Preview text:

CHAPTER 6

INTERNATIONAL PARITY CONDITIONS LE L AR A N R I N N I G G O B O J B E J CTI T V I E V S

•Examine how price levels and price level changes (inflation)

in countries determine the exchange rates at which their currencies are traded

•Show how interest rates reflect inflationary forces within each country and currency

•Explain how forward markets for currencies reflect

expectations held by market participants about the future spot exchange rate

•Analyze how, in equilibrium, the spot and forward currency

markets are aligned with interest differentials and

differentials in expected inflation

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS

International Parity Conditions Some fundamental questions managers of MNEs,

international portfolio investors, importers, exporters, and

government officials must deal with every day are:

◦ What are the determinants of exchange rates?

◦ Are changes in exchange rates predictable?

The economic theories that link exchange rates, price levels,

and interest rates together are called international parity conditions.

These international parity conditions form the core of the

financial theory that is unique to international finance.

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Prices and Exchange Rates

If the identical product or service can be:

Øsold in two different markets; and

Øno restrictions exist on the sale; and

Øtransportation costs of moving the product between markets are equal, then

Øthe product’s price should be the same in both markets.

This is called the law of one price.

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Prices and Exchange Rates

A primary principle of competitive markets is that prices will

equalize across markets if frictions (transportation costs) do not exist.

Comparing prices then, would require only a conversion from one currency to the other: P$ x S¥/$ = P¥.

The product price in U.S. dollars is (P$), the spot exchange rate is

number of yen per dollar (S¥/$), and the price in yen is (P¥). The implied interest rate: P¥. P$

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Prices and Exchange Rates

If the law of one price were true for all goods and services,

the purchasing power parity (PPP) exchange rate could be

found from any individual set of prices.

By comparing the prices of identical products denominated

in different currencies, we could determine the “real” or PPP

exchange rate that should exist if markets were efficient.

This is the absolute version of the PPP theory.

