Preview text:

REVIEW Chap 7: Inventories Merchandising Company Manufacturing Company Inventory • Raw materials • Work in process • Finished goods

➔ Merchandising companies report all under Current Assets

1. Control over Inventory

a) Safeguarding from damage or theft → Keep inventory quantities at proper levels

b) Reporting in financial statements Perpetual Periodic

- Detailed cost of goods purchase & sale

- Not detailed inventory on hand

- Record continuously: COGS & on hand

- Take physical inventory → on hand → COGS

- Record each time a sale occurs

- Record at the end of accounting period

- Taking physical inventory (counting, weighing, measuring on hand) is taken when the

business is closed or slow and at the end of the accounting period.

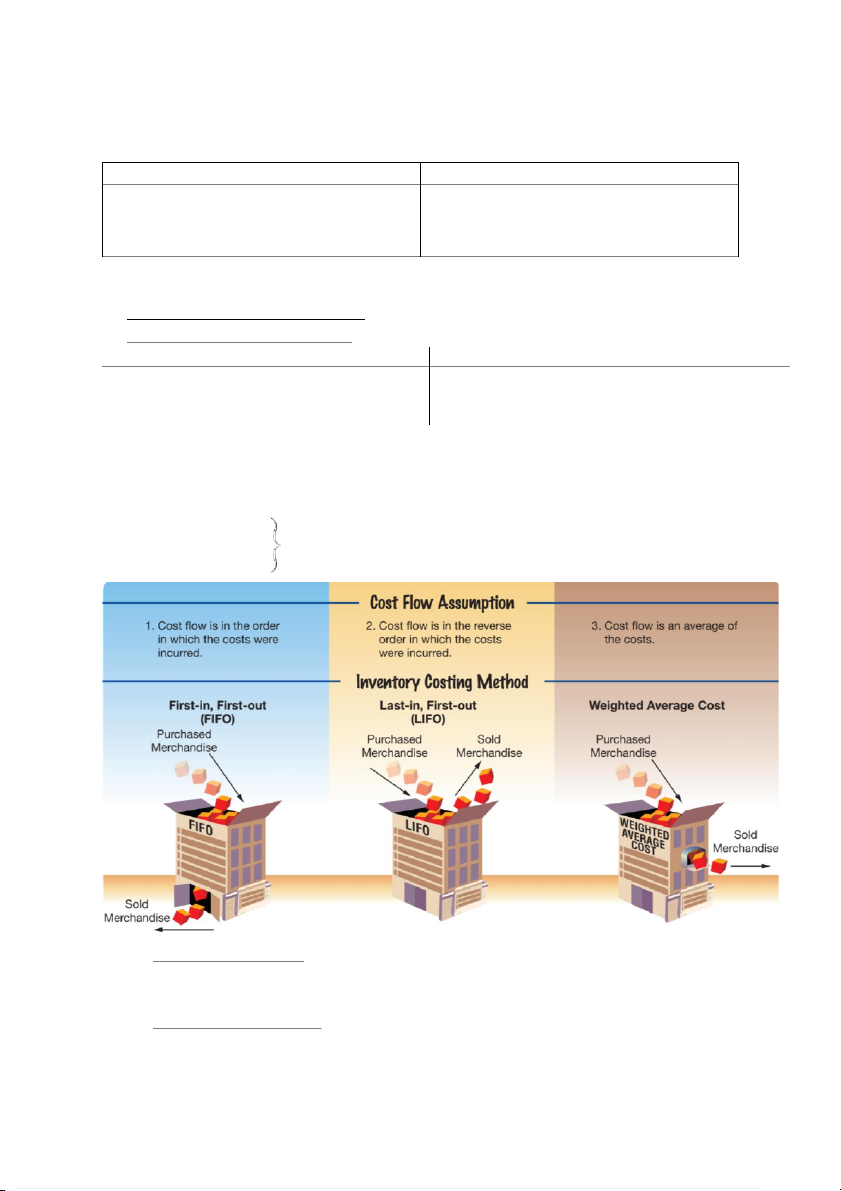

2. Inventory Costing - Specific identification - FIFO - LIFO Cost Flow Assumptions - Average-cost a) Specific Identification

- Unit sold: based on specific purchase

- Unit on hand: based on the real remaining b) First-in, First-out (FIFO)

- Unit sold: first purchase → sold first

- Unit on hand: based on the last purchases c) Last-in, First-out (LIFO)

