Preview text:

MARKETING PLAN NESCAFÉ VỊ TEQUILA TEAM 2 CLASS SUBJECT GROUP MEMBER : - Hoàng Phương Uyên - Đinh Thị Linh Nhi - Trương Mai Anh - Lê Ngọc Bảo Long Contents 1. Company introduction 1.1 - History 1.2 - Vision 1.3 - Mission 2. Situation Analysis 2.1 - Market Analysis 2.2 - SWOT Analysis 2.3 - Competition 3. Marketing Strategy 3.1 - Target Segmentation 3.2 - Positioning 3.3 - Marketing Mix 4. Financial Summary 4.1 - Sale Forecast 4.2 - Marketing Budget 1. Company introduction 1.4 - History

1866 Nestle company was founded by Mr. Henri Nestlé. This

first product was called Farine Lactée Henri Nestlé. Mr.

Products quickly gained popularity in Switzerland.

1912 Nestle join VietNam market

1930 a coffee expert asked to find a way to make a cheaper

coffee that could be consumed immediately by adding only

boiling water, to consume all the annual surplus of coffee beans

in the country. this facility.

1938 Nescafe brand is officially on the market. And it's no

coincidence that the Nescafe brand was used as the official

drink for the US military during World War II.

Currently Nescafe has affirmed the value of the brand not only by

the quality of the product, but also many other interconnected

factors such as competitive prices, marketing programs, always

research efforts to bring the different for products, ... in order to create a global Nescafe brand 1.2 - Vision

Vision 2020 is committed to maintaining the same level of personal

connection that our consumer have grown to love as we build

these qualities into our company culture 1.3- Mission

The company's mission is to provide consumers with the best and

most nutritious coffee that will make them feel something unique

that cannot be explained in words. When they drink nescafe's

coffee, fun moments will be sprinkled into their day 2.Situation Analysis 2.1 - Market Analysis

Market Size: Coffee consumption in 2016 is 26,4 million

packages with the effect of El Nino. In 2018, Coffee

consumption in Viet Nam reach 28,8 million packages and in

2019, the number Increase to 30,4 million packages

Market Growth: In the market, manufacturers are introducing

new coffee flavors in order to expand their consumer-base

because there are more and more type of customers in

Vietnam. Base on their behavior and lifestyle, Coffee

manufacturers focus on making coffee more affordable and

convenient like selling coffee can in the convenient store. Thus,

the population who started to drink coffee is anticipated to grow

in the future. So our prediction is coffee market can be strongly

increase during 2020-2025 with a grow rate of 8,3%. Based on

2019 with 30,4 million, the following years will be 32,9 million in

2020, 35,4 million in 2021 and 37,9 million in 2022.

Market Demand: Our Demand board will based on a person’s

income in a year. With the income above 20 Billion VND a year,

their demand base on 4 point diminutival: Quality, Brand,

Interest, Origin. With the income from 10~20 Billion VND a

year, their demand are: Quality, Interest, Brand, Origin. With the

income below 10 Billion VND a year, they have a demand of

price in addition of the demand of upper group.

Market share: base on expert research in Vietnam, in 2017,

Nescafe have a market share of 33,3%. His 2 competitor,

Vinacafe with 16% and Trung Nguyen with biggest market

sahre with 69,9%. Expert said that the war of market share

between Trung Nguyen, Nescafe and Vinacafe never end in Vietnam instant coffee market

Market Trend: Vietnamese youth have different hobby and

behavior than worker. They have more free time, likes to go out

to a bar to taste a sip of wine or go to a a café with dim light for

a chilly moment with a cup of coffee. Understand that trend,

Nescafe combined 2 different taste - alcohol smell with coffee taste into one package 2.2 SWOT of Nescafe:

Strengh: Nescafe has a variety of product suitable with

consumer’s tastes and emotion. Nescafe also build a strong

distribution with their distributor and retailer to make a big

coverage in the market by making big discount up to 10%.

Nescafe instant coffee stand at top 3 in Vietnam market.

