Preview text:

BỘ GIÁO D O ỤC VÀ ĐÀO TẠ

TRƯỜNG ĐẠI HỌC HOA SEN

MÔN: NGUYÊN LÝ KẾ TOÁN LỚP: 0200 NHÓM: 07

BÀI TIỂU LUẬN CUỐI KÌ 08/2023 BỘ GIÁO D O ỤC VÀ ĐÀO TẠ

TRƯỜNG ĐẠI HỌC HOA SEN

MÔN: NGUYÊN LÝ KẾ TOÁN LỚP: 0200 NHÓM: 07

BÀI TIỂU LUẬN CUỐI KÌ Thành viên MSSV Vũ Ngọc Long 22116987 Lê Nguyễn Phương Nam 2193383 Huỳnh Phước Tân 2182777 Phạm Tri Thức 22112844 Nguyễn Mai Uyên 22104873 08/2023 MỤC LỤC

MỤC LỤC ........................................................................................................................... 1

LỜI CAM KẾT .................................................................................................................... 2

LỜI CẢM ƠN ...................................................................................................................... 3

BẢNG ĐÁNH GIÁ MỨC ĐỘ HOÀN THÀNH CÔNG VIỆC .......................................... 4

I. CASES .......................................................................................................................... 5

II. INVENTORY COSTING ............................................................................................. 9

III. ACCOUNTING CYCLES ...................................................................................... 11

IV. LEARNING OUTCOME ........................................................................................ 20 1 LỜI CAM KẾT

“Chúng tôi đã đọc và hiểu các hành vi vi phạm liêm chính học thuật. Chúng tôi cam kết bằng chính danh sự c a mình r ủ

ằng đây là bài báo cáo nhóm chúng tôi tự thực hiện và không vi phạm liêm chính h c thu ọ

ật. Chúng tôi xin hoàn toàn chịu trách nhiệm trước nhà trường về s cam két ự này.” 2 LỜI CẢM ƠN

Lời đầu tiên, chúng em xin gửi lời cảm ơn đến khoa Kinh tế quản trị trường Đại học Hoa Sen đã

đưa môn học Nguyên lý kế toán vào giảng dạy. Đây là một môn học rất hay và cho chúng em

nhiều kiến thức bổ ích. Bên cạnh đó chúng em xin gửi lời cảm ơn sâu sắc nhất đến cô Lê Thị

Bích Thảo - người đã trực tiếp hướng dẫn e

chúng m hoàn thành bài tiểu luận này.

Trong quá trình làm bài, do hiểu biết của chúng em còn nhiều hạn chế nên bài làm khó tránh

khỏi những thiếu sót. Mong cô xem và góp ý thêm cho chúng i làm ngày càng hoàn em để bà thiện. Chúng e m xin chân thành cảm ơn! 3

BẢNG ĐÁNH GIÁ MỨC ĐỘ HOÀN THÀNH CÔNG VIỆC Thành viên MSSV Công việc Mức độ Vũ Ngọc Long

22116987 I (case 1, case 2 1,2,3) – 100% Lê Nguyễn Phương Nam 2193383 I (case 2 4,5,6,7,8,9,10) – 100% Huỳnh Phước Tân 2182777 II, IV 100% Phạm Tri Thức 22112844 III (a,b) 100% Nguyễn Mai Uyên 22104873 III (c,d) 100% 4 I. CASES 1. Case 1

Kathy and James Mohr, opened the Chip-Shot Driving Range Company on March 1, 20X3. They

invested $25,000 cash and received common stock in exchange for their investment. A caddy

shack was constructed for cash at a cost of $8,000, and $800 was spent on golf balls. The

company leased five acres of land at a cost of $1,000 per month and paid the first month’s rent.

During the first month, advertising costs totaled $750, of which $150 was unpaid at March 31,

and $1,340 was paid to members of the golf team for retrieving golf balls. All revenues from

customers were deposited in the company’s bank account. On March 15, Kathy and James

received a dividend of $1,000. A $100 utility bill was received on March 31 but was not paid. On

March 31, the balance in the company’s bank account was $18,900.

