Preview text:

1 TRƯƠNG THANH HOA – MATHEMATICS FOR BUSINESS

CHAPTER 1: LINEAR EQUATIONS

1.5. SUPPLY AND DEMAND ANALYSIS 1.5.1. Demand function

- Law of demand: Other things equal, when the price of a good rises, the quantity demanded of the

good falls, and when the price falls, the quantity demanded rises.

- Demand function: P = aQd + b 1.5.2. Supply function

- Law of supply: Other things equal, when the price of a good rises, the quantity supplied of the

good also rises, and when the price falls, the quantity supplied falls as well.

- Supply function: P = aQs + b 1.5.3. Equilibrium

- Equilibrium occurs where demand curve and supply curve intersect: Qd = Qs 1.5.4. Tax

- When the government imposes a fixed tax on each good, the supplier will receive less money than in free market.

1.5.5. Different types of goods

- Normal good (hàng hoá thông ng) thườ

is a good for which, other things equal, an increase in

income leads to an increase in demand or a decrease in income leads to a decrease in demand

(food, drink, clothing, household appliances,…)

- Inferior good (hàng hoá thứ cấp) is a good whose demand decreases as income increases (instant noodles, bus ri . des,…)

- Substitutable goods (hàng hoá thay thế): two goods for which an increase in the price of one leads

to an increase in the demand for the other (Coca Cola and Pepsi, sandwiches and hamburgers, butter and margarine,…).

- Complementary goods (hàng hoá bổ sung): two goods for which an increase in the price of one

leads to a decrease in the demand for the other (petrol and cars, movies and popcorn, mobile phones and simcards,…).

Example 1: A potter makes and sells ceramic bowls. It is observed that when the price is $32 only

9 bowls are sold in a week but when the price decreases to $10, weekly sales rise to 20. Assuming

that demand can be modelled by a linear function, obtain a formula for P in terms of Q.

2 TRƯƠNG THANH HOA – MATHEMATICS FOR BUSINESS ---

When Q = 9, P = 32. We have the demand function: P = aQ + b 32 = 9a + b

When Q = 20, P = 10. We have the demand function: P = aQ + b 10 = 20a + b

Then we have simultaneous linear equations: 9a + b = 32 20a + b = 10

Therefore, a = −2 and b = 50. Thus, the demand function is P = −2Q + 50

Example 2: The demand and supply functions of a good are given by P = −2Qd + 50 1 P = 𝑄 2 𝑠 + 25

where P, Qd and Qs denote the price, quantity demanded and quantity supplied respectively.

Determine the equilibrium price and quantity. ---

In equilibrium, Qd = Qs = Q, so P = −2Q + 50 1 P = 𝑄 + 25 2 Hence, − 1 2Q + 50 = 𝑄 + 25 2

The equilibrium quantity is Q = 10 and the equilibrium price is P = 30.

Example 3: The demand and supply functions of a good are given by P = −4Qd + 120 1 P = 𝑄 3 𝑠 + 29

where P, Qd and Qs denote the price, quantity demanded and quantity supplied respectively.

(a) Calculate the equilibrium price and quantity.

(b) Calculate the new equilibrium price and quantity after the imposition of a fixed tax of $13 per good. Who pays the tax? ---

3 TRƯƠNG THANH HOA – MATHEMATICS FOR BUSINESS

(a) In equilibrium, Qd = Qs = Q, so P = −4Q + 120 1 P = 𝑄 + 29 3 Hence, − 1 4Q + 120 = 𝑄 + 29 3

The equilibrium quantity is Q = 21 and the equilibrium price is P = 36.

(b) After the imposition of a $13 of tax per good, the supply function becomes 1 P – 13 = 𝑄 3 𝑠 + 29 1 P = 𝑄 3 𝑠 + 42

The demand equation remains unchanged, so, in equilibrium, Qd = Qs = Q P = −4Q + 120 1 P = 𝑄 + 42 3 Hence, − 1 4Q + 120 = 𝑄 + 42 3

The equilibrium quantity is Q = 18 and the equilibrium price is P = 48. The equilibrium price rises

from $36 to $48. Therefore, the consumer pays an additional $12. The remaining $1 of the tax is paid by the firm.

