Preview text:

VIETNAM NATIONAL UNIVERSITY

INTERNATIONAL UNIVERSITY

FDI INFLOWS OF VIETNAM AND

9 SELECTED ASIAN COUNTRIES SUBMITTED BY NGUYỄN ÁNH NGỌC BABAIU22598 LÊ NGUYỄN MỸ KHANH BABAIU22592 TRẦN DUY TÂN BABAIU22235 HOÀNG THANH NGÂN BABAIU22469 NGUYỄN PHÚC CƯỜNG BABAIU22021 SR NO DESCRIPTION PAGE NO [1.0] ABSTRACT 1 [2.0] METHODS 3 [3.0] RESULTS 4 [4.0] DISCUSSION 5 [5.0] CONCLUSION 10 [6.0] REFERENCES 11 I. ABSTRACT

1.1. Purpose of the Report

FDI plays a crucial role in the economic growth and strategic development plans of Asian

countries, impacting industrial and financial aspects. This study analyzes FDI inflow data from

10 Asian members, including Vietnam, Thailand, Indonesia, Malaysia, Cambodia, China,

Philippines, India, Lao PDR, and Myanmar. FDI analysis serves critical purposes, such as

monitoring global market trends, identifying sectors attracting the most investors, and

understanding factors influencing FDI flows, including potential incentives. It also facilitates

comparing FDI inflows across countries, aiding in identifying reasons for declines, particularly

in Vietnam, to develop strategies for improvement.

Controversial opinions exist regarding the impact of FDI inflows on economic growth in Asian

nations, including the ten mentioned countries. According to Abbasabadi and Soleimani (2021),

an increase in FDI ratio correlates with a decrease in the unemployment ratio, suggesting that

FDI inflows create jobs, improve workers' quality of life, promote trade (exports, imports), and

boost GDP growth rate (Asian Development Bank).

1.2. Global FDI Inflows Overview

Global Foreign Direct Investment (FDI) has shown dynamic trends in recent decades, with

stable fluctuations and notable patterns, as confirmed by reputable sources like the World Bank

and UNCTAD. Since the 1990s, FDI inflows have risen, notably favoring developing

economies, particularly in Asia, driven by countries like China, India, and Southeast Asia.

However, recent disruptions including trade tensions, regulatory shifts, and the COVID-19

pandemic have altered global FDI flows. Developed economies like the US, Europe, and Japan

have benefited, while emerging markets in Asia and Africa are gaining traction due to improved

business environments, abundant resources, expanding consumer markets, and demographic

trends. Industries attracting FDI have shifted, with e-commerce, renewable energy, healthcare,

and technology leading the way. To foster FDI and spur economic growth, policies promoting

a favorable investment climate, such as tax incentives, streamlined regulations, and

infrastructure development, are crucial.

1.3. Factors Influencing FDI Inflows

Foreign Direct Investment (FDI) inflows are influenced by various global and local factors.

Globally, market size and growth potential, political stability, regulatory environment,

infrastructure quality, skilled labor availability, natural resources, and technological

advancements play significant roles in attracting investors. Transparent regulations, robust

transportation, communication networks, and reliable energy systems are key attractions.

Moreover, efficient business operations and innovation are facilitated by quality infrastructure,

skilled labor, and technology.

When examining specific countries, distinct factors contribute to their FDI appeal. China's

large market size, rapid infrastructure development, evolving regulations, and skilled

workforce attract investors. India's policy reforms and sizable consumer base make it attractive

for investment. Southeast Asian nations like Vietnam and Thailand benefit from strategic

locations, improved infrastructure, and pro-investment policies. Additionally, factors such as

natural resources, demographics, trade openness, and geopolitical considerations further

enhance their FDI appeal, shaping the investment landscape across these regions.

1.4. Introduction to Selected Countries 1.4.1. Vietnam

Vietnam's economy is thriving due to industrialization, export-oriented manufacturing, and a

dynamic workforce. Key sectors include manufacturing, services, and agriculture. FDI trends

are shifting towards high-tech industries, supported by government policies and economic reforms. 1.4.2. Thailand

Thailand is attracting foreign direct investment (FDI) in manufacturing, tourism, and services

to boost economic growth, technology transfer, and job creation. High-value industries like

advanced manufacturing and technology are also attracting FDI. However, political

uncertainties and the COVID-19 pandemic have influenced investment decisions. 1.4.3. Indonesia

Indonesia, Southeast Asia's largest economy, has seen growth in sectors like agriculture,

manufacturing, services, and natural resources. In 2022, foreign investment shifted to metal

mining, mining, and infrastructure. The country's digital economy and e-commerce sector

experienced a surge due to increased internet penetration and tech-savvy population. 1.4.4. Malaysia

Malaysia's economic growth is attributed to a mix of manufacturing, services, and natural

resource sectors, with key sectors like manufacturing, electronics, oil and gas, and services.

