Preview text:

Ep2-4.

Trasnsaction. On Oct.1, Alan Sanculi begins business as a real estate agent with a cash investment of $15,000. Basic Analysis

The asset Cash increases $15,000 ; owner’s equity (specifically, Owner’s Capital) increases $15,000 Equation

Assets = Liabilities + Owner’s Equity Analysis Cash = Owner’s Capital +15,000 +15,000 Debit-Credit

Debits increase assets: debit Cash $15,000 Analysis

Credits increase owner’s equity: credit Owner’s Capital $15,000 Journal Entry Oct. 1 Cash 101 15,000 Owner’s Capital 301 15,000

(Owner’s investment of cash in business) Posting Cash 101 Oct. 1 15,000 Owner’s Capital 301 Oct. 1 15,000

Trasnsaction. On Oct. 2, hires an administrative assistant Basic Analysis

No accounting entry because a business transaction has not occurred.

Trasnsaction. On Oct. 3, purchases office furniture for $1,900, on account. Basic Analysis

The asset Supplies increases $1,900 ; the liability Accounts Payable increases $1,900 Equation Assets

= Liabilities + Owner’s Equity Analysis Supplies = Accounts Payable +1,900 +1,900 Debit-Credit

Debits increase assets: debit Supplies $1,900 Analysis

Credits increase liabilities: credit accounts payable $1,900 Journal Entry Oct. 3 Supplies 126 1,900 Accounts payable 201 1,900 Posting

(Purchased supplies on account) Supplies 126 Oct. 3 1,900 Acounts Payable 301 Oct. 3 1,900

Trasnsaction. On Oct. 6, Sells a house and lot for R.Craig; bills R.Craig $3,800 for realty services performed. Basic Analysis

The asset Accounts Receivable increases $3,800 ; the revenue account Service Revenues increases $3,800 Equation

Assets = Liabilities + Owner’s Equity Analysis Accounts Receivable = Service Revenues +3,800 +3,800 Debit-Credit

Debits increase assets: debit Accounts Receivable $3,800 Analysis

Credits increase revenues: credit Service Revenues $3,800 Journal Entry Oct. 6 Accounts Receivable 112 3,800 Service Revenues 400 3,800

(Received cash for services performed) Posting Accounts Receivable 112 Oct. 6 3,800 Service Revenues 400 Oct. 6 3,800

Trasnsaction. On Oct. 27, pays $1,100 on the balance related to the transaction of October 3. Basic Analysis

The asset Cash decreases $1,100 ; the liability Accounts Payable decrease $1,100 Equation

Assets = Liabilities + Owner’s Equity Analysis Cash = Accounts Payables -1,100 - 1,100 Debit-Credit

Debits decrease liabilities: debit Accounts Payable $1,100 Analysis

Credits decrease assets: credit Cash $1,100 Journal Entry Oct. 27 Accounts Payable 301 1,100 Cash 101 1,100 Posting

(Pays cash on balance on Oct.3) Accounts Receivable 301 Oct.27 1,100 Cash 101 Oct.27 1,100

Trasnsaction. On Oct. 30, pays the administrative assitant $2,500 in salary for October . Basic Analysis

The asset Cash decreases $2,500 ; the expense Salaries and Wages Expense increase $2,500 Equation

Assets = Liabilities + Owner’s Equity Analysis Cash = Salaries and Wages Expense -2,500 -2,500 Debit-Credit