Example 4: The demand and supply functions for two interdependent commodities are given by QD1 = 40 − 5P1 – P2 QD2 = 50 − 2P1 − 4P2 QS1 = −3 + 4P1 QS2 = −7 + 3P2

where QD i , QS i and Pi denote the quantity demanded, quantity supplied and price of good i

respectively. Determine the equilibrium price and quantity for this two-commodity model. Are

these goods substitutable or complementary? --- In equilibrium, QD = 1 QS = 1 Q1 and QD = 2 QS = 2

Q2. Then we have simultaneous linear equations: 40 − 5P1 – P2 = −3 + 4P 1 9P1 + P2 = 43 And 50 − 2P1 − 4P2 = −7 + 3P 2

4 TRƯƠNG THANH HOA – MATHEMATICS FOR BUSINESS 2P1 + 7P2 = 57

Therefore, the equilibrium price for good 1 is P1 = 4, the equilibrium price for good 2 is P2 = 7,

the equilibrium quantity for good 1 is Q1 = 13 and the equilibrium quantity for good 2 is Q2 = 14.

These goods are complementary goods because the price of either goes up, the demand for both goods goes down.

Exercise 1: The demand for a good priced at $50 is 420 units, and when the price is $80 demand

is 240 units. Assuming that the demand function takes the form Q = aP + b, find the values of a and b.

Exercise 2: The demand and supply functions of a good are given by P = −3QD + 48 1 𝑃 = 2𝑄𝑠 + 23

Find the equilibrium quantity if the government imposes a fixed tax of $4 on each good.

Exercise 3: The demand and supply functions for two interdependent commodities are given by QD1 = 100 − 2P1 + P2 QD2 = 5 + 2P1 − 3P2 QS1 = −10 + P1 QS2 = −5 + 6P2

where QDi, QS i and Pi denote the quantity demanded, quantity supplied and price of good i

respectively. Determine the equilibrium price and quantity for this two-commodity model.

Exercise 4: The demand and supply functions of a good are given by P = −5QD + 80 P = 2QS + 10

where P, QD and QS denote price, quantity demanded and quantity supplied respectively.

(1) Find the equilibrium price and quantity

(2) If the government deducts, as tax, 15% of the market price of each good, determine the

new equilibrium price and quantity.

Exercise 5: The supply and demand functions of a good are given by P = QS + 8 P = −3QD + 80

5 TRƯƠNG THANH HOA – MATHEMATICS FOR BUSINESS

where P, QS and QD denote price, quantity supplied and quantity demanded respectively.

(a) Find the equilibrium price and quantity if the government imposes a fixed tax of $36 on each good.

(b) Find the corresponding value of the government’s tax revenue.

Exercise 6: The demand and supply functions for three interdependent commodities are QD1 = 15 – P1 + 2P2 + P3 QD2 = 9 + P1 – P2 – P3 QD3 = 8 + 2P1 – P2 − 4P3 QS1 = −7 + P1 QS2 = −4 + 4P2 QS3 = −5 + 2P3

where QD i , QS i and Pi denote the quantity demanded, quantity supplied and price of good i

respectively. Determine the equilibrium price and quantity for this three-commodity model.

Exercise 7 (*): The demand and supply functions of a good are given by P = −3QD + 60 P = 2QS + 40

respectively. If the government decides to impose a tax of $t per good, show that the equilibrium quantity is given by 1 𝑄 = 4 − 5𝑡

and write down a similar expression for the equilibrium price.

(a) If it is known that the equilibrium quantity is 3, work out the value of t. How much of this tax is paid by the firm?

(b) If, instead of imposing a tax, the government provides a subsidy of $5 per good, find the new

equilibrium price and quantity.

6 TRƯƠNG THANH HOA – MATHEMATICS FOR BUSINESS

CHAPTER 2: NON-LINEAR EQUATIONS

2.2. REVENUE, COST AND PROFIT 2.2.1. Revenue

- Revenue (doanh thu) is the total payment received from selling a good or performing a service.

The revenue function, R(𝒙), reflects the revenue from selling “𝒙” amount of output items at a price of “p” per item.

