Preview text:

VIETNAM NATIONAL UNIVERSITY HO CHI MINH CITY INTERNATIONAL UNIVERSITY

Course: Statistics for Business Lecturer: Nguyen Ba Trung

FDI INFLOWS OF VIETNAM AND

NINE SELECTED ASIAN COUNTRIES Group info:

Lê Bảo Ngọc FAFBIU22119

Phan Nguyễn Gia Huy FAFBIU22068

Nguyễn Phương Thùy FAFBIU22192

Võ Ngọc Trâm BABAIU22668

Nguyễn Hoàng Dung BABAUN22053

Hoàng Đình Thanh Quyên BAFNIU21553 Ho Chi Minh City, 2024

TABLE OF CONTENTS

1. INTRODUCTION __________________________________________________________ 2

1.1. The purposes of the report __________________________________________________ 2

1.2. Overview of the global FDI inflows over the past few decades _____________________ 2

1.3. The main factors that affect the FDI inflows ____________________________________ 2

1.4. Introduce to the 10 selected countries with some information about FDI inflows _______ 3

1.5. The key findings _________________________________________________________ 3

2. EMPIRICAL FINDINGS _____________________________________________________ 3

2.1. Descriptive analysis _______________________________________________________ 3

2.2. Result and Discussion _____________________________________________________ 5

2.3. Discuss the findings _______________________________________________________ 6

2.3.1. Overall _____________________________________________________________ 6

2.3.2. Vietnam and Singapore _________________________________________________ 7

2.3.3. Further discussion _____________________________________________________ 9

2.4. Inferential statistics _______________________________________________________ 9

2.4.1. Regression model _____________________________________________________ 9

2.4.2. Discuss the findings ___________________________________________________ 9

3. CONCLUSION ____________________________________________________________ 10

4. REFERENCES ____________________________________________________________ 10 INTRODUCTION

1.1. The purposes of the report

Foreign direct investment (FDI) is one of the most important factors determining the

economic growth of many countries around the world, especially in Asia. Foreign Direct

Investment (FDI) is essential to the economic growth and strategic development objectives of

Asian countries because of its impact on the economies of countries in the region. This study

compares the FDI inflow of Vietnam and 9 countries (Indonesia, Lao, Malaysia, Myanmar,

Philippines, Thailand, China, Korea, and Singapore). Otherwise, the objectives of this study were

to investigate the relationship between foreign direct investment and different factors that affected

the FDI from 1988 to 2022 of those countries. FDI analysis performs significant purposes, such as

helping with decision-making and policymaking concerning economic development and

investment management by providing insight into the origins and caliber of foreign investment

projects. Moreover, differentiating FDI analysis can provide basic information about the health

economy of each country, allowing us to determine some reasons why for the reduced economy of each country.

1.2. Overview of the global FDI inflows over the past few decades

International FDI flows increased significantly in the 1990s at higher rates due to the

integration of global capital markets. As a result, the actions of direct investment businesses are

now being closely examined by international bodies and created further difficulties for

vulnerability analysis, surveillance, balance of payments forecasts, and statistics recording.

At the present, Global FDI capital flows in 2022 reach 1.65 billion USD, an increase of 6%

compared to 2021. Of which, Asia continues to be the most attractive destination for global FDI

capital flows, using 41% of total FDI capital.

Driven by significant cross-border mergers and acquisitions, recorded world FDI inflows

soared by an average of nearly 50% year between 1998 and 2000, after increasing by an average

of 13% annually between 1990 and 1997. Global foreign direct investment (FDI) inflows peaked

in 2000 at US$1.5 trillion but sharply declined to US$0.7 trillion in 2001 due to cross-border

mergers and acquisitions among industrialized nations. From 1990 to 2000, foreign direct

investment (FDI) into developing nations increased by an average of 23% a year; however, in 2001,

FDI inflows fell by 13% to US$215 billion.

1.3. The main factors that affect the FDI inflows

There are many factors that directly and indirectly affect FDI capital flows. In this report,

we have selected two main factors that we think affect FDI Inflow: GDP and population.

The first one is GDP. Foreign direct investment (FDI) can be a valuable tool for promoting

economic growth in developing countries. Moreover, Bi-directional causality exists between FDI

and GDP in developing countries. This means that FDI can lead to economic growth, and economic

growth can also attract more FDI. Which has been proved in Hansen, H., & Rand, J. (2006). On

the causal links between FDI and growth in developing countries. World Economy, 29(1), 21-41.

