Preview text:

6/15/20 Chapter 12 Operating Exposure 1 Learning Objectives

• Examine how operating exposure arises in a

multinational firm through unexpected

changes in corporate cash flows

• Analyze how to measure operating

exposure’s impact on a business unit

through the sequence of volume, price,

cost, and other key variable changes

• Evaluate strategic alternatives to managing operating exposure

• Detail the proactive policies firms use in managing operating exposure 12-2

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 2 1 6/15/20 Operating Exposure

• Operating exposure, also called economic

exposure, competitive exposure, and even

strategic exposure, on occasion, measures

any change in the present value of a firm

resulting from changes in future operating

cash flows caused by an unexpected change in exchange rates.

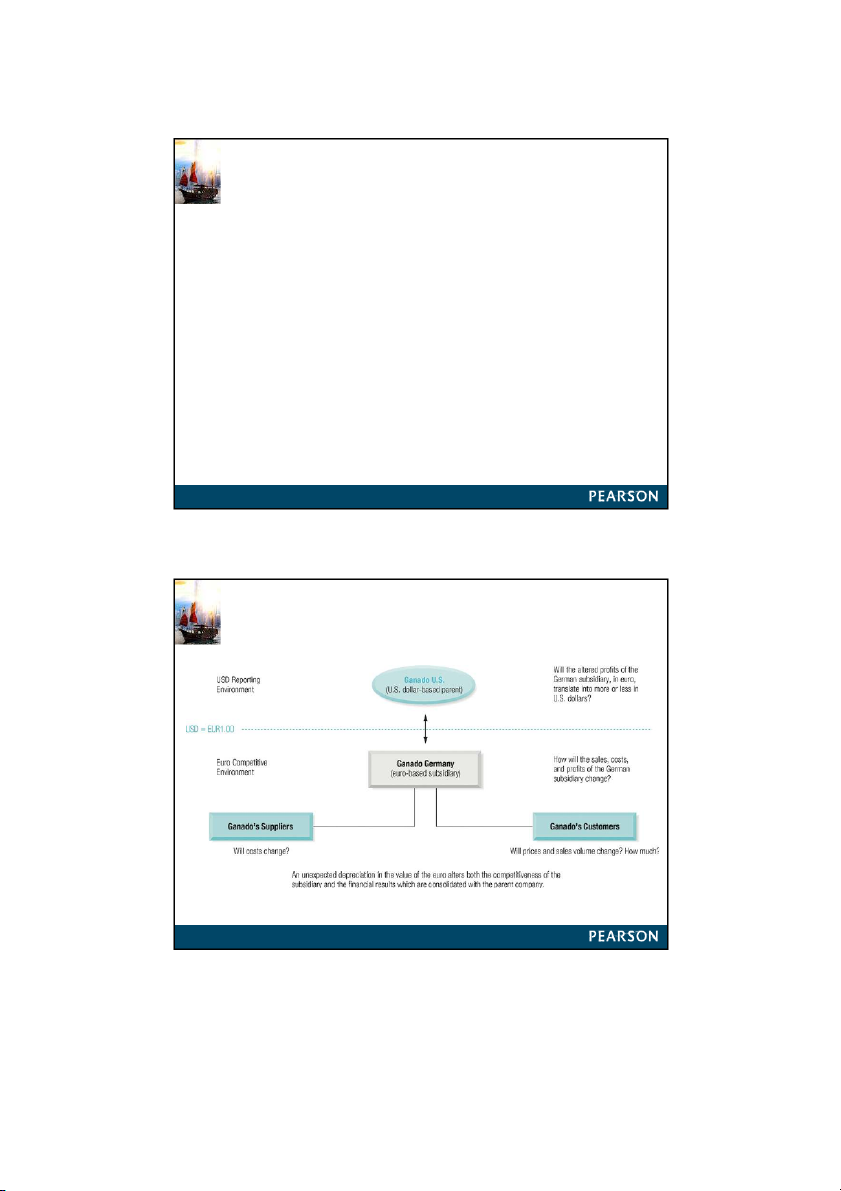

• Ganado Corp. is a U.S.-based multinational

firm. Exhibit 12.1 shows Ganado’s basic

structure and currencies of operation. 12-3

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 3

Exhibit 12.1 Ganado Corporation: Structure and Operations 12-4

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 4 2 6/15/20

Ganado Corporation Cash Flows

• Operationally the functional currencies of

the individual subsidiaries in combination

determine the overall operating exposure of the firm in total.

