Preview text:

CHAP 7

E5.1: Mr. McKenzie has prepared the following list of statements about service companies and merchandisers.

1. Measuring net income for a merchandiser is conceptually the same as for a service company. T rue

2. For a merchandiser, sales less operating expenses is called gross profit.

False For a merchandiser, sales less operating expenses is not called gross profit, it is called

operating income / operating profit.

3. For a merchandiser, the primary source of revenues is the sale of inventory. True

4. Sales salaries and wages is an example of an operating expense. True

5. The operating cycle of a merchandiser is the same as that of a service company.

False The operating cycle of a merchandiser is different from that of a service company.

- The operating cycle of a merchandiser includes: purchasing inventory, selling inventory, and collecting accounts receivable.

- The operating cycle of a service company includes: providing services and collecting payments.

6. In a perpetual inventory system, no detailed inventory records of goods on hand are maintained.

False In a perpetual inventory system, there are detailed inventory records of goods on hand are

maintained. This keeps a continuous and updated record of inventory quantities and values, allowing for

real-time tracking of inventory levels.

7. In a periodic inventory system, the cost of goods sold is determined only at the end of the accounting period. True

8. A periodic inventory system provides better control over inventories than a perpetual system.

False A perpetual inventory system provides better control over inventories than a periodic system.

In a perpetual system, inventory records are continuously updated, providing real-time information on

inventory levels, cost of goods sold, … E5.2

a. Journalizing the transactions using a perpetual inventory system: May 1: Dr. Accounts Payable 4,200 Cr. Inventory 4,200 May 2: Dr. Accounts Receivable 2,100 Cr. Sales Revenue 2,100 Dr. Cost of Goods Sold 1,300 Cr. Inventory 1,300 May 5: Dr. Inventory 300 Cr. Accounts Payable 300 May 9:

Dr. Cash 2,058 ($2,100 - $21 discount)

Dr. Sales Discounts 42 ($2,100 x 1%) discount

Cr. Accounts Receivable 2,100 May 10:

Dr. Accounts Payable 4,158 ($4,200 - ($4,200 x 0.02 discount)) Cr. Cash 4,158 May 11: Dr. Supplies 400 Cr. Cash 400 May 12: Dr. Inventory 1,400 Cr. Cash 1,400 May 15: Dr. Cash 150 Cr. Accounts Payable 150 May 17: Dr. Inventory 1,300 Cr. Accounts Payable 1,300 May 19: Dr. Accounts Payable 130 Cr. Cash 130 May 24: Dr. Cash 3,200 Cr. Sales Revenue 3,200 Dr. Cost of Goods Sold 2,000 Cr. Inventory 2,000 May 25: Dr. Inventory 620 Cr. Accounts Payable 620 May 27:

Dr. Accounts Payable 1,274 ($1,300 - $26 discount) Cr. Cash 1,274 May 29:

Dr. Sales Returns & Allowances 30

Dr. Inventory 40 ($70 - $30 fair value of returned merchandise) Cr. Cash 70 May 31: Dr. Accounts Receivable 1,000 Cr. Sales Revenue 1,000 Dr. Cost of Goods Sold 560 Cr. Inventory 560

