Preview text:

Vietnam National University – HCMC International University

SCHOOL OF BUSINESS ADMINISTRATION COURSE SYLLABUS1 BA010IU Managerial Accounting

Note: The outline with specific venue and time, and updated learning

materials for the current semester will be provided to the enrolled students by the lecturer

This study source was downloaded by 100000829793208 -05:0 0 BA010IU

VNU – International University Managerial Accounting

School of Business Administration 1. COURSE STAFF

Lecturer: Nguyen Kim Thu Room: Telephone: E-mail: nkthu@hcmiu.edu.vn

Consultation Hours: 13.00 – 15:00 Tuesday Teaching Assistant: TBA Room: TBA Telephone: TBA E-mail: TBA Consultation Hours: TBA

Should the students wish to meet the staff outside the consultation hours, they are

advised to make appointment in advance. 2. COURSE INFORMATION 1

22.1 Teaching times and Locations 3 Lecture: TBA Venue: TBA 1 22.2 Units of Credit 3

This course is worth 3 credits.

2.3 Parallel teaching in the course

There is no parallel teaching involved in this course.

2.4 Relationship of this course to others

BA010IU– Managerial Accounting focuses on cost control and cost management in

organizations. It builds on, and extends the materials taught in–Financial Accounting.

2.5 Approach to learning and teaching

Employing the interactive learning and problem-based teaching approach, this course

emphasizes the interaction between lecturers and students. The lecture materials will be

uploaded in Blackboard to help the students to preview the materials and to concentrate

on listening and critical thinking during the lecture. This will help students to interact with

the lecturer during the classroom. The sessions for presentations and discussions

comprise company case studies as well as answering some theoretical and conceptual

questions, which help the students to see how the concepts are applied in the real 2 BA010IU

VNU – International University Managerial Accounting

School of Business Administration

international business context. Students will present the case to the class and discuss with the peers.

3. COURSE AIMS AND OUTCOMES 3.1 Course Aims

3.2 Student Learning Outcomes

Upon successful completion of this course you should be able to:

• Analyze and explain key managerial accounting concepts and principles.

• Analyze and record business transactions common to the manufacture of inventory in: • Job order costing systems • Process costing systems

• Prepare accrual basis financial statements for manufacturers.

• Explain common cost classifications and apply cost behavior concepts using costvolume- profit analysis.

• Explain the budgeting process and prepare a variety of budgets.

• Explain and apply the concepts underlying standard costing systems, including the analysis of variances.

• Explain decentralization and apply related performance measurement concepts.

• Identify relevant costs and prepare analyses of costs and benefits considered in operational decisions.

• Explain the capital budgeting process and apply a variety of methods used to make such decisions.

• Use accounting information to make management decisions.

3.3 Teaching Strategies

The learning system in this course consists of lectures and scheduled

presentations/discussions. Lectures elaborate the appropriate theoretical content in the

textbook and readings. Classes provide a more detailed and refined analysis of both

concepts and applied materials. Classes are strongly oriented towards interactive

discussion of the text and cases. In order to gain the most from the lectures and class

activities, the assigned text/reading should be read before the lecture to participate in the discussions.

4. STUDENT RESPONSIBILITIES AND CONDUCT 4.1 Workload

It is expected that the students will spend at least six hours per week studying this course.

This time should be made up of reading, research, working on exercises and problems,

and attending classes. In periods where they need to complete assignments or prepare

for examinations, the workload may be greater. 3 BA010IU

VNU – International University Managerial Accounting

School of Business Administration

Over-commitment has been a cause of failure for many students. They should take the

required workload into account when planning how to balance study with part-time jobs and other activities. 4.2 Attendance

Regular and punctual attendance at lectures and seminars is expected in this course.

University regulations indicate that if students attend less than eighty per cent of

scheduled classes they may be refused final assessment. Exemptions may only be made on medical grounds.