- Total revenue = Price x Quantity (TR = PQ). 2.2.2. Cost

- Cost (chi phí) is the total cost of producing output. The cost function consists of two different

types of cost: variable costs (chi phí biến đổi) and fixed costs (chi phí c ố định).

- Total cost = Fixed cost + Variable cost per unit x Quantity (TC = FC + VC x Q).

- Average cost (AC) is obtained by dividing the total cost by output: 𝐴𝐶 = 𝑇𝐶 𝑄 2.2.3. Profit

- The profit function (lợi nhuận) is denoted by the Greek letter π and is defined to be the difference

between total revenue, TR, and total cost, TC.

- Profit = Total revenue – Total cost (𝜋 = 𝑇𝑅 − 𝑇𝐶).

- The firm breaks even when profit equals zero (TR = TC).

- Profit maximises when 𝜋′ = 0 𝑎𝑛𝑑 𝜋′′ < 0.

Example 1: Given the demand function P = 1000 Q –

express TR as a function of Q. ---

TR = PQ => TR = 1000Q – Q2

Example 2: Given that fixed costs are 100 and that variable costs are 2 per unit, express TC and AC as functions of Q. --- TC = 100 + 2Q 𝑇𝐶 100 𝐴𝐶 = 𝑄 = 𝑄 + 2

Example 3: If fixed costs are 4, variable costs per unit are 1 and the demand function is

7 TRƯƠNG THANH HOA – MATHEMATICS FOR BUSINESS P = 10 − 2Q

obtain an expression for π in terms of Q.

(a) For what values of Q does the firm break even?

(b) What is the maximum profit? --- TC = 4 + Q TR = PQ = 10Q – 2Q2

𝜋 = 𝑇𝑅 − 𝑇𝐶 = 10𝑄 − 2𝑄2 − 4 − 𝑄 = −2𝑄2 + 9𝑄 − 4

(a) The firm breaks even when 𝜋 = 0 => −2𝑄2 + 9𝑄 − 4 = 0 Therefore, Q = 4 and 𝑄 = 1 2

(b) Profit maximises when 𝜋′ = 0 𝑎𝑛𝑑 𝜋′′ < 0.

𝜋′ = −4𝑄 + 9 𝑎𝑛𝑑 𝜋′′ = −4 < 0 9 9 2 9 49

𝜋′ = 0 => 𝑄 = 4 => 𝜋 = −2 𝑥 (4) + 9 𝑥 4 −4 = 8 = 6.125

Therefore, the maximum profit is 6.125

Example 4: If fixed costs are 25, variable costs per unit are 2 and the demand function is P = 20 − Q

obtain an expression for π in terms of Q.

(a) Find the levels of output which give a profit of 31.

(b) Find the maximum profit and the value of Q at which it is achieved. --- TC = 25 + 2Q TR = PQ = 20Q – Q2

𝜋 = 𝑇𝑅 − 𝑇𝐶 = 20𝑄 − 𝑄2 − 25 − 2𝑄 = −𝑄2 + 18𝑄 − 25

(a) 𝜋 = 31 => −𝑄2 + 18𝑄 − 25 = 31 => −𝑄2 + 1 𝑄 8 − 56 = 0 Therefore, Q = 14 and Q = 4.

(b) Profit maximises when 𝜋′ = 0 𝑎𝑛𝑑 𝜋′′ < 0.

𝜋′ = −2𝑄 + 18 𝑎𝑛𝑑 𝜋′′ = −2 < 0

𝜋′ = 0 => 𝑄 = 9 => 𝜋 = −92 + 18 𝑥 9 − 25 = 56.

Therefore, the maximum profit is 56 and the value of Q is 9 at which it is achieved.

8 TRƯƠNG THANH HOA – MATHEMATICS FOR BUSINESS Exercise 1:

(a) If the demand function of a good is given by P = 80 − 3Q

find the price when Q = 10 and deduce the total revenue.

(b) If fixed costs are 100 and variable costs are 5 per unit find the total cost when Q = 10.