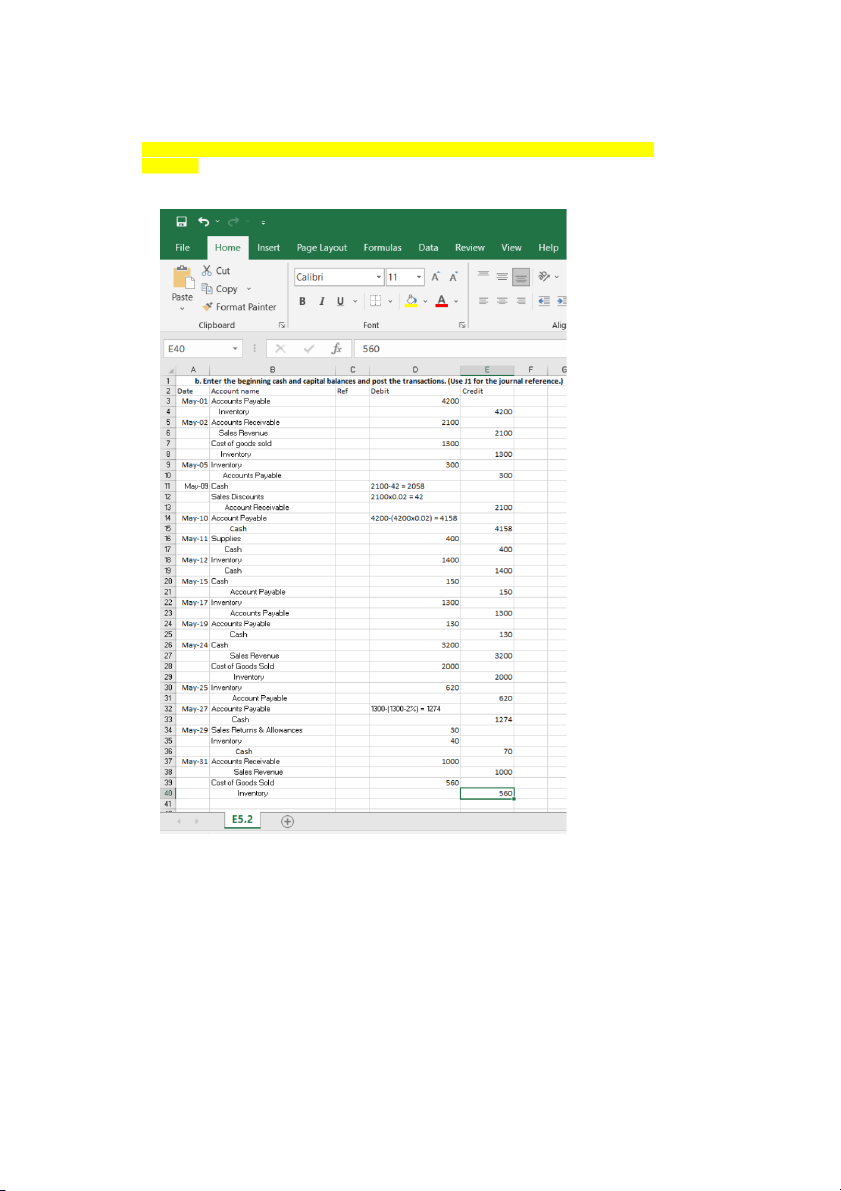

b. Enter the beginning cash and capital balances and post the transactions. (Use J1 for the journal reference.)

c. Income statement through gross profit for the month of May 2020: Renner Hardware Store Income Statement For the Month of May 2020 Sales Cash Sales $3,200

Sales on Account $2,100 + $1,000 = $3,100

Total Sales $3,200 + $3,100 = $6,300 Cost of Goods Sold

Cost of Goods Sold for merchandise sold on May 2 $1,300

Cost of Goods Sold for merchandise sold on May 31 $560

Total Cost of Goods Sold $1,300 + $560 = $1,860

Gross Profit: Total Sales - Cost of Goods Sold = $6,300 - $1,860 = $4,440 P.EX:

a) Journalizing the transactions

June 2: Purchased on account 640 units from AAA, $2.5/unit. Dr. Inventory 1600 Cr. Accounts Payable 1600

June 3: Returned 60 units to AAA, $2.5/unit. Dr. Accounts Payable 150 Cr. Inventory 150

June 10: Sold 800 units on account to TT Company, selling price $8/unit. Dr. Accounts Receivable 6,400 Cr. Sales Revenue 6,400 Dr. Cost of Goods Sold 1,200 Cr. Inventory Credit 1,200

June 12: Purchased 450 units of merchandise purchased on account from PT Company, $3/unit. Dr. Inventory 1,350 Cr. Accounts Payable 1,350

June 12: Paid cash less discount of 2% for AAA. Dr. Accounts Payable 1,568 Cr. Cash 1,568

June 15: Received 20 units returned by TT due to incorrect specifications.

Dr. Sales Returns and Allowances 160 Cr. Accounts Receivable 160 Dr. Inventory 40 Cr. Cost of Goods Sold 40

June 16: Received cash from TT Company, less discount of 5%. Dr. Cash 5,968 Dr. Sales Discounts 240 Cr. Accounts Receivable 6,200

June 22: Purchased on account equipment from PL Company, purchase price $3,600. Paid freight and installation $200. Dr. Equipment 3,800 Cr. Accounts Payable 3,800

June 22: Paid rent, $700, on office space. Dr. Rent Expense 700 Cr. Cash 700

June 30: Paid cash for salary for June, $1,200. Dr. Salary Expense 1,200 Cr. Cash 1,200

June 30: Record monthly depreciation, $1,000.

Dr. Depreciation Expense 1,000

Cr. Accumulated Depreciation 1,000

June 30: Close entries to determine net income.

Dr. Income Summary (Total Revenue - Total Expenses)

Cr. Owner's Capital (Total Revenue - Total Expenses)

a) Post the transactions to T-accounts: | Debit | Credit ------------------------------ Cash | 5,800 | 9,436 ------------------------------

Accounts Receivable | 9,000 | 6,200 ------------------------------ Inventory | 1,710 | 1,310 ------------------------------ Equipment | 4,000 | 7,800 ------------------------------

Accumulated Depreciation | 1,500 | 1,000 ------------------------------

Accounts Payable | 2,000 | 4,918 ------------------------------ Bank loan (LT) | 3,800 | 3,800 ------------------------------

Notes Payable (LT) | 4,000 | 4,000 ------------------------------ Income Tax Payable | 700 | ------------------------------ Owner's Capital | 7,400 | ------------------------------ Sales | 6,400 | ------------------------------ Cost of Goods Sold | 1,240 | ------------------------------

Sales Returns and Allowances | 160 | ------------------------------ Sales Discounts | | 240 ------------------------------

Depreciation Expense | 1,000 | ------------------------------ Rent Expense | 700 | ------------------------------ Salary Expense | 1,200 | ------------------------------

Income Summary | | (Net Income) ------------------------------

b) Multiple-step income statement for June 2020: ABC Company Income Statement

For the Month Ended June 30, 2020 Sales Revenue $6,400

Less: Sales Returns & Allowances $160 Less: Sales Discounts $240 Net Sales $6,000 Cost of Goods Sold $1,240 Gross Profit $4,760 Operating Expenses: Depreciation Expense $1,000 Rent Expense $700 Salary Expense $1,200

Total Operating Expenses $2,900 Operating Income $1,860 Income Tax Expense (20%) $372 Net Income $1,488

b) Classified balance sheet as of June 30, 2020: ABC Company Balance Sheet As of June 30, 2020 Assets: Current Assets: Cash $9,436 Accounts Receivable 6,200 Inventory 1,310 Total Current Assets $16,946

Property, Plant, and Equipment: Equipment 7,800

Less: Accumulated Depreciation 1,000

Net Property, Plant, and Equipment $6,800 Total Assets $23,746 Liabilities: Current Liabilities: Accounts Payable $4,918