Preview text:

CHAPTER 10 • MEASURING SOURCES OF BRAND EqUITY: CAPTURING CUSTOMER MIND-SET 361 BRAND FOCUS 10.0

Young & Rubicam’s Brand Asset Valuator

This appendix summarizes the Brand Asset® Valuator (BAV), has been collected quarterly from an 18,000-person panel, which

originally developed by Young & Rubicam, now overseen and

enables the identification and analysis of short-term branding

expanded by The BAV Group.60 It is the world’s largest database trends and phenomena.

of consumer-derived information on brands. The BAV model is

developmental in that it explains how brands grow, how they get Four Pillars

into trouble, and how they recover.

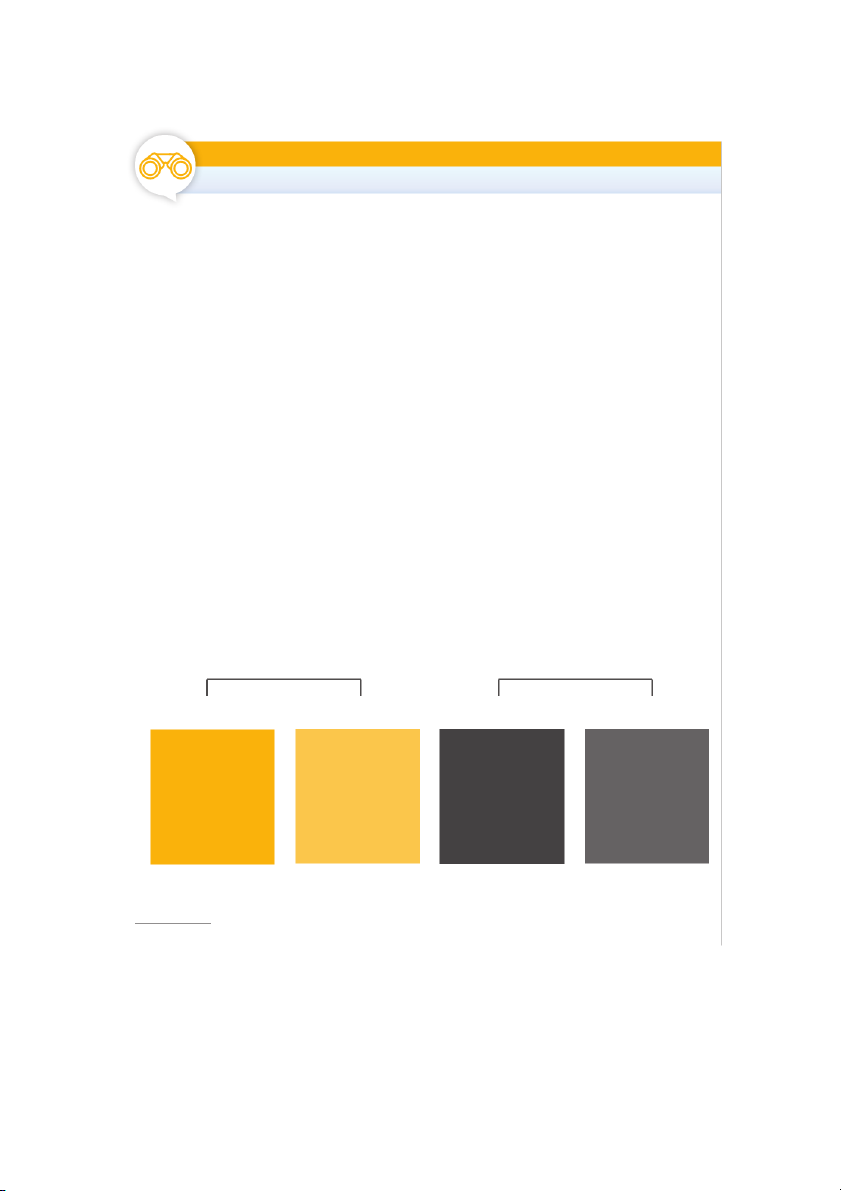

There are four key components of brand health in BAV (see Figure

The BAV measures brands on four fundamental measures

10-14), referred to as “Brand Pillars.” Each pillar is derived from

of brand equity plus a broad array of perceptual dimensions.*

various measures that relate to different aspects of consumers’