(c) Use your answers to parts (a) and (b) to work out the corresponding profit. Exercise 2:

(a) Given the following demand functions, express TR as a function of Q and hence sketch the graphs of TR against Q: P = 4 7 𝑃 = 𝑄 P = 10 − 4Q

(b) Given the following total revenue functions, find the corresponding demand functions: TR = 50Q − 4Q2 TR = 10

(c) Given that fixed costs are 500 and that variable costs are 10 per unit, express TC and AC as functions of Q.

(d) Given that fixed costs are 1 and that variable costs are Q + 1 per unit, express TC and AC as functions of Q.

Exercise 3: The total cost, TC, of producing 100 units of a good is 600 and the total cost of

producing 150 units is 850. Assuming that the total cost function is linear, find an expression for

TC in terms of Q, the number of units produced.

Exercise 4: The total cost of producing 500 items a day in a factory is $40 000, which includes a fixed cost of $2000.

(a) Work out the variable cost per item.

(b) Work out the total cost of producing 600 items a day.

Exercise 5: A taxi firm charges a fixed cost of $10 together with a variable cost of $3 per mile.

(a) Work out the average cost per mile for a journey of 4 miles.

(b) Work out the minimum distance travelled if the average cost per mile is to be less than $3.25.

9 TRƯƠNG THANH HOA – MATHEMATICS FOR BUSINESS

Exercise 6: Find an expression for the profit function given the demand function 2Q + P = 25 and the average cost function 32 𝐴𝐶 = 𝑄 + 5

Find the values of Q for which the firm (a) breaks even (b) makes a loss of 432 units (c) maximises profit.

Exercise 7: If fixed costs are 30, variable costs per unit are Q + 3, and the demand function is P + 2Q = 50

show that the associated profit function is π = −3Q2 + 47Q − 30.

Find the break-even values of Q and deduce the maximum profit.

2.3. INDICES AND LOGARITHMS

- Production function: Q = f(K,L)

- The production function is said to be homogenous if 𝑓(𝜆𝐾, 𝜆𝐿) = 𝜆𝑛𝑓(𝐾, 𝐿 )

• n < 1, the function is said to display decreasing returns to scale.

• n = 1, the function is said to display constant returns to scale.

• n > 1, the function is said to display increasing returns to scale.

Example 1: Show that the following production functions are homogeneous and comment on their returns to scale: (a) Q = 7KL2 (b) Q = 50K1/4L3/4 --- (a) f(K,L) = 7KL2

𝑓(𝜆𝐾, 𝜆𝐿) = 7(𝜆𝐾)(𝜆𝐿)2 = 7𝜆𝐾𝜆2𝐿2 = 𝜆37𝐾𝐿2 = 𝜆3𝑓(𝐾, 𝐿)

=> Increasing returns to scale because n = 3 > 1 (b) f(K,L) = 50K1/4L3/4 1 3

𝑓(𝜆𝐾, 𝜆𝐿) = 50(𝜆𝐾)4(𝜆𝐿)4 = 𝜆 50𝐾1/4𝐿3/4 = 𝜆𝑓(𝜆𝐾, 𝜆𝐿)

10 TRƯƠNG THANH HOA – MATHEMATICS FOR BUSINESS

=> Constant returns to scale because n = 1

Exercise 1: Which of the following production functions are homogeneous? For those functions

which are homogeneous write down their degrees of homogeneity and comment on their returns to scale. (a) Q = 500K1/3L1/4 (b) Q = 3LK + L2 (c) Q = L + 5L2K3

11 TRƯƠNG THANH HOA – MATHEMATICS FOR BUSINESS

CHAPTER 3: MATHEMATICS OF FINANCE 3.1. PERCENTAGES 3.1.1. Index numbers

- Scale factor (hệ số tỉ lệ 𝑡ℎ𝑒 𝑣𝑎𝑙𝑢𝑒 𝑎𝑓𝑡𝑒𝑟 𝑡ℎ𝑒 𝑖𝑛𝑐𝑟𝑒𝑎𝑠𝑒/𝑑𝑒𝑐𝑟𝑒𝑎𝑠𝑒 ): = (1 + 𝑥%)

𝑡ℎ𝑒 𝑖𝑛𝑖𝑡𝑖𝑎𝑙 𝑣𝑎𝑙𝑢𝑒

* Tips: increase: (1 + x%), decrease: (1 – x%), find the value after the increase/decrease: multiple,

find the value before the increase/decrease: divide.

