Preview text:

lOMoAR cPSD| 40419767

Concept Questions and ExercisesCORPORATE FINANCE 11e by Ross, Westerfield, Jaffe Bài tập TCND Chapter 4 CLC CHAPTER 4

INVESTMENT CRITERIAS

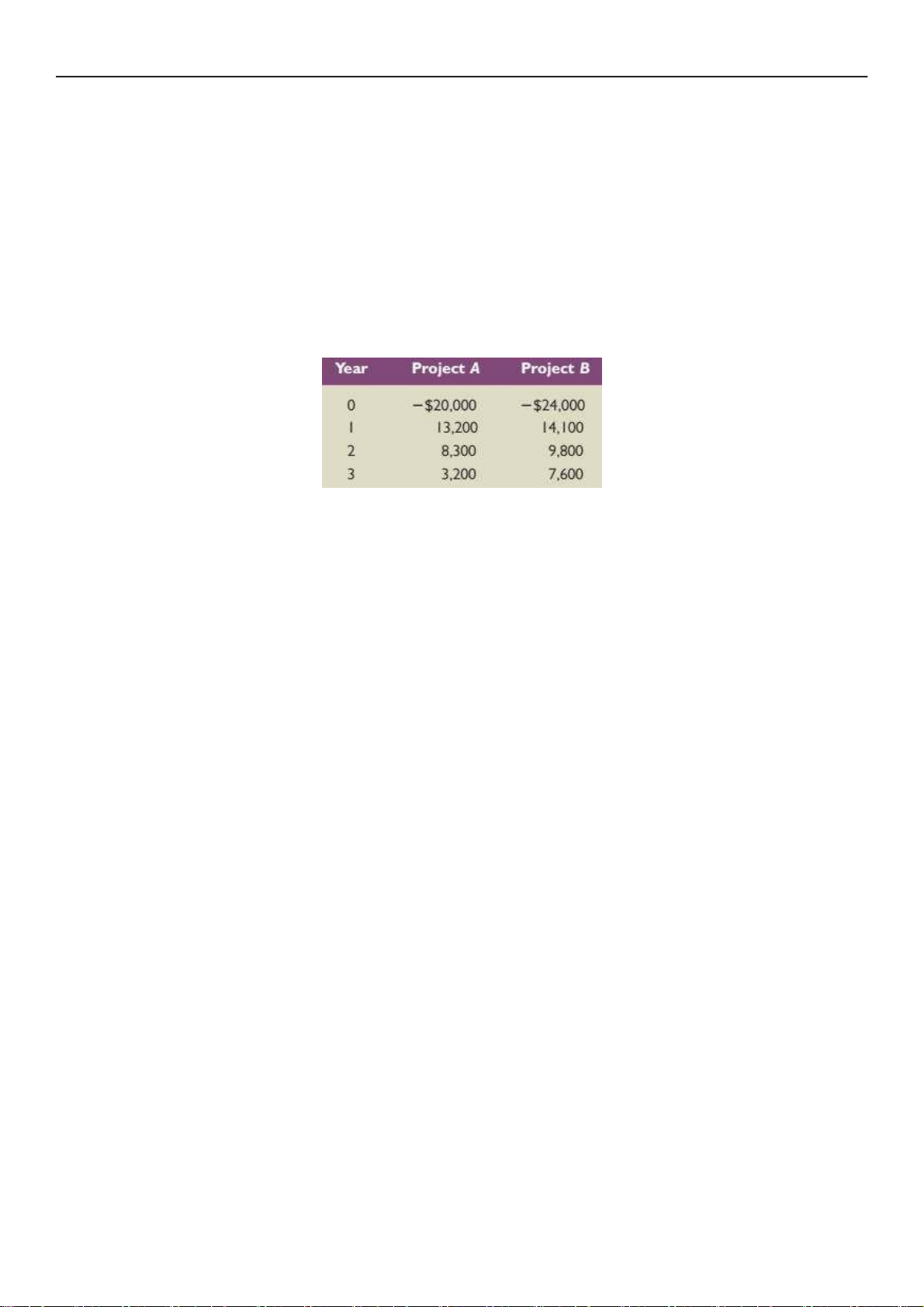

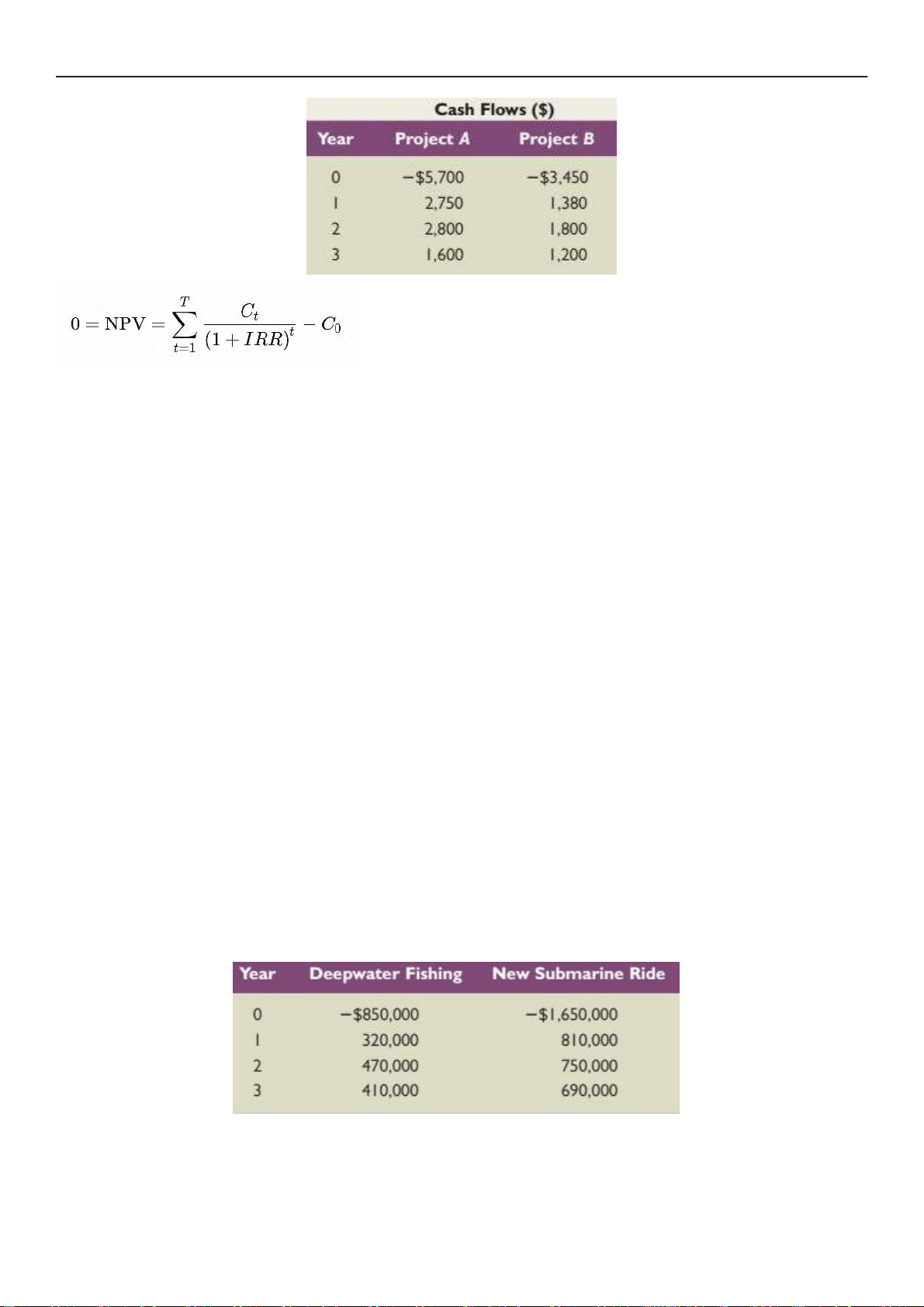

1. Calculating Payback Period and NPV Maxwell Software, Inc., has the following mutually exclusive projects. a.

Suppose the company’s payback period cutoff is two years. Which of these two projects should be chosen?

The cumulative CF of project A= 13200 + 8300= 21500 > 20000

The cumulative CF of project B= 14100 + 9800= 23900 < 24000 => Should choose project A b.