The second factor we selected is total population. Aziz, A., & Makkawi, B also pointed out

2-dimensional relationships of mutual impact between populuation and FDI. From there, it is

recognized that population is also an important factor for multinational corporations to decide

whether to invest in a country or not. Aziz, A., & Makkawi, B. (2012). Relationship between

foreign direct investment and country population. International Journal of Business and Management, 7(8), 63-70. 2

1.4. Introduce to the 10 selected countries with some information about FDI inflows

In overview, Indonesia is the largest country in Southeast Asia and its economy is the largest

in the region, driven by natural resources, manufacturing, and tourism. In contrast, Laos' economy

is one of the least developed in the region. Vietnam is a rapidly developing country with a young

population and a booming economy. It's a major exporter of textiles, footwear, and electronics, and

it's attracting significant foreign investment. Besides that, the economies of the Philippines,

Thailand, Myanmar, Singapore, and Malaysia are diversified, with strong sectors in manufacturing,

agriculture, and tourism. In 2 East Asian countries, China is the world's secondlargest economy

and a major global power while Korea is A high-tech economy with a global presence in electronics.

Vietnam is one of the developing countries that has attracted strong FDI in recent years.

Vietnam's total registered investment capital reaches 30.8 billion USD in 2022, an increase of

10.4% compared to 2021. Vietnam has many potentials to attract FDI, such as: economic growth

rate is stable and high, large market scale, abundant and cheap labor resources, macroeconomic

policies, and a favorable investment environment. 1.5. The key findings

Foreign direct investment (FDI), GDP, Asian countries. 2. EMPIRICAL FINDINGS 2.1. Descriptive analysis 0 Thailand Malaysia