Nescafe create Café Viet to strike into the physical and

emotional benefit of Vietnamese male. Beside, Nescafe

making a lot of marketing campaign and promotion activity

such as TVC, print ads with a challenge quote “Do you

strong enough to try?” focus on consumers mentality

Weakness: Some expert warned about the side effect of

caffein affect a lot to health condition. Nescafe still not come

up to a solution for this. Besides, the cost of marketing is

high and lead to losses in profit in the future

Opportunities: Beside coffee product, Nescafe may produce

many product to support their coffee product like Vietnamese

filter or Coffee machine. In the future, customer behavior

may change so Nescafe should be prepare for that situation

or maybe Nescafe can come up to a new product. Nescafe

can make a product with less cost for rural area since Vietnam is mostly rural area

Threats: The taste of customers may change in the future.

They may become less and less interest in the current taste

and they will find a new taste instead. Futhermore, some

new competitor from foreign will appear in the market or new

competitor in Vietnam like Nutifood began to participate in coffee market with Nuticafe 2.3 Competition: 1. Trung Nguyên: -

Current Strategies: Trung Nguyen focus on promoting the

brand by delivering value to the furthes places in Vietnam.

Trung Nguyen also focus on oushing the brand worldwide

with a view of becoming the best coffee brand from Vietnam. -

Weakness: Trung Nguyen profit began to loss with 37,4%

in 2016, 34% in 2017 and 27,9% in 2018. The reason for

that is because the price of their product is more

expensive than other competitor. In spite of being a top

player in Vietnam, Trung Nguyen still struggling in racing

to the top coffee brand in the world -

Strengh: Trung Nguyen has a grow rate of 200% in Asia

market by focusing in invest in more than 80 countries, in

every mall, every supermarket,...More than that, Trung

Nguyen build a museum called “Coffee world” to spread

the value of Vietnamese coffee over the world. In

domestic, Trung Nguyen is one of the three top player in instant coffee. -

Future Goal: Trung Nguyen are being focusing on

becoming a great company serve humanity by bringing

Vietnamese coffee over the world with the best brand over the world 2. Vinacafe -

Strength: Vinacafe is one if the first coffee company in

Vietnam since 1968. Their product based on Vietnamese

routine and tastes. They make product to make customers

reminded of their familiar taste and traditional coffee -

Weakness: Their product is not diversity since it focus on

instant coffee and instant cereal. Their ads used to make

a controvesy in the community that threaten their brand

like in 2017, they promise to make clean coffee. That

promise make a big controversy. In 2017, their coffee was

revoked in America due to some ingredient affect to consumer’s health -

Current Strategies: Vinacafe keep making their product

with new quality and familiar names for Vietnamese

customers like “Sai Gon Ice Milk Coffee” or “Café Sai

Gon” to improve the value of traditional Vietnamese

coffee. Beside, Vinacafe introduce Wake Up 247 with the

gamer model makes it become popular with most of young consumers -

Future Strategies: In the future, Vincacafe continue to

export their coffee to many potential foreign market like

Japan or China. Thus, they still keep on improving their

quality of Vietnamese coffee and Vietnamese value in domestic market 3.Marketing Strategy

3.1 - Target Segmentation Geographic - Region: Viet Nam - Density: Urban - Demographic - Age: 18-30 - Gender: Males & Females

- Occupation: student, officer, business, employees - Income: >4 million VND Psychographic

