Preview text:

_______________________ Tyre Maharajahs Case Study _______________________

TYRE MAHARAJAHS AGAINST CHINESE EXPORTERS

AND TYRE GLOBAL MAKERS.

THE STRUGGLE FOR LEADERSHIP IN THE INDIAN TYRE INDUSTRY

The Tyre Industry in India: Growth, Trends and Technologies

“The Indian tyre industry is emerging as a

Even for large Indian companies that have

force to reckon within the global tyre

expanded their operations abroad, they

manufacturing ecosystem […]. The industry

remain greatly dependent on the Indian

has undergone a metamorphosis of sorts in

market for their turnover, growth and

the last few years and has received global

profitability. Their home country remains

recognition too […]. As a fast developing

their so-called “cash cow” market.

nation, being the fastest growing economy in

Among these uncertainties and risks looming

the world, India offers immense potential for

over the Indian tyre industry, we can first

the growth of the tyre industry”(Anant

highlight the variations in the raw material

Goenka’s interview, CEO of CEAT and

prices. Tyre inputs, such as natural and

Chairman of the Indian Automotive Tyre

synthetic rubber and crude oil, have become Manufacturers’ Association - ATMA)1.

more expensive due to their cyclical price

Indeed, in a 10-year period, the Indian tyre

increase, the depreciation of the Rupee and

production has increased from 80 to 180

the 25% customs duty imposed on imports by

million units; in the meantime, Indian tyre

the Indian government5. Moreover, some tyre

companies have thrived investing heavily

manufacturing facilities cannot operate at

abroad and exporting annually Rs. 100,000

full scale as they are short of supply due to

million (US$ 1.5 billion). As a result, four

bad crop of natural rubber in India6.

Indian tyre companies are ranked among the

top 30 global tyre makers by turnover2. For

Second, the Indian tyre industry is

the coming years, India’s GDP is predicted to

confronted with tough competition from

grow at a pace of 7.4%, ahead of other

imported Chinese tyres, which are on

emerging economies. It would surpass China

average 50% cheaper than domestic

by 1% while other BRICS economies would

products7. The Indian government has

stick to growth rate ranging from 1 to 2%3. In

recurrently imposed some tariff and non-

the automotive industry, the Society of

tariff barriers to imported tyres with the aim

Indian Automotive Manufacturers (SIAM)

to reducing the attractiveness of low-cost

expects that the production will increase by

foreign products, such as in September 2017

3.5 to 4 times from 2016 to 20264. Boosted

and September 20188. But these measures

by this strong momentum, the tyre industry

have only partly deterred price-sensitive

plans on growing from Rs. 550,000 (US$ 8

Indian customers from buying imported

billion) to 2,000,000 million (US$ 30 products. billion).

Third, a series of Indian government

Although India will experience high or

initiatives have been launched with mixed

hyper-growth, uncertainties and risks will

and unforeseeable consequences. In July

also rise in such a fast pace that tyre

2017, the Indian government enforced a

companies could see their return on

consumption tax known as the GST (Goods

investment dented and their growth thwarted.

and Services Tax). This tax enforcement has

This case study was written by Dr. Alexandre Bohas (Professor at ESSCA Business School) and Dr. Pierre-Xavier

Meschi (Professor at IAE, Aix-Marseille Université). It is intended as an illustration to be used in class discussions.

The authors gratefully acknowledge Michelin’s irreplaceable cooperation in providing them complete access to world

tyre industry data. They wish to thank in particular: Thierry Anglade (Michelin’s Corporate Development & Progress

manager) and Frédéric-Patrice Vincent (Michelin’s Vice-President Strategy & Development).

_________________________________ 1 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

made it harder for low-cost imported tyres to

Fourth, recent rising protectionism from the

enter the domestic market. These imported

US government under the initiative of

tyres can no longer circumvent GST by

President Donald Trump threatens the Indian

making cash deals. Along the same lines, the

tyre industry: (i) directly, with the

demonetization regulation, which led to

enforcement of anti-dumping measures

withdrawal of Rs. 500 and 1,000 bank notes,

against tyre imports from emerging

has also caused a drop in massive imports by

economies, including India. These measures

diminishing excessive cash in the economic

represent a major threat, as the US is the first

system9. All these government measures

export country for Indian tyre makers

have triggered destocking behavior from tyre

(especially, for JK Tyre, the third largest tyre

dealers and garages. Besides, environmental

maker in India). (ii) Indirectly, with the trade

and sustainable development concerns have

war currently occurring between the US and

raised pressures to curb air pollution. Since

China. This war could have adverse side

2000, Bharat Stage (BS) emission standards,

effects for Indian tyre makers since a

inspired from European “Euro” regulations,

decrease in Chinese tyres exports to the US

have been progressively imposed on all

would mean an additional flow of discounted

motor vehicles. The BS-IV grade was

Chinese tyres diverted to India.

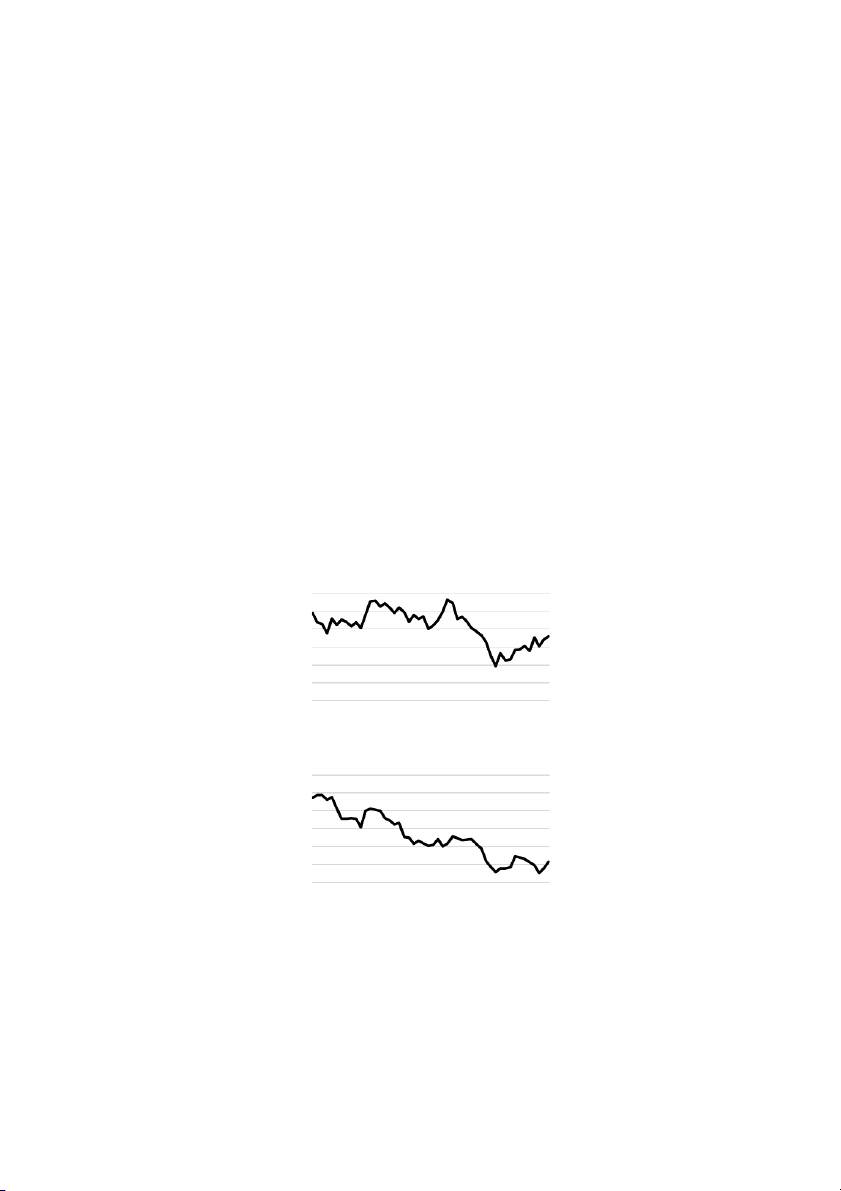

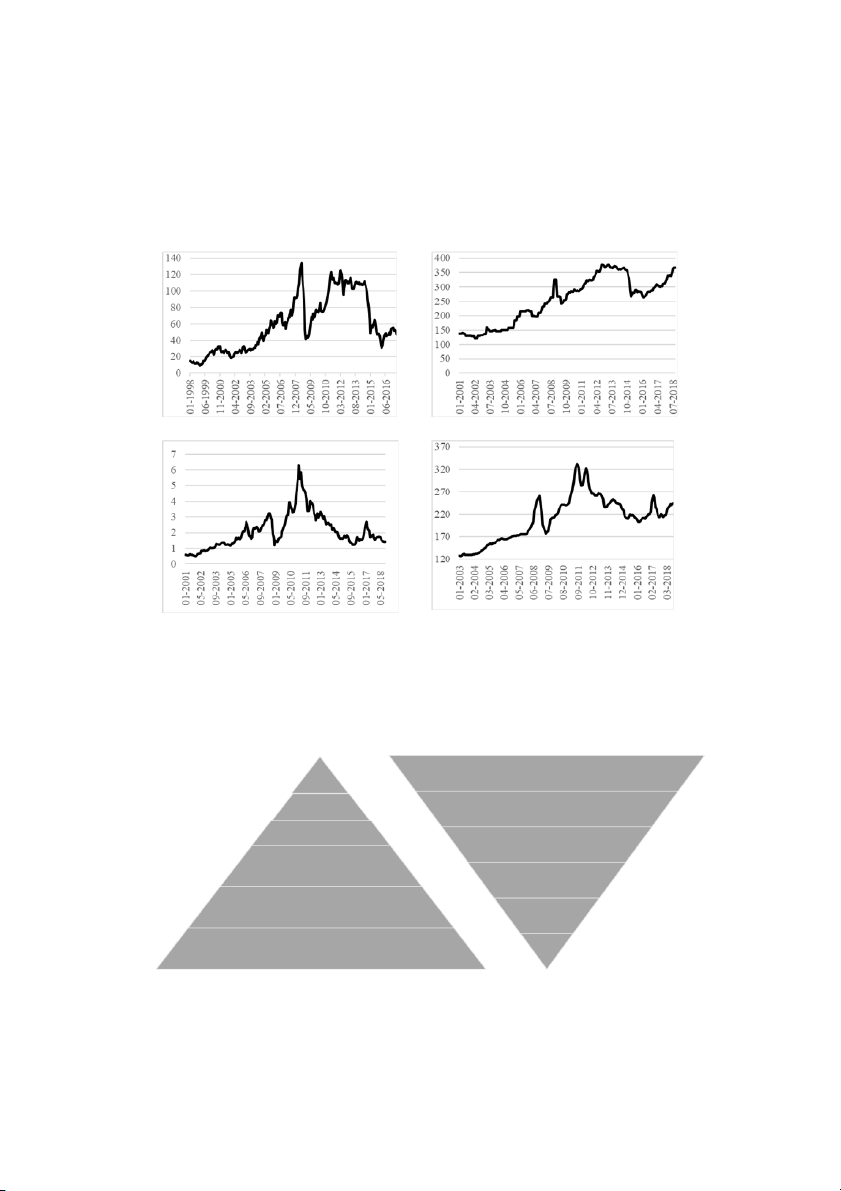

enforced for the whole country since April All these headwinds increase the

2017. Faced with increased air pollution, the

uncertainties and risks for the Indian tyre

Indian government has decided to skip BS-V

makers, which explain the sharp decrease in

and looked forward to implementing BS-VI

stock prices for leading players such as

in the short term10. The acceleration in

Apollo Tyres and JK Tyre (see Figure 1) and,

enforcing environmental norms comes along

to a lesser extent, MRF, in 2018.

with the increase in the price of cars and gas.