It provides comparative measures of the equity value of thou-

brand perceptions. Taken together, the four pillars trace the pro-

sands of brands across hundreds of different categories, as

gression of a brand’s development.

well as a set of strategic brand management tools for plan-

ning: brand positioning, brand extensions, joint branding

• Energized Differentiation measures the degree to which

ventures, and other strategies designed to assess and direct

a brand is seen as different from others, and captures the

brands and their growth. The BAV is also linked to financial

brand’s direction and momentum. This is a necessary condition

metrics and is used to determine a brand’s contribution to a

for profitable brand building. It relates to pricing power and company’s valuation.

is often the key brand pillar in explaining valuation multiples

Since 1993, the BAV has researched nearly 1,200,000 consumers like market value to sales.

in 52 countries, enabling BAV to identify truly global brand trends.

• Relevance measures the appropriateness of the brand to con-

Consumers’ perceptions of approximately 56,000 brands have been

sumers and the overall size of a brand’s potential franchise or

collected across the same set of 75 dimensions, including 48 image penetration.

attributes, usage, consideration, and cultural and customer values.

• Esteem measures how wel the brand is regarded and respected—

These elements are incorporated into a specially developed set of

in short, how well it’s liked. Esteem is related to loyalty. brand loyalty measures.

The BAV represents a unique brand equity research tool.

• Knowledge measures how intimately familiar consumers

Unlike most conventional brand image surveys that adhere to a

are with a brand and is related to the saliency of the brand.

narrowly defined product category, respondents evaluate brands in

Interestingly, high knowledge is inversely related to a brand’s

a category-agnostic context. Brands are percentile ranked against potential.

all brands in the study for each brand metric. Thus, by comparing

Relationship Among the Pillars

brands across as well as within categories, the BAV can draw the

broadest possible conclusions about how consumer-level brand

Examining the relationships between these four dimensions—a

equity is created and built—or lost. In the United States, data

brand’s “pillar patterns”—reveals much about a brand’s current

B R A N D E Q U I T Y P I L L A R S

BR A N D S T R E N G T H BR A N D S TAT U R E Future Growth Potential Current Operating Value ENERGIZED DIFFERENTIATION RELEVANCE ESTEEM KNOWLEDGE Unique Meaning Appropriateness Regard Understanding

Relates to margins, loyalty, cultural currency

Relates to market penetration

Relates to perception of quality & respect Relates to consumer experience FIGURE 10-14

Four Pillars Assess Brand Health, Development, and Momentum

* In Chapter 11, we discuss five BAV dimensions, with energy being listed as a separate dimension. Young and Rubicam has combined

energy and differentiation dimensions and now call it energized differentiation. 362

