Preview text:

IKEA IN CHINA

Biggest Market in the World Hanaa Ibrahim El Sayad Mohamed Foad El-Karany Hoor Elmorshdy Amira Gad Noha ARazek Ahmed Ahmed Mohamed-Samy International Finance Project Winter 2017 Table of Contents

CHAPTER ONE: Introduction.......................................................................................................5

1.1 Back ground about IKEA......................................................................................................5

1.2 The colors of IKEA and development of its brand logo........................................................5

1.3 Store Format and Design......................................................................................................6

1.4 Entry of IKEA in Different International Markets................................................................8

1.4.1 Entry of IKEA in China.................................................................................................8

1.4.2 Entry of IKEA in Russia..............................................................................................10

1.5 Definition and Classification of Risk in International Trade...............................................11

1.5.1 Definition of Risk.........................................................................................................11

1.5.2 Classification of Risk...................................................................................................11

CHAPTER TWO: Commercial Risks...........................................................................................13

2.1 Weak Partner - The suppliers of IKEA in China.................................................................13

2.2 Operational Problems.........................................................................................................13

2.2.1 Shoppers Behavior.......................................................................................................13

2.2.2 DIY Preferences...........................................................................................................15

2.2.3 Adapting to Customer’s Changing Needs – Changes in Size of Apartments................15

2.2.4 Stores Locations...........................................................................................................15

2.3 Timing of Entry...................................................................................................................15

2.4 Competitive Intensity..........................................................................................................16

2.5 Poor Execution Strategy.....................................................................................................17

2.6 Different Types of Commercial Risks and Mitigating Strategies........................................19

CHAPTER THREE: Currency (Financial) Risks..........................................................................21

3.1 The Finance Strategy of IKEA............................................................................................21

3.2 Purchase Strategy................................................................................................................22

3.3 Foreign Direct Investment in China....................................................................................24 1 IKEA in China International Finance Project Winter 2017

3.4 Financial Risks facing IKEA in China................................................................................26

3.4.1 Currency Exposure.......................................................................................................26

3.4.2- Asset valuation............................................................................................................27

3.4.3 Foreign Taxation..........................................................................................................28

3.4.4 Inflationary and Transfer Pricing.................................................................................28

3.4.5 Foreign Exchange Risk................................................................................................29

3.5 Summary of the Financial Risks and how to mitigate it......................................................32

CHAPTER FOUR: Country Risks................................................................................................33

4.1 Assessing the International Environment............................................................................33

4.1.1 Country Analysis and International Entry....................................................................33

4.1.2 Cultural Assessment.....................................................................................................36

4.1.3 The Chinese Market: Huge Potential and High Risk....................................................37

4.2 Country Risks that faced IKEA in China............................................................................38

4.2.1 Government Intervention, Protectionism and Barriers to Trade and Investment..........38

4.2.2 Bureaucracy, Red Tape, Administrative Delays and Corruption...................................39

4.2.3 Lack of Legal Safeguards for Intellectual Property Rights...........................................40

4.2.4 Legislation Unfavorable to Foreign Firms...................................................................41

4.2.5 Economic Failures and Mismanagement......................................................................43

4.2.6 Social and Political Unrest and Instability...................................................................44

4.2.7 Different Types of Country Risks and Mitigation Strategies........................................44

CHAPTER FIVE: Cross Cultural Risks.......................................................................................46

5.1 Introduction to the Chinese Culture....................................................................................46

5.2 Cultural Differences............................................................................................................48

5.2.1 Language Difference....................................................................................................48

5.2.2 Cultural Risk:...............................................................................................................48

5.2.3 Personality as affected by culture.................................................................................49

5.3 Negotiation Patterns............................................................................................................51 2 IKEA in China International Finance Project Winter 2017

5.4 Decision Making Styles......................................................................................................52

5.5 REGULATIONS & ETHICAL PRACTICES.....................................................................52

5.6 Different Types of Cross Cultural Risks and Mitigation Strategies....................................54

REFERENCES.............................................................................................................................56 3 IKEA in China International Finance Project Winter 2017 List of Figures Figure No. Description Page No. Figure 1.1 Flag of Sweden Figure 1.2 Evolution of IKEA Logo Figure 1.3