- Unit sold: last purchase → sold first

- Unit on hand: based on the first purchases d) Average-cost

- Unit sold: cost is average of purchase costs

- Unit on hand: cost is average of purchase costs

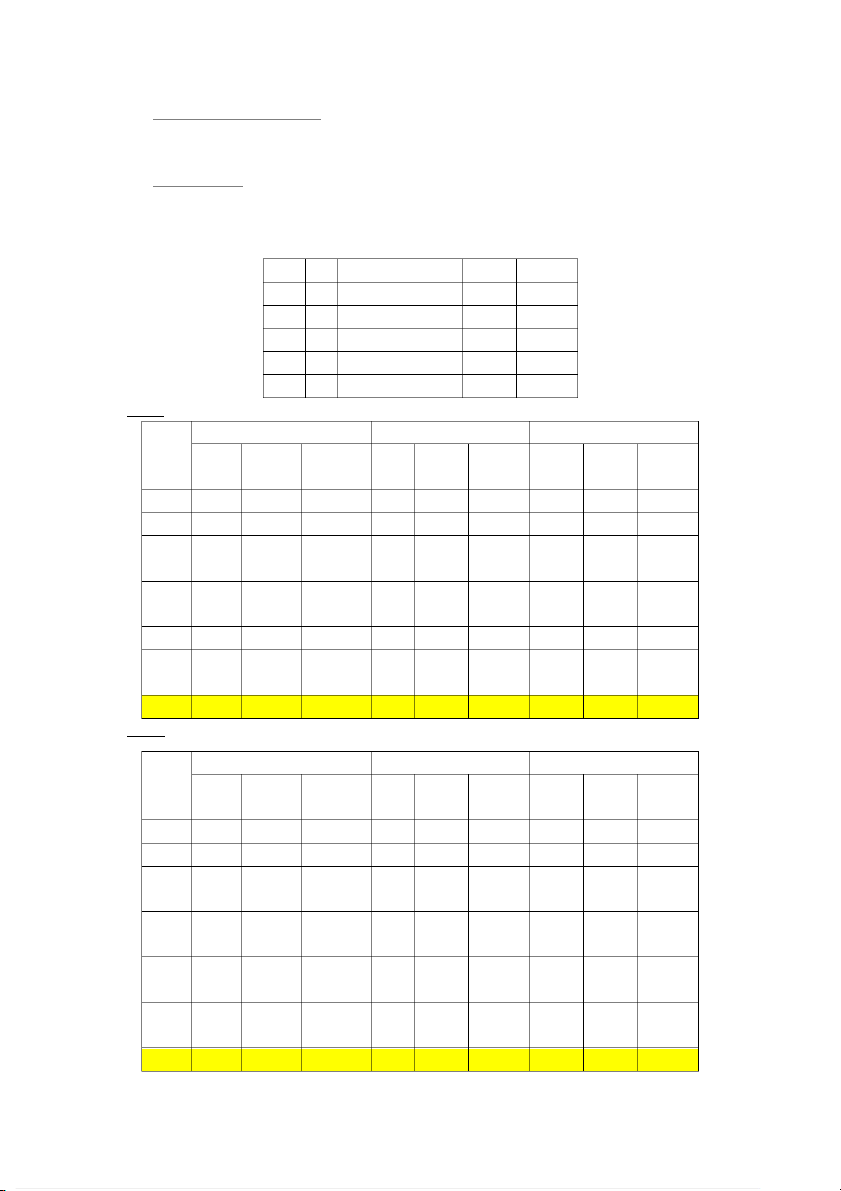

3. Perpetual Inventory System Jan. 1 Inventory 1,000 $20.00 4 Sale at $30/unit 700 10 Purchase 500 22.40 22 Sale at $30/unit 360 28 Sale at $30/unit 240 30 Purchase 600 23.30 a) FIFO Purchases COGS Inventory Date Unit Total Unit Total Unit Total Q Q Q Cost Cost Cost Cost Cost Cost 1 1,000 20.00 20,000 4 700 20.00 14,000 300 20.00 6,000 10 500 22.40 11,200 300 20.00 6,000 500 22.40 11,200 22 300 20.00 6,000 60 22.40 1,344 440 22.40 9,856 28 240 22.40 5,376 200 22.40 4,480 30 600 23.30 13,980 200 22.40 4,480 600 23.30 13,980 31 Bal. 26,720 18,460 b) LIFO Purchases COGS Inventory Date Unit Total Unit Total Unit Total Q Q Q Cost Cost Cost Cost Cost Cost 1 1,000 20.00 20,000 4 700 20.00 14,000 300 20.00 6,000 10 500 22.40 11,200 300 20.00 6,000 500 22.40 11,200 22 360 22.40 8,064 300 20.00 6,000 140 22.40 3,136 28 140 22.40 3,136 200 20.00 4,000 100 20.00 2,000 30 600 23.30 13,980 200 20.00 4,000 600 23.30 13,980 31 Bal. 27,200 17,980 c) Average-cost Purchases COGS Inventory Date Unit Total Unit Total Unit Total Q Q Q Cost Cost Cost Cost Cost Cost 1 1,000 20.00 20,000 4 700 20.00 14,000 300 20.00 6,000 10 500 22.40 11,200 800 21.50 17,200 22 360 21.50 7,740 440 21.50 9,460 28 240 21.50 5,160 200 21.50 4,300 30 600 23.30 13,980 800 22.85 18,280 31 Bal. 26,900 800 22.85 18,280 d) Journal FIFO LIFO Average-cost 4 A/R 21,000 21,000 21,000 Sales 21,000 21,000 21,000 4 COGS 14,000 14,000 14,000 M/I 14,000 14,000 14,000 10 M/I 11,200 11,200 11,200 A/P 11,200 11,200 11,200 22 A/R 10,800 10,800 10,800 Sales 10,800 10,800 10,800 22 COGS 7,344 8,064 7,740 M/I 7,344 8,064 7,740 28 A/R 7,200 7,200 7,200 Sales 7,200 7,200 7,200 28 COGS 5,376 5,136 5,160 M/I 5,376 5,136 5,160 30 M/I 13,980 13,980 13,980 A/P 13,980 13,980 13,980

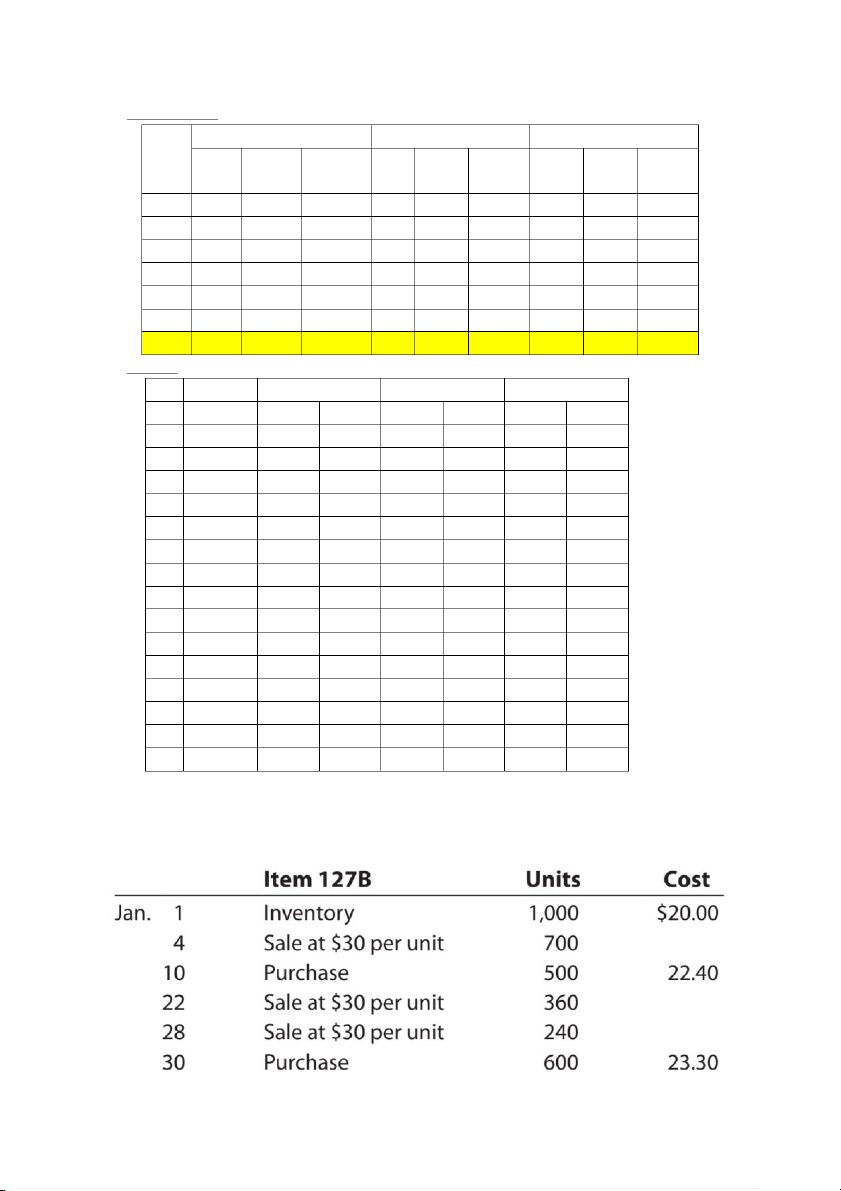

4. Periodic Inventory System

- Only rev. is recorded each time a sale is made

- At the end of the accounting period, a physical inventory is taken to determine the cost

of the ending inventory & COGS Prepare: 1 Inventory 1,000 units $20.00 $20,000 10 Purchase 500 units 22.40 11,200 30 Purchase 600 units 23.30 13,980 Available for sale 2,100 units $45,180 Sale 1,300 units a) FIFO Ending inventory 600 units 23.30 18,460 200 units 22.40 COGS = Available - Ending 26,270 b) LIFO Ending inventory 800 units 20.00 16,000 COGS = Available - Ending 29,180 c) Average-cost

𝑇𝑜𝑡𝑎𝑙 𝑐𝑜𝑠𝑡 𝑜𝑓 𝐴𝑣𝑎𝑖𝑙𝑎𝑏𝑙𝑒

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑈𝑛𝑖𝑡 𝐶𝑜𝑠𝑡 =

𝑈𝑛𝑖𝑡𝑠 𝐴𝑣𝑎𝑖𝑙𝑎𝑏𝑙𝑒 $45,180 = = $21.51/𝑢𝑛𝑖𝑡 2,100 𝑢𝑛𝑖𝑡𝑠 Ending inventory 800 units 21.51 17,208 COGS = Available - Ending 27,972 d) Comparing

