Preview text:

2. Theoretical basis: 2.1. Exclusive model:

A monopolistic market is the polar opposite of perfect competition. There

is only one provider of a product in an oligopolistic market. A monopolist is a

company that only sells to one company. The monopolist's supply curve is the

industry supply curve, and the market demand curve is the demand curve for the

monopolist's product, since the monopolist is the only provider of the item.

When the following two requirements are satisfied, an industry is

considered to be a full monopoly:

- Rivals are unable to join the market: Because a monopoly has no

competitors, it may set output or price unilaterally without fear of luring other

companies into the industry., because new businesses will find it difficult to

enter due to obstacles and production costs.

- There are no comparable alternatives. The monopolist is unconcerned

with the influence of his pricing strategy on the responses of other enterprises if there are no alternatives. 2.2. Trends lead to monopoly

2.2.1. Costs of Production:

Monopolies emerge when there are economies of scale in the industry.

Long-run average cost (LAC) decreases as production rises in various sectors.

As a result, large-scale organizations are often those that create lower costs and

may remove competitors by lowering the selling price of their goods while still making a profit.

Because new enterprises operate at a low level of production, paying large

expenses, it will be difficult for other firms to join the sector once a dominant

position has been established. By cutting the selling price of their items, the

monopolist will be able to simply eliminate these businesses from the market. A

natural monopoly is a monopoly generated by such cost competition.

2.2.2. Monopoly from legal reasons:

Monopoly may be formed through legal means, and the law can do it in one of two ways:

- Invention and patent protection.

- Using law and pricing policy to protect critical national security sectors.

2.2.3. Monopoly from the merger trend of large companies:

2.3. Features of a monopoly economy

Large-scale mergers are becoming more common in today's globe. The

following are the causes for this trend:

- The stress of trying to find consumers. The merging of firms will extend

each member company's market, allowing them to gain market share and

eventually dominate the industry, allowing them to benefit from economies of

scale. As a result, the merger may generate favorable circumstances for

businesses to acquire market share and establish monopolies.

- Lower manufacturing and business expenses.