Typical Shopper’s Path in an IKEA Store Figure 1.4

Types of Risk in International Trade Figures 2.1

Sleeping in IKEA Stores in China Figure 2.2

Sleeping in IKEA Stores in China Figure 2.3

Change in the Operations of IKEA in China to suit the market Figure 3.1

Organization Structure of the Inter IKAE group Figure 3.2 US Profitable Firms in China Figure 3.3 The Annual Inflation in China Figure 3.4

IKEA Asia Treasury Centre (IATC) – cross-border CNY/CNH pool account operations Figure 4.1

Some of the key events during China’s opening up (1978- 2003) Figure 4.2

Examples of encouraged, restricted and prohibited industries in China Figure 4.3

“11 Furniture” – is one of the most notorious IKEA imitators. Yellow and blue company colors Figure 4.4

Demonstration of the Danger of IKEA furniture unit Figure 5.1 Photo of the leader Mao Zedong List of Tables Table No. Description Page No. Table 2.1

Different Types of Commercial Risks and Mitigating Strategies Table 3.1

Foreign direct investment in China Table 3.2 Sectors invested in China 2016 Table 3.3

Strong and weak points of Chinese Market Table 3.4

Different Types of Financial Risks and Mitigating Strategies Table 4.1

Different Types of Country Risks and Mitigating Strategies Table 5.1

Culture differences between China and Sweden Table 5.2

Different Types of Cross Cultural Risks and Mitigating Strategies 4 IKEA in China International Finance Project Winter 2017 CHAPTER ONE INTRODUCTION

1.1 Back ground about IKEA

The name IKEA comes from the initials of the founder, Ingvar Kamprad, his farm

Elmtaryd, and his county, Agunnaryd, in Småland, South Sweden (Moon, 2004). Since

IKEA’s humble beginnings in 1943 on Kamprad s small farm, to opening it’ ʼ s first

furniture showroom in Almhult, and later large scale Scandinavian and international

expansion in Europe, North America, Asia Pacific and Russia/Ukraine, IKEA has become

one the world’s most successful global retailers (Hill & Jones, 2005; Jonsson, 2008;

Moon, 2004). Today IKEA has 389 stores in 48 countries and is visited by 915 million

shoppers annually (IKEA website, 2017).

IKEA’s advertising and promotion is dominated by the catalogue; a marketing instrument

that is unusual for an international retailer but at the core of the marketing strategy of

IKEA. It is the most important marketing tool as can be seen by the fact that 70 % of the

annual marketing budget is spent on the catalogue. It is produced in 38 different editions,

in 17 languages for 28 countries. The catalogue is produced in-house with a standardised

layout, with the same products and same overall information; adjustments for editions in

different countries or regions are fairly minor (Johansson and Thelander, 2009).

1.2 The colors of IKEA and development of its brand logo

To build a presence in Germany, it was decided to push the Swedish origin of IKEA by

painting the stores in the colors of the Swedish flag (Figure 1.1), blue and yellow. IKEA

soon realized that painting the stores blue and yellow would make it easier for them to

stand out in other areas where there are many other retailers. 5 IKEA in China International Finance Project Winter 2017

Figure 1.1 Flag of Sweden

Over the years IKEA has also changed its brand logo as can be seen in Figure 1.2

Figure 1.2 Evolution of IKEA Logo (https://www.bebrilliant.com/be-brilliant-

blog/2014/10/21/brand-experiences-part-3-ikea)