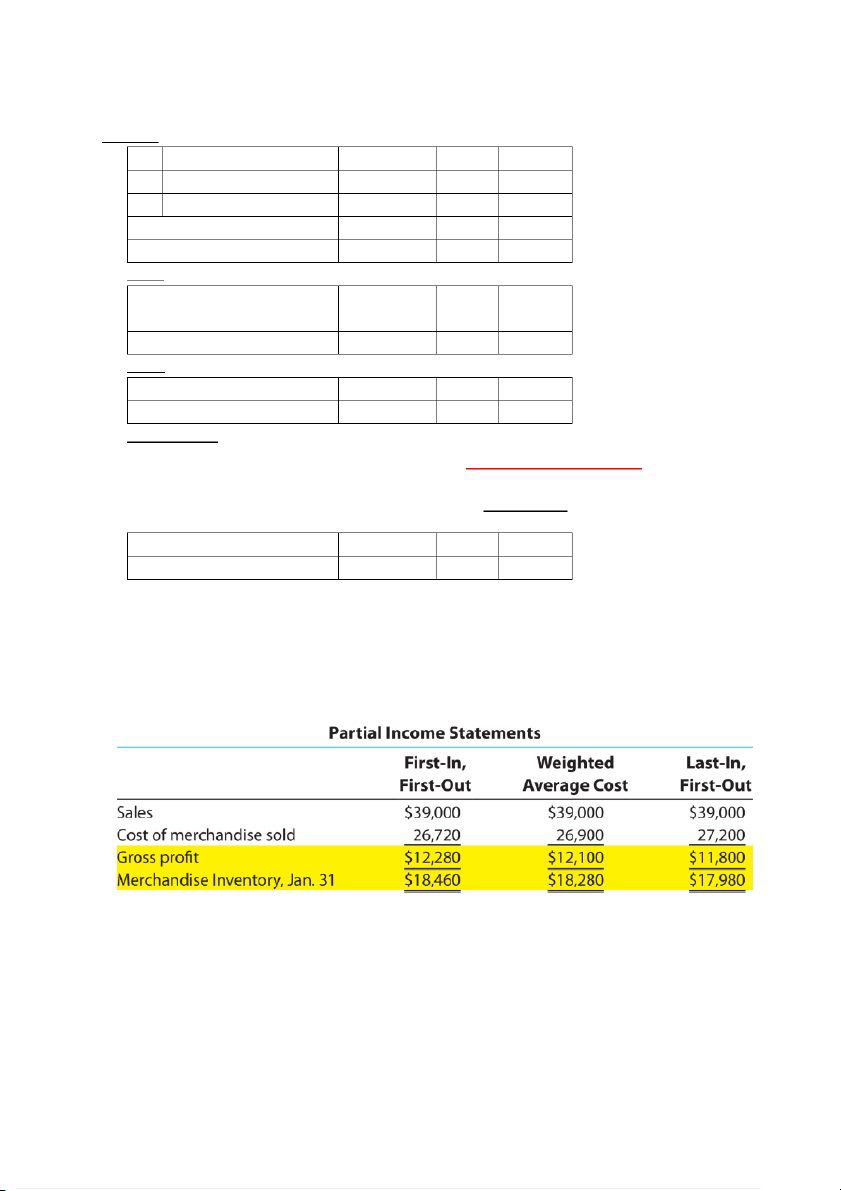

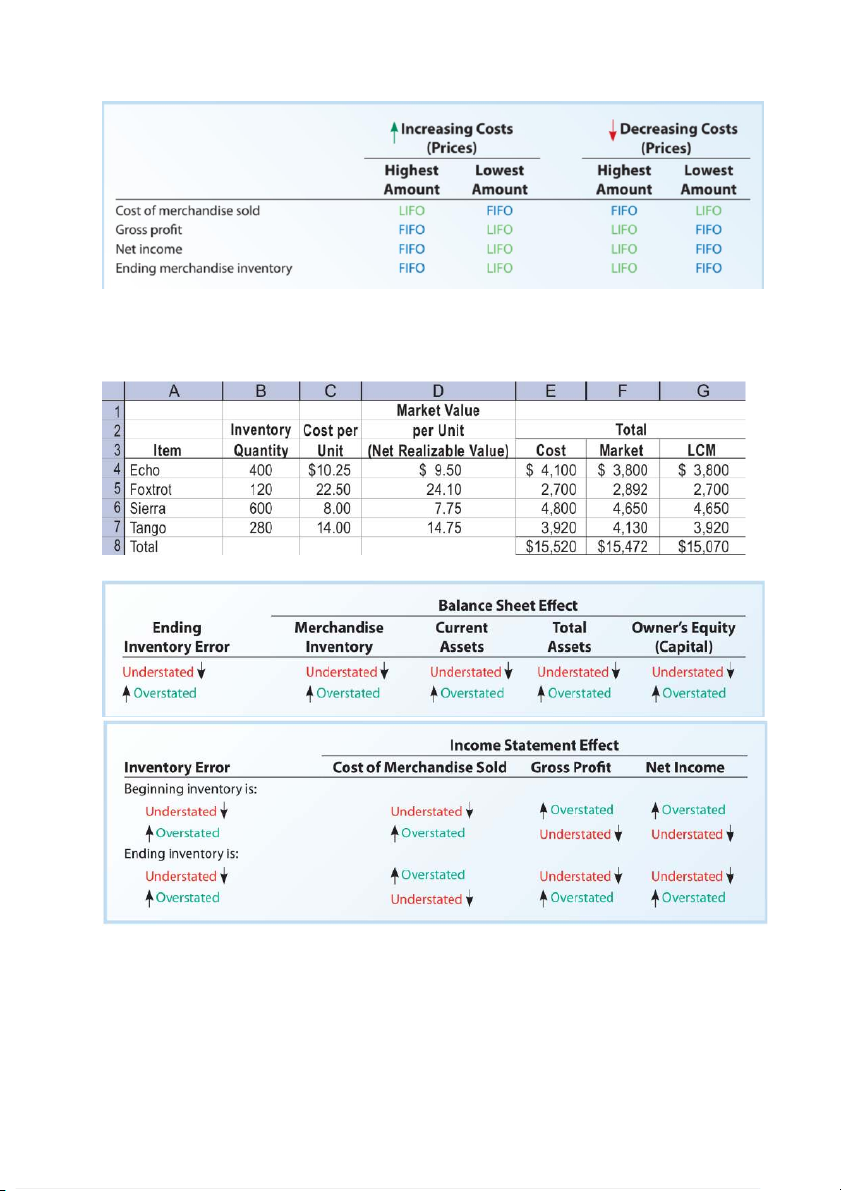

- Different method → different: o COGS o Gross profit o Net income o Ending inventory

e) Valuation at Lower of Cost or Market (LCM)

- When the market is lower than the purchase cost → value inventory

- Market value ~ Net realizable value: replacement cost

𝑁𝑒𝑡 𝑅𝑒𝑎𝑙𝑖𝑧𝑎𝑏𝑙𝑒 𝑉𝑎𝑙𝑢𝑒 = 𝐸𝑠𝑡𝑖𝑚𝑎𝑡𝑒𝑑 𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 − 𝐷𝑖𝑟𝑒𝑐𝑡 𝐶𝑜𝑠𝑡𝑠 𝑜𝑓 𝐷𝑖𝑠𝑝𝑜𝑠𝑎𝑙

f) Effect of Inventory Errors s:

- Recognizing → on account - Valuing - Disposing

1. Classification - Trade Receivables: o A/R: short period o N/R: credit period - Non-trade Receivables: 2. Valuing A/R

- Seller records losses resulting from extending credit as Bad Debts Expense

(uncollectible accounts exp. or doubtful accounts exp.)

