Preview text:

Vocabulary

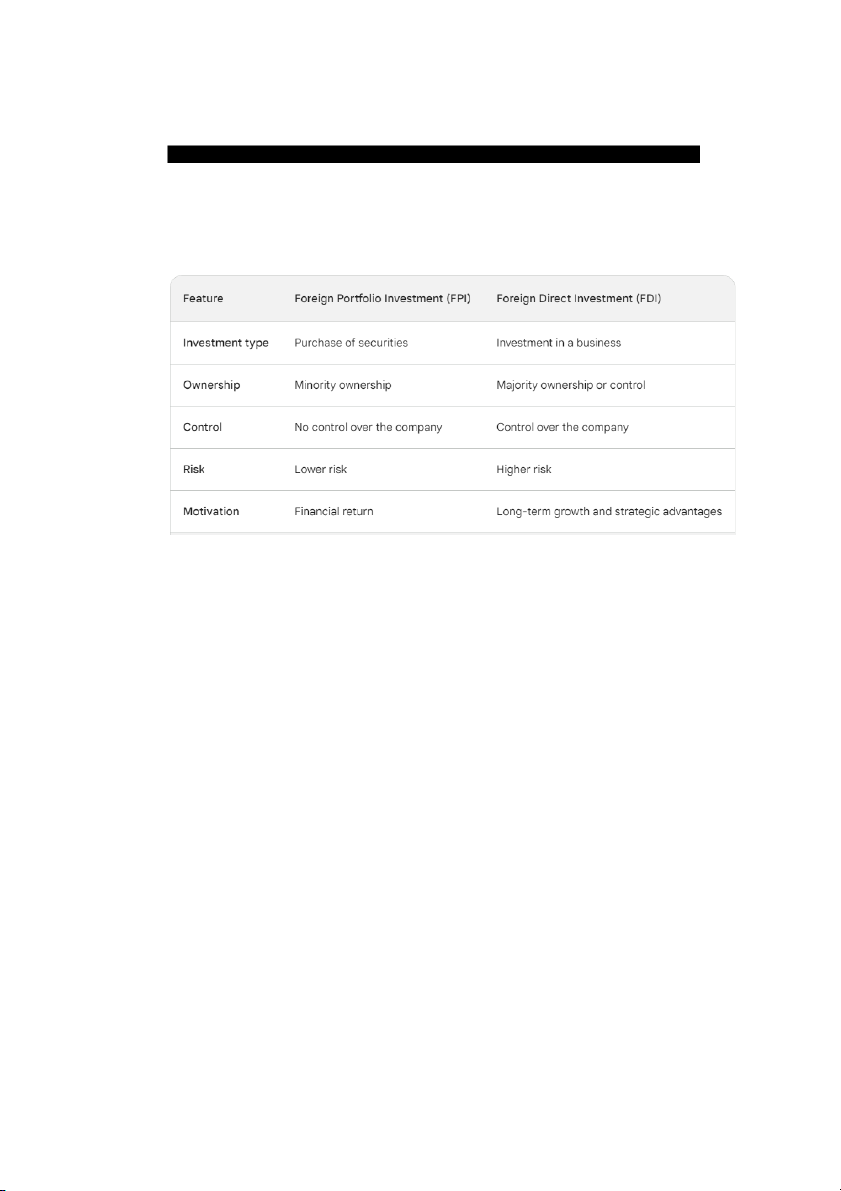

1. Define foreign portfolio investment. How does it differ from foreign direct investment?

+ FPI refers to the investment in financial assets such as stocks and bonds of foreign

companies or governments, without obtaining significant control or influence over

the management of the invested entity.

+ The key differences between FPI and FDI:

2. Foreign direct investment decisions are normally based on clear business strategies.

Name at least three categories that companies are looking for. 1. Market Access:

Expanding into new and potentially lucrative markets

Gaining access to a larger customer base and increased sales potential

Bypassing trade barriers and tariffs

2. Resource Acquisition:

Accessing essential resources like raw materials, labor, or technology.