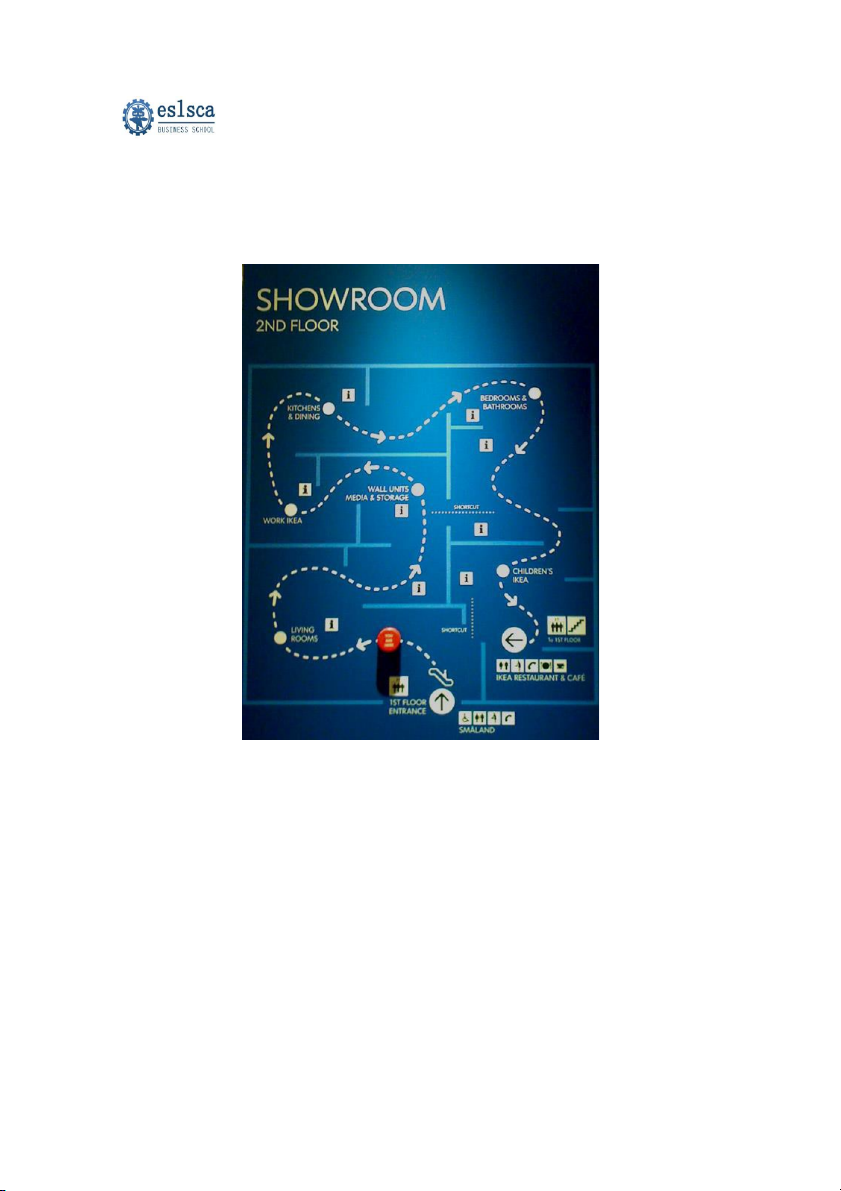

1.3 Store Format and Design

IKEA stores follow a fixed basic format. The size of an IKEA store has increased over

the years. Currently the smallest standard stores that are built are 32,000 square meters

and the largest are 45,000 square meters. Having standard stores is also in line with the

general cost-efficiency goal. As land is expensive to buy in some markets, IKEA has

currently developed buildings with several floors, with parking lots both in the basement

and on the roof. This is an example of how the Concept in Practice needs to be adjusted

to meet local peculiarities. A selection of furniture is displayed in room- like settings,

adjacent to which is the self-service warehouse section, with the ready-to-assemble

furniture placed in boxes on pallets. All stores also follow a "traffic flow" that takes

customers through the store in a manner that maximizes the exposure of IKEA products

in different settings (Bartlett, 1990). All stores have a restaurant with essentially the same 6 IKEA in China International Finance Project Winter 2017

menu (IKEA is Sweden's largest food exporter), in-store child care in the form of

supervised play areas and ballrooms, hot dog/hot sausage stands, and food markets with

traditional Swedish food near the exits, etc. (Jonsson and Foss, 2011). A typical journey

in a store is seen in Figure 1.3.

Figure 1.3 Typical Shopper’s Path in an IKEA Store (Source: Cordes, 2015). 7 IKEA in China International Finance Project Winter 2017

1.4 Entry of IKEA in Different International Markets

According to concept of Alexander and Myers (2000), IKEA’s vision to offer products with good

design and functioned products at low price by using innovative idea is the driver of change that

drive the company to internationalize. IKEA possess some ownership advantages which include

not only creative concept and technologies but also the experience, leadership, perception and

attitudes to expand the company in international market. The company begins to go to

international market starting with the country near by the market of origin in Scandinavian and

other distant countries later on

The international expansion of IKEA started in 1963 with the opening of its first store in

Norway. From that moment on IKEA showed a massive expansion. The first IKEA store

outside Scandinavia was opened in Zurich in 1973. The success in Switzerland paves the

way for a rapid expansion into Germany, today IKEA’s largest market. IKEA arrived then

in Australia and Canada, in 1976 and 1977respectively. The expansion in Europe

continued in Austria (1977), the Netherlands (1979), France (1981), Belgium (1984), UK

(1985), Italy (1989), Hungary (1990),Poland (1991), Spain (1996), Russia (2000),

Portugal (2004). IKEA opened its first store in USA in 1987 and in Japan in 2006 (Giunta, 2016).