- Social class: Middle class, Upper class

- Lifestyle: out-going, busy, enjoyable, youth

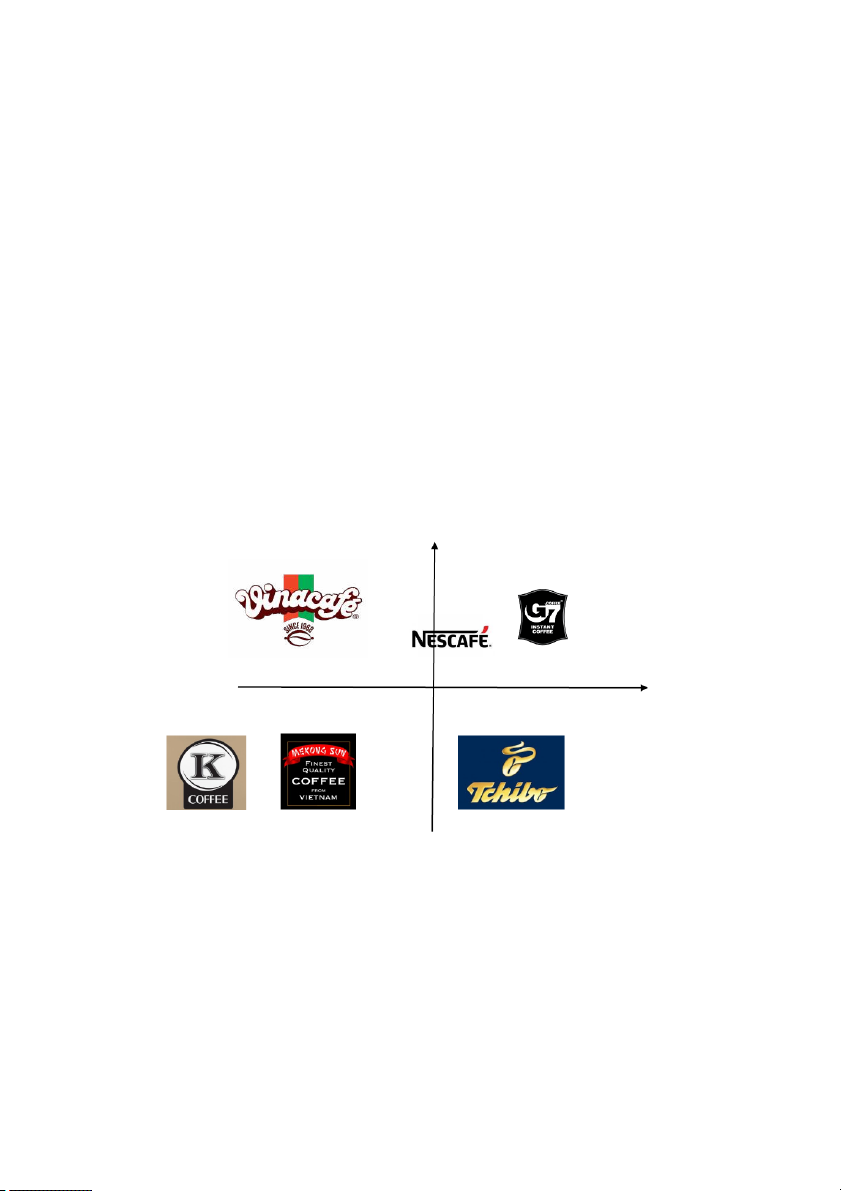

- Personality: Trendy, maturity, personality, tranquility Behavioral - Likes to relax - There is brand awareness - Catch the trend - Constantly stressed 3.2 - Positioning POSITONING High diversity Low price High price Low diversity POPS AND PODS POPS: Clean non-chemical coffee Creative product packaging New and strange ideas PODS: Nescafé Tequila

Drip bag coffee of Typical coffee Instant coffee

Drip bag coffee - Paper bags are designed modernly, environmentally friendly and safe for consumers' health

New combination, breaking Keep the traditional definition the way of roasted coffee Convenient Inconvenience Cheaper price

More expensive than instant coffee 4P Product: Brand and packaging Flavor Impressive names Tequila - a very famous Mexican wine ( sour, with a Eye-catching packaging little spicy) with beautiful images colorful with neon tones as

Both tasty and delicious,unique mainstream taste, easy to drink Impressive changes

Feel quite chill but don't get drunk

Creative slogan “Coffee and Chill” Non-alcoholic drinks keep you awake but still very chill Place

