Preview text:

CHAPTER 14

LONG-TERM LIABILITIES: BONDS AND NOTES DISCUSSION QUESTIONS 1.

(1) To pay the face (maturity) amount of the bonds at a specified date. (2) To pay periodic

interest at a specified percentage of the face amount. 2. a.

Bonds that may be exchanged for other securities under specified conditions. b.

The issuing corporation reserves the right to redeem the bonds before the maturity date. 3.

More than face amount. Because comparable bonds provide a market interest rate (11%) that

is less than the rate on the bond being issued (12%), the bond will sell at a premium as the

market’s means of equalizing the two interest rates. 4. a. Greater than $26,000,000 b. 1. $26,000,000 2. 7% 3. 9% 4. $26,000,000 5. More than the contract rate 6. a. Premium b. $125,000 Premium c. Premium on Bonds Payable 7.

A loss of $50,000 [($5,000,000 × 0.98) – ($5,000,000 – $150,000)] 8.

A mortgage note is an installment note that is secured by a pledge of the borrower’s assets.

If the borrower fails to pay the note, the lender has the right to take possession of the pledged

asset and sell it to pay off the debt. 9.

A bond is an interest-bearing note that requires periodic interest payments and repayment of

the face amount of the bonds at maturity. Bonds consist of two different components:

(1) interest payments made periodically over the life of the bond and (2) the face amount that

must be repaid at maturity. The periodic payments consist entirely of interest, and the final

payment at maturity consists entirely of principal. Installment notes, on the other hand, have

periodic payments that consist partially of interest and partially of principal. Each payment

reduces the principal on the note so that at maturity the entire amount borrowed will have been repaid. 10. a.

As a current liability on the balance sheet. b.

As a long-term liability on the balance sheet. 14-1

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

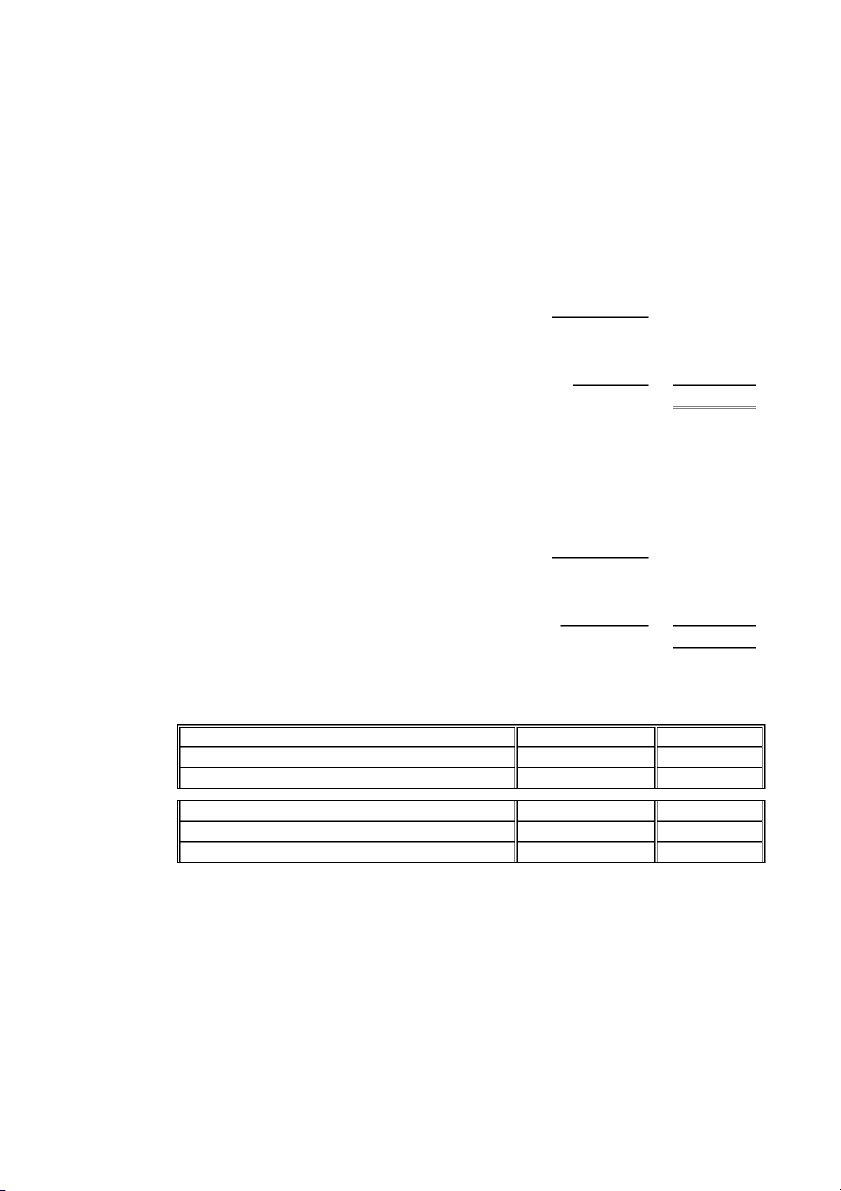

CHAPTER 14 Long-Term Liabilities: Bonds and Notes PRACTICE EXERCISES PE 14–1A Plan 1 Plan 2

Earnings before bond interest and income tax………… $750,000 $750,000 1 3

Deduct interest on bonds…………………………………… 350,000 238,000

Income before income tax………………………………… $400,000 $512,000 2 4

Deduct income tax…………………………………………… 160,000 204,800

Net income…………………………………………………… $240,000 $307,200 5

Dividends on preferred stock……………………………… 0 180,000

Available for dividends on common stock……………… $240,000 $127,200

Shares of common stock outstanding…………………… ÷200,000 ÷120,000

Earnings per share on common stock…………………… $ 1.20 $ 1.06 1 $5,000,000 × 7% 2 $400,000 × 40% 3 $3,400,000 × 7% 4 $512,000 × 40%

5 ($3,600,000 ÷ $20) × $1.00 PE 14–1B Plan 1 Plan 2

Earnings before bond interest and income tax………… $2,000,000 $2,000,000 1 3

Deduct interest on bonds…………………………………… 400,000 250,000

Income before income tax………………………………… $1,600,000 $1,750,000 2 4

Deduct income tax…………………………………………… 640,000 700,000

Net income…………………………………………………… $ 960,000 $1,050,0005

Dividends on preferred stock……………………………… 0 300,000

Available for dividends on common stock……………… $ 960,000 $ 750,000

Shares of common stock outstanding…………………… ÷ 400,000 ÷ 250,000

Earnings per share on common stock…………………… $ 2.40 $ 3.00 1 $4,000,000 × 10% 2 $1,600,000 × 40% 3 $2,500,000 × 10% 4 $1,750,000 × 40%

5 ($3,000,000 ÷ $25) × $2.50 14-2

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes PE 14–2A a. Cash 500,000 Bonds Payable 500,000 b. Interest Expense 12,500 Cash 12,500 c. Bonds Payable 500,000 Cash 500,000 PE 14–2B a. Cash 800,000 Bonds Payable 800,000 b. Interest Expense 16,000 Cash 16,000 c. Bonds Payable 800,000 Cash 800,000 14-3