1.4.1 Entry of IKEA in China

The driver of change affects location decisions, entry method and strategy of IKEA. The

decision of IKEA to enter China comes from those supporting environments which are

political and social and economic conditions allowing IKEA to beneficial exploit

advantage in Chinese market. The adjustment of law and regulation to attract foreign

investment, the rapid economic growth, the huge demand in domestic market and

abundant of raw materials and labors for furniture manufacturing are push and pull

factors that lead IKEA to enter and exploit Internationalization of IKEA in the Japanese

and Chinese markets 2008 Master thesis- Group 2022 35 advantages in Chinese market

(Capdevielle, Li & Nogal, 2007). At this point, location advantage highly influences the

expansion of IKEA to China (Dunning, 1981, 1988).

IKEA entered China in 1998 opening its first retail store in Shanghai followed by another

store in Beijing in 1999. IKEA was one of the first furniture-company to establish its 8 IKEA in China International Finance Project Winter 2017

presence in China. The company’s trading partnership with China dates back to the early

1960s. IKEA had therefore a solid network of Chinese suppliers and a good

understanding of the Chinese furniture industry when it entered the Chinese market. Over

the years, IKEA expanded its presence in China opening new retail stores (Beijing,

Guangzhou, Nanjing) and establishing several trading offices and a purchase center.

In 1998 when IKEA first entered into the mainland China, it set up a joint venture with a

local partner in Shanghai (Fong, 2006), and open its first store by renting land from

government. According to Linda Xu, this entry mode choice was made passively, “As a

retail company, joint venture was the sole way to operate business in China because at

that time, the retail industry has just opened and the Chinese government set many

restrictions on regions and in entry mode. IKEA opened retail stores in the regions that

were allowed; Nonetheless, IKEA selected its partner and maintained full management

control of their partner (Jonsson, 2007).

Also, this strategy minimizes financial risk and enables IKEA to handle with distant

market (Evans et al, 2000). Moreover, joint venture provides IKEA a great opportunity to

build partner and relationship with suppliers in China and make China became one of

important supply center of IKEA in Asia (Carpell, 2006)

Linda Xu stressed the influence of institutional factor by arguing that IKEA was heavily

constrained by institutional pressures and couldn’t make decision out of the company’s

own interests, and there were no chances for other factors to play a role. Obviously, for

IKEA’s first entry, the institutional factor played a dominant role because of the coercive

power from the government. In a later stage, IKEA changed this entry mode as soon as

new policies rolled out allowing foreign retailers to build wholly owned stores (Wang, 2011).

Before 2001 IKEA had only two retail stores in China, which were located in Shanghai

and Beijing respectively, those two stores were opened under IKEA’s joint ventures, but

after China joined the WTO and the government allowed foreign retailers to establish

wholly owned subsidiaries, IKEA promptly purchased the remaining shares from their

partners and wholly owned the stores, furthermore, when IKEA expanded into other 9 IKEA in China International Finance Project Winter 2017

cities of China from 2004, they adopted the same strategy of buying land and built their own stores (Wang, 2011).

The decision of entering the Chinese market was prompted by the economic growth

recorded since the beginning of the 1980s. Industrialization, rising incomes, better

education, postponed life stages, urbanization and the widespread of Western values give

birth to a growing middle classes with new needs and consumption patterns. The Chinese

middle class has been growing incredibly fast: the per-household disposable income of

urban consumers is expected to double from about $4000 to about $8000 between 2010

and 2020 (Atsmon & Magni, 2012).

China has enjoyed more than 20 years of rapid economic development since it opened its

doors to the international market with open door policy started by Deng Xiao Ping in

1978. The GDP has been increasing steadily by an average annual increase of 7–8 %.

Due to the increased purchase power of Chinese consumers and the growing popularity

of Western values, demand for high-end Western products soared. It is estimated that

China currently has approximately 30 million middle class consumers with annual

incomes ranging from $10,000 to $50,000.