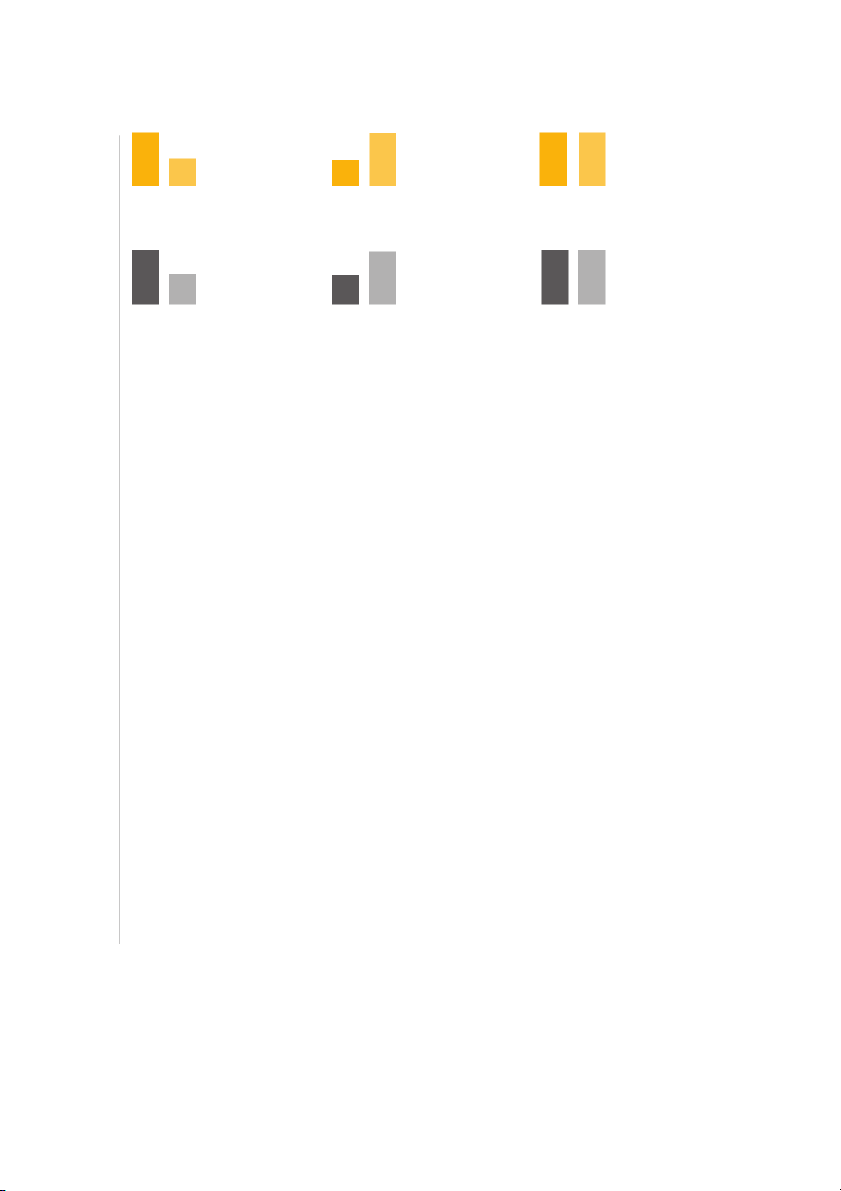

PART IV • MEASURING AND INTERPRETING BRAND PERFORMANCE UNREALIZED POTENTIAL COMMODITY BRAND CULTURAL ICON The brand has captured

Price or convenience is the

Brand has the full potential

attention for its uniqueness. dominant reason to buy.

to realize its momentum. Examples: Examples: Examples: E_DIF REL TRADER Kashi TYLENOL Hanes BAND-AID Airbnb E_DIF REL E_DIF REL Apple Google JOE’S DESIRE TO FIND OUT MORE

LOOKING FOR BETTER OPTIONS CREDIBLE LEADERS

Brand is recognized for its

Brand is better liked than known.

Brand is better known than liked. leadership. Examples: Examples: Examples: EST KNO TESLA Calphalon EST KNO SPAM EXXON Bank of America EST KNO Coca-Cola Walmart Method FIGURE 10-15

Pillar Patterns Tell a Story

Source: BrandAsset Consulting. Used with permission.

and future status (see Figure 10-15). It is not enough to look at

Brands generally begin their life in the lower left quadrant,

each brand pillar in isolation; it is the relationships between the

where they first need to develop Relevant Differentiation and

pillars that tell a story about brand health and opportunities. Here

establish their reason for being. Some brands get “stuck” in this are some key relationships:

quadrant because of their commodity image or specialized mar-

keting, like Lincoln Financial and Marvin Windows. Most often,

• When Energized Differentiation is greater than Relevance, the

the movement from there is “up” into the top left quadrant.

brand is standing out and receiving attention in the market-

Increased Differentiation, followed by Relevance, initiates growth

place. It now has the potential to channel this point of differ-

in Brand Strength. These developments occur before the brand

ence and energy into building meaningfulness for consumers

has acquired significant Esteem or is widely known. by driving Relevance.