Suppose the company uses the NPV rule to rank these two projects. Which project should be

chosen if the appropriate discount rate is 15 percent? NPV = PV - initial investment

NPV of project A= 13200/(1+0,15) + 8300/(1+0,15)^2 + 3200/(1+0.15)^3 - 20000 = - 141.69 <0

N.PV of project B= 14100/(1+0,15) + 9800/(1+0,15)^2 + 7600/(1+0.15)^3 - 24000 = 668.2 > 0 => Should choose project B 2.

Calculating Discounted Payback An investment project has annual cash inflows of $5,000,

$5,500, $6,000, and $7,000, and a discount rate of 12 percent. What is the discounted payback period

for these cash flows if the initial cost is $8,000? What if the initial cost is $12,000? What if it is $16,000? lOMoAR cPSD| 40419767

Concept Questions and ExercisesCORPORATE FINANCE 11e by Ross, Westerfield, Jaffe a. Year CF DCF = CF x PV Cumulative CF 0 -8000 -8000 -8000 1 5000 5000/(1+12%)^1 = 4464, 29 -8000 + 4464,57= -3535,71 2 5500 5500/(1+12%)^2 = 4384, 57 848,86 3 6000 6000/(1+12%)^3 = 4270, 68 5119,54 4 7000 7000/(1+12%)^4 = 4448, 63 9568,17

DPP for project 1: 1+ 3535,71/4384,57 = 1,8063 year b. Year CF DCF = CF x PV Cumulative CF 0 -12000 -12000 -12000 1 5000 4464,57 -7535,71 2 5500 4384,57 -3151,14 3 6000 4270,68 1119,54 4 7000 4448,63 5568,17

DPP for project 2: 2+ 3151,14/4270,68 = 2,738 year Year CF DCF = CF x PV Cumulative CF 0 -16000 -16000 -16000 1 5000 4464,57 -11535,71 2 5500 4384,57 -7151,14 3 6000 4270,68 - 2880, 46 4 7000 4448,63 1568,17

DPP for project 3: 3+ 2880,46/4448,62 = 3,647 year 3.

Calculating IRR Compute the internal rate of return for the cash flows of the following two projects: lOMoAR cPSD| 40419767

Concept Questions and ExercisesCORPORATE FINANCE 11e by Ross, Westerfield, Jaffe IRR of project A is: + + - 5700 = 0 => IRR= 0,1339 = 13,39% IRR of project B is: + + - 3450 = 0 => IRR= 0,1321 = 13,21% 4.

Calculating Profitability Index Bill plans to open a self-serve grooming center in storefront.

The grooming equipment will cost $265,000, to be paid immediately. Bill expects aftertax cash

inflows of $59,000 annually for seven years, after which he plans to scrap the equipment and retire

to the beaches of Nevis. The first cash inflow occurs at the end of the first year. Assume the required

return is 13 percent. What is the project’s PI? Should it be accepted?

PI = PV of Future Cash Flows/ Initial investment = (59000/(1+0,13)^7)/ 265000 = 0.09 < 1

=> the project's PV is less than the initial investment → the project should be rejected 5.

