Preview text:

Final Revision – Financial Accounting CHAPTER 6: INVENTORIES I. Classifying inventory Merchandising company Manufacturing company • Inventory • Raw Materials • Work in Process • Finished Goods II.

Determining inventory quantities: 1. 2 systems:

• Perpetual: accuracy of records & determination of inventory lost.

• Periodic: determination of inventory on hand & COGS.

Beginning + Purchased = Ending + COGS

COGS = Beg + Purchased - End

2. Taking Physical Inventory = counting, weighting, measuring.

- Thời điểm để “take inventory”: ngừng kinh doanh, kiểm kê cuối kì.

- Goods in Transit: goods purchased not yet received (for buyers),

goods sold not yet delivered (for sellers).

• FOB shipping point: phí freight do buyers trả. Ngay từ lúc giao

goods cho bên vận chuyển là ownership chuyển sang cho buyers.

• FOB destination: phí freight do sellers trả. Chỉ từ khi bên vận

chuyển giao goods tới tay buyers thì ownership mới chuyển cho buyers.

- Consigned Goods: giữ goods để bán nhưng không giữ ownership

(Vd: những intermediaries/whole sale giữ hàng để bán nhưng không

sở hữu,, bán để lấy fee từ cty giữ ownership). III. Inventory methods

- Cost flow assumptions DO NOT need to be consistent with the

physical movement of the goods.