- Index number = scale factor from base year x 100 3.1.2. Inflation

- Inflation (lạm phát) means that the general level of prices is going up, the opposite of deflation

(giảm phát). More money will need to be paid for goods (like a loaf of bread) and services (like

getting a haircut at the hairdresser's).

- Nominal data are the original, raw data such as those listed in tables in the previous subsection.

- Real data are the values that have been adjusted to take inflation into account. Example 1:

(a) A firm’s annual sales rise from 50 000 to 55 000 from one year to the next. Express the rise as a percentage of the original.

(b) The government imposes a 15% tax on the price of a good. How much does the consumer pay

for a good priced by a firm at $1360?

(c) Investments fall during the course of a year by 7%. Find the value of an investment at the end

of the year if it was worth $9500 at the beginning of the year. ---

(a) The rise in annual sales is 55,000 – 50,000 = 5000

As a fraction of the original this is 5000 10 50000 = 100 = 0.1

Therefore, the percentage rise is 10%.

(*) Or we can use scale factors: 55000 10

50000 = 1.1 = 1 + 0.1 = 1 + 100

Therefore, the percentage rise is 10%

12 TRƯƠNG THANH HOA – MATHEMATICS FOR BUSINESS

(b) The tax is 1360 𝑥 15 = 204 100

Therefore, consumers have to pay 1360 + 204 = 1564

(*) Or we can use scale factors: 𝑥 15

1360 = 1 + 100 = 1 + 0.15 = 1.15

x = 1564. Therefore, consumers have to pay 1564 (c) The fall in value is 7 9500 𝑥 100 = 665

Therefore, the value of an investment at the end of the year is 9500 665 = – 8835

(*) Or we can use scale factors: 𝑥 7

9500 = 1 − 100 = 1 − 0.07 = 0.93

x = 8835. Therefore, the value of an investment at the end of the year is 8835 Example 2:

(a) The value of a good rises by 13% in a year. If it was worth $6.5 million at the beginning of

the year, find its value at the end of the year.

(b) The GNP of a country has increased by 63% over the past 5 years and is now $124 billion. What was the GNP 5 years ago?

(c) Sales rise from 115 000 to 123 050 in a year. Find the annual percentage rise. --- (a) The rise in value is 13 6.5 𝑥 100 = 0.845

The value at the end of the year is 6.5 + 0.845 = 7.345

(*) Or we can use scale factors: 𝑥 13

6.5 = 1 + 100 = 1 + 0.13 = 1.13

x = 7345. Therefore, the value of an investment at the end of the year is 7345 (b) The GNP 5 years ago is 124 = 76 1 + 63 100

13 TRƯƠNG THANH HOA – MATHEMATICS FOR BUSINESS

(c) The annual percentage rise is 𝑥

115,000 (1 + 100) = 123050 => 𝑥 = 7%

Example 3: Find the single percentage increase or decrease equivalent to

(a) an increase of 30% followed by an increase of 40%.

(b) a decrease of 30% followed by a decrease of 40%.

(c) an increase of 10% followed by a decrease of 50%. ---

(a) (1 + 0.3)(1 + 0.4) = 1.82, which corresponds to an 82% increase.

(b) (1 – 0.3)(1 – 0.4) = 0.42, which corresponds to a 58% decrease (nếu đáp án lớn hơn 1 thì lấy 1 tr ừ

đi đáp án để tính được % giảm).

(c) (1 + 0.1)(1 – 0.5) = 0.55, which corresponds to a 45% decrease.

