Preview text:

THE INTERNATIONAL UNIVERSITY (IU) Course: Engineering Economy

School of Industrial Engineering and Management SAMPLE TEST Duration 120 minutes

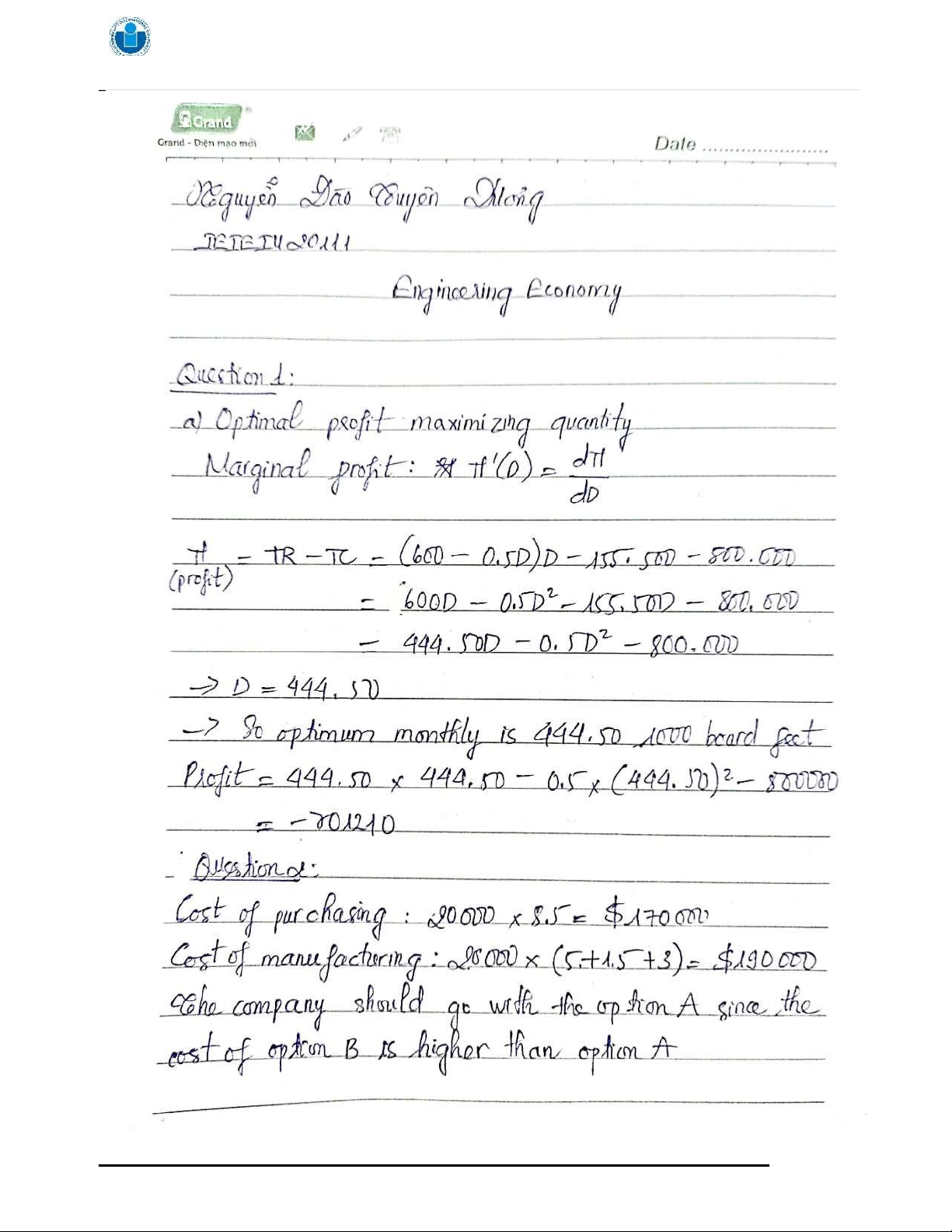

Question 1 (10 points): A furniture company has a contract to sell products overseas. The fixed

cost that can be allocated to the production of the product is $800,000 per month. The variable

cost per thousand board feet is $155.50. The price charged will be determined by p = $600 − (0.5) D per 1,000 board feet.

a. For this situation, determine the optimal monthly sales volume for this product and

calculate the profit (or loss) at the optimal volume.

b. What is the domain of profitable demand during a month?

