Preview text:

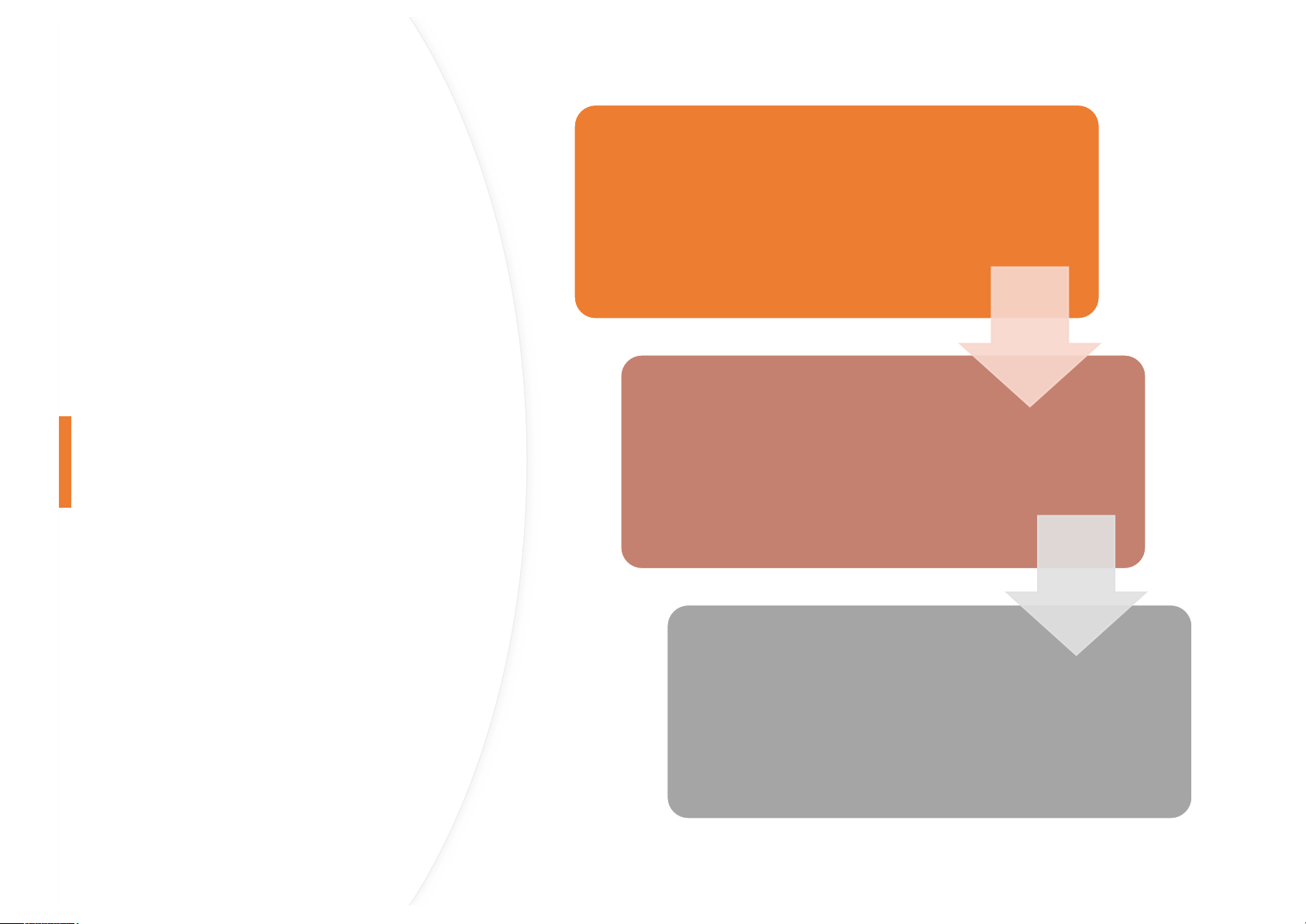

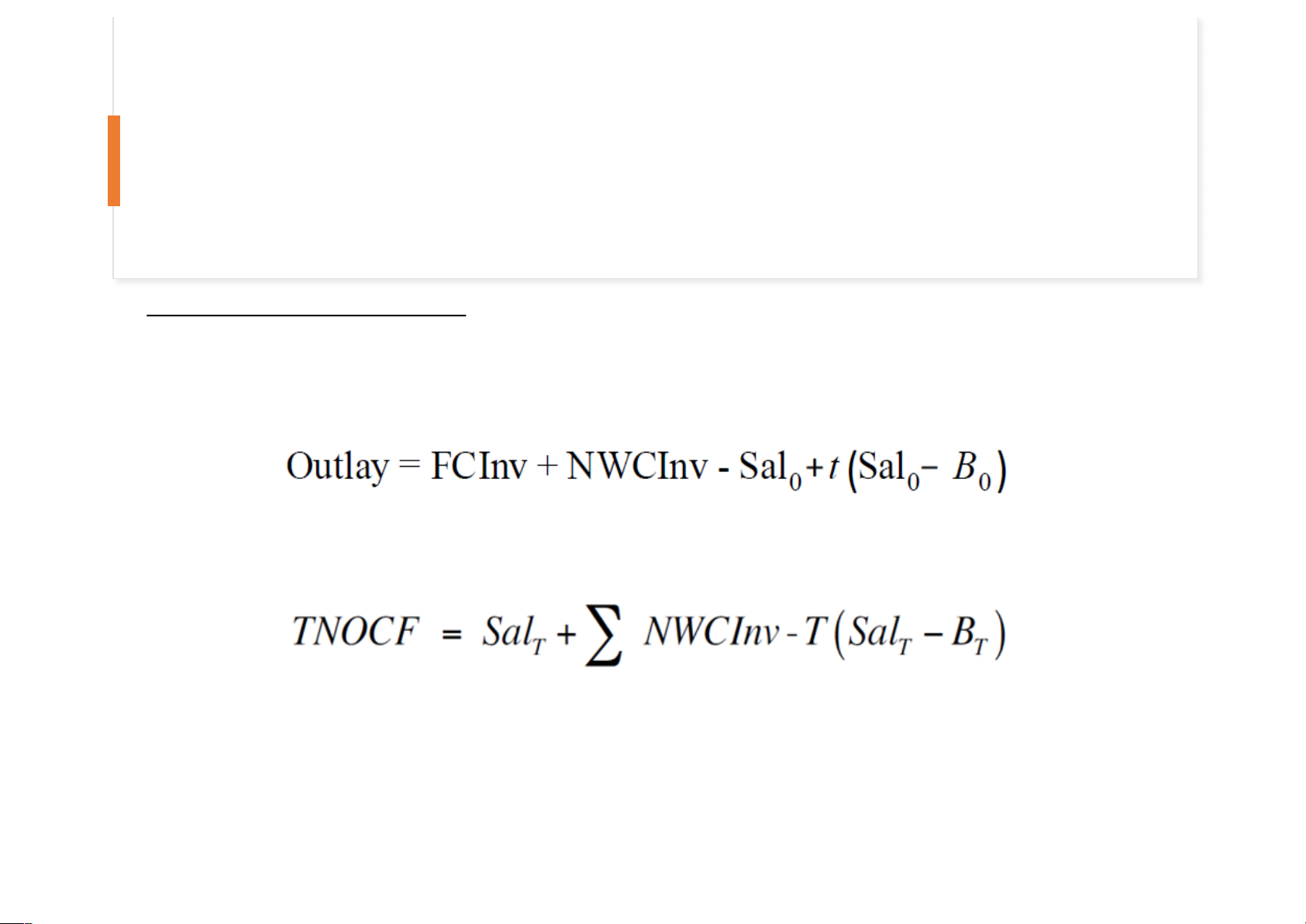

Initial outlay 5 – Cash Annual after-tax Flows operating cash projections flows Terminal year after-tax non- operating cash flows Quyen Nguyen, PhD - FBF - FTU 58 5 – Cash Flows projections • Initial outlay

For a new investment: Outlay = FCInv + NWCInv Where:

FCInv : Investment in net fixed capital

NWCInv : Investment (variation) in net working capital Quyen Nguyen, PhD - FBF - FTU 59 5 – Cash Flows projections

• Annual after-tax operating cash flows

CF = (S – C - D)(1- T) + D – NWCInv Or

CF = (S – C) (1- T) + T*D – NWCInv Where: S : Sales C : Cash operating expenses D : Depreciation charge T : Tax rate Quyen Nguyen, PhD - FBF - FTU 60 5 – Cash Flows projections