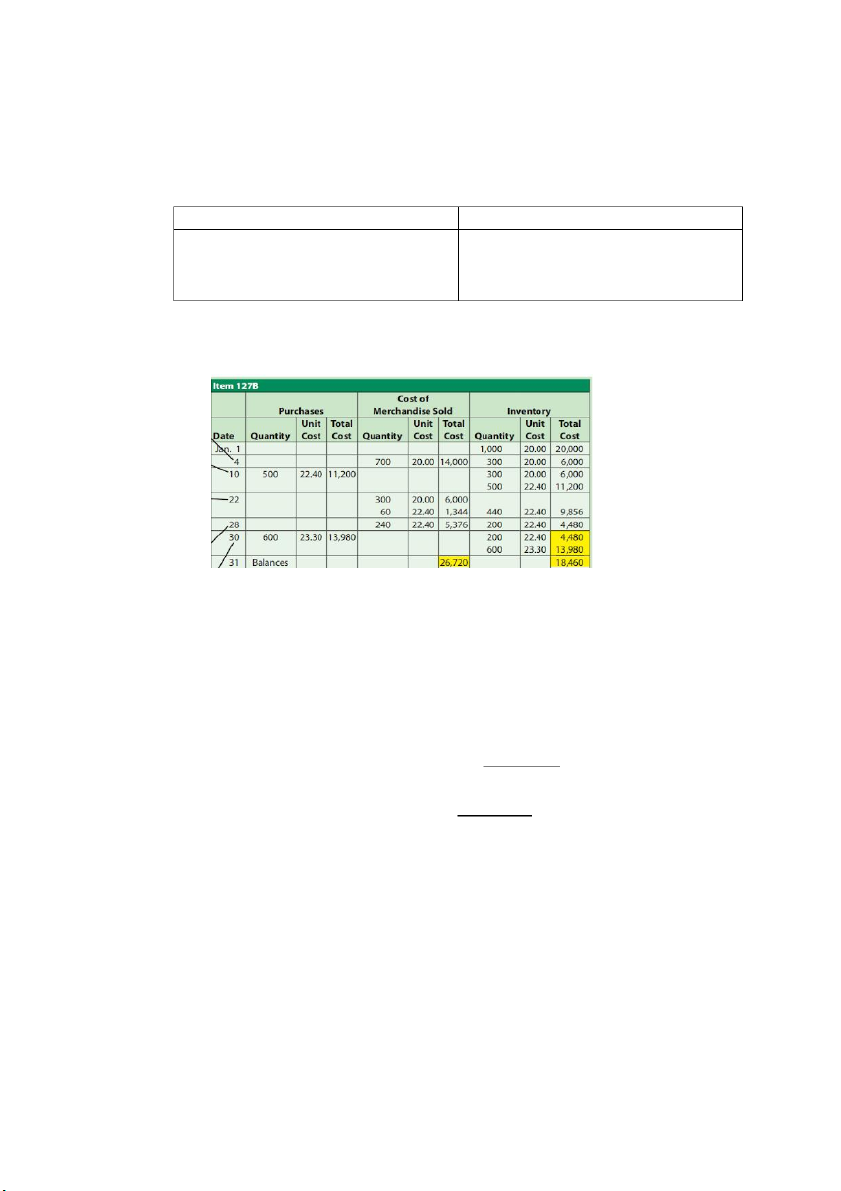

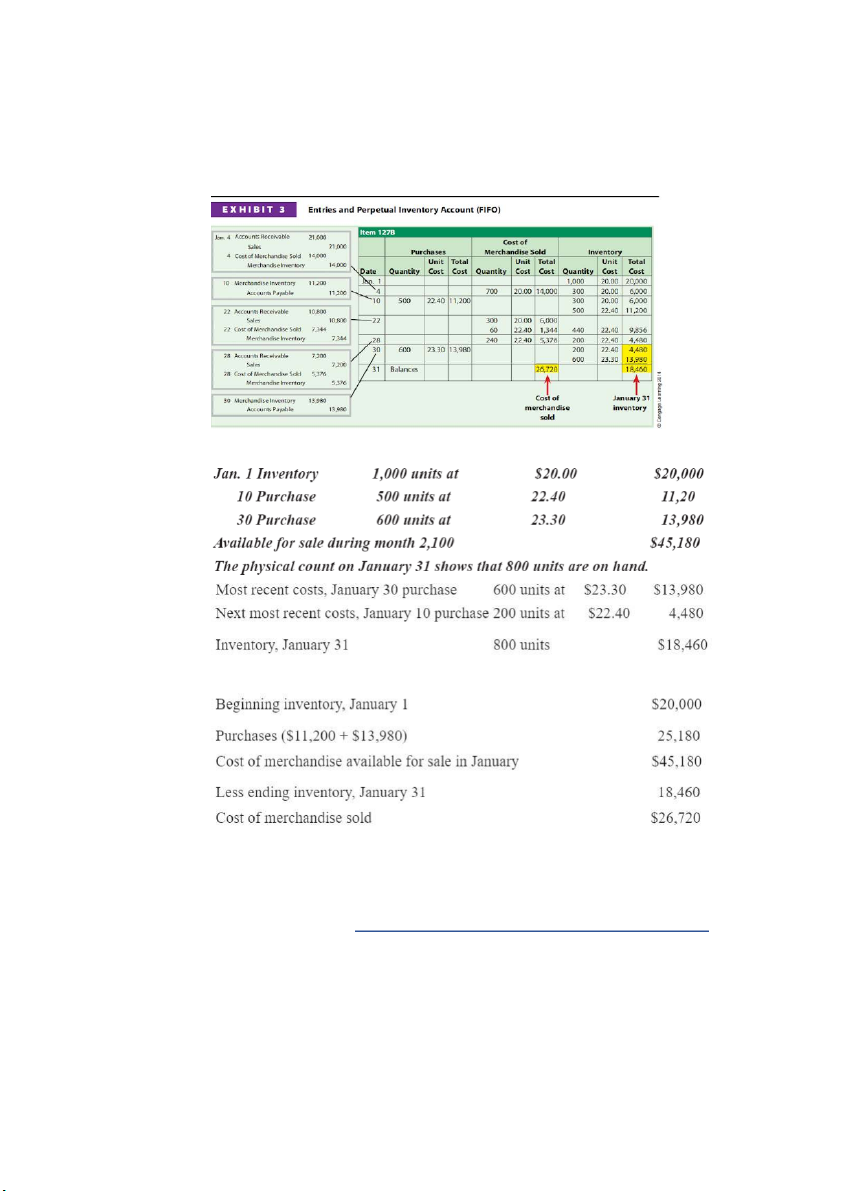

1. FIFO (First-in, first-out): goods vào kho trước bán trước. • Perpetual: • Periodic

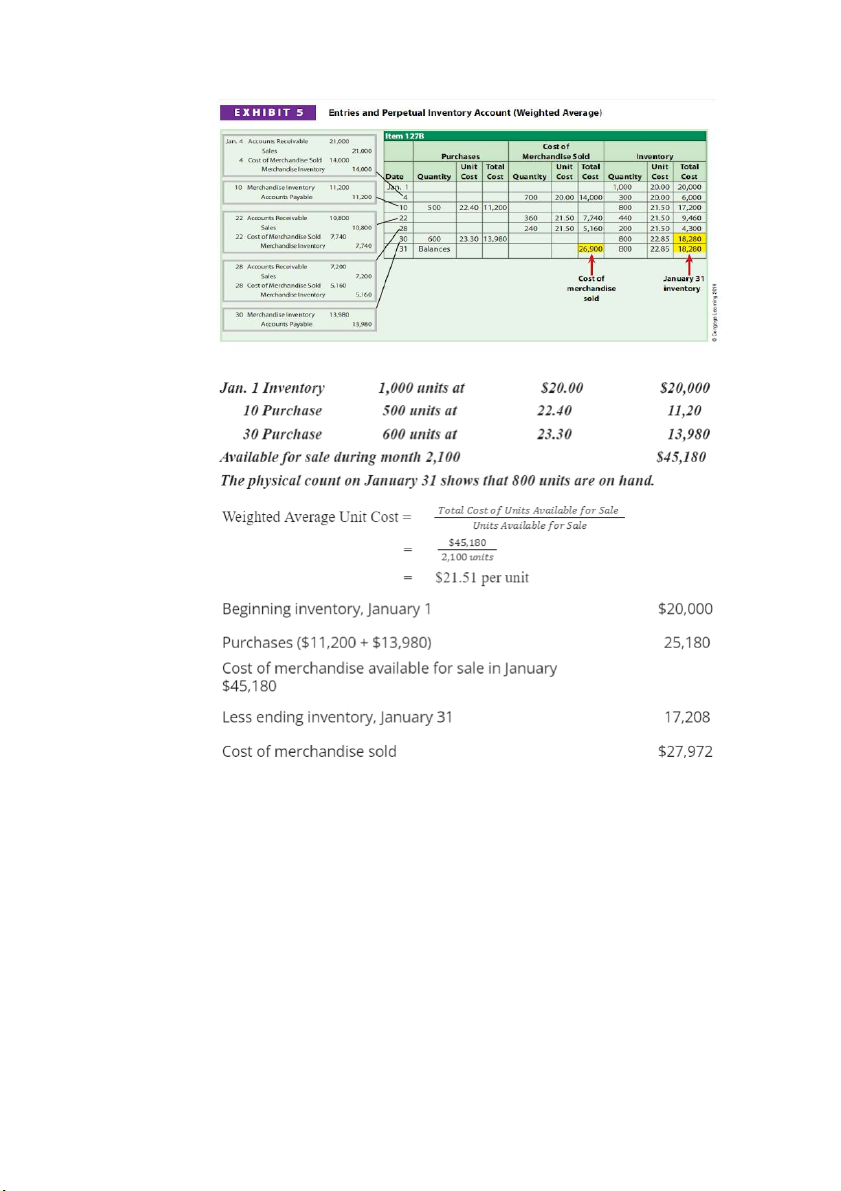

2. Weighted Average Cost: không phân loại vào trước vào sau. Tính giá COGS là giá trung bình.

𝑾𝒆𝒊𝒈𝒉𝒕𝒆𝒅 𝑨𝒗𝒆𝒓𝒂𝒈𝒆 𝑼𝒏𝒊𝒕 𝑪𝒐𝒔𝒕

𝑻𝒐𝒕𝒂𝒍 𝑪𝒐𝒔𝒕 𝒐

𝒇 𝑼𝒏𝒊𝒕𝒔 𝑨𝒗𝒂𝒊𝒍𝒂𝒃𝒍𝒆 𝒇𝒐𝒓 𝑺𝒂𝒍𝒆 =

𝑻𝒐𝒕𝒂𝒍 𝑼𝒏𝒊𝒕𝒔 • Perpetual: • Periodic: IV.

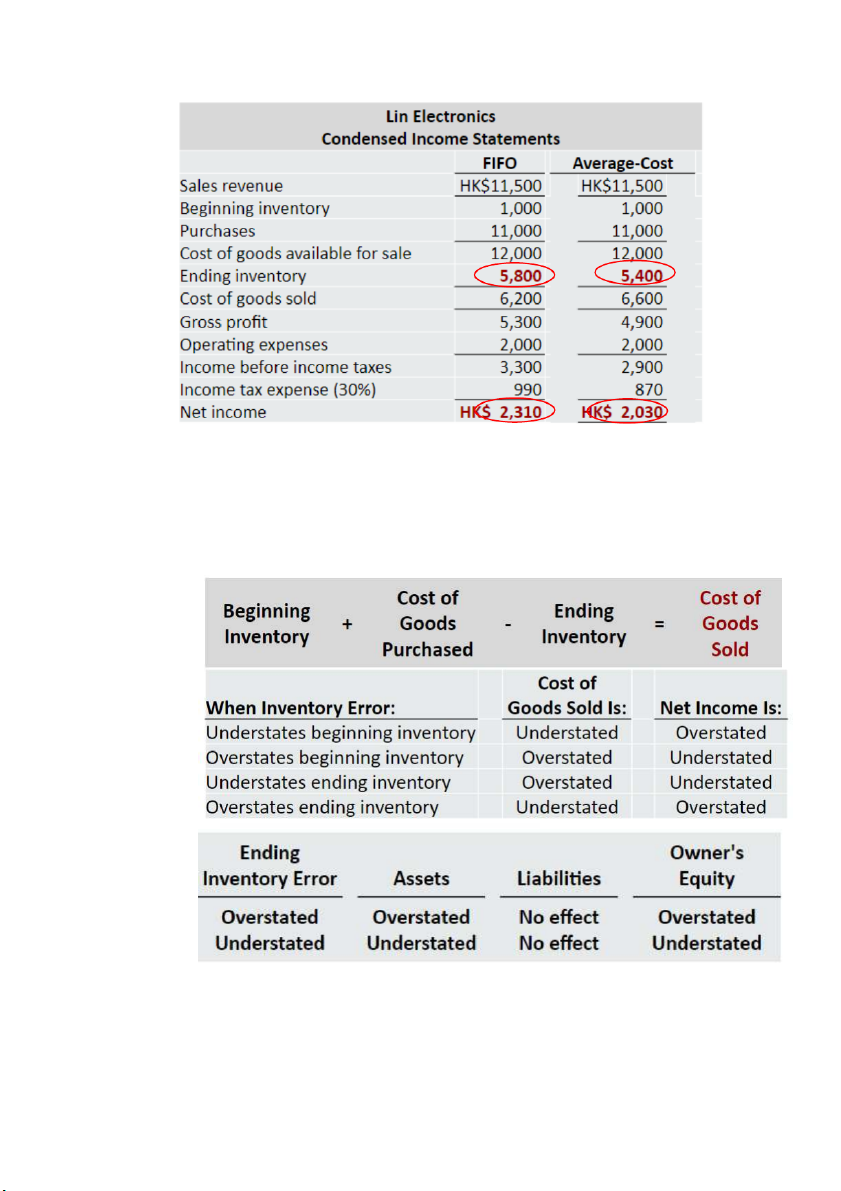

Income statement & Tax effects

- COGS is deducted when calculate NI.

- Inventory (ending) appears as assets in Statement of Financial Position.

- Do NI của FIFO lớn hơn nên tax payable lớn hơn khi sử dụng WA. V. Inventory errors

- Failure to count or price inventory correctly.

- Not properly recognizing the transfer of legal title to goods in transit.

- Errors affect both the income statement and the statement of financial position. CHAPTER 9: RECEIVABLES I. Recognition of AR Accounts Receivable Notes Receivable Other Receivable - Customer owe from - Written promise for - Nontrade receivable sale of good/service. amt to be received. (interest, loans to - No interest. - Interest officers, …) - Current assets - Current/Long-term - Point of record:

• Service: when perform service on account.

• Merchandiser: when sale on account. II.

Valuation and disposition of AR

- Uncollectible AR: Sales on account raise the possibility of accounts not being collected.

- Record credit losses as debits to Bad Debt Expense.