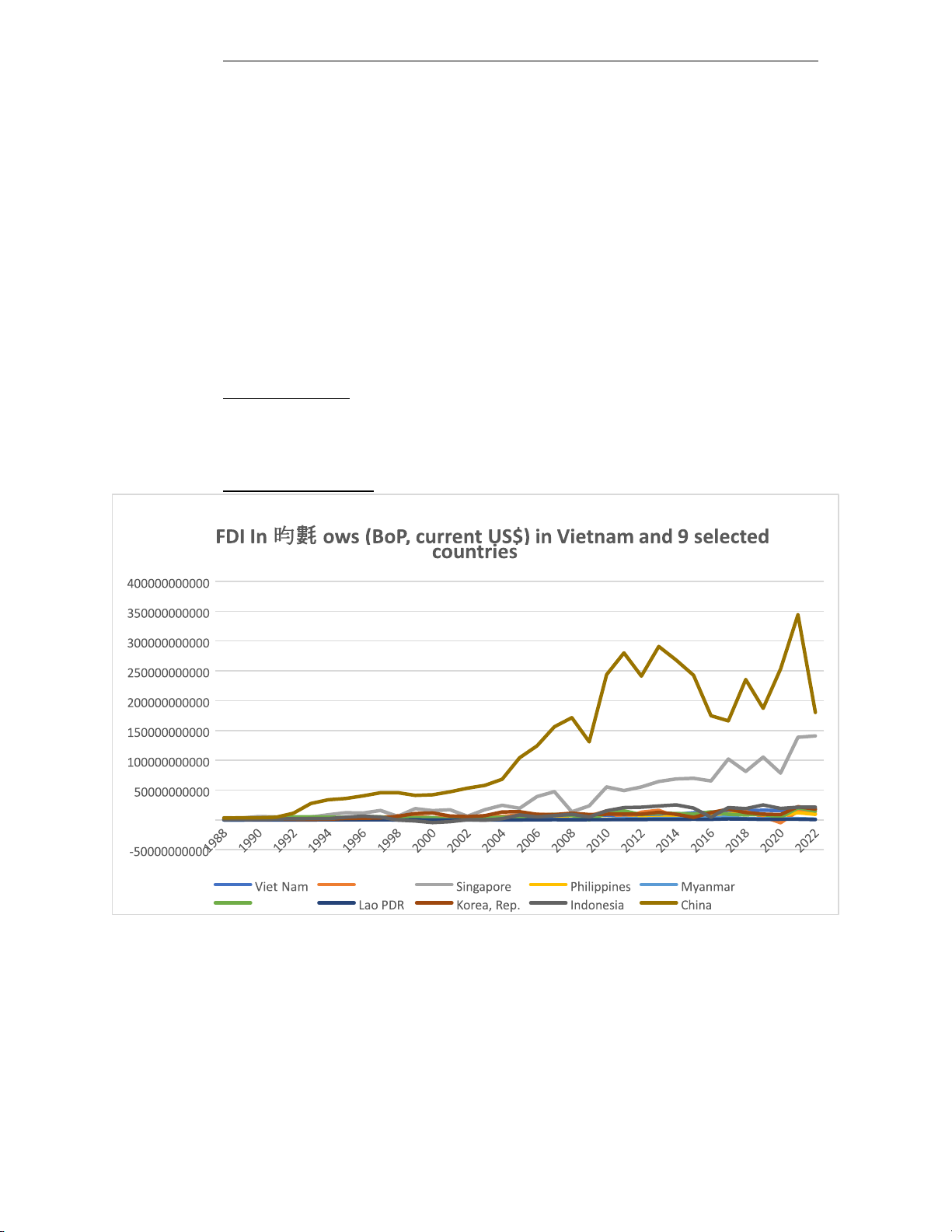

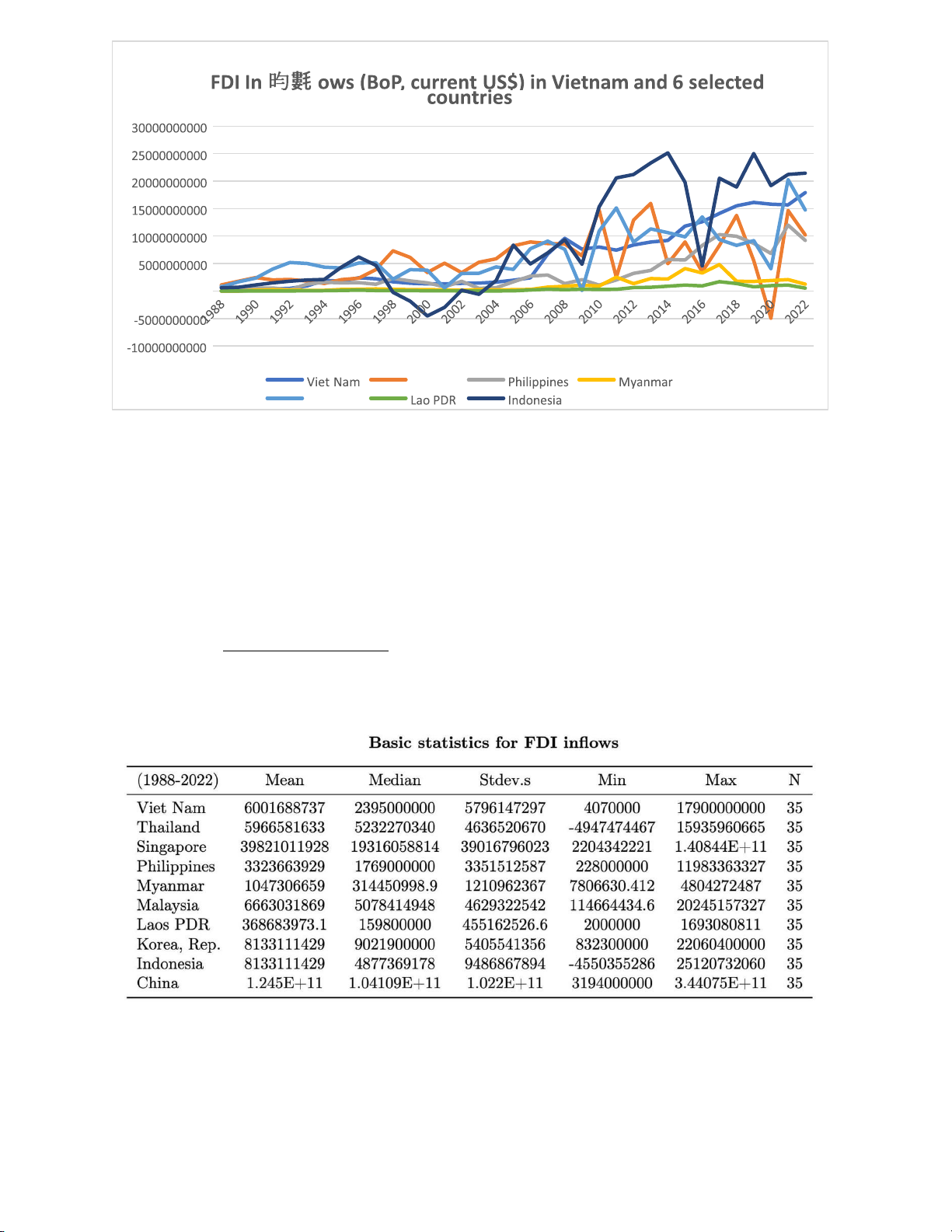

In this graph, we can see that the FDI inflow of countries in the Asia region fluctuates over

time. During the 20 years from 1988 to 2008, Asian countries focused on economic recovery after

the war, so it can be seen that the trend of investing money from capitalist countries into Asia was

huge. However, in the 2008-2010 period, most Asian countries experienced a decline in FDI

because the global economic crisis forced developed countries to tighten funding sources for other

countries to overcome the consequences of the crisis. Having only gone through 8 years post-crisis,

countries were preparing for a new trend: developing Asia to become a trade bridge for the whole

world, but the Covid-19 pandemic struck, causing many countries to be miserable in all aspects,

so we see an apparent decline in FDI inflows in Asian countries in recent years. Although the 3

general trend is downward, there are still bright spots in the region: Singapore and Vietnam

maintain and increase investment from other countries because of their steadfastness in controlling

the epidemic while not being closed off. Hinder and still create conditions for normal economic and production activities.