Required. How much Revenue and net income (or profit) that the company has in the business

operated? Calculate and specific explanations. Answer:

Investment and Capital Stock: Kathy and James invested $25,000 cash and received common

stock in exchange. => This does not af

fect revenue or expenses since it's an investment by the owners. (Owner’s capital) Expenses: - Caddy shack: $8,000 - Golf balls: $800

- Lease: $1,000 (for the first month)

- Advertising: $750 (total), of which $150 is unpaid - Golf team payment: $1,340

Total expenses: $8,000 + $800 + $1,000 + $750 - $150 + $1,340 = $11,740

Revenue: The revenue generated from customers isn't explicitly provided in the scenario. It's

important to note that revenue is typically earned from services provided to customers. Since the

exact revenue amount isn't given, we'll assume a revenue value.

Dividend: A dividend of $1,000 was paid to Kathy and James on March 15. Dividends are not

considered expenses; they are distributions of profits to the owners.

Utility Bill: A utility bill of $100 was received but not paid. This unpaid bill will be recorded

as a liability but won't impact revenue or expenses directly.

Ending Bank Balance: The ending bank balance on March 31 was $18,900. This is not directly

relevant to revenue or expenses

Net Income = Revenue - Expenses 5

Since the exact revenue is not given, we assume a hypothetical revenue of $30,000 for the first month.

Net Income = $15,000 - $11,740 = $3,260

(Please note that this calculation is based on the assumptions made regarding the revenue

amount. Additionally, this calculation does not take into account other potential expenses

such as the unpaid advertising cost and the unpaid utility bill, as they are not specified to impact the revenue directly). 6 2. Case 2

Tom Parkey has prepared the following list of statements about depreciation

1. Depreciation is a process of asset valuation, not cost allocation

2. Depreciation provides for the proper matching of expenses with revenues

3. The book value (carrying amount) of a plant asset should approximate its fair value

4. Depreciation applies to three classes of plant assets: land, buildings, and equipment

5. Depreciation does not apply to a building because its usefulness and revenue-producing

ability generally remain intact over time

6. The revenue-producing ability of a depreciable asset will decline due to wear and tear and to obsolescence

7. Recognizing depreciation on an asset results in an accumulation of cash for replacement of the asset

8. The balance in accumulated depreciation represents the total cost of asset that has been charged to expense

9. Depreciation expense and accumulated depreciation are reported on the income statement

10. Four factors affect the computation of depreciation: cost, useful life, salvage value, and residual value

Required: Identify each statement as true or false. If false, indicate how to correct the statement

1. False: Depreciation is a process of cost allocation, where the cost of an asset is allocated over its useful life.

2. True: Depreciation helps in matching the expenses of an asset with the revenues it generates.

3. False: The book value (carrying amount) of a plant asset may not necessarily

approximate its fair value. Fair value is determined based on market conditions and may differ from the book value.

4. True: Depreciation applies to three classes of plant assets: land, buildings, and equipment.

5. False: Buildings can also be subject to depreciation as their useful life and revenue-

producing ability may decrease over time.

6. True: The revenue-producing ability of a depreciable asset will decline due to wear and

tear and obsolescence over its useful life.

7. False: Recognizing depreciation on an asset does not result in an accumulation of cash

for replacement. Depreciation is a non-cash expense.

8. False: The balance in accumulated depreciation represents the accumulated amount of

depreciation charged to the asset over its useful life, not the total cost of the asset that has been charged to expense.

9. False: Depreciation expense is reported on the income statement, but accumulated

depreciation is reported on the balance sheet as a contra-asset account. 7

10. True: The four factors that affect the computation of depreciation are cost, useful life,

salvage value (sometimes referred to as residual value), and estimated residual value. 8

II. INVENTORY COSTING

Balboa Bank and Trust are considering giving Rodrigo Company a loan. Before doing so, they

decide that further discussions with Rodrigo’s accountant may be desirable. One area of

particular concern is the inventory account, which has a year-end balance (December 31) of

$297,000. Discussions with the accountant reveal the following.

1. Rodrigo sold goods costing $38,000 to Santoro Company, , on FOB shipping point

December 28. The goods are not expected to arrive at Santoro until January 12. The

goods were not included in the physical inventory because they were not in the warehouse.