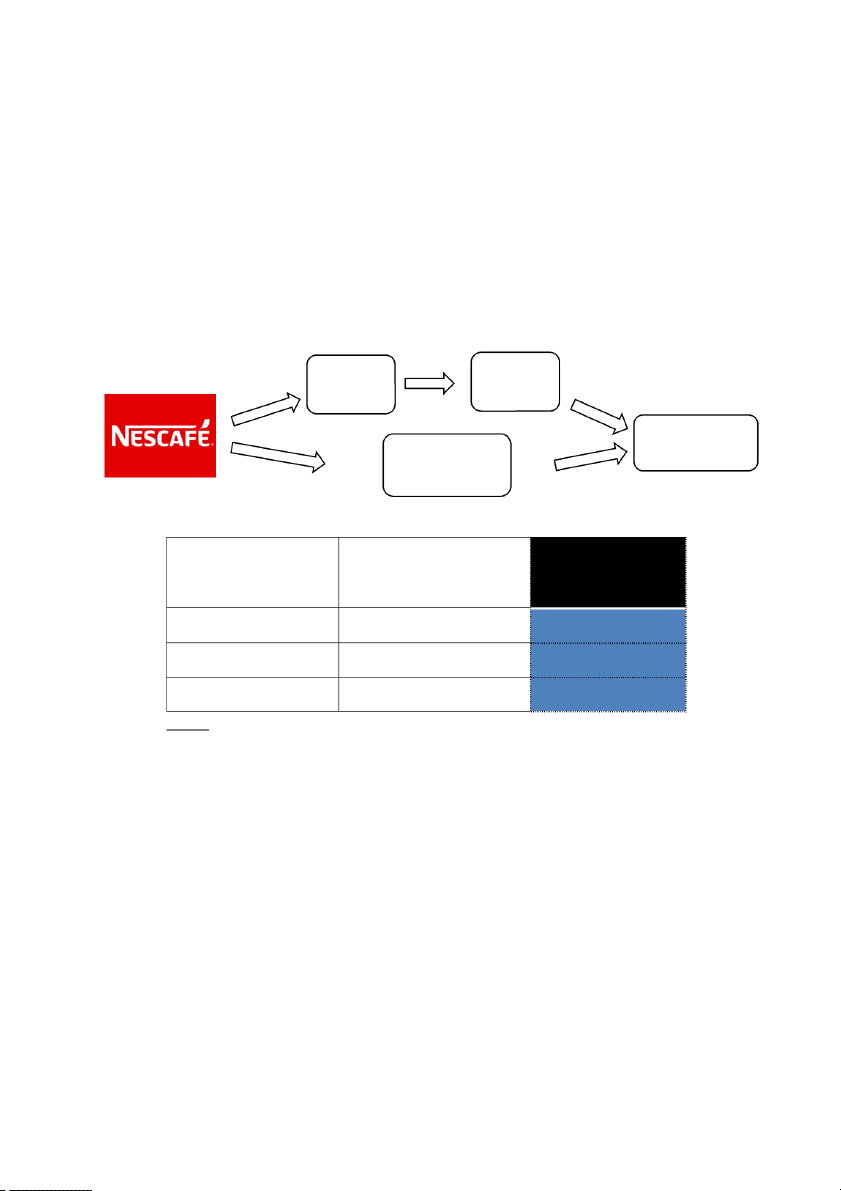

Nescafe Viet Nam currently has: 1 factory in Dong Nai 8 exclusive distributors 500 wholesales point --> 4000 retail locations

Nescafe is using 2 distribution channels (consumer can not buy product direct at Nescafe) Whole Retailers salers Consumers Supermarkets Nescafe Nescafe Nescafe 3in1 Cafe Vi t ệ Tequila flavor 340g 240g 192g 20 packs 15 packs 12 packs 45.000 50.000 39.000 Price Promotion Advertising Event Posters Entertainment - acoustic Videotapes show Social Network Word-of-mouth marketing Sales Promotion Sampling

Person-to-person (PRarticles on social network) Gift 4. Financial Summary 4.1 Sale Forecast POTENTIAL CUSTOMER

