Preview text:

lOMoAR cPSD| 58583460 ENGINEERING ECONOMY

HO THI THU THAO – IELSIU18140 27/05/20 Name: HO THI THU THAO Class Tuesday morning ID: IELSIU18140 Lecturer: LUU VAN THANH ASSIGNMENT 6 BENEFIT – COST RATIO Problem 10.1

MARR = 10%/year, we calculated B-C ratio by: AW(B) $100,000 B

We realize that B-C ratio = 0.769 < 1.

Therefore, the treatment is not economically attractive the B-C ratio measurement of merit. Problem 10.3 a.

MARR = 8%/year, we calculated B-C ratio by: AW(B)

$400,000 + $300,000 + $50,000 + $50,000 B b.

For a 20-year project life and MARR = 10%, we calculated B-C ratio by: AW(B)

$400,000 + $300,000 + $50,000 + $50,000 B − C = = = 0.823

CR + AW(O&M) + AW(D) $7,000,000(A/P, 10%, 20) + $150,000

The proposed plan is no longer economical y attractive the B-C ratio measurement of merit. lOMoAR cPSD| 58583460

HO THI THU THAO – IELSIU18140 27/05/20 ENGINEERING ECONOMY Problem 10.8 a. The capitalized worth (CW):

𝐶𝑊 = $3,000,000/(10%) − $22,500,000 − $250,000/(10%) − $1,000,000(𝐴/𝐹, 10%, 7)/(10%)

− $1,750,000(𝐴/𝐹, 10%, 20)/(10%) = $3,639,750 b. MARR = 10%, we have: 𝑃𝑊(𝐵) 𝐵 − 𝐶 = 𝐼 + 𝑃𝑊

𝐵 − 𝐶 = ($3,000,000/(10%))/($22,500,000 + ($250,000 + $1,000,000(𝐴/𝐹, 10%, 7)

+ $1,750,000(𝐴/𝐹, 10%, 20))/(10%)) = 1.138 c. PW (Benefit) = (𝑃/𝐹, (𝐹/𝑃, 2. = = $28,654,293 25%

PW (cost) = $17,500,000 + $325,000(𝑃/𝐴, 10%, 30) + $1,250,000(𝐴/𝐹, 10%, 5)(𝑃/𝐴, 10%, 25) = $22,422,258

Compute the incremental analysis: $30,000,000 − $28,654,293 B − C(2−1) = = 0.3418 < 1 $26,360,250 − $22,422,258

Initial alternative should be selected Problem 10.10

a. The conventional B-C ratio for 3 projects: For project A: PW(Benefits) B − C = == 1.174 PW(costs) lOMoAR cPSD| 58583460

HO THI THU THAO – IELSIU18140 27/05/20 ENGINEERING ECONOMY For project B: PW(Benefits) $255,000 B − C = = = 1.1087 PW(costs) $230,000 For project C: PW(Benefits) $120,000 B − C = = = 1.5 PW(costs) $80,000

=> All three plans should be selected. b.

8% of the costs are reclassified as disbenefits, the conventional B-C ratio of the plans are: For project A:

𝐵 − 𝐶 = (𝑃𝑊(𝐵𝑒𝑛𝑒𝑓𝑖𝑡𝑠) − 𝑃𝑊(𝑑𝑖𝑠𝑏𝑒𝑛𝑒𝑓𝑖𝑡𝑠))/(𝑃𝑊(𝑐𝑜𝑠𝑡𝑠) − 𝑃𝑊(𝑑𝑖𝑠𝑏𝑒𝑛𝑒𝑓𝑖𝑡𝑠) ) $135,000 − 8% × $115,000 = $115,000 − 8% × $115,000 = 1.189 → +1.2882% For project B:

𝐵 − 𝐶 = (𝑃𝑊(𝐵𝑒𝑛𝑒𝑓𝑖𝑡𝑠) − 𝑃𝑊(𝑑𝑖𝑠𝑏𝑒𝑛𝑒𝑓𝑖𝑡𝑠))/(𝑃𝑊(𝑐𝑜𝑠𝑡𝑠) − 𝑃𝑊(𝑑𝑖𝑠𝑏𝑒𝑛𝑒𝑓𝑖𝑡𝑠) ) $255,000 − 8% × $230,000 = $230,000 − 8% × $230,000 = 1.118 → +0.8525% For project C:

𝐵 − 𝐶 = (𝑃𝑊(𝐵𝑒𝑛𝑒𝑓𝑖𝑡𝑠) − 𝑃𝑊(𝑑𝑖𝑠𝑏𝑒𝑛𝑒𝑓𝑖𝑡𝑠))/(𝑃𝑊(𝑐𝑜𝑠𝑡𝑠) − 𝑃𝑊(𝑑𝑖𝑠𝑏𝑒𝑛𝑒𝑓𝑖𝑡𝑠) ) $120,000 − 8% × $80,000 = $80,000 − 8% × $80,000 = 1.543 → +2.8986% c.

The rank-orderings in (a) are unaffected by the changes in (b)

(both denominator and numerator are subtracted by a constant amount) lOMoAR cPSD| 58583460

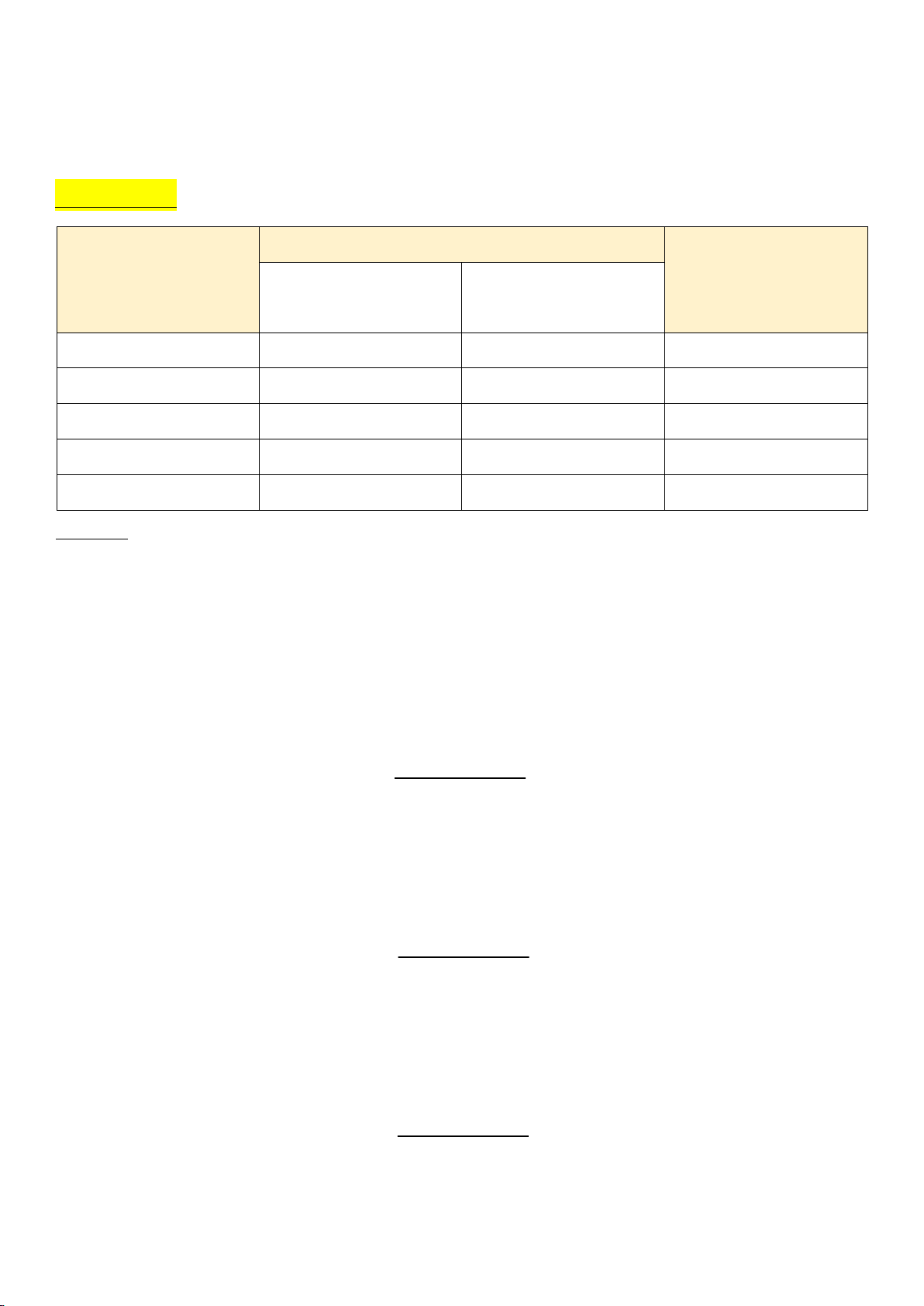

HO THI THU THAO – IELSIU18140 27/05/20 ENGINEERING ECONOMY Problem 10.11 Annual Equivalent ($) Alternatives B-C ratio Costs Benefits A $1,200 $1,000 0.84 B $2,000 $2,400 1.2 C $2,600 $2,800 1.077 D $4,000 $4,500 1.125 E $5,000 $5,000 1 Ranking: DN→A→B→C→D→E

Because + alternative A’s B-C ratio < 1 => not accepted.

+ alternative B’s B-C ratio > 1 => B is the new baseline. We calculate B-C(C-B): $2,800 − $2,400 B − C(C−B) = = 0.67 < 1 $2,600 − $2,000 B is stil the baseline. We calculate B-C(D-B): $4,500 − $2,400 B − C(D−B) = = 1.05 > 1 $4,000 − $2,000 D is the new baseline. We calculate B-C(E-D): $5,000 − $4,500 B − C(E−D) = = 0.5 < 1 $5,000 − $4,000 D is stil the baseline. lOMoAR cPSD| 58583460

HO THI THU THAO – IELSIU18140 27/05/20 ENGINEERING ECONOMY Conclusion: We should adopt D Problem 10.12

Ranking according to increasing costs: DN→A→B→D→C + MARR = 12% per year