FDI in finance, healthcare, and education is increasing, with Islamic finance and renewable energy attracting FDI. 1.4.5. Cambodia

Cambodia's economy is diverse, with key sectors including agriculture, textiles, construction,

and tourism. FDI mainly focuses on manufacturing, textiles, real estate, and tourism, with

China being a significant source. Cambodia's low labor costs attract labor-intensive industries like textiles and footwear. 1.4.6. China

China's rapid economic growth has accelerated FDI towards high-tech industries, services, and

domestic consumption sectors, with initiatives like "Made in China 2025", the Belt and Road

Initiative facilitating global investment. However, China remains crucial to global supply

chains, and potential national security risks are being scrutinized. 1.4.7. Philippines

The Philippines, a Southeast Asian developing country, experiences steady growth in its mixed

economy, driven by BPO, remittances, and domestic consumption. The government seeks

foreign direct investment in sectors like services, manufacturing, real estate, and IT, driven by

a growing middle class and urbanization. 1.4.8. India

India's economy is attracting foreign direct investment (FDI) in IT, pharmaceuticals,

telecommunications, and financial services, with key areas including manufacturing, services,

IT, and renewable energy. The "Make in India" initiative boosts manufacturing and infrastructure. 1.4.9. Lao PDR

Lao PDR, a landlocked Southeast Asian nation, relies on agriculture, hydropower, and mining

for its economy. Key FDI sectors include hydropower, mining, agriculture, manufacturing, and

tourism, with China's influence in infrastructure. Challenges include limited infrastructure,

small domestic market, and capacity building. 1.4.10. Myanmar

Myanmar faces political challenges despite economic reforms, attracting FDI in key sectors

like energy, telecommunications, manufacturing, and services. Political uncertainties,

government changes, and human rights concerns pose challenges to Myanmar's economic landscape. II. METHODOLOGY

Foreign Direct Investment (FDI) on the economic growth of ten selected countries has been

analyzed using a structured methodology that included data collection, variable selection, and

rigorous statistical techniques. 2.1. Data Collection

The analysis basically relied on obtaining accurate and complete information. To achieve this,

primary data sources were used, specifically reliable databases like the World Bank for each

country under examination. These sources offered broad datasets, covering various aspects

such as FDI inflows, key economic indicators (like GDP growth, inflation rates), and other

relevant socio-economic factors.

2.2. Statistical Techniques

The analysis included descriptive and inferential statistical methods to catch meaningful insights: 1.

Descriptive Analysis: using descriptive statistics (mean, median, standard deviation)

toprovide an overview of the main trends and distribution of FDI inflows within each country.

This approach aimed to disclose trends and variations over time and across the selected nations. 2.

Inferential Analysis: applying multiple regression analysis as the primary

inferentialtechnique. The regression model was constructed to explore the relationship between

FDI inflows and their determinants. This involved evaluating coefficients to verify the impact

and significance of GDP growth, political stability, infrastructure quality, and trade openness

on FDI. The model aimed to evaluate these effects, enlightening their role in attracting foreign investment.

2.3. Considerations and Limitations:

Several considerations and limitations were recognized within this methodology. Data

availability and consistency across countries and periods of time were potential limitations.

Moreover, while the chosen variables were important, there might exist ignored factors

impacting FDI inflows. Sensitivity analysis and strength checks were performed where

possible to address these limitations and ensure the reliability of the findings. III. RESULTS

The research findings reveal diverse trends in Foreign Direct Investment (FDI) across the

selected countries. Thailand exhibits fluctuating FDI trajectories, notably experiencing a dip in

2020, while Indonesia displays variable trends with occasional declines, particularly in 2000.

China, despite historical increases, witnesses recent decreases, reflecting changing economic

dynamics. The Philippines and India demonstrate mixed FDI patterns with minor fluctuations.

Malaysia's FDI trends are marked by fluctuations, reflecting shifting investment patterns,

whereas Lao PDR and Myanmar also show varying trajectories tied to changing economic

conditions and policy dynamics. Notably, Cambodia stands out with a remarkable trajectory,

experiencing substantial and consistent growth in FDI, indicating increased investor

confidence and supportive business environments. These findings underscore the unique FDI

dynamics across the countries, shaped by their respective economic landscapes and policies.

Furthermore, the analysis identifies significant correlations between FDI inflows and economic

growth indicators. The findings suggest that factors such as Political Stability and Absence of

Violence/Terrorism, Rule of Law, GDP per capita, PPP, Inflation, and GDP deflator influence

FDI inflows across the examined countries. For instance, Vietnam's recession is analyzed in

detail, highlighting the influence of variables like GDP and stability on investor decisions. The

conclusion emphasizes the methodology, including statistical analysis, and directly addresses

Vietnam, providing valuable insights for potential strategies for improvement. Despite

acknowledging drawbacks, the research presents opportunities for further study and offers a

coherent and informative narrative on the impact of FDI on economic growth in the analyzed countries. IV. DISCUSSION

4.1. Descriptive Analysis

Foreign Direct Investment (FDI) inflows play a pivotal role in shaping a nation's economic

landscape, and examining the trajectory of FDI among countries offers critical insights into

their investment attractiveness.