Question 2 (15 points): An assembley company is analyzing a situation which has to make or

purchase for a component used in several products, and the engineering department has developed these data:

Option A: Purchase 20,000 items per year at a fixed price of $8.50 per item. The cost of placing

the order is negligible according to the present cost accounting procedure.

Option B: Manufacture 20,000 items per year, using available capacity in the factory. Cost

estimates are direct materials = $5.00 per item and direct labor = $1.50 per item.

Manufacturing overhead is allocated at 200% of direct labor (= $3.00 per item).

Based on these data, should the item be purchased or manufactured?

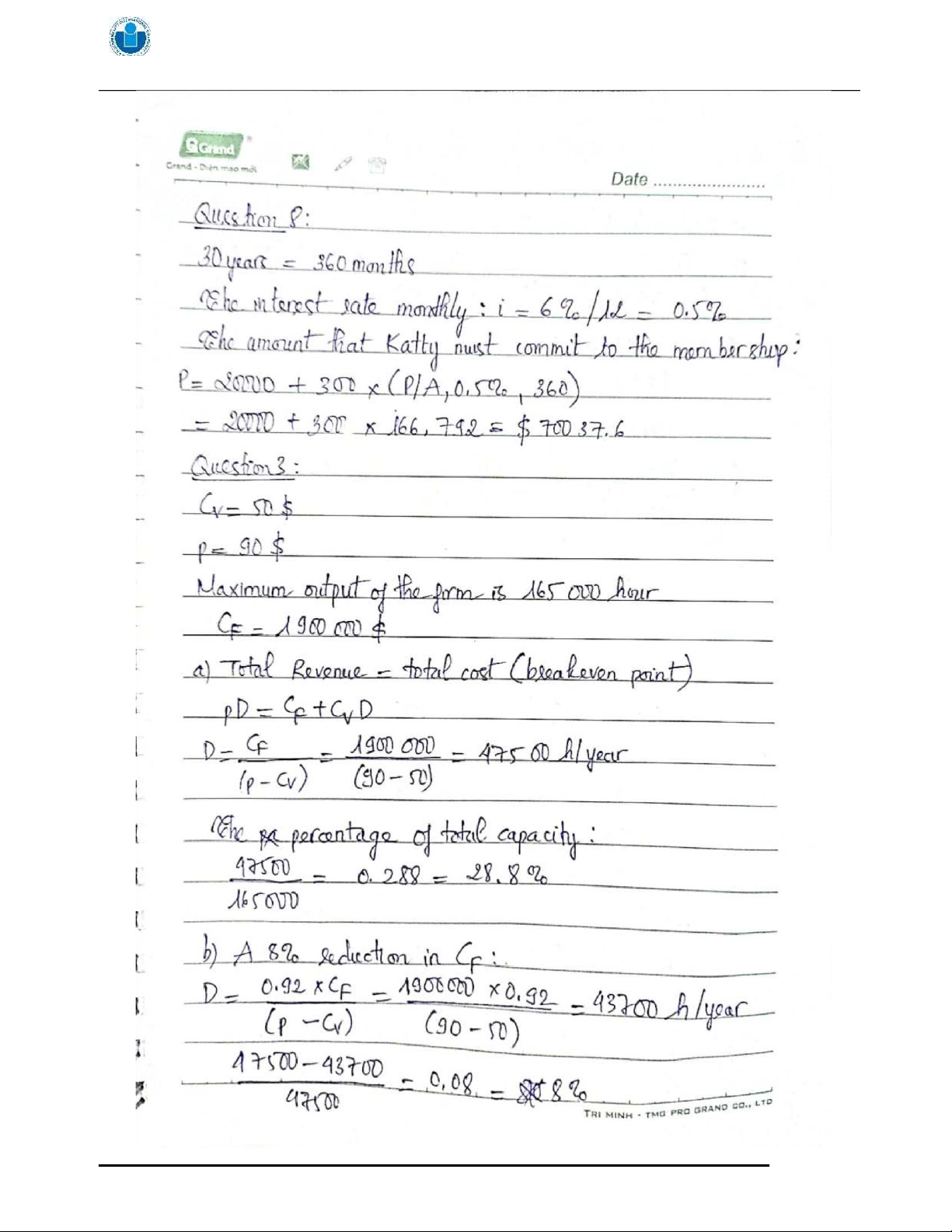

