Preview text:

Question 1:

Eastern Management Ltd acquired all the assets and liabilities of King Ltd on 30 June 2017. The

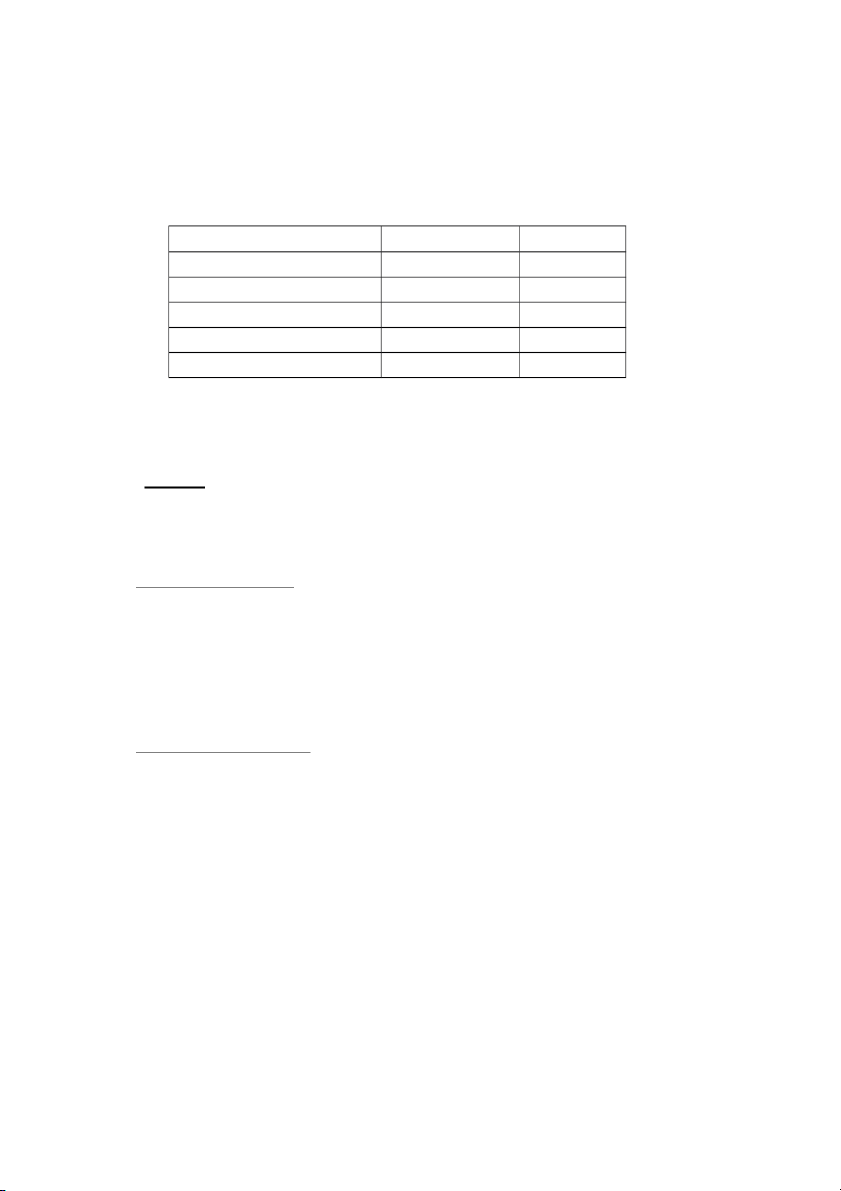

carrying amount and estimated fair value of assets and liabilities of King Ltd to be taken over are as follows: Carrying amount Fair value Accounts Receivable $760,000 $720,000 Inventory $1,300,000 $1,440,000 Property, plants and equipment $1,680,000 $1,560,000 Accounts payables $680,000 $680,000 Note payable $90,000 $100,000

In addition to these assets and liabilities, due diligence identified the existence of brand names

that were valued by an expert at $500,000. The due diligence process also uncovered contingent

liabilities that were reliably measured at $150,000.

The price paid was $4.8 million Required:

Calculate the amount of goodwill that would be recorded in the books of Eastern Management

Ltd following the acquisition of King Ltd. Show all workings Solution

Fair value of assets acquired Account receivables = 720,000 Inventory = 1,440,000

Properly , plant and equipment = 1,560,000 Brand = $500,000

Total fair value of assets = $4,220,000

Fair value of liabilities acquired Account payables = 680,000

Reliable estimate for liability = 150,000 Note payable = 100,000

Total fair value of liabilities = 930,000

Fair value of net assets acquired

= $4,220,000 - $930,000 = $3,290,000

Goodwill = $4,800,000 - $3,290,000 = $1,510,000 Question 2:

Global-Innovator Ltd included the following information concerning the research and

development activities in its company accounting records over recent years. Global-Innovator

complied with IAS 38, has used the cost method to account for intangible assets and calculated

amortisation on a straight-line basis.

Project 1 – Product Rosehip: the carrying amount of the project development asset at 30

June 20x7 was $1,600,000. Further development costs of $1,100,000 were capitalised between July

and December 20x7. Production of Product Rosehip commenced on 1 January 20x8. Profitable

sales were expected for a total of six years commencing on 1 January 20x8.

Project 2 – Research: research costs for 20x6/20x7 and 20x7/20x8 were $500,000 and

$400,000, respectively. At 30 June 20x8, the project manager advised that further research should

allow development of the final product to commence in 20x9.

Project 3 – Product Jasmine: research costs of $300,000 were expensed in 20x5/20x6.

Applied research costs incurred in 20x6/20x7 were $400,000. During the 20x7/20x8 year,

development costs of $600,000 were capitalised. Product Jasmine is expected to generate high profits

over 10 years after commercial production commences in December 20x8.

Project 4 – Product Apple: research costs of $900,000 were incurred in the 20x6/20x7 year

and development commenced in the 20x7/20x8 year. On 30 May 20x8, when total development

costs were $500,000, Project Apple was abandoned following a change in economic conditions. Required:

1. Calculate the total amount of research and development costs, including any

amortisation, which would be recognised in Global-Innovator Ltd’s 20x7/20x8 statement of comprehensive income. Solution: Project 1

Development cost 30/6/20x7 – capitalised $1,600,000

Development cost 7-12/20x7 – capitalised $1,100,000

Production commenced 1 Jan 20x8 – expected benefit 6 years => amortisation of development cost = $2,700,000 / 6 = $450,000 Project 2: Research

Cost 20x6/20x7 – expensed $500,000

Cost 20x7/20x8 – expensed $400,000 Project 3: Jasmine

Research costs 20x5/20x6 – expensed $300,000

Appled research costs incurred 20x6/20x7 – expensed $400,000

Development cost 20x7/20x8 – capitalised $600,000

No amortisation in 20x7/20x8 as production not commenced Project 4: Apple

Research costs 20x6/20x7 – expenses $900,000 Development costs 20x7/20x8 $500,000

May 2018 – project abandoned – write-off development costs