To see the fluctuations in Foreign direct investment (FDI) inflow of country groups, we

have divided nine countries into two small groups: the developing and developed countries. The

group of developed countries includes Singapore, China, and Korea. The developing countries

include Thailand, Philippines, Myanmar, Malaysia, Laos and Indonesia. The purpose of our

division is because developed countries have superior economies to developing countries, so we

divide them to see the economic development of the group of developing countries. In addition,

we also want to understand the characteristics of each group better. 0

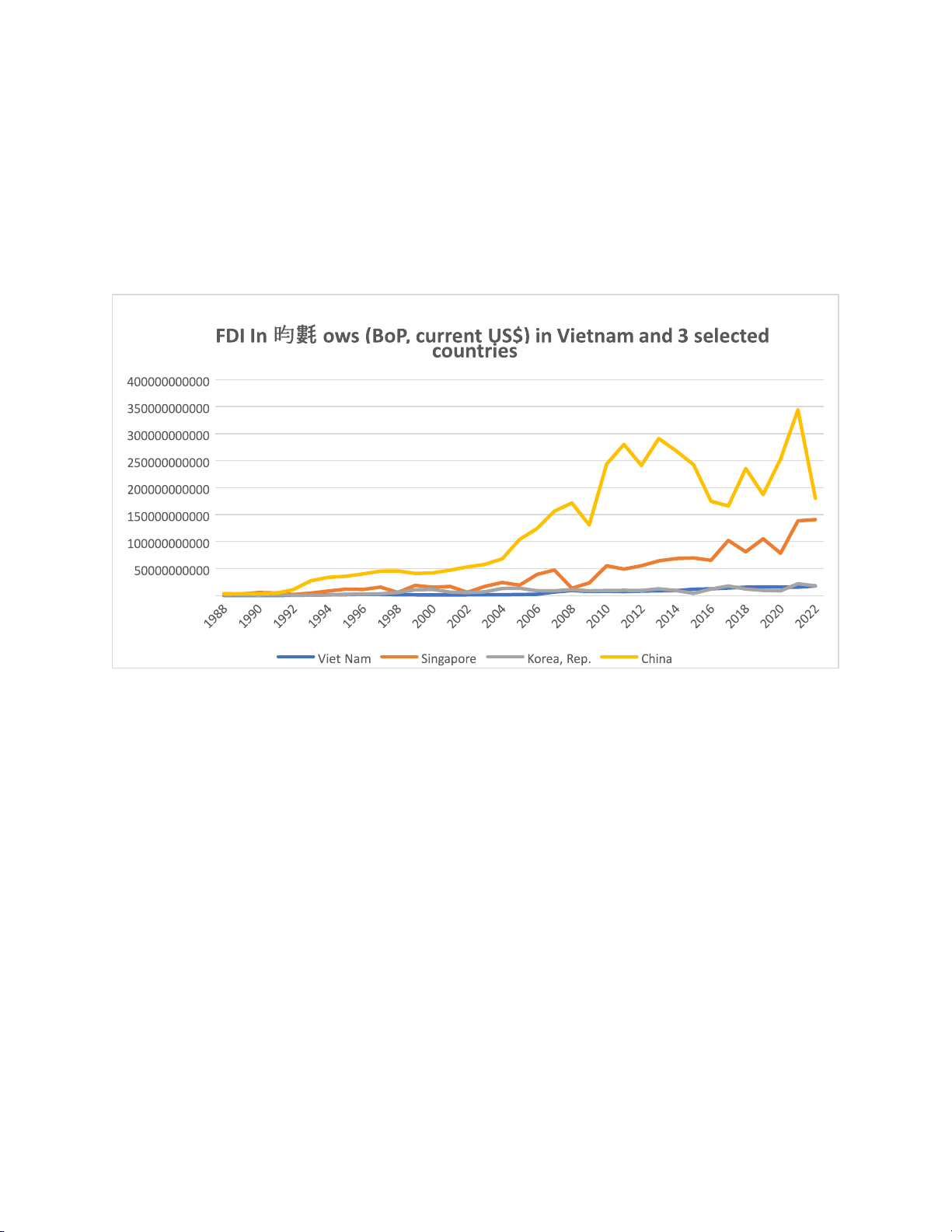

The developed countries - Singapore, Korea, and China - have developed significantly

compared to developing countries - especially Vietnam. More specifically, by 2021, China has

nearly 21 times more FDI inflow than Vietnam. However, in recent times, specifically from 2015

to 2022, China has no longer been a destination for FDI inflow. Specific evidence shows that China

had a relatively large standard deviation during that period. In contrast, Singapore and Vietnam

have stable FDI growth over time, without too much fluctuation, even though the world economy

has experienced a sharp decline. That shows that FDI Inflow moves from developed countries like