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS

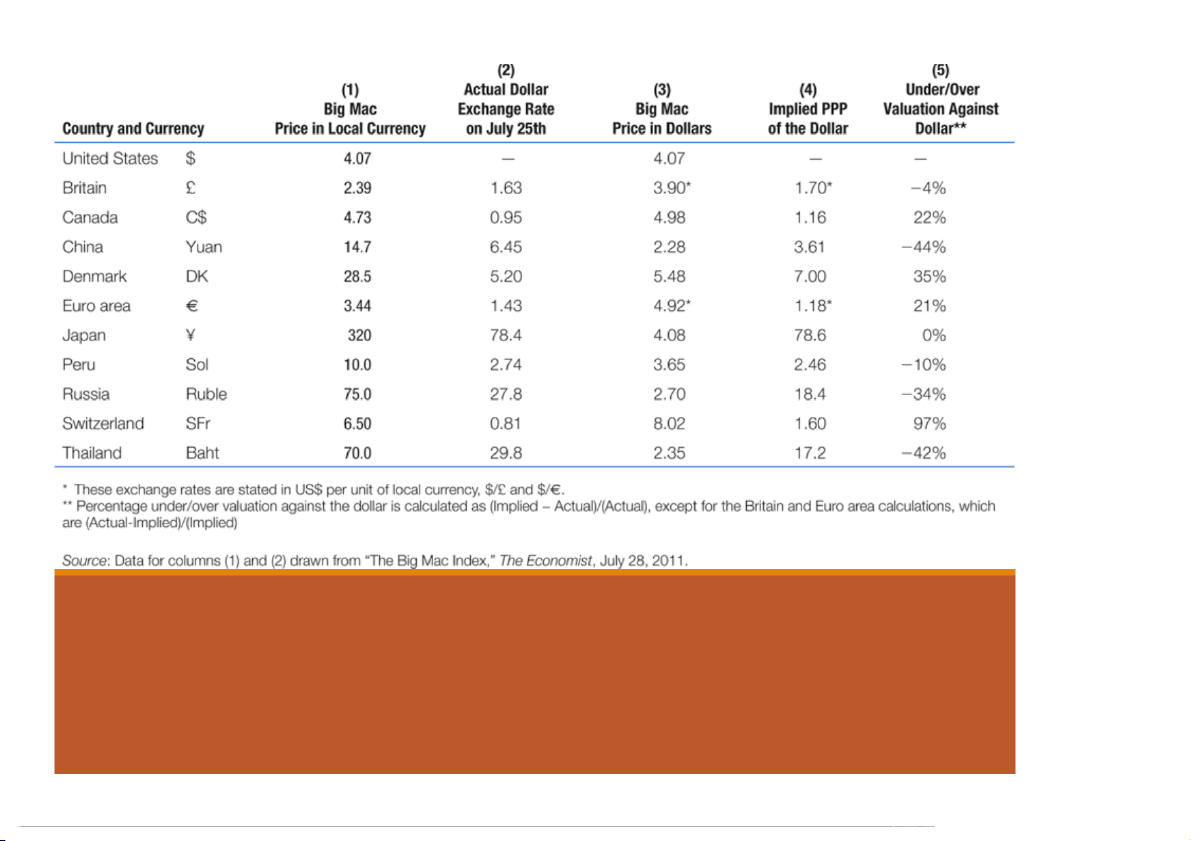

Selected Rates from the Big Mac Index

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS

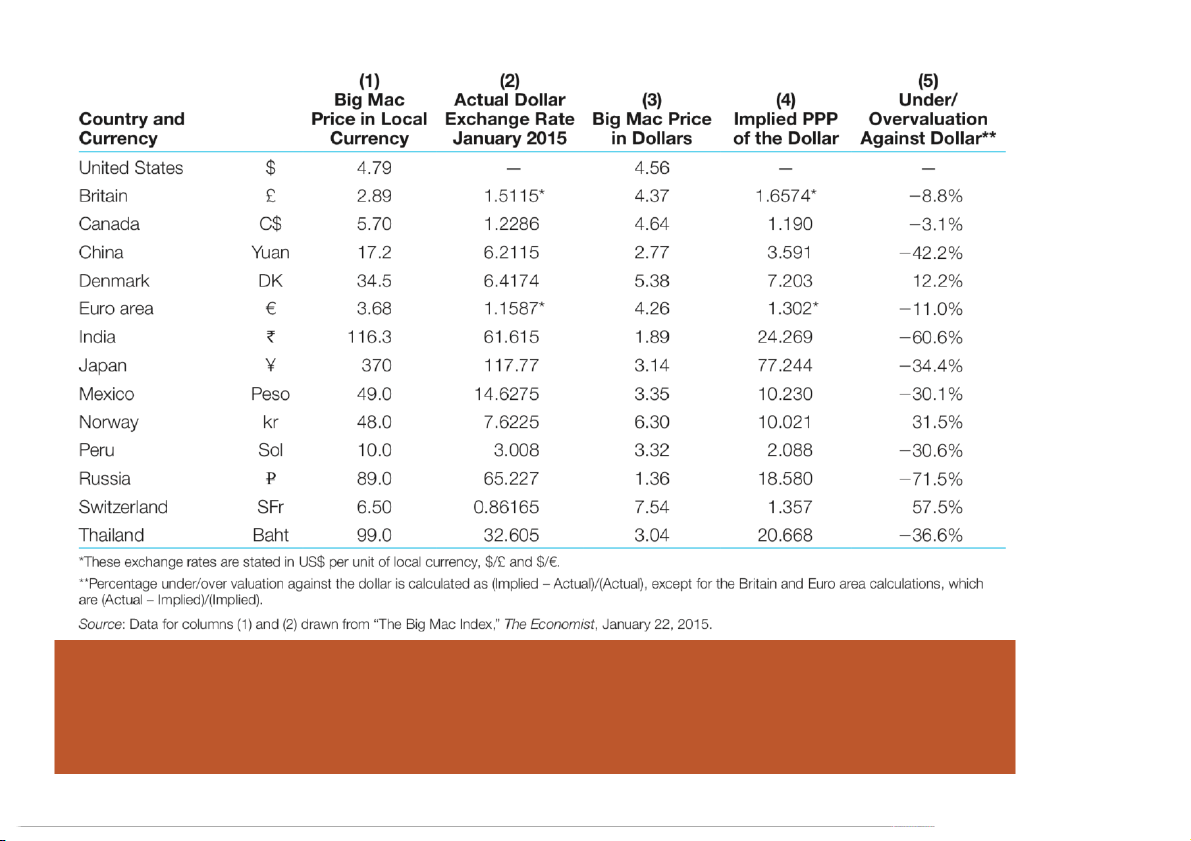

Selected Rates from the Big Mac Index

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Prices and Exchange Rates

qIf the assumptions of the absolute version of the PPP theory

are relaxed a bit more, we observe what is termed relative

purchasing power parity (RPPP).

qRPPP holds that PPP is not particularly helpful in determining

what the spot rate is today, but that the relative change in

prices between two countries over a period of time

determines the change in the exchange rate over that period.

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Prices and Exchange Rates

More specifically, with regard to RPPP:

“If the spot exchange rate between two countries

starts in equilibrium, any change in the differential

rate of inflation between them tends to be offset over

the long run by an equal but opposite change in the spot exchange rate.”

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS

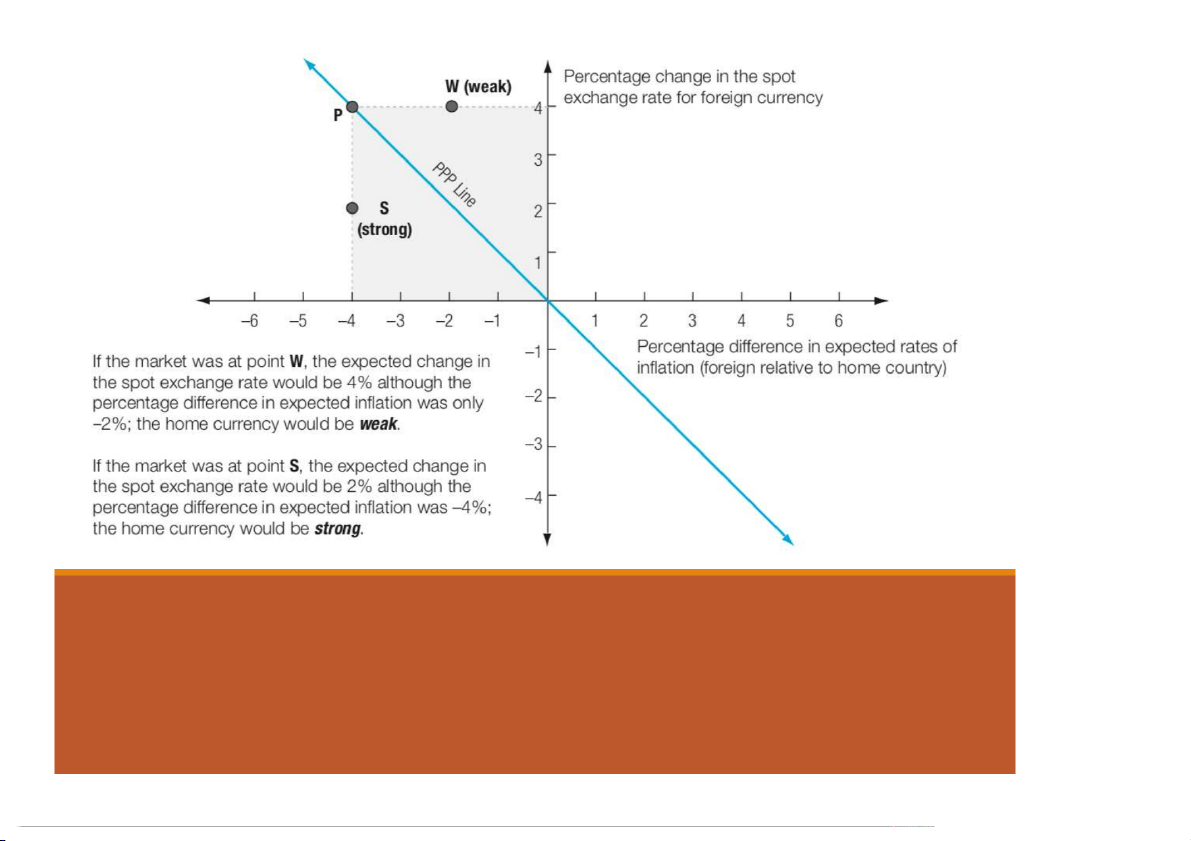

Relative Purchasing Power Parity (PPP)

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Prices and Exchange Rates

Empirical testing of PPP and the law of one price has been

done, but has not proved PPP to be accurate in predicting future exchange rates.