Reducing production costs and enhancing competitiveness.

Securing reliable and long-term resource supply

3. Strategic Advantages:

Building brand recognition and establishing a global presence

Acquiring knowledge and expertise through technology transfer or partnerships

Leveraging local capabilities and economies of scale

3. Give some examples of investment incentives. What are they supposed to achieve? 1. Tax Breaks:

Reduced corporate income tax rates: A lower tax burden directly increases a

company's profits, making the investment more attractive.

Tax holidays: A temporary exemption from paying taxes allows companies to focus

on establishing their operations without immediate financial pressure.

Exemptions from import duties: Lowering the cost of importing equipment and

materials reduces overall investment costs.

Attract businesses by decreasing their financial burden and boosting profitability. 2. Subsidies:

Direct financial grants: Cash injections provide immediate capital for companies to

invest in infrastructure, machinery, or research and development.

Matching grants: Governments can match a portion of a company's investment,

incentivizing them to commit more resources to the project.

Directly offset investment costs and make projects financially viable. 3. Infrastructure Development:

Government investment in improving roads, ports, and other infrastructure: Better

infrastructure reduces transportation costs, improves operational efficiency, and

makes the region more attractive to businesses.

Create a more accessible and business-friendly environment, attracting a wider range of investors.

4. What is non-exclusive distributor called? What does this mean?

A non-exclusive distributor is simply called "non-exclusive distributor". This means

they are authorized to sell a manufacturer's products but are not the only or sole

distributor in a particular territory. Key points to remember:

Non-exclusive distributors share distribution rights with other companies.

This allows manufacturers to reach a wider market and potentially increase sales.

It also increases competition and can lead to lower prices for consumers.

Exclusive distributors have sole rights to sell a manufacturer's products in a specific territory.

This gives them more control over the market and can lead to higher prices for consumers.

5. What are royalty payments?

Royalty payments are essentially fees paid by one party, called the licensee, to

another party, called the licensor, for the ongoing use of the licensor's intellectual

property or other intangible assets.

6. Define joint venture.

A joint venture is a business entity created by two or more parties, typically

companies, to collaborate on a specific project, venture, or market. It involves

shared ownership, shared resources, shared profits and losses, and shared governance.

FOREIGN DIRECT INVESTMENT

The decision to invest outside the home country is a major one that requires

careful analysis. Investments overseas can be portfolio investments, where investors

buy shares and debentures (long-term obligations) that can be liquidated at market

value any time. These investments can be made without leaving the home country

through an international investment broker or a banking institution. Foreign direct

investments are quite different. They usually involve the establishment of plants or

distribution networks abroad. Investors may acquire part or all of the equity of an

exciting foreign company with the objective of controlling or sharing control over

production, research and development, and sales. Contrary to portfolio investments,

foreign direct investments mean a long-term commitment where capital funds will be tied up for a long time.

Multinational corporation usually take a strategic approach is to locate or

create markets for its present and future products. Markets for products are no

longer national in today’s world. The technological and cultural changes of the

twentieth century and particularly in the three decades after World War II, have

created fairly uniform world markets, with increasingly similar economic and social

needs. All countries in the world strive to full technological growth and the highest

possible standard of living, regardless of their present stage of development.

Consequently, MNCs of all types and nationalities, large and small, have expanded

with great vitality abroad, often overshadowing their market shares at home. Such is

the case, for example, of the Swiss drug companies and the leading German,

Japanese, and American automobile manufacturers.

The typical MNC pools all its resources to achieve the highest possible

efficiency and obtain the maximum return on investments. Research and

development, raw materials, investment capital, and managerial skills are utilized

for the benefit of many world markets. For examples, an automobile originally

designed in Japan is later sold, assembled or manufactured, with minor changes, in

the United States, Canada, Brazil, Western Europe, and so on. The basis

development costs, like research and design, can be expected to be amortized on

sales in many markets. Research may be carried out in one country, parts made in

another, then assembled and sold in a third country.