This quadrant represents two types of brands. For brands des-

• But if a brand is more Relevant than Differentiated, this suggests

tined for a mass target, like Method, illy, and Apple Pay, this is

commoditization. While the brand is appropriate and meaning-

the stage of emerging potential. Specialized or narrowly targeted

ful within the lives of consumers, it is perceived as interchange-

brands, however, tend to remain in this quadrant (when viewed

able with other players in the category. Therefore, consumers

from the perspective of a mass audience) and can use their strength

will not go out of their way for this brand, remain loyal to it, or

to occupy a profitable niche. This includes brands like Square,

pay a premium for it, since it lacks that special something we

Kimpton, and Snapchat. From the point of view of brand leaders,

quantify as Energized Differentiation. Convenience, habit, and

new potential competitors will emerge from this quadrant.

price become drivers of brand choice in this scenario.

The upper right quadrant, the Leadership Quadrant, is popu-

• Leadership brands are strong on both pillars, resulting in con-

lated by brand leaders—those that have high levels of both Brand

sumer passion as well as market penetration.

Strength and Brand Stature. Both older and relatively new brands

can be in this quadrant, meaning that brand leadership is truly a

Brands often strive to build awareness, but if the brand’s pil-

function of the pillar measures, not of longevity. When properly

lars are not in the proper alignment, then consumer knowledge

managed, a brand can build and maintain a leadership position

of a brand becomes an obstacle that may need to be surmounted

indefinitely. Examples of brands in the leadership position include

before the brand can continue to build healthy momentum. Apple, the NFL, and Disney.

• When a brand’s Esteem is greater than its Knowledge, con-

Although declining brand equity is not inevitable, brands for

sumers like what they know about the brand so far, and typi-

whom strength has declined (usually driven by declining Ener-

cally want to find out more, suggesting growth potential.

gized Differentiation) can also be seen in this same quadrant.

• However, if a brand’s Knowledge is greater than its Esteem, then

Brands whose Strength has started to dip below the level of their

consumers may feel that they know more than enough about

Stature display the first signs of weakness, which may well be

the brand, and they are not interested in getting to know it any

masked by their still-buoyant sales and wide penetration. Exam-

better. In this case, Knowledge is an impediment that the brand

ples include such brands as Macy’s, V8, and Visa.

must try to overcome if it wishes to attract more consumers.

Brands that fail to maintain their Brand Strength—their Rel-

evant Differentiation—begin to fade and move “down” into the

bottom right quadrant. These brands become vulnerable not just The PowerGrid

to existing competitors, but also to the depredations of discount

The Brand Asset® Valuator has integrated the two macro dimen-

price brands, and they frequently end up being drawn into heavy

sions of Brand Strength (Energized Differentiation and Relevance)

and continuous price promotion in order to defend their con-

and Brand Stature (Esteem and Knowledge) into a visual analyti-

sumer franchise and market share: American Airlines, Citibank,

cal representation known as the PowerGrid (see Figure 10-16).

ExxonMobil, and Kmart fall into this category.