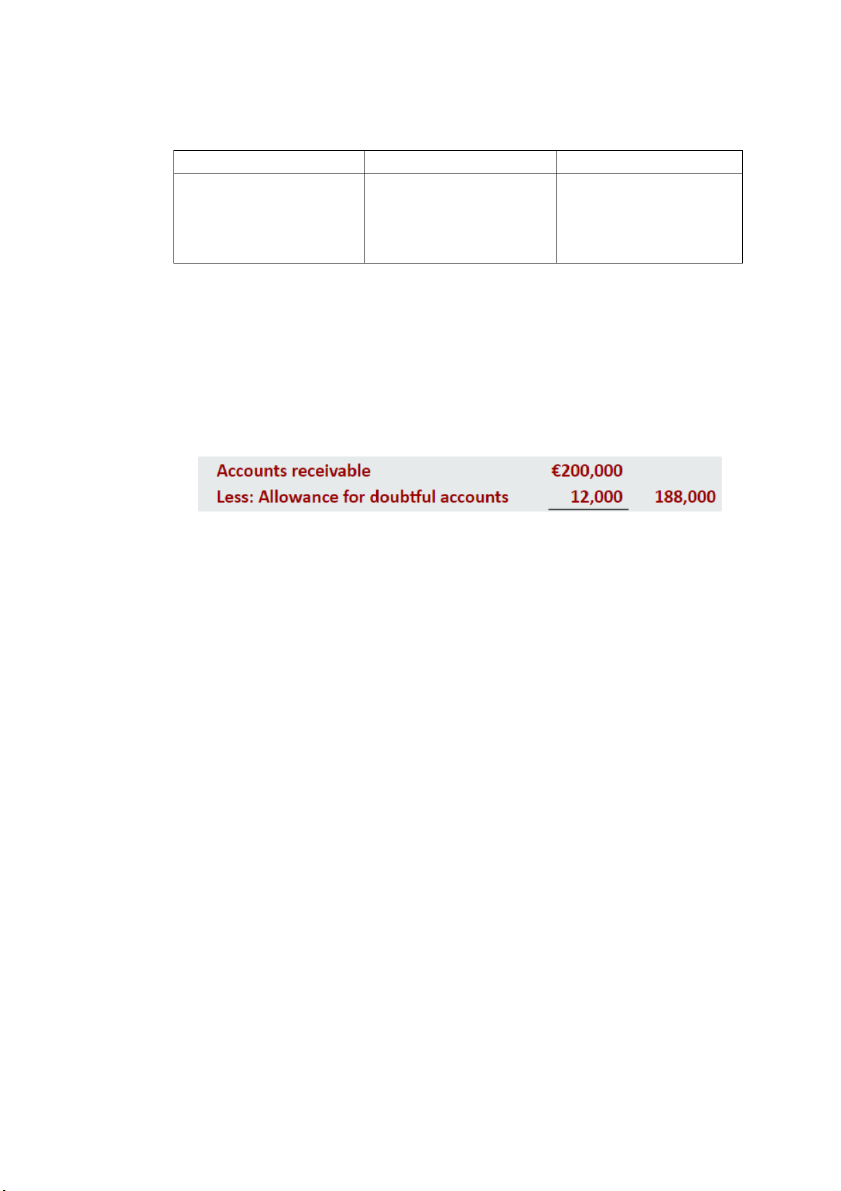

- Valuing AR: report AR as the net realizable value.

1. Direct write-off method: xóa bỏ trực tiếp khoản phải thu, nhưng có

thể không thu được trong tương lai. Từ AR -> Bad debt expense. • Write-off Entry: Dr Bad debt expense Cr AR • Recovery of receivable Entry: Dr AR Cr Bad debt expense And Dr Cash Cr AR

2. Allowance method: ước tính và ghi lại khoản dự trù, vẫn có thể nhận

lại được trong tương lai.

• Estimates Uncollectible accounts receivable.

Estimated uncollectible = Outstanding AR x Estimated % uncollectible Entry: Dr Bad debt expense

Cr Allowance for Doubtful Accounts (contra-assets account)

• Write-off khi chắc chắn không thể thu được khoản Receivable

Entry: Dr Allowance for Doubtful Accounts Cr AR • Recovery of Receivable Entry: Dr AR

Cr Allowance for Doubtful Accounts And Dr Cash Cr AR III. Notes receivable - May be used:

+ when individuals and companies lend or borrow money

+ when amount of transaction and credit period exceed normal limits

+ in settlement of accounts receivable (AR -> NR)

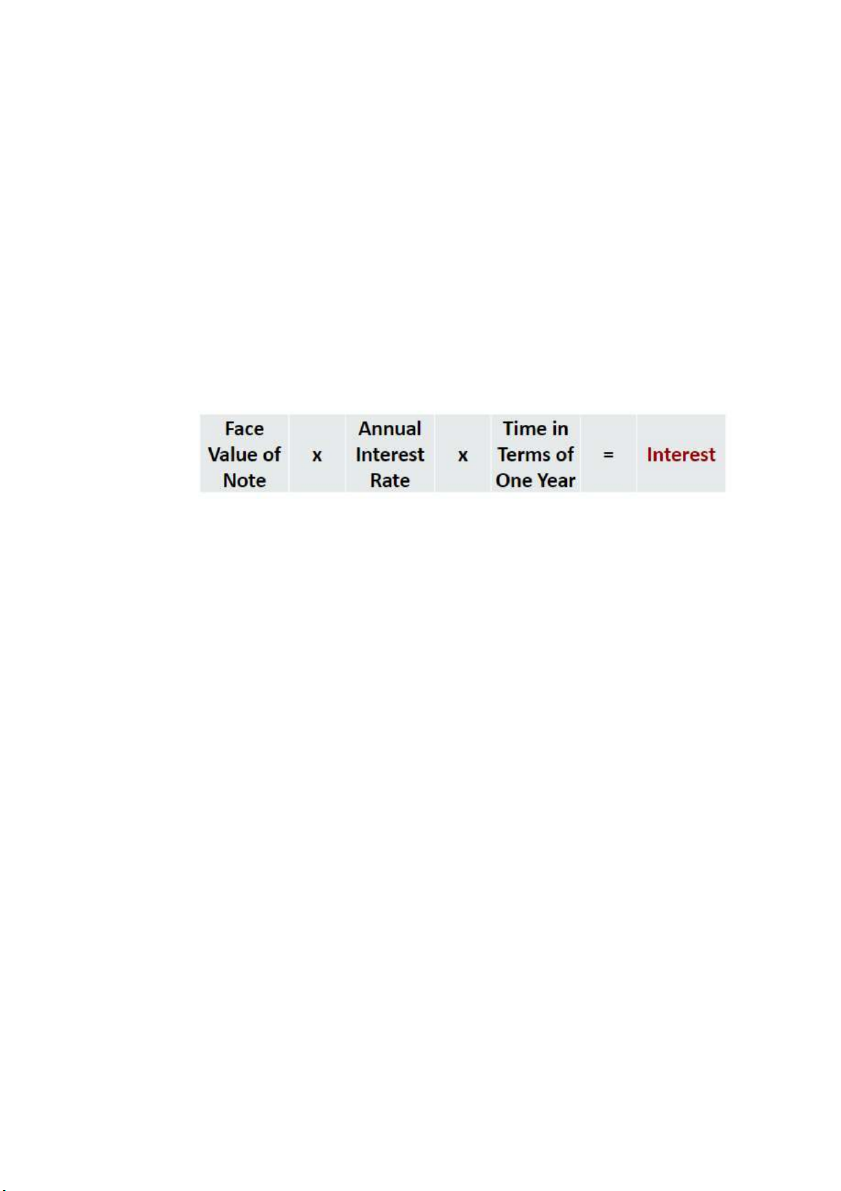

- Usually incurred interest: omit the date the note is issued, but include

the due date. Incurred interest adjust at the end of accounting period. Entry: Dr Interest receivable Cr Interest Revenue

- Valuing NR: Report short-term notes receivable at their cash (net)

realizable value. Những cái khác tương tự AR. ⮚ Fixed asset:

⮚ Straight-Line Method:

Equipment acquired at the beginning of the year at a cost of $125,000 has an

estimated residual value of $5,000 and an estimated useful life of 10 years.

Determine (a) the depreciable cost, (b) the straight-line rate, and (c) the annual

straight-line depreciation. Follow My Example 10-2

a. $120,000 ($125,000 – $5,000) b. 10% = 1/10

c. $12,000 ($120,000 × 10%), or ($120,000/10 years)

⮚ Units-of-Output Depreciation:

Equipment acquired at the beginning of the year at a cost of $180,000 has an

estimated residual value of $10,000, has an estimated useful life of 40,000 hours,

and was operated 3,600 hours during the year. Determine (a) the depreciable

cost, (b) the depreciation rate, and (c) the unit-of-output depreciation for the year.