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes PE 14–3A Cash 1,153,670

Discount on Bonds Payable 46,330 Bonds Payable 1,200,000 PE 14–3B Cash 2,889,599

Discount on Bonds Payable 110,401 Bonds Payable 3,000,000 PE 14–4A Interest Expense 58,633

Discount on Bonds Payable* 4,633 Cash 54,000

* $46,330 ÷ 10 semiannual payments PE 14–4B Interest Expense 176,040

Discount on Bonds Payable* 11,040 Cash 165,000

* $110,401 ÷ 10 semiannual payments PE 14–5A Cash 2,170,604

Premium on Bonds Payable 170,604 Bonds Payable 2,000,000 PE 14–5B Cash 8,308,869

Premium on Bonds Payable 308,869 Bonds Payable 8,000,000 14-4

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes PE 14–6A Interest Expense 62,940

Premium on Bonds Payable* 17,060 Cash 80,000

* $170,604 ÷ 10 semiannual payments PE 14–6B Interest Expense 409,113

Premium on Bonds Payable* 30,887 Cash 440,000

* $308,869 ÷ 10 semiannual payments PE 14–7A Bonds Payable 1,500,000

Loss on Redemption of Bonds 25,100

Discount on Bonds Payable 70,100 Cash 1,455,000 PE 14–7B Bonds Payable 500,000

Premium on Bonds Payable 67,000

Gain on Redemption of Bonds 77,000 Cash 490,000 PE 14–8A a. Cash 65,000 Notes Payable 65,000

Issued installment notes for cash. b. Interest Expense 3,900 Notes Payable 11,531 Cash 15,431

Paid principal and interest on installment notes. 14-5

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes PE 14–8B a. Cash 45,000 Notes Payable 45,000

Issued installment notes for cash. b. Interest Expense 3,600 Notes Payable 6,134 Cash 9,734

Paid principal and interest on installment notes. PE 14–9A a.

Number of times interest charges earned: $3,200,000 + $320,000 2016: = 11.0 $320,000 $3,600,000 + $300,000 2015: = 13.0 $300,000 b.

The number of times interest charges are earned has decreased from 13.0 in 2015

to 11.0 in 2016. Although the company has adequate earnings to pay interest, the

decline in this ratio may cause concern among debtholders. PE 14–9B a.

Number of times interest charges earned: $5,544,000 + $440,000 2016: = 13.6 $440,000 $4,400,000 + $400,000 2015: = 12.0 $400,000 b.

The number of times interest charges are earned has increased from 12.0 in 2015 to

13.6 in 2016. The increase in this ratio increases debtholders’ confidence in the

company’s ability to make its interest payments. 14-6

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes EXERCISES Ex. 14–1 Domanico Co. a.

Earnings before bond interest and income tax………………………… $10,500,000*

Bond interest………………………………………………………………… 800,000

Balance………………………………………………………………………… $ 9,700,000

Income tax…………………………………………………………………… 3,880,000

Net income…………………………………………………………………… $ 5,820,000**

Dividends on preferred stock……………………………………………… 5,000,000

Earnings available for common stock…………………………………… $ 820,000

Shares of common stock outstanding…………………………………… ÷ 500,000***

Earnings per share on common stock…………………………………… $ 1.64 b.

Earnings before bond interest and income tax………………………… $11,800,000*

Bond interest………………………………………………………………… 800,000

Balance………………………………………………………………………… $11,000,000

Income tax…………………………………………………………………… 4,400,000

Net income…………………………………………………………………… $ 6,600,000**

Dividends on preferred stock……………………………………………… 5,000,000

Earnings available for common stock…………………………………… $ 1,600,000

Shares of common stock outstanding…………………………………… ÷ 500,000***

Earnings per share on common stock…………………………………… $ 3.20 c.

Earnings before bond interest and income tax………………………… $13,000,000*

Bond interest………………………………………………………………… 800,000

Balance………………………………………………………………………… $12,200,000

Income tax…………………………………………………………………… 4,880,000

Net income…………………………………………………………………… $ 7,320,000**

Dividends on preferred stock……………………………………………… 5,000,000

Earnings available for common stock…………………………………… $ 2,320,000

Shares of common stock outstanding…………………………………… ÷ 500,000***

Earnings per share on common stock…………………………………… $ 4.64

* $10,000,000 bonds payable × 8% interest

** ($10,000,000 preferred stock ÷ $10 par value) × $5 preferred dividend per share

*** $10,000,000 common stock ÷ $20 par value Ex. 14–2

Factors other than earnings per share that should be considered in evaluating

financing plans include: bonds represent a fixed annual interest requirement, while

dividends on stock do not; bonds require the repayment of principal, while stock

does not; and common stock represents a voting interest in the ownership of the

corporation, while bonds do not. 14-7

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Ex. 14–3

Nike’s major source of financing is common stock. It has relatively little long-term debt

compared to stockholders’ equity. Ex. 14–4

The bonds were selling at a premium. This is indicated by the selling price of 103.00,

which is stated as a percentage of the face amount and is more than par (100%). The

market rate of interest for similar quality bonds was lower than 7.375%, and this is why

the bonds were selling at a premium. Ex. 14–5 May 1 Cash 600,000 Bonds Payable 600,000 Nov. 1 Interest Expense 24,000 Cash 24,000 Dec. 31 Interest Expense* 8,000 Interest Payable 8,000

* $600,000 × 8% × 2/12 Ex. 14–6 a. 1. Cash 17,138,298

Discount on Bonds Payable 1,361,702 Bonds Payable 18,500,000 2. Interest Expense 1,061,170

Discount on Bonds Payable 136,170 Cash 925,000 3. Interest Expense 1,061,170

Discount on Bonds Payable 136,170 Cash 925,000 14-8

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Ex. 14–6 (Concluded) b.

Annual interest paid……………………………………………………………… $1,850,000

Plus discount amortized………………………………………………………… 272,340

Interest expense for first year………………………………………………… $2,122,340 c.