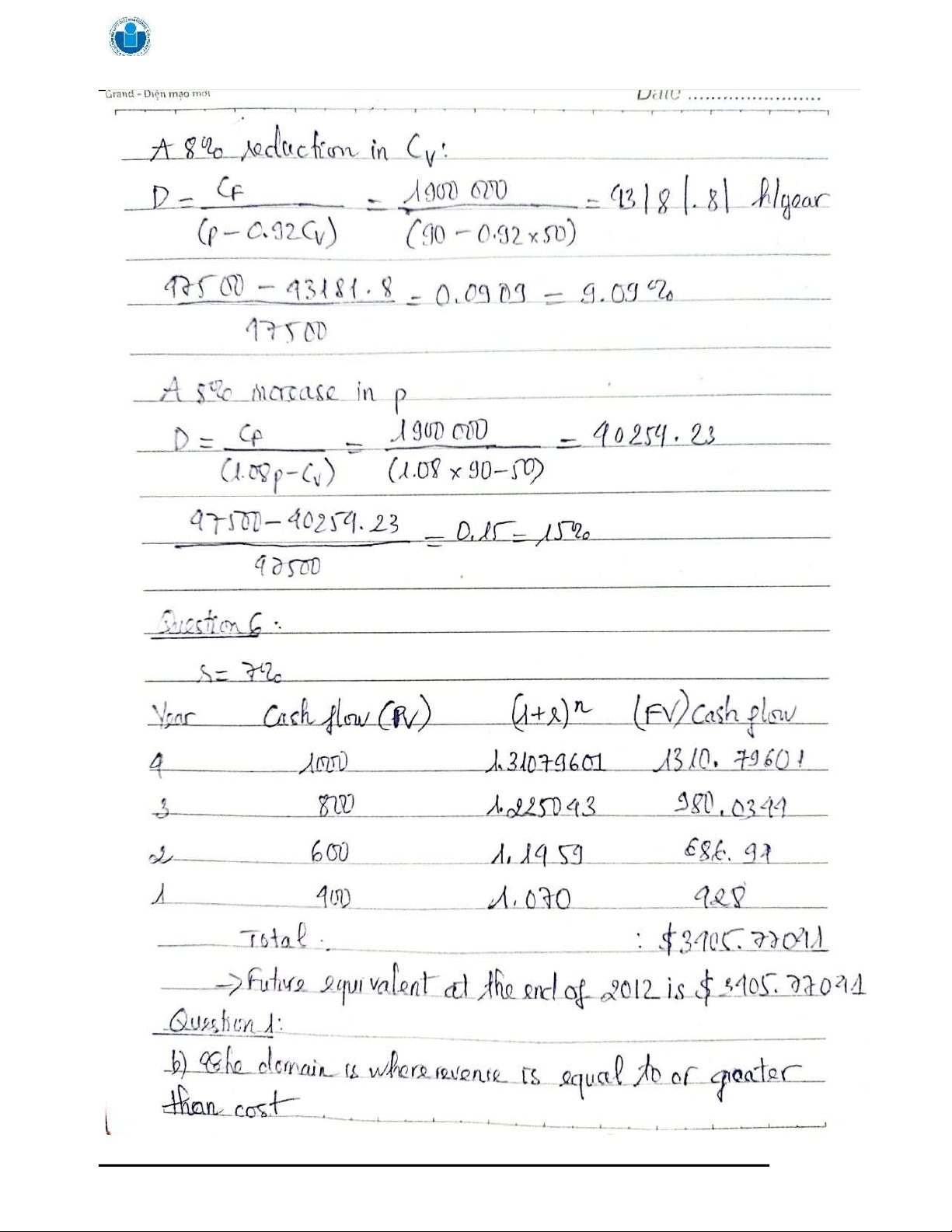

Question 3 (15 points) : A factory measures its output in a standard process hour unit, which is

a function of the personnel grade levels in the professional staff. The variable cost (cv) is $50

per standard service hour. The selling price (p) is $90 per hour. The maximum output of the

firm is 165,000 hours per year, and its fixed cost (CF) is $1,900,000 per year. For this firm, a.

What is the breakeven point in standard process hours and in percentage of total capacity?

b. What is the percentage reduction in the breakeven point (sensitivity) if fixed costs are reduced

8%; if variable cost per hour is reduced 8%; and if the selling price per unit is increased by 8%?

