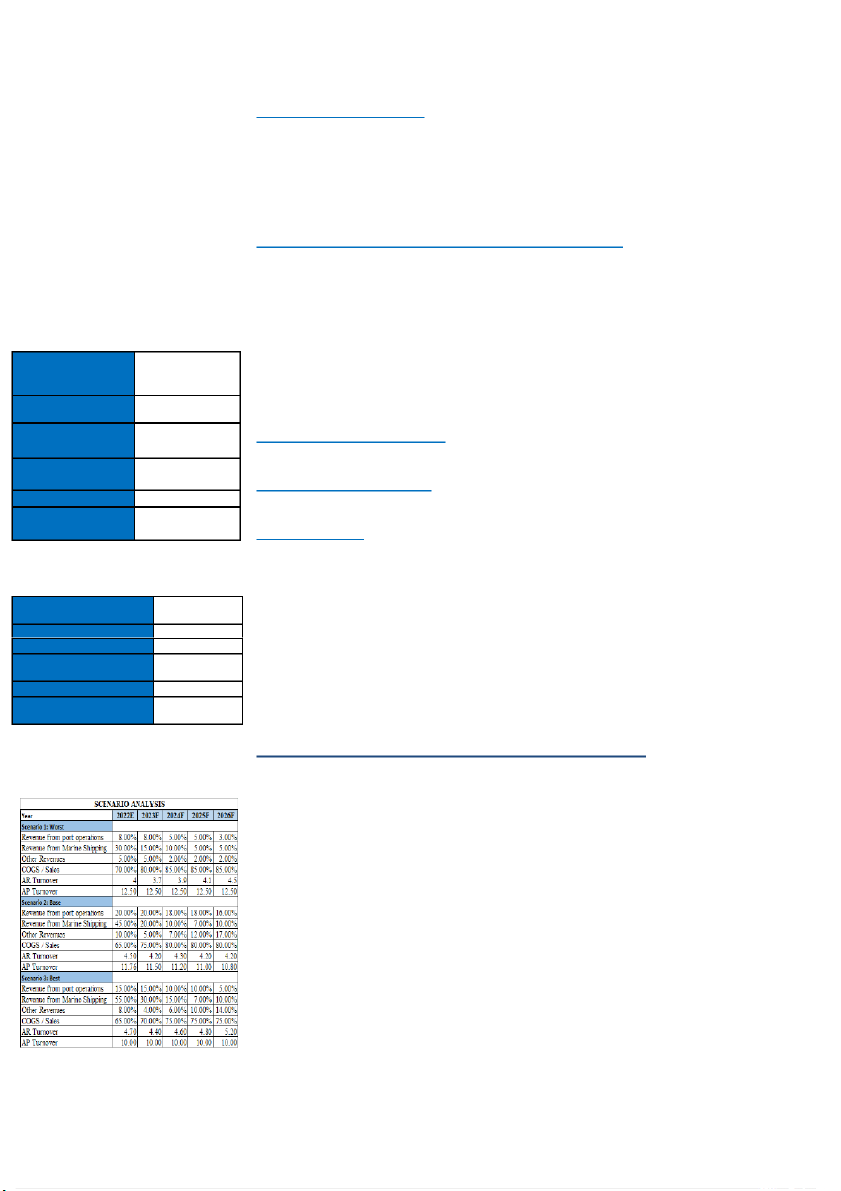

SCENARIO AND SENSITIVITY ANALYSIS

In our scenario analysis, we consider six main factors affecting HAH’s operation from

2022E to 2026F, including the 3 components of HAH’s Revenues (Revenues from Port, Table 6: S cenario Analysis

Marine Shipping, and Other services), COGS/Sales ratio, Receivables and Payables

turnovers. In the best case, we assume that inflation is wel control ed by the

Government’s policies, putting restrictions on the rise of oil prices, one of the main input

costs of the firm, hence reduced COGS and improved Gross Profit Margin. Also, in such

a scenario, we expect the demand for imports and exports to be strong and HAH can stil

maintain its large market share, guaranteeing the firm can utilize its transport capacity,

hence its optimal revenues and cash flows generated. By contrast, in the worst case, we

assume the supply of Container ships may progress faster than we have expected, driving

the market towards equilibrium quicker, hence a sooner decrease in freight rates and ship

leasing fees. Also, the increasing ship supply may pose to HAH a risk of losing its market

share. Another factor is that the inflation fails to be control ed effectively, causing HAH's