• Net operating cash flow is the source of

value created by the firm over time

• Ganado in Germany buys and sells in euros,

Ganado U.S. buys and sells in dollars, but

Ganado China has sales based in dollars,

euros, and renminbi—the latter being the

dominant cash flow for Ganado China 12-5

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 5

Static versus Dynamic Operating Exposure

• Measuring exchange rate exposure required analysis of short

and intermediate term fixed or static) contracts, and longer

term (more dynamic) forecasting

• Using Ganado as an example, we have 3 divisions of roughly

equal size and we assume the dollar is depreciating against

the euro while the renminbi is slowly revaluing.

– Ganado China: In the short-term, fewer profits, may need to raise prices in the long-term

– Ganado Germany: No change in the short–term, may also be

affected by eventual higher prices from China

– Ganado U.S.: No change in the short–term, may also be affected

by eventual higher prices from China 12-6

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 6 3 6/15/20

Operating and Financing Cash Flows

• The cash flows of the MNE can be divided into

operating cash flows and financing cash flows.

• Operating cash flows arise from intercompany

(between unrelated companies) and intracompany

(between units of the same company) receivables

and payables, rent and lease payments, royalty and

license fees and assorted management fees.

• Financing cash flows are payments for loans

(principal and interest), equity injections and

dividends of an inter and intracompany nature.

• Exhibit 12.2 summarizes cash flow possibilities for Ganado U.S. and China. 12-7

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 7

Exhibit 12.2 Financial and Operating Cash Flows Between Parent and Subsidiary 12-8

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 8 4 6/15/20 Expected versus Unexpected Changes in Cash Flow

• Operating exposure is far more important for the

long-run health of a business than changes caused

by transaction or translation exposure.

• However, operating exposure is inevitably

subjective because it depends on estimates of

future cash flow changes over an arbitrary time horizon.

• Planning for operating exposure is a total

management responsibility because it depends on

the interaction of strategies in finance, marketing, purchasing, and production. 12-9

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 9 Expected versus Unexpected Changes in Cash Flow

• An expected change in foreign exchange rates is not included in the

definition of operating exposure, because both management and

investors should have factored this information into their evaluation

of anticipated operating results and market value.

• From a manager’s perspective, budgeted financial statements

already reflect information about the effect of an expected change in exchange rates.

• From a debt service perspective, expected cash flow to amortize debt

should already reflect the international Fisher effect.

• From an investor’s perspective, if the foreign exchange market is

efficient, information about expected changes in exchange rates

should be reflected in a firm’s market value.