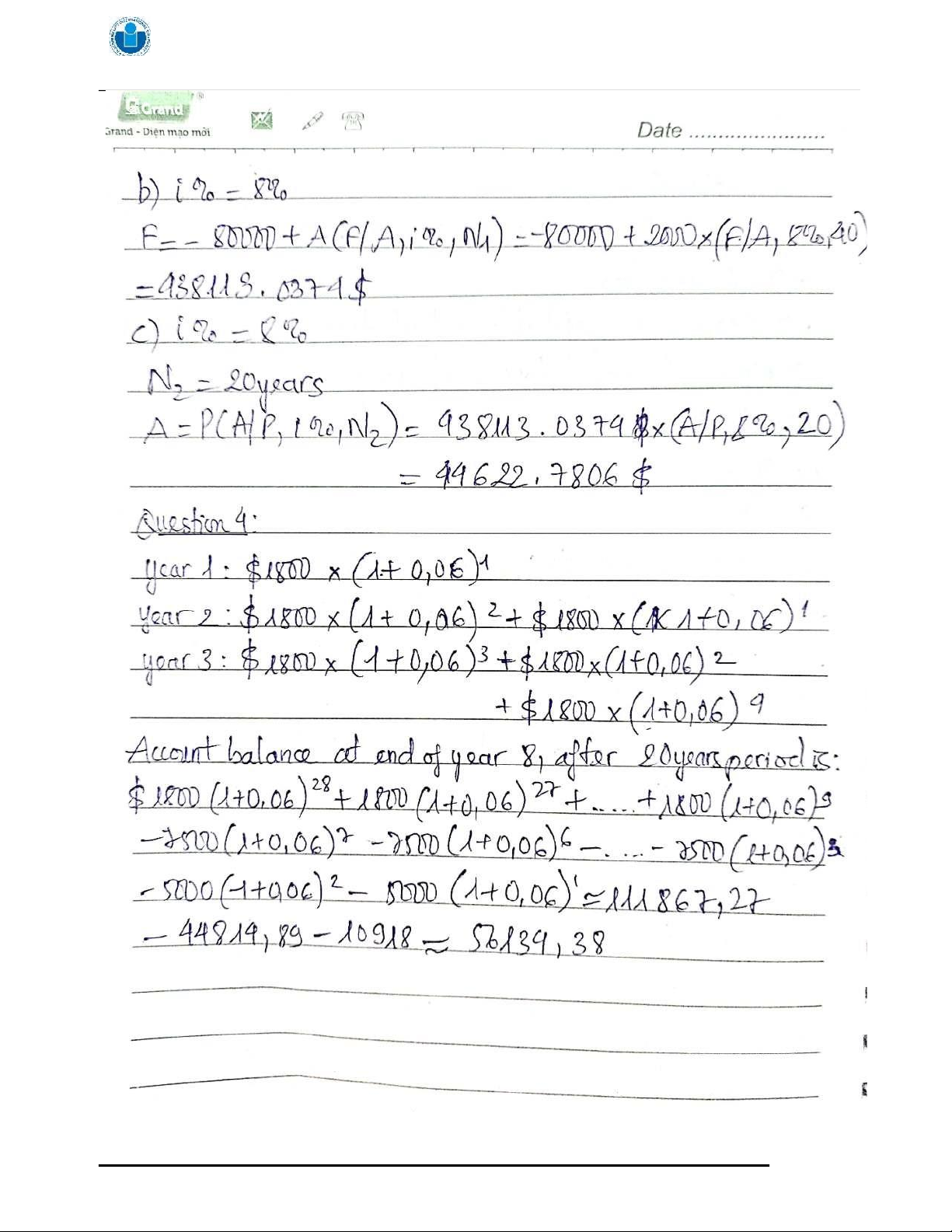

Question 4 (15 points): A worker has saved $1,800 each year for 20 years to repair for retiring.

A year after the saving period ended, he withdrew $7,500 each year for a period of 5 years. In

the sixth and seventh years, he only withdrew $5,000 per year. In the eighth year, he decided to

withdraw the remaining money in his account. If the interest rate was 6% per year throughout

the whole period, what was the amount he withdrew at the end of the eighth year?