- Method of accounting for uncollectible receivables:

o Direct write-off method: record only when an account is determined to be worthless

o Allowance method: record by estimating uncollectible accounts at the end of the accounting period

3. Direct Write-Off Method

Ex: on May 10, a $4,200 A/R from D.L.Ross has been determined to be uncollectible May 10 Bad Debt Exp. 4,200 A/R D – .L.Ross 4,200

Account written-off → collect later → record again to reverse the write-off entry → reinstate

Ex: on November 21, D.L.Ross account is collected Nov. 21 A/R D – .L.Ross 4,200 Bad Debt Exp. 4,200 21 Cash 4,200 A/R D – .L.Ross 4,200 4. Allowance Method

- Estimate → not know specific account → Allowance for Doubtful Accounts

- Allowance for Doubtful Accounts: contra asset account

Ex: Dec. 31 Estimate $30,000 of A/R will be uncollectible Dec. 31 Bad Debt Exp. 30,000

Allowance for Doubtful Accounts 30,000

5. Write-off for Allowance

- Adjusting entry → increase Allowance for Doubtful Accounts

- Writing off accounts → decrease Allowance for Doubtful Accounts Ex: Jan. 21

John’s account of $6,000 with Company E is written off Jan.

21 Allowance for Doubtful Accounts 6,000 A/R - John 6,000 Ex: June 10

Company E record the reinstatement June 10 A/R J – ohn 5,000

Allowance for Doubtful Accounts 5,000 10 Cash 5,000 A/R J – ohn 5,000 Ex: July 9

Received $1,200 from Jay and wrote off the remainder owed of $3,900 Oct. 11

Reinstated the account of Jay and received $3,900 cash in full payment July 9 Cash 1,200