Debits increase owner’s equity: debit Salaries and Wages Expense $2,500 Analysis

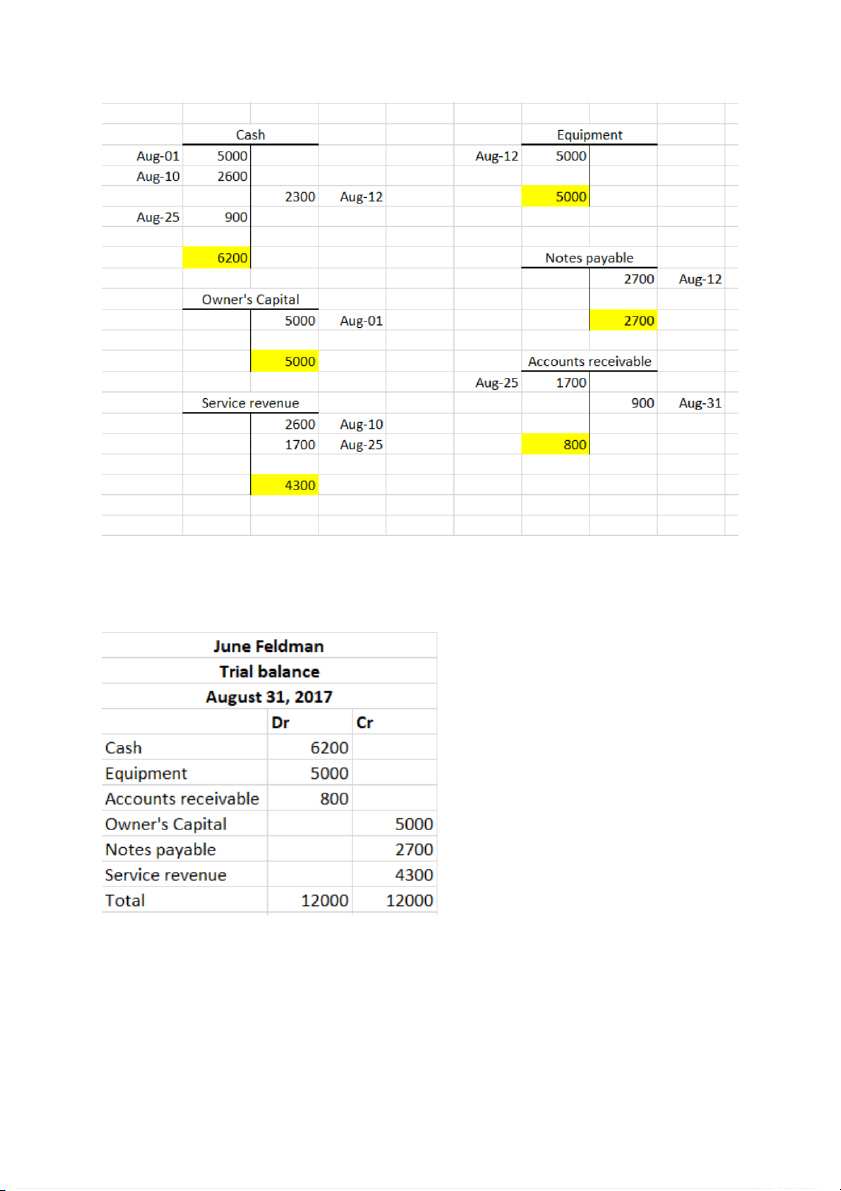

Credits decrease assets: credit Cash $2,500 Journal Entry Oct. 30 Salaries and Wages Expense 726 2,500 Cash 101 2,,500 Posting (Pays salary for October) Salaries and Wages Expense 301 Oct.30 2,500 Cash 101 Oct.30 2,500 Ep 2-5 Date

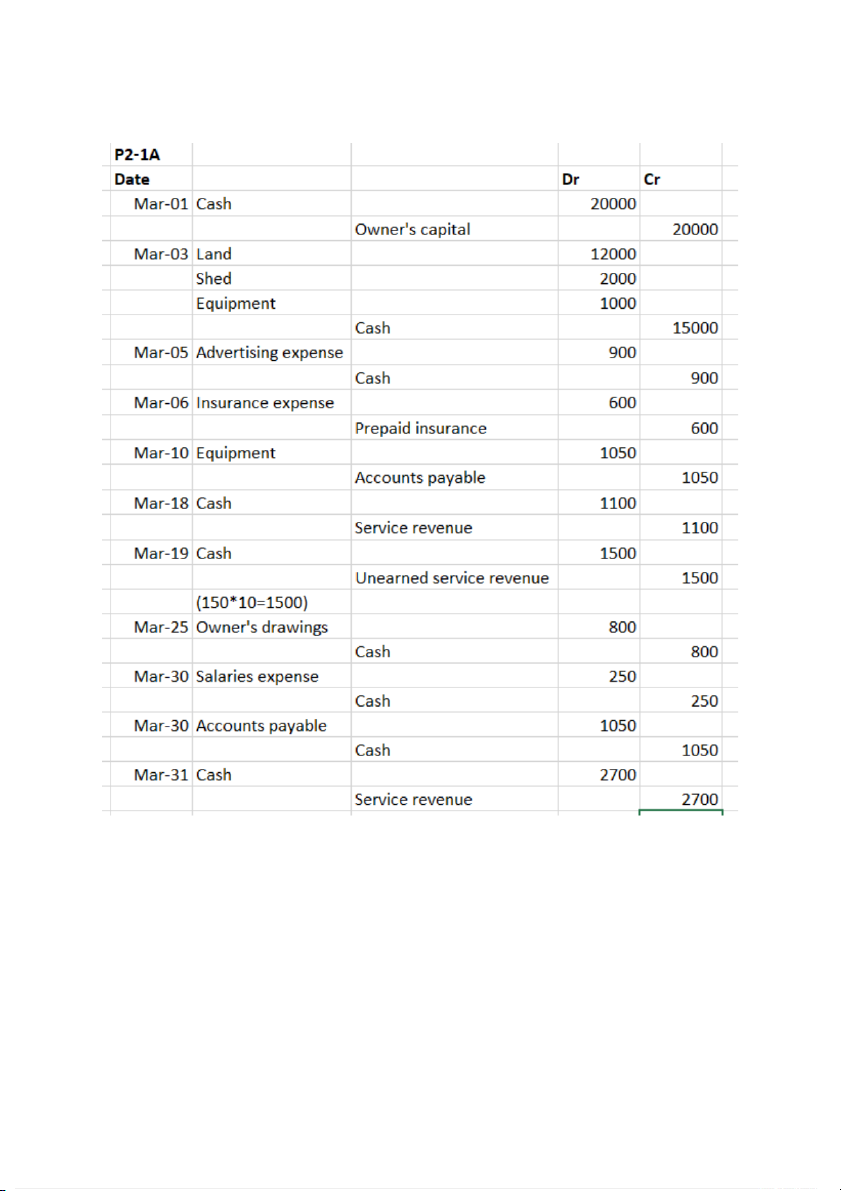

Account Titles and Explanation Ref. Debit Credit Oct. 1 Cash 101 15,000 Owner’s Capital 301 15,000

(Owner’s investment of cash in business) 2 No entry 3 Supplies 126 1,900 Accounts payable 201 1,900

(Purchased supplies on account) 6 Accounts Receivable 112 3,800 Service Revenues 400 3,800

(Received cash for realty services performed) 27 Accounts Payable 301 1,100 Cash 101 1,100

(Pays cash on balance on Oct.3) 30 Salaries and Wages Expense 726 2,500 Cash 101 2,,500 (Pays salary for October) Ep 2-9 a) B) P2-1A