• Only unexpected changes in exchange rates, or an inefficient foreign

exchange market, should cause market value to change. 12-10

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 10 5 6/15/20

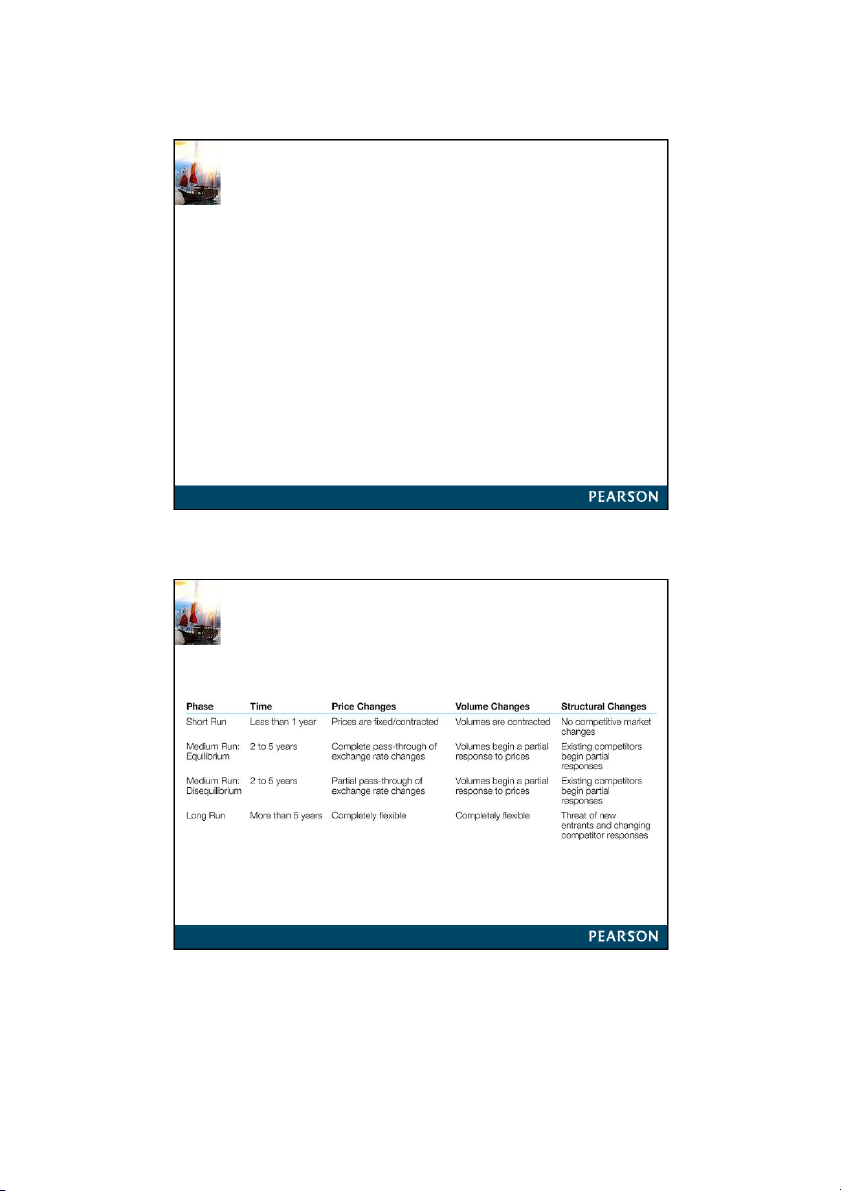

Measuring Operating Exposure

• Exhibit 12.3 shows how a change in

exchange rates can impact expected cash flows at four levels: – Short Run – Medium Run (equilibrium)

– Medium Run (disequilibrium) – Long Run 12-11

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 11

Exhibit 12.3 Operating Exposure’s

Phases of Adjustment and Response 12-12

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 12 6 6/15/20

Measuring Operating Exposure: Ganado Germany

• Exhibit 12.4 presents the impact on the firm given

an unexpected change in exchange rates.

• Exhibit 12.5 summarizes the current baseline

forecast for Ganado Germany’s income and operating cash flows

– Case 1: Depreciation, no change in any variable

– Case 2: Increase in sales volume; other variables remain constant

– Case 3: Increase in sales price; other variables remain constant

– Case 4: Sales price, cost, and volume increase 12-13

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 13

Exhibit 12.4 Ganado and Ganado Germany 12-14

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 14 7 6/15/20

Exhibit 12.5 Ganado Germany’s Valuation: Baseline Analysis 12-15

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 15

Ganado Germany, Case 4: Price, Cost, and Volume Increases

• Exhibit 12.6 is a combination of possible outcomes

– Price increases by 10% to €14.08,

– direct cost per unit increases by 5% to €10.00,

– and volume rises by 10% to 1,100,000 units.