Example 4: Table shows the values of household spending (in billions of dollars) during a 5-

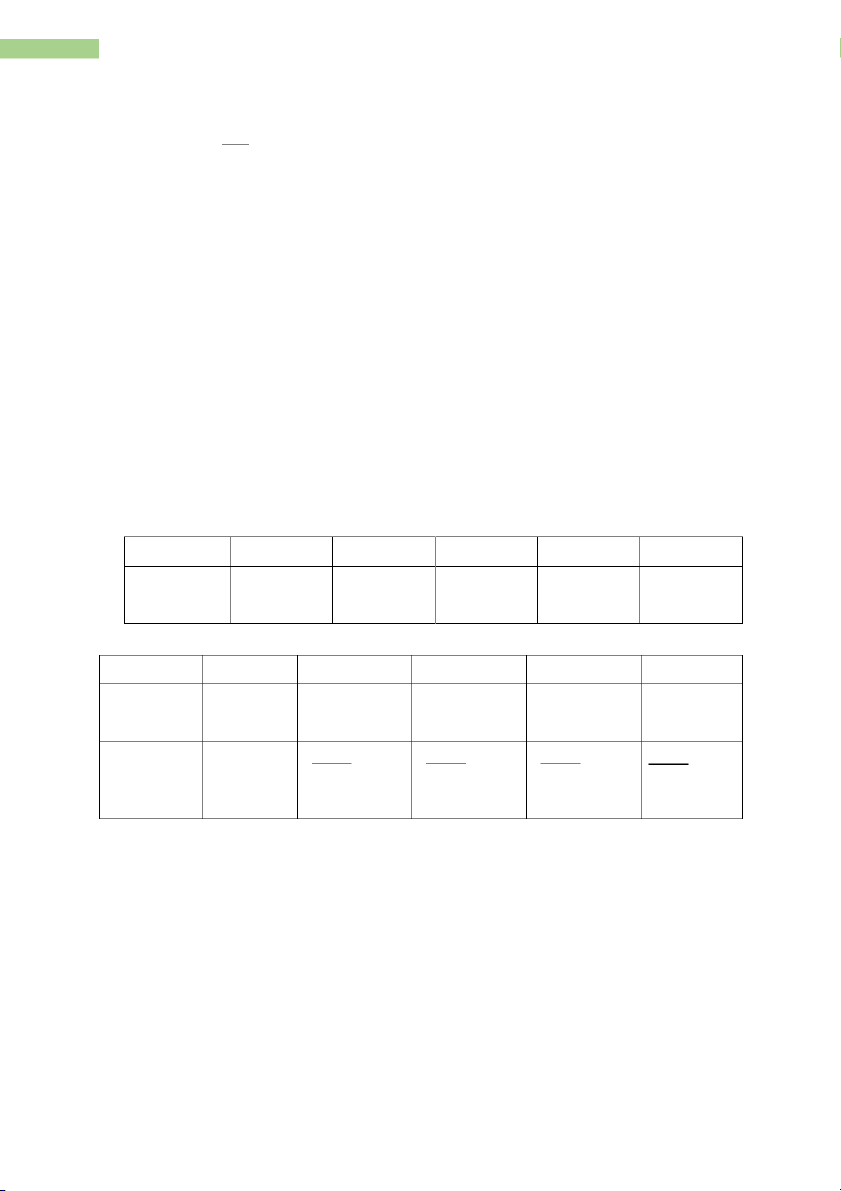

year period. Calculate the index numbers when 2010 is taken as the base year and give a brief interpretation. Year 2010 2011 2012 2013 2014 Household 686.9 697.2 723.7 716.6 734.5 spending --- Year 2010 2011 2012 2013 2014 Household 686.9 697.2 723.7 716.6 734.5 spending Index 100 697.2 723.7 716.6 734.5 686.9 𝑥 100 686.9 𝑥 100 686.9 𝑥 100 686.9 𝑥 100 numbers = 101.5 = 105.4 = 104.3 = 106.9

Example 5: Table shows the average annual salary (in thousands of dollars) of employees in

a small firm, together with the annual rate of inflation for that year. Adjust these salaries to the

prices prevailing at the end of 2001 and so give the real values of the employees’ salaries at constant ‘2001 prices’.