Figure 1 – Stock Market Price Variations in 2018 (in Rs., Apollo Tyres and JK Tyre) 300 275 250 225 200 175 Apollo Tyres 150 8 8 8 8 8 8 8 8 8 8 8 8 -1 -1 -1 l-1 -1 -1 -1 ar-1 r-1 p n g ct-1 v ec-1 Jan eb ay-1 u ep o F Ju M A M Ju A S O N D 200 180 160 140 120 100 JK Tyre 80 8 8 8 8 8 8 8 8 8 8 8 8 -1 -1 -1 -1 -1 -1 ar-1 r-1 l-1 p n g ct-1 v Jan eb ay-1 u ep o ec-1 F M A Ju M Ju A S O N D

Source: stock market prices for Apollo Tyres and JK Tyre are

available on the website: https://in.finance.yahoo.com/quote,

accessed on December 20, 2018.

_________________________________ 2 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

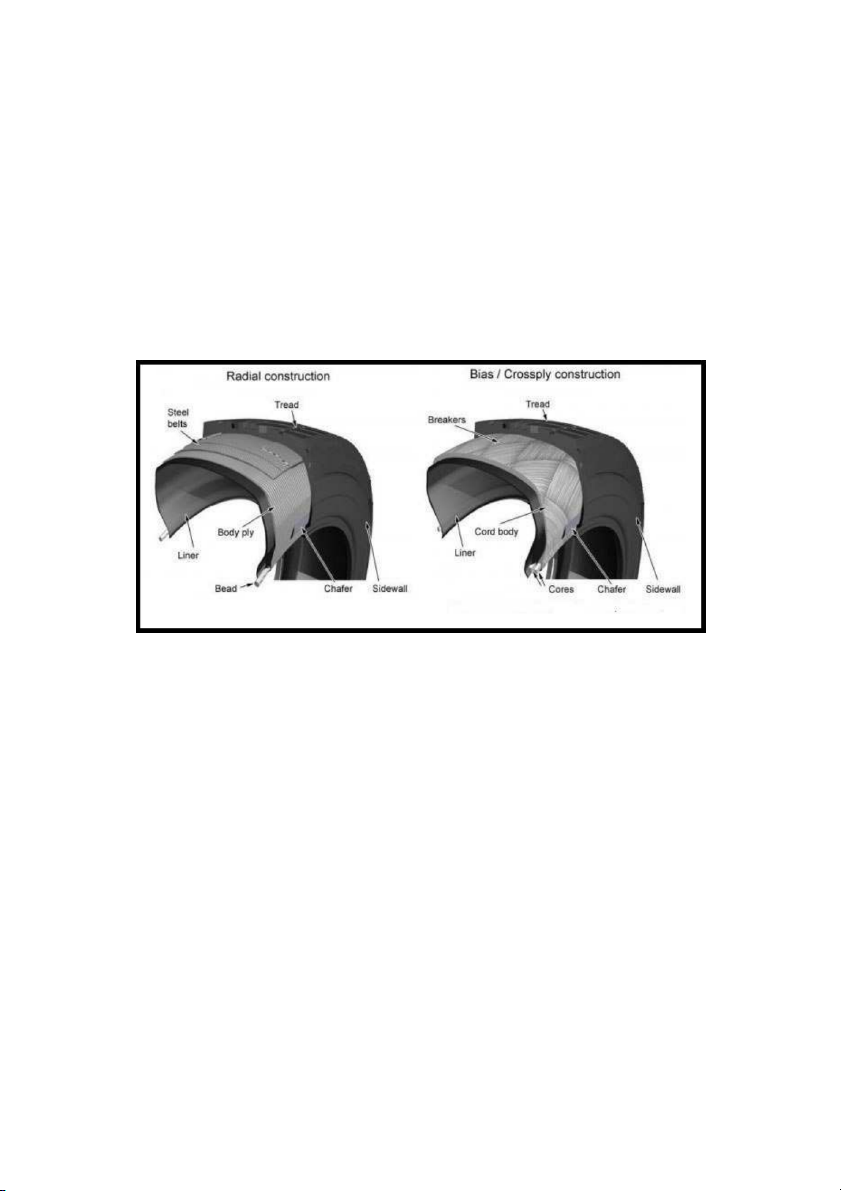

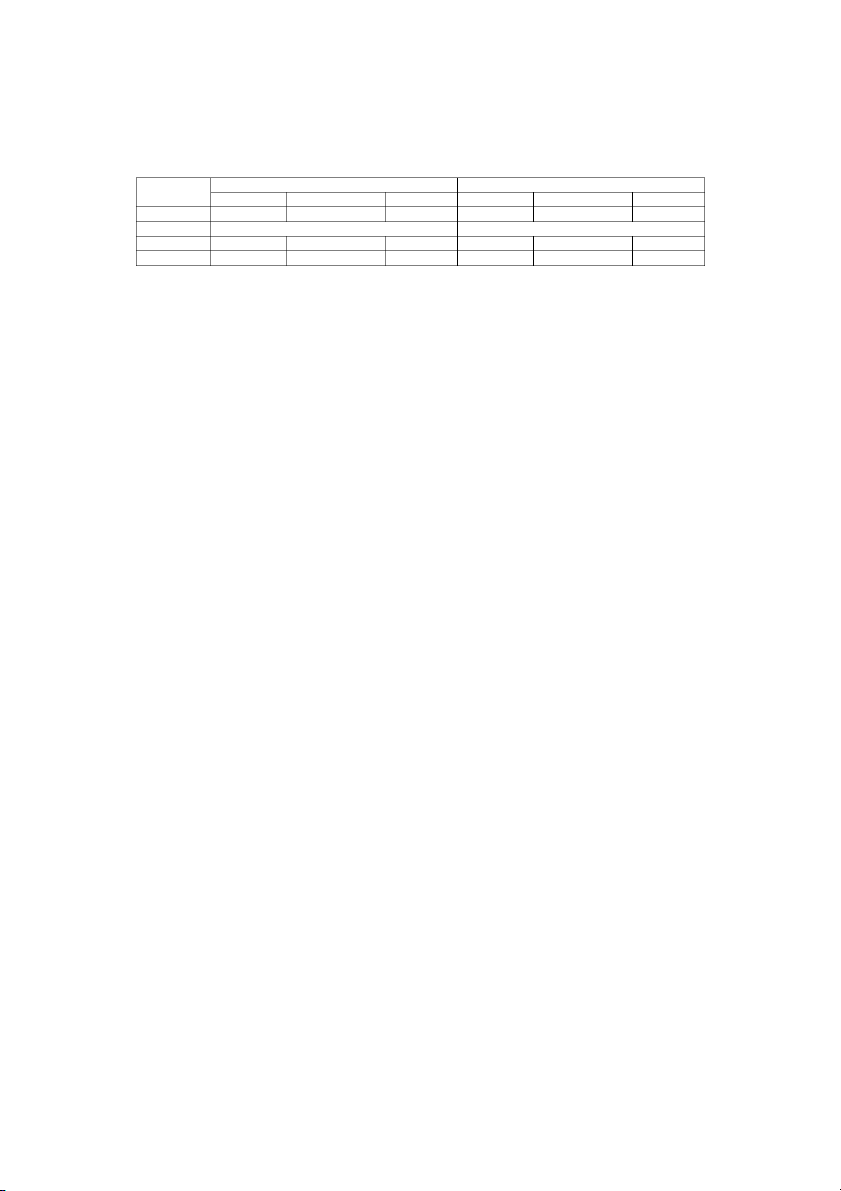

As regards technologies used for making

textile and metal steel cords are braided

tyres, one can distinguish two types,

radially or at 90° (see Figure 2). The radial

corresponding to the tyre body construction

tyre has gradually imposed itself in

and the combination of textile and metal steel

developed countries with the increased

cords (see Figure 2), namely, “diagonal” or

performance of cars and trucks. With soft

cross-ply technology, and “radial” or radial-

sidewalls, the radial tyre has better adhesion

ply technology. In the cross-ply technology

and greater resistance to torsion than the

(created in 1950), the textile and metal steel

cross-ply one. The imprint of the tyre is

cords are braided diagonally on the external

wider and the pressure is more equally

surface of the tyre. In the radial technology

distributed over the crowns of the tyre, which

(patented on June 4, 1946 by Michelin), the insure better tread wear.

Figure 1 – Radial and Cross-Ply (“Diagonal”) Tyre Technologies

Source: https://otrwheel.com/otr-blog/radial-vs-bias-need-know/ (accessed on December 17, 2018).

In India, 65% of tyre sales are cross-ply (or

the passenger vehicle tyre segment (see

“diagonal”). This situation is explained by Table 1).

different factors inherent to Indian road

A later-than-expected and steady process of

infrastructures and consumer behaviour,

“radialization” has taken place for a few

which can observed in most emerging

years. Road infrastructures have improved

economies: the very unequal quality of the

and cheap radial tyre imports from China

road infrastructure, the tendency to overload

have explained the switch to radial tyre, in

vehicles and the cheaper buying-in price of

particular in M&HCV tyres. In this segment,

cross-ply tyres. Moreover, in rough

between 2008 and 2018, the ratio of radial

conditions where tyre is easily punctured, the

tyres in the market has risen from 4 to 45%

cross-ply tyre can have longer life-time than

(see Table 1). Another reason is that radial

radial tyre although, by mileage’s standards,

tyres have a lower rolling resistance than

the latter lasts longer. However, cross-ply

cross-ply tyres in a country where air

tyre has poor road-holding at high speed and,

pollution has become an important concern

when it is subjected to high torsion, there are

among public authorities. Due to its

strong risks of it coming off the rim or

construction specificities, the crown and

blowing out. These various factors explain

sidewalls of radial tyres can be composed

that cross-ply tyres still represent the

differently, which brings about better

majority sales in most segments, excluding

performance in rolling-resistance.