• Revenues clearly rise by more than costs, and net

income for Ganado Germany rises to €2,113,590.

• Operating cash flow rises to 2 € ,623,683 in 2014 (after NWC increase), and 2 € ,713,590 for each of the following four years.

• Ganado Germany’s present value is now $9,018,195. 12-16

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 16 8 6/15/20

Exhibit 12.6 Ganado Germany: Case 4—

Sales Price, Volume, and Costs Increase 12-17

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 17 Measurement of Loss

• Exhibit 12.7 summarizes the change in Ganado’s

German subsidiary value across our small set of

simple cases from an instantaneous and permanent

change in the value of the euro from $1.20/ € to $1.00/ . €

– Case 1: Ganado’s German subsidiary’s value falls by the percent

change in the exchange rate, -16.7%.

– Case 2: Volume increased by 40% as a result of increasing price

competitiveness, the German subsidiary’s value increased 22.5%.

– Case 3: The change in the exchange rate was completely passed-

through to a higher sales price, which resulted in a massive 66% increase in subsidiary value.

– Case 4: The resulting change in subsidiary valuation of +24.2%

may be creeping toward a “realistic outcome.” 12-18

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 18 9 6/15/20

Exhibit 12.7 Summary of Ganado

Germany Value Changes to Depreciation of the Euro 12-19

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 19 Strategic Management of Operating Exposure

• The objective of both operating and transaction

exposure management is to anticipate and

influence the effect of unexpected changes in

exchange rates on a firm’s future cash flows, rather

than merely hoping for the best.

• To meet this objective, management can diversify

the firm’s operating and financing base.

• Management can also change the firm’s operating and financing policies.

• A diversification strategy does not require

management to predict disequilibrium, only to recognize it when it occurs. 12-20

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 20 10 6/15/20 Strategic Management of Operating Exposure

• If a firm’s operations are diversified internationally,

management is pre-positioned both to recognize

disequilibrium when it occurs and to react competitively.

• Recognizing a temporary change in worldwide

competitive conditions permits management to

make changes in operating strategies.

• Domestic firms may be subject to the full impact of

foreign exchange operating exposure and do not

have the option to react in the same manner as an MNE. 12-21

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 21 Strategic Management of Operating Exposure

• If a firm’s financing sources are diversified,

it will be pre-positioned to take advantage

of temporary deviations from the international Fisher effect.

• However, to switch financing sources, a firm

must already be well-known in the

international investment community.

• Again, this would not be an option for a

domestic firm (if it has limited its financing to one capital market). 12-22

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 22 11 6/15/20 Proactive Management of Operating Exposure

• Operating and transaction exposures can be

partially managed by adopting operating or

financing policies that offset anticipated foreign exchange exposures.

• The most commonly employed proactive policies include:

– Matching currency cash flows – Risk-sharing agreements

– Back-to-back or parallel loans – Cross-currency swaps – Contractual approaches 12-23

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 23 Proactive Management of Operating Exposure

• Matching Currency Cash Flows (Exhibit 12.8)

– One way to offset an anticipated continuous long

exposure to a particular company is to acquire

debt denominated in that currency (matching).

– An alternative would be for the US firm to seek

out potential suppliers of raw materials or

components in Canada as a substitute for U.S. or other foreign firms.

– In addition, the company could engage in

currency switching, in which the company would

pay foreign suppliers with Canadian dollars. 12-24

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 24 12 6/15/20

Exhibit 12.8 Debt Financing as a Financial Hedge 12-25

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 25 Proactive Management of Operating Exposure • Risk-Sharing Agreements

– An alternate method for managing a long-term

cash flow exposure between firms is risk-sharing.

– This is a contractual arrangement in which the

buyer and seller agree to “share” or split

currency movement impacts on payments between them.

– This agreement is intended to smooth the impact

on both parties of volatile and unpredictable exchange rate movements. 12-26

© 2 01 6 P ear so n E du catio n, I nc . All rig hts res erv ed . 26 13