Preview text:

International Finance/2022 Balance of payments

Student’s name: …………………………………………………………………………… Review exercise 1

You are Australia, For each of the financial flows ,indicate whether they are recorded as

debits or credits, and the section of the ……account to which they belong. i.

The export of lamb to the United States. ii.

Financial aid (food and clothing) to a developing country such as Bangladesh. iii.

Dividend payment on overseas investments to an Australian company. iv.

Interest paid on loans by the Federal government to a foreign bank. v.

Income from Australian swimmers competing overseas. vi.

UK citizens living in Australia who receive pensions from the British government. vii.

The payment by an Australian company for computers imported from China. viii.

A Japanese tourist company paying for a cruise on the Great Barrier Reef. ix.

Insurance of a new Australian cargo ship with Lloyds of London. x.

The purchase of a bottle of Hunter Valley wine in Sydney. Review exercise 2

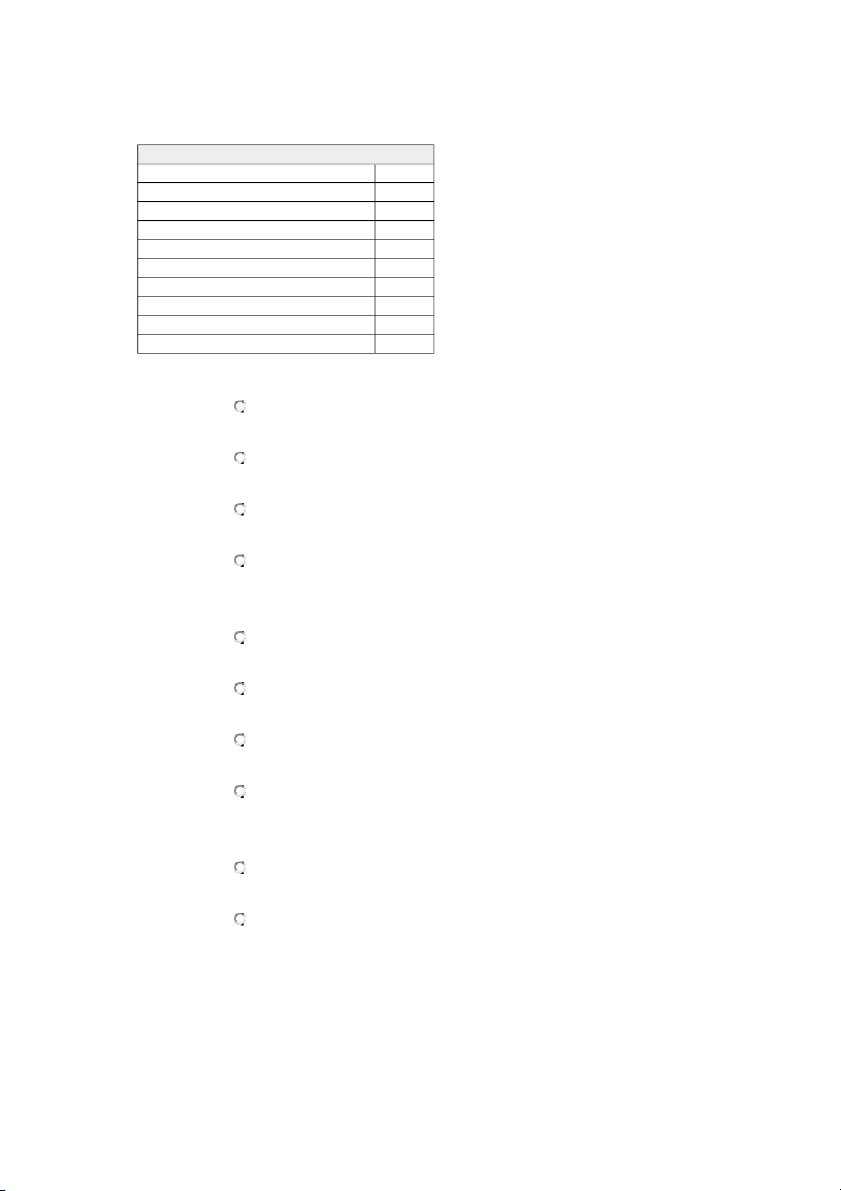

Consider the following information for a hypothetical economy with a floating exchange rate. Page 1 of 4 International Finance/2022 Components ($billions) Goods credits 50 Goods debits -70 Current transfers credits 10 Current transfers debit -5 Service credits 15 Service debits -10 Income credits 5 Income debits -32 Capital transfers credits 20 Capital transfers debits -15 i.

According to these figures net goods and services has a: a. A surplus of $135 billion b. A deficit of $15 billion c. A surplus of $20 billion d. A deficit of $65 billion ii.

The balance of payments on current account shows a: a. A deficit of $37 billion b. A surplus of $15 billion c. A deficit of $27 billion d. A surplus of $5 billion iii.

From the information given the value of the financial account is: a. A surplus of $37 billion b. A deficit of $5 billion Page 2 of 4 International Finance/2022 c. A deficit of $10 billion d. A surplus of $32 billion Answers:

View the full balance of payments information for this exercise. Review exercise 3

Australia’s current account

Historically Australia has recorded large current account deficits (CAD) which have had

implications for foreign investors. Australia has averaged a CAD of around 4.5 per cent of

GDP over the past two decades. The CAD in 1999-2000 averaged 5.4 per cent of GDP reducing to 2.8% in 2000-01.

These CADs have led to an increase in net foreign liabilities (debt and equity), largely the

outcome of private sector transactions rather than actions by the public sector (government).

By 2007 and 2008 the Current Account Deficit had grown to approximately 6% of Gross

Domestic Product and in early 2008 had risen to 6.5% of GDP. Many economists believe that

this CAD to GDP ratio was too high and becoming unsustainable. Others believe that this

deficit in the current account is the result of rational decisions made by businesses in the

pursuit of profit (Pitchford thesis) and so is not of such concern. The CAD rose in 2008

because the economy was booming and consumers were increasing their purchase of

imported goods. However, the global financial crisis caused economic growth to slow down,

imports fell and the current account fell rapidly. By the end of 2009 the Current Account

Deficit (CAD) had fallen to around 3.4 % of GDP. i. What is a CAD? Answer Page 3 of 4 International Finance/2022 ii.

Outline some economic factors that may have contributed to the CAD. Answer iii.

Explain why the GFC helped reduce Australia's CAD. Answer iv.

Give an outline of the 'Pitchford thesis'. Answer Answer Page 4 of 4