COGS proportion to rise, limiting its gross profit. Al those factors can significantly

restrict the firm’s revenues. Some other negative factors to be considered include that

HAH provide credits to customers with poor creditworthiness, reducing its Receivables

turnover, or its suppliers restrict the terms of the loans granted to HAH, increasing the

firm’s Payables turnover, hence more cash outflows of HAH.

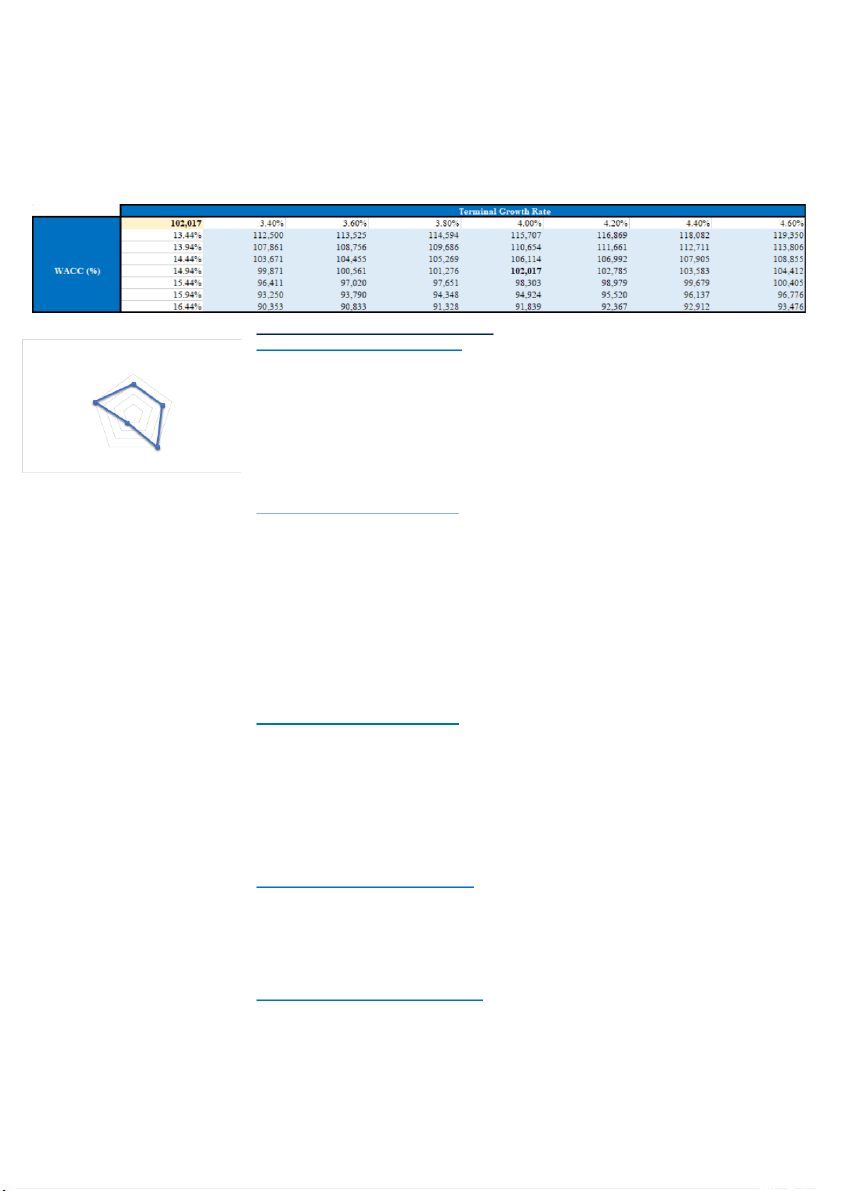

We run a sensitivity analysis on the fluctuations of the WACC and Terminal Growth