B − CA = ($100(𝑃/𝐹, 12%, 1) + $80(𝑃/𝐹, 12%, 2) + $70(𝑃/𝐹, 12%, 3) + $60(𝑃/𝐹, 12%, 4))/$200 = 1.205 > 1 →A is acceptable

B − C(B−A) = ($30(𝑃/𝐹, 12%, 1) + $45(𝑃/𝐹, 12%, 2) + $20(𝑃/𝐹, 12%, 3) + $10(𝑃/𝐹, 12%, 4))/ ($250 − $200) = 1.665 > 1 →B is the new baseline.

B − C(D−B) = ($20(𝑃/𝐹, 12%, 1) + 0(𝑃/𝐹, 12%, 2) + $40(𝑃/𝐹, 12%, 3) + $40(𝑃/𝐹, 12%, 4))/($280 − $250) = 2.39 > 1 →D is the new baseline.

B − C(C−D) = (−$10(𝑃/𝐹, 12%, 1) − $5(𝑃/𝐹, 12%, 2) − $30(𝑃/𝐹, 12%, 3) + $15(𝑃/𝐹, 12%, 4))/($300 − $280) = −1.24 < 1 →D is stil the baseline.

Therefore, system D should be adopted. Problem 10.15 For alternative A: PWBenefits=$21,316,851

PWcosts = $8,500,000 + $750,000(𝑃/𝐴, 10%, 50) = $15,936,100 For alternative B: PWBenefits = $22,457,055 lOMoAR cPSD| 58583460

HO THI THU THAO – IELSIU18140 27/05/20 ENGINEERING ECONOMY

PWcosts = $10,000,000 + $725,000(𝑃/𝐴, 10%, 50) = $17,188,230 For alternative C: PWBenefits = $24,787,036

PWcosts = $12,000,000 + $700,000(𝑃/𝐴, 10%, 50) = $18,940,360 Reordering due to PW costs): DN→A→B→C $21,316,851 B − CA = = 1.3376 > 1 $15,936,100

→A is acceptable and then becomes the new baseline. $22,457,055 − $21,316,851 B − C(B−A) = = 0.9106 < 1 $17,188,230 − $15,936,100 →B is not acceptable. $24,787,036 − $21,316,851 B − C(C−A) = = 1,1551 > 1 $18,940,360 − $15,936,100 →C is recommended.

