Preview text:

lOMoAR cPSD| 59085392 INTERNATIONAL UNIVERSITY VNU-HCM

SCHOOL OF ECONOMICS, FINANCE, AND ACCOUNTING AUDITING Instructor: Mr. Vu Tuan Anh

Progress assessment Group Assessment Report Group members: Student Name and ID Responsibility % of Contribution

1. Lê Thị Vân Nga – BAACIU21029 Do all cases 100%

2. Vương Phương Thảo – FAACIU22061 Do all cases 100%

3. Nguyễn Lê Đan Vy – BAFNIU21640 Do all cases 100%

4. Phạm Minh Dũng – BAFNIU21422 Do all cases 100%

5. Nguyễn Vũ Bảo Ngọc - FAACIU22045 Do all cases 100% Score:

Date submitted and signatures: 6th January, 2024

Lê Thị Vân Nga – BAACIU21029 lOMoAR cPSD| 59085392 Group Assignment 1G Case 1:

A CPA has been requested to audit the financial statements of a publicly

traded company for the first time. All initial verbal discussions and inquiries between

the CPA, the company, the previous auditor, and all other relevant parties have

been completed. The CPA is now in the process of drafting an engagement letter. Required:

a. List the elements that should be included in a typical engagement letter under these circumstances.

b. Explain the benefits of preparing an engagement letter. *Solution:

a. Elements of a Typical Engagement Letter •

Addressee: This report is directed to the board of directors and the audit committee. •

Objective and Scope: The purpose of this audit is to evaluate

the financial statements for the fiscal year ending December 31, 2023,

including an assessment of internal controls. •

Auditor’s Responsibilities: The auditors will adhere to

professional standards, maintain independence, exercise professional

judgment, and acknowledge the inherent limitations of the audit process. •

Management’s Responsibilities: Management is responsible

for preparing accurate financial statements, ensuring effective internal

controls, and providing all necessary documentation for the audit. •

Reporting Framework: The audit will be conducted in accordance with GAAP. lOMoAR cPSD| 59085392 •

Audit Report and Deliverables: The final report will be an

unqualified opinion, accompanied by a management letter detailing any findings. •

Timing: The audit is scheduled to commence on January 15,

2024, and conclude by March 15, 2024, with provisions for potential delays. •

Fees: The billing structure will be based on hourly rates, with

payment due within 30 days of invoicing, and additional charges may apply for unforeseen circumstances. •

Termination Clause: Either party may terminate the

engagement with written notice under specified conditions. •

Signatures: The agreement will be signed by representatives

from both the CPA firm and the client.

b. Benefits of Preparing an Engagement Letter •

Clarifies Expectations: Clearly outlines the scope, roles, and

deliverables, reducing uncertainty. •

Reduces Misunderstandings: Provides explicit terms to help avoid disputes. •

Legal Protection: Functions as a legally binding document, helping to limit liability. •

Manages Risk: Specifies audit limitations and the reliance on clientprovided information. •

Fee Transparency: Lays out clear payment terms to prevent conflicts. •

Enhances Relationships: Fosters trust and establishes a professional atmosphere. •

Improved Documentation: Guarantees a written record of

terms, timelines, and deliverables. Case 2: lOMoAR cPSD| 59085392

The CPA firm of Wells & Partners employs a qualitative approach to

implementing the audit risk model. Audit risk is classified using two terms: very low

and low. The risk of material misstatement and detection risk are categorized using

three terms: low, moderate, and high. Determine detection risk for each of the

following hypothetical clients.