Follow My Example 10-3

a. $170,000 ($180,000 – $10,000)

b. $4.25 per hour ($170,000/40,000 hours)

c. $15,300 (3,600 hours × $4.25)

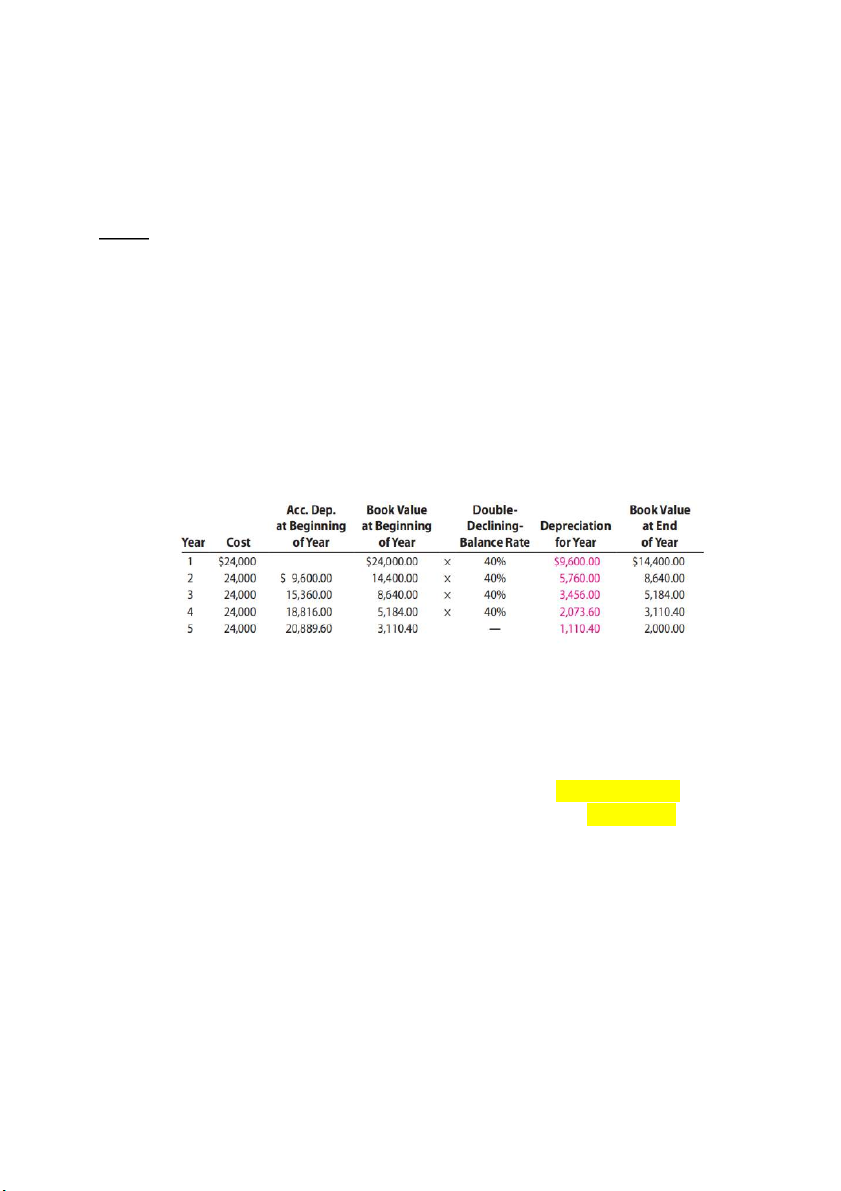

⮚ Double-declining-balance method:

Step 1. Determine the straight-line percentage, using the expected useful life.

Step 2. Determine the double-declining-balance rate by multiplying the straight line rate from Step 1 by 2.

Step 3. Compute the depreciation expense by multiplying the double-declining

balance rate from Step 2 times the book value of the asset.

To illustrate, the equipment purchased in the preceding example is used to

compute double-declining-balance depreciation. For the first year, the

depreciation is $9,600, as shown below. Solve:

Step 1. Straight-line percentage = 20% (100%/5)

Step 2. Double-declining-balance rate = 40% (20% 3 2)

Step 3. Depreciation expense = $9,600 ($24,000 3 40%)

For the first year, the book value of the equipment is its initial cost of $24,000.

After the first year, the book value (cost minus accumulated depreciation) declines

and, thus, the depreciation also declines. The double-declining-balance

depreciation for the full five-year life of the equipment is shown below.

First-Year Partial Depreciation = $9,600 × 3/12 = $2,400

Second-Year Depreciation = $8,640 = [40% × ($24,000 – $2,400)]

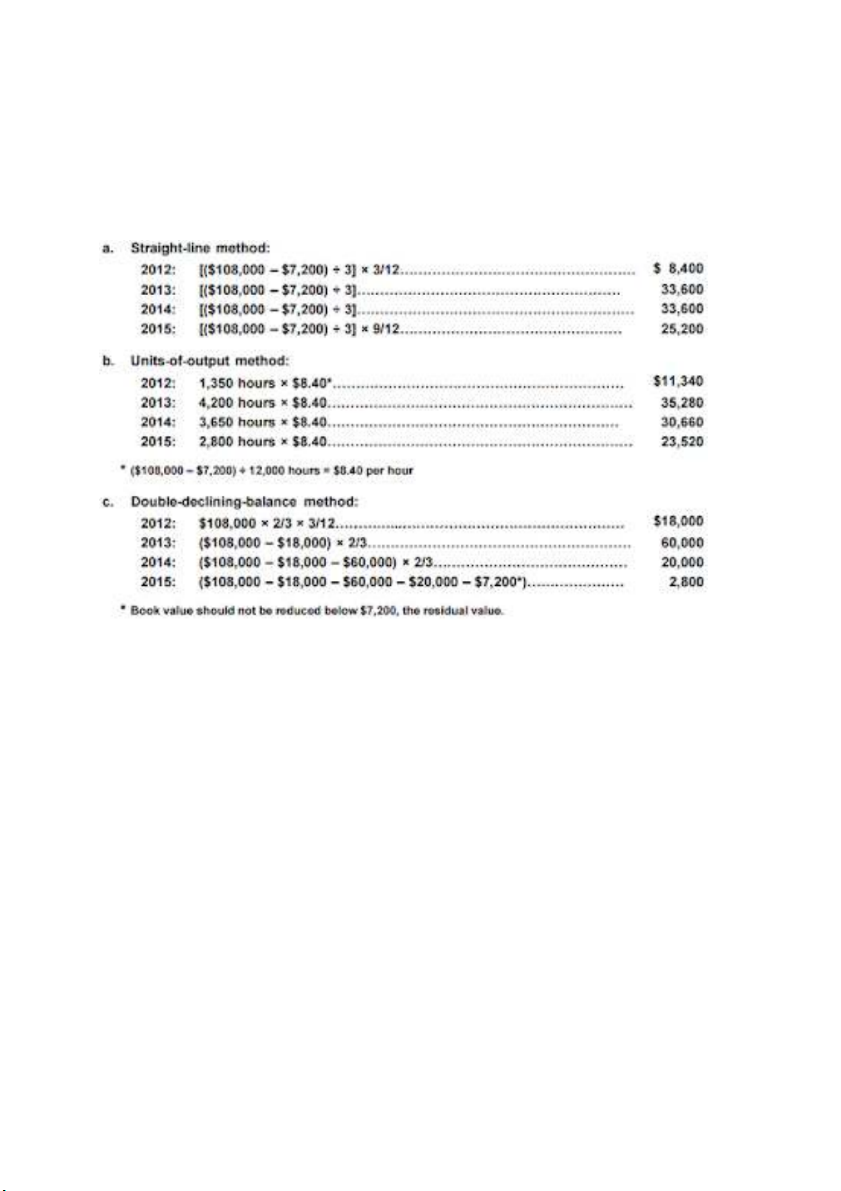

Layton Company purchased tool sharpening equipment on October 1, 2012, for

$108,000. The equipment was expected to have a useful life of three years, or

12,000 operating hours, and a residual value of $7,200. The equipment was used

for 1,350 hours during 2012, 4,200 hours in 2013, 3,650 hours in 2014, and 2,800 hours in 2015. Instructions

Determine the amount of depreciation expense for the years ended December 31,

2012, 2013, 2014, and 2015, by (a) the straight-line method, (b) the units-of-output

method, and (c) the double-declining-balance method.

Depreciation cost : 108,000-7,200 = 100,800 Each year 100,800/3 =33,600

▪ Disposal of Fixed Assets

1/ Discarding Fixed Assets:

Accumulated Depreciation—Equipment 25,000 Equipment 25,000

To write off equipment discarded.