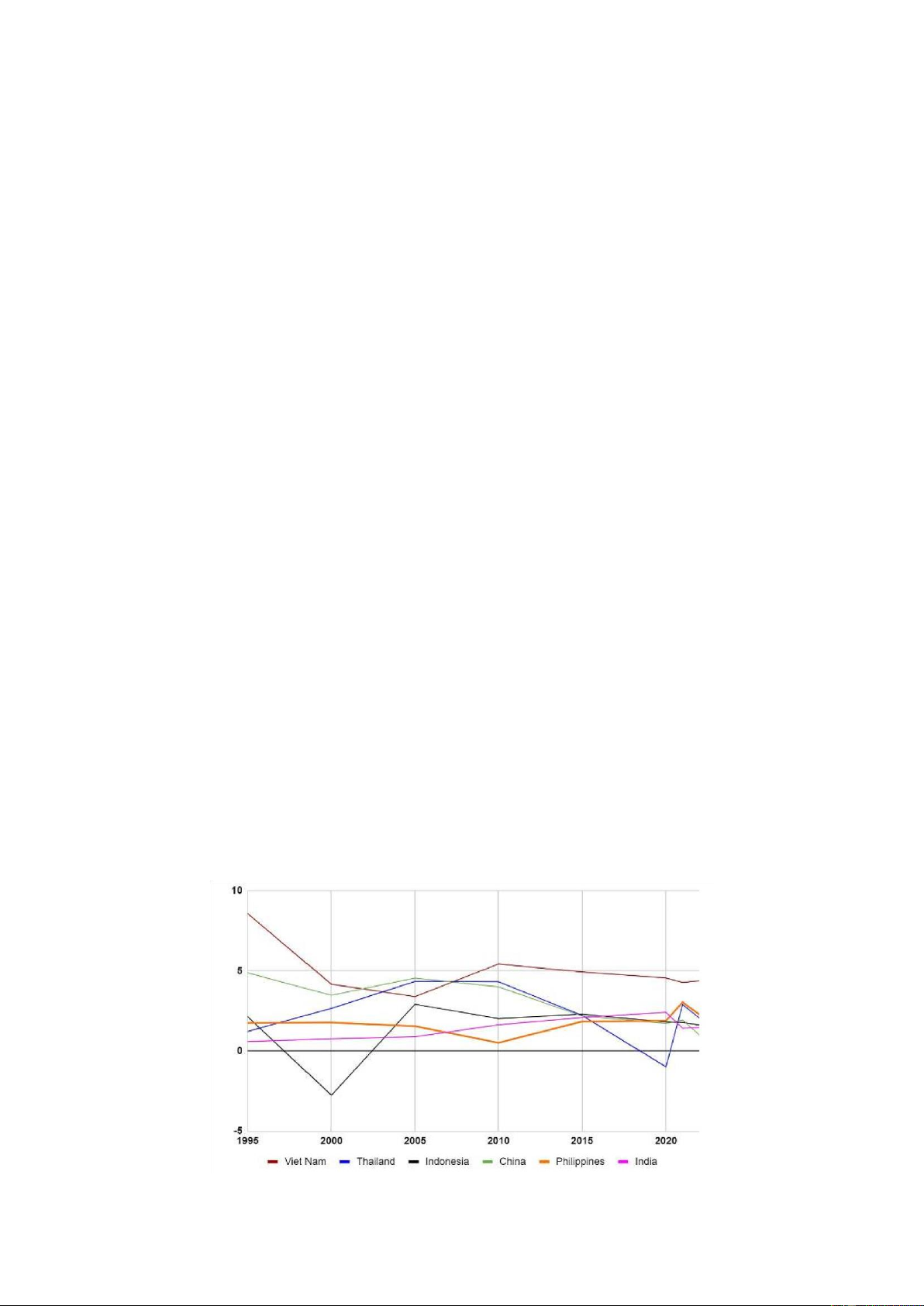

Figure 1: FDI Inflows (% of GDP) in Vietnam and 5 selected countries

The FDI landscape for the specified countries reveals diverse trends. Thailand's trajectory

shows fluctuations, notably in 2020 with an alarming dip below zero (figure 1), while Indonesia

exhibits variable trends, including periods of decline, bottoming out near -3.0 in 2000. China,

despite historical growth, experiences recent decreases. The Philippines and India show mixed

FDI patterns with minor fluctuations.