_________________________________ 3 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

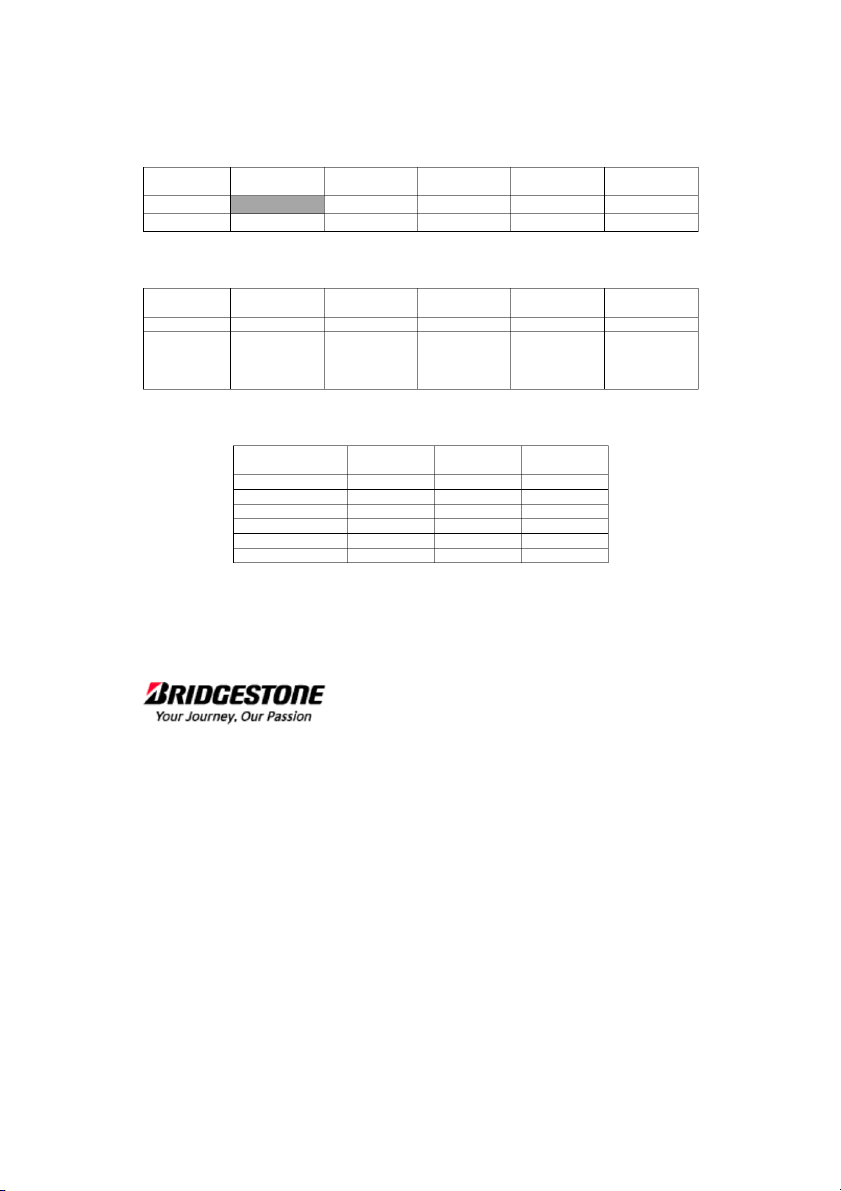

In the other tyre segments, the “radialization”

two- and three-wheeler tyre segment (see

process is more contrasted. The market

Table 1). This can be related to the

transformation in favor of radial technology

customer’s price sensitiveness and the

is almost achieved in the passenger car tyre difference in tyre use.

segment while it has almost not started in the

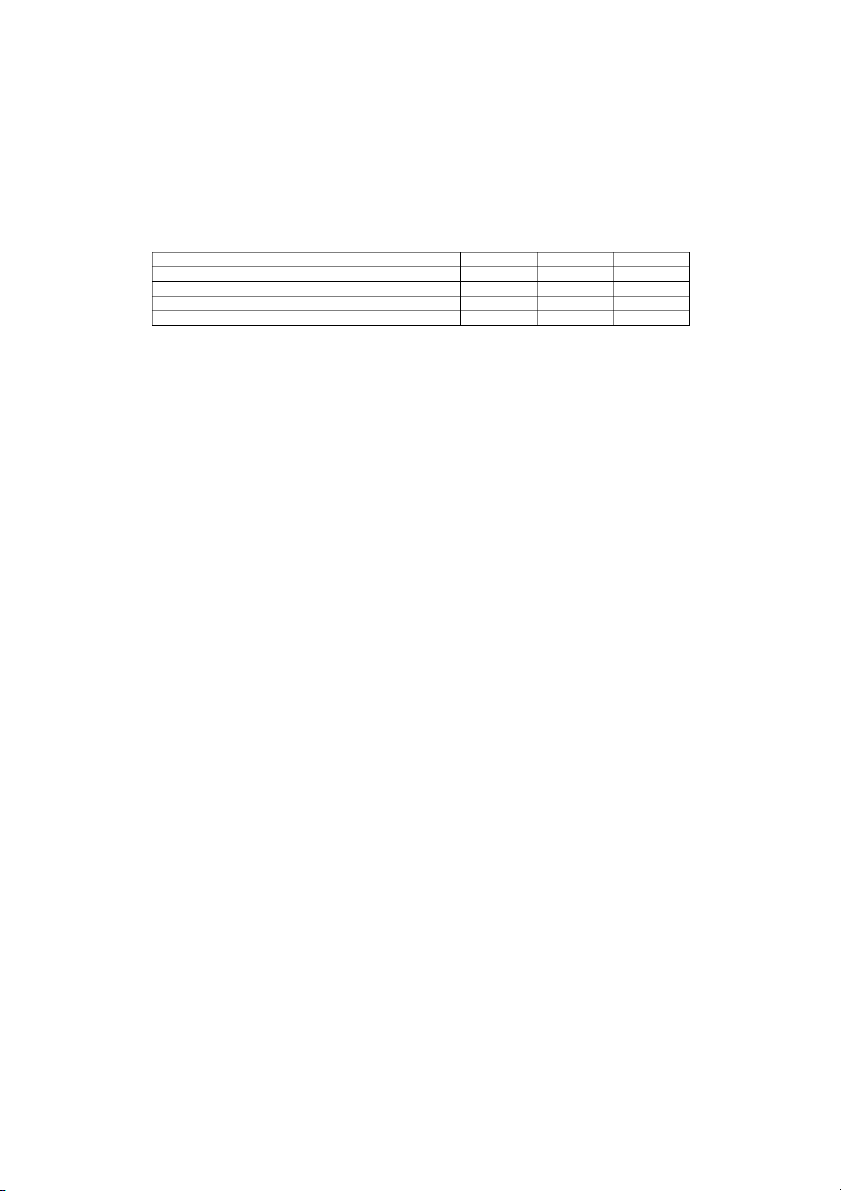

Table 1 – Tyre Market “Radialization” in India

Radial tyre market share (in volume) 1995 2008 2018 Passenger vehicle 28% 95% 98%

Light commercial vehicle (LCV) 9% 12% 40%

Medium & high commercial vehicle (M&HCV) 1% 4% 45%

Two- and three-wheeler (motorcycle, scooter and “tuk-tuk”) 0% 0% 1.5%

Source: (i) Michelin in the Land of the Maharajahs (A): Note on the Tire Industry in India (Case Study, Ivey

Publishing, Ivey Business School, 9B07M030). (ii) ATMA (2017b) ATMA Review. Indian Automobile Industry,

FY2016-17 (Apr-Dec), ATMA Periodicals (http://www.mohitnarang.in/atma/wp-content/uploads/2018/03/Atma-

Periodicals_17-4-17.pdf, accessed on December 6, 2018). (iii) FY2018 Apollo Tyres’ annual reports

(https://corporate.apollotyres.com/en-in/investors/financial-reporting/, accessed on December 1, 2018).

The Tyre Industry in India: Markets and Products

New tyre distribution corresponds to three

better tyre mileage and improved road

main channels in India. First, tyres are

infrastructure. It is also much more uncertain

directly sold to carmakers through a

since it annually varies according to tyre

business-to-business channel, also known as imports.

OEM (Original Equipment Manufacturers)

The OEM market consists of the major

(see Figure 3). Second, the replacement

Indian and non-Indian carmakers. The main

market takes place once the tyres get worn-

tyre buyers are presented below:

out or punctured. It consists of garages and

tyre dealers, including small retailers and

In the passenger vehicle market,

large distribution networks. Third, tyres

Maruti Suzuki (Maruti Udyog group) is

produced by the Indian tyre industry are

India’s oldest and largest carmaker. Owned

exported abroad. In 2018, unit sales are

by the Japanese Suzuki and the Indian

broken down across these three markets as

State, it detains a 47% share of the

follows: 43% for OEM market, 51% for

passenger vehicle market13. Although it has

replacement market and 6% for export

lost some market share since 2005 (51%), it

market11. This sales breakdown is distinct

remains the dominant player with 1.3

from that observed worldwide: 25-30% for

million cars sold in 2016. Its closest

OEM market and 70-75% the replacement

competitor is Hyundai whose market share

market. This is specific to emerging is only 17%.

economies where the level of household

In the commercial vehicle market,

equipment, still low, is booming by high

Tata Motors (Tata group) is the market

growth. It is worth mentioning that

leader with a 55% market share14. It started

penetration of passenger vehicles is below 20

to build cars in 1954 in partnership with

per 1,000 people in India compared to 786 in

Daimler Benz. Its closest competitor is

the US12. But, in value, the market is skewed

Ashok Leyland with a 31% market share.

toward the replacement segments which

While Tata Motors has balanced sales

account for 70% of total sales. In the coming

across the commercial vehicle market,

years, the considerable OEM distribution

Ashok Leyland is more focused on

channel will not only maintain but may

commercial vehicles ranging from 12 to

strengthen its position since it is nurtured by 16.2 tons.

the structural growth of customer’s original

As regards two- and three-wheelers,

equipment. The replacement market for the

the segment is highly concentrated around

tyre industry is much less dynamic due to

the following players: Hero Moto (32%),

_________________________________ 4 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

Honda (24%), Bajaj (18%) and TVS

and tyre dealers. Some are exclusive

(14%)15. It is worth noting that these

(franchised or not) distributors, while others

companies have crossed the 20 million unit

are multi-brand. The trend is towards vertical

sales in 201816 . Among them, the Hero

integration of distribution and development

Moto, formerly linked with Honda until

of online distribution by tyre makers. This is

2010, is the world largest two-wheeler

notably the case for JK Tyre, with the maker.

development of “JK Tyre Steel Wheels,” and

As regards tractors and agriculture

for CEAT, with “CEAT Shoppes.” In the

vehicles, OEM in India forms the world’s

replacement market, the price of tyres is a

largest industry in this domain. It is

priority purchase criterion for customers,

dominated by Mahindra Motors with more

particularly for those who have a motorcycle,

than a quarter of market share, TAFE

a scooter or a three-wheeler (“tuk-tuk”).

(19%), which produces and sells under its

At the other end of this capital-intensive

brand name and Massey Ferguson brand,

industry, 60 to 65% of sales are devoted on

and Swaraj (16%), part of Mahindra group

average to raw material cost (or input cost) since 200717. whereas SG&A (sales, general &

Various foreign carmakers such as

administration) and personnel cost amounts

Toyota, Ford and Nissan have entered the

to 13 to 26% of sales (see Figure 5).