The bonds sell for less than their face amount because the market rate of

interest is greater than the contract rate of interest. Investors are not willing to

pay the full face amount for bonds that pay a lower contract rate of interest than

the rate they could earn on similar bonds (market rate). Ex. 14–7 a. Cash 13,023,576

Premium on Bonds Payable 1,023,576 Bonds Payable 12,000,000 b. Interest Expense 377,642

Premium on Bonds Payable* 102,358 Cash** 480,000

* $1,023,576 ÷ 10 semiannual payments

** $12,000,000 × 8% × 6/12 c.

The bonds sell for more than their face amount because the market rate of

interest is less than the contract rate of interest. Investors are willing to pay

more for bonds that pay a higher rate of interest (contract rate) than the rate

they could earn on similar bonds (market rate). Ex. 14–8 2016 Mar. 1 Cash 22,000,000 Bonds Payable 22,000,000 Sept. 1 Interest Expense 770,000 Cash 770,000 2020 Mar. 1 Bonds Payable 22,000,000

Loss on Redemption of Bonds 440,000 Cash* 22,440,000 * $22,000,000 × 1.02 14-9

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Ex. 14–9 2016 May 1 Cash 15,000,000 Bonds Payable 15,000,000 Nov. 1 Interest Expense 675,000 Cash 675,000 2022 Nov. 1 Bonds Payable 15,000,000

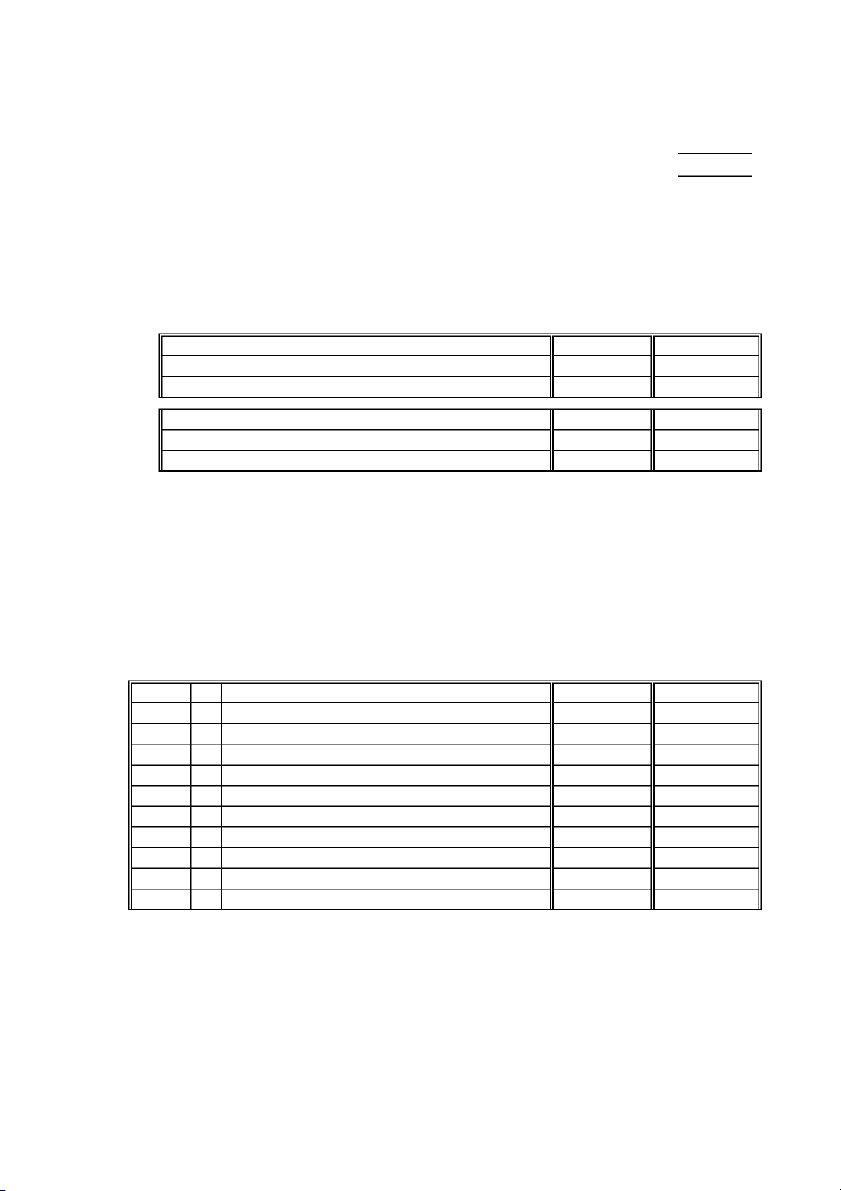

Gain on Redemption of Bonds 600,000 Cash* 14,400,000 * $15,000,000 × 0.96 Ex. 14–10 a. 1. Cash 85,000 Notes Payable 85,000 2. Interest Expense* 5,950 Notes Payable 9,822 Cash 15,772 * $85,000 × 0.07 b.

Notes payable are reported as liabilities on the balance sheet. The portion of the

note payable that is due within one year is reported as a current liability. The

remaining portion of the note payable that is not due within one year is reported

as a long-term liability. For this company, the current and noncurrent portions

of the note payable would be reported as follows: 14-10

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Ex. 14–10 (Concluded) Current liabilities:

Notes payable*………………………………………………………………………… $10,510

* The principal repayment portion of the next installment payment. See computation below. Noncurrent liabilities:

Notes payable**……………………………………………………………………… $64,668

** Original note payable………………………………………………………………… $85,000

Less principal repayment from year 1…………………………………………… 9,822

Note payable balance at the end of year 1……………………………………… $75,178

Annual payment on note…………………………………………………………… $15,772

Second year interest payment ($75,178 × 0.07)………………………………… 5,262

Principal repayment portion of next installment………………………………… $10,510

Note payable balance at the end of year 1……………………………………… $75,178

Current portion of note payable (due within one year)………………………… 10,510

Noncurrent portion of note payable……………………………………………… $64,668 Ex. 14–11 2016 Jan. 1 Cash 175,000 Notes Payable 175,000 Dec. 31 Interest Expense 14,000 Notes Payable 29,830 Cash 43,830 2019 Dec. 31 Interest Expense 6,253 Notes Payable* 37,577 Cash 43,830 *$43,830 – $6,253 14-11