Goods sold to Santoro on December 28 but not yet arrived at their destination should

not be included (no adjustment) in the inventory, as they were not in the warehouse

2. The physical count of the inventory did not include goods costing $95,000 that were

shipped to Rodrigo, FOB destination on December 27 and were still in transit at year-end

Goods shipped to Rodrigo on December 27 and still in transit at year-end should not

be included (no adjustment) in the inventory, as they were shipped FOB destination

3. Rodrigo received goods costing $22,000 on January 2. The goods were shipped FOB

shipping point on December 26 by Penelope Co. The goods were not included in the physical count

Goods received on January 2 that were shipped on December 26 should be

(+$22,000) included in the inventory, as they were shipped FOB shipping point

4. Rodrigo sold goods costing $35,000 to Naomi Co., FOB destination, on December 30.

The goods were received at Naomi on January 8. They were not included in Rodrigo’s physical inventory.

Goods sold to Naomi on December 30 and received on January 8 should be

(+$35,000) included in the inventory, as they were shipped FOB destination

5. Rodrigo received goods costing $44,000 on January 2 that were shipped FOB destination

on December 29. The shipment was a rush order that was supposed to arrive December

31. This purchase was included in the ending inventory of $297,000

Goods received on January 2 that were shipped on December 29 and included in the

ending inventory of $297,000 should not be included (-$44,000) in the inventory.

Because Rodrigo received goods after December 31.

The exact ending inventory balance on December 31:

$297,000 +$22,000 + $35,000 - $44,000 = $310,000 Note:

FOB shipping point: The responsibility transfers to the buyer once the goods are loaded

onto the transportation vehicle at the seller’s shipping point. The buyer bears the

transportation costs and is responsible for any damage or loss during transit. 9

FOB destination: The responsibility remains with the seller until the goods are delivered

to the buyer’s specified destination. The seller bears the transportation costs and is

responsible for any damage or loss during transit. 10

III. ACCOUNTING CYCLES

Hoàng Minh Trading & Service Co. Ltd., established in 2015, specializes in trading product X in

nutritional food. The company uses a perpetual inventory system, first-in-first-out (FIFO), and straight-line depreciation.