China to more potential countries like Singapore and Vietnam. 4 0 Thailand Malaysia

On the other hand, the group of developing countries, such as Vietnam, Thailand,

Philippines, Myanmar, Malaysia, Laos, and Indonesia, still shows a clear increasing trend over

time. But there are still differences among them. Which, Vietnam is the leading country in

attracting foreign investment capital because of FDI inflow and sustainable development.

Meanwhile, Thailand, Indonesia and Malaysia have had huge fluctuations in FDI over many

periods due to the critical politics and unstable economic situation, and unexpected natural

disasters that have created a fear of investing in these countries. The remains like Laos and

Myanmar do not show economic potential development, so multinational corporations are still not

very interested in investing money here. 2.2. Result and Discussion

Result and discussion part of the present study starts with the descriptive analysis of

variables considered for this study. The table below represents the basic statistics of the variables considered for this study

Comparing FDI flows across countries with differences, Singapore and South Korea are

often considered highly developed countries, while China and Malaysia are also experiencing

strong growth. Other countries such as Thailand, Philippines, Indonesia, Laos, and Myanmar are

experiencing economic development, although the level of development may vary. 5

According to data, the FDI capital flow into Singapore is more significant than that in

Vietnam. Singapore's average value is 39821011928, greater than Vietnam's 6001688737.

Vietnam's average value is also 16.92 billion USD, lower than Singapore's. Evidence for the above

data is that Singapore has an effective policy to attract foreign investment, does not discriminate

against foreign investment, combines financial and labor policies, and the administrative apparatus

solves the problem. The speedy settlement, simple and friendly tax system, the transparent, fair, and impartial legal system 2.3. Discuss the findings 2.3.1. Overall

Based on UNCTAD's statistical table, FDI capital flows in the world tend to grow in the

period 2021-2022. In 2021, global FDI capital flows reach 1.652 trillion USD, an increase of 60%

compared to 2020. In 2022, global FDI capital flows are expected to reach 1.952 trillion USD, an

increase of 18% compared to 2021.

However, the growth trend of FDI capital flows is not uniform across countries. Some

countries, such as Vietnam, Singapore, China, and South Korea, are regular destination countries

for FDI, with stable and growing FDI capital flows over the past many years. Vietnam

Vietnam is one of the countries attracting the largest FDI in Southeast Asia. According to

data from the Foreign Investment Agency, Ministry of Planning and Investment, total registered

FDI capital in Vietnam in 2022 reached 31.15 billion USD, an increase of 18.3% compared to 2021.

FDI capital flows into Vietnam have tended to grow steadily in recent years. In 2021, FDI capital

flows into Vietnam reached 26.08 billion USD, an increase of 9.2% compared to 2020. In 2020,

FDI capital flows into Vietnam reached 23.7 billion USD, an increase of 19.7% compared to 2020. 2019. Singapore

Singapore is one of the world's largest financial and business centers. According to data

from the Singapore Department of Statistics, total registered FDI capital in Singapore in 2022 will

reach 98.7 billion USD, an increase of 22.2% compared to 2021. FDI capital flows into Singapore

have tended to grow steadily in recent years. In 2021, FDI capital flows into Singapore reached

80.8 billion USD, an increase of 12.6% compared to 2020. In 2020, FDI capital flows into

Singapore reached 71.2 billion USD, an increase of 12.1% compared to 2019. China

China is the world's second largest economy and one of the most potential investment

markets. According to data from the Chinese Ministry of Commerce, total registered FDI capital

in China in 2022 reached 1.112 trillion USD, an increase of 10.7% compared to 2021. FDI capital

flows into China have tended to grow steadily in recent years. In 2021, FDI capital flows into

China reached 1.005 trillion USD, an increase of 14.9% compared to 2020. In 2020, FDI capital

flows into China reached 863.5 billion USD, an increase of 6.2% compared to 2019 . Korea

Korea is a developed economy with a large domestic market and dynamic export market.

According to data from the Korean Ministry of Planning and Finance, total registered FDI capital

in Korea in 2022 reached 110.8 billion USD, an increase of 22.8% compared to 2021. FDI capital

flows into Korea have tended to grow steadily in recent years. In 2021, FDI capital flows into 6

Korea reached 89.6 billion USD, an increase of 13.5% compared to 2020. In 2020, FDI capital

flows into Korea reached 77.6 billion USD, an increase of 15.2% compared to 2020. 2019.