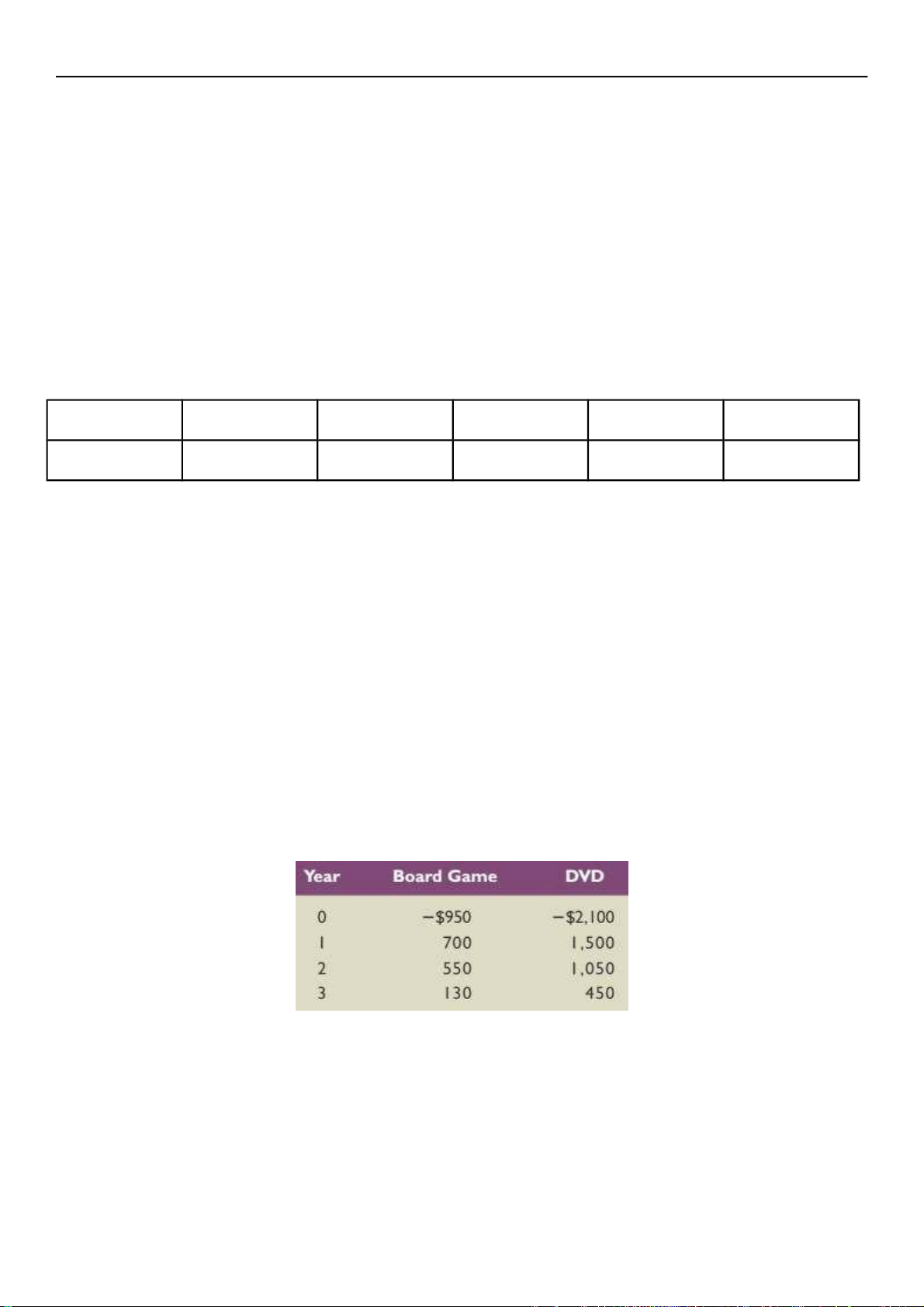

NPV versus IRR Consider the following cash flows on two mutually exclusive projects for

the Bahamas Recreation Corporation (BRC). Both projects require an annual return of 14 percent. b

As a financial analyst for BRC, you are asked the following questions:

a. If your decision rule is to accept the project with the greater IRR, which project should you choose?

IRR of Deepwater Fishing (A): 320000/(1+IRR) + 470000/1+IRR)^2 + 410000/(1+IRR)^3 - lOMoAR cPSD| 40419767

Concept Questions and ExercisesCORPORATE FINANCE 11e by Ross, Westerfield, Jaffe 850000 = 0

=> IRR=0.185 => IRR= 18.5%

IRR of New Submarine Ride (B): 810000/(1+IRR) + 750000/(1+IRR)^2 + 690000/(1+IRR)^3= 1650000

=> IRR=0.178 => IRR= 17.8%

=> Should chosen Deepwater Fishing

b. Because you are fully aware of the IRR rule’s scale problem, you calculate the incremental IRR

for the cash flows. Based on your computation, which project should you choose? B - A Project 0 1 2 3 IRR B - A -800000 490000 280000 280000 16.8 %

Because 16.8% > 14% so should choose B

c. To be prudent, you compute the NPV for both projects. Which project should you choose? Is it

consistent with the incremental IRR rule?