4.3 General Conduct and Behavior

The students are expected to conduct themselves with consideration and respect for the

needs of the fellow students and teaching staff. Conduct which unduly disrupts or

interferes with a class, such as ringing or talking on mobile phones, is not acceptable and

students will be asked to leave the class. More information on student conduct is

available at the university webpage. 4.4 Keeping informed

The students should take note of all announcements made in lectures or on the course’s

Blackboard. From time to time, the university will send important announcements to their

university e-mail addresses without providing a paper copy. The students will be deemed

to have received this information. 5. LEARNING ASSESSMENT

5.1 Formal Requirements

In order to pass this course, the students must:

• Achieve a composite mark of at least 50; and

• Make a satisfactory attempt at all assessment tasks (see below). 5.2 Assessment Details Mid-Term Exam 30% Quizzes 20% Group assignments 10%

Final Exam (Two Hours) 40% Total 100% 5.3 Quiz

There will be 3 quizzes given in class to provide you with a gauge of your progress and

understanding of the more difficult concepts. The quizzes will cover material contained in the

lectures and homework assignments. The quizzes will be given after covering the assigned homework. 4 BA010IU

VNU – International University Managerial Accounting

School of Business Administration

5.4 Class participation and Presentation

A minimum attendance of 80 percent is compulsory. Students will be assessed on the basis of quizzes. 1

5.5 Special Consideration

Request for special consideration (for final examination only) must be made to the Office

of Academic Affairs within one week after the examination. General policy and

information on special consideration can be found at the Office of Academic Affairs.

6. ACADEMIC HONESTY AND PLAGIARISM

Plagiarism is the presentation of the thoughts or work of another as one’s own

(definition proposed by the University of Newcastle). Students are also reminded that

careful time management is an important part of study and one of the identified causes

of plagiarism is poor time management. Students should allow sufficient time for

research, drafting, and the proper referencing of sources in preparing all assessment

items. The university regards plagiarism as a form of academic misconduct, and has very

strict rules regarding plagiarism.1 7. STUDENT RESOURCES 7.1 Course Resources

Please note that it is very important to gain familiarity with the subject matter in the

readings and cases prior to attendance in classes.

Textbook: Warren, Reeve, Fess, Accounting, 23rd Edition (Chapters 18-25); Thomson

South-Western Publishing Co., 2009 Reference Books:

Managerial Accounting – Needles/Crosson. Houghton Mifflin.

Additional materials provided in Blackboard

The lecturer will attempt to make lecture notes and additional reading available on

Blackboard. However this is not an automatic entitlement for students doing this subject.

Note that this is not a distance learning course, and you are expected to attend lectures

and take notes. This way, you will get the additional benefit of class interaction and demonstration.

Recommended Readings & Internet sites Business Week Forbes The Wall Street Journal The Journal of Accountancy

7.2 Other Resources, Support and Information 1

1 This is adapted with kind permission from the University of New South Wales. 5 BA010IU

VNU – International University Managerial Accounting

School of Business Administration

2Additional learning assistance is available for students in this course and will be made

available in Blackboard. Academic journal articles are available through connections via

the VNU - Central Library. Recommended articles will be duly informed to the students.