Rate. From the results generated, the Final Share price in the worst case is VND 90,353

when the WACC is 16.44% and Terminal Growth Rate is 3.4%, which stil support our BUY recommendation. Table 7: Sensitivity analysis

PORTER’S FIVE FORCES

Figure 16: Porter’s Five Forces

Threat of new entrants: Moderate Porter's Five Forces

The maritime industry natural y needs high capital requirements. To make a seaport Threat 4 of new entrants

company available for operation requires a huge initial investment in fixed assets 3 2

(buildings, offices, etc.) and mobile equipment such as vessels, vessel’s operational risk, Bargaining power of 1 Threat of substitution customers 0

and cargo availability. Furthermore, the region in which maritime activities take place

includes both the port's infrastructure such as berths, quays, docks, and storage yards as

wel as the superstructure. This high cost of entry partial y limits the number of players in Bargaining power of Rivalry within the suppliers industry

this industry. However, as the maritime sector provides the foundation for most of the

countries’ economies, the government will strongly support the new entrance. In Source: Team estimate

conclusion, the threat of new entrants is moderate in the seaport industry.

Threat of substitution: Moderate

Substitution risk comes from a change in consumer behavior toward a rival or against the

company. Substitution can also occur as a result of a change in service quality, a rise in

freight charges, or a shipment increase. If the price of oil rises, the company's

transportation fees wil have to rise as wel . Due to growing transportation prices and

difficulties in reaching their destinations on time, customers would seek alternatives such

as airplanes, trucks, or goods trains. Customers wil explore such alternatives if an

airplane, a freight train, or a truck can match the pricing of shipping companies while

also delivering on time. However, in the case of imports and exports, ships are stil

preferred by the customers due to many advantages, including scope of wide

transportation, long distance, large carrying capacity and low transportation costs in the

relative comparison to other means of transportation. As a result, the threat of substitution is moderate.

Rivalry within the industry: High

Due to the low differentiation of services, the competition is tremendously high between

different marine carriers and every shipping line relies on its core competency through

different strategies. The industry’s profit margin is high because of significantly rising

transport fees in 2021, which are not expected to decline in the near future. Furthermore,

in terms of global competition, domestic maritime companies are somewhat weaker

compared with foreign transport enterprises. Big Vietnamese shipping players in the

industry can be mentioned like Vosco, Vinaship, and Falcon, which are stil limited in

transport capacity. Most of the remaining maritime companies are smal in scale and cannot meet market demand.

Bargaining power of suppliers: Low

Suppliers provide fuel oil, lube oil, freshwater, paints, repair services, etc. to the maritime

companies while the number of suppliers in the market is large. Therefore, they are

chosen based on their price differences. Also, various enterprises in the industry construct

ships for themselves and require a large supply of ship parts whose manufacturers are

ubiquitous and aggressively compete with one another, reducing the bargaining power of such suppliers.

Bargaining power of customers: High

The industry’s buyers include exporters, importers, manufacturers, freight agents, and

brokers from different parts of the world who can control business and shipments through

negotiation and bargaining of prices to select the suitable shipping carriers which can

deal due to suitable sea freights, transit time, service provision, destinations and so on.

Manufacturing is becoming increasingly customized, which appeals to customers but

makes things more difficult for the maritime industry. The switching cost is low because

of the substantial number of operators.

Rivalry within the industry and bargaining power are regarded as the two key

factors that affect the maritime industry due to the low differentiation in the products

and services of this industry. As a result, the companies in the maritime industry such as

HAH need to constantly improve services and technology to reduce costs but stil

maintain the quality of services and products to increase profits and compete with other rivals. INVESTMENT RISKS 1. Macroeconomic risks

National economic growth risk: HAH is a company operating in seaport services,

shipping and logistics, so the company's production and business results are directly

correlated with the state of Vietnam’s economy, the ease of international trade (i.e.,

import-export activity) and industry growth. Therefore, the economic growth rate is an

important indicator for companies to decide medium and long-term development orientation.