NPV of A = 320000/(1+0.14) + 470000/1+0.14)^2 + 410000/(1+0.14)^3 - 850000 = 69089.81

NPV of B = 810000/(1+0.14) + 750000/(1+0.14)^2 + 690000/(1+0.14)^3 - 1650000 = 103357.3083 => Should choose B

Yes, it true because the IRR on the incremental investment B - A is 16.8% > 14%

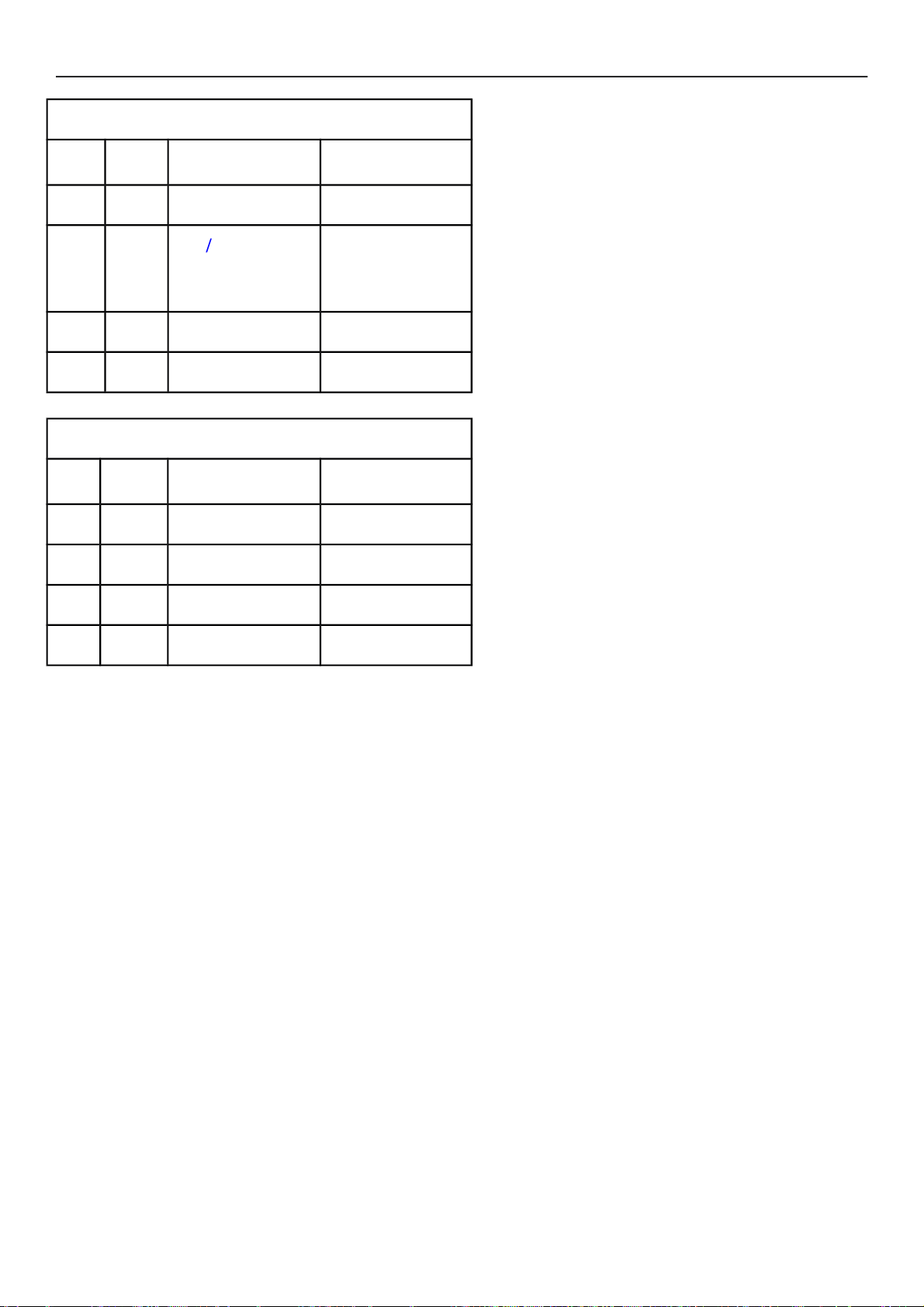

6. Comparing Investment Criteria Wii Brothers, a game manufacturer, has a new idea for an

adventure game. It can market the game either as a traditional board game or as an interactive DVD,

but not both. Consider the following cash flows of the two mutually exclusive projects for the

company. Assume the discount rate for both projects is 10 percent.

a. Based on the payback period rule, which project should be chosen?

b. Based on the NPV, which project should be chosen?

c. Based on the IRR, which project should be chosen?

d. Based on the incremental IRR, which project should be chosen? a. lOMoAR cPSD| 40419767