On December 31, 2013, the accumulated depreciation balance, is $4,650. On

March 24, 2014, the asset is removed from service and discarded. The entry to

record the depreciation for the three months:

Mar. 24 Depreciation Expense—Equipment 150

Accumulated Depreciation—Equipment 150

To record current depreciation on equipment discarded ($600x3/12).

Mar. 24 Accumulated Depreciation—Equipment 4,800

Loss on Disposal of Equipment 1,200 Equipment 6,000

(To write off equipment discarded.)

2/ Selling Fixed Assets

Oct. 12 Depreciation Expense—Equipment 750

Accumulated Depreciation—Equipment 750

To record current depreciation on equipment sold ($10,000 × ⁹∕₁₂ × 10%).

Sold at book value, for $2,250. No gain or loss. Oct. 12 Cash 2,250

Accumulated Depreciation—Equipment 7,750 Equipment 10,000

Sold below book value, for $1,000. Loss of $1,250. Oct. 12 Cash 1,000

Accumulated Depreciation—Equipment 7,750 Loss on Sale of Equipment 1,250 Equipment 10,000

Sold above book value, for $2,800. Gain of $550. Oct. 12 Cash 2,800

Accumulated Depreciation—Equipment 7,750 Equipment 10,000 Gain on Sale of Equipment 550 Current Liabilities

- Pay within ONE year or the operating cycle, whichever is longer.

- Notes payable, accounts payable, unearned revenues, and accrued

liabilities (taxes payable, salaries and wages payable, and interest payable). I. Notes payable - Written promissory note - Pay interest

- Issued for varying periods (những note nào có tgian lớn hơn 1 năm thì

tính vào long-term liabilities).

• Acquire note: nhận tiền và tăng liabilities Entry: Dr Cash Cr Notes Payable

• Incurred interest: adjust at the end of accounting period. Entry: Dr Interest Expense Cr Interest Payable

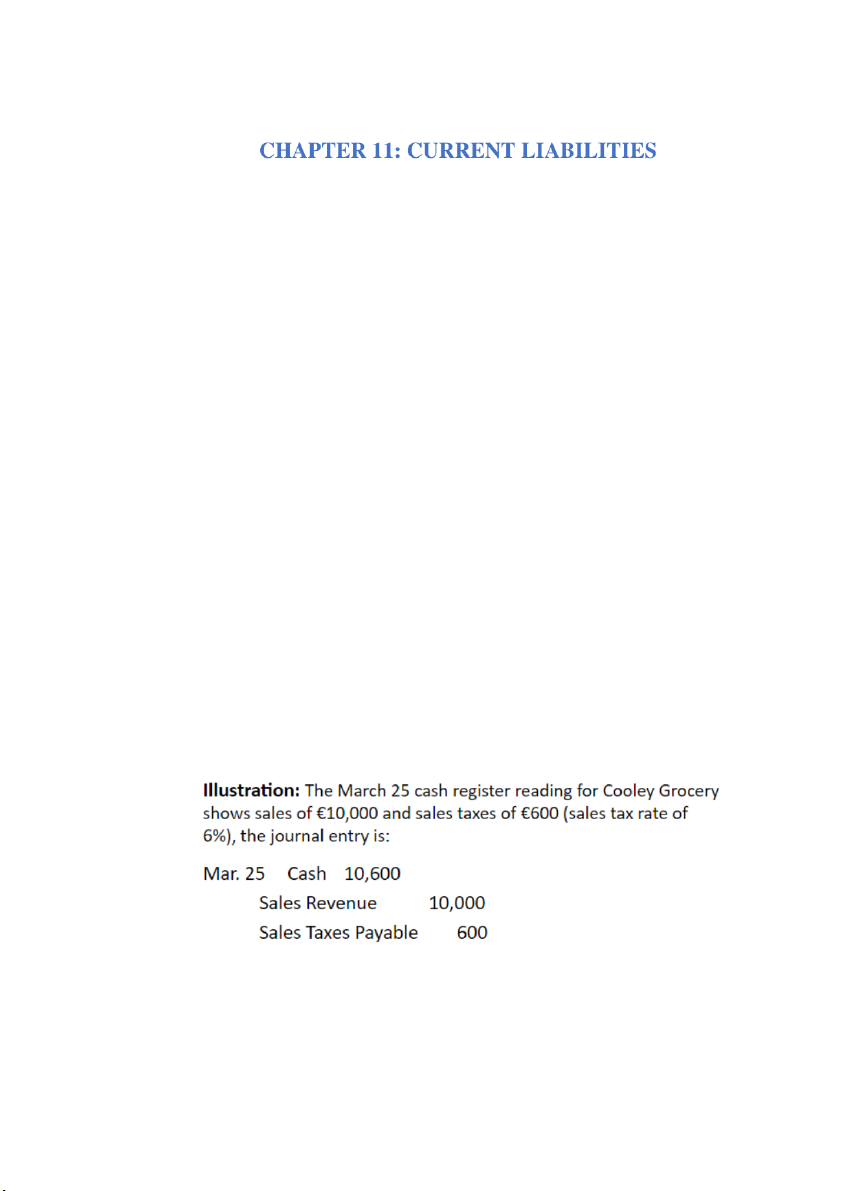

• Payment at maturity: trả face and interest Entry: Dr Notes Payable Interest Payable Cr Cash II. Sales Taxes Payable

- Selling company collects tax from customer and later submit to the

government. Có 2 loại: tax đã được tách khỏi sale sẵn và tax được included in receipt.

1. Tax separate in cash register

2. Tax included in total receipts

𝐓𝐨𝐭𝐚𝐥 𝐫𝐞𝐜𝐞𝐢𝐯𝐞𝐝 𝐒𝐚𝐥𝐞𝐬 =

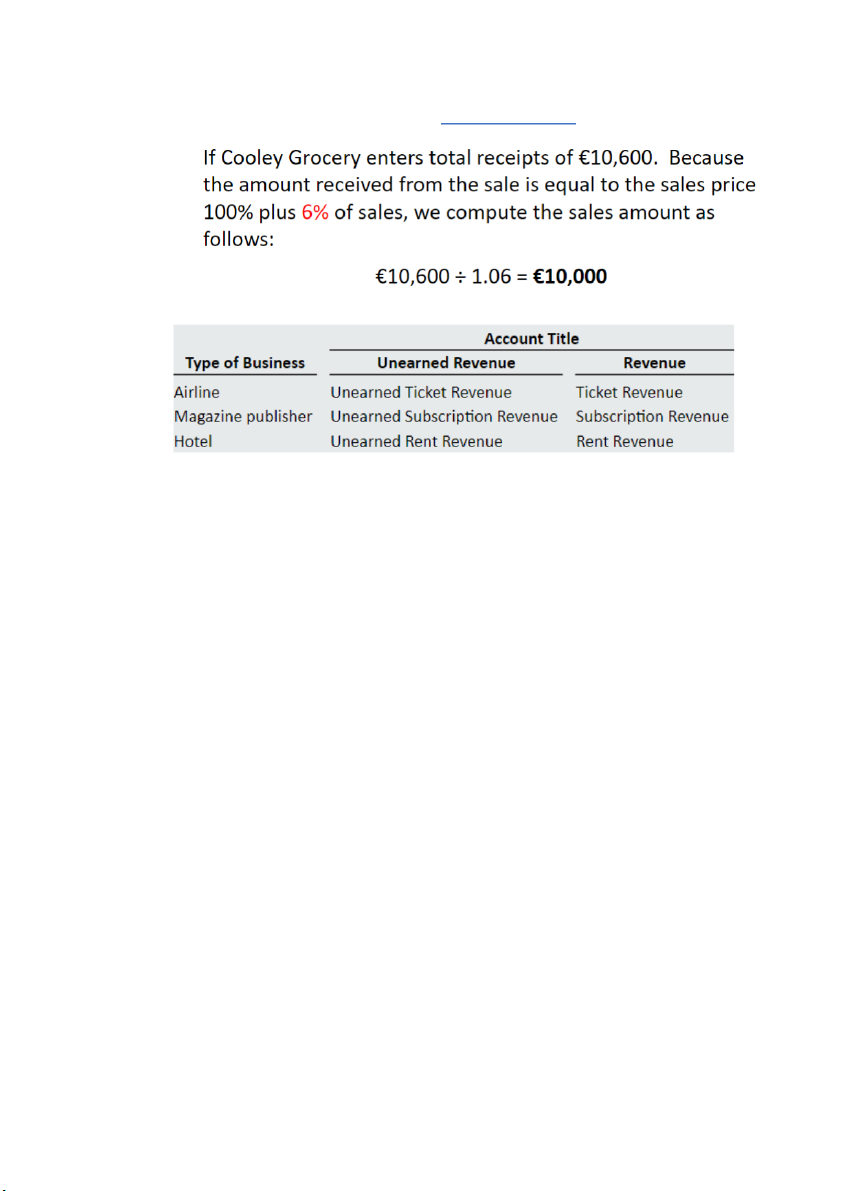

𝟏 + 𝐓𝐚𝐱 𝐫𝐚𝐭𝐞 III.