Exchange rate risk: In transportation services, most of the revenue and expenses payable

such as the cost of raw materials or commission fees for foreign brokers are paid in

foreign currency. In transferring between currencies, HAH would face exchange rate

fluctuation. Therefore, exchange rate fluctuations have a certain effect on the revenue and profit of HAH.

Regulation risk: The policy for control ing the import and export of border-crossing

commodities between Vietnam and other countries, including tax, fee, and quarantine

policies, has a direct impact on the Company's economic activities. Inspect product

quality requirements, as wel as specific management rules for each sort of product in each period.

These are systematic risks and unavoidable, however, to minimize legal risks, Hai An

leadership always catches up with the information and is flexible in changing the plan. In

addition, the Company always maintains the update of new legal regulations for al

employees, and at the same time consult more with legal consulting organizations when necessary. 2. Industry risks

Fuel price risk: The company's activities are affected by the rises and fal s in fuel costs

because of its transportation and freight forwarding activities. However, because

petroleum is entirely dependent on global conditions, the corporation may have to adjust

service prices in accordance with the market. The fluctuation of oil price affects since the

cost of raw materials (oil) accounts for 30-35% of the total cost of shipping. However,

this risk is mitigated quite wel by HAH when HAH leases out 3-4 ships to foreigners and

hence, it can transfer a portion of this risk to the lessee.

Competitive risk: After Lach Huyen port is put into use, it has put competitive pressure

on the surrounding regional port system including Dinh Vu, Bach Dang, Song Cam, Song

Tranh in general, and Hai An Port in particular. Furthermore, the company is competing

in price with other ports in the Hai Phong area. Businesses in the same industry are

wil ing to cut prices by 20% or tolerate losses in order to attract customers.

Freight rate risks: As freight rate is one of the two major drivers of revenue in maritime

firms. The increase and decrease in freight rates directly affect the revenue of the industry

in the short term. Due to the scarcity of containers and congestion at major ports in the

world in general and in Vietnam in specific, in case freight rates have surged, it cuts off

the number of goods circulating through seaports. On the other hand, if freight rate goes

down, the income of HAH would inevitably suffer.

However, the business leadership clearly saw these chal enges and actively prepared a

plan to invest in container ships and organize container shipping routes inland from the

end of 2013 to ensure work for Hai An port. With the development of domestic container

shipping routes and cooperation with foreign container carriers to maintain short

container shipping routes (Feeder) to ensure input for the port so business efficiency of

the Company wil be guaranteed.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

Environmental: Hai An already and is going to take action on environmental problems.

Evidently, two ships ordered from China's manufacturer in August 2021 equipped with

MO TIER II tuners which meet emission standards of Europe and America.

Social: Workers’ health and safety is the main concern of Hai An, particularly this

industry where piracy, weather exposes huge threats to assets or crews. Al employees in

the Company have a labor contract, insurance, guaranteed employment, paid according to ability.

Governance: Board of Management has many years of seasoned experience and

expertise in the company's business fields. As a result, the management team is expected

to be able to come up with appropriate strategies and take timely responses to the fluctuations of the economy. APPENDIX

Figure 17. WACC Components and Trend

Figure 18. Hai An’s Acquired Container ships during 2017 - 2024 Time Ship purchased Capacity 2017 HAIAN BELL 1,200 TEUs HAIAN FAIR 1,706 TEUs 2018 HAIAN LINK 1,060 TEUs 2019 HAIAN MIND 1,794 TEUs 2020 HAIAN VIEW 1,577 TEUs HAIAN EAST 1,702 TEUs 2021 HAIAN WEST 1,740 TEUs HAIAN CITY 1,577 TEUs 2022 ANBIEN BAY 1,708 TEUs 2023 - 2024 4 new Container ships 1,800 TEUs each Figure 19. Breakdown Revenues Figure 20. Income Statement

Figure 21. Statement of Financial Position

Figure 22. Cash Flow Statement

Figure 23. D bt Schedule forecast e

Figure 24. Retained Earnings forecast