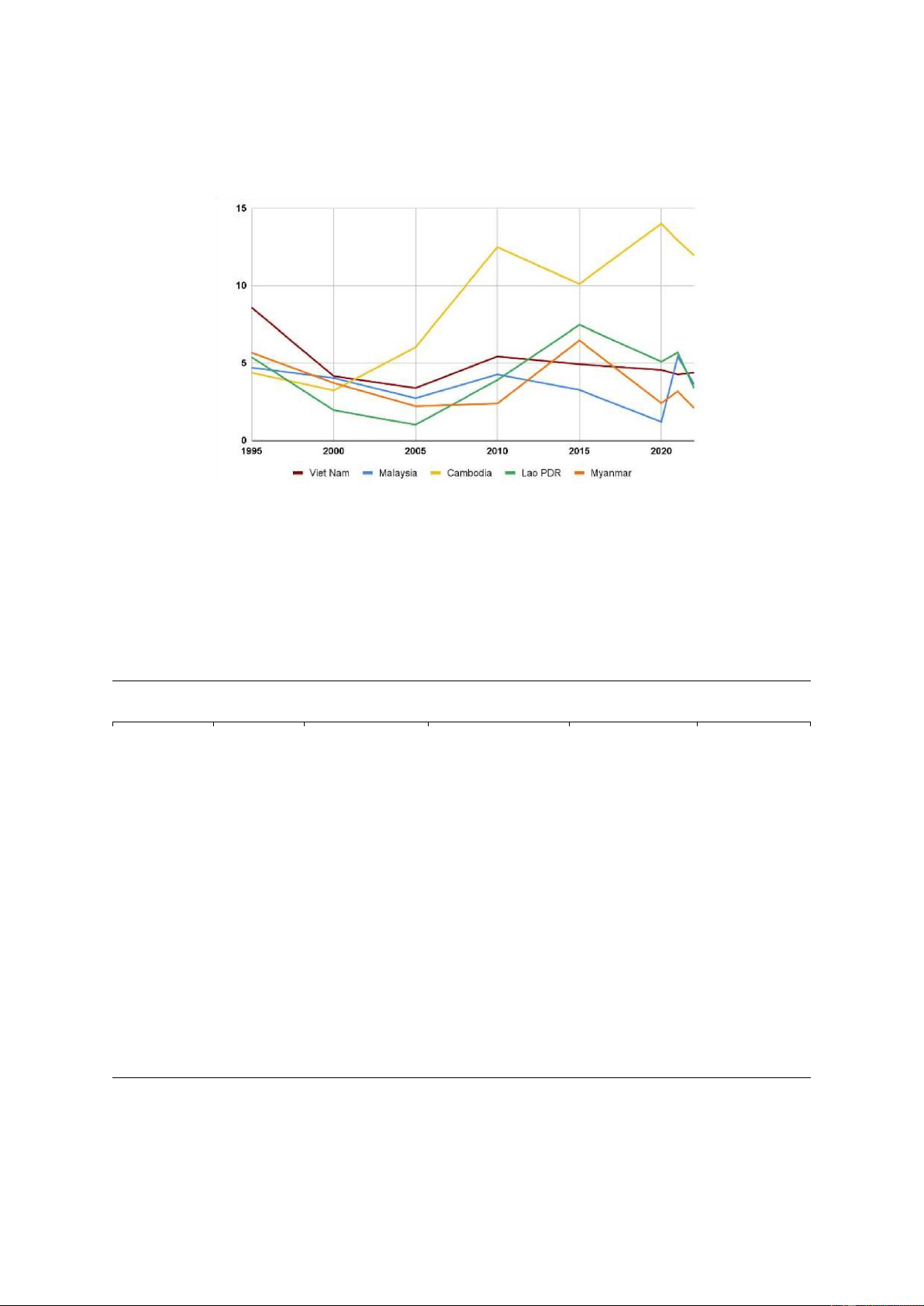

Figure 2: FDI Inflows (% of GDP) in Vietnam and 4 selected countries

In Figure 2, Malaysia's FDI trends show fluctuations reflecting changing investment patterns.

Lao PDR and Myanmar also display varying FDI trajectories, mirroring shifts in economic

conditions and policies. In contrast, Cambodia stands out with remarkable consistent FDI

growth, signaling enhanced investor confidence and favorable business environments. These

countries showcase distinct FDI dynamics shaped by their economic landscapes and policies.

Figure 3: Basic Statistics for FDI Inflows N Mean SD Min Max Vietnam 30 5,614606453 2,221697894 3,390403639 11,93948283 Thailand 30 2,58488969 1,522625655 -0,9885908043 6,434806789 Indonesia 30 1,284813592 1,401789898 -2,757439934 2,916114833 Malaysia 30 3,679754121 1,553904166 0,05669231464 7,482839123 Cambodia 30 8,247027498 4,404317784 1,751316579 14,14572541 China 30 3,361606832 1,367751947 1,002979297 6,186882076 Philippines 30 1,775987161 0,7485142494 0,5136980516 3,122387771 India 30 1,385916492 0,7795835977 0,1970564295 3,620523209 Lao PDR 30 4,592183694 2,431680896 0,2531768934 9,917782999 Myanmar 30 3,894421842 1,602446824 2,086268507 7,818258794

In the intricate tapestry of FDI trends among ten nations, distinct patterns emerge. Focusing on

Cambodia, Indonesia, and China—representing dominant, low, and comparable FDI levels to

Vietnam—provides valuable insights into factors shaping their FDI dynamics, offering

nuanced perspectives for comparative analysis. Cambodia - The FDI Leader

In analyzing the provided data on Foreign Direct Investment (FDI) inflows, Cambodia emerges

as a notable standout with a mean FDI of 8.247 and a standard deviation of 4.404. This signifies

not only a high average of FDI but also a considerable degree of variability in investment levels.

Conversely, Vietnam, while still attracting substantial FDI with a mean of 5.614 and a standard

deviation of 2.221, demonstrates a slightly lower average and less variability in comparison to

Cambodia. This achievement is because Cambodia smartly used incentives and trade

opportunities to help grow a strong manufacturing sector. The graph visually displays FDI

flows into Vietnam,Thailand, Indonesia, Malaysia, Cambodia, China, Philippines, India, Lao,

PDR,Myanmar. According to figure 2, in 1995, FDI inflows accounted for 4.38% of

Cambodia's GDP, which decreased slightly to 3.24% by 2000. However, from 2005 onwards,

there was a noticeable uptick in FDI inflows, reaching 6.03% in 2005 and significantly rising

to 12.49% by 2010. Despite a slight dip in 2015 to 10.10%, FDI inflows surged again to 14.01%

in 2020, indicating a robust and increasing trend in FDI as a percentage of GDP. This trend

continued in 2021 with FDI inflows at 12.92% and remained high at 11.95% in 2022. This data

illustrates Cambodia's consistent attractiveness to foreign investors, with FDI inflows playing

a substantial role in the country's economic development and growth trajectory over the years.