Most American multinationals, already technologically advanced, do not have

to invest overseas to seek “know-how”. Many European and Japanese companies,

however, come to the United States to do just that. Their primary aim is to benefit

from American technology. For example, The British company, Plessey, made a

$190 million bid to take over American Alloys Unlimited, before the bid. Plessey

believed that it would be less costly to pay a higher price for technical “know-how”

than to do research and development in the alloy field over a period of time.

Financial considerations are also the most important and sometimes decisive

factors. What is the expected return on an investment? What are the sources of

working capital? What are interest rates? What is the cash flow projection? – i.e. the

amount of cash that remains after a company has paid taxes and other cash expenses?

Only when reliable access to outside financing is available can a project for foreign

direct investment be termed viable. A non-viable project is one where the expected

rate of return, or profits realized on assets employed, is likely to be lower than from

a comparable investment in the host country.

Local regulations or legislation is another factor that must be studied before an

investment is made. When Thomson, the French electronics group, set up a

company to produce military electronic devices in Chicago, it found out about the

Buy American Act only after the acquisition. This act prohibits the United States

government form purchasing foreign-made military equipment with the exception

of components. Subsequently, Thomson withdrew from the company at a

substantial loss. United States antitrust legislation prohibits corporations from

dominating or monopolizing an industry. When British Oxygen bought 35 percent

of Airco, a major United States producer of industrial gases, it was sued by the US

federal government for violating antitrust laws. Labor laws are still another

important legislative factor. Before an investment is made, it is important to

consider right-to-work laws and the existence of absence of labor unions.

The likelihood of government interference has to be studied. Despite France’s

efforts to attract foreign investment in the past companies to divest themselves of

their French subsidiaries. In 1976 International Telephone and Telegraph (ITT) sold

its interest in Le Matériel Téléphonique (producer of telephone equipment) to

Thomson, a French company, as a result of government pressure.

Investment incentives are still another consideration. These incentives are

usually of a monetary nature, such as cash grants, lower taxes, accelerated

depreciation, training allowances, research subsidiaries, and interest rebates on

loans. Incentives differ from country to country and region to region and are

always highest in a depressed area. In Belgium, where many coal mines have shut

down, certain regions experienced long periods of unemployment. These regions

are likely to offer incentives to foreign investors.

Prior to making a foreign investment, a corporation has usually had some form

of trade with the foreign nation. When a corporation starts to export for the first

time, it will usually engage distributors, who receive a commission on products

sold. Distributors are called exclusive if they are under contract to sell only the

exporter’s products. Otherwise, they are called multiple, representing other manufacturers as well.

When the foreign country becomes familiar with the products, the company

might not renew the contract with the distributors but rather will set up its own sales

organization. It will acquire its own network of dealers throughout the country,

probably supervised by various regional sales offices. Again, dealers can be exclusive or multiple.

Building up a dealer network is complicated and expensive. The exporter may

prefer to license a foreign manufacturer. The later is then authorized to manufacture

the product under license, using the original manufacturer’s brand name. In return,

the exporter will receive royalty payments. A drawback of licensing, as well as of

authorizing foreign distribution, is that the original manufacturer gives up control

over the product. If the licensed product lacks quality, the exporter’s reputation will

suffer. It may be very difficult to correct a distributor’s marketing mistakes if the

exporter eventually decided to handle the distribution.

Therefore, licensing and distributing are almost always of a temporary nature.

Sooner or later the exporter will be faced with the foreign direct investment

question. The basis decision is whether to set up a manufacturing plant or make an

acquisition of an existing one. Then there is the question of whether to create a joint

venture or go it alone. A joint venture is a subsidiary formed by two or more

corporations. This form is chosen when companies want to share capital outlay and

“know-how”. In the long run, it is often an unsatisfactory relationship, as the

respective partners find it increasingly difficult to share control. However, in some

countries, such as Japan and Spain, a foreign investor cannot own more than 50

percent of a corporation; that is, local interests in the foreign venture must equal at least 50 percent.