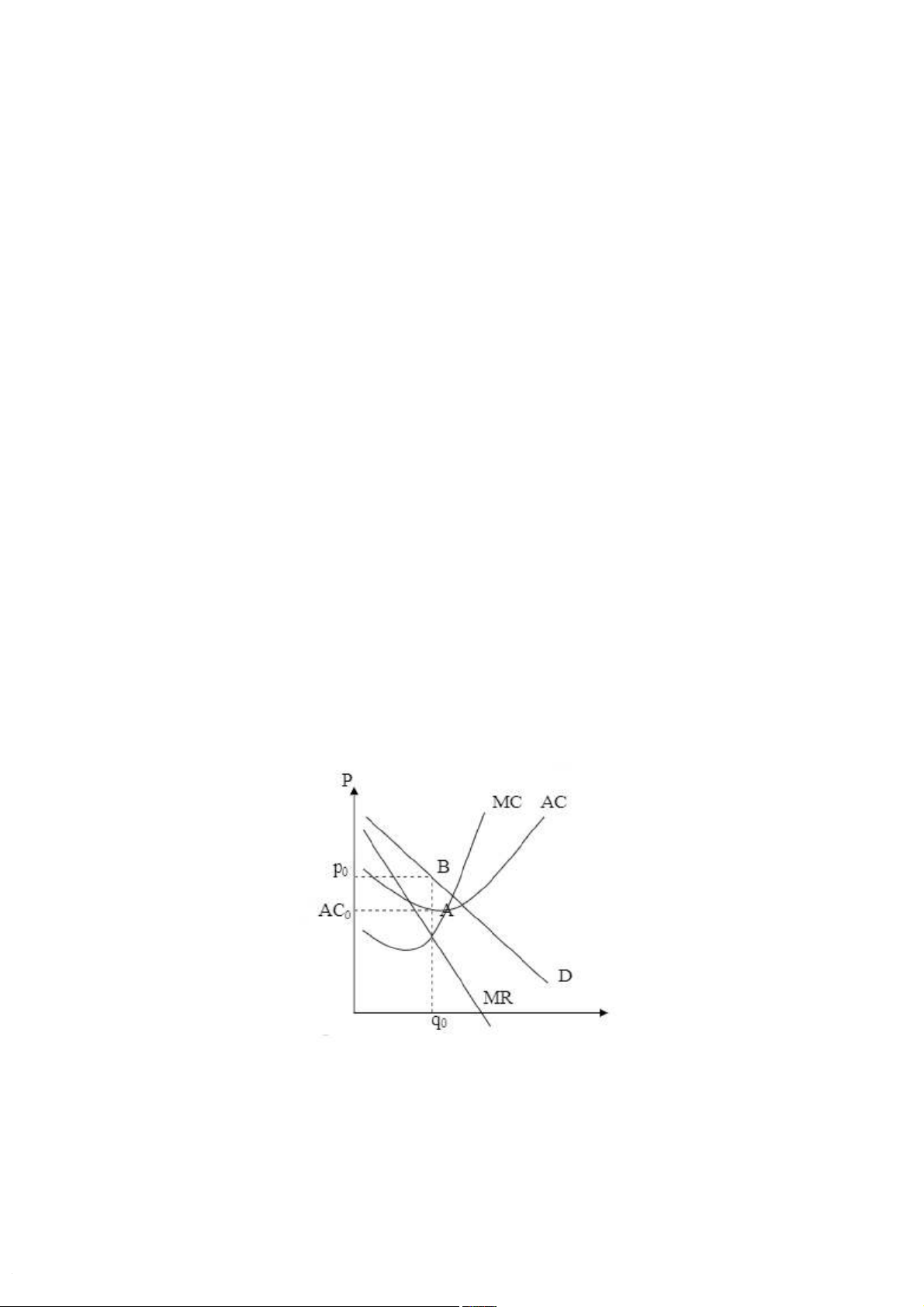

2.3.1. Monopolist Profit Maximization Principle

A monopolistic firm's demand curve is the market demand curve (because

the firm is unique in the market). The marginal revenue will be smaller than the

price of the product since the market demand curve is downward sloping.

Marginal revenue is positive when demand is elastic, zero when demand is

elastic, and negative when demand is inelastic, as previously mentioned.

As we all know, a company's profit is maximized by producing at a level of

production where marginal revenue equals marginal cost (as long as P > AC). At

output Q0, MR = MC for the monopolistic company represented in the graphic

above. The company charges P0 as its fee (the price the firm can charge at each

level of output with a given demand curve). The company will profit since the

price P0 exceeds the average total cost (AC0) at this production level.

Nonetheless, these monopoly earnings vary from those earned by properly

competitive enterprises since they will be sustained over time (since barriers to

entry are characteristic of a monopoly market)

Figure 1: Monopolist profit maximization principle

A monopoly may, of course, incur losses. This is seen in the graph below.

The rectangle region p0BAAC0 in this graph represents the company's loss.

Although the firm will continue to function in the short term owing to a higher

price than AVC, it will exit the market in the long run. It's important to

remember that owning a business does not ensure that you'll continue to make

money. It's conceivable that few individuals seek a monopoly on a certain good's manufacturing...

Figure 2. Manifesting the damage of monopolist

People who haven't studied economics often assume that a monopolist can

set whatever price it likes and can always increase profits by rising prices.

Monopolies, like all other market systems, are limited by the amount of demand

for their product. A monopoly must determine the production level at which

MR=MC in order to maximize profits. This sets the line of business's one-of-a-

kind pricing. A price rise that is higher than this will result in a decrease in the company's profitability.

2.3.2. Price discrimination policy

Full Price Discrimination: A monopolist's strategy of setting a maximum

price for each client (group) of prices that they can pay.

Price Discrimination in Two Markets: Firms operating in marketplaces

that aren't totally competitive might boost profits by discriminating pricing

based on demand elasticity, a strategy in which consumers with the most

inelastic demand for a product pay a higher price. The following are necessary

prerequisites for pricing discrimination:

- The firm cannot set the price;

- The company must be able to categorise clients according to their demand elasticity;

- The product cannot be resold.

Figure 4: Price discrimination for two markets

2.4. The reason why petroleum is classified as a monopoly:

2.4.1. Factors indicating that petroleum is a monopolistic product

According to the Competition Law, if a company has more than 30% of the

market, it is dominating the market, and monopoly occurs when a company

owns more than 30% of the market. Only locally produced gasoline can fulfill

30% of demand in Vietnam; the other 70% must be imported and executed by

11 important companies, with Petrolimex alone accounting for almost 60% of

the market. As a result, Vietnam's petroleum market is effectively monopolistic.

Moreover, petroleum is a one-of-a-kind item, with no “close” substitute.

The corporation or organization has total control over the quantity of it sold on

the market, may set the selling price, and profit from the sale of it and the provision of services.

In addition, when a new firm wishes to invest in petroleum, it will

encounter significant obstacles and will be unable to compete with the original.

The following are the obstacles:

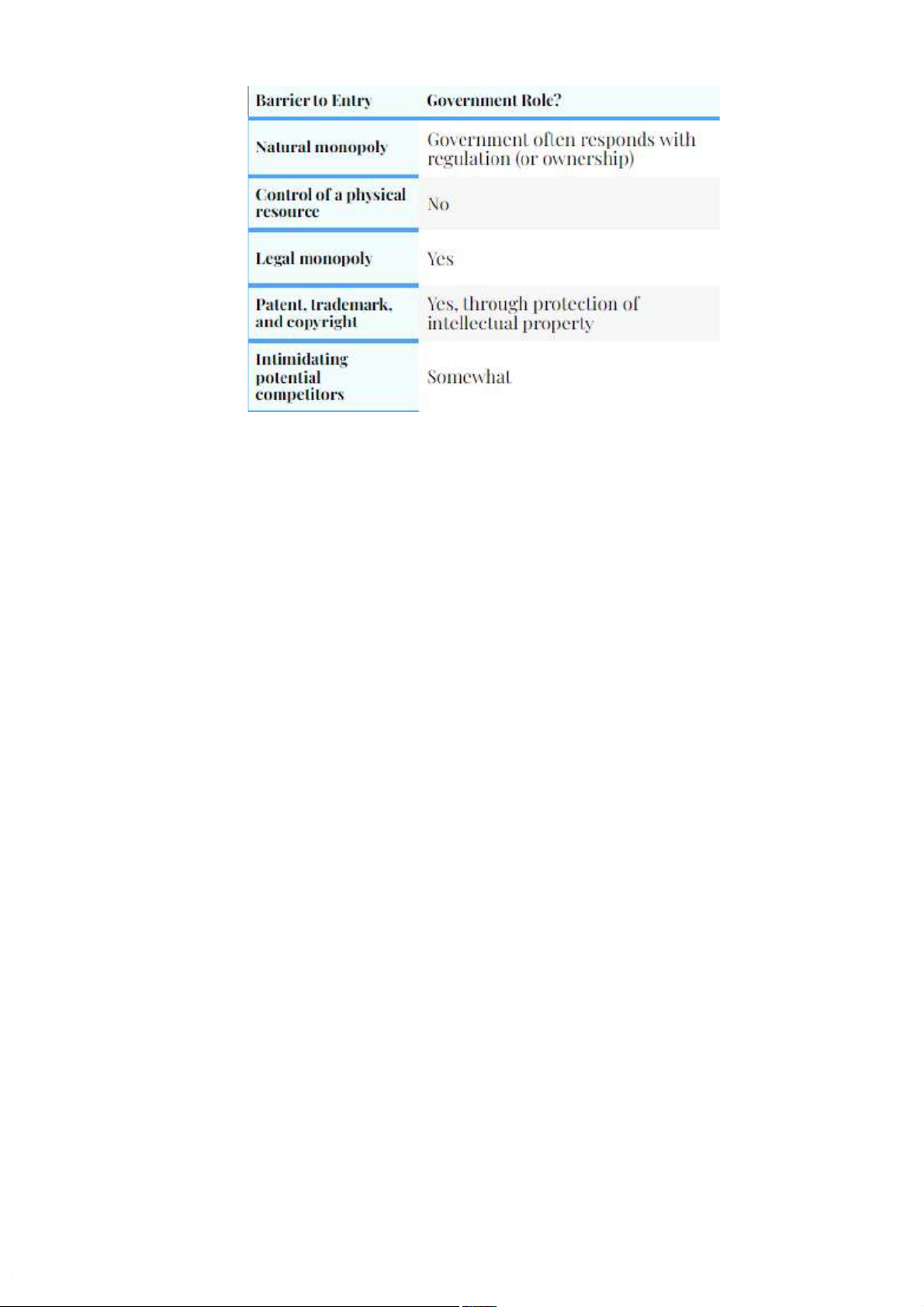

- Economies of scale ( Natural monopoly): Existing firms will be more

established and have a cost of petroleum advantage over other prospective

companies if production costs reduce as company size develops and output is

generated in higher numbers; this will prevent new companies from joining.

- Control of resources: Early market entrants might confine existing scarce

resources of petroleum, making it harder for fresh entrants to use them.

- Government restrictions: The government grants a corporation exclusive

rights to provide a patented or copyrighted product or component of petroleum.

Patents and copyrights safeguard firms' ideas, which have been costly to create,

test, and commercialize. To protect customers and suppliers, governments

demand licenses from professionals such as attorneys, physicians, accountants, and taxi drivers.

- Policy of Governments: Competitors are prohibited from entering the

market by the government. For the benefit and long-term development of a

country, an enterprise can become a legal monopoly if it is the only one licensed

to manufacture and trade petroleum.

- Collusion strategies: Businesses have devised a variety of strategies for

erecting barriers to entry in order to keep prospective rivals out. Predatory

pricing is one strategy, in which a company threatens to reduce the price of

petroleum to discourage competition.

2.4.2. The advantages and disadvantages of petroleum in monopoly: Advantages:

- Companies, monopolistic businesses, will be able to set their own profits

and extend their business scale; the firm has led to lower production costs than

the common market level; people will be able to purchase gasoline at a cheaper cost.

- Many enterprises and monopolistic corporations in the petroleum industry

may conserve earnings from the monopoly and utilize that cash for research and financial accumulation.

- The petroleum industry's reputation and prestige will expand and spread farther. Disadvantages:

- Having a monopoly in the petroleum industry makes it hard for rivals to

join the market. The distribution market, product manufacturing, and user

segment are not as effective and high as projected due to the absolute space of these enterprises.

- Having a monopoly in the petroleum industry would demotivate many

firms and companies from developing and innovating, while other companies

will improve and enhance their petroleum quality to increase revenues.

monopoly will progressively fall behind in terms of attracting users, improving

reputation, and gaining a top position in the hearts of customers.

- A petroleum monopoly would restrict customers' options, causing

suffering only when they have no other option.