Allowance for Doubtful Accounts 3,900 A/R - Jay 5,100 Oct. 11 A/R - Jay 3,900

Allowance for Doubtful Accounts 3,900 11 Cash 3,900 A/R - Jay 3,900

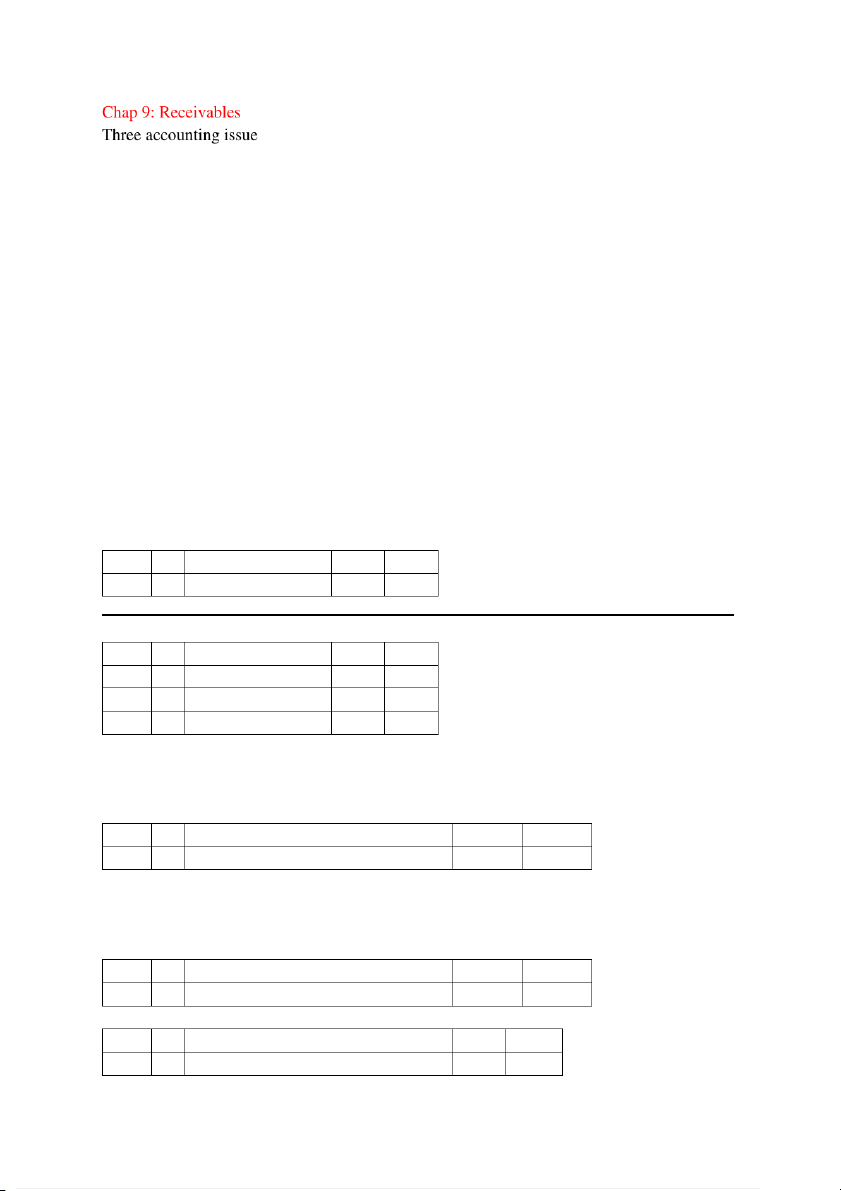

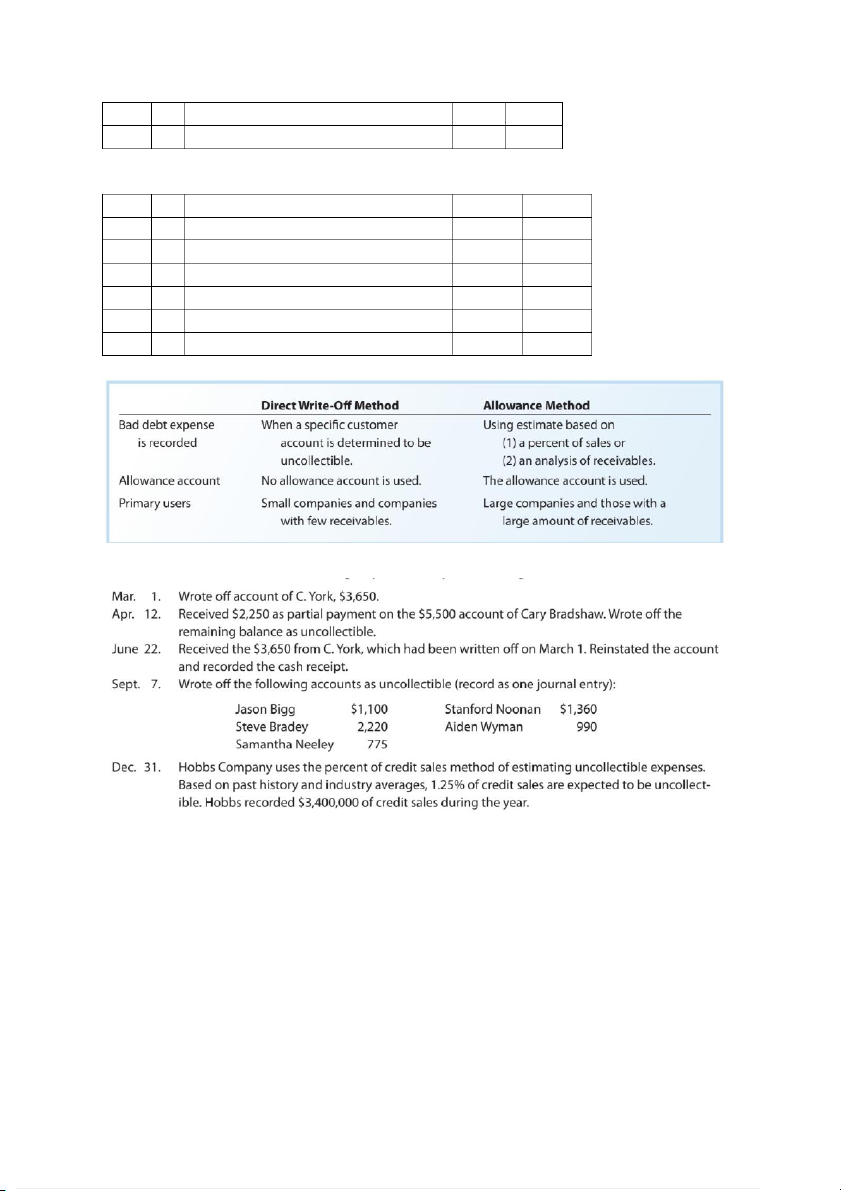

6. Comparing Direct Write-off & Allowance Method Ex:

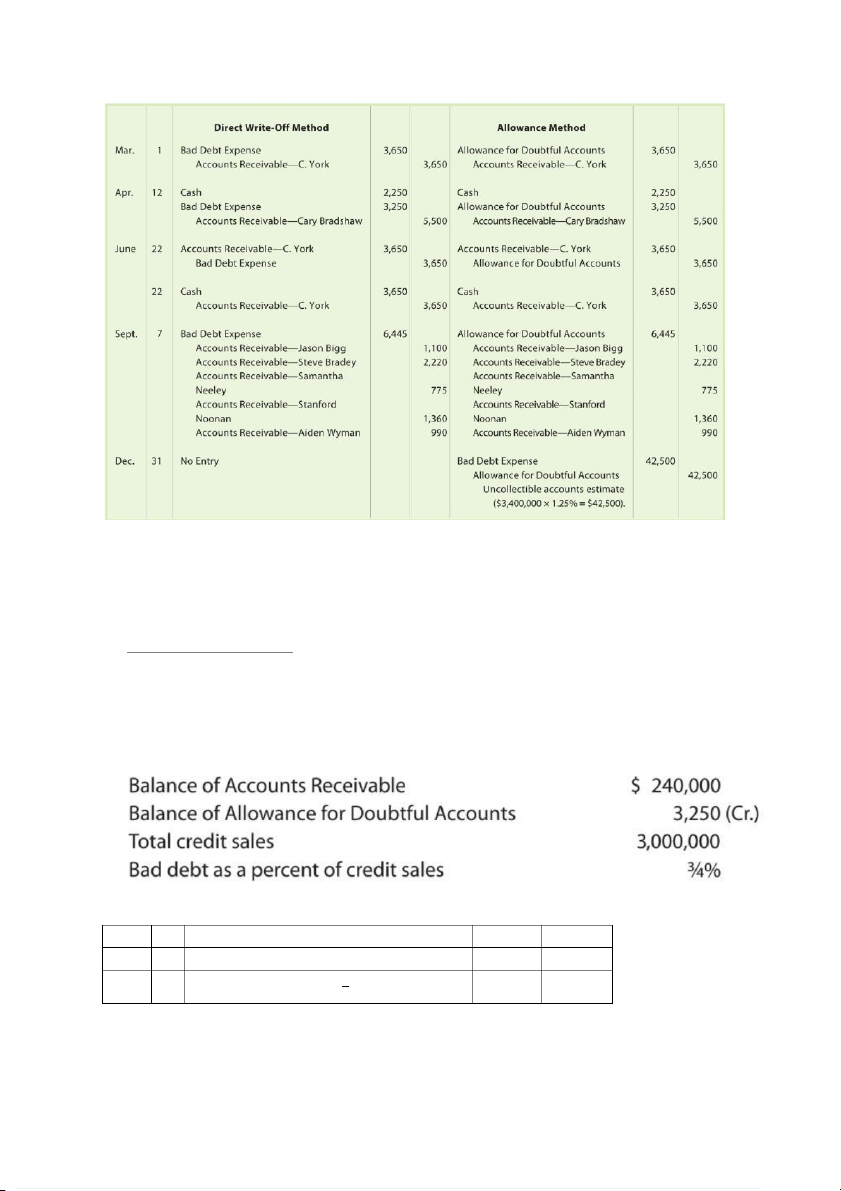

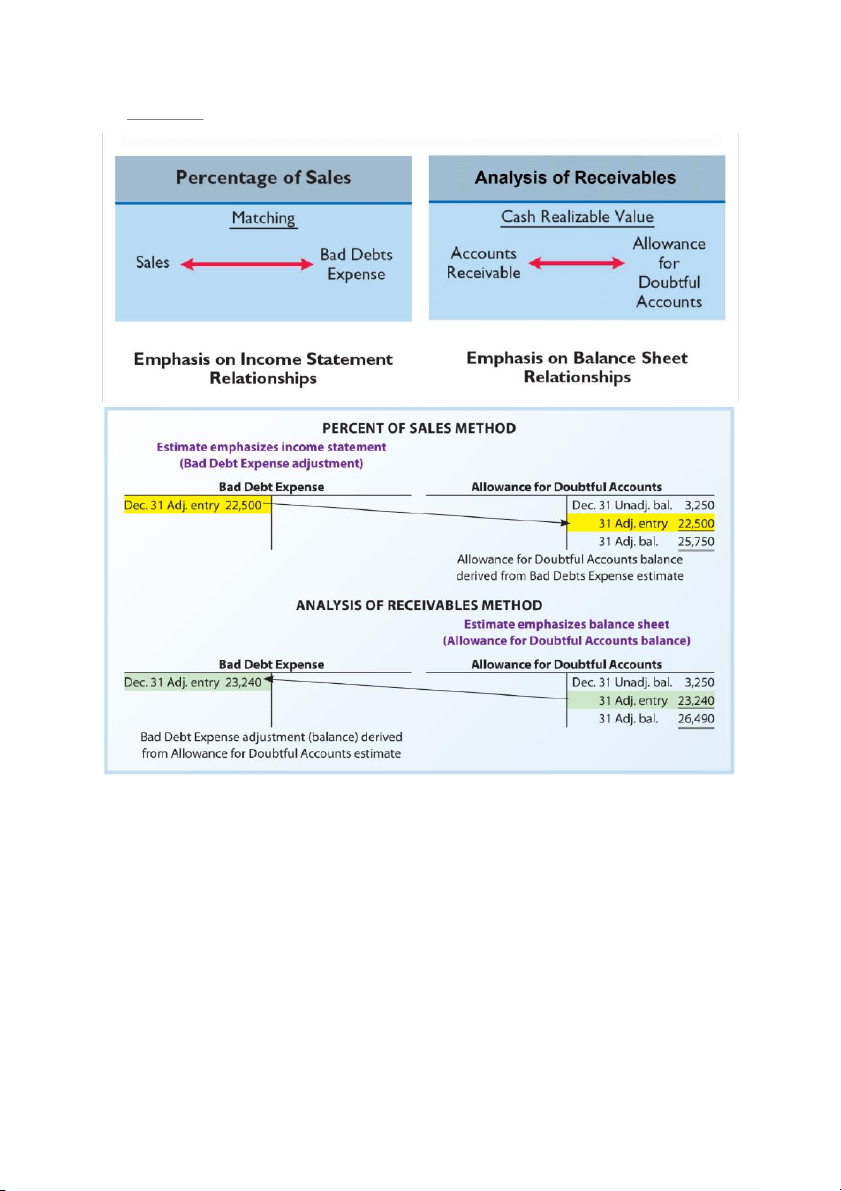

7. Estimating the Allowance

- Based on past experience, industry averages, and forecast of the future - 2 methods: o Percent of sales o Analysis of receivables a) Percent of Sales Method