Conclusion: The decision does not change when market values are treated as $0. Problem 10.17 Ranking: DN→A→B→C We have:

B − CA = $80,000(𝑃/𝐴, 10%, 100)/$500,000 = 1.6 > 1 →A is the new baseline.

B − C(B−A) = ($90,000 − $80,000)(𝑃/𝐴, 10%, 100)/($550,000 − $500,000) = 2 > 1 →B is the new baseline.

B − C(A−C) = ($95,000 − $90,000)(𝑃/𝐴, 10%, 100)/($600,000 − $550,000) = 0.99 < 1 lOMoAR cPSD| 58583460

HO THI THU THAO – IELSIU18140 27/05/20 ENGINEERING ECONOMY →B is the best project. Problem 10.20 a. Ranking: DN→B→C→A We have: $18,000 − $5,000 B − CB = $50 ,000(A/P, 8%, 10) = 1.745 > 1 →B is the new baseline.

$20,000 − $4,700 − $13,000 B − C(C−B) = (

$65,000 − $50,000)(𝐴/𝑃, 8%, 10) = 1.03 > 1 →C is the new baseline.

$20,000 − $4,000 − $15,300 B − C(A−C) = (

$75,000 − $65,000)(𝐴/𝑃, 8%, 10) = 0.47 < 1 →C is recommended. => Choose plan C b. Annual maintenance expenses

AW(costs)A = $75,000(𝐴/𝑃, 8%, 10) + $4,000 = $15,175

AW(costs)B = $50,000(𝐴/𝑃, 8%, 10) + $5,000 = $12,450

AW(costs)C = $65,000(𝐴/𝑃, 8%, 10) + $4,700 = $14,385 Ranking: DN→B→C→A $18,000 B − CB = = 1.446 > 1 $12,450 lOMoAR cPSD| 58583460

HO THI THU THAO – IELSIU18140 27/05/20 ENGINEERING ECONOMY →B is acceptable. $20,000 − $18,000 B − C(C−B) = = 1.034 > 1 $14,385 − $12,450 →C is the new baseline. $20,000 − $20,000 B − C(A−C) = = 0 $15,175 − $14,385 →C is recommended.

=> Conclusion: Choose plan C. c.

The recommendations in part (a) the same with (b) Problem 10.25

For design A: CW(benefits) = $2 ,150,000 = $21,500,000 10%

CW(costs) = $17,000,000 + $12,000(𝑃/𝐴, 10%, 34)(𝐴/𝑃, 10%, 35)/(10%)

+ $40,000(𝐴/𝐹, 10%, 7)/(10%) + $3,000,000(𝐴/𝐹, 10%, 35)/(10%) = $17,272,729

For design B: CW(benefits) = $1 ,900,000 = $19,000,000 10%

CW(costs) = $14,000,000 + $17,500(𝑃/𝐴, 10%, 24)(𝐴/𝑃, 10%, 25)/(10%)

+ $40,000(𝐴/𝐹, 10%, 5)/(10%) + $3,500,000(𝐴/𝐹, 10%, 25)/(10%) = $14,595,790

For design C: CW(benefits) = $1 ,750,000 = $17,500,000 10%

CW(costs) = $12,500,000 + $20,000(𝑃/𝐴, 10%, 24)(𝐴/𝑃, 10%, 25)/(10%)

+ $40,000(𝐴/𝐹, 10%, 5)/(10%) + $3,750,000(𝐴/𝐹, 10%, 25)/(10%) = $13,146,043 Ranking: DN → C → B → A lOMoAR cPSD| 58583460

HO THI THU THAO – IELSIU18140 27/05/20 ENGINEERING ECONOMY $17,500,000 B − CC = = 1.331 > 1 $13,146,043 →C is the new baseline. $19,000,000 − $17,500,000 B − C(B−C) = = 1.035 > 1 $14,595,790 − $13,146,043 →B is the new baseline. $21,500,000 − $19,000,000 B − C(A−B) = = 0.934 < 1 $17,272,729 − $14,595,790 →B is recommended. Conclusion: Choose design B