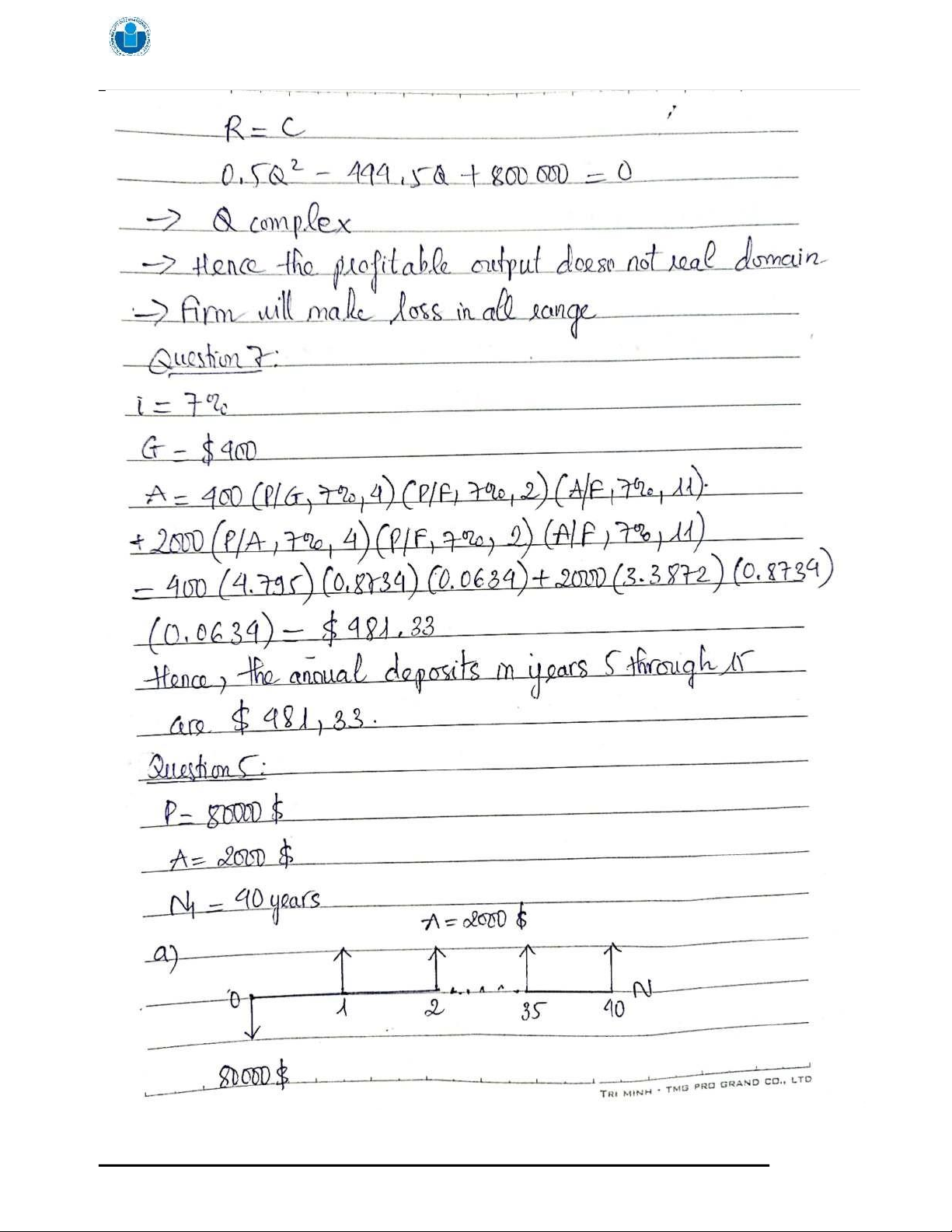

Question 5 (15 points): Amy Smith will pay about $80,000 into the insurance program over the

40-year life span. For simplicity, assume this is an annuity of $2,000 per year, starting with her

24th birthday and continuing through his 63th birthday. a. Draw the cash flow. b.

What is the future equivalent worth of the program when she retires at age 63 if

thegovernment’s interest rate is 8% per year? c.

What annual withdrawal can Amy makes if she expects to live 20 years in retirement?