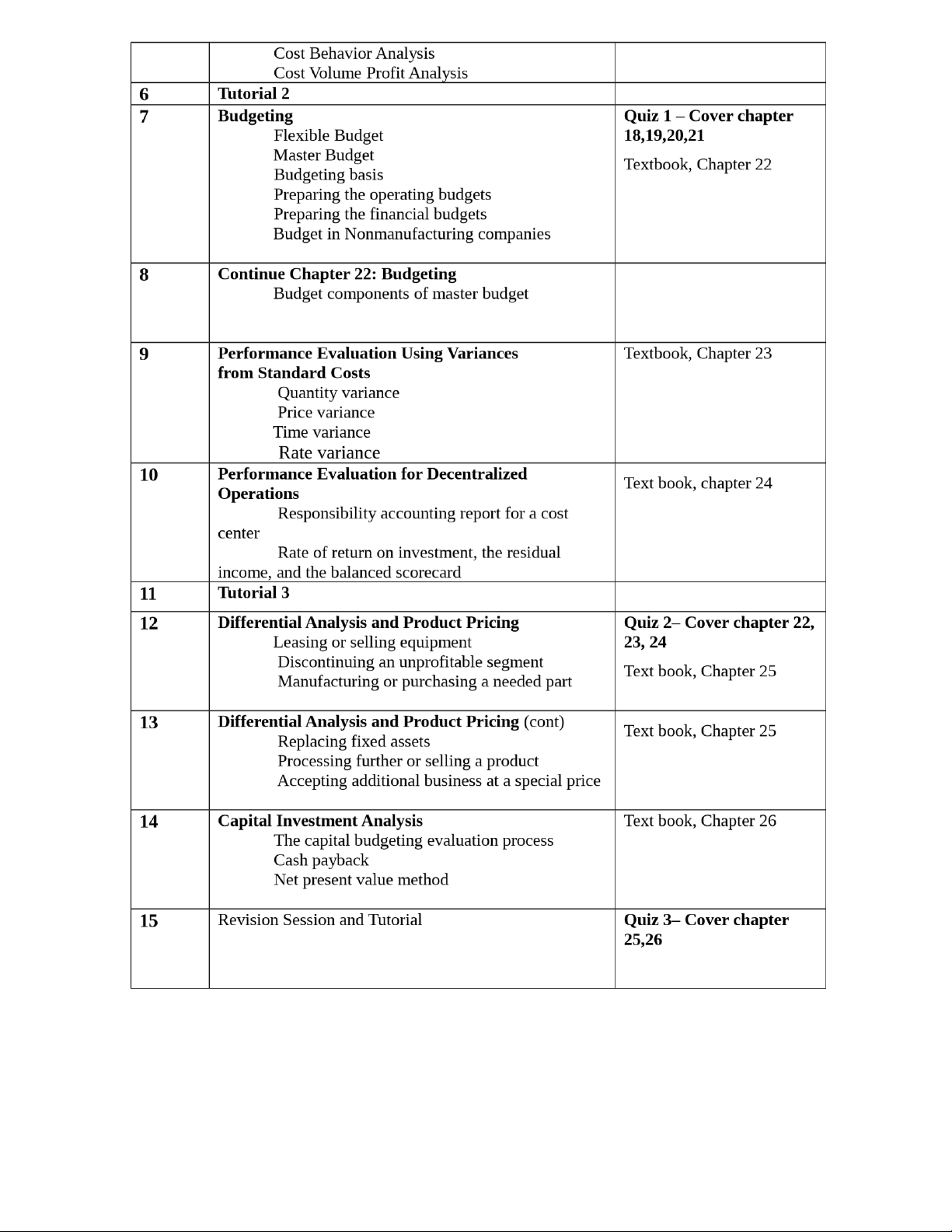

8. COURSE SCHEDULE Week Topic Learning materials and activities 1 Managerial Accounting Textbook, Chapter 18 Managerial accounting basics Managerial Cost concepts

Manufacturing Costs in Financial Statements Managerial accounting today 2

Job Order Cost Accounting Textbook, Chapter 19 Cost Accounting Systems Job Order Cost Flow Reporting Job Cost Data

Under or Overapplied Manufacturing Overhead 3 Turorial 1 4

Process Cost Accounting

The nature of process cost systems Textbook, Chapter 20 Equivalent units

Comprehensive example of process costing

Cost systems – Final comments 5 Cost-Volume-Profit Textbook, Chapter 21 6 BA010IU

VNU – International University Managerial Accounting

School of Business Administration 7 lOMoARcPSD|47206417

1 The syllabus is prepared following the format provided by the School of Organization and Management, University of

New South Wales, with kind permission.

Powered by TCPDF (www.tcpdf.org)