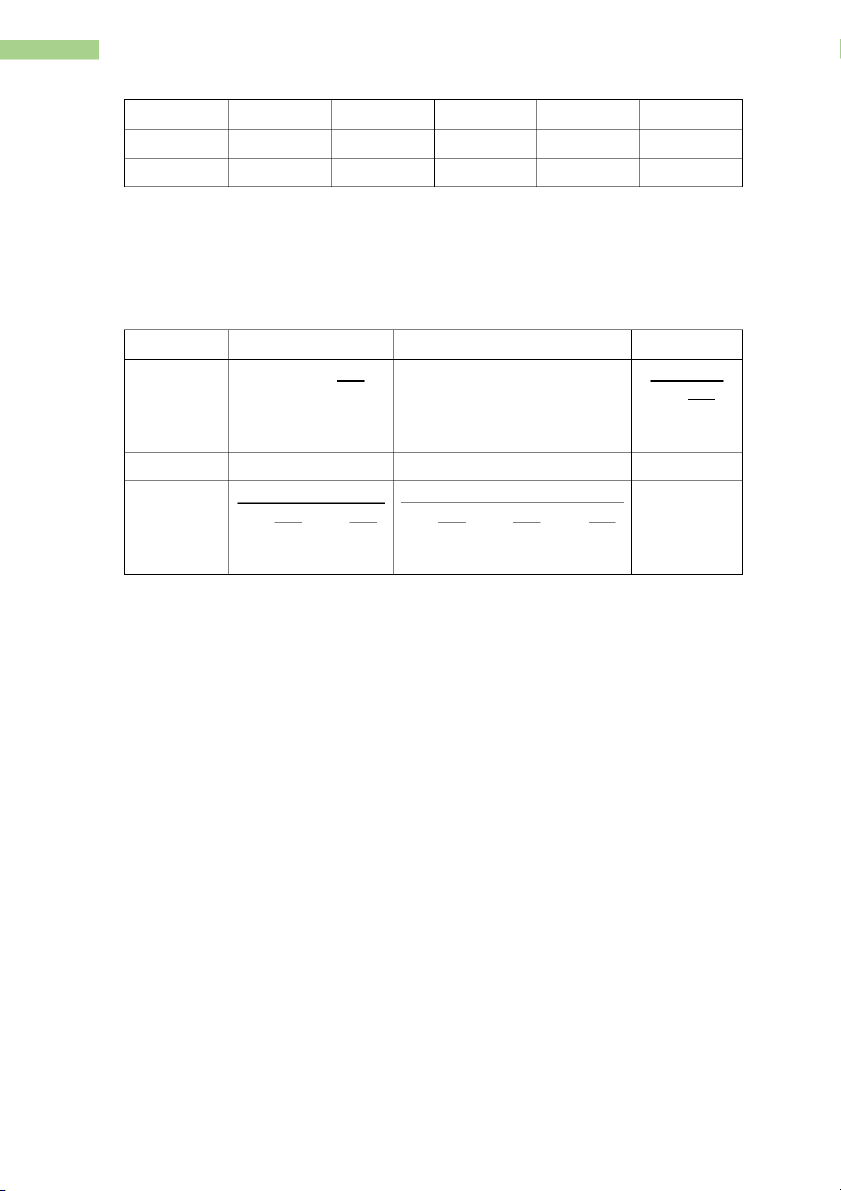

14 TRƯƠNG THANH HOA – MATHEMATICS FOR BUSINESS Year 2000 2001 2002 2003 2004 Salary 17.3 18.1 19.8 23.5 26.0 Inflation 4.9 4.3 4.0 3.5 Year 2000 2001 2002 Real values 4.9 17.3 𝑥 (1 + 18.1 19.8 at ‘2001 100) (1 + 4.3 = 18.15 100) prices’ = 18.98 Year 2003 2004 Real values 23.5 26.0 at ‘2001 (1 + 4.3 100) (1 + 4.0 100) (1 + 4.3 100) (1 + 4.0 100) (1 + 3.5 100) prices’ = 21.7 = 23.16

Exercise 1: A firm has 132 female and 88 male employees.

(a) What percentage of staff are female?

(b) During the next year 8 additional female staff are employed. If the percentage of female

staff is now 56%, how many additional male staff were recruited during the year?

Exercise 2: Find the new quantities when

(a) $16.25 is increased by 12%

(b) the population of a town, currently at 113 566, rises by 5%

(c) a good priced by a firm at $87.90 is subject to a sales tax of 15%

(d) a good priced at $2300 is reduced by 30% in a sale

(e) a car, valued at $23 000, depreciates by 32%.

Exercise 3: A student discount card reduces a bill in a restaurant from $124 to $80.60. Work out the percentage discount.