The healthy economy coupled with rising income and a booming estate market provided

impetus to the growth in Chinese furniture market. After the housing reform in the

Chinese mainland, demand for privately owned homes has been constantly increasing in

both urban and rural areas, leading to a consequent surge in furniture sales.

However, the high import taxation the complex government regulation, strong

competition of local players and the complexity of the consumer buying behavior,

entering the Chinese market can prove extremely difficult (Giunta, 2016).

1.4.2 Entry of IKEA in Russia

On 17 August 1998 Lennart Dahlgren, the general director of IKEA Russia, arrived in

Moscow to set up the company's first superstore. He walked into an unfolding economic

crisis as he had arrived on the same day that the Rouble crashed, losing three-quarters of

its value against the dollar overnight. “I was a bit shaken, but my friends from other

businesses said I was lucky, as it would be much easier to invest following the 10 IKEA in China International Finance Project Winter 2017

devaluation. And it was. There was a complete change in attitude. Where the authorities

were difficult and arrogant before, after the crisis they welcomed foreign investors with

open arms,” says Mr. Dahlgren sitting in the airy, open-plan office you would expect of

the world's leading furniture producer. IKEA had already tried to set up in Russia twice –

once in 1988 shortly before the Soviet Union's collapse and again in 1993 when Boris

Yeltsin unleashed tanks in the capital – the first store opened with much fanfare in March

2000 and a second followed a year later. IKEA had already invested $400m, buying its

60-plus suppliers equipment and granting credit for investment and working capital – as

Russian companies' biggest headache is their inability to borrow from the local banks.

The company planned to invest another $600m over the next five years (Ditter, 2011).

1.5 Definition and Classification of Risk in International Trade

1.5.1 Definition of Risk

Risk can be referred as the chances of having an unexpected or negative outcome. Any

action or activity that leads to loss of any type can be termed as risk.

1.5.2 Classification of Risk

Figure 1.4 Types of Risk in International Trade (Source: Dinu, 2015)

Risks can be classified into the categories shown in Figure 1.4 (Dinu, 2015): Commercial risk

This refers to probable losses arising from the market or the transaction partners.

An important measure is to secure that the trading partners are reliable. It is also 11 IKEA in China International Finance Project Winter 2017

important to take into account the partner's possible bankruptcy or indisposition to

pay. Weak partner, operational problems, competitive intensity, and poor

execution of strategy are all forms of commercial risks. Commercial risk faced by

IKEA shall be discussed in Chapter Two. Financial risk

This is risk that contains financial loss to organizations. This type of risk usually

appears as a result of instability and losses in the financial market produced by

changes in interest rates, currencies, stock prices, and much more. It also includes

currency exposure, asset valuation, foreign taxation, inflationary, and transfer

pricing. Financial risk faced by IKEA shall be discussed in Chapter Three. Country risk

Country risk refers to the possibility that fluctuations in the business environment

in another country where companies are doing business may impact badly their

operations or payment for imports resulting in a financial loss. It includes

sovereign risk, which is a subdivision of risk generally connected to the

government or one of its agencies refusing to comply with the terms of a credit

agreement. Other forms of this risk include: government intervention,

protectionism and barriers to trade and investment, red tape, lack of safeguards for

intellectual propriety rights, legislation unfavorable to foreign firms, economic

failures, social and political instability. Country risk faced by IKEA shall be discussed in Chapter Four.

Cross-cultural risk

These risks occur where a cultural miscommunication puts human value at stake.

Examples of this are cultural differences, negotiation patterns, decision making

styles, ethical practices. Cross-cultural risk experienced by IKEA shall be discussed in Chapter Five. 12 IKEA in China International Finance Project Winter 2017 CHAPTER TWO COMMERCIAL RISKS

2.1 Weak Partner - The suppliers of IKEA in China

In 2013 some of the suppliers who have been working with IKEA for more than 10 years

have decided to stop delivering products to the IKEA supply chain. The reason for this

has been pressures put by IKEA on the suppliers to further reduce their prices. However,

with increased costs in raw materials and labor, the suppliers could not break even. Now

IKEA is conducting negotiations with new suppliers (ANON-2, 2013).