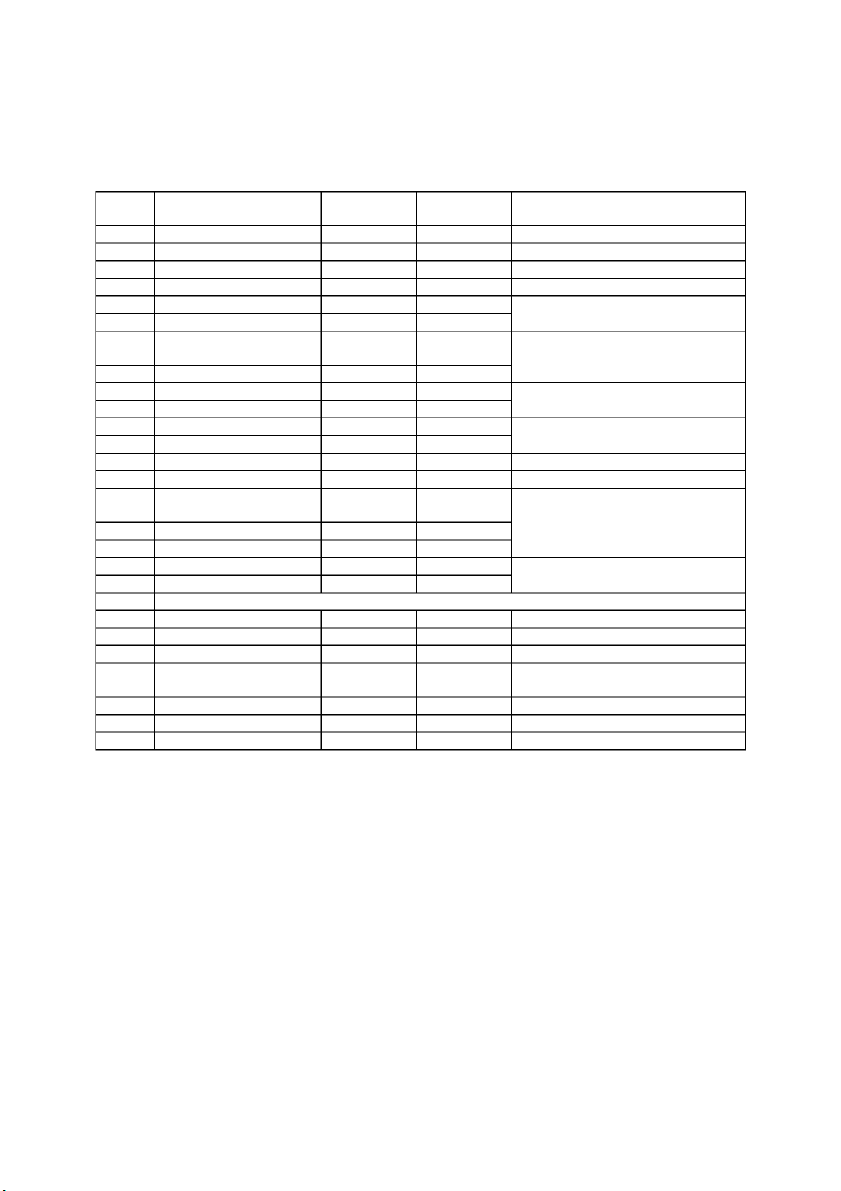

Beginning balance of accounts in Jan 1, 2023 are listed as follow Amount / Số tiền Accounts / Tài khoản (VND) Cash / Tiền 12,828,708,413

Retained Earnings / Lợi nhuận giữ lại 340,160,215

Salaries Payables / Tiền lương phải trả 112,417,234 Supplies / Công c d ụ ng c ụ ụ 345,723,100

Notes payable / Vay ngân hàng X = 7,594,833,705 Accounts receivable / Phả i thu khách hàng 697,975,441

Accounts payable / Phải trả người bán 675,300,000 Equipment / Thiết bị 4,894,263,600

Merchandise inventories / Hàng hóa 800,000,000 Units / S ố lượ

: 10.000 product X; unit price / ng đơn giá: 80.000đ/sp Owner’s Capital 10,000,000,000

Accumulated Depreciation / Hao mòn lũy kế 843,959,400 11

a. Using the accounting equation, calculate the Notes Payable (Y) on January 1, 2023 Assets :

= Cash + Supplies + Accounts receivable + Equip

ment + Merchandise inventories - Accumulated Depreciation

= 12,828,708,413 + 345,723,100 + 697,975,441 + 4,894,263,600 + 800,000,000 - 843,959,400 = 18,722,711,154 (VND) Liabilities: = Salaries Payables + +

Notes payable Accounts payable

= 112,417,234 + X + 675,300,000 = 787,717,234 + X (VND) Owner’s equity:

= Retained Earnings + Owner’s Capital

= 340,160,215 + 10,000,000,000 = 10,340,160,215 (VND)

Total Asset = Total Liabilities + Total Owner’s Equity X = 18,722,71

1,154 (787,717,234 + 10,340,160,215) – = 7,594,833,705 (VND) 12

b. Record the transactions to the General Journal and transfer the data to the T accounts

The following are transactions incurred in January 2023.

1. On January 2, purchase equipment and sign a note payable to borrow VND50,000,000 from the bank.

2. On January 5, purchased supplies for cash, VND 25.100.000.

3. On January 9, purchased 6.000 units of product X on account, purchase price 80.500VND/unit.

4. On January 10, issued 15.000 units of product X to sell to client A at 150.000 VND per unit

and allow the customer pay cash to next month.

5. On January 15, purchased on account 9.000 units of product X, purchase price 81.000VND/unit.

6. On January 20, paid cash for utility expenses (electronic, water, telephone) of VND 27.315.000.

7. On January 26, issued 7.000 units of product X to sell to client B at 150.000 VND per unit.

Client B paid 30% in cash and 70% on credit.

8. On January 28, the company was considering signing a sale contract to sell merchandise to

client C according to the delivery method to the warehouse’s C company.