Unearned revenue: Cash before performance. • Receive cash Entry: Dr Cash Cr Unearned accounts

• Perform service/ deliver goods Entry: Dr Unearned accounts Cr Revenue accounts IV.

Current Maturities of Long-Term Debt

- Portion of debt that comes due in current year - No adjusting entry required

- Khi chuẩn bị financial statement thì tách phần trả trong năm nay thành

current liabilities phần trả trong những năm sau tính là non-

current/long-term liabilities. V.

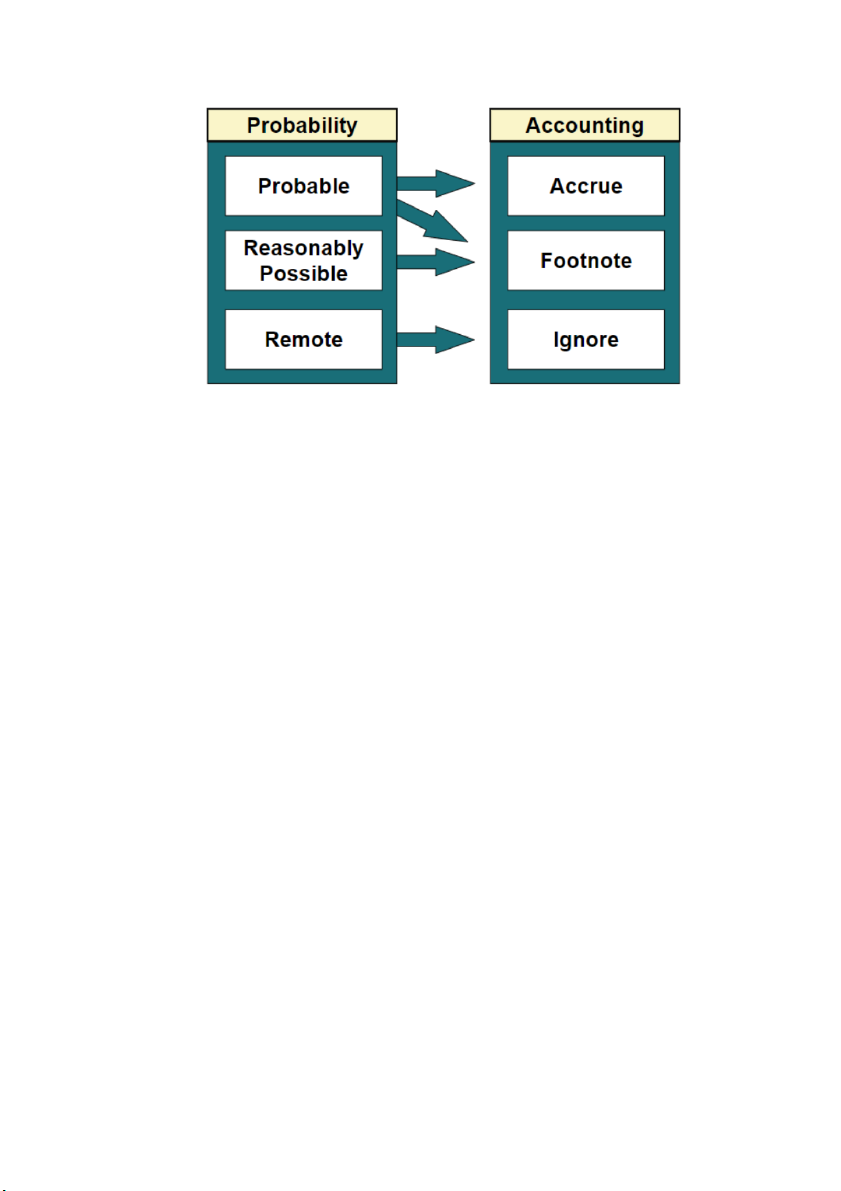

Provision: Potential liability that may become an actual liability in the future.

- Three levels of probability: probable, reasonably possible, remote.

Warranty: Promise made by a seller to a buyer to make good on a

deficiency of quantity, quality, or performance in a product. Recognized

as an expense in the period in which the sale occurs. • Adjusting entry Dr Warranty Expense Cr Warranty Liabilities • Repair cost of warranty Dr Warranty Liabilities Cr Repair Parts VI. Payroll

- Salaries: managerial, administrative, and sales personnel (monthly or yearly rate).

- Wages: store clerks, factory employees, and manual laborers (rate per hour).

