Preview text:

CERTIFICATE OF FUMIGATION

This document will be issued after the health quarantine and disinfection agency injects plant

protection drugs. Using this fumigation voucher will help protect, clean and eliminate bacteria

and termites in ship compartments when transported by sea from Thailand to Vietnam. The

main chemical used in the fumigation process is Bromide.

Picture: Certificate of fumigation

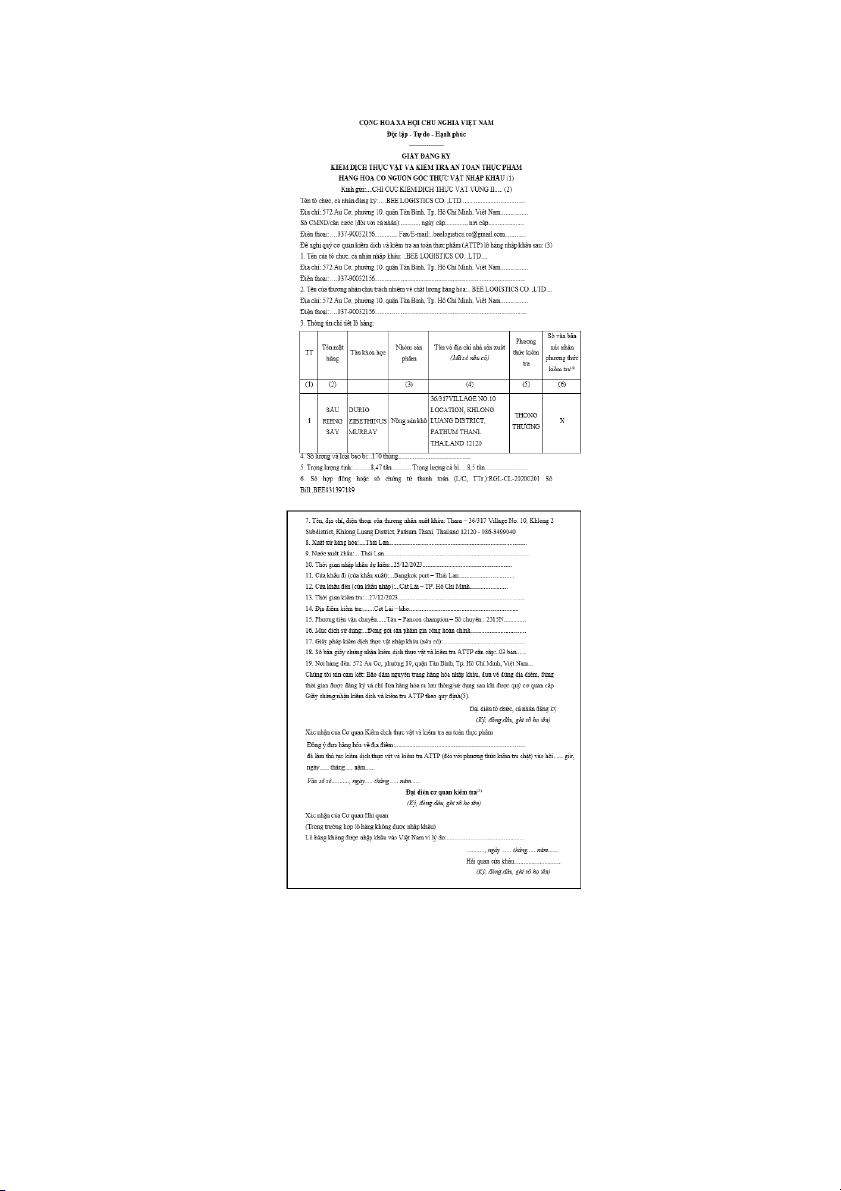

CERTIFICATE FOR PLANT QUARANTINE AND FOOD SAFETY INSPECTION

OF IMPORTED GOODS OF PLANT ORIGIN.

Picture: Certificate for Plant Quarantine and Food Safety Inspection of imported goods of plant origin.

TAX CALCULATION OF SHIPMENTS OF DRIED DUONG IMPORTED FROM THAILAND TO VIETNAM. Picture: Dried durian POL: BANGKOK, THAILAND POD: CÁT LÁI PORT, HCM TERMS: FOB VOLUME: 8.5 CBM COMMODITY: DRIED DRIED DURIAN

Total amount of import tax for the shipment

Imported goods: Dried durian, 50kg/box (box size: 60cm x 40cm x 40cm) HS code: 08134090 Quantity: 89 boxes

CIF: Cat Lai – City. Ho Chi Minh Unit price: 1000 USD/barrel Value added tax: 5% Normal import tax: 45%

However, here we have C/O form D which is an export certification document applicable to

goods exported to ASEAN member countries that are eligible for preferential tariffs under the

CEPT agreement. Based on HS code we know that:

=> The shipment is exempt from import tax and the tax rate will be 0%

Shipping fee for the shipment is 50,000,000 VND /20'DC

The insurance fee for the shipment is 50,000,000 for the entire shipment Exchange rate from USD to VND:

USD = 24,345 VND (updated December 19, 2023) Assignment

Boat fare: 50,000,000 VND/ 20’DC Insurance: 50,000,000 VND PROVINCE VALUE OF THE GOODS:

Value of goods (USD)= Unit price x quantity = 1,000 x 89 = 89,000USD

Value of goods (VND)= 89,000 x 24,345 = 2,166,705,000 VND

So the value of the goods is: 2,166,705,000 VND

PROVINCE TAX CALCULATION VALUE:

Because it is FOB imported goods and uses CIF as standard, we have to add freight and insurance fees

Taxable value of the shipment (VND) = Value of goods Freight + Insurance fee

= 2,166,705,000 +50,000,000+50,000,000 = 2,266,705,000 (VND) CALCULATE TOTAL TAX PAYABLE:

Import tax: Taxable value x tax rate 2,266,705,000 x 0% = 0 VND

VAT: (Taxable value in VND + import tax) x Tax rate (%)

(2,266,705,000 +0) x 5% = 113,335,250 (VND)

Total tax payable: Import tax + VAT

0 + 113,335,250 = 113,335,250 VND CALCULATE TAX UNIT PRICE:

Tax calculation unit price: Total tax payable / quantity

113,335,250 / 89 = 1,273,430 VND

So the total tax amount payable is: 113,335,250 VND CONCLUDE

After completing this final report, our group has drawn lessons experience:

- Apply knowledge of the subject to complete the report. Including: calculating import and

export tax for a shipment, how to look up the import and export tax schedule, how to look up the product's HS code.

- Team members can create a set of records for a shipment and customer through reporting.

- Members can learn from each other and share practical experiences of subject lecturers in

the process of completing this report. Besides, we have acquired basic to in-depth knowledge

in implementing documents for an import-export shipment. From here, each of us clearly

realizes the importance of each step in the process as well as the necessity of each type of

document. The person making these documents is required to be very careful, meticulous, and

knowledgeable. Clear all specialized knowledge to limit errors and incorrect information

filling. Although we have tried to apply theory into practice when implementing the set of

documents, due to lack of experience, the assignment cannot avoid shortcomings. But through

this report, each member has collected and accumulated necessary information and important

professional knowledge about freight forwarding and customs declaration, as well as applying

theory into practice at home. maximum possible level. The process of making reports

constantly improves knowledge to improve oneself and is a stepping stone for future work.