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

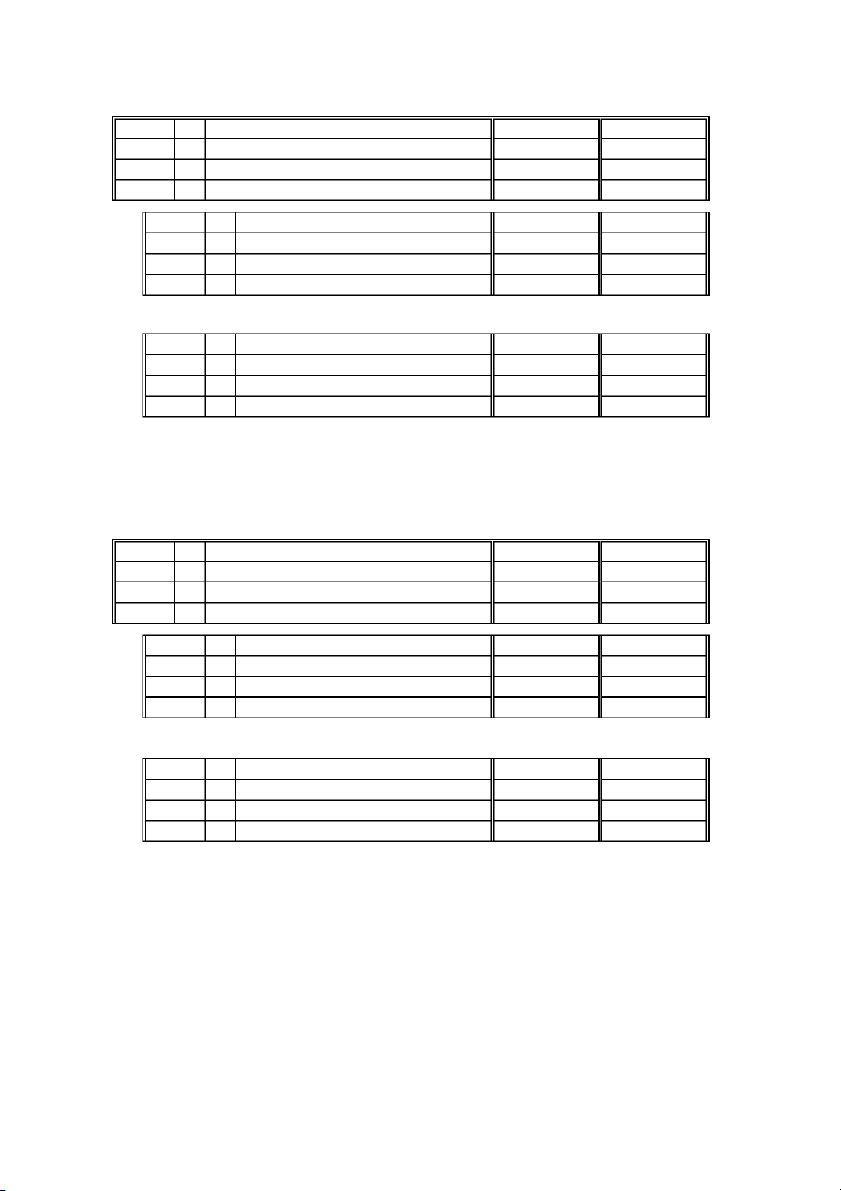

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Ex. 14–12 a.

Amortization of Installment Notes A B C D E Decrease Dec. 31 For the January 1 Note Interest Expense in Notes Carrying Year Carrying Payment (7% of January 1 Payable Amount Ending Amount (Cash Paid) Note Carrying Amount) (B – C) (A – D) Dec. 31, 2016 $147,750 $ 43,620

$10,343 (7% of $147,750) $ 33,277 $114,473 Dec. 31, 2017 114,473 43,620 8,013 (7% of $114,473) 35,607 78,866 Dec. 31, 2018 78,866 43,620 5,521 (7% of $78,866) 38,099 40,767 Dec. 31, 2019 40,767 43,620 2,853* 40,767 0 $174,480 $26,730 $147,750

* The interest expense in 2019 is rounded to $2,853. b. 2016 Jan. 1 Cash 147,750 Notes Payable 147,750 Dec. 31 Interest Expense 10,343 Notes Payable 33,277 Cash 43,620 2017 Dec. 31 Interest Expense 8,013 Notes Payable 35,607 Cash 43,620 2018 Dec. 31 Interest Expense 5,521 Notes Payable 38,099 Cash 43,620 2019 Dec. 31 Interest Expense 2,853 Notes Payable 40,767 Cash 43,620 c.

Interest expense of $10,343 would be reported on the income statement. 14-12

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Ex. 14–13 1.

The significant loss on redemption of the Simmons Industries bonds should be

reported in the Other Income and Expense section of the income statement,

rather than as an extraordinary loss. 2.

The Hunter Corporation bonds outstanding at the end of the current year

should be reported as a current liability on the balance sheet because they mature within one year. Ex. 14–14 a.

Number of times interest charges earned:

$685,000,000 + $147,000,000 Current year: = 5.7 $147,000,000

$323,000,000 + $194,000,000 Preceding year: = 2.7 $194,000,000 b.

The number of times interest charges are earned has increased from 2.7 in the

prior year to 5.7 in the current year. Although Southwest Airlines had enough

earnings to pay interest in the preceding year, the improvement in this ratio will

be welcomed by the debtholders. Ex. 14–15 a.

Number of times interest charges earned:

$310,500,000 + $13,500,000 2016: = 24.0 $13,500,000

$432,000,000 + $16,000,000 2015: = 28.0 $16,000,000 b.

The number of times interest charges are earned has decreased from 28.0 in 2015

to 24.0 in 2016. Although Loomis has adequate earnings to pay interest, the

decline in this ratio may cause concern among debtholders. 14-13

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Ex. 14–16 a.

Number of times interest charges earned: $3,500,000 + $5,000,000 2016: = 1.7 $5,000,000 $6,000,000 + $5,000,000 2015: = 2.2 $5,000,000 b.

The number of times interest charges are earned has decreased from 2.2 in 2015

to 1.7 in 2016. Although the company has enough earnings to pay interest in 2016,

the deterioration in this ratio is a cause for concern to debtholders. Ex. 14–17 a.

$1,000,000 × 0.75131 = $751,310 b.

Cash on hand today can be invested to earn income. If $751,315 is invested at 10%,

it will be worth $1,000,000 at the end of three years. Ex. 14–18 a. First Year: $200,000 × 0.93458 = $186,916 Second Year: $200,000 × 0.87344 = $174,688 Third Year: $200,000 × 0.81630 = $163,260 Fourth Year: $200,000 × 0.76290 = $152,580 Total present value $677,444 b.

$200,000 × 3.38721 = $677,442*

*$2 difference between a. and b. is due to rounding. c.

Cash on hand today can be invested to earn income. If each of the $200,000 of cash

receipts is invested at 7%, it will be worth $677,444 at the end of four years. Ex. 14–19

$6,250,000 × 6.46321 = $40,395,063 14-14

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Ex. 14–20

No. The present value of your winnings using an interest rate of 12% is $31,047,750

($6,250,000 × 4.96764), which is less than the present value of your winnings using

an interest rate of 5% ($40,395,063; see Ex. 14–19). This is because the winnings are

affected by the higher interest rate. Ex. 14–21

Present value of $1 for 10 semiannual

periods at 4.5% semiannual rate………………………… 0.64393

Face amount of bonds……………………………………… × $25,000,000 $16,098,250

Present value of an annuity of $1

for 10 periods at 4.5%…………………………………… … 7.91272

Semiannual interest payment……………………………… × $875,000* 6,923,630

Total present value (proceeds)…………………………… $23,021,880 * $25,000,000 × 3.5% Ex. 14–22

Present value of $1 for 10 semiannual

periods at 4.5% semiannual rate………………………… 0.64393

Face amount of bonds……………………………………… × $42,000,000 $27,045,060

Present value of an annuity of $1

for 10 semiannual periods at 4.5% semiannual rate… 7.91272

Semiannual interest payment……………………………… × $2,310,000* 18,278,383

Total present value (proceeds)…………………………… $45,323,443 * $42,000,000 × 5.5% Ex. 14–23 a. 1. Cash 43,495,895

Discount on Bonds Payable 6,504,105 Bonds Payable 50,000,000 2. Interest Expense* 1,957,315

Discount on Bonds Payable 207,315 Cash** 1,750,000 * $43,495,895 × 4.5% ** $50,000,000 × 3.5% 14-15

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Ex. 14–23 (Concluded) 3. Interest Expense* 1,966,644

Discount on Bonds Payable 216,644 Cash 1,750,000

* ($43,495,895 + $207,315) × 4.5%

Note: The following data in support of the proceeds of the bond issue stated in

the exercise are presented for the instructor’s information. Students are not

required to make the computations.