Concept Questions and ExercisesCORPORATE FINANCE 11e by Ross, Westerfield, Jaffe Board game Year CF DCF = CF x PV Cumulative CF 0 -950 -950 -950 1 700 700/ -313,64 (1+10%)^1=636 ,36 2 550 454,54 140,9 3 130 97 , 67 238,59

DPP of board game= 1+ 313,64/454,54 =1,69 year DVD Year CF DCF = CF x PV Cumulative CF 0 -2100 -2100 -2100 1 1500 1363,63 -736,37 2 1050 867,76 131,39 3 450 338,09 469,48

DPP of DVD = 1 + 735,37/867,76 = 1,84 year

=> Should choose Board game b.

NPV of board game = + + - 950 = 238,58

NPV of DVD = + + - 2100 = 469,49

=> Should choose DVD c.

IRR of board game = + + - 950 = 0,275 = 27,5%

IRR of DVD = + + - 2100 = 0,2509 = 25,09 %

=> Should choose board game d. lOMoAR cPSD| 40419767

Concept Questions and ExercisesCORPORATE FINANCE 11e by Ross, Westerfield, Jaffe CF of DVD - board game Year CF 0 -1150 1 800 2 500 3 320

The incremental IRR = + + - 1150 = 0,2319 = 23,19% > 10%

=> Should choose DVD

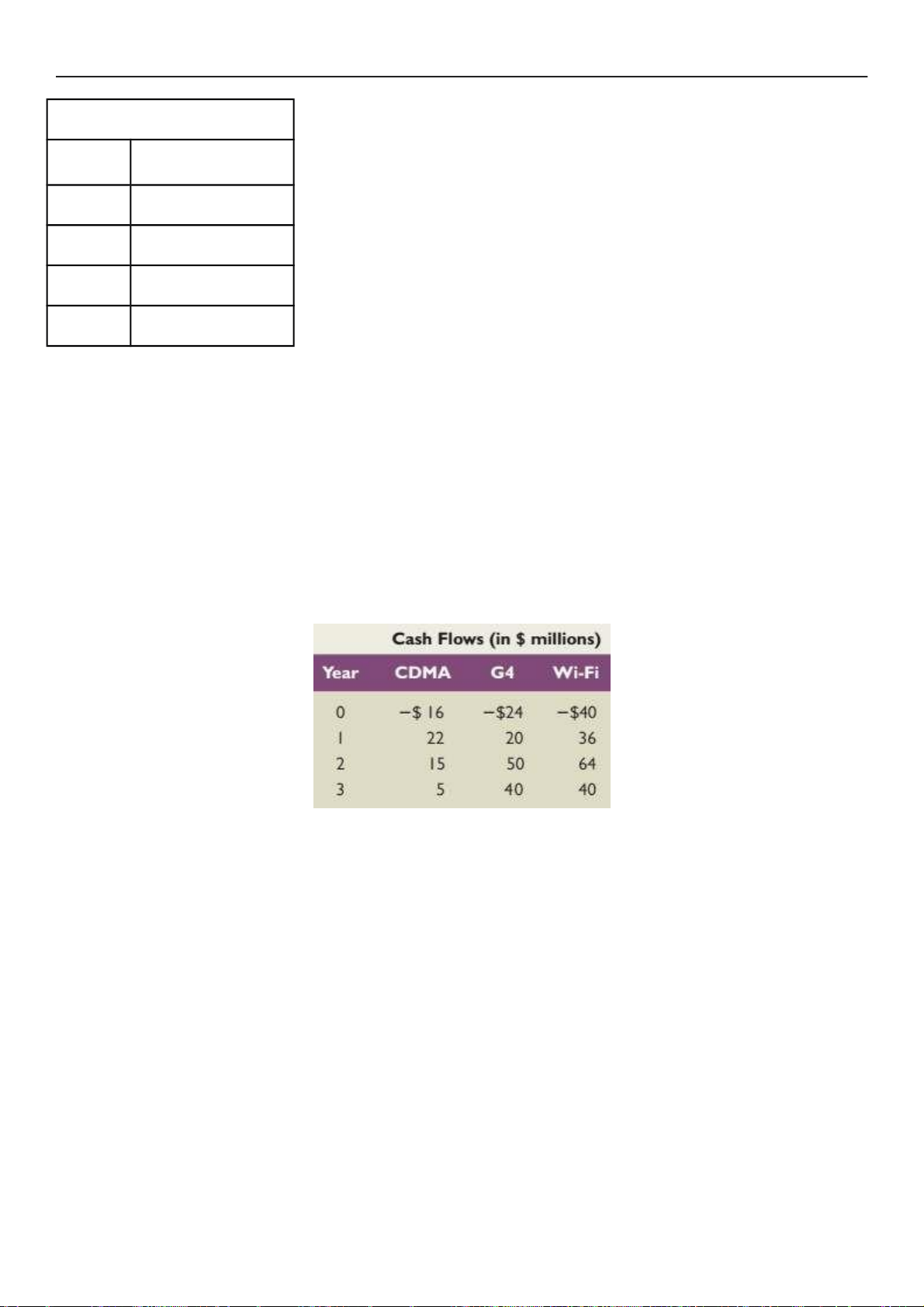

7. Profitability Index versus NPV Hanmi Group, a consumer electronics conglomerate, is reviewing

its annual budget in wireless technology. It is considering investments in three different technologies

to develop wireless communication devices. Consider the following cash flows of the three

independent projects available to the company. Assume the discount rate for all projects is 10 percent.

Further, the company has only $40 million to invest in new projects this year.

a. Based on the profitability index decision rule, rank these investments.

b. Based on the NPV, rank these investments.

c. Based on your findings in (a) and (b), what would you recommend to the CEO of the company and why?

a. PV of CDMA = + + = 36,153 PI of CDMA= = 2,25 PV of G4 = + + = 89,557 PI of G4 = = 3,73 PV of Wifi = + + = 115,67 PI of Wifi = = 2,89

=> Rank the projects: G4 - Wifi - CDMA b. lOMoAR cPSD| 40419767

Concept Questions and ExercisesCORPORATE FINANCE 11e by Ross, Westerfield, Jaffe

NPV of CDMA: 36,153-16= 20,153

NPV of G4: 89,557 - 24 = 65,557

NPV of Wifi : 115,67 - 40 = 75,67