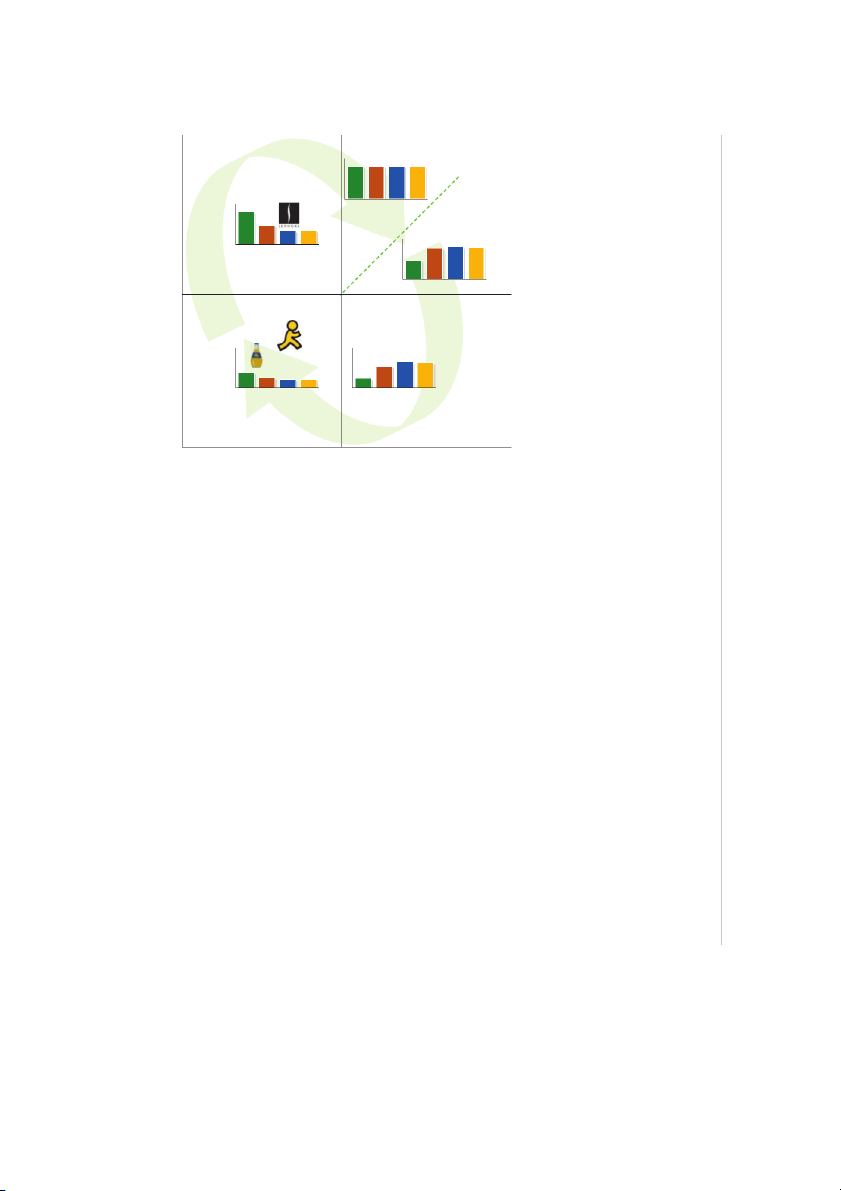

The PowerGrid depicts the stages in the cycle of brand

A PowerGrid can also be used to measure a brand’s equity

development—each with its characteristic pillar patterns—in

among different constituencies. Figure 10-17 depicts The Wall successive quadrants.

Street Journal’s brand equity among various usage or demographic

CHAPTER 10 • MEASURING SOURCES OF BRAND EqUITY: CAPTURING CUSTOMER MIND-SET 363 facebook 100 Leadership Google Niche Apple NIKE yelp amazonkindle D_E R E K Cocla-Cola e IKEA HBO anc ev baskin macys el UNDER ARMOUR BRrobbins R D_E R E K d lululemon th an W VISA g n athletica HOTELS PUMA ren io method D_E R E K detox your home St tiat 50 d en Mass Market ran B iffer The Athlete’s HUNGRY-MAN D Foot Shell BLOCKBUSTER ized g er AmericanAirlines Time Out Spint En New York TV GUIDE D_E R E K D_E R E K Citibank New, Unfocused, Commodity or or Unknown Eroded FIGURE 10-16 0

Brand Development Cycle as 0 50 100

Illustrated by the PowerGrid Brand Stature

Source: BrandAsset Consulting. Esteem and Knowledge Used with permission.