Present value of $1 for 20 semiannual

periods at 4.5% semiannual rate…………………… 0.41464

Face amount of bonds………………………………… × $50,000,000 $20,732,000

Present value of annuity of $1

for 20 semiannual periods at 4.5%

semiannual rate………………………………………… 13.00794

Semiannual interest payment………………………… × $1,750,000* 22,763,895

Total present value (proceeds)……………………… $43,495,895 * $50,000,000 × 3.5% b.

Annual interest paid…………………………………………………………… $ 3,500,000

Plus discount amortized*…………………………………………………… 423,959

Interest expense for first year……………………………………………… $ 3,923,959 * $207,315 + $216,644 c.

The bonds sell for less than their face amount because the market rate of interest is

greater than the contract rate of interest. Investors are not willing to pay the full face

amount for bonds that pay a lower contract rate of interest than the rate they could

earn on similar bonds (market rate). Ex. 14–24 a. 1. Cash 23,829,684

Premium on Bonds Payable 1,829,684 Bonds Payable 22,000,000 2. Interest Expense* 834,039

Premium on Bonds Payable 155,961 Cash** 990,000 * $23,829,684 × 3.5% ** $22,000,000 × 4.5% 3. Interest Expense* 828,580

Premium on Bonds Payable 161,420 Cash 990,000

* ($23,829,684 – $155,961) × 3.5% 14-16

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Ex. 14–24 (Concluded) b.

Annual interest paid……………………………………………………………… $1,980,000

Less premium amortized*……………………………………………………… 317,381

Interest expense for first year………………………………………………… $1,662,619 * $155,961 + $161,420 c.

The bonds sell for more than their face amount because the market rate of interest

is less than the contract rate of interest. Investors are willing to pay more for bonds

that pay a higher rate of interest (contract rate) than the rate they could earn on

similar bonds (market rate). Ex. 14–25 a.

Present value of $1 for 10 semiannual

periods at 5% semiannual rate……………………… 0.61391

Face amount of bonds…………………………………… × $35,000,000 $21,486,850

Present value of an annuity of $1 for 10

semiannual periods at 5% semiannual rate………… 7.72173

Semiannual interest payment…………………………… × $2,100,000 16,215,633

Proceeds of bond sale…………………………………………………………… $37,702,483 b.

First semiannual interest payment…………………………………………… $ 2,100,000

5% of carrying amount of $37,702,483………………………………………… 1,885,124

Premium amortized……………………………………………………………… $ 214,876 c.

Second semiannual interest payment………………………………………… $ 2,100,000

5% of carrying amount of $37,487,607*……………………………………… 1,874,380

Premium amortized……………………………………………………………… $ 225,620

* $37,702,483 – $214,876 d.

Annual interest paid……………………………………………………………… $ 4,200,000

Less premium amortized*……………………………………………………… 440,496

Interest expense for first year………………………………………………… $ 3,759,504 * $214,876 + $225,620 14-17

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Ex. 14–26 a.

Present value of $1 for 10 semiannual

periods at 6.0% semiannual rate………………………… 0.55839

Face amount of bonds……………………………………… ×$80,000,000 $44,671,200

Present value of an annuity of $1 for 10 semiannual

periods at 6.0% semiannual rate………………………… 7.36009

Semiannual interest payment……………………………… × $3,600,000* 26,496,324

Proceeds of bond sale…………………………………………………………… $71,167,524 * $80,000,000 × 4.5% b.

6.0% of carrying amount of $71,167,524…………………………………… … $ 4,270,051

First semiannual interest payment…………………………………………… 3,600,000

Discount amortized……………………………………………………………… $ 670,051 c.

6.0% of carrying amount of $71,837,575*…………………………………… … $ 4,310,255

Second semiannual interest payment………………………………………… 3,600,000

Discount amortized……………………………………………………………… $ 710,255

* $71,167,524 + $670,051 d.

Annual interest paid…………………………………………………………… … $ 7,200,000

Plus discount amortized*……………………………………………………… … 1,380,306

Interest expense for first year…………………………………………………… $ 8,580,306 * $670,051 + $710,255 14-18

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

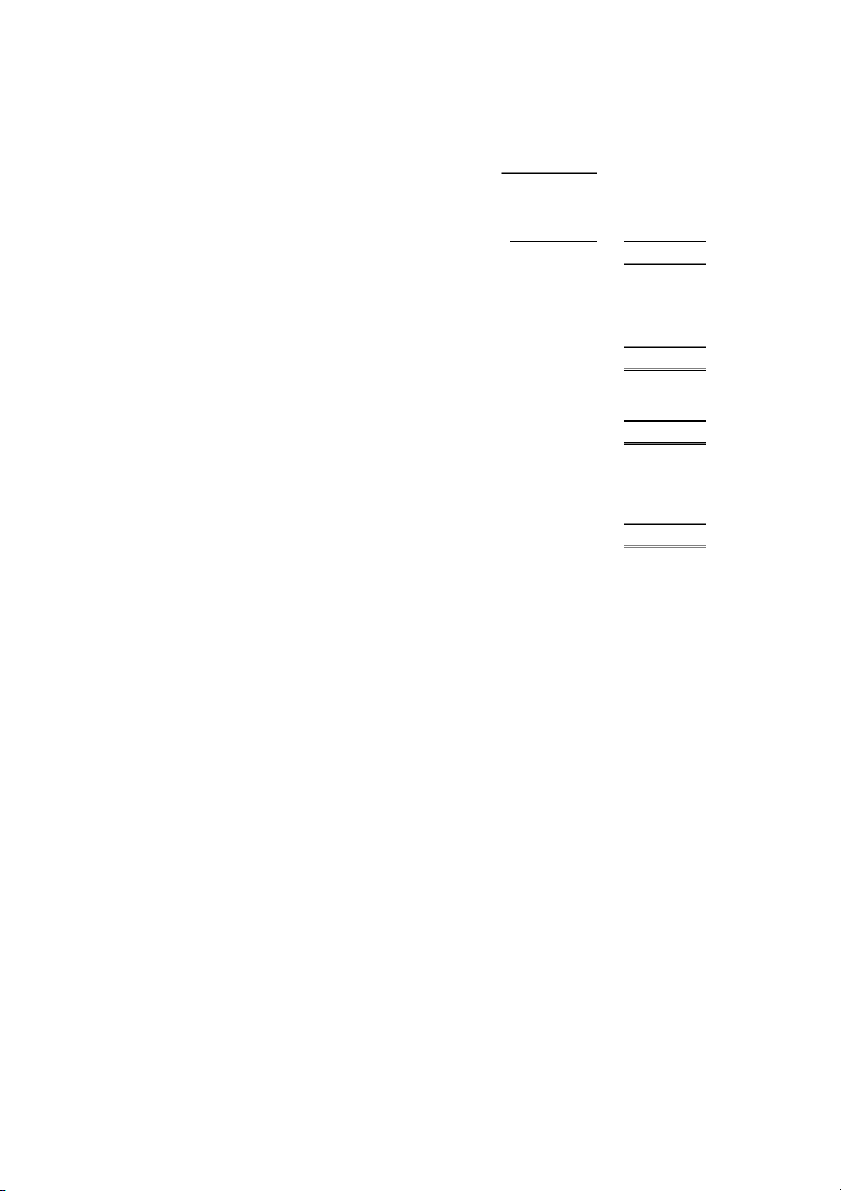

CHAPTER 14 Long-Term Liabilities: Bonds and Notes PROBLEMS Prob. 14–1A 1. Plan 1 Plan 2 Plan 3