=> Rank the project: Wifi - G4 - CDMA

c. Base on the company has only $40 million to invest in new projects this year, I would

recommend the CEO to take the both the CDMA and G4 project

8. NPV and Multiple IRRs You are evaluating a project that costs $75,000 today. The project has

an inflow of $155,000 in one year and an outflow of $65,000 in two years. What are the IRRs for the

project? What discount rate results in the maximum NPV for this project? How can you determine that this is the maximum NPV?

IRR for project is the rate of return at which NPV is zero

0 = -75000 + 155000/(1+IRR) - 65000/(1+IRR)^2 => IRR = 0.482 Let us assume X= 1/(1+R)

NPV = -65000X^2 + 155000 X - 75000

NPV’ = -130000X + 155000=0 ⇔ X= 1.192 = 1/(1+R) ⇔ R = -0.16 (1) NPV” = -130000 < 0 (2)

(1), (2) => maximum NPV in R = - 0.16 9.

Payback and NPV An investment under consideration has a payback of six years and a cost

of $573,000. If the required return is 12 percent, what is the worst-case NPV? The best-case NPV?

Explain. Assume the cash flows are conventional.

The worst- case NPV= 573000/1.12^6 - 573000 = -282700.37

In the best case PV has infinite CF The best- case NPV = infinite 10.

Calculating IRR Consider two streams of cash flows, A and B. Stream A’s first cash flow is

$11,600 and is received three years from today. Future cash flows in Stream A grow by 4 percent

in perpetuity. Stream B’s first cash flow is $13,000, is received two years from today, and will

continue in perpetuity. Assume that the appropriate discount rate is 12 percent. a. What is the

present value of each stream? PV2 of A=CF/(r-g) = 11600/(0.12 - 0.04)= 145000

=> PV0 of A= 145000/(1+0.12)^2= 115593.1122

PV1 of B= 13000/0.12 = 108333 =>

PV0 of B= 108333/1.12= 96725.89

b. Suppose that the two streams are combined into one project, called C. What is the IRR of Project C? lOMoAR cPSD| 40419767

Concept Questions and ExercisesCORPORATE FINANCE 11e by Ross, Westerfield, Jaffe Cash flow of project C: Year 1 2 3 4 5 Project C 0 -13000 1400 IRR of C:

c. What is the correct IRR rule for Project C ?