cuts including gender, age, income and political views. The Wall

Differentiation and less Esteem, consumers began to lose inter-

Street Journal is generally an established brand with high Brand

est until finally, AOL’s Knowledge pillar followed the other pillars

Stature, but depending on the audience, Brand Strength differs.

and began to decline. Figure 10-18 displays the sharp contrast in

The Wall Street Journal is more differentiated and relevant among

brand development between the two.

readers, Republicans, men, and individuals of age 55+ and income

How has Google developed and maintained brand leader-

$100K+. This is a powerful tool to identify opportunities and tar-

ship? From the BAV perspective, there are three main contribut- get audiences for brands.

ing factors: (1) consistently strong brand attributes that translate

Significant investigations have been done on relating the BAV

into competitive advantages, (2) successful brand extensions

metrics to financial performance and stock price. First, the posi-

into new categories, and (3) successful expansion into global

tion of a brand on the PowerGrid indicates the level of intangible

markets building on differentiation to become a leadership

value (market value of a brand or company-invested capital) per brand.

dollar of sale. The leadership quadrant produces brands with the

largest intangible value per dollar of sale. Next, through exten-

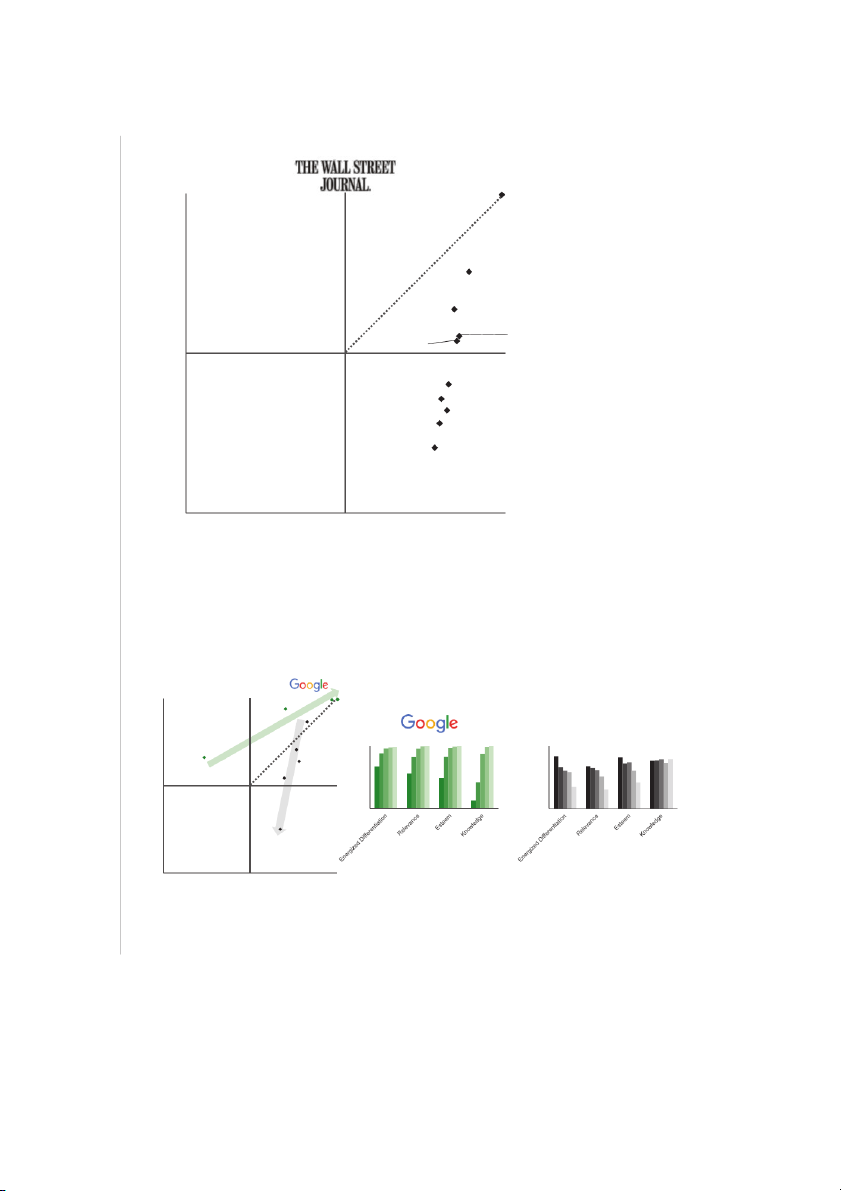

Competitive Advantages on Brand Attributes

sive modeling, the BAV has shown that a change in brand assets

Google’s leadership is supported by competitive advantages on

impacts stock price. From a macro perspective, two-thirds of

the key attributes to driving the pillars and loyalty. The BAV uses

the change in brand assets directly impacts stock price and the

48 emotional attributes to see through the eyes of consumers

expectation for future returns. One-third of the change in brand

when considering Google and its competitive set.

assets impacts current earnings. The importance of brand assets

As shown in Figure 10-19, Google is stronger than the com-

on stock price and company valuation is highly dependent on the

petitive average on innovative and visionary. These elements category or economic sector.

build Google’s Energized Differentiation. Google’s advantage on