In comparing Vietnam's FDI performance to Cambodia's, several factors contribute to

Cambodia's superiority in FDI inflows. Firstly, Cambodia's strategic geographical location

within the ASEAN region provides investors with access to a burgeoning market and regional

trade opportunities. Secondly, Cambodia's investor-friendly policies, including tax incentives

and simplified regulations, foster a favorable business environment that attracts foreign

investment. Additionally, ongoing infrastructure developments, particularly in transportation

and energy sectors, further enhance Cambodia's appeal as an investment destination.

Comparatively, Vietnam may face challenges such as occasional policy changes, bureaucratic

complexities, and infrastructural limitations, which could potentially hinder its FDI

attractiveness when compared to Cambodia. Overall, Cambodia's robust FDI performance

underscores its attractiveness as a prime investment hub in Southeast Asia, supported by stable

economic policies, strategic location, and proactive investment promotion efforts. Indonesia -

Struggling with Low FDI

According to Figure 3, Indonesia has the lowest mean among other countries. Compared to

Vietnam or China, it is lower by 4.3298 and 1.3, respectively. It can be understood that

Indonesia has low FDI inflows based on the calculated mean and standard deviation. The mean

represents the average FDI inflow in Indonesia. This means that, on average, Indonesia receives

less FDI than the other countries listed. Additionally, a lower mean makes it more challenging

for Indonesia to draw in foreign investment and convince them of its improvement potential.

Furthermore, Indonesia's standard deviation is 1.4017, only higher than the Philippines' 0.748,

India's 0.779, and China's 1.367.A low standard deviation suggests less pronounced

fluctuations in FDI, with many periods experiencing investment inflows significantly lower

than average. Figures 1 and 2 illustrate that Indonesia's FDI inflows are lower than those of

major peers, indicating challenges in attracting international investment. Limited resources

hinder resource-dependent businesses compared to peers like Malaysia and Thailand.

Inadequate infrastructure increases operating expenses and complicates logistics, while

bureaucratic hurdles and corruption contribute to a lack of transparency and fair play. Despite

economic potential, some perceive investing in Indonesia as risky due to its political history.

Especially in 2000, FDI inflows in Indonesia reached the bottom with -2.7574. Indonesia's

foreign investment hit rock bottom due to the lingering shadows of the Asian financial crisis.

Due to the significant devaluation of the rupiah, Indonesia became more expensive for foreign

investments, and the unstable economic environment reduced investor trust, making it difficult

for Indonesia to raise money. Indonesia will need more infrastructure improvements,

transparency and long term policy stability to exploit its potential

The mean (average) of Vietnam is 5.6146 while the mean of Indonesia is 1.2848. This means

that Vietnam has higher FDI inflows and a higher average GDP per capita than Indonesia. The

gap in GDP per capita between Vietnam and Indonesia is caused by several causes. One factor

is that Vietnam has a more developed manufacturing sector than Indonesia. Indonesia provides

natural resources, while Vietnam is a big exporter of agricultural goods. In addition, Vietnam

has a more educated population than Indonesia. The literacy rate in Vietnam is 94%, while the

literacy rate in Indonesia is 87%. Vietnamese workers are better equipped for today's economy,

but lag behind Indonesia due to infrastructure and government efficiency issues. Bureaucracy

and limited skilled labor hinder businesses. To improve, Vietnam should focus on infrastructure,

education, and reducing bureaucracy to attract foreign investment and boost economic growth.

Prioritizing industry and agriculture would strengthen the economy. China - Parallel FDI with Vietnam

In terms of China, the average mean FDI inflow is comparable to other countries. However,

when compared to Vietnam and Indonesia, China's mean FDI inflow is lower by 2.253 and

4.8854 units, respectively. From this analysis, we can infer that China receives moderate FDI

inflows based on the calculated mean and standard deviation. China's mean FDI inflow

suggests a moderate level compared to other mentioned countries. Recent surveys indicate

cautious attitudes among companies due to rising geopolitical tensions and China's slower

growth, potentially leading to reduced reinvestment and increased earnings repatriation.

Additionally, China's low standard deviation, among the lowest in the listed countries, implies

FDI flows closely cluster around the mean, indicating a predictable pattern. This stability may

attract investors seeking a reliable investment environment with fewer fluctuations. As we can

conclude from Figure 1 and 3, China has difficulties in getting more FDI inflows. This is caused

by several reasons. Firstly, there is now less of an incentive for direct investment in China. The

excess return on FDI – the rate of return on FDI minus the risk-free rate – has fallen

significantly since the US Federal Reserve’s sharp policy tightening raised the risk-free rate to

an average 5.25% in the first three quarters of 2023 from just over 2.0% in 2022 and 0% in

2021. This increase has reduced businesses’ risk appetite and their motivation to invest

abroad.Secondly, negative sentiment over China’s disappointing post-

Covid economic recovery and geopolitical tensions with the US have hurt FDI flows. This, too,

may be changing. China's economy appears to have reached a ‘pain point’ (see “Beijing mulls

aggressive easing as ‘pain point’ hits”, by Chi Lo, 15 November 2023). The current problems

are expected to prompt Beijing to ease policy more aggressively to stabilize the property market

and reverse the declining growth momentum. China should focus more on stable relations to

go a long way to reducing the risk premium on cross-border investment, allowing companies

to focus on the economic fundamentals.