Table 1.1.2. FDI capital flows into some typical countries regularly Nation 2020 2021 2022 Growth in 2022 compared to 2021 Vietnam 23.7 12.2% billion 26.08 billion 29.2 billion USD USD USD Singapore 71.2 22.2%

billion 80.8 billion 98.7 billion USD USD USD China 863.5 billion 10.7% 1005.6 billion 1112.0 billion USD USD USD Korea 77.6 22.8% billion 89.6 billion 110.8 billion USD USD USD

Table 1.1.2 shows that FDI capital flows into frequently visited countries such as Vietnam,

Singapore, China, and Korea have tended to grow steadily in recent years. •

Vietnam is the country attracting the largest FDI in Southeast Asia. FDI capital

flows into Vietnam increase by 12.2% in 2022 compared to 2021, reaching 29.2 billion USD. •

Singapore is one of the world's largest financial and business centers. FDI capital

flows into Singapore increased by 22.2% in 2022 compared to 2021, reaching 98.7 billion USD. •

China is the world's second largest economy. FDI capital flows into China increased

by 10.7% in 2022 compared to 2021, reaching 1112.0 billion USD. •

Korea is a developed economy with a large domestic market and dynamic export

market. FDI capital flows into Korea increased by 22.8% in 2022 compared to 2021, reaching 110.8 billion USD.

These countries have economic, political and social characteristics that are favorable for attracting FDI, including: •

The economy is developed and stable, with a large domestic market and potential export markets. •

Open economic policy, attracting foreign investment. •

Developed infrastructure, abundant and high-quality human resources.

Differences between countries

In addition to frequent destination countries for FDI such as Vietnam, Singapore, China,

and Korea, FDI capital flows into remaining countries tend to be more volatile. This may be

because these countries have different economic, political, and social characteristics, leading to

changes in factors that attract FDI. 2.3.2. Vietnam and Singapore

Vietnam and Singapore still attract FDI in the context of world economic recession 7

According to UNCTAD's report, global FDI capital flows in 2022 are expected to reach

1.952 trillion USD, an increase of 18% compared to 2021. However, this FDI capital flow is still

lower than 2.527 trillion USD in 2019, before when the COVID-19 pandemic broke out. In the

context of a world economic recession, Vietnam and Singapore are two countries that still have the

potential to attract FDI capital.

Vietnam: Attractive destination for FDI

Vietnam is the country attracting the largest FDI in Southeast Asia. According to data from

the Foreign Investment Agency, Ministry of Planning and Investment, total registered FDI capital

in Vietnam in 2022 reached 31.15 billion USD, an increase of 18.3% compared to 2021. FDI capital

flows into Vietnam have tended to grow steadily in recent years. In 2021, FDI capital flows into

Vietnam reached 26.08 billion USD, an increase of 9.2% compared to 2020. In 2020, FDI capital

flows into Vietnam reached 23.7 billion USD, an increase of 19.7% compared to 2020. 2019.

Vietnam has many factors that attract FDI, including: •

The economy grows steadily, has a large domestic market and potential export markets. •

Open economic policy, attracting foreign investment. •

Developed infrastructure, abundant and high-quality human resources.

Singapore: Global economic and financial center

Singapore is one of the world's largest financial and business centers. According to data

from the Singapore Department of Statistics, total registered FDI capital in Singapore in 2022 will

reach 98.7 billion USD, an increase of 22.2% compared to 2021. FDI capital flows into Singapore

have tended to grow steadily in recent years. In 2021, FDI capital flows into Singapore reached

80.8 billion USD, an increase of 12.6% compared to 2020. In 2020, FDI capital flows into Singa

pore reached 71.2 billion USD, an increase of 12.1% compared to 2019.

Singapore has many factors that attract FDI, including: •

The economy develops stably, with a small domestic market but a large export market. •

Open economic policy, attracting foreign investment. •

Developed infrastructure, abundant and high-quality human resources. Compare

Both Vietnam and Singapore have the potential to attract FDI, but there are fundamental

differences. Vietnam has a larger domestic market than Singapore, but Singapore has a larger

export market than Vietnam. Vietnam has abundant and high-quality human resources, but

Singapore has higher quality human resources than Vietnam. In the context of a world economic

recession, Vietnam and Singapore can still attract FDI from foreign investors. However, foreign

investors will tend to choose countries with stable economies, potential markets and high-quality human resources.