Indian automotive industry to reach the

Nevertheless, these average input costs can

consumer markets but also as a basis for

hide wide differences across Indian tyre

export in Asia. Nissan dedicates 73% of its makers (see following section on

vehicles manufactured in India to export;

competitors). In addition, as illustrated in

Ford 58%. In stark contrast, the Indian

Figure 5, the price of raw materials tends to

commercial vehicle industry exports 10%

cyclically change according to stock

of its production while 19% of passenger

speculations, political contexts but also

vehicle production is exported.

economic dynamics linked to each raw

As their major customers are heavily

material industry. In addition to this, Indian

concentrated in competitive segments, these

companies are faced with specific issues of

OEMs have obtained large price cuts from

import tax on raw materials from the Indian

suppliers such as tyre companies while these

government. Consequently, the major

latter have been unable to pass on higher raw

challenge for this industry is to reach

material prices, fearing market share losses.

profitability despite the ups-and-downs of

the supply market and its dependence on

As regards the replacement market, it large customers.

consists of thousands of independent garages

_________________________________ 5 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

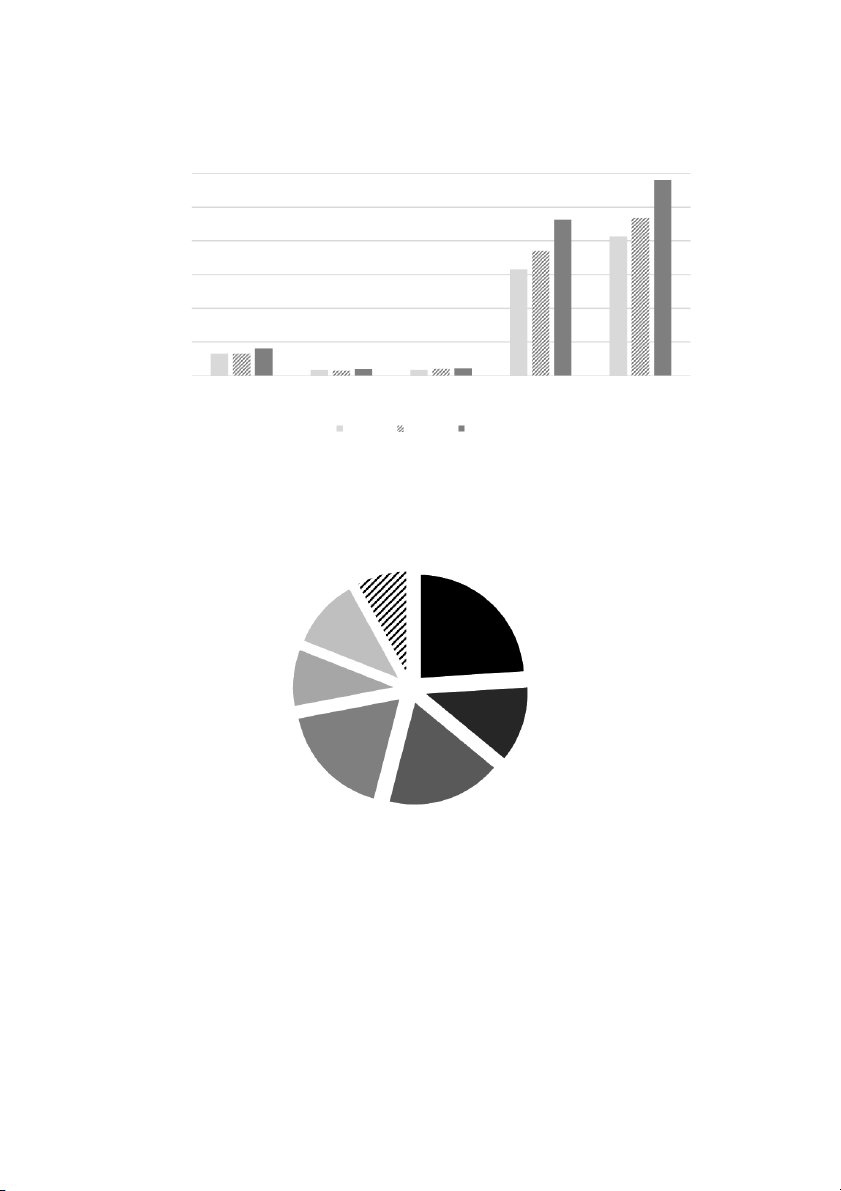

Figure 3 – Vehicle Production in India (2013-2018) 30 25 20 its n u n 15 illio M 10 5 0 Passenger vehicles Commercial Three wheelers Two wheelers Grand total vehicles 2012-13 2014-15 2017-18

Source: Society of Indian Automobiles Manufacturers (SIAM), 2018

(http://www.siamindia.com/uploads/filemanager/47AUTOMOTIVEMISSIONPLAN.pdf, accessed on December 3, 2018).

Figure 4 – Tyre Cost Structure in India Margin and depreciation 9-22% Natural rubber cost Personnel cost 23-26% 7-14% SG&A cost 6-12% Synthetic rubber cost 10-13% Other raw material costs 16-20% Other crude derivative cost 16-20%

Source: Alphà Invesco, Understanding the Indian tyre industry, key players and the road ahead, 2018

(https://www.alphainvesco.com/blog/understanding-the-indian-tyre-industry/, accessed on December 16, 2018).

As Indian customers are highly price-

Apollo Tyres and CEAT) have tried to team

sensitive, they are attracted by tyres imported

up with Chinese tyre makers in order to

at low prices from China. These imported

jointly produce radial tyres and match the

tyres have an average price that is 30% lower

lower-priced imported Chinese tyres.

than tyres sold by Indian companies.

Tyre exports have reached Rs. 100 million in

Besides, some Indian companies (JK Tyre,

2017. Recording a 20% increase, the US has

_________________________________ 6 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

emerged as the biggest market for Indian

companies are also present in other emerging

tyres exports. The US market has imported

economies in Latin America, South-East

28 million tyres from India, accounting for

Asia, the Middle East and Africa.

15% of all Indian exports18. Indian tyre

Figure 5 – Variations in Input Costs

(Brent Crude Oil, Carbon Black, Natural Rubber and Synthetic Rubber Costs)

Source: from top left to bottom right, brent crude oil, carbon black, natural rubber and synthetic rubber. (i) For

synthetic rubber, crude oil and carbon black, Federal Reserve Economic, monthly, not seasonally adjusted. (ii) For

synthetic rubber, Data index Jun 1981=100. (iii) For carbon black Dec. 1983=100. All data available on the

website: https://fred.stlouisfed.org, accessed on December 16, 2018. (iv) For natural rubber, US Dollar per

kilogram, monthly, not seasonally adjusted (www.indexmundi.com, accessed on December 16, 2018).

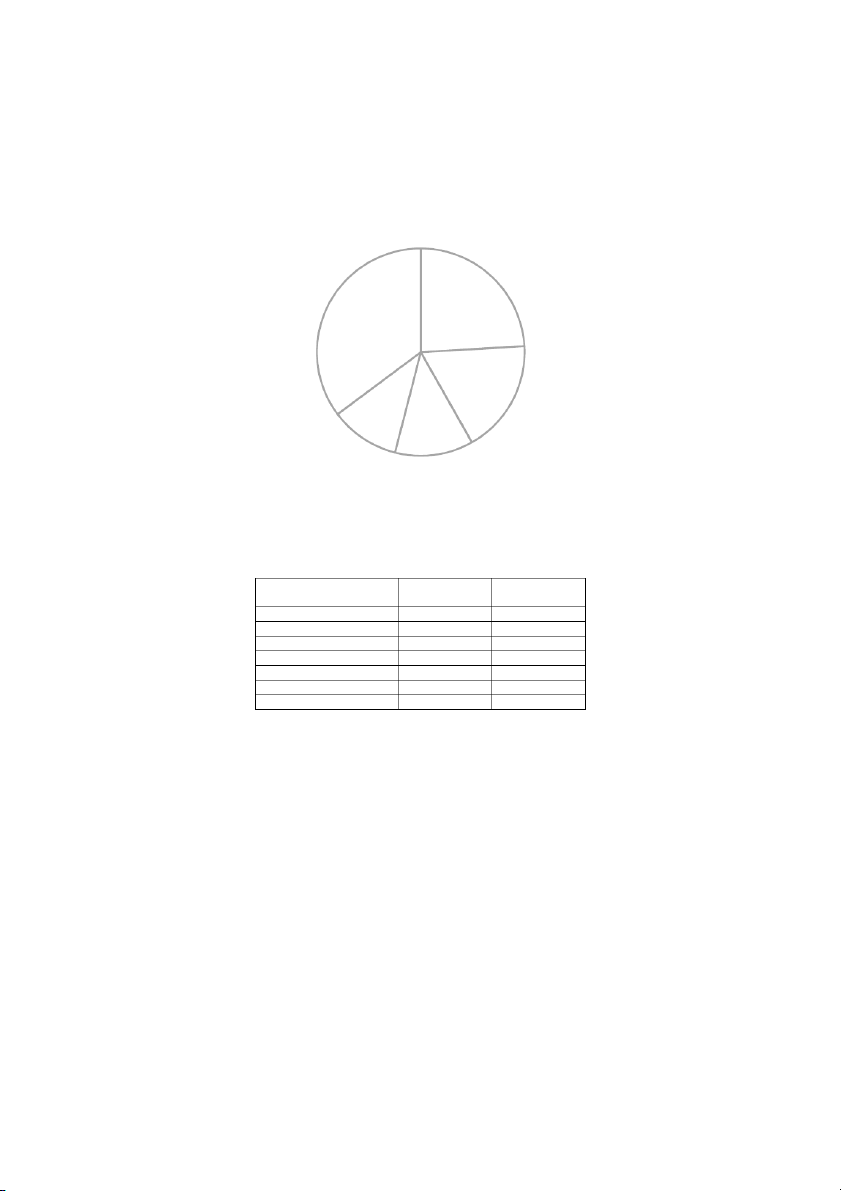

Figure 6 – Breakdown of Market Sales and Volume by Tyre Segment (FY2016) VOLUME SALES Others 54% Truck & bus 1% 5% Farm Passenger vehicle 14% 5% LCV 2- and 3-wheeler 13% 13% Truck & bus LCV 9% 23% Passenger vehicle Farm 8% 54% 2- and 3-wheeler 2% Others

Source: ATMA (2017b) ATMA Review. Indian Automobile Industry, FY2016-17 (Apr-Dec), ATMA Periodicals

(http://www.mohitnarang.in/atma/wp-content/uploads/2018/03/Atma-Periodicals_17-4-17.pdf, accessed on December 6, 2018).

_________________________________ 7 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

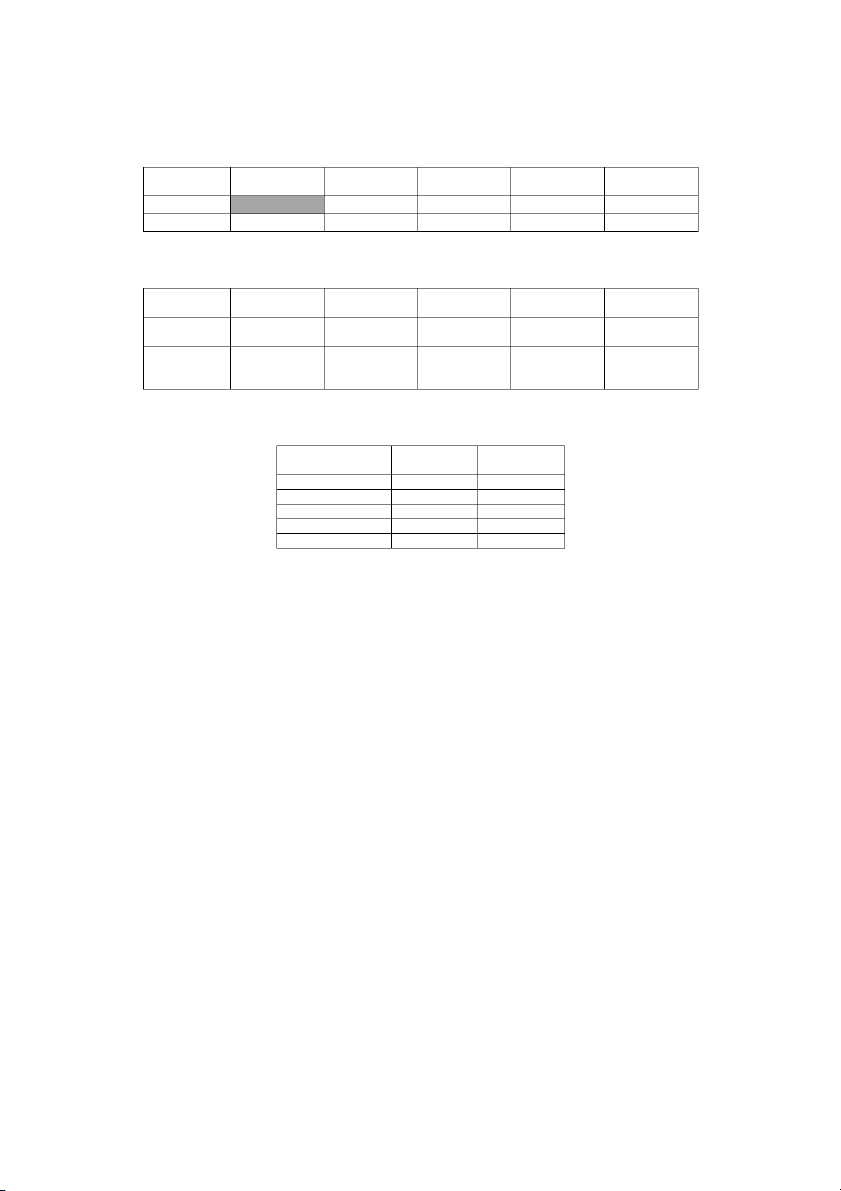

Table 2 – Breakdown of Tyre Sales in India by Market and Product (FY2017, in volume) Passenger vehicle