2.2 Operational Problems 2.2.1 Shoppers Behavior

Among all the countries that IKEA operates in the world they faced a challenge with

Chinese shoppers. It is reported that people treat the shops as a furniture theme park.

They occupied every furniture piece, sleeping or sitting on it for hours. They sleep

because the air conditioned stores provides them with an escape from the heat outside.

Some people use the designs as a background to take selfies pretending that they were in

their house. Children play on toys in the showroom as if they are in a public park (Hatton,

2013). However, IKEA store managers have not been too upset about this. This behavior

is illustrated in Figures 2.1 and 2.2. 13 IKEA in China International Finance Project Winter 2017

Figure 2.1 Sleeping in IKEA Stores in China (Source: Kevin Frayer/Getty Images)

Figure 2.2 Sleeping in IKEA Stores in China (Source: Kevin Frayer/Getty Images) 14 IKEA in China International Finance Project Winter 2017 2.2.2 DIY Preferences

IKEA had to adapt its DIY (do-it-yourself) concept to the Chinese realities. Since labor is

cheap there, most of the people don’t feel like assembling furniture themselves. Whereas

in the west, customers look at DIY as a chance to save money. For this reason, IKEA in

China offers fee-based assembly services and provides local home delivery and long-

distance delivery to major cities in China (Kornienko, 2016).

2.2.3 Adapting to Customer’s Changing Needs – Changes in Size of Apartments

IKEA, which offers same range of products in every country, certainly couldn’t adapt

them for every one of them. Since typical Chinese apartment is quite small, IKEA’s

furniture was a bit bulky in the beginning. This is why Swedish retailer had to adjust

product sizes so they will be in tune with reality. Additionally, layout of the IKEA store

matches typical size of the apartments and also includes a balcony section (since most

apartments have it) (Kornienko, 2016).

In terms of housing, the average square meters per person in China has been increasing

considerably. Until recently, apartments averaged 40 m ; now Beijing and Shanghai 2

apartments’ average 80 m . This means several things: Chi 2 nese residents need more

furnishings and, because consumers are buying more gadgets, they need more storage

containers and facilities. It also means IKEA needs to keep its home-life study up-to-date

because change happens so fast (Miller, 2004). 2.2.4 Stores Locations

Store location should reflect the reality of the market condition as well. Traditionally,

IKEA stores are situated away from the city, this why shoppers usually travel there by

car. In China, however, percentage of car ownership is not high. Therefore, IKEA had to

situate its stores on the outskirts of the city so people can go there using public

transportation (Kornienko, 2016). 2.3 Timing of Entry

The Chinese government allowed foreign investments in the real estate industry in the

mid 1990s. As the construction of commercial and residential establishments increased, it

also boosted the sales of home decoration and furnishings companies. The demand for 15 IKEA in China International Finance Project Winter 2017

housing increased considerably over the late 1990s and early 2000s. Increased home

ownership further boosted the home improvements and decoration market. People wanted

better quality products. To fill this need, many foreign home decoration and furnishings

companies like B&Q entered China during the 1990s. IKEA started its retailing

operations in China with the opening of its first store in Shanghai in 1998 (ICMR, 2005).

IKEA is a later comer in Chinese furniture market. They missed the best time to enter

China market as there were more than 100,000 domestic furniture markets in China when

IKEA started there. There were more than 40 furniture markets just in Beijing. (Li, 2007).

2.4 Competitive Intensity

In the Chinese market IKEA had to compete with a number of rivals both local and

international. The local competitors include Qumei group, Markor Furniture

International, Royal Furniture and Chengdu QuanU furniture Co, whilst the international

competitors included OBI from Germany, B&Q from the UK, and Hola from Taiwan. All

of these competitors exercised a pressure on IKEA’s initial prices as they were selling at

lower prices (Giunta, 2016). IKEA reduced the prices drastically. One example is the

price of its “Lack” table that has dropped to 39 Yuan from 120 Yuan when IKEA first

came to the Chinese market (Hansegard, 2012). 16 IKEA in China International Finance Project Winter 2017

2.5 Poor Execution Strategy

Figure 2.3 Change in the Operations of IKEA in China to suit the market (Source: )

At the start of the operations in China, IKEA operated in the same manner as they were

operating in Europe, but they had to quickly change their mode of operation as seen in

Figure 2.3 above to suit the Chinese market.