Two general conclusions from these tests:

◦ PPP holds up well over the very long run but poorly for shorter time periods

◦ the theory holds better for countries with relatively high rates of

inflation and underdeveloped capital markets.

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Prices and Exchange Rates

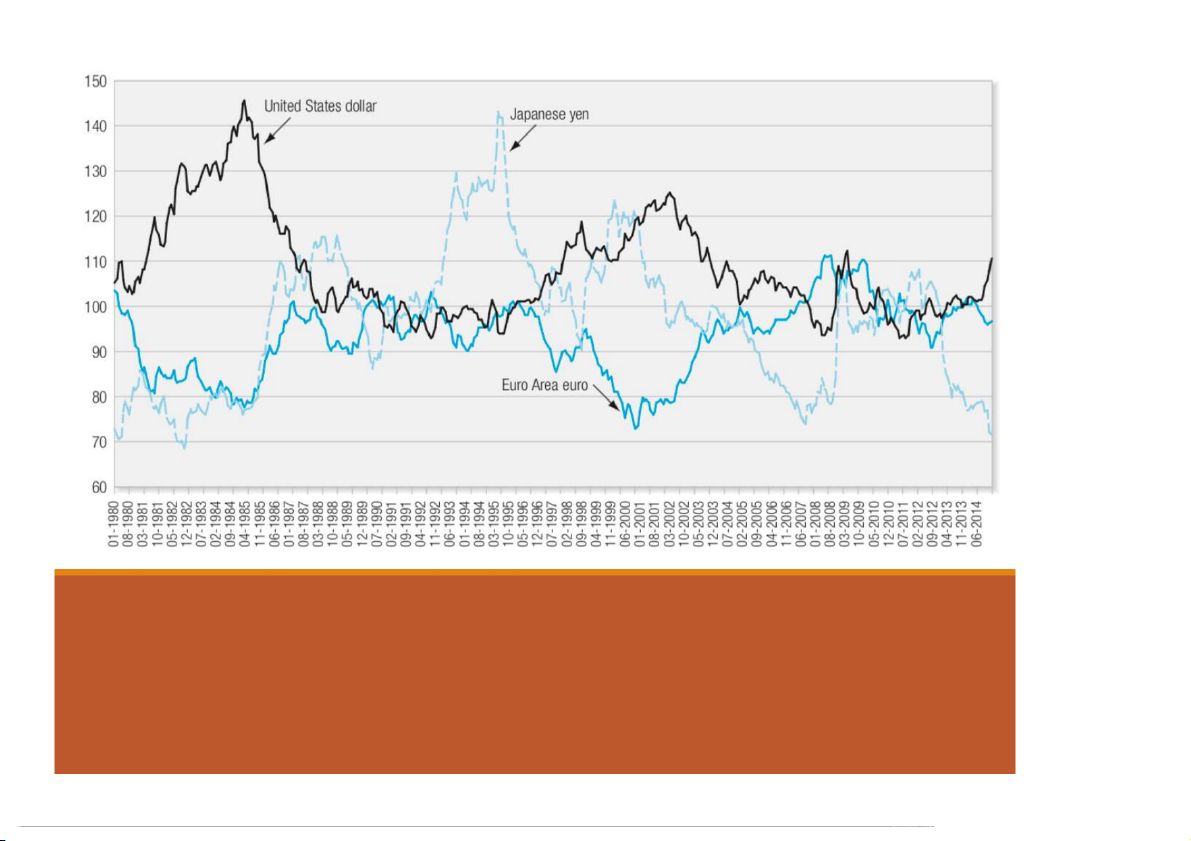

Individual national currencies often need to be evaluated against other currency values to determine relative purchasing power.

The objective is to discover whether a nation’s exchange rate

is “overvalued” or “undervalued” in terms of PPP.

This problem is often dealt with through the calculation of

exchange rate indices such as the nominal effective exchange rate index.