trustworthy and helpful helps keep the Relevance pillar strong, Applying BAV to Google

and Google’s strength on reliable and leader supports both the

The best way to understand the BAV model is to apply it to a brand

Relevance and the Esteem pillars.

and category. Google is a dramatic example. Google achieved

leadership status faster than any other brand measured in the

Successful Category Extensions

BAV. Google built each brand pillar, beginning with Energized

Google has done a masterful job of entering new categories with

Differentiation, both quickly and strongly. After rapidly establish-

sub-brands. In many of these categories—such as Google Docs,

ing Energized Differentiation, Google built the other three pillars.

Chrome, and Gmail—the Google entrant has become the cat-

It took only three years for Google’s percentile-ranking on all four

egory leader. Most of the sub-brands also have very high Brand pillars to reach the high 90s.

Strength, which helps replenish the Brand Strength of the Google

At the same time, AOL began to falter, losing first Energized

corporate brand (see Figure 10-20). In this way, the leadership of

Differentiation, then Relevance and Esteem. For a period, AOL’s

the sub-brands helps support the parent brand, a common theme

Knowledge remained high, but with declining Relevance, eroding

among strong parent brands with sub-brands. 364

PART IV • MEASURING AND INTERPRETING BRAND PERFORMANCE

B R A N D E Q U I T Y P O W E R G R I D ( 2 0 1 6 ) 100 The Wall Street Journal Readers ) ce n va Leadership le Income $100K+ e R Niche H d Age 55+ n a Mass Market NGT n Republicans E R tio Men T 50 S tia d n n re Homeowners ra Democrats B iffe D Age 35–54 d Women ize rg e Age < 34 n (E Undeveloped Com o m dity 0 0 50 1 0 0 Brand STATURE (Esteem a d n Knowledge) FIGURE 10-17

Profile of The Wall Street Journal

Source: BrandAsset Consulting. Used with permission.

B R A N D E Q U I T Y P O W E R G R I D O F G O O G L E A N D A O L

2 0 0 1 , 2 0 0 3 , 2 0 0 6 , 2 0 11 , 2 0 1 6 2011 100 2006 2016 2003 ) ce n 2001 Aol. Niche va Leadership le e 100 100 R d 2003 H n 80 80 2001 T 2006 G a n Mass Market N 60 60 E R tio 2011 T 40 40 tia 50 S n d 20 20 n re ra Undeveloped Com o m dity 0 0 B iffe D d ize 2016 rg e n Aol. (E 0 0 50 1 0 0 Brand STATURE (Esteem and Knowledge) FIGURE 10-18

Google vs. AOL Brand Development

Source: BrandAsset Consulting. Used with permission.