Some specific articles demonstrate this: •

"Vietnam and Singapore still attract FDI capital in the context of world economic

recession" - VnExpress Newspaper •

"Vietnam and Singapore are still attractive destinations for FDI" - Thanh Nien Newspaper 8 •

"Vietnam and Singapore: Two attractive destinations for FDI in the context of world

economic recession" - Investment Newspaper 2.3.3. Further discussion

Vietnam's economy has grown significantly in the last few years, making it one of the most

notable in Southeast Asia. Vietnam has improved its standing in the regional economy through

business reform initiatives, economic diversification, and attracting foreign investment.

In the meantime, China's economy has changed from being centered on exports and

infrastructure investment to being centered on innovation and consumption. This laborious and

protracted process may impact economic growth. In addition, pressure from international

competition and a slowdown in production and exports present difficulties for Korea, such as

demand and variations in global markets.

Uneven growth in specific economic sectors and public debt are issues that both nations

must deal with. This may have an impact on the economy's resilience and its capacity to make

investments in cutting-edge new industries. It still needs to be chosen for the remaining nations

due to (taxation, capital attraction policies, challenging institutional procedures, etc.). To ensure

long-term sustainability and adapt to the global economic context, these challenges frequently call

for changes to economic and strategic policies. 2.4. Inferential statistics 2.4.1. Regression model

The data for GDP growth and the total population are collected from World Bank

Development Indicators (WDI) databases, with data from 1988 to 2022. To analysis the factors

determining Foreign Direct Investment (FDI), and be able to synthesize this statistics data, we used

the mean function to calculate and used a multiple linear regression model of the following form: 2.4.2. Discuss the findings

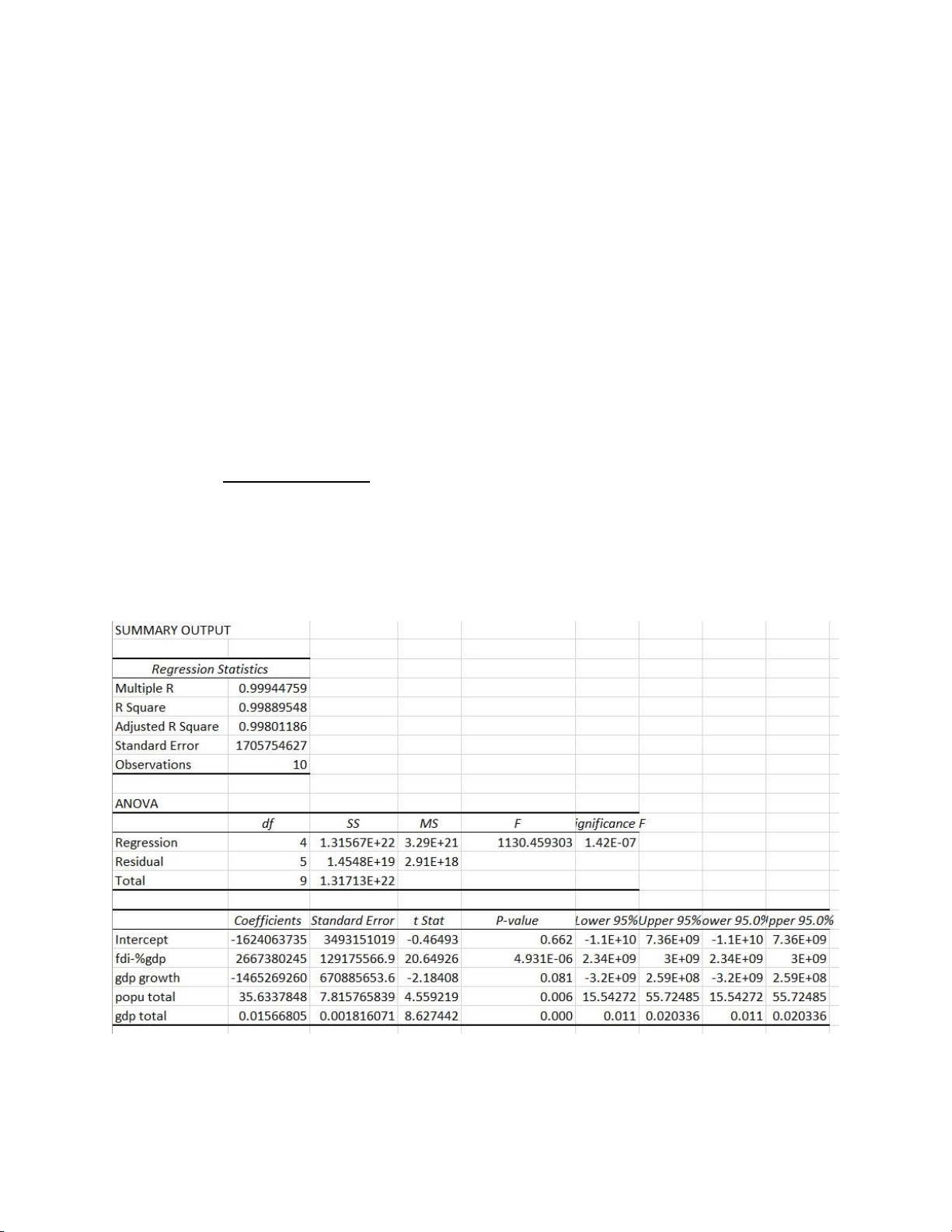

We have shown some the correlation of FDI inflow with some of the factors influencing