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS

IMF’s Real Effective Exchange Rate Indexes for the United

States, Japan, and the Euro Area

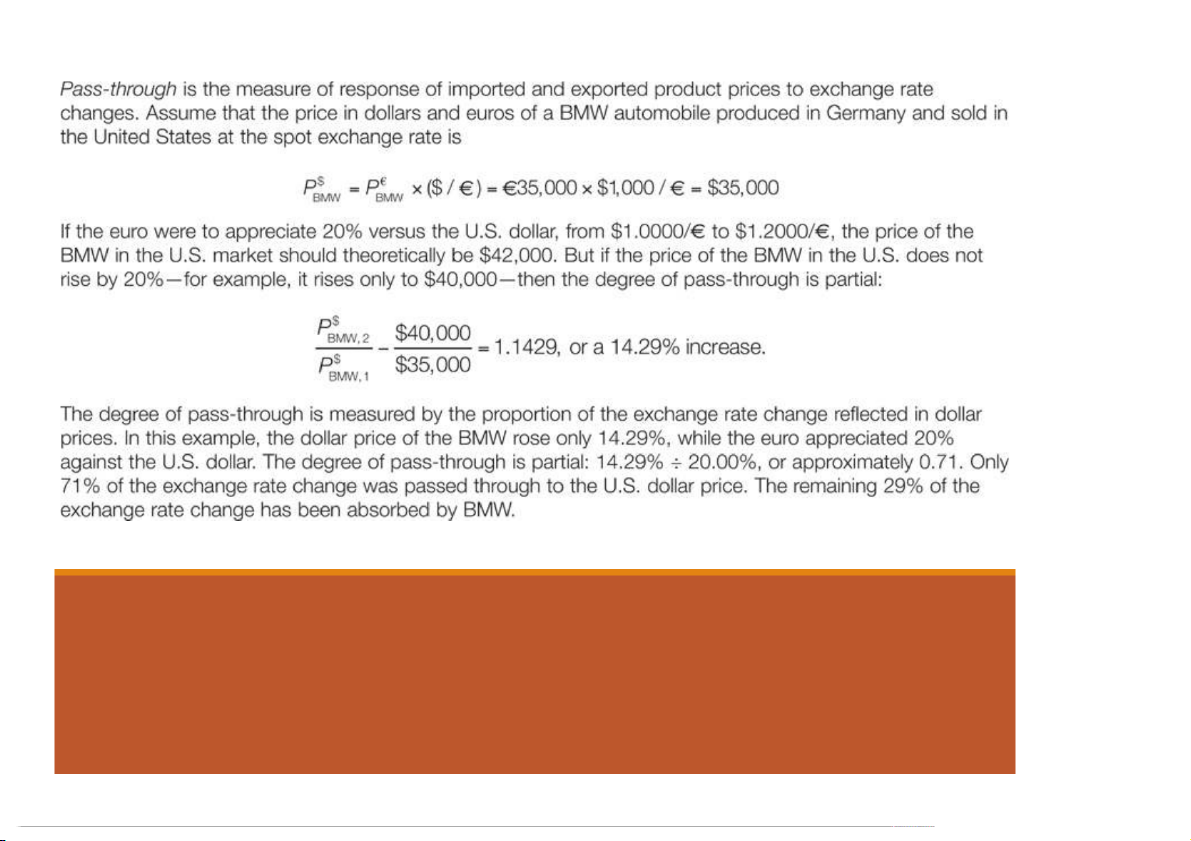

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Exchange Rate Pass-Through

Incomplete exchange rate pass-through is one reason that a

country’s real effective exchange rate index can deviate.

The degree to which the prices of imported and exported

goods change as a result of exchange rate changes is termed pass-through.

For example, a car manufacturer may or may not adjust

pricing of its cars sold in a foreign country if exchange rates

alter the manufacturer’s cost structure in comparison to the foreign market.

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Exchange Rate Pass-Through

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Prices and Exchange Rates

Pass-through can also be partial as there are many

mechanisms by which companies can compartmentalize or

absorb the impact of exchange rate changes.

Price elasticity of demand is an important factor when

determining pass-through levels.

The own-price elasticity of demand for any good is the

percentage change in quantity of the good demanded as a

result of the percentage change in the good’s own price.

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Interest Rates and Exchange Rates

The Fisher effect states that nominal interest rates in each country are

equal to the required real rate of return plus compensation for expected inflation.

This equation reduces to (in approximate form): i = r +

where i = nominal interest rate, r = real interest rate and = expected inflation.

Empirical tests (using ex-post) national inflation rates have shown the

Fisher effect usually exists for short-maturity government securities (treasury bills and notes).

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS

Interest Rates and Exchange Rates

qThe relationship between the percentage change in the spot exchange

rate over time and the differential between comparable interest rates in

different national capital markets is known as the international Fisher effect.

q“Fisher-open” - the spot exchange rate should change in an equal

amount but in the opposite direction to the difference in interest rates between two countries.

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Interest Rates and Exchange Rates More formally:

where i$ and i¥ are the respective national interest rates

and S is the spot exchange rate using indirect quotes (¥/$).

Justification for the international Fisher effect is that

investors must be rewarded or penalized to offset the

expected change in exchange rates.

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Interest Rates and Exchange Rates Example:

1. Suppose the interest rate on a one-year insured U.S. bank

deposit is 9% and the rate on a one-year insured British

bank deposit is 10%. What does the International Fisher

Effect predict will happen to the exchange rate?

2. Suppose the interest rate in the U.S. is 1.5% and the

interest rate in France is 2.25%, where USD is foreign

currency. Suppose that the spot exchange rate between

USD and EUR is EUR/USD 0.7088. What is the future spot

exchange rate assuming that the International Fisher Effect holds?

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS

Interest Rates and Exchange Rates

qA forward rate is an exchange rate quoted for settlement at some future date.

qA forward exchange agreement between currencies states

the rate of exchange at which a foreign currency will be

bought forward or sold forward at a specific date in the future.

qThe forward rate is calculated for any specific maturity by

adjusting the current spot exchange rate by the ratio of

eurocurrency interest rates of the same maturity for the two subject currencies.

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Interest Rates and Exchange Rates