9. On January 31, accrued the salary expenses payable to the employees at the end of the month of VND 115.483.000.

10. On January 31, accrued depreciation expense of VND 120.000.000.

11. On January 31, paid VND 10.000.000 for online advertising on the VN Express website.

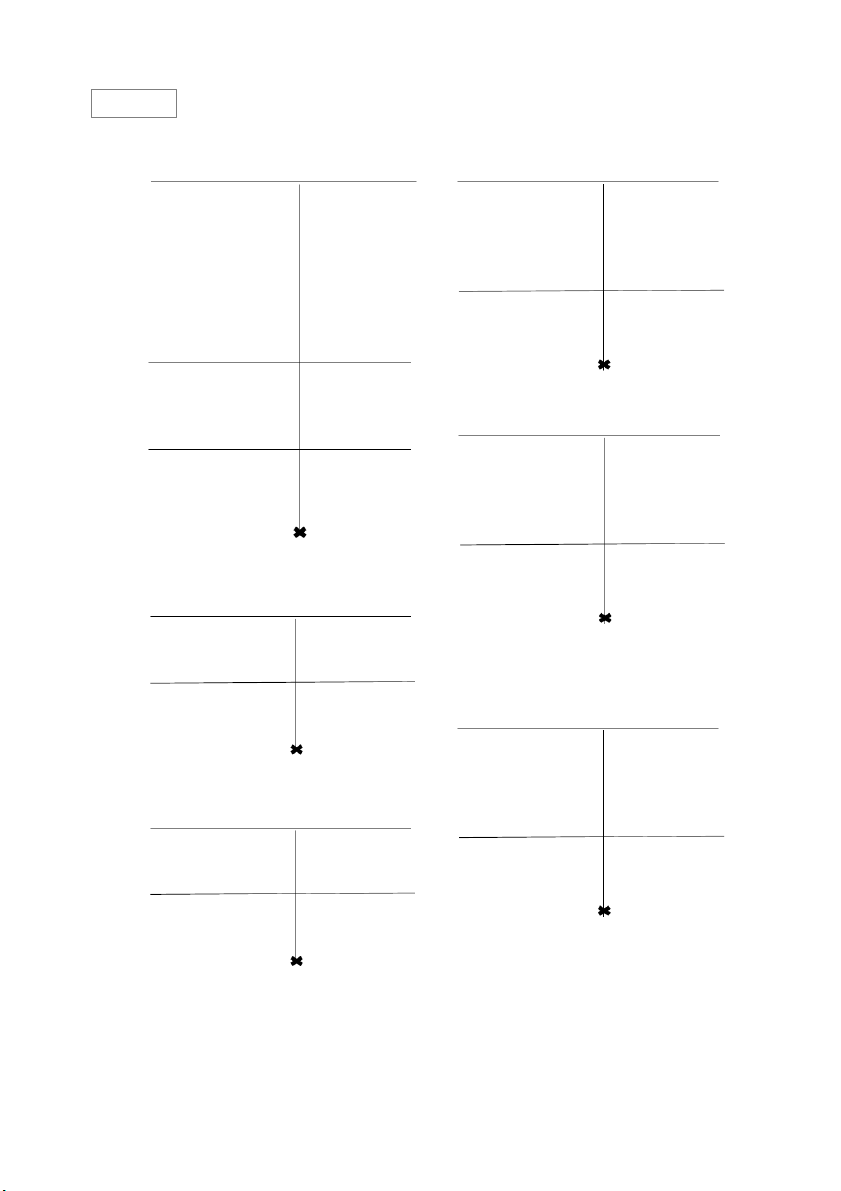

12. Determine the profit after tax. Assume that a corporate income tax rate is 20%. 13 GENERAL JOURNAL Date Account title Dr Cr Notes (VND) (VND) (VND) Jan 2 Equipment 50,000,000 Note payable 50,000,000 Jan 5 Supplies 25,100,000 Cash 25,100,000 Jan 9

Merchandise inventories 483,000,000 80,500 x 6000 = 483,000,000 Account payable 483,000,000 Jan 10 Account receivable 2,250,000,000

150,000 x 15,000 = 2,250,000,000 (1) Sales revenue 2,250,000,000 (2) Cost of goods sold 1,202,500,000 80,000 x 10,000 = 800,000,000 Merchandise inventories