Medium & high commercial vehicle (M&HCV) OEM Replacement Export OEM Replacement Export Volume 43% 51% 6% 15% 71% 14% Two- and three-wheeler

Light commercial vehicle (LCV) OEM Replacement Export OEM Replacement Export Volume 51% 47% 2% 27% 53% 20%

Source: (i) Michelin’s Internal Data on the World Tyre Market (2018). (ii) ATMA (2017b) ATMA Review. Indian Automobile

Industry, FY2016-17 (Apr-Dec), ATMA Periodicals, available on the webpage: http://www.mohitnarang.in/atma/wp-

content/uploads/2018/03/Atma-Periodicals_17-4-17.pdf, accessed December 6, 2018).

These three markets (OEM, replacement and

Passenger vehicle (or car) tyre sales represent

export markets) concern several lines of

14% of total tyre sales by volume and around

products: M&HCV tyres (mainly bus and

23% by value (see Figure 6). This difference

truck tyres), car tyres, two- and three-wheeler

is explained by the increase in car

tyres, LCV tyres (see Table 2).

performance, the development of the radial

tyre and the emergence of strong brands in

In the fiscal year 2015-16 (or FY2016),

the Indian market. In the coming years, both

commercial vehicle tyres accounted for 18%

replacement and OEM markets are expected

of all tyres sold in India while their sales

to grow annually in line of years 2015-17, at

constitute 63% of the revenue (see Figure 6).

a pace above 5% (Michelin’s Internal Data

This is explained not only by the cost

on the World Tyre Market, 2018). OEM

production but also by truck driver’s and

market will lead the way as passenger vehicle

fleet manager’s business needs. They

market is forecast to grow yearly at 10%

demand a robust tyre at a good price, rate20.

withholding the load all the way. They have

been led to think in terms of cost per

In stark contrast to the commercial vehicle

kilometre rather than the tyre buy-in cost,

tyre segment, two- and three-wheeler tyres

which prompts them to include the tyre

represent 54% of all tyres sold in India

mileage and retreading in their cost

whereas its forms 13% of sales (see Figure

calculation. Furthermore, some sense of

6). There is strong competition in this

relationship between the tyre and fuel

segment, with a strong focus of customers on

consumption has grown since several years.

price, which results for tyre makers in regular

From this point of view, the radial tyre is

drops in prices and margins. Due to its

much more economical than the cross-ply

affordability and low maintenance cost, this

tyre. From the tyre industry’s standpoint, all

means of transport should grow at a faster

these factors mean at best a stagnant demand,

pace than passenger vehicle. As this tyre

which has even decreased in the years 2015-

market is quasi-exclusively made up of

2017, especially in the replacement segment

cross-ply tyres, it is sheltered from Chinese

(Michelin’s Internal Data on the World Tyre imports. Consequently, the domestic

Market, 2018). The only increasing market

industry will fully benefit from this demand,

will be the OEM, driven by commercial

which explains that all major tyre companies

vehicle sales, which are correlated with the

have lately invested this segment 21. GDP growth19.

The Tyre Industry in India: Market Shares and Competition

In FY2018, the Indian tyre market

locally 60 manufacturing facilities along

amounted to approximately Rs. 595,000 with dozen of importers (mostly

million. This market is made up of 39

Chinese). However, four Indian tyre

Indian and foreign companies operating

makers alone―MRF (leader), Apollo

_________________________________ 8 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

Tyres, JK Tyre and CEAT―stand out

industry concentration is even stronger,

with cumulated sales accounting for

especially in the commercial tyre segment

around 65% of the entire tyre market (see (see Table 3).

Figure 7). In terms of volume, the

Figure 7 – Market Shares (in Value) of Tyre Makers in India (FY2018) MRF 24% Others 35% Apollo Tyres 18% CEAT 11% JK Tyre 12%

Nota Bene: we estimated the market shares of tyre makers in this figure by dividing their respective

FY2018 total sales (minus foreign sales) by the FY2018 total value of the Indian tyre market

(amounting to approximately Rs. 595,000 million).

Table 3 – Market Shares (in Volume) by Product (FY2018) Passenger Commercial Tyre maker vehicle vehicle MRF 10.9% (leader) 21.5% Apollo Tyres 8.9% 24.9% (leader) JK Tyre 6.0% 20.1% Other Indian tyre makers 33.4% 22.2% Global tyre makers* 32.6% 7.0% Chinese exporters** 3.9% 4.3% Other Asian exporters*** 4.3% -

* Cumulated market shares of the five world’s largest tyre makers

(Bridgestone, Goodyear, Michelin, Continental and Pirelli).

** This category also includes Taiwanese tyre makers such as Maxxis.

*** Cumulated market shares of Hankook (South Korea), Nexen (South

Korea), Kumho (South Korea), GITI (Singapore), Toyo (Japan),

Sumitomo (Japan) and Yokohama (Japan).

Source : Michelin’s Internal Data on the World Tyre Market (2018).

Despite a growing tyre market, several

commercial vehicle radial and two- and

incumbents have recently encountered

three-wheeler tyres), to JK Tyre on April

tougher competitive conditions and 2016.

subsequently faced financial distress,

Many factors may explain the difficulties

leading to company restructuring and

faced by some Indian tyre makers,

industry consolidation: for instance,

especially in the commercial vehicle

Falcon Tyres, a full-range tyre maker,

radial tyre and passenger car radial tyre

filed for bankruptcy in 2017 and Birla

segments (see developments in the

Tyres, a highly indebted tyre maker, sold

introductory section) but the aggressive

off one of its subsidiaries, Cavendish

pricing of Chinese and Taiwanese

Industries (specialized in manufacturing

exporters (Maxxis, Shandong Linglong

_________________________________ 9 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

yre and Hangzhou Zhongce Rubber) in

CAGR) during the same period22. On

the replacement market seems to be a key

September 2018, the Indian government

destabilizing factor. Chinese tyre makers

responded to this trend by imposing

started exporting commercial vehicle

another set of customs duties (15%) on

radial tyres for the OEM market at the end

imported passenger car radial tyres.

of the 1990s, as the local capacity was not These higher customs duties will

sufficient to fulfil the Indian truck

probably lead Chinese exporters to

makers’ needs. Over time, Indian truck

modify their Indian market strategy and makers considerably reduced their

to favor equity entry modes over exports.

Chinese tyre purchase, as they were not

A good illustration is the recent

satisfied with the tyre quality. Chinese

greenfield investment decision made by

exporters have redirected their sales to

one of the world’s largest two-wheeler

the replacement market where end

tyre maker, the Taiwan-based Maxxis

customers are more sensitive to tyre

group. Targeting 15% (in volume) of the

price. Today, they grab a record 14.9%

Indian two- and three-wheeler tyre

share for commercial vehicle radial tyres

segment in five years, Maxxis has locally

sold to the replacement market (see Table

set up a manufacturing facility with a 4).

yearly capacity of 7.3 million tyres in

Consequently, Indian tyre makers have March 2018.

lobbied their government to increase

Facing with these threats, Indian tyre

customs duties on tyre imports. In

makers are currently reviewing their

September 2017, the Indian government

competitive strategy and pursuing new

took a first step against Chinese imports,

directions for growth: (i) extending their

known as the Anti-Dumping Duty

product range and striving to become full-

(ADD): customs duties on commercial

range tyre makers, (ii) expanding abroad,

vehicle radial tyres imported from China

especially in emerging economies, and

and Taiwan rose from 10 to 15%. Over

(iii) developing their online distribution.

time, the ADD enforcement has had

As regards this last growth direction,

opposite impacts on the Indian tyre

Indian tyre makers have devised distinct

market: on one side, it has led to slowing

online distribution strategies: some tyre

down the flows of imported Chinese

makers sell tyres on their own e-

commercial vehicle radial tyres in India

commerce website (Bridgestone India,

but on the other side, it has diverted these

GoodYear India, Michelin India, MRF

flows to the passenger vehicle radial tyre

and Apollo Tyres) while others favor

segment. While total tyre imports have

independent and specialized websites

risen by 6.1% (compound average growth

such as tyres.cardekho.com or consumer

rate, CAGR) between FY2015 and goods shopping websites such as

FY2018, imported passenger car radial Snapdeal or Flipkart.

tyres have grown at a faster pace (12.7%

_________________________________ 10 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

Table 4 – Market Shares (in Volume) by Product / Market (FY2018) Passenger vehicle Commercial vehicle Tyre maker OEM Replacement OEM Replacement MRF 20.4% (leader) 15.2% 22.9% Apollo Tyres 16.6% 31.2% (leader) 23.5% (leader) 64.3% JK Tyre 11.2% 26.2% 18.7% Other Indian tyre makers 6.7% 23.5% 21.9% Global tyre makers* 32.6% 32.6% 3.1% 8.0% 7.1% (7.2% in the 5.0% (14.9% in Chinese exporters** - 0.8% radial segment) the radial segment) Other Asian exporters*** 3.1% 5.4% - -

* Cumulated market shares of the five world’s largest tyre makers (Bridgestone, Goodyear, Michelin, Continental and Pirelli).

** This category also includes Taiwanese tyre makers such as Maxxis.

*** Cumulated market shares of Hankook (South Korea), Nexen (South Korea), Kumho (South Korea), GITI (Singapore), Toyo

(Japan), Sumitomo (Japan) and Yokohama (Japan).

Source: Michelin’s Internal Data on the World Tyre Market (2018).

Table 5 – Market Shares (in Volume) by Product / Technology (FY2018) Passenger Commercial vehicle Tyre maker vehicle radial Cross-ply Radial MRF 10.7% (leader) 26.6% (leader) 13.7% Apollo Tyres 8.9% 23.7% 26.7% (leader) JK Tyre 5.9% 19.4% 21.1% Other Indian tyre makers 33.4% 30.3% 14.6% Global tyre makers* 32.9% - 13.2% Chinese exporters** 3.8% - 10.7% Other Asian exporters*** 4.4% - -

* Cumulated market shares of the five world’s largest tyre makers (Bridgestone, Goodyear,

Michelin, Continental and Pirelli).

** This category also includes Taiwanese tyre makers such as Maxxis.

*** Cumulated market shares of Hankook (South Korea), Nexen (South Korea), Kumho (South

Korea), GITI (Singapore), Toyo (Japan), Sumitomo (Japan) and Yokohama (Japan).