Vietnam has an average FDI inflow mean of 5.6146, whereas China has an average FDI inflow

mean of 3.3616. While Vietnam receives a higher average amount of FDI compared to China,

the FDI inflows of China are considerably larger in scale compared to Vietnam. Here are some

key points of comparison between Vietnam and China in terms of FDI. Firstly, China

consistently receives much larger FDI inflows than Vietnam. China's sheer size and market

potential make it an attractive destination for multinational companies seeking to establish a

presence in a major global economy. The scale of FDI inflows into China far surpasses that of

Vietnam. Secondly, China has long been recognized as the "world's factory" due to its extensive

manufacturing capabilities. It has a well-developed supply chain, infrastructure, and skilled

labor force, making it a preferred location for manufacturing operations for numerous industries.

While Vietnam has also experienced growth in manufacturing, it has yet to reach the same level

as China. Finally, China's economy is significantly larger than Vietnam's. It offers a vast

consumer market and a diverse range of industries, which provides greater opportunities for

investment and market expansion. Vietnam, while experiencing strong economic growth, has

a smaller market size in comparison. It's important to note that while Vietnam may not match

China's FDI scale, it has made impressive strides in attracting FDI in recent years. Vietnam's

advantages include its strategic location, lower labor costs, improving business environment,

and growing middle class, which have contributed to its increased attractiveness as an investment destination

4.2. Inferential Analysis

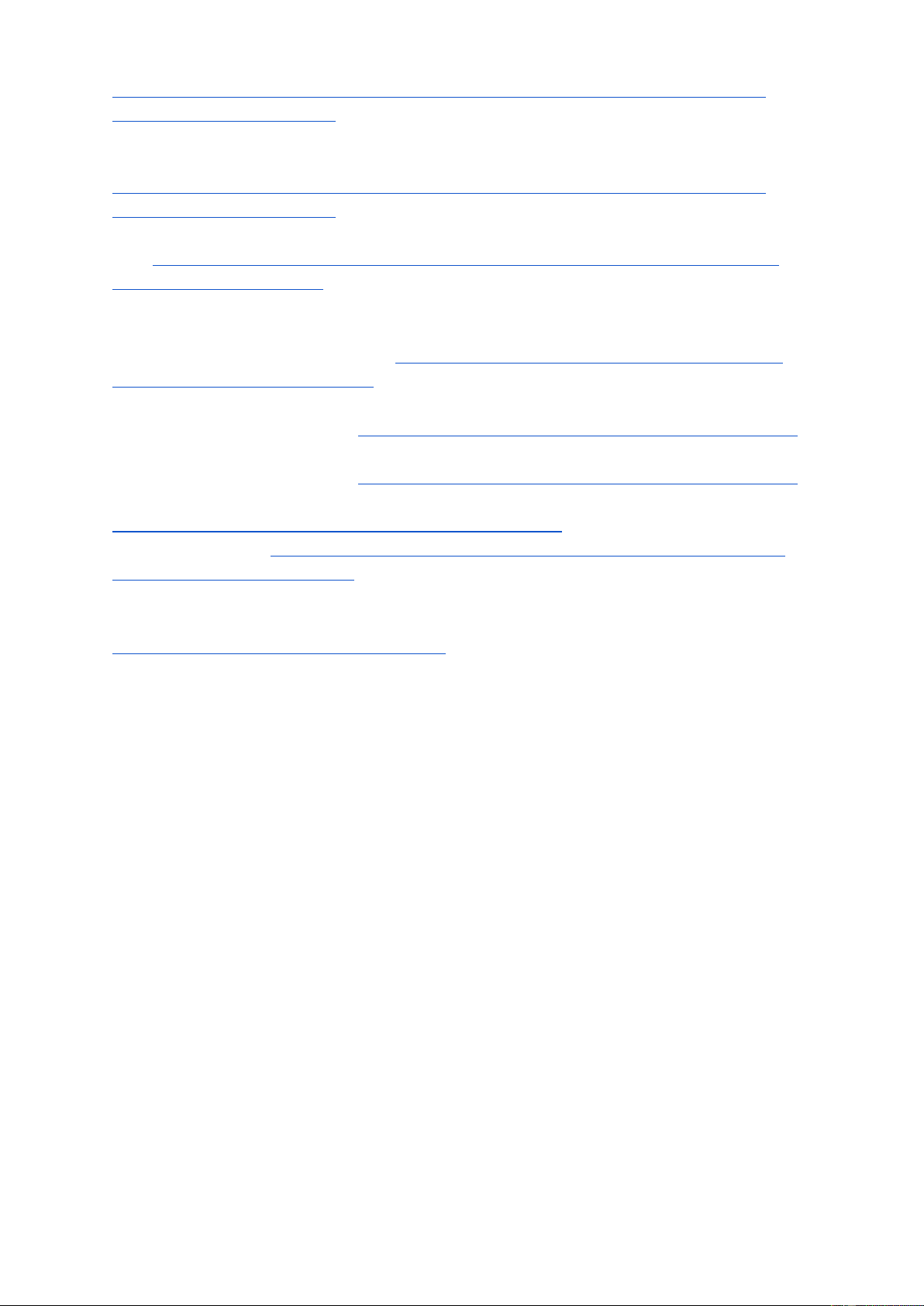

The R Square explains coefficient determinants. With the R Square value of 0.535, it can be

concluded that FDI inflows are explained by 53.5% of independent variables, so that it can be seen as an average equation.