- The amount of the adjusting entry is the amount estimated for Bad Debt Expense

- Estimate as a percent of credit sales

𝐵𝑎𝑑 𝐷𝑒𝑏𝑡 𝐸𝑥𝑝𝑒𝑛𝑠𝑒 = 𝐶𝑟𝑒𝑑𝑖𝑡 𝑆𝑎𝑙𝑒𝑠 × 𝐵𝑎𝑑 𝐷𝑒𝑏𝑡 𝑎𝑠 𝑎 𝑃𝑒𝑟𝑐𝑒𝑛𝑡 𝑜𝑓 𝐶𝑟𝑒𝑑𝑖𝑡 𝑆𝑎𝑙𝑒𝑠 Ex: Dec. 31 Bad Debt Exp. 22,500

Allowance for Doubtful Accounts 22,500 ($3,00 , 0 000 × 3 % = $22,500) 4

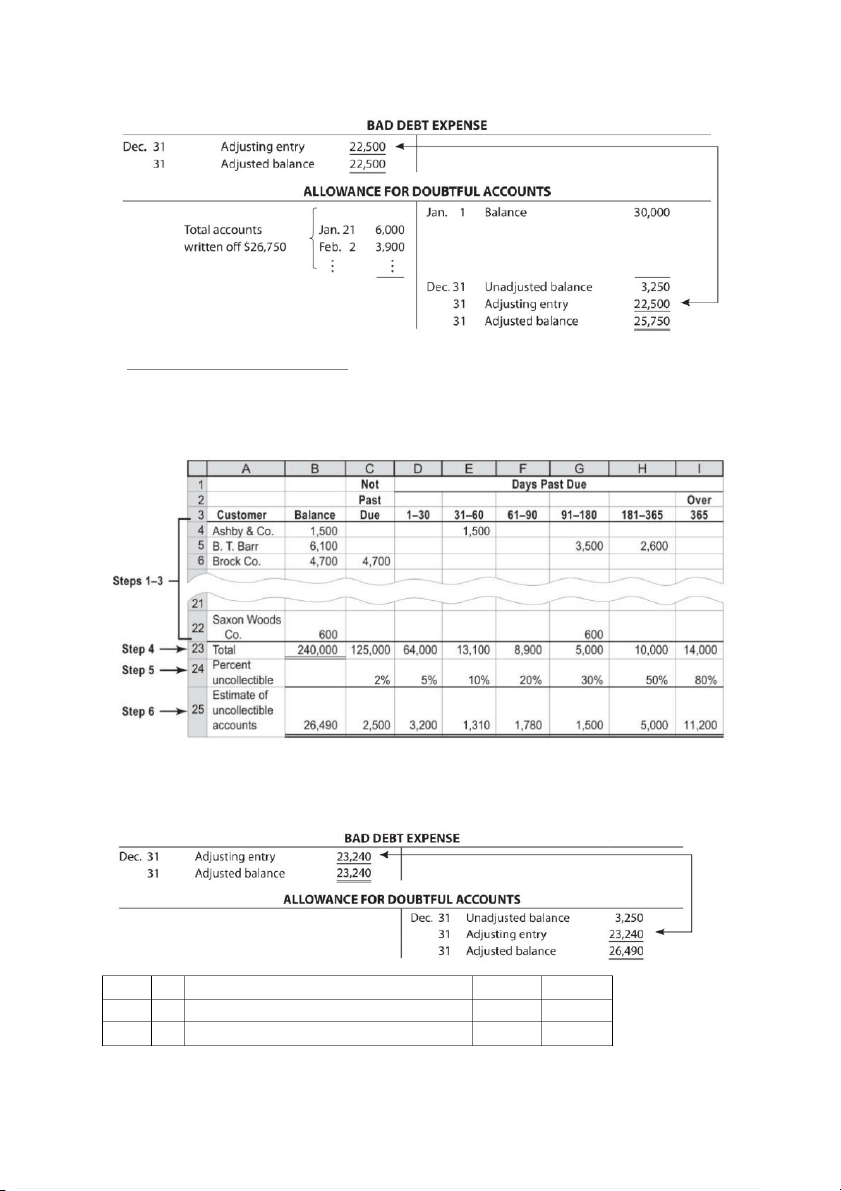

b) Analysis of Receivables Method

- The longer A/R is outstanding, the less likely it will be collected - Aging the receivables:

Ex: E Co. sold merchandise to Saxon Co. on August 29 with terms 2/10, n/30

- Sum of the estimated uncollectible accounts for each aged classes is the estimated

uncollectible accounts on Dec. 31 → the desired adjusted balance for Allowance for Doubtful Accounts Dec. 31 Bad Debt Exp. 23,240

Allowance for Doubtful Accounts 23,240 ($26,490 − $3,250) c) Comparing

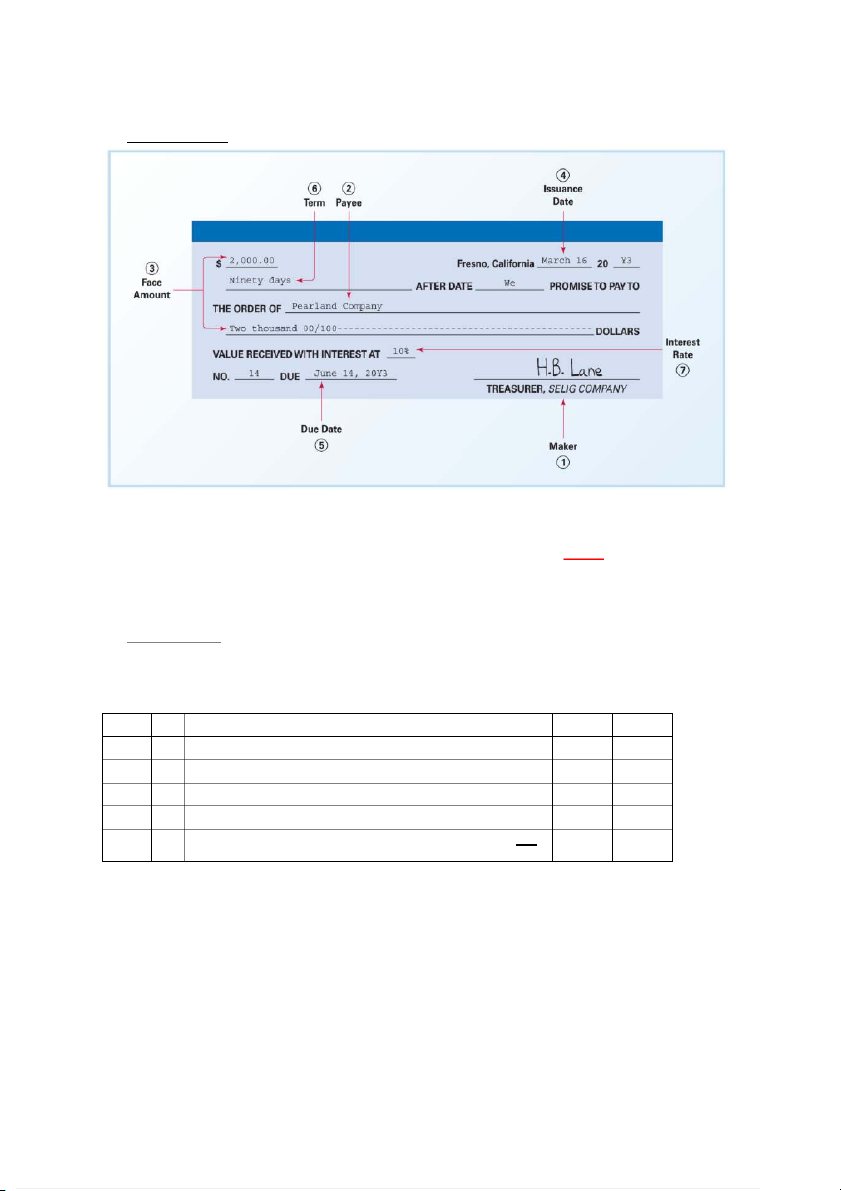

8. Notes Receivables a) Characteristics

- Interest Rate (annual/yearly): the rate must be paid on the face amount for the term of the note 𝑇𝑒𝑟𝑚