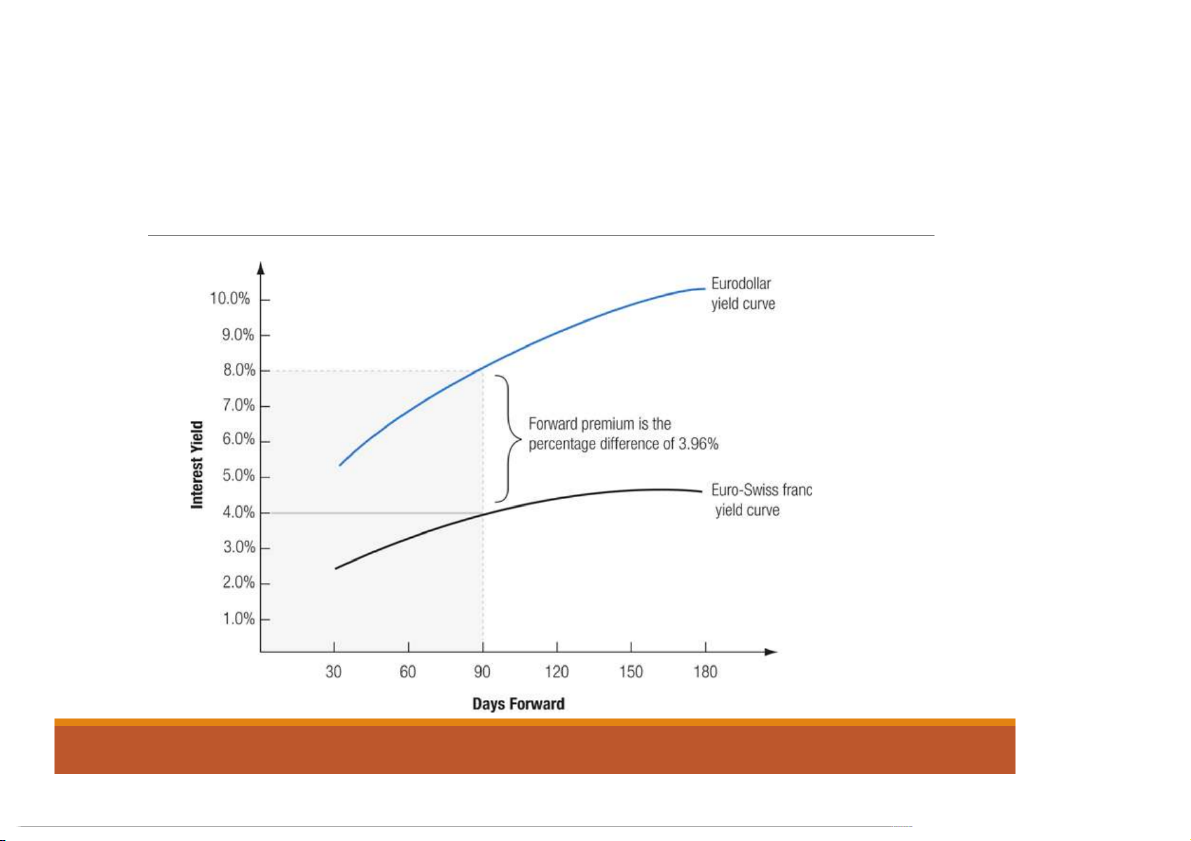

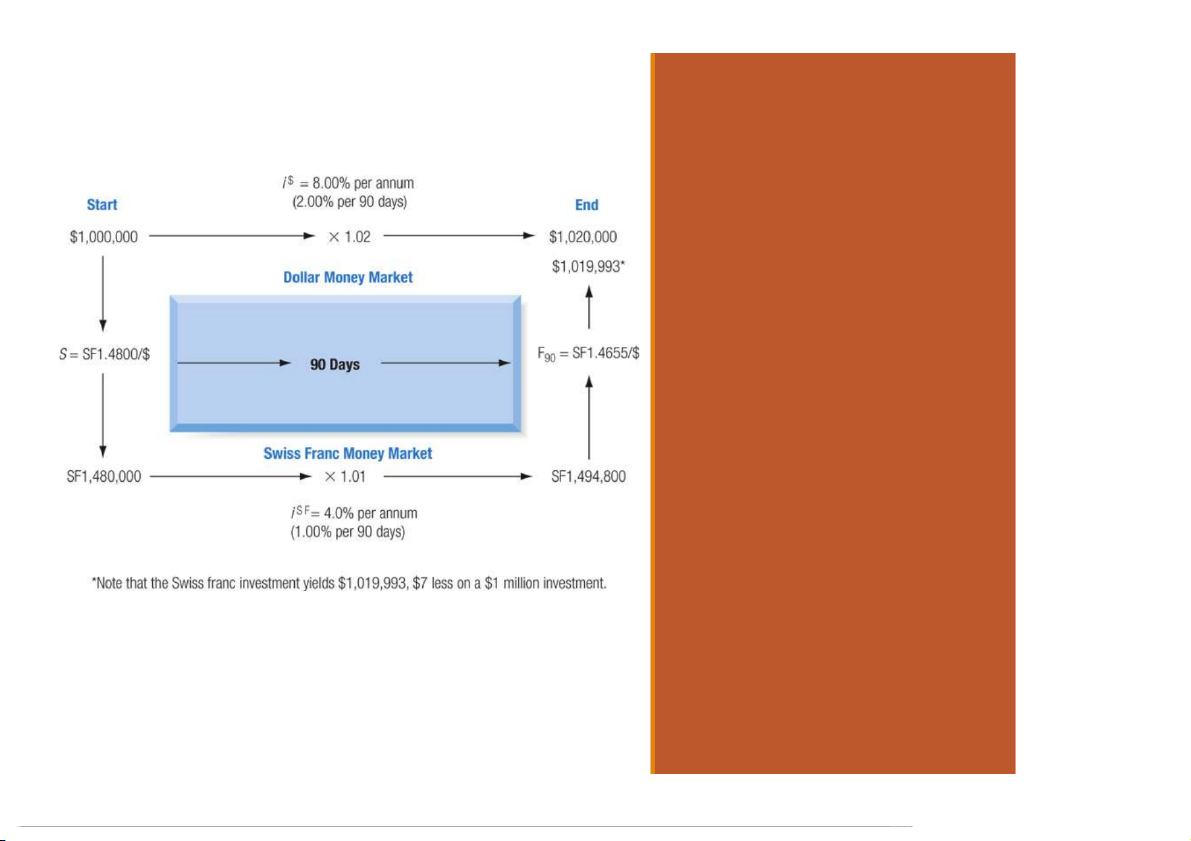

qFor example, the 90-day forward rate for the Swiss

franc/U.S. dollar exchange rate (FSF/$90) is found by

multiplying the current spot rate (SSF/$) by the ratio of the

90-day euro-Swiss franc deposit rate (iSF) over the 9 - 0 day eurodollar deposit rate (i$).

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Interest Rates and Exchange Rates

Forward premium or discount of the numerator currency: percentage difference

between the spot and forward exchange rates, in annual percentage terms FSF = Spot – Forward 360 x x 100 Forward days

This is the case when the foreign currency price of the home currency is used (SF/$).