CHAPTER 10 • MEASURING SOURCES OF BRAND EqUITY: CAPTURING CUSTOMER MIND-SET 365

G O O G L E ’ S T O P AT T R I B U T E S DRIVER OF… Innovative Energized Differentiation Visionary Trustworthy Relevance Helpful Reliable Relevance & Esteem Leader 0 10 20 30 40 Competitive Average Google FIGURE 10-19

Google’s Top Attributes

Source: BrandAsset Consulting. Used with permission. 100 ) ce n va Leadership le e R Niche d H n T G a n Mass market N E R tio T tia 50 S n d n re ra Undeveloped Commodity B iffe D d ize rg e n (E 0 0 50 100 Brand STATURE (Esteem and Knowledge) FIGURE 10-20

Google’s Successful New Product Introductions

Source: BrandAsset Consulting. Used with permission. 366

PART IV • MEASURING AND INTERPRETING BRAND PERFORMANCE

The significant strength of Google’s image profile has made

• BAV’s Differentiation relates to brand superiority.

entrance into new categories easier. Google does not face the

• BAV’s Relevance relates to brand consideration.

entrance issues that weaker brands have when their image pro-

• BAV’s Esteem relates to brand loyalty.

files are not robust enough to create differentiation in the new

category, a key condition for a successful extension.

• BAV’s Knowledge relates to brand resonance.

Successful Global Expansion

Note that brand awareness and familiarity are handled

differently in the two approaches. The brand resonance frame-

The Brand Asset® Valuator (BAV) metrics uniquely gauge the

work maintains that brand salience, and breadth and depth

nature of international marketing opportunities. The BAV shows

of awareness is a necessary first step in building brand equity.

global brands must build consistently strong Brand Strength,

The BAV model treats familiarity more effectively—almost in

Brand Stature, and meaning in each market. Specifically, finan-

a warm feeling or friendship sense—and thus see it as the

cial analysis of global brands has shown that brands that have

last step in building brand equity, more akin to the resonance

consistently high Brand Strength and consistently high common component itself.

meaning will deliver better margin growth rates and are more

The main advantage of the BAV model is that it provides rich

efficient at producing higher pretax margins.

category-agnostic descriptions and profiles across a large number

Google has achieved leadership status in global markets the

of brands. It also provides focus on four key branding dimensions.

same way it achieved leadership status in the United States—by

It provides a brand landscape in which marketers can see where

quickly outperforming competitors on Brand Strength and Brand

their brands stand relative to other prominent brands in many

Stature. In all countries recently surveyed, Google is a super- different markets.

leadership brand on the PowerGrid (see Figure 10-21). Reviewing

The descriptive nature of the BAV model does mean, how-

the key imagery across countries shows that Google ranks consis-

ever, that there is potentially less insight as to exactly ho w a brand

tently high on reliable and intelligent, according to consumers in

could rate highly on specific attributes. Because the measures

each local market. This is true consistency and a great strategic

underlying the four pillars have to be relevant across a very dis- base from which to build.

parate range of product categories, the measures (and, conse-

quently, the pillars) tend to be abstract in nature and not related Summary

directly to product attributes and benefits, or more specific

There is much commonality between the basic BAV model and

marketing concerns. Nevertheless, the BAV model represents a

the brand resonance model. The four factors in the BAV model

landmark study regarding its ability to enhance marketers’ under-

can easily be related to specific components of the brand reso-

standing of what drives top brands and where their brands fit in nance model: a vast brandscape. 100 Helpful ) ce High Performance n va Innovative le e R H d T n G a Leadership n Best Brand Best Brand N E R tio Down-to-Earth Distinctive T S tia n Helpful Down-to-Earth d re RELIABLE n ra B iffe INTELLIGENT D d ize Mass Market rg e n Trustworthy Authentic (E Up-to-Date Daring Dynamic Down-to-Earth 70 100 Brand STATURE (Esteem and Knowledge) FIGURE 10-21

Google Is Consistently a Global Brand Leader

Source: BrandAsset Consulting. Used with permission.