VN population…………………………………………………………………..….. 96,208,984

Aged 18-30 …………………………………… 16,3% …………………..……… 15,700,000

Living in urban………………..……………. 34.4% ………………..………….. 5,400,000

Class………………………………………..……. 26% ………………..…………..… 1,400,000

Coffee penetration…………………….….. 67% ……….………………………. 940,000 POTENTIAL MARKET SIZE

Frequency / year………………………………………………………………172

Market size (units)……………………………………………………………..161,800,000

POTETIAL MARKET SHARE & SALE

Market share……………………………………………………………………...33.3%

Unit price……………………………………………………………………………1,500 Potential

Sell out in unit……………………………………………………..53,900,000

Sell out in value…………………………………………….80,800,000,000

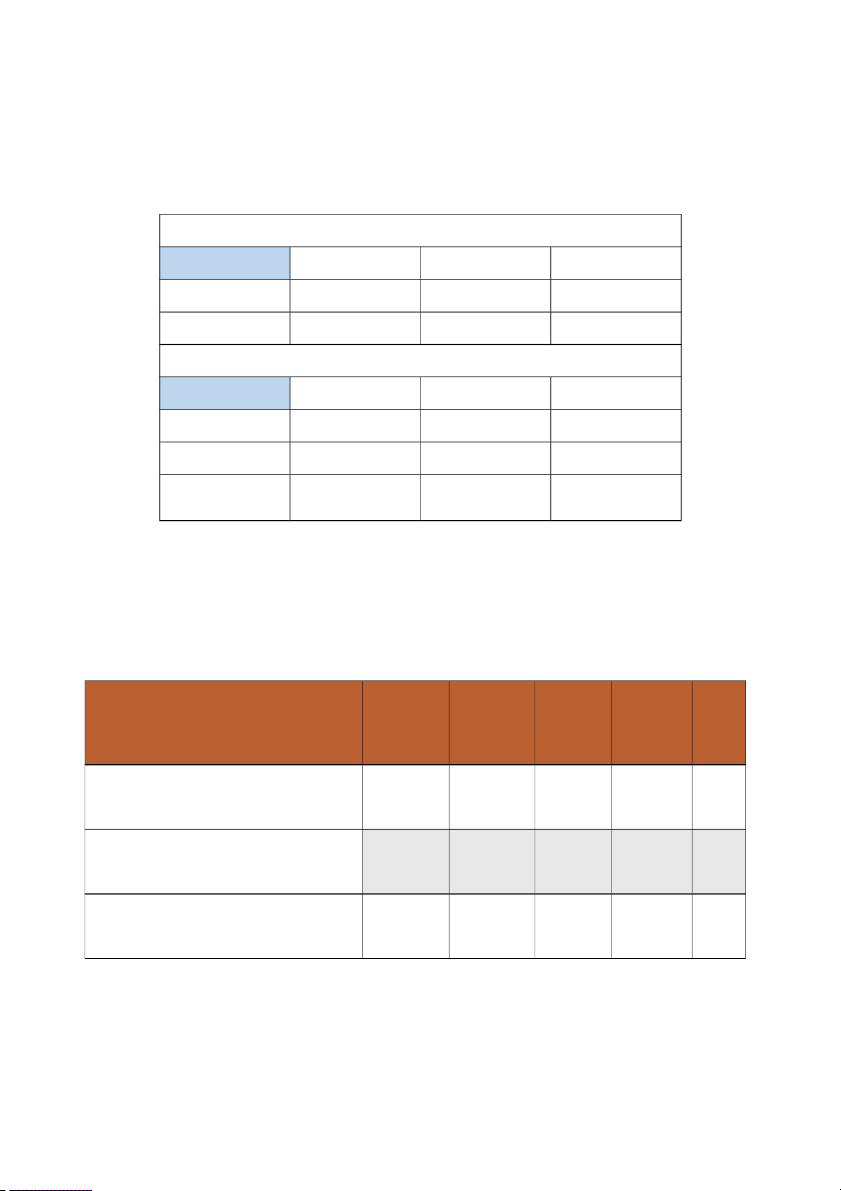

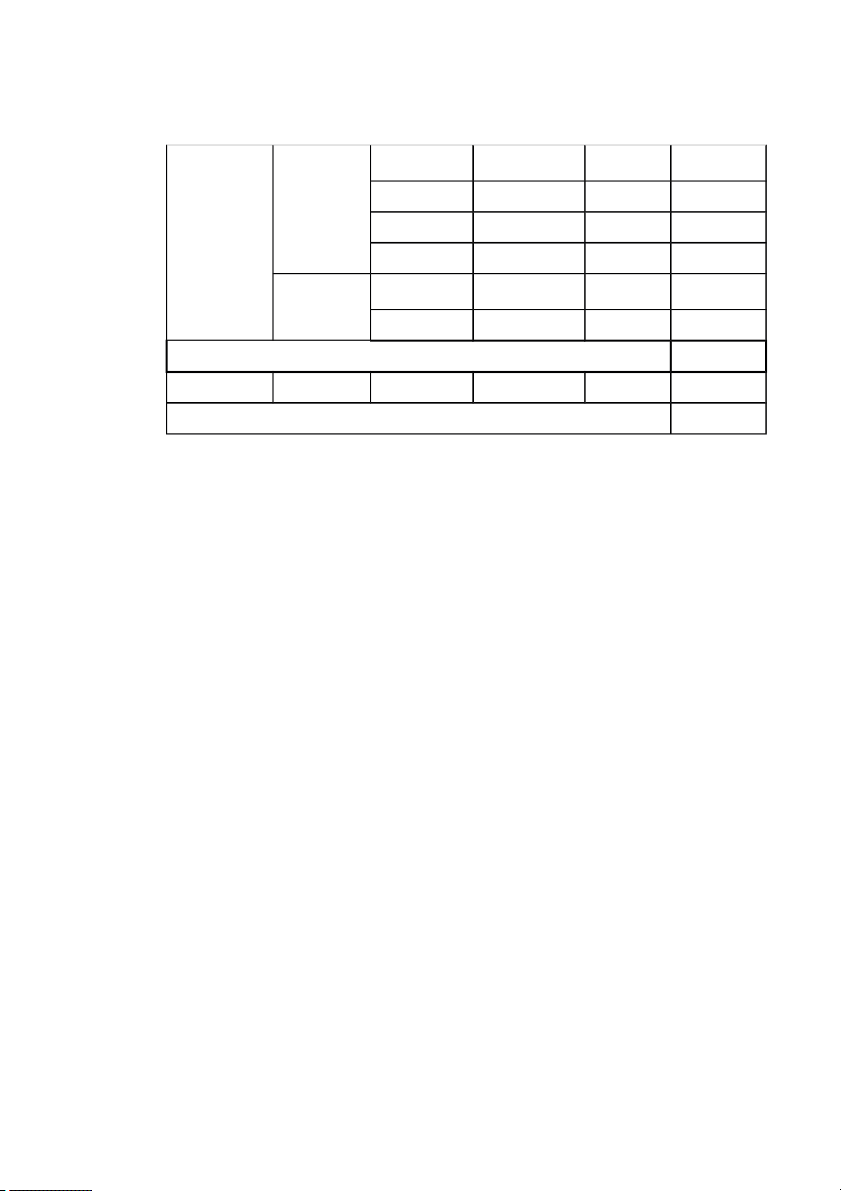

3 YEAR MARKET PROJECTION YEAR 1 YEAR 2 YEAR 3 Market size 161,800,000 175,229,400 189,773,400 Market growth 8,3% 8,3%

3 YEAR BUSINESS AMBITITION YEAR 1 YEAR 2 YEAR 3 Market share 33.3% 36% 39% Sell out 53,879,400 63,082,584 74,011,626 Growth 17% 17,3% POTENTIAL CUSTOMER VN

population…………………………………………..….. 96,208,984

Aged 18-30 …………….…… 16,3% …………………… 15,700,000

Living in urban…………….... 34.4% …………………….. 5,400,000

Class…………………………. 26% …..……..…….…..… 1,400,000

Coffee penetration………….. 67% ……………….………. 940,000 POTENTIAL MARKET SIZE

Frequency / year………………………………………………172

Market size (units)………………….…………………..161,800,000

POTETIAL MARKET SHARE & SALE Market

share………………………………………………………...33.3%

Unit price……………………………………………………1,500 Potential

Sell out in unit………………………………..53,900,000

Sell out in value……….……………….80,800,000,000 3 YEAR PROJECTOR

3 YEAR MARKET PROJECTION YEAR 1 YEAR 2 YEAR 3 Market size 161,800,000 175,229,400 189,773,400 Market growth 8,3% 8,3%

3 YEAR BUSINESS AMBITITION YEAR 1 YEAR 2 YEAR 3 Market share 33.3% 36% 39% Sell out 53,879,400 63,082,584 74,011,626 Growh 17% 17,3% 4.1 Marketing budget

Sale Revenue ~ 80 billion VND. → Total marketing budget: ~ 8 billion VND (10%)