Letthe interest rate, i = 8% per year. P a g e 1 | 7

THE INTERNATIONAL UNIVERSITY (IU) Course: Engineering Economy

School of Industrial Engineering and Management

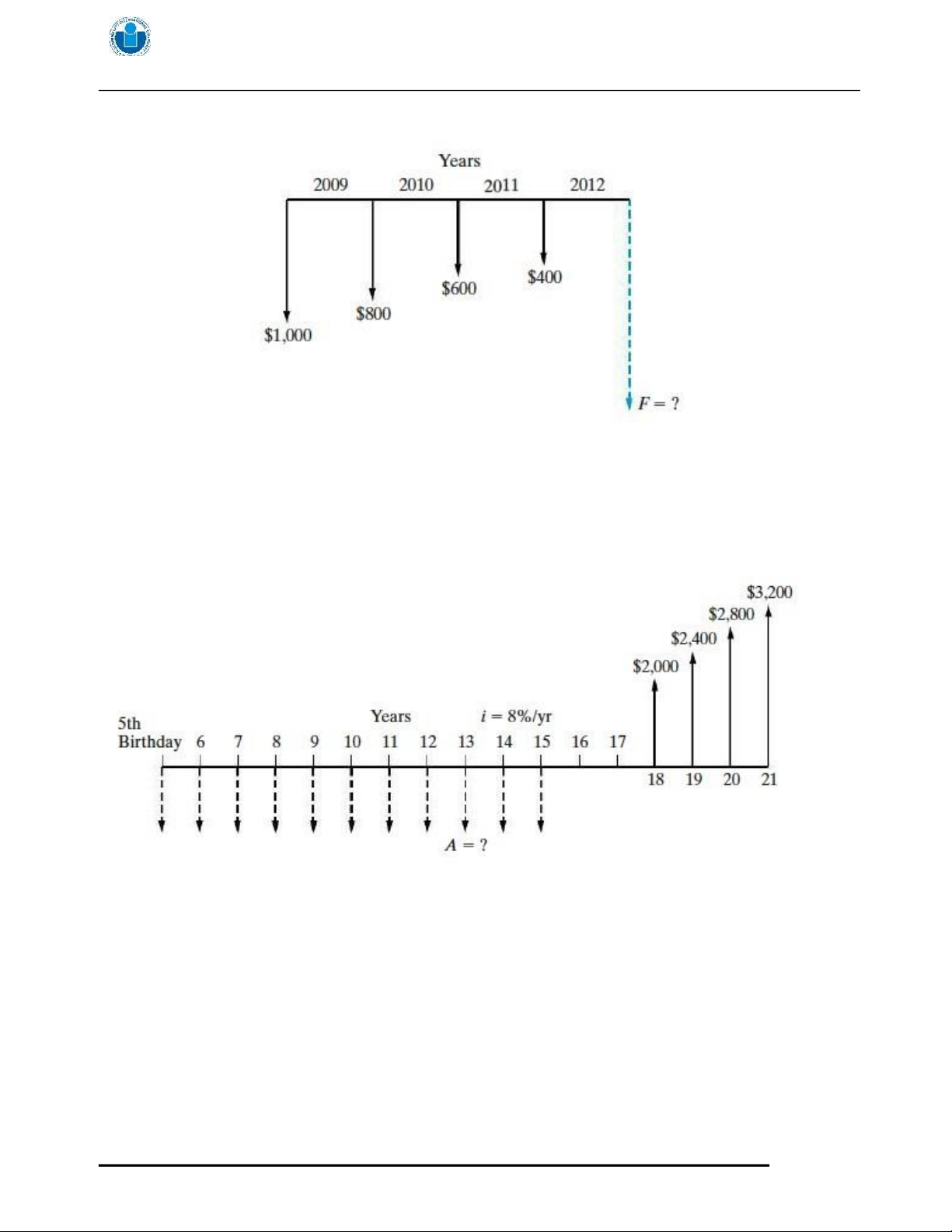

Question 6 (10 points): Calculate the future equivalent at the end of 2012, at 7% per year, of

the following series of cash flows in

Question 7 (10 points): Suppose that the Smith family decide to make annual payments into a

savings account, with the first payment being made on the child’s fifth birthday and the last

payment being made on the 15th birthday. Then, starting on the child’s 18th birthday, the

withdrawals as shown will be made in cash-flow below. If the effective annual interest rate is

7% during this period of time, what are the annual deposits in years 5 through 15? Use a

uniform gradient amount (G) in your solution.

Question 8 (10 points): To join into a community, an Katty must first purchase a membership

bond for $20,000. In addition, monthly membership dues are $300. Suppose an individual

wants to put aside a lump sum of money now to pay for her basic membership expenses

(including the $20,000 bond) over the next 30 years. She can earn an APR of 6%, compounded

monthly, on her investments. What amount must this person now commit to the membership? THE END P a g e 2 | 7

THE INTERNATIONAL UNIVERSITY (IU) Course: Engineering Economy

School of Industrial Engineering and Management P a g e 3 | 7

THE INTERNATIONAL UNIVERSITY (IU) Course: Engineering Economy

School of Industrial Engineering and Management P a g e 4 | 7

THE INTERNATIONAL UNIVERSITY (IU) Course: Engineering Economy

School of Industrial Engineering and Management P a g e 5 | 7

THE INTERNATIONAL UNIVERSITY (IU) Course: Engineering Economy

School of Industrial Engineering and Management P a g e 6 | 7

THE INTERNATIONAL UNIVERSITY (IU) Course: Engineering Economy

School of Industrial Engineering and Management P a g e 7 | 7