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS

Exhibit 6.5 Currency Yield Curves and the Forward Premium

Interest Rates and Exchange Rates

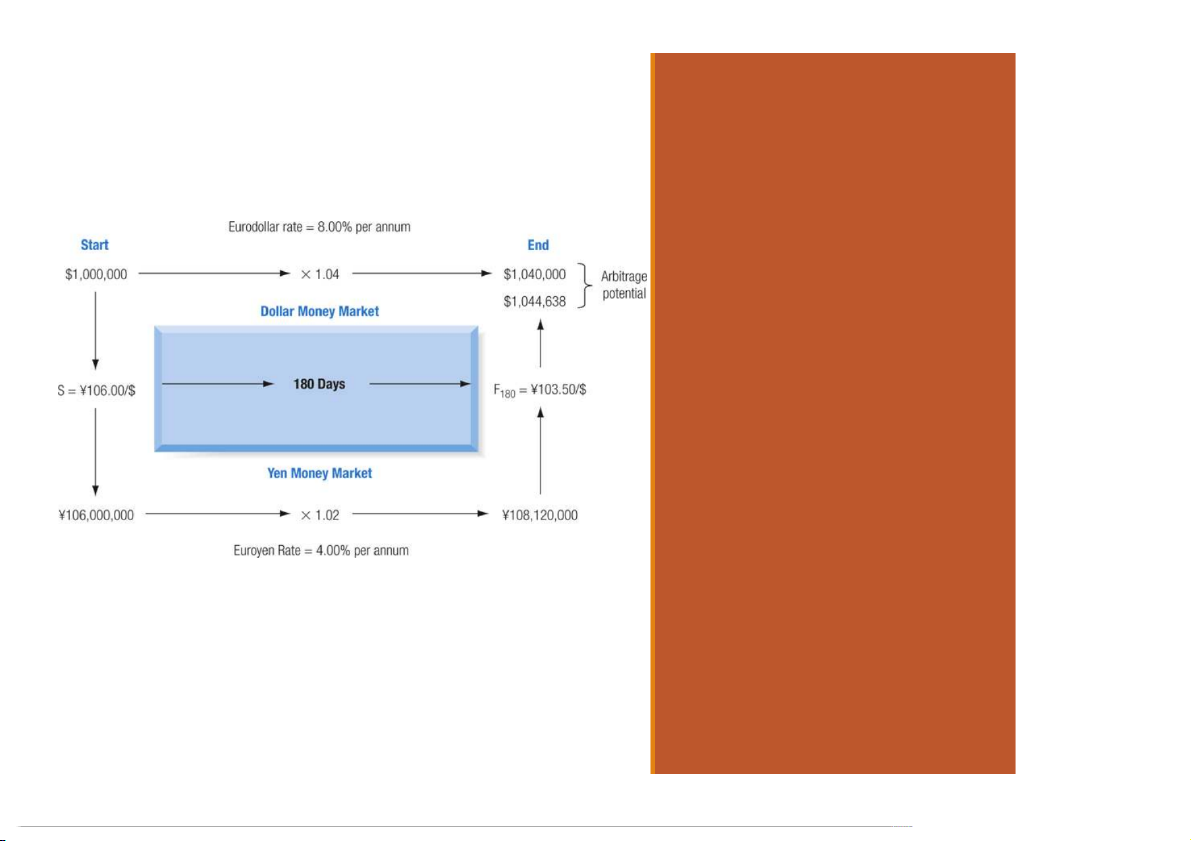

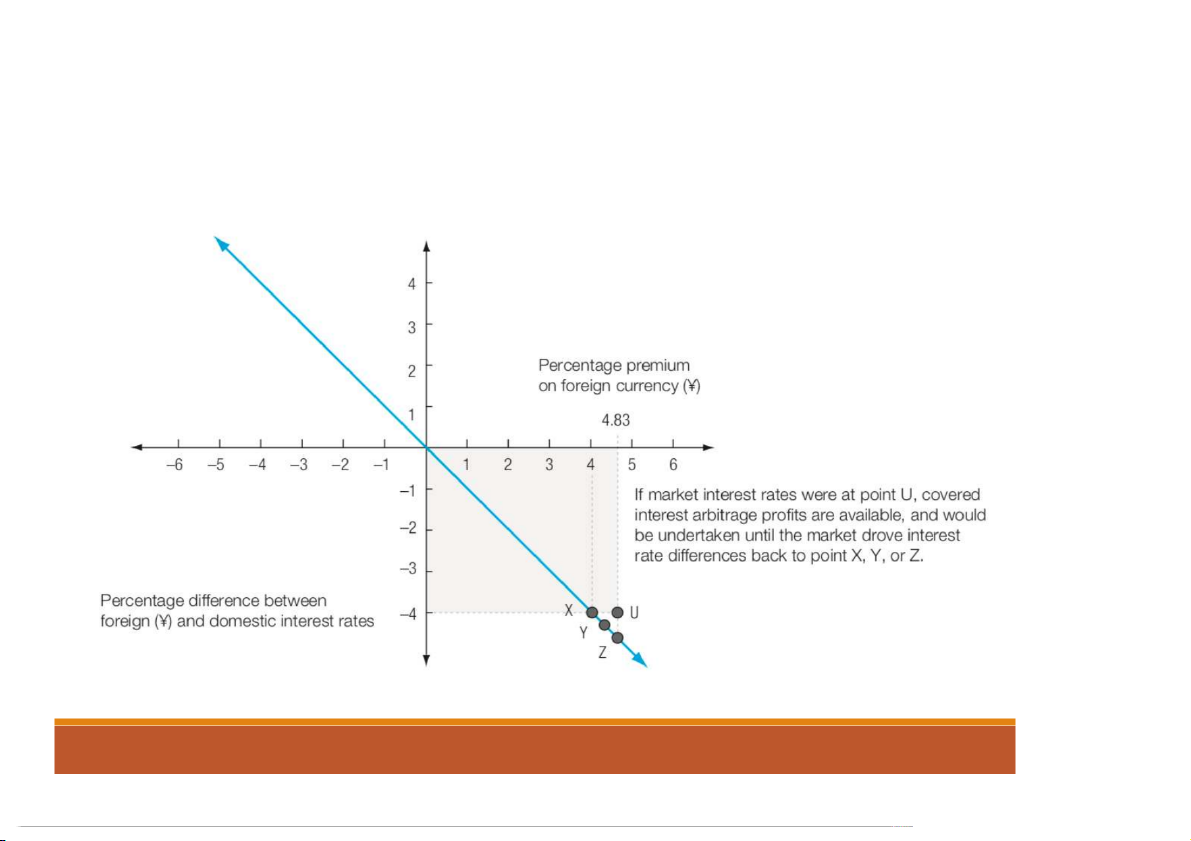

Theory of Interest Rate Parity (IRP) provides the linkage between the foreign exchange markets and the international money markets.

The difference in the national interest rates for securities

of similar risk and maturity should be equal to, but

opposite in sign to, the forward rate discount or premium

for the foreign currency, except for transaction costs.