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 = 𝐹𝑎𝑐𝑒 𝐴𝑚𝑜𝑢𝑛𝑡 × 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑅𝑎𝑡𝑒 × 360

- Maturity Value: the amount must be paid at the due date

𝑀𝑎𝑡𝑢𝑟𝑖𝑡𝑦 𝑉𝑎𝑙𝑢𝑒 = 𝐹𝑎𝑐𝑒 𝐴𝑚𝑜𝑢𝑛𝑡 + 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 b) Honor of N/R

- Maker pays full at maturity date

Ex: Nov. 21 Receive a $6,000, 12%, 30-day note in settlement of the account of W Co. Dec. 21 Record the receipt of $6,060 Nov. 21 N/R W – Co. 6,000 A/R W – Co. 6,000 Dec. 21 Cash 6,060 N/R W – Co. 6,000 Interest Rev. 60 ($6,060 = $6,000 + $ ( 6,000 × 12% × 30 ) 360 c) Dishonor of N/R - Not paid full at maturity

- Company has earned the interest, even though the note is dishonored Ex: Dec. 21 Note is dishonored Dec. 21 A/R W – Co. 6,060 N/R W – Co. 6,000 Interest Rev. 60 Ex: Dec. 1

Craw Co. issues a $4,000, 90-day, 12% note to settle its A/R Dec. 1 N/R C – raw Co. 4,000 A/R C – raw Co. 4,000 31 Interest Receivable 40 Interest Rev. 40

Accrued interest ($4,000 × 12% × 30 ) 360 Mar. 1 Cash 4,120 N/R C – raw Co. 4,000 Interest Receivable 40 Interest Rev. 80

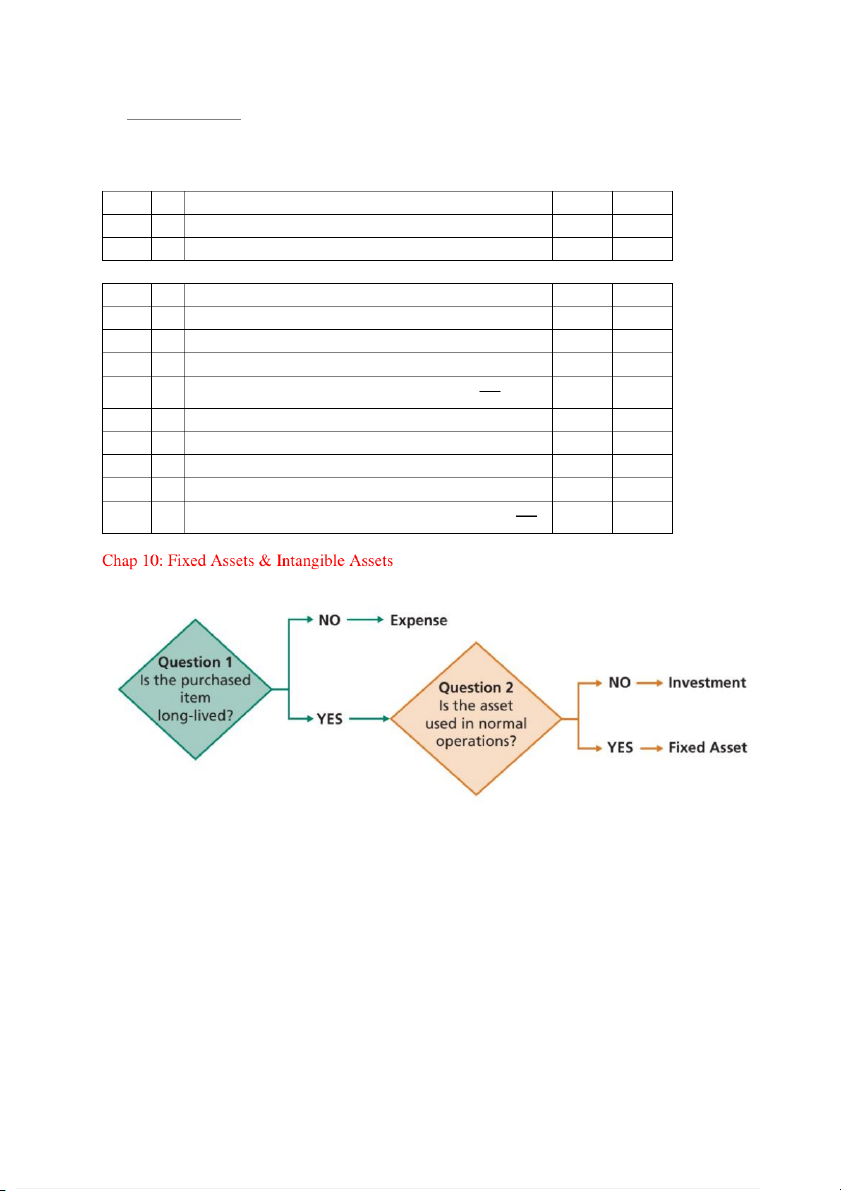

Total interest of $120 ($4,000 × 12% × 90 ) 360 1. Classifying - Fixed Assets:

o Includes physical & intangible o Used in normal operations

o Not offered for sale as part of normal operations

o Last more than 1 year (long-lived) - Investments: o Long-lived

o Not used in normal operations o Held for future resale

2. Cost of Fixed Assets

- Only cost necessary for preparing the fixed asset for use → record as the cost of asset

- Unnecessary costs not increase the asset’s usefulness → record as expense

Ex: Purchase equipment for $12,000. Freight costs of $600

Installation costs of $1,500, including $500 due to an error in installation Equipment 13,600 Cash 13,600