In many countries, especially in parts of the Third World, there is resistance to

foreign direct consequence of criticism of multinational corporations. In the

industrialized nations, such as France and the United States, opposition is also

growing. Even in some quarters in the United States, foreign investment is seen as a

threat. The critics forget, however, that their countrymen invested six times as much

overseas in 1976 as did foreigners in the United States.

Some strategic industries (such as food, computers, nuclear reactors, and

energy) will find it increasingly difficult to expand abroad. Foreign investment will

be dependent on the power struggle between governments and multinational

corporations. But direct investment is likely to continue its adventurous course in

many areas. The economic integration of the United States, Europe, and Japan will stimulate its development.

1. When foreign direst investors acquire a company, what do they normally seek to control?

Foreign direct investors normally seek to control:

Production: They aim to influence the process of manufacturing or assembling

products in the target country.

Research and development: They want to steer the research and development

activities related to the acquired company's products or services.

Sales: They desire to manage the distribution and marketing of the company's

offerings in the target market.

2. In considering foreign investment, what is an MNC’s first strategic objective?

An MNC's first strategic objective when considering foreign investment is to locate

or create markets for its present and future products. This means expanding their

customer base and ensuring long-term growth by entering new markets or

reinforcing their presence in existing ones.

3. What are some financial considerations in making a foreign direct investment?

Some financial considerations for FDI include:

Expected return on investment: The potential profit generated by the investment compared to other options.

Sources of working capital: Access to necessary funds to finance the investment.

Interest rates: Cost of borrowing money for the project.

Cash flow projection: Forecasting the available cash after all expenses are paid.

Availability of outside financing: Securing additional funding if needed.

4. When is a foreign project said to be viable? What is a nonviable project?

A foreign project is considered viable when the expected rate of return exceeds the

return on a comparable investment in the host country. It should also have reliable

access to funding and a positive cash flow projection. A non-viable project, on the

other hand, has a lower expected return than alternative investments or lacks financial feasibility.

5. Name two kinds of legislation that foreign investors study closely prior to making an investment?

Two types of legislation foreign investors closely examine before investing are:

Antitrust laws: Regulations prohibiting monopolies and ensuring fair competition within an industry.

Labor laws: Regulations concerning labor rights, unions, and working conditions in the host country.

6. Why are investment incentives highest in a depressed area?

Investment incentives are highest in depressed areas to attract foreign investors and

stimulate economic activity in those regions. These incentives typically offer

financial benefits like tax breaks, cash grants, or subsidized resources to make FDI more appealing.

7. When a corporation starts to export for the first time, how will it organize its sales?

Initially, a corporation likely relies on distributors to sell its products in the new

market. These distributors can be exclusive, representing only the exporter's

products, or multiple, handling various brands.

8. What is a drawback of licensing or authorizing foreign distribution?

A drawback of licensing or authorizing foreign distribution is the loss of control

over the product. The licensed manufacturer or distributor could compromise

product quality or make marketing mistakes that damage the exporter's reputation.

9. If a company does not want complete manufacturing responsibility for a foreign

market, what ownership possibility remains?

If a company doesn't want full manufacturing responsibility, it can consider a joint

venture. This involves partnering with another company, sharing manufacturing,

research and development, and other resources in the foreign market. While

sacrificing complete control, it reduces financial risk and potentially leverages the

partner's expertise and local presence. D. Exercises

Exercise 1: Fill in the blanks in the sentences below with the correct word or phrase.

1. When investors establish a plant overseas, this is called ………………… If they

buy shares or long-term debt obligations, this is called ……………

2. The amount of cash that remains after a company has paid taxes and other cash

expenses is ……………….

3. Rate of return is often measured in terms of profits realized on …………

4. A cash grant is called an ……………., whose purpose is to ………..

5. Prior to making a foreign direct investment, exporters can make a contract with a

……………. or with a foreign manufacturer, who will be

.................................................................................................................................... to manufacture their products. For this, the foreign manufacturer pays ………………….