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Interest Rate Parity (IRP)

Interest Rates and Exchange Rates

The spot and forward exchange rates are not, however,

constantly in the state of equilibrium described by interest rate parity.

When the market is not in equilibrium, the potential for “risk-

less” or arbitrage profit exists.

The arbitrager will exploit the imbalance by investing in

whichever currency offers the higher return on a covered basis.

This is known as covered interest arbitrage (CI ) A .

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Covered Interest Arbitrage (CIA) If the difference in

interest rates is greater than the forward Covered

premium (or expected change in the spot interest

rate), invest in the higher interest yielding

currency. If the difference in interest rates is arbitrage

less than the forward premium (or expected (CIA)

change in the spot rate), invest in the lower

interest yielding currency.

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS

Interest Rates and Exchange Rates

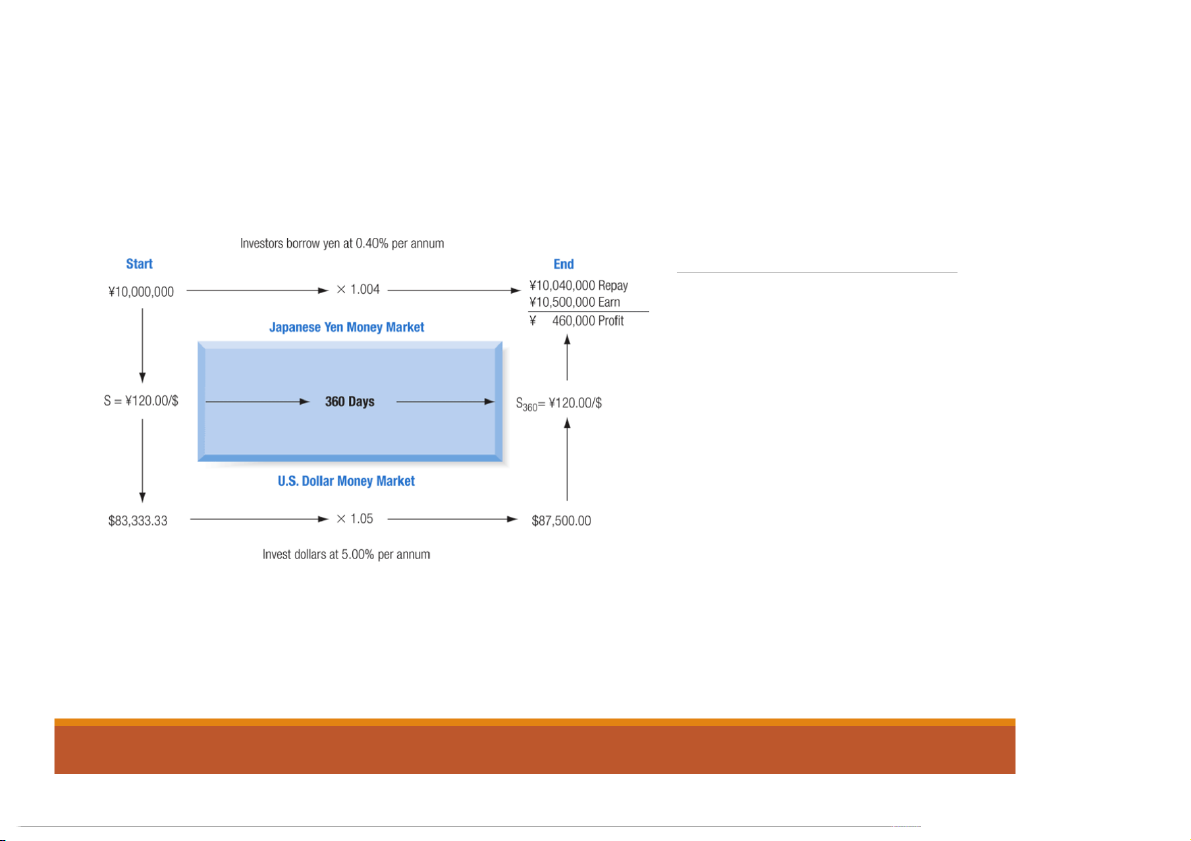

A deviation from covered interest arbitrage is uncovered interest arbitrage (UI ) A .

In this case, investors borrow in countries and currencies

exhibiting relatively low interest rates and convert the proceed

into currencies that offer much higher interest rates.

The transaction is “uncovered” because the investor does not

sell the higher yielding currency proceeds forward, choosing to

remain uncovered and accept the currency risk of exchanging

the higher yield currency into the lower yielding currency at the end of the period.

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS Uncovered Interest Arbitrage (UIA): The Yen Carry Trade