Source: Michelin’s Internal Data on the World Tyre Market (2018).

The Tyre Industry in India: Competitors ■ MRF

(in value) in India hovers around 24.1% (see

Figure 7). MRF is a full-range tyre maker

(see Table 6), which occupies a leading

position in most product segments in India

(passenger vehicle, two- and three-wheeler, agriculture and OTR tyres).

CEO (FY2018): K.M. Mammen

MRF has eight manufacturing facilities

Sales (FY2018): Rs. 156,956.2 million ($US 2,396

(mostly located in the south of India) and a million)

distribution network of 5,000 dealers in India

Indian and world market shares (in value, (including 4,200 directly-operated

FY2018): 24.1% (ranked 15 th world tyre maker)

stores―MRF TireTok, MRF MuscleZone

Listed on the Bombay Stock Exchange: Yes

and MRF FASST―and 800 MRF T&S

franchised stores). In 2017, the Indian tyre

The creation of Madras Rubber Factory

company started distributing its products

(MRF) in Chennai (Tamil Nadu province)

online through its website and the MRF T&S

dates back to 1946. The company has been network.

leading the Indian tyre industry for 40 years

and ranks 15th among the 30 largest tyre

The first international move of the Indian

makers in the world. Its current market share

tyre company occurred in 1964 with the

_________________________________ 11 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

opening of a commercial representative

Philippines and Middle East countries. Over

office in Lebanon. Today, the Indian tyre

the FY2013-18 period, MRF’s sales in its

company achieves 8.6% of its sales abroad

export markets have stagnated following the

through exports. Its main geographical

intense price competition imposed by

markets are Sri Lanka, Indonesia, the Chinese tyre makers.

Table 6 – MRF: Product and Technology (FY2018) Passenger Commercial Two- and three- Agriculture and LCV vehicle vehicle wheeler OTR vehicle Cross-ply ■ ■ ■ ■ Radial ■ ■ ■ ■

Source: FY2018 MRF’s annual report (www.mrftyres.com/financial-results, accessed on November 26, 2018).

Table 7 – MRF: Market Shares (Value) (FY2005 and FY2018) Passenger Commercial Two- and three- Agriculture and LCV vehicle vehicle wheeler OTR vehicle 2005 25% 19% n.a. 42% leader 2018 23% (leader) 25% n.a. 37% (leader) leader

Source : FY2018 MRF’s annual report (https://www.mrftyres.com/financial-results, accessed on November 26, 2018).

Table 8 – MRF: Financial Data (in Rs. m) 2013-14 2014-16 2016-17 2017-18 (FY 2014) (18 months) (FY2017) (FY2018) Total sales 133,961.9 228,146.1 152,601.8 156,956.2 Foreign sales 13,320.0 18,560.0 13,160.0 13,530.0 Total assets 98,339.9 132,538.1 150,484.7 164,784.8 Shareholder equity 45,395.5 72,243.4 85,444.2 96,042.0 CSR expenses n.a. 225.5 392.4 94.9 R&D expenses 340.8 548.9 1,996.8 1,108.6 Input cost 82,989.0 111,629.1 76,799.5 89,853.8 Net profit 9,083.2 24,870.8 14,862.2 11,316.1 Market-to-book ratio 3.05 2.25 2.98 3.15

Note Bene: Before 2014, financial data of MRF were estimated over a yearly period ranging from

September N-1 to September N and from 2016, over a yearly period ranging from March N-1 to March N.

Source: (i) Orbis (https://orbis.bvdinfo.com, accessed on November 26, 2018). (ii) MRF’s

annual reports (2014, 2015, 2016, 2017, and 2018; https://www.mrftyres.com/financial-results,

accessed on November 26, 2018). ■ Apollo Tyres

share in value) and 17th among the 30 largest

tyre makers in the world. Initially, Apollo

Tyres was specialized in manufacturing and

selling truck tyres. Building on a leading

competitive position in the commercial

vehicle segment (27% market share in value

CEO (FY2018): Onkar S. Kanwar

and 24.9% in volume), Apollo Tyres has

Sales (FY2018): Rs. 152,119.5 million ($US 2,322

followed two directions for growth: product million)

range extension and internationalization.

Indian and world market shares (in value,

Throughout its history, the Indian tyre maker

FY2018): 17.7% (ranked 17 th world tyre maker)

has strived to expand into all tyre segments,

Listed on the Bombay Stock Exchange: Yes

with its latest entry into the two- and three-

wheeler tyre segment in 2016 (see Table 9).

Created in 1972, Apollo Tyres ranks 2nd in

Today, Apollo Tyres is a full-range tyre

the Indian tyre industry (with a 17.7% market

maker with a strong focus on the replacement

_________________________________ 12 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

market where it achieves the largest share of

While its internationalization strategy is its sales in India.

unique in the Indian tyre context, Apollo

Tyres has also suffered notable setbacks in

As regards its internationalization, Apollo

this matter. First, the rising level of South

Tyres differentiates itself from most of the

Africa’s political and economic uncertainty,

Indian tyre makers, which rely on exports to

which was observed at the beginning of the

expand abroad (except JK Tyre). First,

2010s, produced operational disruptions,

Apollo Tyres is today the Indian tyre maker

sharp labor cost increase and financial issues

with the highest internationalization intensity

for the Apollo Tyres’ local subsidiary. As

with a 30.5% foreign sales-to-total sales ratio

stated by the tyre maker’s Chief Business

(see Table 11). The Indian tyre maker sells

Officer, Sunam Sarkar, in Forbes India: “post

its products in 102 countries with a majority

the 2010 Fifa World Cup in South Africa,

proportion of foreign sales achieved in the

there was a lot of industrial unrest.

European market. Second, the tyre maker’s

Electricity rates rose rapidly and the entire

has leveraged its foreign sales mostly

tyre industry went on strike for a month.

through taking over local tyre makers and

Cheap Chinese imports to South Africa also

setting up wholly-owned manufacturing and

caused a lot of pain to domestic tyre

distribution subsidiaries. These different

manufacturers”24. Finally, Apollo Tyres

internationalization features explain why

decided to sell off Dunlop Tyres South

Apollo Tyres is often cited as an example of

Africa and the “Dunlop” brand rights to “emerging multinational.”

Sumitomo Rubber in 2014. Second, Apollo

Apollo Tyres started its internationalization

Tyres attempted to enter the US tyre market

by taking over Dunlop Tyres South Africa in

by launching a takeover bid on Cooper Tire

2006. This acquisition allowed the Indian

& Rubber (ranked 12th world tyre maker) in

tyre maker to benefit from a manufacturing

2013. However, after a long negotiation

base in South Africa and the “Dunlop” brand

process, the bid ended up negatively with the

rights for 32 African countries. After this first

bid rejection from the US tyre maker’s

international entry, Apollo Tyres accelerated

shareholders and after a strong opposition

its international expansion pace with the

expressed by Cooper subsidiary’s employees

takeover of the Dutch tyre maker, in China.

Vredestein, in 2009. Lastly, Apollo Tyres

Apollo Tyres has four manufacturing

consolidated its European position with a

facilities (with two additional manufacturing

record investment (Rs. 40,000 million) to set

facilities in Europe) and a distribution

up a wholly-owned manufacturing facility in

network of 5,300 dealers in India (including

Hungary. As emphasized by the tyre maker’s

1,700 franchised exclusive stores: “Apollo

CEO, Onkar S. Kanwar, during the

Zone” “Apollo CV Zone” and “Apollo

inauguration: “this is the first time the

Point”). Its main ambition for the next years

company has set up a plant outside India

is to dethrone MRF as the leader of the Indian

from scratch”23 . Fully operating in 2018, this

tyre industry. To this purpose, Apollo Tyres

second manufacturing base in Europe (the

has unveiled an ambitious 5-year investment

first one is the Vredestein’s manufacturing

plan (Rs. 38,000 million), aiming to set up a

facility in the Netherlands) allowed Apollo

new manufacturing facility in India with a

Tyres to supply the local OEM and

capacity of 5.3 million passenger vehicle

replacement markets with an additional 5.5

tyres and 1 million commercial vehicle tyres.

million passenger vehicle tyres and 675,000 commercial vehicle tyres.

_________________________________ 13 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

Table 9 – Apollo Tyres: Product Mix, Type and Technology (FY2018) Passenger Commercial Two- and three- Agriculture and LCV vehicle vehicle wheeler OTR vehicle Sales 39% 42% 7% 2% 10% Cross-Ply ■ ■ ■ (since 2016) ■ Radial ■ (since 2000) ■ ■ ■ (since 2016) ■

Source: FY2018 Apollo Tyres’ annual reports (https://corporate.apollotyres.com/en-in/investors/financial-reporting/,

accessed on December 1, 2018).

Table 10 – Apollo Tyres: Market Shares (Value) (FY2005 and FY2018) Passenger Commercial Two- and three- Agriculture and LCV vehicle vehicle wheeler OTR vehicle 2005 13% 26% 26% - 23% 27% (leader) and 24% in the 2012 17% n.a. 2% n.a. radial segment (leader)

Source: FY2018 Apollo Tyres’ annual report (https://corporate.apollotyres.com/en-in/investors/financial-reporting/,

accessed on December 1, 2018).

Table 11 – Apollo Tyres: Financial Data (in Rs. m) 2013-14 2014-15 2015-16 2016-17 2017-18 (FY2014) (FY2015) (FY2016) (FY2017) (FY2018) Total sales 135,098.2 128,692.2 129,195.1 143,217.6 152,119.5 Foreign sales 50,526.7 35,905.1 34,624.2 42,965.2 46,457.3 Total assets 90,455.8 91,352.2 116,538.2 152,961.1 201,532.4 Shareholder equity 45,746.2 54,190.3 66,046.1 72,899.5 97,766.7 CSR expenses n.a. 56.8 129.3 185.0 215.6 R&D expenses 757.5 1,042.7 1,712.5 1,749.4 1,559.7 Input cost 71,067.4 64,188.4 53,142.1 53,132.2 62,811.5 Net profit 10,050.5 9,776.0 11,229.6 10,989.9 7,238.8 Market-to-book ratio 1.76 1.70 1.35 1.46 1.61

Nota Bene: Apollo Tyres’ financial data were estimated over a yearly period ranging from March N-1 to March N.

Source: Orbis (https://orbis.bvdinfo.com, accessed on November 26, 2018) and Apollo Tyres’ annual reports (2014,

2015, 2016, 2017, and 2018; https://corporate.apollotyres.com/en-in/investors/financial-reporting/, accessed on December 1, 2018). ■ JK Tyre

JK Tyre is a subsidiary of JK Industries,

which is a conglomerate operating in

different Indian industries: cement (JK

Lakshmi), paper (JK Paper), food processing (Umang Dairies), biotech (JK Agri

Genetics), insurance (JK Risk Managers &

CEO (FY2018): Raghupati Singhania

Insurance Brokers) and tyres. JK Industries

created its tyre business unit in 1972. The

Sales (FY2018): Rs. 66,109.5 million ($US 1,009

company ranks 3rd in the Indian tyre industry million)

(with a 12.2% market share in value) and

Indian and world market shares (in value,

22nd among the 30 largest tyre makers in the

FY2018): 12.2% (ranked 22 nd world tyre maker)

world. Throughout its history, JK Tyre has

Yearly manufacturing capacity (FY2018): 31.8

privileged the acquisition mode to expand

million tyres (7.9 million in Mexico and 23.9 million

quickly in the tyre industry, both locally and in India) internationally.