Earnings before interest and income tax……… $2,100,000 $2,100,000 $2,100,000

Deduct interest on bonds………………………… 0 0 720,000

Income before income tax……………………… $2,100,000 $2,100,000 $1,380,000

Deduct income tax………………………………… 840,000 840,000 552,000

Net income………………………………………… $1,260,000 $1,260,000 $ 828,000

Dividends on preferred stock…………………… 0 360,000 180,000

Available for dividends on common stock…… $1,260,000 $ 900,000 $ 648,000

Shares of common stock outstanding………… ÷1,800,000 ÷ 900,000 ÷ 450,000

Earnings per share on common stock………… $ 0.70 $ 1.00 $ 1.44 2. Plan 1 Plan 2 Plan 3

Earnings before interest and income tax……… $1,050,000 $1,050,000 $1,050,000

Deduct interest on bonds………………………… 0 0 720,000

Income before income tax……………………… $1,050,000 $1,050,000 $ 330,000

Deduct income tax………………………………… 420,000 420,000 132,000

Net income………………………………………… $ 630,000 $ 630,000 $ 198,000

Dividends on preferred stock…………………… 0 360,000 180,000

Available for dividends on common stock…… $ 630,000 $ 270,000 $ 18,000

Shares of common stock outstanding………… ÷1,800,000 ÷ 900,000 ÷ 450,000

Earnings per share on common stock………… $ 0.35 $ 0.30 $ 0.04 3.

The principal advantage of Plan 1 is that it involves only the issuance of common

stock, which does not require a periodic interest payment or return of principal,

and a payment of preferred dividends is not required. It is also more attractive to

common shareholders than is Plan 2 or 3 if earnings before interest and income tax

is $1,050,000. In this case, it has the largest EPS ($0.35). The principal disadvantage

of Plan 1 is that, if earnings before interest and income tax is $2,100,000, it offers

the lowest EPS ($0.70) on common stock.

The principal advantage of Plan 3 is that less investment would need to be made

by common shareholders. Also, it offers the largest EPS ($1.44) if earnings before

interest and income tax is $2,100,000. Its principal disadvantage is that the bonds

carry a fixed annual interest charge and require the payment of principal. It also

requires a dividend payment to preferred stockholders before a common dividend

can be paid. Finally, Plan 3 provides the lowest EPS ($0.04) if earnings before

interest and income tax is $1,050,000.

Plan 2 provides a middle ground in terms of the advantages and disadvantages

described in the preceding paragraphs for Plans 1 and 3. 14-19

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Prob. 14–2A 1. Cash 26,646,292

Discount on Bonds Payable 1,853,708 Bonds Payable 28,500,000 2. a. Interest Expense 1,232,685

Discount on Bonds Payable* 92,685 Cash 1,140,000

* $1,853,708 ÷ 20 semiannual payments b. Interest Expense 1,232,685

Discount on Bonds Payable* 92,685 Cash 1,140,000

* $1,853,708 ÷ 20 semiannual payments 3. $1,232,685 4.

Yes. Investors will not be willing to pay the face amount of the bonds when the

interest payments they will receive from the bonds are less than the amount of

interest that they could receive from investing in other bonds of a similar risk. 5.

Present value of $1 for 20 semiannual

periods at 4.5% semiannual rate……………………… 0.41464

Face amount of bonds…………………………………… × $28,500,000 $11,817,240

Present value of annuity of $1 for 20

semiannual periods at 4.5% semiannual rate……… 13.00794

Semiannual interest payment…………………………… × $1,140,000 14,829,052

Proceeds of bond issue………………………………………………………… $26,646,292 14-20

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Prob. 14–3A 1. Cash 66,747,178

Premium on Bonds Payable 4,247,178 Bonds Payable 62,500,000 2. a. Interest Expense 2,600,141

Premium on Bonds Payable* 212,359 Cash 2,812,500

* $4,247,178 ÷ 20 seminannual payments b. Interest Expense 2,600,141

Premium on Bonds Payable* 212,359 Cash 2,812,500

* $4,247,178 ÷ 20 semiannual payments 3. $2,600,141

4. Yes. Investors will be willing to pay more than the face amount of the bonds

when the interest payments they will receive from the bonds exceed the amount

of interest that they could receive from investing in other bonds of a similar risk.

5. Present value of $1 for 20 semiannual

periods at 4.0% semiannual rate………………………… 0.45639

Face amount of bonds………………………………………… × $62,500,000 $28,524,375

Present value of annuity of $1

for 20 semiannual periods at 4.0% semiannual rate… 13.59033

Semiannual interest payment……………………………… × $2,812,500 38,222,803

Proceeds of bond issue…………………………………………………………… $66,747,178 14-21

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Prob. 14–4A 1. 2016 July 1 Cash 63,532,267

Discount on Bonds Payable 10,467,733 Bonds Payable 74,000,000 Oct. 1 Cash 200,000 Notes Payable 200,000 Dec. 31 Interest Expense 3,000 Interest Payable 3,000 31 Interest Expense 4,331,693

Discount on Bonds Payable 261,693 Cash 4,070,000 31 Income Summary 4,334,693 Interest Expense 4,334,693 2017 June 30 Interest Expense 4,331,693

Discount on Bonds Payable 261,693 Cash 4,070,000 Sept 30 Interest Expense 9,000 Interest Payable 3,000 Notes Payable 28,673 Cash 40,673 Dec. 31 Interest Expense 2,570 Interest Payable 2,570 31 Interest Expense 4,331,693

Discount on Bonds Payable 261,693 Cash 4,070,000 31 Income Summary 8,674,956 Interest Expense 8,674,956 2018 June 30 Bonds Payable 74,000,000

Loss on Redemption of Bonds 7,940,961

Discount on Bonds Payable 9,420,961 Cash* 72,520,000 * $74,000,000 × 0.98 14-22

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes

Prob. 14–4A (Concluded) 2018 Sept 30 Interest Expense 7,710 Interest Payable 2,570 Notes Payable 30,393 Cash 40,673 2. a. 2016: $4,334,693 b. 2017: $8,674,956 3.