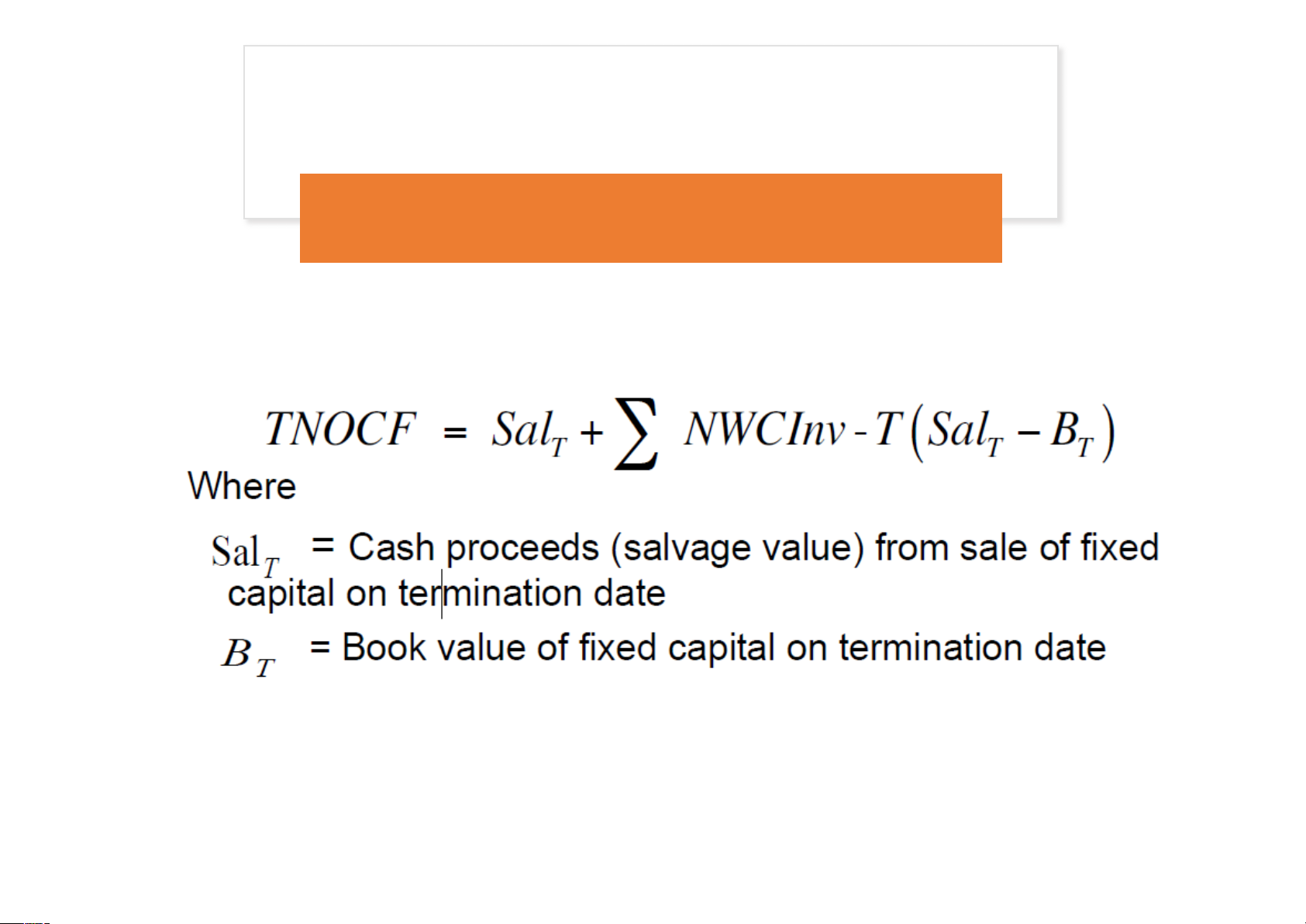

Terminal year after-tax non-operating cash flows Quyen Nguyen, PhD - FBF - FTU 61 5 – Cash Flows projections