1,202,500,000 80,500 x 5000 = 402,500,000

Jan 15 Merchandise inventories 729,000,000 81,000 x 9000 = 729,000,000 Account payable 729,000,000 Jan 20 Utility expenses 27,315,000 Cash 27,315,000 Jan 26 Cash 315,000,000

150,000 x 7000 = 1,050,000,000 (1)

1,050,000,000 x 30% = 315,000,000 Account receivable 735,000,000

1,050,000,000 x 70% = 735,000,000 Sales revenue 1,050,000,000 (2) Cost of goods sold 566,500,000 80,500 x 1000 = 80,500,000 Merchandise inventories

566,500,000 81,000 x 6000 = 486,000,000 Jan 28 NE Jan 31 Salary expenses 115,483,000 Salary payable 115,483,000 Jan 31 Depreciation expense 120,000,000 Accumulated 120,000,000 depreciation Jan 31 Advertising expense 10,000,000 Cash 10,000,000 Total 6,628,898,000 6,628,898,000

Profit before tax = Total revenues – Total expenses

= 3,300,000,000 - 2,041,798,000 = 1,258,202,000 (VND)

Profit after tax = Profit before tax - corporate income tax

= 1,258,202,000 - 1,258,202,000 x 20% = 1,006,561,600 (VND) 14 Unit: VND SALARIES CASH PAYABLE Dr Cr Dr Cr Beginning: Beginning: 12,828,708,413 112,417,234 Jan 5: 25,100,000 Jan 31: 115,483,000 Jan 20: 27,315,000 Jan 26: 315,000,000 Balance: Jan 31: 10,000,000 227,900,234 Total arising: 315,000,000 62,415,000 SUPPLIES Dr Cr Beginning: Balance: 345,723,100 13,081,293,413 Jan 5: 25,100,000 RETAINED Balance: EARNINGS Dr Cr 370,823,100 Beginning: 340,160,215 NOTES Balance: PAYABLE Dr Cr 340,160,215 Beginning: 7,594,833,705 OWNER’S CAPITAL Jan 2: 50,000,000 Dr Cr Beginning: Balance: 10,000,000,000 7,644,833,705 Balance: 15 10,000,000,000 ACCOUNT EQUIPMENT Dr Cr RECEIVABLE Dr Cr Beginning: Beginning: 4,894,263,600 697,975,441 Jan 2: 50,000,000 Jan 10: 2,250,000,000 Jan 26: 735,000,000 Balance: 4,944,263,600 Balance: 3,682,975,441 ACCOUNT PAYABLE Dr Cr Beginning: MERCHANDISE Dr INVENTORIES Cr 675,300,000 Beginning: Jan 9: 483,000,000 800,000,000 Jan 15: 729,000,000 Jan 9: 483,000,00 0 Jan 10: 1,202,500,000 Balance: Jan 15: 729,000,000 1,887,300,000 Jan 26: 566,500,000 Total arising: 1,212,000,000 1,769,000,000 ACCUMULATED Dr DEPRECIATION Cr Balance: Beginning: 243,000,000 843,959,400 Jan 31: 120,000,000 Balance: 963,959,400 16 COST OF SALES Dr REVENUE Cr GOODS SOLD Dr Cr Jan 10: 2,250,000,000 Jan 10: 1,202,500,000 Jan 26: 1,050,000,000 Jan 26: 566,500,000 Balance: Balance: 3,300,000,000 1,769,000,000 UTILITY SALARY EXPENSE Dr Cr EXPENSE Dr Cr Jan 20: 27,315,000 Jan 31: 115,483,000 Balance: Balance: 27,315,000 115,483,000 DEPRECIATION EXPENSE Dr Cr ADS EXPENSE Dr Cr Jan 31: 120,000,000 Jan 31: 10,000,000 Balance: Balance: 120,000,000 10,000,000 17