Initial carrying amount of bonds……………………………………………… $63,532,267

Discount amortized on December 31, 2016………………………………… 261,693

Discount amortized on June 30, 2017……………………………………… 261,693

Discount amortized on December 31, 2017………………………………… 261,693

Carrying amount of bonds, December 31, 2017…………………………… $64,317,346 14-23

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Prob. 14–5A 1. 2016 July 1 Cash 26,646,292

Discount on Bonds Payable 1,853,708 Bonds Payable 28,500,000 2. a. 2016 Dec. 31 Interest Expense* 1,199,083

Discount on Bonds Payable 59,083 Cash 1,140,000 *$26,646,292 × 4.5% b. 2017 June 30 Interest Expense* 1,201,742

Discount on Bonds Payable 61,742 Cash 1,140,000

*($26,646,292 + $59,083) × 4.5% 3. $1,199,083 Prob. 14–6A 1. 2016 July 1 Cash 66,747,178

Premium on Bonds Payable 4,247,178 Bonds Payable 62,500,000 2. a. 2016 Dec. 31 Interest Expense* 2,669,887

Premium on Bonds Payable 142,613 Cash 2,812,500 *$66,747,178 × 4.0% b. 2017 June 30 Interest Expense* 2,664,183

Premium on Bonds Payable 148,317 Cash 2,812,500

*($66,747,178 – $142,613) × 4.0% 3. $2,669,887 14-24

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Prob. 14–1B 1. Plan 1 Plan 2 Plan 3

Earnings before interest and income tax……… $10,000,000 $10,000,000 $10,000,000

Deduct interest on bonds………………………… 0 0 3,600,000

Income before income tax………………………… $10,000,000 $10,000,000 $ 6,400,000

Deduct income tax………………………………… 4,000,000 4,000,000 2,560,000

Net income…………………………………………… $ 6,000,000 $ 6,000,000 $ 3,840,000

Dividends on preferred stock…………………… 0 2,000,000 1,000,000

Available for dividends on common stock…… $ 6,000,000 $ 4,000,000 $ 2,840,000

Shares of common stock outstanding………… ÷ 4,000,000 ÷ 2,000,000 ÷ 1,000,000

Earnings per share on common stock………… $ 1.50 $ 2.00 $ 2.84 2. Plan 1 Plan 2 Plan 3

Earnings before interest and income tax……… $6,000,000 $6,000,000 $6,000,000

Deduct interest on bonds………………………… 0 0 3,600,000

Income before income tax………………………… $6,000,000 $6,000,000 $2,400,000

Deduct income tax………………………………… 2,400,000 2,400,000 960,000

Net income…………………………………………… $3,600,000 $3,600,000 $1,440,000

Dividends on preferred stock…………………… 0 2,000,000 1,000,000

Available for dividends on common stock…… $3,600,000 $1,600,000 $ 440,000

Shares of common stock outstanding………… ÷4,000,000 ÷2,000,000 ÷1,000,000

Earnings per share on common stock………… $ 0.90 $ 0.80 $ 0.44

3. The principal advantage of Plan 1 is that it involves only the issuance of

common stock, which does not require a periodic interest payment or return of

principal, and a payment of preferred dividends is not required. It is also more

attractive to common shareholders than is Plan 2 or 3 if earnings before interest

and income tax is $6,000,000. In this case, it has the largest EPS ($0.90). The

principal disadvantage of Plan 1 is that, if earnings before interest and income tax

is $10,000,000, it offers the lowest EPS ($1.50) on common stock.

The principal advantage of Plan 3 is that less investment would need to be made

by common shareholders. Also, it offers the largest EPS ($2.84) if earnings before

interest and income tax is $10,000,000. Its principal disadvantage is that the bonds

carry a fixed annual interest charge and require the payment of principal. It also

requires a dividend payment to preferred stockholders before a common dividend

can be paid. Finally, Plan 3 provides the lowest EPS ($0.44) if earnings before

interest and income tax is $6,000,000.

Plan 2 provides a middle ground in terms of the advantages and disadvantages

described in the preceding paragraphs for Plans 1 and 3. 14-25

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Prob. 14–2B 1. Cash 42,309,236

Discount on Bonds Payable 3,690,764 Bonds Payable 46,000,000 2. a. Interest Expense 2,392,269

Discount on Bonds Payable* 92,269 Cash 2,300,000

*$3,690,764 ÷ 40 semiannual payments b. Interest Expense 2,392,269

Discount on Bonds Payable* 92,269 Cash 2,300,000

*$3,690,764 ÷ 40 semiannual payments 3. $2,392,269 4.

Yes. Investors will not be willing to pay the face amount of the bonds when the

interest payments they will receive from the bonds are less than the amount of

interest that they could receive from investing in other bonds of a similar risk. 5.

Present value of $1 for 40 semiannual

periods at 5.5% semiannual rate……………………… 0.11746

Face amount of bonds…………………………………… × $46,000,000 $ 5,403,160

Present value of an annuity of $1 for 40

semiannual periods at 5.5% semiannual rate……… 16.04612

Semiannual interest payment…………………………… × $2,300,000 36,906,076

Proceeds of bond issue………………………………………………………… $42,309,236 14-26

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Prob. 14–3B 1. Cash 73,100,469

Premium on Bonds Payable 8,100,469 Bonds Payable 65,000,000 2. a. Interest Expense 3,494,977

Premium on Bonds Payable* 405,023 Cash 3,900,000

*$8,100,469 ÷ 20 semiannual periods b. Interest Expense 3,494,977

Premium on Bonds Payable* 405,023 Cash 3,900,000

*$8,100,469 ÷ 20 semiannual periods 3. $3,494,977 4.

Yes. Investors will be willing to pay more than the face amount of the bonds when

the interest payments they will receive from the bonds exceed the amount of

interest that they could receive from investing in other bonds of a similar risk. 5.

Present value of $1 for 20 semiannual

periods at 5% semiannual rate…………………… 0.37689

Face amount of bonds………………………………… × $65,000,000 $24,497,850

Present value of an annuity of $1 for 20

semiannual periods at 5% semiannual rate……… 12.46221

Semiannual interest payment………………………… × $3,900,000 48,602,619

Proceeds of bond issue……………………………………………………… $73,100,469 14-27

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Prob. 14–4B 1. 2016 July 1 Cash 62,817,040

Premium on Bonds Payable 7,817,040 Bonds Payable 55,000,000 Oct. 1 Cash 450,000 Notes Payable 450,000 Dec. 31 Interest Expense 9,000 Interest Payable 9,000 31 Interest Expense 2,084,148

Premium on Bonds Payable 390,852 Cash 2,475,000 31 Income Summary 2,093,148 Interest Expense 2,093,148 2017 June 30 Interest Expense 2,084,148

Premium on Bonds Payable 390,852 Cash 2,475,000 Sept. 30 Interest Expense 27,000 Interest Payable 9,000 Notes Payable 61,342 Cash 97,342 Dec. 31 Interest Expense 7,773 Interest Payable 7,773 31 Interest Expense 2,084,148

Premium on Bonds Payable 390,852 Cash 2,475,000 31 Income Summary 4,203,069 Interest Expense 4,203,069 2018 June 30 Bonds Payable 55,000,000

Premium on Bonds Payable 6,253,632

Gain on Redemption of Bonds 4,603,632 Cash* 56,650,000 *$55,000,000 × 1.03 14-28

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes

Prob. 14–4B (Concluded) 2018 Sept. 30 Interest Expense 23,320 Interest Payable 7,773 Notes Payable 66,249 Cash 97,342 2. a. 2016: 2,093,148 b. 2017: 4,203,069 3.