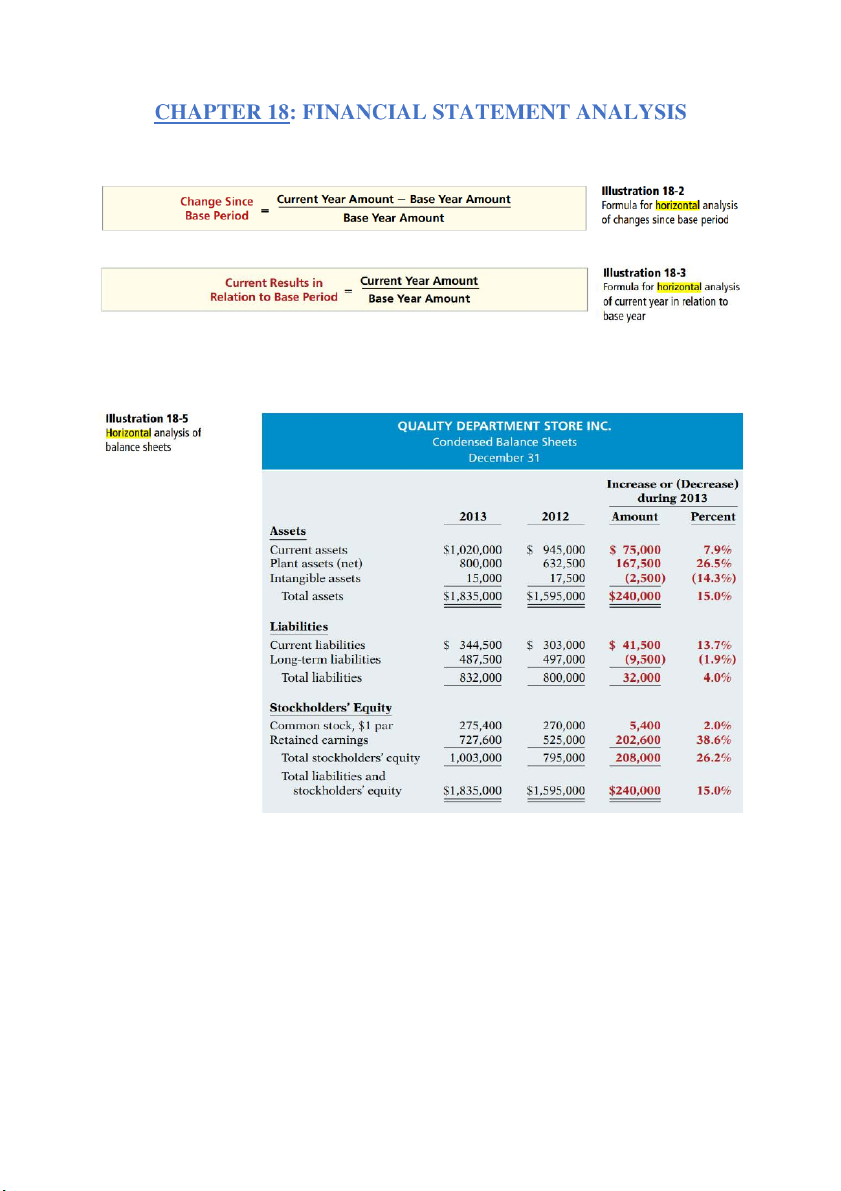

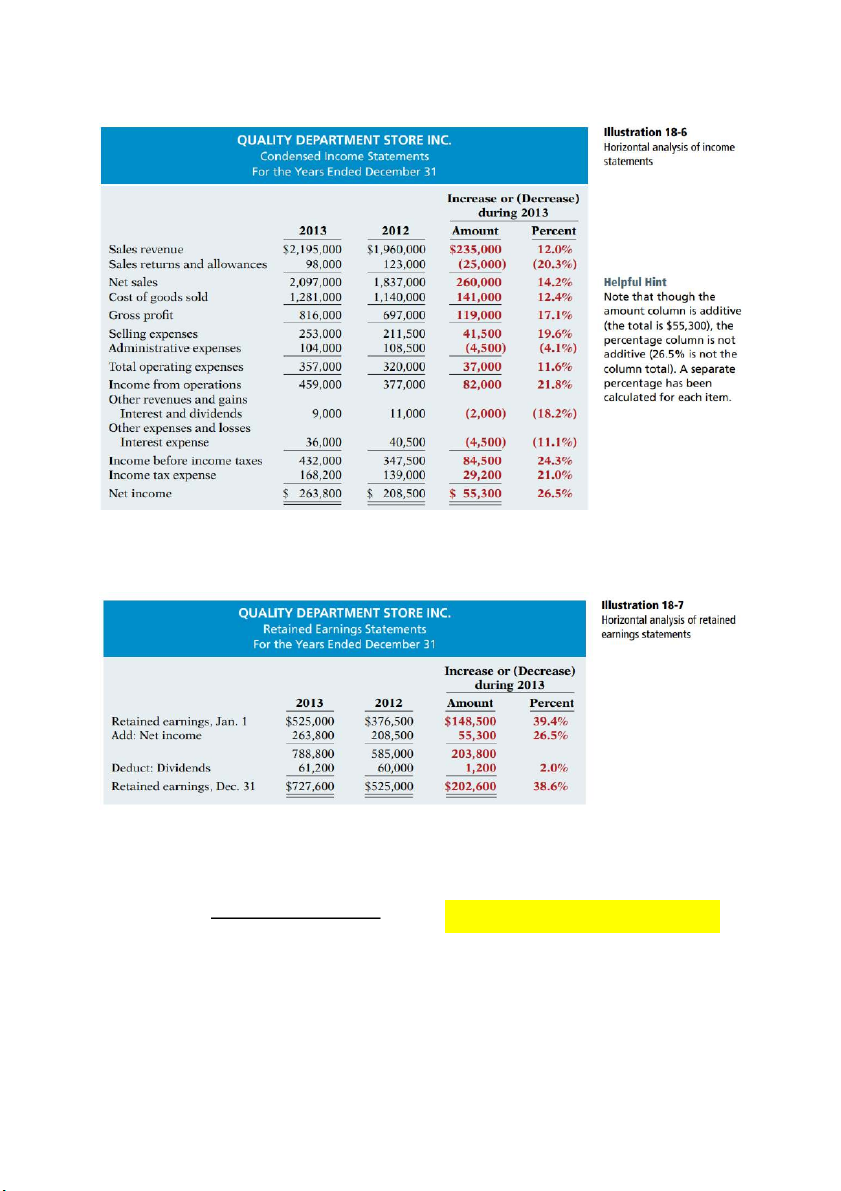

❖ Horizontal analysis

Balance Sheet of Horizontal Analysis:

Income Statement of Horizontal Analysis

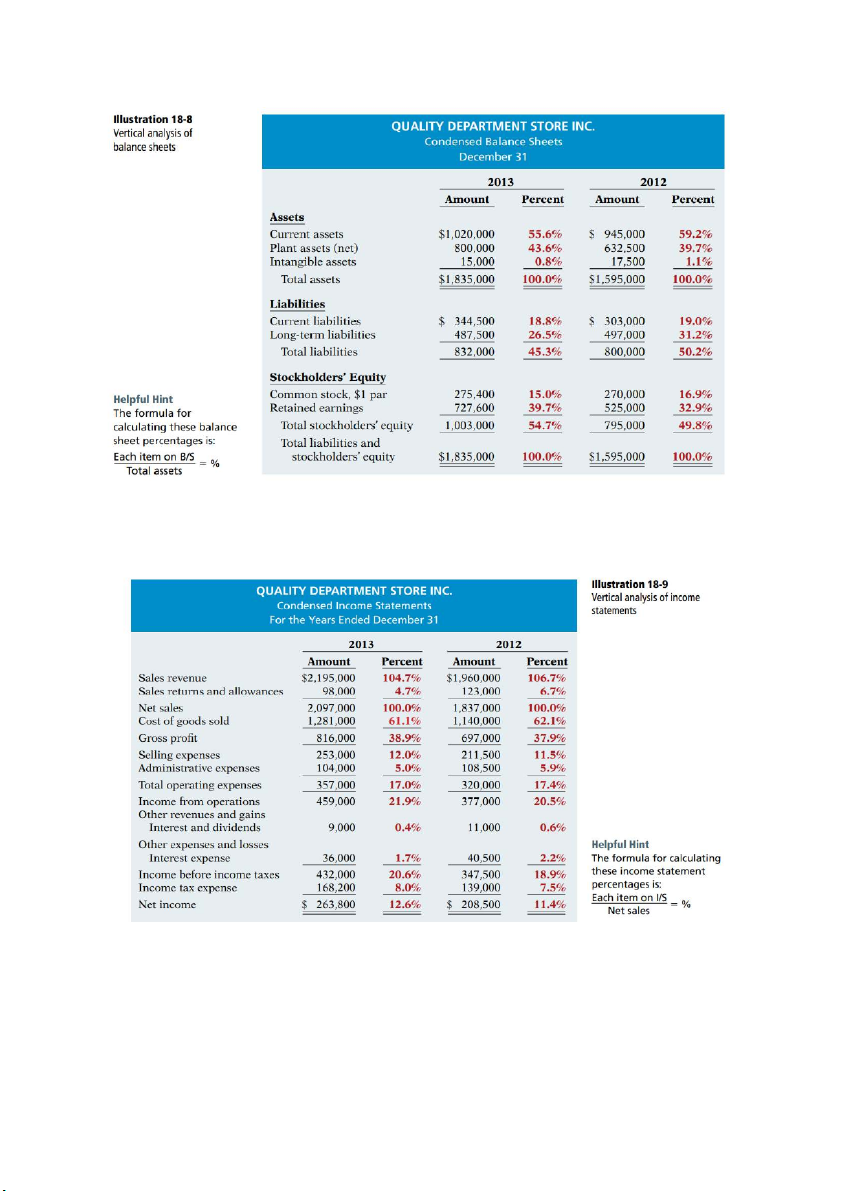

Retained Earnings of Horizontal Analysis ❖ Vertical Analysis

Balance Sheet of Vertical Analysis 𝐼𝑡𝑒𝑚 Percentage =

Note: Net Sales and Total Assets is base

𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝑜𝑟 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 (100%)