1. Foreign direct investment (FDI), portfolio investment 2. Cash flow 3. Assets employed

4. Incentive, attract foreign investors

5. Distributor, licensed, authorized, royalty payments

Exercise 2: Complete this passage by using the word in italics. attitude

equity incentives investors levels prosperity dominate

employ train set up bring out

Countries in the Third World have different approaches to foreign investment.

Some welcome foreign firms, encouraging them to (1) foreign investment

subsidiaries by offering them tax (2) incentives or cheap loans. These countries believe that the

foreign firms will provide jobs, pay good wages, (3) train local workers,

bring new technology, and contribute to their (4) prosperity

Other countries have a different (5) attitude to foreign investment. They know

that they need the multinationals, but they do not want these firms (6) to dominate

important sectors of their economies. Therefore, they (7) pass laws which

force foreign companies to sell shares to local (8) investors. They insist that local

businessmen own a certain percentage of the foreign firm’s (9) equity Some .

governments also make the foreign firm (10) employ a certain percentage of local

workers at all (11) levels in the company.

Exercise 3: Find an appropriate word for each blank space. In all sections

the initial letter of each word is provided.

a) Most multinational companies are vast enterprises with networks of (1)

s………………… or (2) a……………… throughout the world. Originally, they

expanded overseas because trade barriers such as (3) t……………… and (4)

q…................had been set up against their goods.

b) When incomes are rising and business is thriving, in other words, when there is an

(5) e………………. (6) b…………….. in a country, a multinational may decide to

establish a subsidiary there. Later, however, the government of the country may

only allow the company to operate on a (7) j………………. (8) v……………..

basis, in which case it will compel the company to reduce its (9) s………………. to

a fixed percentage. It could even restrict the subsidiary by allowing only a fixed

proportion of profits to be (10)r……………….

c) The OECD code gave (11) g…..........................on how multinationals should behave.

None of its provisions were (12)l………………. (13) e……………… and

therefore some say it lacked legal teeth.

d) A factory whose production resources are not being fully utilized is said to

be suffered from (14) o……………… a) (1) subsidiaries (2) affiliates (3) tariffs (4) quotas b) (5) economic boom (6) prosperity (7) joint venture (8) basis (9) stake (10) repatriated c) (11) guidelines (12) legally binding (13) enforceable d) (14) overcapacity

Exercise 4: Picture yourself as a corporation president who is about to decide

on making a foreign direct investment. What questions would you ask yourself? Market and Opportunity:

1. Which new market(s) offer the most promising opportunity for our products or services?

2. What are the potential demand dynamics and growth projections in this market?

3. Do we face any unique cultural, social, or legal barriers in this market?

4. Who are our main competitors in this market, and what are their strengths and weaknesses? Financial Feasibility:

5. What is the expected return on investment (ROI) for this project?

6. What are the estimated start-up and operational costs?

7. Are there any available government incentives or tax breaks in the target country?

8. How will we secure funding for this project?

9. What are the potential currency exchange risks and fluctuations? Operational Considerations:

10. What entry mode should we choose: greenfield investment, acquisition, joint venture, or licensing?

11. What kind of infrastructure and supply chain is available in the target market?

12. How will we recruit and manage skilled employees in a new country?

13. What are the local labor laws and regulations regarding working conditions and benefits?

14. How will we ensure compliance with environmental and sustainability regulations? Risk Management:

15. What are the political and economic risks in the target country?

16. What are the potential intellectual property risks involved in this project?

17. How will we mitigate the risk of corruption or bribery in the target country?

18. Have we prepared contingency plans for unforeseen challenges or disruptions?

19. What kind of exit strategy do we have in place if the project is unsuccessful? Long-Term Vision:

20. How does this foreign investment align with our company's overall strategic goals and vision?

21. What are the potential long-term benefits for our company, employees, and stakeholders?

22. How will this investment contribute to the sustainable development of the target country?