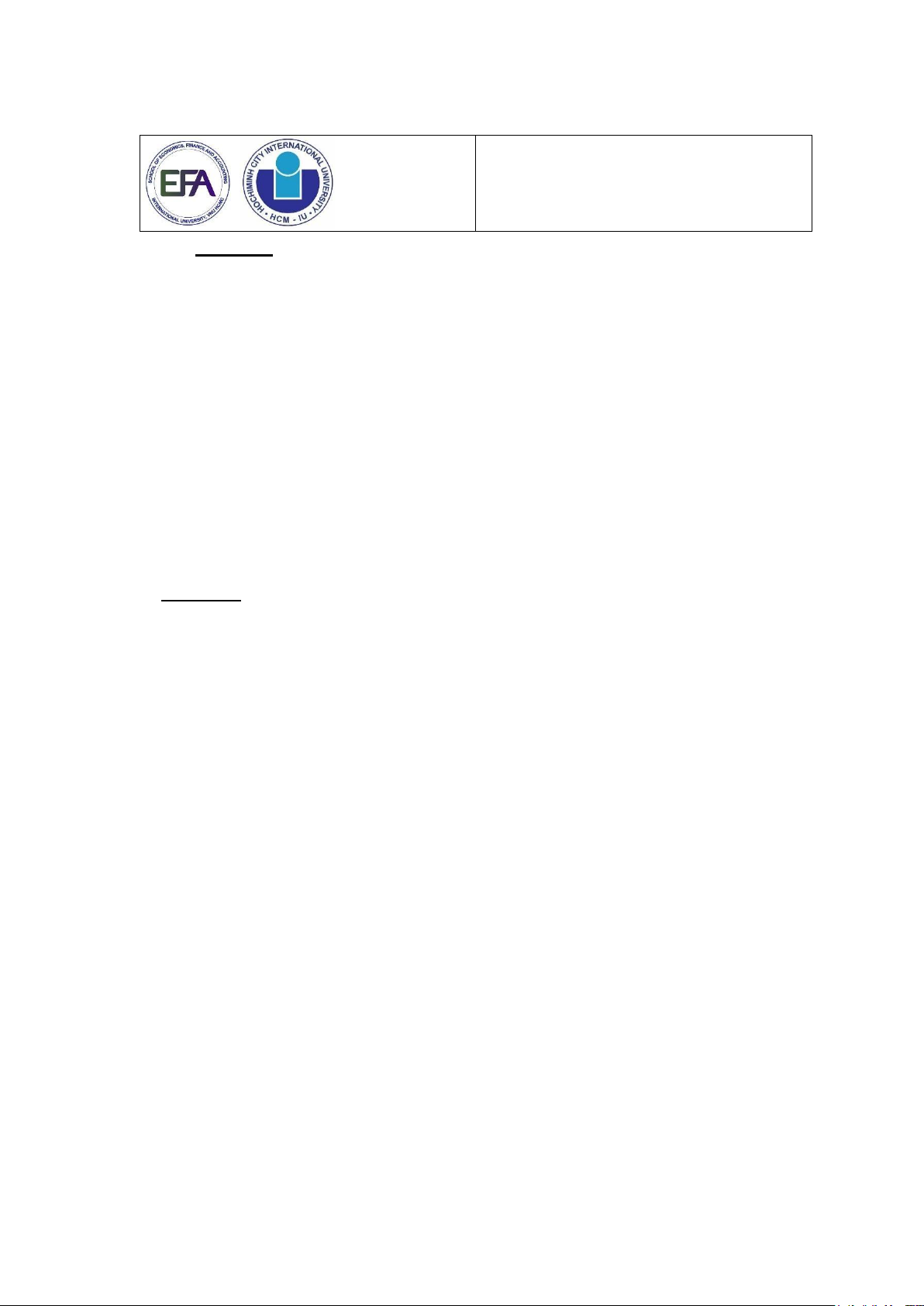

Client No. Audit Risk Risk of Material Misstatement Detection Risk 1 Low Moderate 2 Very Low High 3 Low Low 4 Very Low Moderate *Solution:

Audit Risk = Inherent Risk × Control Risk × Detection Risk

= Risk of Material Misstatement × Detection Risk

Client 1: Audit Risk: Low, Risk of Material Misstatement: Moderate

Since audit risk is low and risk of material misstatement is moderate, the

auditor will need to set detection risk at a moderate level to achieve the desired level of audit risk. ⟹ Detection Risk: Moderate

Client 2: Audit Risk: Very Low, Risk of Material Misstatement: High

Since audit risk is very low and risk of material misstatement is high, the

auditor must reduce detection risk to low to maintain the very low audit risk. ⟹ Detection Risk: Low

Client 3: Audit Risk: Low, Risk of Material Misstatement: Low

Since both audit risk and risk of material misstatement are low, the auditor

can afford to set detection risk at a high level because the risk of material misstatement is minimal. ⟹ Detection Risk: High lOMoAR cPSD| 59085392

Client 4: Audit Risk: Very Low, Risk of Material Misstatement: Moderate

Since audit risk is very low and risk of material misstatement is moderate,

detection risk must be reduced to low to maintain a very low overall audit risk. ⟹ Detection Risk: Low

Client No. Audit Risk Risk of Material Misstatement Detection Risk 1 Low Moderate Moderate 2 Very Low High Low 3 Low Low High 4 Very Low Moderate Low lOMoAR cPSD| 59085392

References and Citations

Johnstone, K., Gramling, A., & Rittenberg, L. E. (2013). Auditing: A risk-based

approach to conducting quality audits (9th ed.). Cengage Learning.

Illinois CPA Society. (2023). 8 critical elements of an effective engagement letter. Retrieved from

https://www.icpas.org/information/copydesk/insight/article/fall-

2023/8critical-elements-of-an-effective-engagement-letter