Listed on the Bombay Stock Exchange: Yes

Pioneer of radial tyres in India, JK Tyre has

built a strong competitive position in the

_________________________________ 14 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

LCV and commercial vehicle tyre segment.

JK Tyre has nine manufacturing facilities

The Indian tyre maker enjoys the second (with three additional manufacturing

largest share for commercial vehicle radial

facilities in Mexico) and a distribution

tyres (with 21.1% market share in volume,

network of 3,700 dealers in India (including

see Table 5) and commercial vehicle tyres

400 directly-operated stores: 60 “JK Tyre

sold in the OEM market (with 26.2% market

Xpress Wheels” stores for two- and three-

share in volume, see Table 4). It is also the

wheeler tyres, 300 “JK Tyre Steel Wheels”

volume leader in the LCV (cross-ply and

stores for passenger vehicle tyres and 40 “JK

radial) tyre segment with 32% market share.

Tyre Truck Wheels” stores for commercial

This strong focus on the LCV and vehicle tyres).

commercial vehicle tyre segments is

JK Tyre expanded abroad early in its history.

reflected in the company’s total sales: this

In 1974, it signed a distribution agreement

segment accounts for 60% of the company

with General Tire & Rubber to sell its tyres

sales. Another focus of the tyre maker is the

in the US. This was its first international

replacement market where it achieves 58%

move. Today, JK Tyre exports its products in

of its sales (with 19% for foreign sales and

over 100 countries and achieves 14.7% of its 23% for OEM).

sales abroad. The acquisition (completed on

While strengthening its competitive position

April 11, 2008) of the Mexican tyre maker,

in the LCV and commercial vehicle tyre

Tornel, was a milestone in its international

segment, JK Tyre has sought new directions

expansion strategy. It has allowed JK Tyre to

for growth. First, it recently entered the two-

access the Central and South American tyre

and three-wheeler tyre segment: on April 18,

market and gain greater access to the North

2016, it completed the acquisition of the two-

American tyre market benefitting from the

and three-wheeler tyre maker, Cavendish

North American Free Trade Association

Industries (from the financially distressed

(NAFTA) agreement. JK Tyre has steadily

Birla Tyres). This acquisition brings JK Tyre

invested in its Mexican subsidiary, growing

three manufacturing facilities with a yearly

the yearly manufacturing capacity from 4.5

capacity of 8.5 million tyres. This acquisition

million tyres (FY2008) to 7.9 million tyres

adds manufacturing capacities in the

(FY2018). This acquisition can be viewed as

commercial vehicle radial tyre segment and

a success with regard to the foreign sales

allows JK Tyre to enter the two- and three-

growth reported from 2007 (year prior to the

wheeler tyre segment. Second, attracted by

acquisition) to 2018. Over this period, the

the high growth in the Indian aircraft

foreign sales grew from Rs. 4,810 million

industry, JK Tyre intends to develop new

(15% of total sales) to Rs. 12,580 million

product lines for this industry in the near (19%) (see Table 14). future.

Table 12 – JK Tyre: Product Mix, Type and Technology (FY2018) Passenger Commercial Two- and three- Agriculture and LCV vehicle vehicle wheeler OTR vehicle 21% (including See passenger Sales 60% 3% 16% LCV) vehicle Cross-ply ■ ■ ■ (since 2016) ■ Radial ■ ■ ■ ■

Source: FY2018 JK Tyre’s annual reports (https://www.jktyre.com/annualreports.aspx, accessed on November 28, 2018).

Table 13 – JK Tyre: Market Shares (in Value) (FY2005 and FY2018) Passenger Commercial Two- and three- Agriculture and LCV vehicle vehicle wheeler OTR vehicle 2005 18% 25% n.a. - n.a. 2018 14% 32% n.a. 3% n.a.

Source: FY2018 JK Tyre’s annual report (https://www.jktyre.com/annualreports.aspx, accessed on November 28, 2018).

_________________________________ 15 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

Table 14 – JK Tyre: Financial Data (in Rs. m) 2013-14 2014-15 2015-16 2016-17 2017-18 (FY2014) (FY2015) (FY2016) (FY2017) (FY2018) Total sales 82,609.7 80,428.5 76,069.8 83,832.8 85,434.1 Foreign sales 10,400.0 8,440.0 5,810.0 9,370.0 12,580.0 Total assets 60,426.1 67,321.9 70,781.3 104,351.9 105,674.6 Shareholder equity 10,971.2 14,010.1 17,514.3 21,097.9 21,031.1 CSR expenses n.a. 20.7 47.5 43.5 45.5 R&D expenses 290. 381.3 478.1 570.1 609.6 Input cost 48,843.3 44,346.5 37,893.2 44,514.0 52,466.5 Net profit 2,630.2 3,296.6 4,696.1 3,602.2 576.3 Market-to-book ratio 0.67 1.71 1.09 1.41 1.74

Nota Bene: JK Tyre’s, financial data were estimated over a yearly period ranging from March N-1 to March N.

Source : (i) Orbis (https://orbis.bvdinfo.com, accessed on November 26, 2018). (ii) JK Tyre’s annual reports (2014, 2015,

2016, 2017, and 2018; https://www.jktyre.com/annualreports.aspx, accessed on November 28, 2018). ■ CEAT

Historically, CEAT has expanded over time

by focusing on two product segments:

commercial vehicle and two- and three-

wheeler tyres. Recently, it shifted its focus

more on the passenger vehicle tyre,

CEO (FY2018): Anant Goenka

agriculture and OTR segments as these

record increasing margin and growth (see

Sales (FY2018): Rs. 64,291.4 million ($US 981 million)

Table 16). The CEAT’s market mix follows

a standard pattern for the largest Indian tyre

Indian market share (in value, FY2018): 10.8%

makers, with a strong emphasis on

Yearly manufacturing capacity (FY2018): 34.6

replacement (61% of its sales with 12% for million tyres

foreign sales and 27% for OEM).

Listed on the Bombay Stock Exchange: Yes

CEAT has six manufacturing facilities (five

The CEAT brand originates from the

in India and one in Sri Lanka) and a

Italian CEAT group (Cavi Electrici Affini

distribution network of 4,500 dealers in

Torino), which created a wholly-owned

India (including 280 directly-operated two-

subsidiary in India in 1958, CEAT Tyres of

wheeler stores and 500 exclusive franchised

India. RPG group took over the tyre maker stores, “CEAT Shoppes”).

in 1982. RPG group is an Indian

conglomerate operating in communication

In 1981, CEAT initiated its first

technology (KEC International), software

international move by signing a worldwide

(Zensar Technologies), biotech (RPG Life

distribution agreement with Pirelli. Today,

Sciences), and tea and rubber plantations

CEAT exports its products in over 100

(Harrisons Malayalam). While being part of

countries, achieving 12% of its sales abroad

the Indian RPG group, CEAT has kept

(see Table 17). It has established

strong ties with Italy: in 1981 and 2011, it representative offices in Indonesia,

signed an agreement with the Italian tyre

Germany and the United Arab Emirates, maker, Pirelli, for transferring its

and has set up a 50:50 manufacturing joint

worldwide rights for the CEAT brand; and

venture (CEAT Kelani) in Sri Lanka where

in 2018, it became the official sponsor of the

it now occupies a leading market position.

Italian football team, Torino FC.

_________________________________ 16 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

Table 15 – CEAT: Product Mix, Type and Technology (FY2018) Passenger Commercial Two- and three- Agriculture and LCV vehicle vehicle wheeler OTR vehicle 7% (agriculture) Sales 14% 32% 12% 31% and 4% (OTR) Cross-ply ■ ■ ■ ■ Radial ■ ■ ■

Source: FY2008 CEAT’s annual report (https://www.ceat.com/corporate/investor/financials, accessed on November 30, 2018).

Table 16 – CEAT: Market Shares (in Value) (FY2005 and FY2018) Passenger Commercial Two- and three- Agriculture and LCV vehicle vehicle wheeler OTR vehicle 2005 11% 18% 22% 11% 16% 2018 8% 11% n.a. 28% n.a.

Source: FY2018 CEAT’s annual report (https://www.ceat.com/corporate/investor/financials, accessed on November 30, 2018).

Table 17 – CEAT: Financial Data (in Rs. m) 2013-14 2014-15 2015-16 2016-17 2017-18 (FY2014) (FY2015) (FY2016) (FY2017) (FY2018) Total sales 55,679.7 57,747.3 61,735.9 64,599.4 64,291.4 Foreign sales 11,135.9 10,394.5 8,025.6 7,751.9 7,714.9 Total assets 35,400.5 37,816.7 41,079.5 49,169.4 51,609.9 Shareholder equity 10,286.1 17,461.1 20,869.8 24,441.0 26,294.6 CSR expenses 37.8 34.4 77.3 101.1 107.1 R&D expenses 187.0 215.5 532.8 1,331.6 1,008.0 Input cost 35,649.9 33,626.1 29,537.8 33,088.8 36,521.4 Net profit 2,707.8 3,139.2 4,357.1 3,592.2 2,332.9 Market-to-book ratio 1.49 1.90 2.09 2.19 2.31

Nota Bene: CEAT’s financial data were estimated over a yearly period ranging from March N-1 to March N.

Source : (i) Orbis (https://orbis.bvdinfo.com, accessed on November 30, 2018). (ii) CEAT’s annual reports (2014, 2015,

2016, 2017, and 2018; https://www.ceat.com/corporate/investor/financials, accessed on November 30, 2018). ■ TVS Srichakra

Srichakra manufactures and sells the full

range of two- and three-wheeler tyres and

has recently expanded into the OTR and

agriculture tyre segment. The two- and

three-wheeler tyre specialist has a leading

CEO: Shobhana Ramachandhran

position in the OEM market where it

Sales (FY2018): Rs. 22,181.3 million ($US 339

achieves most of its sales (see Table 18). million)

As regards its international expansion, the

Indian market share (in value, FY2018): 3.3%

Indian tyre maker exports its products in 65

Yearly manufacturing capacity (FY2018): 26.0

countries (mostly in Africa and South million tyres

America), achieving 9.4% of its sales

Listed on the Bombay Stock Exchange: Yes abroad (see Table 20).

The TVS automobile distribution group

created TVS Srichakra in 1982. TVS

_________________________________ 17 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

Table 18 – TVS Srichakra: Tyre and Technology (FY2018) Passenger Commercial Two- and three- Agriculture and LCV vehicle vehicle wheeler OTR vehicle Cross-ply ■ ■ Radial ■

Source : FY2018 TVS Srichakra’s annual report https://www.tvstyres.com/financial/annual.php, accessed on December 6, 2018).

Table 19 – TVS Srichakra: Market Shares (in Value) (FY2005 and FY2018) Passenger Commercial Two- and three- Agriculture and LCV vehicle vehicle Wheeler OTR vehicle 2005 - - - 21% n.a. 2018 - - - 26% n.a.

Source : FY2018 TVS Srichakra’s annual report https://www.tvstyres.com/financial/annual.php, accessed on December 6, 2018).

Table 20 – TVS Srichakra: Financial Data (in Rs. m) 2013-14 2014-15 2015-16 2016-17 2017-18 (FY2014) (FY2015) (FY2016) (FY2017) (FY2018) Total sales 19,393.0 21,805.1 23,606.0 21,355.3 22,181.3 Foreign sales 2,237.5 2,065.7 2,044.8 2,005.1 2,102.0 Total assets 10,252.2 9,695.5 9,617.3 13,909.6 14,250.7 Shareholder equity 2,134.1 2,822.8 4,121.4 5,534.3 6,312.4 CSR expenses n.a. 8.8 15.6 31.2 41.8 R&D expenses 296.2 171.5 235.9 250.8 295.9 Input cost 11,009.0 11,487.6 10,624.4 11,411.6 12,299.1 Net profit 565.8 996.3 1,862.2 1,496.9 1,173.4 Market-to-book ratio 0.95 3.76 4.29 4.76 3.03

Nota Bene: TVS Srichakra’s financial data were estimated over a yearly period ranging from March N-1 to March N.