Initial carrying amount of bonds…………………………………………… $62,817,040

Premium amortized on December 31, 2016……………………………… (390,852)

Premium amortized on June 30, 2017…………………………………… … (390,852)

Premium amortized on December 31, 2017……………………………… (390,852)

Carrying amount of bonds, December 31, 2017………………………… $61,644,484 14-29

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes Prob. 14–5B 1. 2016 July 1 Cash 42,309,236

Discount on Bonds Payable 3,690,764 Bonds Payable 46,000,000 2. a. 2016 Dec. 31 Interest Expense* 2,327,008

Discount on Bonds Payable 27,008 Cash 2,300,000 *$42,309,236 × 5.5% b. 2017 June 30 Interest Expense* 2,328,493

Discount on Bonds Payable 28,493 Cash 2,300,000

*($42,309,236 + $27,008) × 5.5% 3. $2,327,008 Prob. 14–6B 1. 2016 July 1 Cash 73,100,469

Premium on Bonds Payable 8,100,469 Bonds Payable 65,000,000 2. a. 2016 Dec. 31 Interest Expense* 3,655,023

Premium on Bonds Payable 244,977 Cash 3,900,000 *$73,100,469 × 5% b. 2017 June 30 Interest Expense* 3,642,775

Premium on Bonds Payable 257,225 Cash 3,900,000

*($73,100,469 – $244,977) × 5% 3. $3,655,023 14-30

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes CASES & PROJECTS CP 14–1

GE Capital’s action was legal but caused a great public relations stir at the time. Some quotes:

“A lot of people feel like they have been sorely used,” said one bond fund manager.

“There was nothing illegal about it, but it was nasty.”

The fund manager said that GE Capital’s decision to upsize its bond issue to $11

billion from $6 billion midway through the offering ordinarily wouldn’t have upset bondholders.

“But then to find out two days later that they had filed a $50 billion shelf?” he said.

“People buy GE because it’s like buying Treasuries, not because they want to get jerked around.”

GE Capital’s action was probably ethical, even though it caused some stir. In its own defense, it stated:

In a statement released late Thursday, GE Capital said “with the $11 billion bond

issuance of March 13, GE Capital exhausted its existing debt shelf registration;

consequently, on March 20, GE Capital filed a $50 billion shelf registration.”

The release said the shelf filing was not an offering and that it would be used in

part to roll over $31 billion in maturing long-term debt.

In retrospect, GE Capital could have been a little more forthcoming about its

financing plans prior to selling the $11 billion of bonds, but there was nothing

unethical or illegal about its disclosures.

Source: “GE Capital Timing on $50B Shelf Filing Added to Backlash,” Dow Jones Capital

Markets Report , March 22, 2002, Copyright (c) 2002, Dow Jones & Company, Inc. CP 14–2

Without the consent of the bondholders, Bob’s use of the sinking fund cash to

temporarily alleviate the shortage of funds would violate the bond indenture contract

and the trust of the bondholders. It would therefore be unprofessional. In addition,

the use of Bob’s brother-in-law as trustee of the sinking fund is a potential conflict

of interest that could be considered unprofessional. 14-31

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes CP 14–3

Receive $100,000,000 today:

Present value of $100,000,000 today = $100,000,000

Receive $25,000,000 today, plus $9,000,000 per year for 8 years:

Present value of $25,000,000 today = $25,000,000

Present value of annual payments = $9,000,000 × 5.97130 (Present value of an

annuity of $1 for 8 periods at 7%) = $53,741,700

Total value = Present value of $25,000,000 + Present value of annual payments

Total value = $25,000,000 + $53,741,700 = $78,741,700

Receive $15,000,000 per year for 10 years:

Present value of annual payments = $15,000,000 × 7.02358 (Present value of an

annuity of $1 for 10 periods at 7%) = $105,353,700

The option that has the highest value in terms of present value is to receive

$15,000,000 a year for 10 years. CP 14–4

The primary advantage of issuing preferred stock rather than bonds is that the

preferred stock does not obligate Xentec to pay dividends, while interest on

bonds must be paid. The issuance of bonds will require annual interest payments,

necessitating a periodic (probably semiannual) cash outflow. Given Sweeping

Bluff Golf Course’s volatility of operating cash flows, the required interest

payments might strain Xentec’s liquidity. In the extreme, this could even lead to a bankruptcy of Xentec.

The issuance of bonds has the advantage of providing a tax deduction for interest

expense. This would tend to reduce the net (after-tax) cost of the bonds. Probably

the safest alternative is for Xentec to issue preferred stock. Of course, another

alternative might be to issue a combination of preferred stock and bonds. 14-32

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes CP 14–5 1. Plan 1 Plan 2

Shares of common stock………………………………… 400,000 950,000

Earnings before bond interest and income tax……… $5,000,000 $5,000,000

Deduct interest on bonds………………………………… 2,080,000 1,200,000

Income before income tax………………………………… $2,920,000 $3,800,000

Deduct income tax………………………………………… 1,168,000 1,520,000

Net income…………………………………………………… $1,752,000 $2,280,000

Earnings per share on common stock………………… $ 4.38* $ 2.40** * $1,752,000 ÷ 400,000

** $2,280,000 ÷ 950,000 2. a.

Factors to be considered in addition to earnings per share: 1.

There is a definite legal obligation to pay interest on bonds, but there is

no definite commitment to pay dividends on common stock. Therefore, if

net income should drop substantially, bonds would be less desirable than common stock. 2.

If the bonds are issued, there is a definite commitment to repay the

principal in 20 years. In case of liquidation, the claims of the bondholders

would rank ahead of the claims of the common stockholders. 3.

Present stockholders must purchase the new stock if they are to retain

their proportionate control and financial interest in the corporation. b.

Because the net income has been relatively stable in the past and anticipated

earnings under Plan 1 offer earnings per share of $4.38 for each share of

common stock, Plan 1 appears to be somewhat more advantageous for stockholders. 14-33

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 14 Long-Term Liabilities: Bonds and Notes CP 14–6 $173,751 + $1,459,141 1. Year 3: 9.4 = $173,751 $214,824 + $1,356,595 Year 2: 7.3 = $214,824 $237,025 + $1,155,894 Year 1: 5.9 = $237,025

2. The number of times interest charges are earned has increased from Year 1 to Year 3.

This was due to the company’s decreasing interest expense and increasing earnings during this period. 14-34

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.