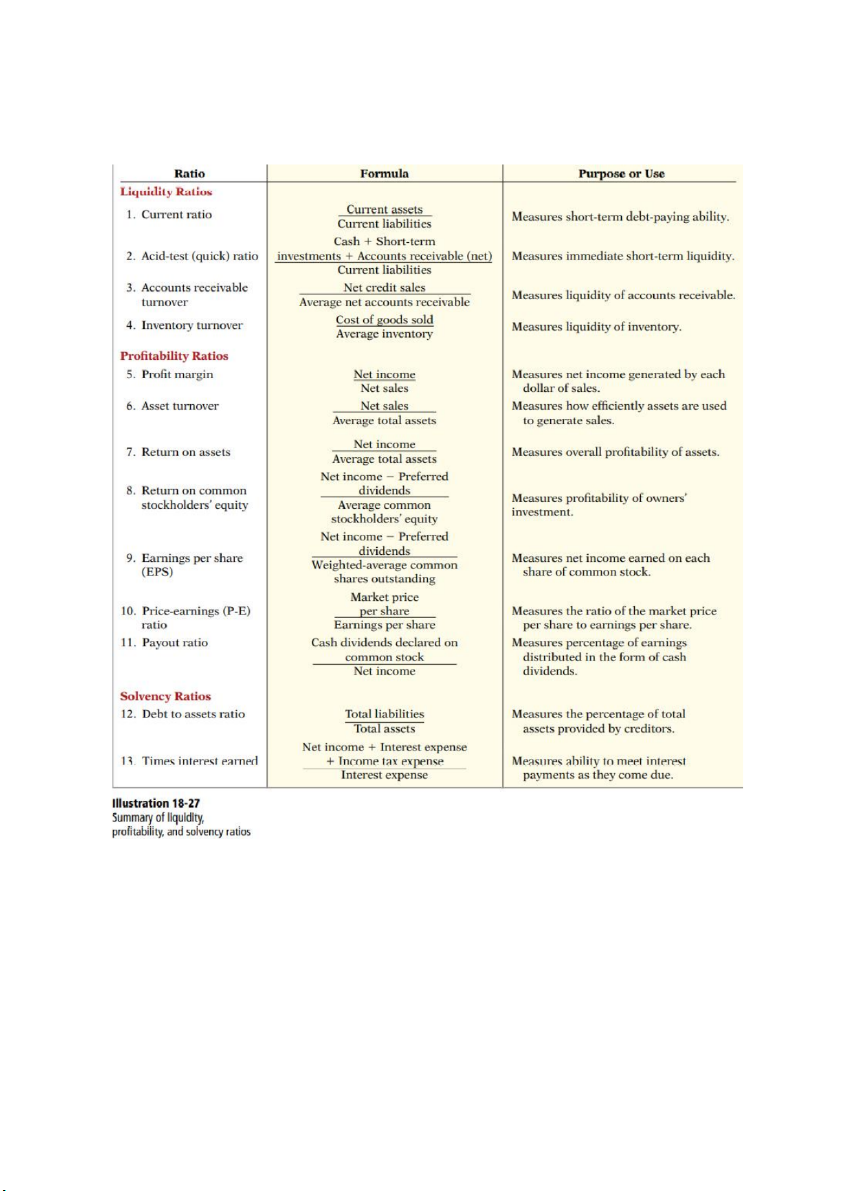

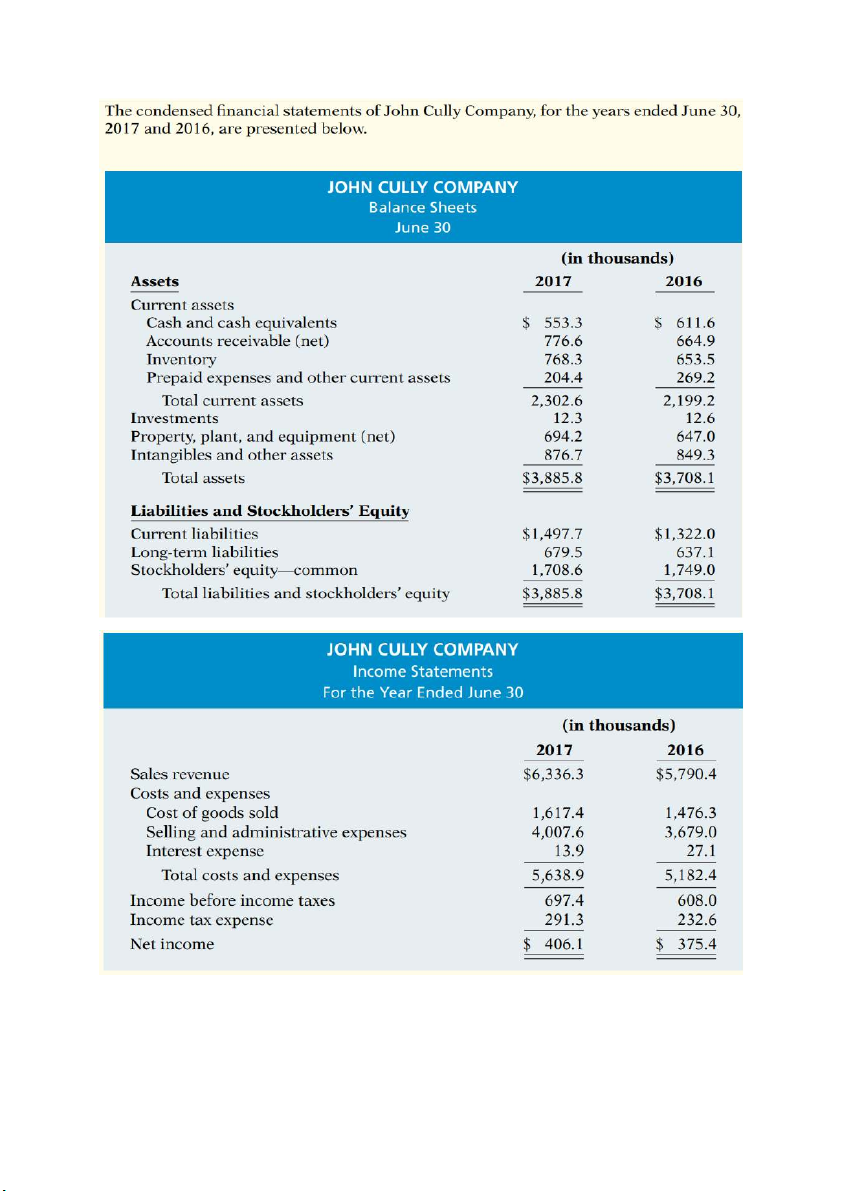

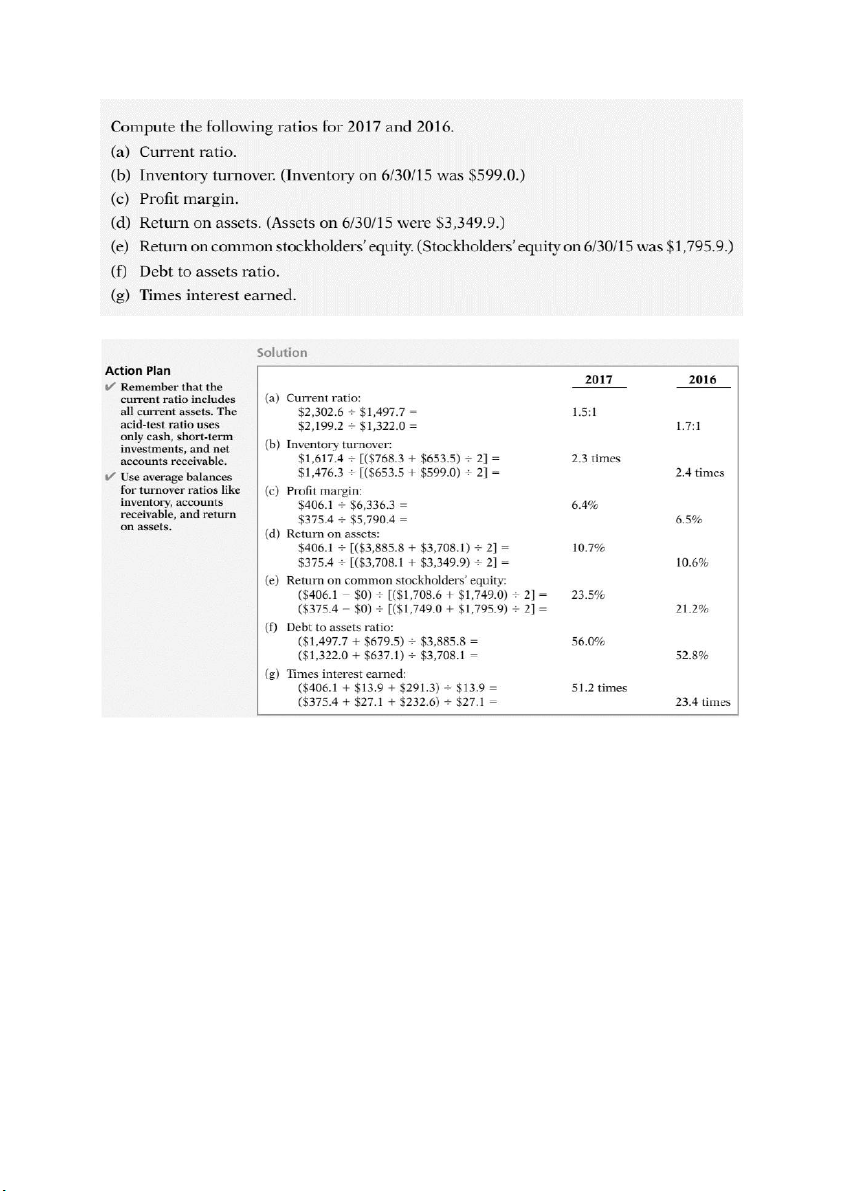

Income Statement of Vertical Analysis ❖ Ratio