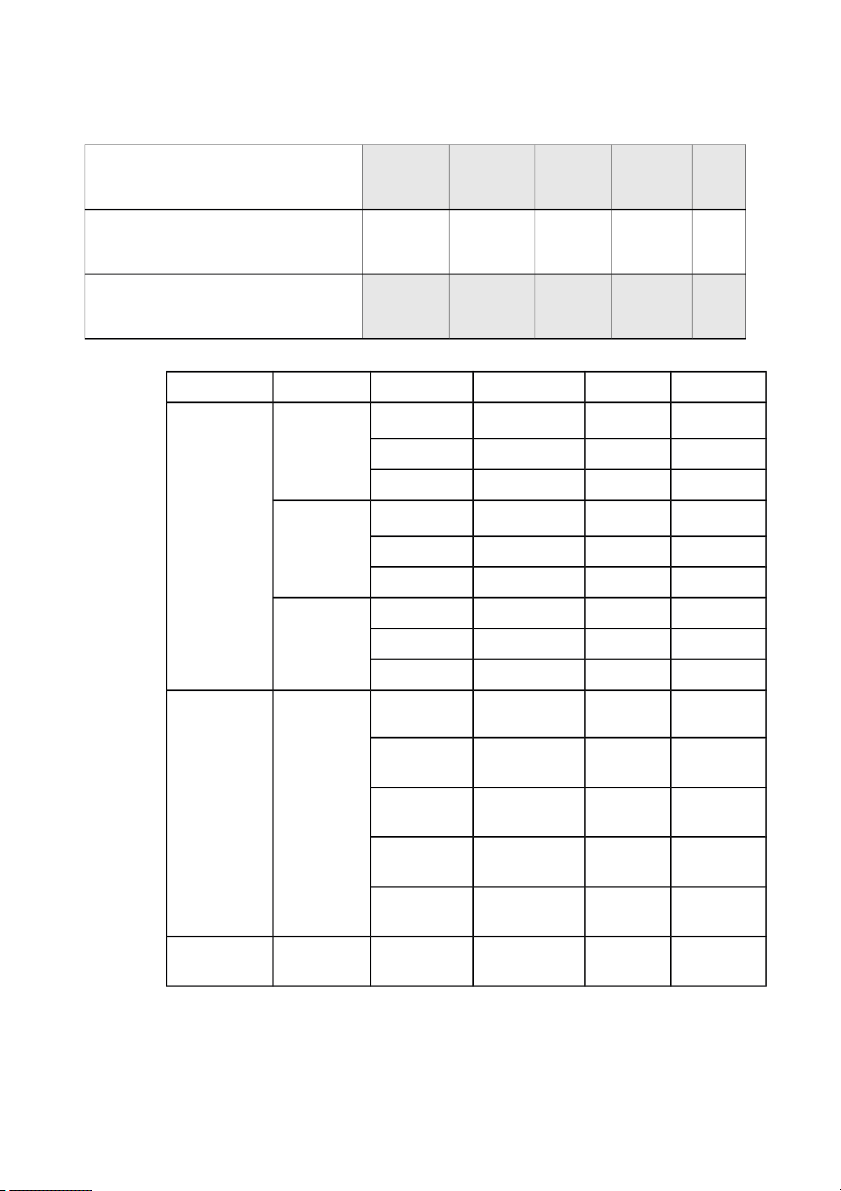

QIII/2020 QIV/2020 QI/2021 QII/2021 Expense Total (32%) (27%) (22%) (19%) Advertising (26,4%) 763 620 506 437 2300 Event (60,1%) 5040 5040

Word-of-mouth marketing (1,7%) 48 40.5 33 28.5 150 Sales Promotion (0,3%) 6.9 5.8 4,73 4,1 21.5 Backup plan (10%) 253 212 174 150 790 Total 6110 878 717,73 619 8.020 Programs Detail Price Quatity Total Design posters 1.500.000/poster 1 poster 1.500.000 Posters Print 29.000/poster 100 posters 2.900.000 Rent poster place 2.000.000/week 4 week 8.000.000 Idea 47.000.000/clip 1 clip 47.000.000 Advertising Videotapes Influencer 10.000.000/person 4 persons 40.000.000 Ekip 12.500.000 2 days 25.000.000 Youtube 300.000.000/month 4 months 1.200.000.000 Social media Facebook 200.00.000/month 4 months 800.000.000 Tiktok 100.000.00/month 4 months 400.000.000 Creative & 60.000.000/1 plan 1 plan 120.000.000 Planing 870.000.000/1 Production 1 event 2.500.000.000 event Entertainment - 760.000.000/1 Event Activity 1 event 1.000.000.000 acoustic show event 500.000.000/1 Technical 1 event 1.300.000.000 event 120.000.000/1 Vanue 1 event 320.000.000 event

Word-of-mouth Person-to-person Write pr articles 30.000.000 5 post 150.000.000 marketing Booth sampling 1.000.000/p 1 booth 1.000.000 Rent location 2.000.000/day 2 months 4.000.000 Sampling Hire staff 500.000/person 4 persons 2.000.000 Sales Promotion Design posters 1.500.000/poster 1 poster 1.500.000 Glass 15.000/p 800 pieces 12.000.000 Gif Tea spoon 1.000/p 1000 pieces 1,000,000 Total 7.935.000.000 Back up plan 10% 790.000.000 Total 8.735.000.000