Figure 4: Regression Model Regression Statistics Multiple R 0,731 R Square 0,535 Adjusted R Square 0,520 Standard Error 2,316 Observations 130 ANOVA Signifi df SS MS F cance F Regression 4

771,279 192,82 35,951 5,68E-20 Residual 125 670,422 5,363 Total 129 1441,702 Standard Lower Upper Lower Upper

Coefficients Error t Stat P-value 95% 95% 95,0% 95,0% Intercept 5,285 0,643 8,224 2,16E-13 4,013 6,557 4,013 6,557 Political Stability and Absence of Violence/Terrorism: 0,102 0,0122 8,339 1,16E-13 0,078 0,126 0,078 0,126 Percentile Rank Rule of Law: Percentile Rank -0,078 0,018 -4,345 2,86E-05 -0,114 -0,043 -0,113 -0,043 GDP per capita, PPP (current -0,0001 4,92E-05 -2,093 0,038

-0,0002 -5,60E-06 -0,0002 -5,60E-06 international $) Inflation, GDP deflator (annual %) -0,120 0,044 -2,761 0,007 -0,207 -0,034 -0,207 -0,034

ANOVA and The Coefficients Table are used to illustrate Regression analysis results. While

ANOVA indicates overall data on whether the independents influence FDI inflows, the

Coefficient Table shows the specific effects of those variables on the dependent factor (FDI Inflows).

Multiple Linear Regression Formula is

Y=B0+B1X1+B2X2+B3X3+B4X4 where Y: FDI Inflows

X1, X2, X3, X4 : values of independent variables

From the Coefficients Table, we have

Y=5.285+0.102 X1−0.078 X2−0.0001X3−0.120 X4 Choose Alpha = 0.005

- The hypothesis of relationship between Y and all X H0:

Y has no relationship with any X (B1=B2=B3=B4)

H1: Y has a relationship with at least one X (at least one B#0)

Significance F (5,68E - 20) < Alpha

⇒ We have enough evidence to reject H0

⇒ Y has a relationship with at least one X.

- The hypothesis between Y and each X

H0: Y has no relationship with Xn (n=1,2,3,4)

H1: Y has a relationship with Xn (Bn¿0) P-value of B1=1,16E-13 P-value of B2=2,86E-05 P-value of B3=0,038 P-value of B4=0.007

⇒ X1, X2, X3, X4 have a relationship with Y.

From all the calculations, it is proved that Political Stability and Absence of

Violence/Terrorism: Percentile Rank; Rule of Law: Percentile Rank; GDP per capita, PPP

(current international $); Inflation and GDP deflator (annual %) affect The FDI Inflows. The

conclusion effectively links back to the introduction, analyzing FDI in 10 Asian nations with a

focus on Vietnam's recession. It highlights the influence of variables like GDP and stability on

investor decisions, underscores the statistical methodology, and provides insights for

improvement strategies, despite acknowledging limitations. Overall, it offers a concise and informative overview. V. CONCLUSION

In conclusion, our report comprehensively analyzed Foreign Direct Investment (FDI) inflows

in Vietnam and nine other selected Asian countries, namely Thailand, Indonesia, Malaysia,

Cambodia, China, Philippines, India, Lao PDR, and Myanmar. The study aimed to

understand the dynamics of FDI in the region, identify factors influencing FDI inflows, and

provide insights for Vietnam to enhance its FDI attractiveness.

The analysis began with a thorough examination of global FDI trends, highlighting the

increasing significance of developing economies, particularly in Asia, as key destinations for

investment. The study then delved into the factors influencing FDI inflows, both globally and

at the individual country level. Key determinants such as market size, political stability,

infrastructure quality, skilled labor availability, and technological advancements were

explored in the context of the ten selected countries.

Subsequently, an in-depth analysis of FDI trends in each country revealed diverse trajectories.

Cambodia emerged as an FDI leader, experiencing consistent and substantial growth, whereas

Indonesia struggled with lower FDI inflows attributed to challenges like bureaucratic hurdles,

limited resources, and political uncertainties. China, despite being a global economic

powerhouse, faced challenges in sustaining FDI inflows due to geopolitical tensions and a changing economic landscape.

Through multiple linear regression, the analysis has provided valuable insights into the

specific factors influencing FDI inflows. The results indicated that political stability, rule of

law, GDP per capita, and inflation were significant determinants of FDI inflows across the

selected countries. The regression model explained 53.5% of the variance in FDI inflows,

highlighting the relevance of the chosen variables in understanding FDI dynamics. In

summary, the findings of this report contribute to a nuanced understanding of FDI trends in

the selected Asian countries. By connecting the analysis with its initial purpose, the report

has emphasized the importance of addressing the factors influencing FDI for Vietnam's

economic development. Despite acknowledging limitations and challenges, the report

highlights opportunities for further research and offers a coherent narrative that informs

strategic decision-making for FDI enhancement. REFERENCES 1.

Investment flows to developing countries in Asia remained flat in 2022. (2023, July 5).

unctad. Retrieved December 19, 2023, from https://unctad.org/news/investment-

flowsdeveloping-countries-asia-remained-flat-2022 2.

Impact of Foreign Direct Investment on Economic Growth: Empirical evidence from

Tanzania (1990-2020) 2022. (n.d.). KDI Central Archives. Retrieved December 19, 2023,

from https://archives.kdischool.ac.kr/bitstream/11125/46600/1/Impact%20of%20foreign

%20direct%20investment%20on%20economic%20growth.pdf 3.

ASEAN Investment Report 2020–2021 – Investing in Industry 4.0. (2021, September

30). Asean. Retrieved December 19, 2023, from https://asean.org/wp-

content/uploads/2021/09/AIR-2020-2021.pdf 4.