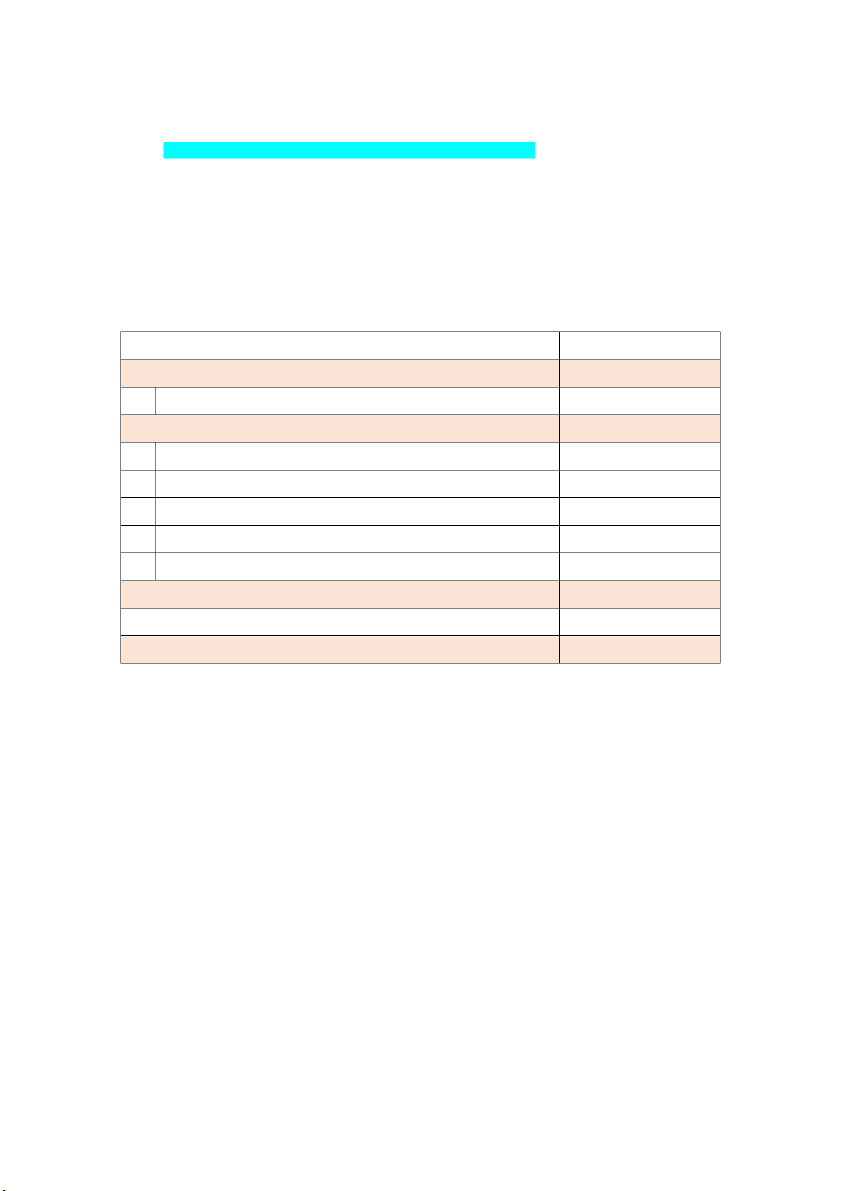

c. Prepare Income Statement for the month ended January 31, 2023

HOANG MINH TRADING & SERVICE CO. INCOME STATEMENT MONTH-ENDED JANUARY 31, 2023 CHỈ TIÊU SỐ TIỀN

Tổng doanh thu (Total Revenue): 3,300,000,000

Doanh thu bán hàng &cung cấp dịch v (Revenues) ụ 3,300,000,000

Tổng Chi phí (Total Expenses): 2,041,798,000

Giá v n hàng bán (Cost of goods sold) ố 1,769,000,000

Chi phí tiện ích (Utilities expense) 27,315,000

Chi phí lương (Salaries Expense) 115,483,000

Chi phí khấu hao (Depreciation expense) 120,000,000

Chi phí quảng cáo (Advertising expense) 10,000,000 Tổng l i nhu ợ

ận trước thuế thu nh p doanh nghi ậ

ệp (Profit before Tax) 1,258,202,000

Chi phí thuế thu nhập doanh nghiệp (Coporate Income Tax charge) 251,640,400 Tổng l i nhu ợ n sau thu ậ ế thu nh p doanh nghi ậ

ệp (Profit after Tax) 1,006,561,600 18