Interest Rates and Exchange Rates

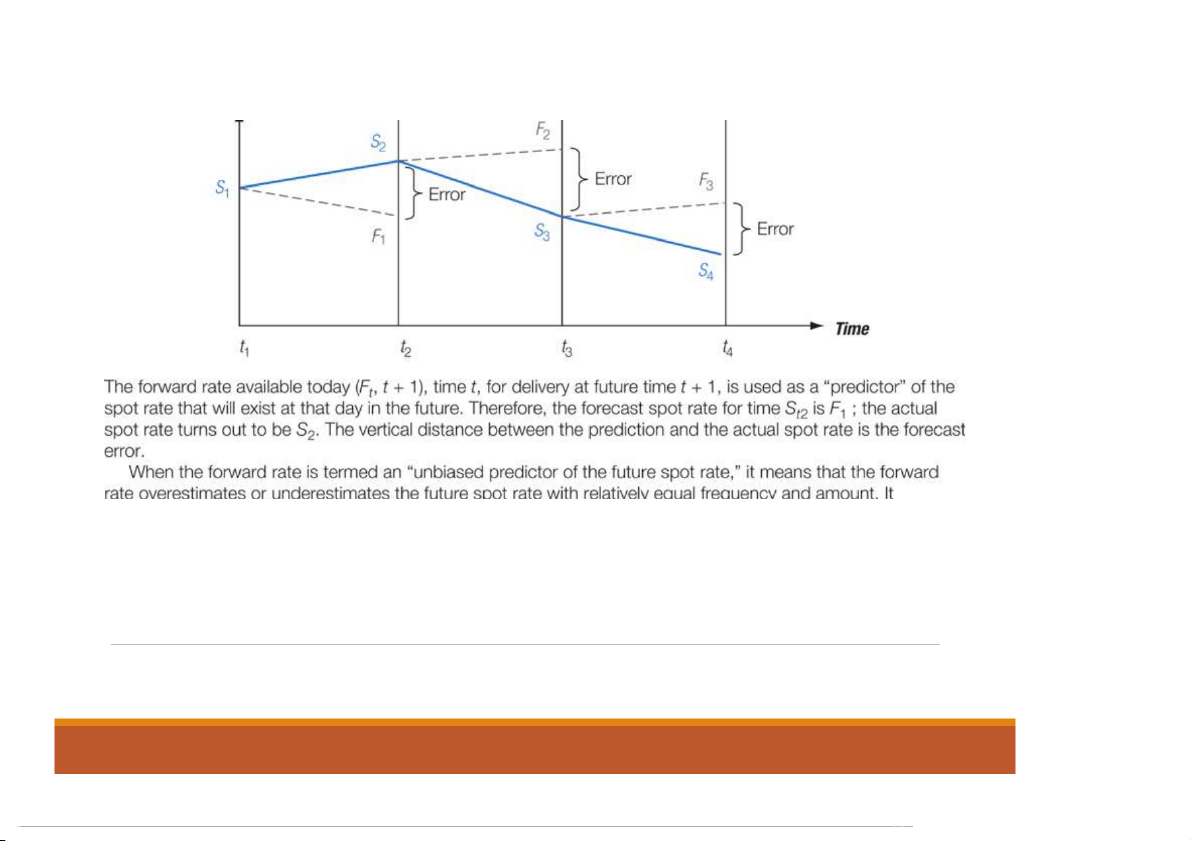

Some forecasters believe that forward exchange rates are

unbiased predictors of future spot exchange rates.

Thus, the distribution of possible actual spot rates in the

future is centered on the forward rate.

Unbiased prediction: the forward rate will, on average,

overestimate and underestimate the actual future spot rate in equal frequency and degree.

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS

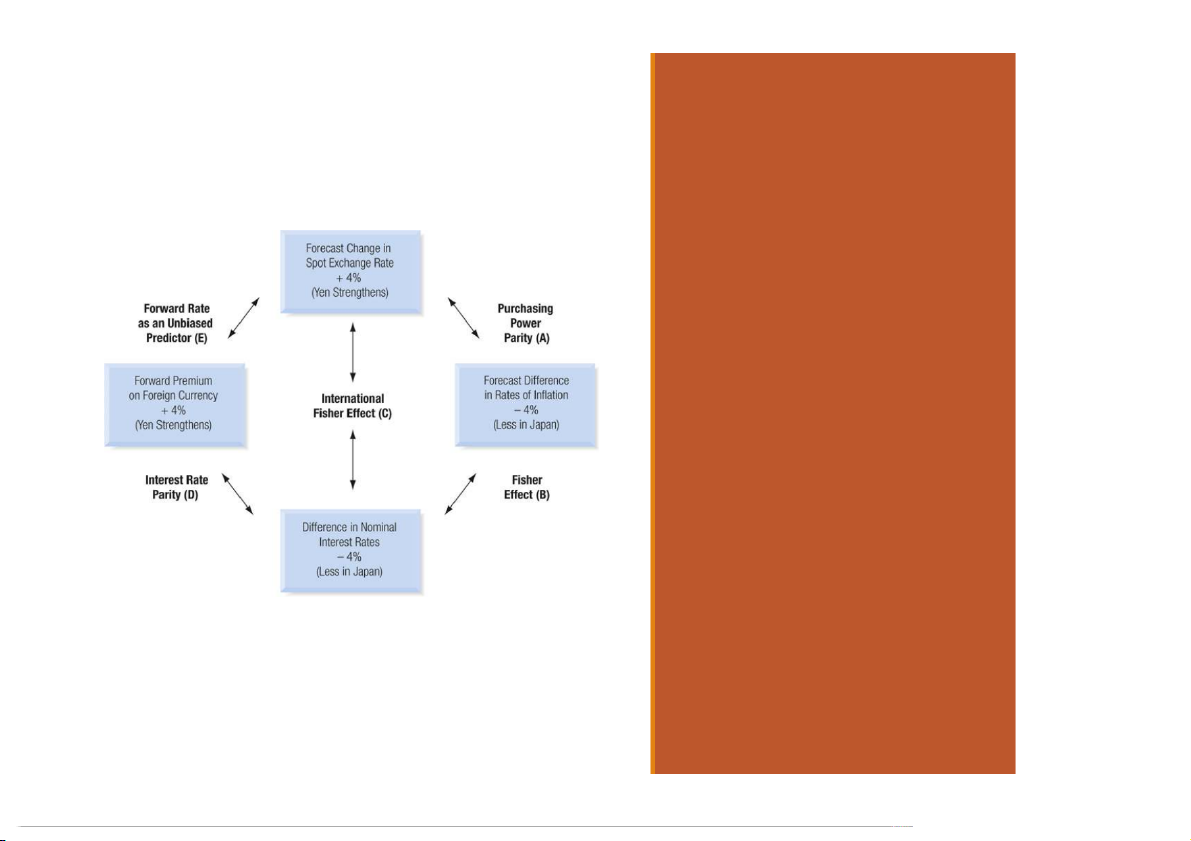

Forward Rate as an Unbiased Predictor for Future Spot Rate International Parity Conditions in Equilibrium (Approximate Form) In I ter e na n ti t o i n o a n l lP ar a i r t i y t y C on o d n it i i t o i n o s n s in i n E quiliilb i r b iu i m u A. Purchasing Power Partity B. The Fisher effect C. International Fisher effect

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS In I ter e na n ti t o i n o a n l lP ar a i r t i y t y C on o d n it i i t o i n o s n s in i n E quiliilb i r b iu i m u D. Interest Rate Parity

E. Forward rate as an unbiased predictor

INTERNATIONAL FINANCE - CHAPTER 6 – INTERNATIONAL PARITY CONDITIONS