As the company opened more stores from Beijing to Shanghai, the company's revenue

grew rapidly. In 2004, for instance, its China revenue jumped 40 per cent from the year

before. But there was a problem - its local stores were not profitable.

IKEA identified the strategic challenges and made attempts to overcome them. One of the

main problems for IKEA was that its prices, considered low in Europe and North

America, were higher than the average in China. Prices of furniture made by local stores

were lower as they had access to cheaper labor and raw materials, and because their design costs were usually nil. 17 IKEA in China International Finance Project Winter 2017

Entering China was also an example of poor execution strategy in terms of pricing.

IKEA has a vision of delivering low cost to its customers. However, IKEA’s prices were

not considered low by the middle-class Chinese customers, IKEA’s main target segment.

Chinese customers’ purchase power was in fact significantly lower than that of their

counterparts in developed countries. IKEA products were, consequently, not affordable to

the vast majority of Chinese customers. Even if a significant portion of Chinese

customers, particularly the younger generations, were attracted by IKEA’s innovative

solutions, symbols of Western lifestyles, they were simply not able to buy them. On the

other hand, the prices were not within the consumption patterns of the Chinese upper

classes that were more inclined to buy foreign products as a symbol of status and not for

their functionality. In such a market, foreign brands were seen as aspirational brands.

Therefore, low prices were the rule for everyday-life products, IKEA’s positioning and

pricing strategy seemed unable to create value to its target group. Furthermore, the IKEA

concept based on the value for money proposition was completely alien to the Chinese

traditional culture. As the Chinese proverb haohuobupianyipianyimeihaohuo (high

quality goods are not cheap, and the cheap goods are not high quality) suggests, in the

Chinese consumers’ view, low prices are often associated to low quality. This cultural

aspect caused resistance to IKEA products mainly among older generations.

The Company realized this and started targeting the young middle-class population.

This category of customers has relatively higher incomes, is better educated and is

more aware of western styles. Targeting this segment helped IKEA project itself as an

aspirational western brand. This was a massive change in strategy, as IKEA was

targeting the mass market in other parts of the world.

In addition, the China expansion came at a cost. Since 1999, IKEA has been working on becoming more .

eco-friendly It has been charging for plastic bags, asking suppliers for

green products, and increasing the use of renewable energy in its stores. All this proved

difficult to implement in China. Price-sensitive Chinese consumers seem to be annoyed

when asked to pay extra for plastic bags and they did not want to bring their own

shopping bags. Also, a majority of suppliers in China did not have the necessary

technologies to provide green products that met IKEA's standards. Helping them adopt 18 IKEA in China International Finance Project Winter 2017

new technologies meant higher cost, which would hurt business. IKEA decided to stick

with low prices to remain in business.

The company also learnt that emerging economies are not ready for environment-

friendly practices, especially if they result in higher prices.

High pressure from competitors’ lower prices coupled with high import tariffs made it

even more difficult for IKEA to decrease significantly its costs. As a consequence, during

the first few year profit in China was poor. Only in 2012 IKEA was finally able to

generate profits in China (Giunta, 2016).

IKEA started to take measures to reduce prices. According to Chinese business review,

IKEA’s China sales rose 35 % in 2003 after lowering prices nearly 10 %. Sales were up

50 % in the first three months of 2004 (Miller, 2004).

To achieve a price decrease of more than 60%, IKEA built a number of factories in China

and increased local sourcing of materials. While globally 30 % of IKEA’s range comes

from China, about 65 % of the volume sales in the country come from local sourcing

(Wei & Zou, 2007). This strategy reduced enormously production costs and resolved the problem of high import taxes.

Table 2.1 Different Types of Commercial Risks and Mitigating Strategies Risk Nature of the risk Mitigation of risks Weak Partner: Supplier

Suppliers decided not to work with IKEA Seeking new suppliers. Operational: shoppers

People enjoy spending their time at the store IKEA decided to accept thi behavior and rarely buy any items behavior as this provided th with positive publicity and the profits picked up. Operational: DIY

DYI concept is not popular in China Offer assembly service to customers Operational: Size of

Size and layout of apartments in China are Adapt furniture size, chang Apartments

different to most international countries. layout. Change product rage as nee

Operational: Stores locations

Store location was crucial for people to be Locate stores where there a able to visit the stores public transportation. 19 IKEA in China