Global foreign direct investment flows over the last 30 years. (2023, May 5).

UNCTAD. https://unctad.org/data-visualization/global-foreign-direct-investment-flows-over- last-30years 5.

Global foreign direct investment rebounded strongly in 2021, but the recovery is

highly uneven. (2022b, January 19). UNCTAD. https://unctad.org/news/global-foreign-

directinvestment-rebounded-strongly-2021-recovery-highly-uneven 6.

Lipsey, R. E., & Dunning, J. H. (n.d.). “Factors Influencing FDI Inflows in South-

Asian Countries: A Panel Data Analysis” By Md. Jobaer Hossain. DiVA portal. Retrieved December 20, 2023, from

https://www.diva-portal.org/smash/get/diva2:1371372/FULLTEXT01.pdf 7.

Al-Kasasbeh, O., Alzghoul, A., & Alghraibeh, K. (2022). Global FDI inflows and

outflowsin emerging economies Post-COVID-19 era. Future Business Journal, 8(1).

https://doi.org/10.1186/s43093-022-00167-z 8.

Pettinger, T. (2021, December 9). Factors that affect foreign direct investment (FDI).

Economics Help. https://www.economicshelp.org/blog/15736/economics/factors-that-

affectforeign-direct-investment-fdi/ 9.

Topic: Foreign direct investment (FDI) into China. (2024, January 5). Statista.

https://www.statista.com/topics/8962/foreign-direct-investment-fdi-into-china/ #topicOverview 10.

Bloomenthal, A. (2022, January 31). 6 factors driving investment in China.

Investopedia. https://www.investopedia.com/articles/economics/09/factors-drive-investment-

in-china.asp 11. India, F. (2023, November 9). Foreign Direct Investment (FDI) in India:

Inflows in 2023 and last 10 years. Forbes India.

https://www.forbesindia.com/article/explainers/fdi-in-indiainflows/89609/1

12. Foreign direct investment trends and outlook in Asia and the Pacific 2021/2022. (n.d.).

ESCAP. https://www.unescap.org/kp/2021/foreign-direct-investment-trends-and-

outlookasia-and-pacific-20212022

13. Foreign Direct investment in South Asia. (2017, November 15). Asian Development

Bank. https://www.adb.org/publications/foreign-direct-investment-south-asia

14. Foreign investment in developing Asia hit a record $619 billion in 2021. (2022, June 9).

UNCTAD. https://unctad.org/news/foreign-investment-developing-asia-hit-record- 619billion-2021

15. Foreign direct investment (FDI) in Vietnam - International Trade Portal. (n.d.).

https://www.lloydsbanktrade.com/en/market-potential/vietnam/investment 16.

TRADING ECONOMICS. (n.d.). Vietnam Foreign Direct Investment.

https://tradingeconomics.com/vietnam/foreign-direct-investment

17. Foreign direct investment (FDI) in Thailand - International Trade Portal. (n.d.).

https://www.lloydsbanktrade.com/en/market-potential/thailand/investment

18. Indonesia Foreign Direct Investment 1970-2024. (n.d.). MacroTrends.

https://www.macrotrends.net/countries/IDN/indonesia/foreign-direct-investment 19.

Malaysia Foreign Direct Investment 1970-2024. (n.d.). MacroTrends.

https://www.macrotrends.net/countries/MYS/malaysia/foreign-direct-investment 20.

Foreign Direct Investment Trends and Policies in Cambodia: A preliminary note.

(2022, December 5). LSE Southeast Asia Blog.

https://blogs.lse.ac.uk/seac/2022/12/07/foreigndirect-investment-trends-and-policies-in- cambodia-a-preliminary-note/ 21.

Foreign Direct Investment Trends and Policies in Cambodia: A preliminary note.

(2022, December 5). LSE Southeast Asia Blog.

https://blogs.lse.ac.uk/seac/2022/12/07/foreigndirect-investment-trends-and-policies-in- cambodia-a-preliminary-note/ 22.

Online, S. (2023, December 13). Cambodia leads FDI growth in South-East Asia. The

Star. https://www.thestar.com.my/aseanplus/aseanplus-news/2023/12/13/cambodia-leads- fdigrowth-in-south-east-asia 23.

Miachung. (2022, August 15). Drivers of foreign investment in Cambodia - Open

Development Mekong. Open Development Mekong - Sharing Information About Mekong

and Its Development With the World. https://opendevelopmentmekong.net/stories/drivers-

offoreign-investment-in-cambodia/ 24.

Indonesia Overview: Development news, research, data. (n.d.). World Bank.

Retrieved January 5, 2024, from https://www.worldbank.org/en/country/indonesia/overview 25.

Indonesia Overview: Development news, research, data. (n.d.). World Bank.

Retrieved January 5, 2024, from https://www.worldbank.org/en/country/indonesia/overview

26. World Investment Report 2023. (2023, July 5). UNCTAD.

https://unctad.org/publication/world-investment-report-2023 27.

Home. (n.d.). https://www.oecd-ilibrary.org/sites/5453f3a1-en/index.html?itemId=/ content/component/5453f3a1-en 28.

Freeman, N. (1994). Vietnam and China: Foreign direct investment parallels.

Communist Economies & Economic Transformation, 6(1), 75–97.

https://doi.org/10.1080/14631379408427781