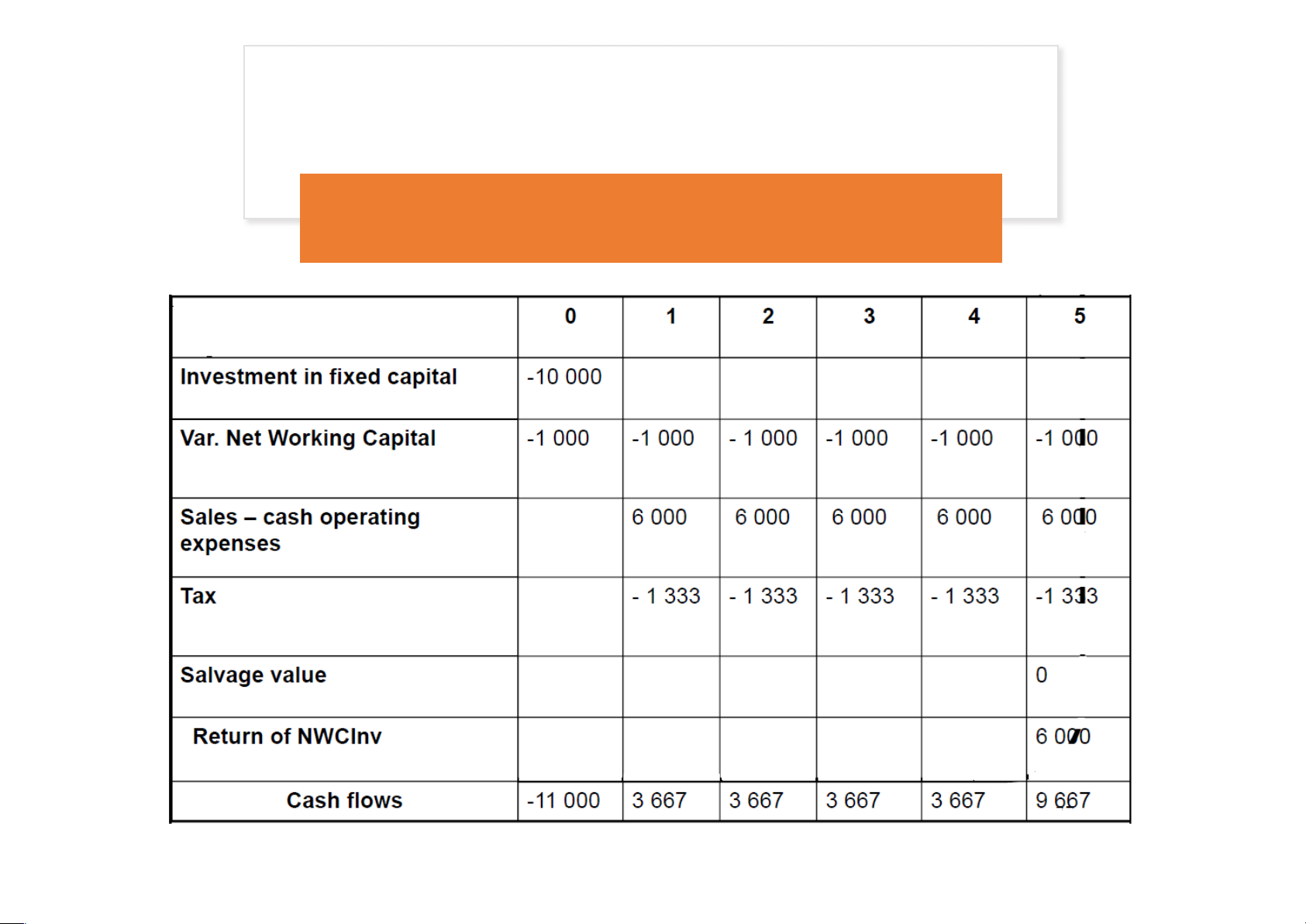

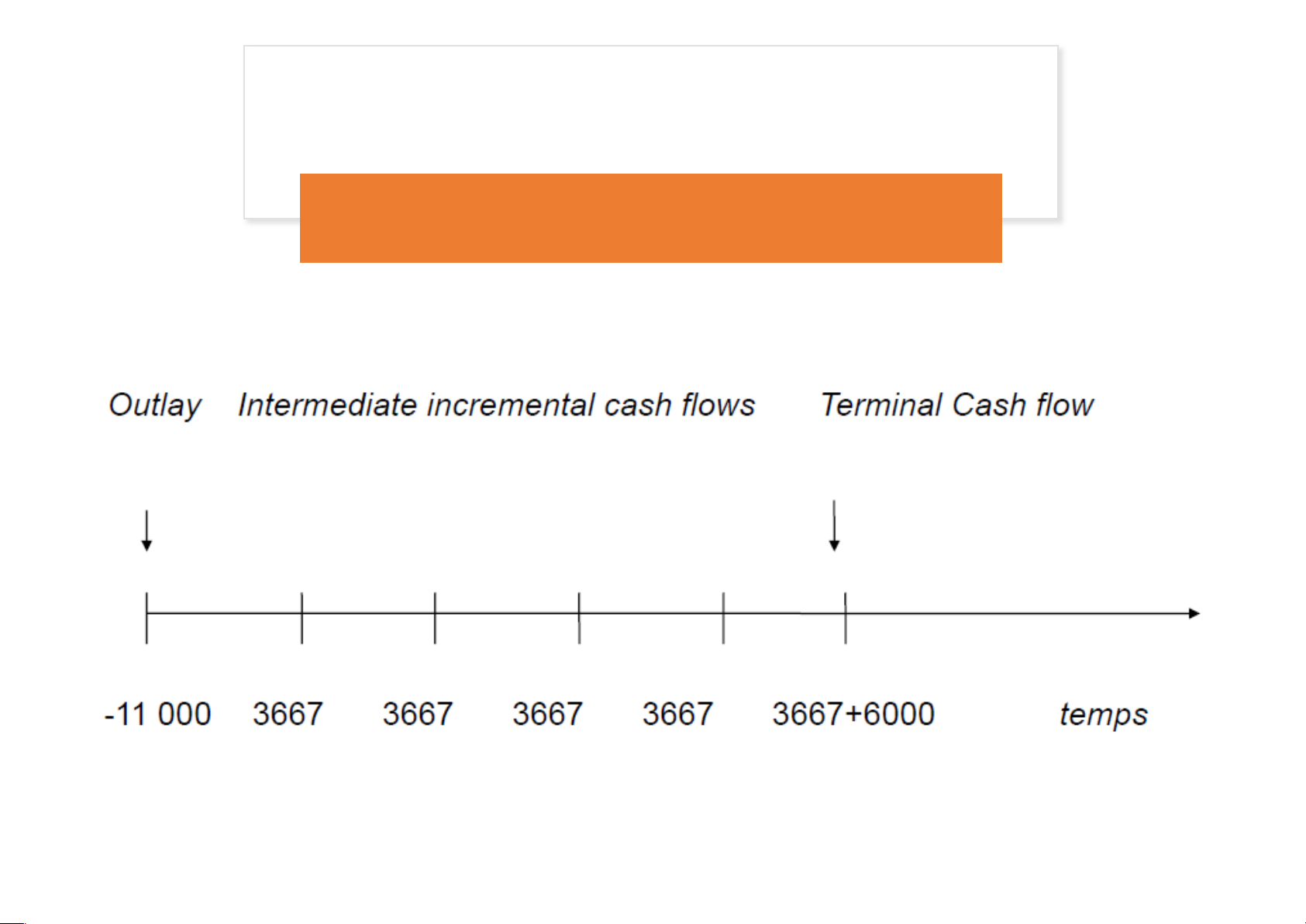

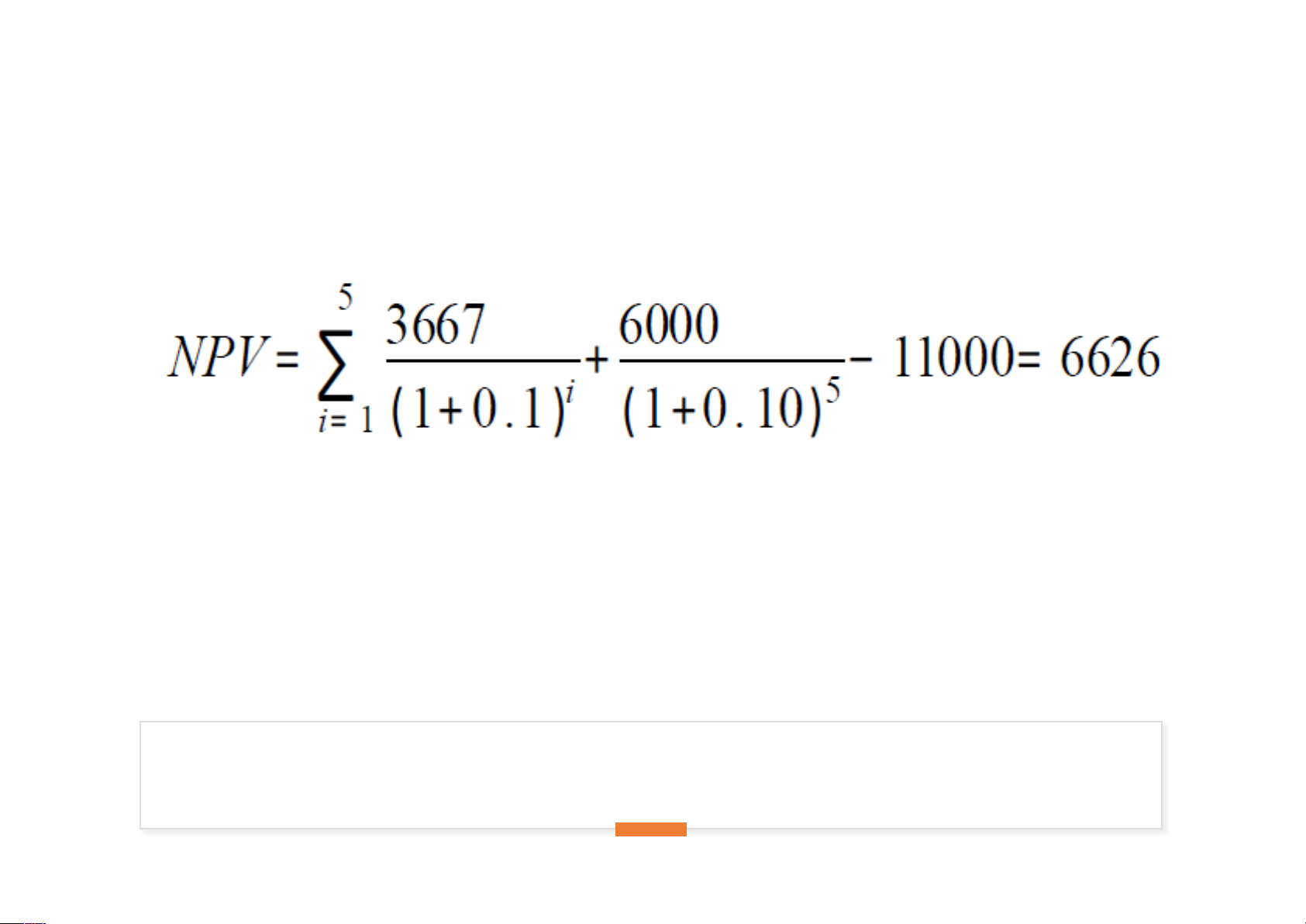

§ Investment in fixed capital: 10,000

§ Straight line depreciation to zero over 5 years § Length: 5 years § Annual Sales: 10,000

§ Cash operating expenses: 4,000

§ NWCInv: 1,000 beginning at t = 0 to t = 5

§ Required rate of return: 10% § Tax rate: 33 1/3% Quyen Nguyen, PhD - FBF - FTU 62 Example Quyen Nguyen, PhD - FBF - FTU 63 Example Quyen Nguyen, PhD - FBF - FTU 64 NPV Example Quyen Nguyen, PhD - FBF - FTU 65 Example

You have to decide to invest or not for an expansion project. The project has an expected 5 years life.

We assume that sales wil be equal to $55,000 each year, variable cash operating

expenses $18,000 ; and fixed operating expenses $24,000. Fixed operating expenses contain depreciations.

We consider an investment outlay of $100,000 concerning fixed capital items that wil

be depreciated straight-line to zero over five years.

We assume an annual investment in net working capital to t = 0 to t = 5 of $5,000.

The expected after-tax salvage value is equal to $6,000. The tax rate is equal to 34%.

1°) Determine the cash flows.

2°) The expected rate of return is equal to 10%. What is the project NPV?

