Preview text:

I. Why and how to control?

Controlling purpose is to measure performance in order to take corrective action. The target of

it is to assure the right things happen, with the right process at the right time II. Types of control

Feedforward controls input: solve problem before it occurs: make sure the objective is cleared,

direction is set and resource is available

Concurrent controls throughput: solve problem during it occurs: keep things go as planned

Feedback controls output: solve problem after it occurs: perform improvement or learning

Internal – self-control: self-discipline influences the behavior.

External: external factors influnece behavior -

Bureaucratic control: influences behavior by authority, policies, budget, regulations -

Clan control: influence behavior by the organizational culture, norms -

Market control: market influences organization behavior with product adjustment, process improvement III. Steps of controlling process: IV. Tools and techniques:

1. Gantt chart: graphic display of scheduled tasks required to complete a project

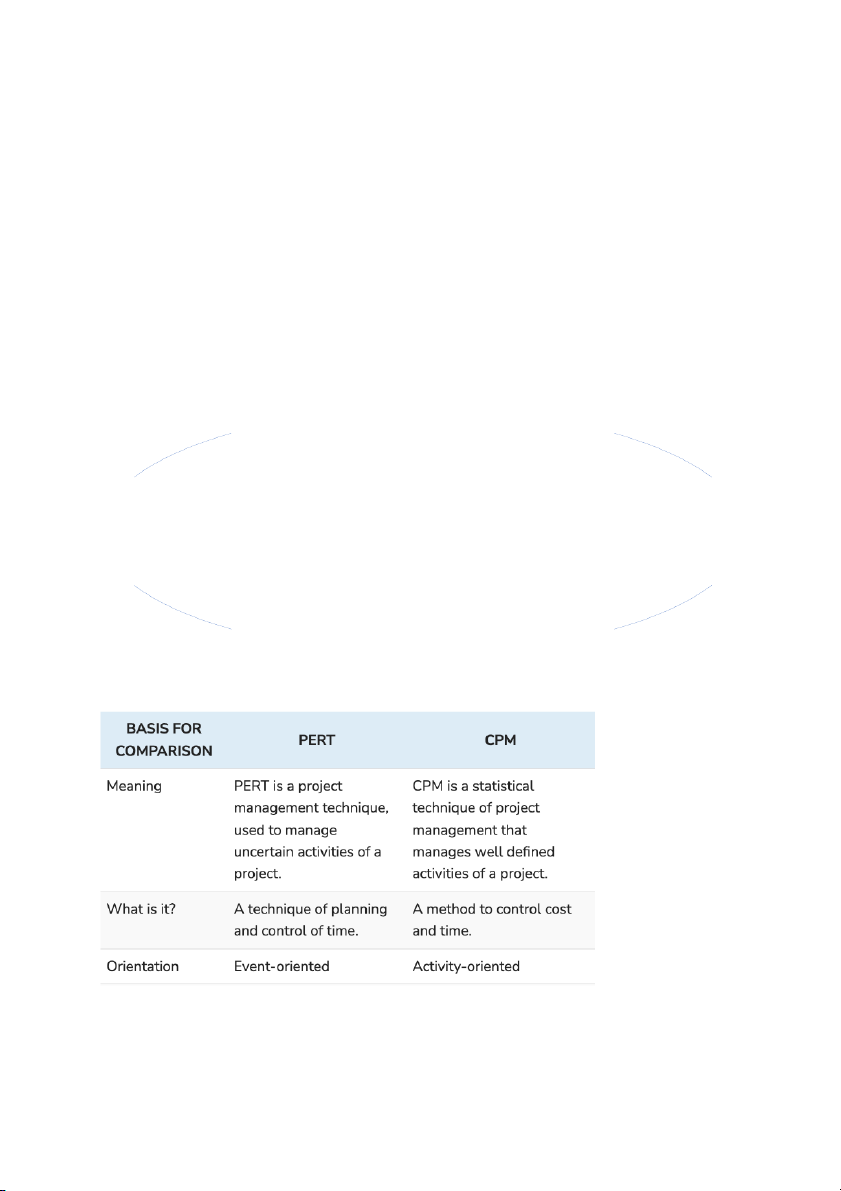

2. CPM/PERT chart: combination of the critical path method and program evaluation and review technique

3. Inventory control: ensures that inventory is only big enough to meet immediate needs

i. Economic order quantity: places new orders when inventory levels fall to predetermined points

ii. Just-in-time scheduling: routes materials to workstations just in time for use

4. Breakeven analysis: performs what-if calculations under different revenue and cost conditions

i. Breakeven point: occurs where revenues just equal costs

5. Financial control: basic Financial Ratios o

Liquidity measures ability to meet short-term obligations: the higher the better

Current Ratio = Current Assets/Current Liabilities

Quick Ratio = Current Assets - Inventories/Current Liabilities o

Leverage measures use of debt: the lower the better

Debt Ratio = Total Debts/Total Assets o

Asset Management measures asset and inventory efficiency: the higher the better

Asset Turnover = Sales/Total Assets

Inventory Turnover = Sales/Average Inventory o

Profitability measures ability to earn revenues greater than costs: the higher the better Net Margin = Net Income/Sales

Return on Assets (ROA) = Net Income/Total Assets

Return on Equity (ROE) = Net Income/Owner’s Equity

6. Balanced Scorecard: tallies organizational performance in financial, customer service, internal process, and innovation o

Factors used to develop scorecard goals and measures: – Financial performance – Customer Satisfaction

– Internal process improvement – Innovation and learning