Source: (i) Orbis (https://orbis.bvdinfo.com, accessed on November 30, 2018). (ii) TVS Srichakra’s annual reports (2014,

2015, 2016, 2017, and 2018; https://www.tvstyres.com/financial/annual.php, accessed on December 6, 2018). ■ Goodyear India

1961 and corresponds to the first entry of

the Goodyear Tire & Rubber group into the Indian tyre market.

Goodyear India operates two plants, which

manufacture radial (passenger vehicle,

CEO (FY2018): Rajeev Anand

commercial vehicle, LCV and agriculture

Sales (FY2018): Rs. 17,426.2 million ($US 266

and OTR) tyres. The Indian tyre maker is million)

the leader (in value) in the radial agriculture

Indian market share (in value, FY2018): 2.9% tyre segment (see Table 22).

Listed on the Bombay Stock Exchange: Yes

Goodyear India achieves the majority share

Goodyear India is the Indian wholly-owned

of its sales in the OEM market. It also

subsidiary of the US Goodyear Tire &

distributes its products through a multi-

Rubber group, the third largest tyre maker brand dealer network.

in the world. This subsidiary was created in

_________________________________ 18 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

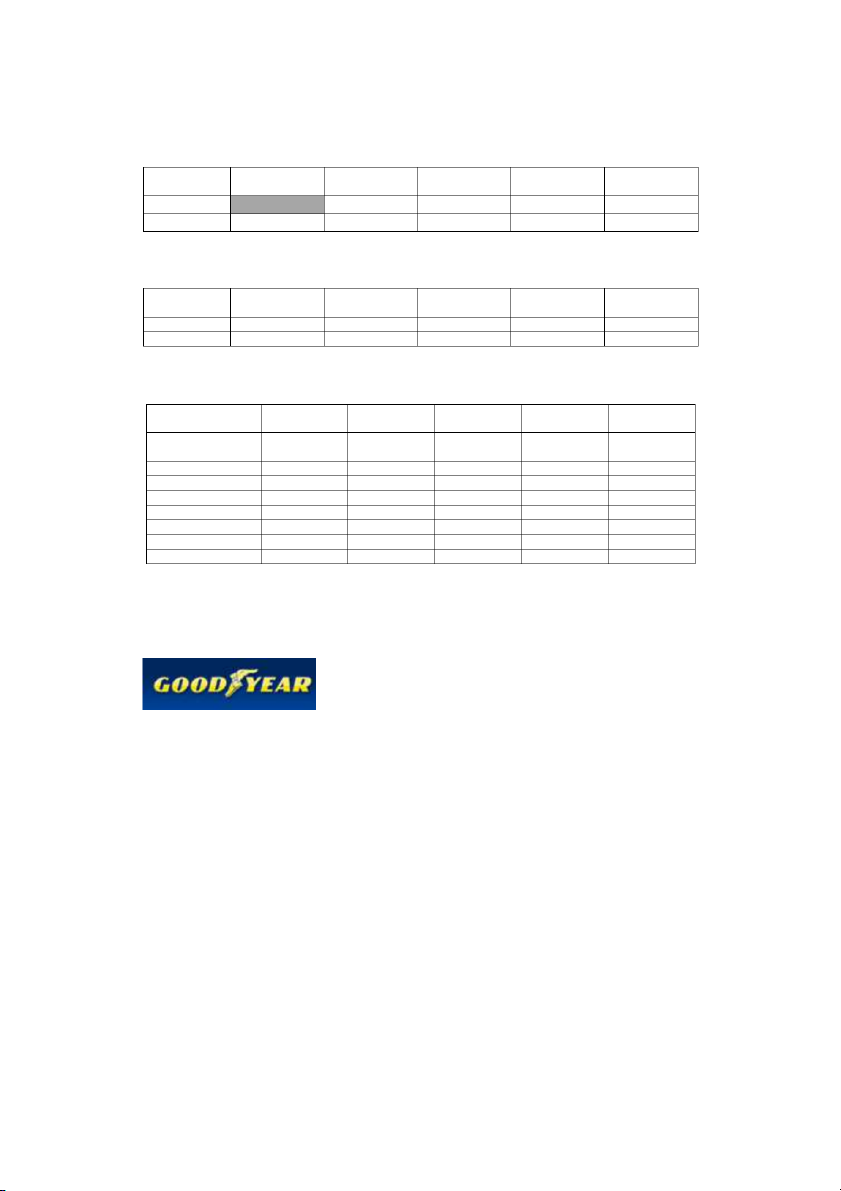

Table 21 – Goodyear India: Tyre and Technology (FY2018) Passenger Commercial Two- and three- Agriculture and LCV vehicle vehicle wheeler OTR vehicle Cross-ply Radial ■ ■ ■ ■

Source: FY2018 Goodyear India’s annual report (https://www.goodyear.co.in/investor-relations; accessed on December 5, 2018).

Table 22 – Goodyear India: Market Shares (in Value) (FY2005 and FY2018) Passenger Commercial Two- and three- Agriculture and LCV vehicle vehicle Wheeler OTR vehicle 2005 10 to 14% 4% - - 10 to 14% Leader in the radial 2018 n.a. n.a. - - agriculture segment

Source: FY2018 Goodyear India’s annual report (https://www.goodyear.co.in/investor-relations; accessed on December 5, 2018).

Table 23 – Goodyear India: Financial Data (in Rs. m) 2015-16 2016-17 2017-18 (FY2016) (FY2017) (FY2018) Total sales 18,969.7 16,600.1 17,426.2 Total assets 9,349.6 10,895.7 12,975.7 Shareholder equity 6,141.2 7,070.8 8,021.9 Input cost 6,245.2 5,736.1 6,998.6 Net profit 1,196.6 1,262.8 1,298.1 Market-to-book ratio 1.90 2.76 3.20

Nota Bene: Goodyear India’s financial data were estimated over a yearly period

ranging from March N-1 to March N.

Source : (i) Orbis (https://orbis.bvdinfo.com, accessed on November 30, 2018). (ii)

Goodyear India’s annual reports (2014, 2015, 2016, 2017, and 2018;

https://www.goodyear.co.in/investor-relations, accessed on November 30, 2018). ■ Bridgestone India

manufacturing facility in 1996. Today,

Bridgestone India operates two plants,

which manufacture 5.4 million radial

(passenger vehicle, commercial vehicle and CEO: Parag Satpute

two- and three-wheeler) tyres. This

manufacturing capacity allows Bridgestone

Yearly manufacturing capacity (2018): 5.4 million tyres

India to meet 90% of its India tyre demand

(the remainder is covered with imports).

Listed on the Bombay Stock Exchange: No

Bridgestone India has a balanced approach

Bridgestone India is the Indian wholly-

to the Indian tyre market with 53% of its owned subsidiary of the Japanese

sales in the OEM segment and 47% in the

Bridgestone group, the world’s largest tyre replacement segment. maker.

Bridgestone India has a distribution

The Japanese group entered the Indian tyre

network of 3,000 dealers in India (including industry by setting up its first

500 exclusive “Bridgestone” stores).

_________________________________ 19 _________________________________

_______________________ Tyre Maharajahs Case Study _______________________

Table 24 – Bridgestone India: Tyre and Technology (FY2018) Passenger Commercial Two- and three- Agriculture and LCV vehicle vehicle wheeler OTR vehicle Cross-ply Radial ■ (since 1996) ■ (since 1996) ■ (since 2016)

Source: FY2018 Bridgestone India’s annual report (http://www.bridgestone.co.in/Investors_Information.aspx; accessed on December 5, 2018).

Table 25 – Bridgestone India: Market Shares (in Value) (FY2005 and FY2018) Passenger Commercial Two- and three- Agriculture and LCV vehicle vehicle Wheeler OTR vehicle 30% in the 2005 n.a. - - - radial segment 19% (leader in 2018 the radial n.a. - n.a. - segment)

Source: FY2018 Bridgestone India’s annual report (http://www.bridgestone.co.in/Investors_Information.aspx; accessed on December 5, 2018).

Table 26 – Bridgestone India: Financial Data (in Rs. m) 2015-16 2016-17 (FY2016) (FY2017) Total sales 28,088.7 26, 963.4 Total assets 38,063.3 41,314.6 Shareholder equity 27,121.3 30,217.2 Input cost 11,268.0 9,730.4 Net profit 1,942.3 3,101.8

Nota Bene: Bridgestone India’s financial data were estimated

over a yearly period ranging from March N-1 to March N.

Source: Orbis (https://orbis.bvdinfo.com, accessed on December 5, 2018). End Notes

1 RubberAsia, Indian tyre industry has big growth potential; interview of Anant Goenka, ATMA Chairman, May 18, 2018

(https://www.rubberasia.com/2018/05/18/indian-tyre-industry-big-growth-potential-anant-goenka-chairman-atma/, accessed on December 3, 2018).

2 TyreAsia, Changing face of Indian tyre industry, November 5, 2018 (http://tyre-asia.com/2018/11/05/changing-face-of-

indian-tyre-industry/, accessed on December 3, 2018).

3 International Monetary Fund, World Economic Outlook: Challenges to Steady Growth, October 2018,

(https://www.imf.org/en/Publications/WEO/Issues/2018/09/24/world-economic-outlook-october-2018, accessed on December 3, 2018). 4 Society of Indian Automotive Manufacturers (SIAM), Automotive Mission Plan 2026,

(http://www.siamindia.com/uploads/filemanager/47AUTOMOTIVEMISSIONPLAN.pdf, accessed on December 3, 2018).

5 The Economic Times Auto , Imported car tyres to become dearer; Govt hikes custom duty by 5%, September 26, 2018

(https://auto.economictimes.indiatimes.com/news/tyres/imported-tyres-to-become-dearer-govt-hikes-custom-duty-by-

5/65968616, accessed on December 16, 2018. Commodity Online,

Indian tyre industry hit by weak Natural Rubber supplies, December 4, 2017

(https://www.commodityonline.com/commodity-news/indian-tyre-industry-hit-by-weak-natural-rubber-supplies/news-

now/18049, accessed on December 17, 2018).

6 The Financial Express, Natural rubber output may decline by 20% due to Kerala Floods, adversely impact Indian tyre

industry, September 7, 2018 (https://www.financialexpress.com/industry/natural-rubber-output-may-decline-by-20-due-to-

kerala-floods-adversely-impact-indian-tyre-industry/1305061/, accessed on December 17, 2018).

7 Money Control , Not after volume, but after profitable growth, says Neeraj Kanwar of Apollo Tyres, May 24, 2018

(https://www.moneycontrol.com/news/business/companies/not-after-volume-but-after-profitable-growth-says-neeraj-kanwar-

of-apollo-tyres-2575311.html, accessed on December 17, 2018).

8 The Economic Times Auto , Imported car tyres to become dearer; Govt hikes custom duty by 5%, September 26, 2018,

(https://auto.economictimes.indiatimes.com/news/tyres/imported-tyres-to-become-dearer-govt-hikes-custom-duty-by-

5/65968616, accessed on December 16, 2018).

_________________________________ 20 _________________________________