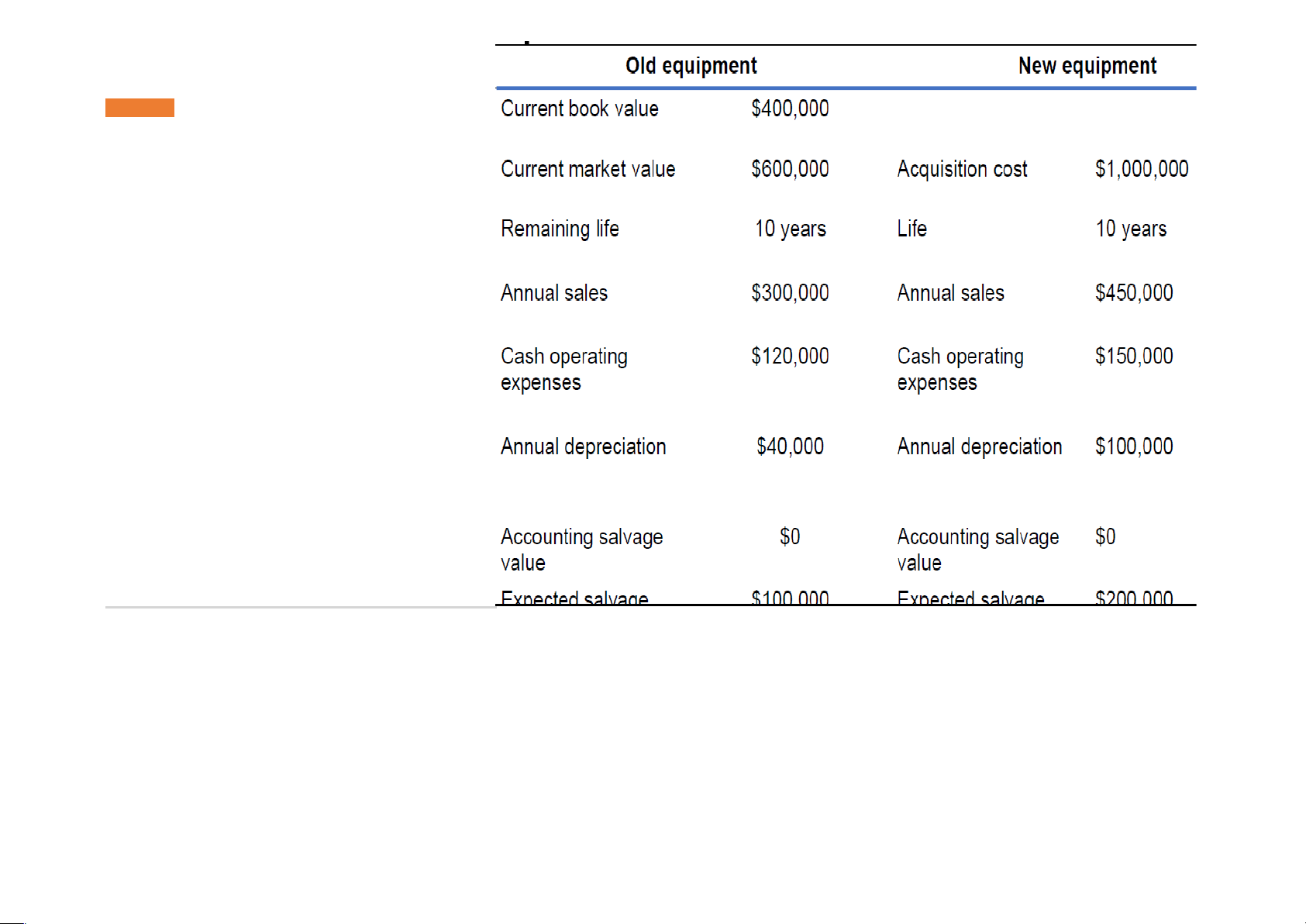

3°) The IRR is equal to 12.14%. Is it compatible with the decision given by the NPV? Why? Quyen Nguyen, PhD - FBF - FTU 66 Cash flows for a replacement project § Incremental cash flows

⇒ the CF the company realizes with the investment compared to the CF the

company would realize without the investment.

⇒ The terminal year after-tax non operating cash flow: Quyen Nguyen, PhD - FBF - FTU 67 Cash flows for a replacement project

§ If the new equipment replaces the old equipment, an additional investment of

$80,000 in net working capital wil be required. § Tax rate = 30% § Required rate of return: 8% Quyen Nguyen, PhD - FBF - FTU 68