FDI inflows to some Asian countries in the table below. The R Square describes coefficient 9

determining factor. With Adjusted R square (0.998) > Alpha (0.05), it has been proven that the

regression model used in this study is statistically significant, in other words, the statistical data in the article can be used.

In this model, we discover there are 3 factors vary in direct proportion with FDI inflow,

which are FDI/GDP, Total population, and Total GDP. Meanwhile, GDP growth is a factor

inversely proportional to FDI inflow for countries in Asia. That will be expressed through the

following Multiple Linear Regression Formula:

Y = B0 + B1X1 +B2X2 + B3X3 + B4X4 + ε Where: Y: FDI inflows

X1, X2, X3, X4: FDI/GDP, GDP growth rate, Total population, Total GDP respectively ε: error term

From the table below, we have a specific function:

Y = -1624x106 + 2667x106X1 – 1465x106X2 + 35.6X3 + 0.016X4 + ε

Of the 4 factors we consider in this article, 1 factor had the opposite effect, which was

surprising and led to many doubts about this factor, which is GDP growth rate. So we tested again

to see if this factor had a negative effect on FDI or if it was just an error in the data we collected.

The result was exactly as we had predicted because of the error of this model, the above factor had

the opposite result than expected (p-value > Alpha: 0.081 > 0.05). Therefore, we cannot confirm

whether GDP growth rate is really a factor to promote FDI inflows while the remaining three

factors show a significantly influence on FDI inflows. 3. CONCLUSION

In short, Foreign Direct Investment (FDI) plays an extremely important role in improving

and developing the economies of countries around the world. In fact, there are many factors that

directly and indirectly affect FDI capital flows. This study tries to investigate the association

between FDI inflows and selected macroeconomic determinants, namely, total GDP, FDI/GDP,

GDP growth rate and democracy factors, like Total Population as well. Empirical outcomes

depicted that total GDP, Total population, FDI/GDP have a major relationship with FDI inflows to

Asia countries. However, it can not make sure that the GDP growth rate affect the FDI inflows or not.

The economic data taken in this study are limited to the belief that they expose the

authenticity and an accurate picture. There are some specific limitations in this study. The study is

based on 10-nation’s data, which may constrain the generalization of the results. Moreover, the

collected data is still not large enough (34-year period: 1988-2022), so there are still many errors in the calculation process. 4. REFERENCES 1.

WORLD FDI FLOWS TO DROP THIS YEAR (Latest FDI data). (2001,

September 18). UNCTAD. https://unctad.org/press-material/world-fdi-flows-drop-year-latestfdi- data#back1 2.

Ram, R., & Zhang, K. H. (2002). Foreign Direct Investment and Economic

Growth: Evidence from Cross Country Data for the 1990s. ‐ Economic Development and Cultural 10

Change, 51(1), 205–215. https://doi.org/10.1086/345453 3.

Foreign direct investment (FDI) in Singapore - International Trade Portal. (n.d.).

https://www.lloydsbanktrade.com/en/market-potential/singapore/investment 4.

Foreign investment in South Korea - Santandertrade.com. (n.d.).

https://santandertrade.com/en/portal/establish-overseas/south-korea/foreign-

investment#:~:text=The%20Foreign%20Investment%20Promotion%20Act,reduction%2C

%20exception%20from%20custom%20duties 5.

http://data.worldbank.org/indicator/CM.MKT.LCAP.CD. (n.d.). Retrieved from

http://data.worldbank.org/indicator. 6.

Pettinger, T. (2021, December 9). Factors that affect foreign direct investment (FDI). Economics Help. 7.

Workneh, A. M. (2014). Factors affecting FDI flow in Ethiopia: an Empirical

investigation. European Journal of Business and Management, 6(20), 118–125.

https://www.iiste.org/Journals/index.php/EJBM/article/download/16555/16962 8.

Charaia, V., Chochia, A., & Lashkhi, M. (2020). The impact of FDI on Economic

Development: The Case of Georgia. TalTech Journal of European Studies, 10(2), 96–116,

https://doi.org/10.1515/bjes-2020-0017 11