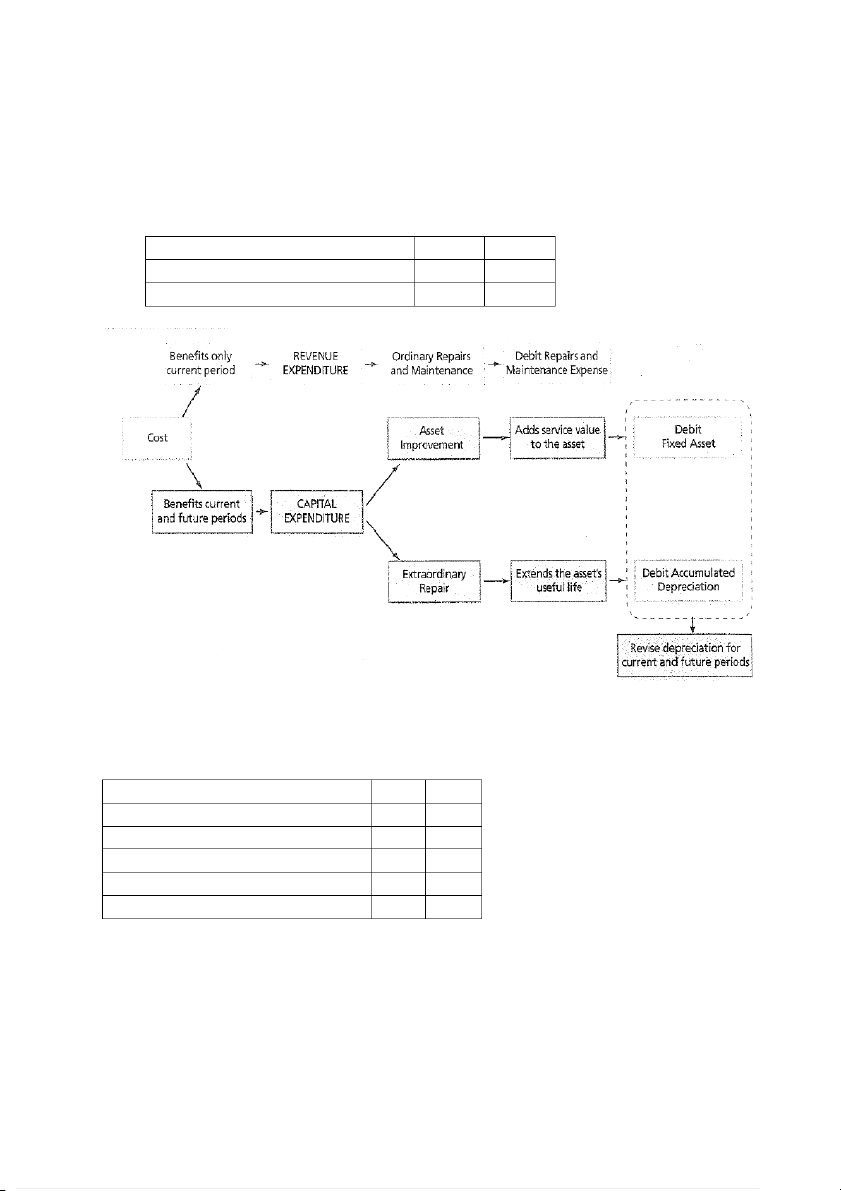

($12,000 + $600 + $1,500 - $500) 3. Expenditures

Ex: $300 paid for a tune-up of a delivery truck

Add a $5,500 hydraulic lift to allow for easier and quicker loading of cargo

The engine of a forklift that is near the end of its useful life may be overhauled at a cost of $4,500 Repairs and Maintenance Exp. 300 Cash 300 Delivery Truck 5,500 Cash 5,500 Accumulated Depreciation F – orklift 4,500 Cash 4,500 4. Depreciation - Factors in computing:

o Initial cost = Purchase price + All costs to obtain & ready for use

o Expected useful life: the estimated length of time the asset be used

o Estimated residual/salvage value: the estimated value of the asset at the end of its useful life

o Depreciable cost: the difference between initial cost & residual cost

5. Depreciation Methods

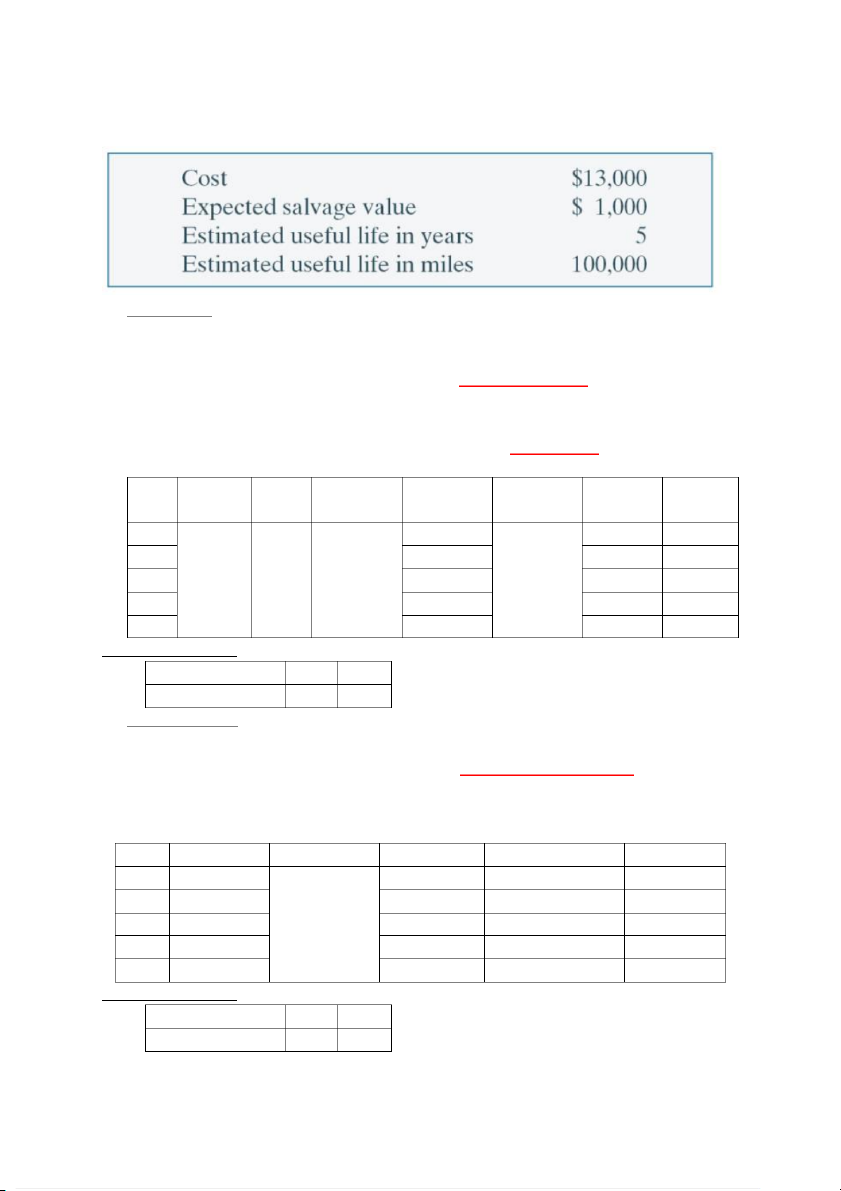

Ex: Barb purchased a small delivery truck on Jan. 1, 2015 a) Straight-line

- Depreciation Exp. is the same for each year

𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑏𝑙𝑒 𝐶𝑜𝑠𝑡 = 𝐶𝑜𝑠𝑡 − 𝑆𝑎𝑙𝑣𝑎𝑔𝑒/𝑅𝑒𝑠𝑖𝑑𝑢𝑎𝑙 𝑉𝑎𝑙𝑢𝑒

𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑏𝑙𝑒 𝐶𝑜𝑠𝑡

𝐴𝑛𝑛𝑢𝑎𝑙 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 =

𝑈𝑠𝑒𝑓𝑢𝑙 𝐿𝑖𝑓𝑒

𝐵𝑜𝑜𝑘 𝑉𝑎𝑙𝑢𝑒 = 𝐹𝑖𝑥𝑒𝑑 𝐴𝑠𝑠𝑒𝑡 𝐴𝑐𝑐𝑜𝑢𝑛𝑡 − 𝐴𝑐𝑐𝑢𝑚𝑢𝑙𝑎𝑡𝑒𝑑 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 100%

𝐴𝑛𝑛𝑢𝑎𝑙 𝑅𝑎𝑡𝑒 𝑜𝑓 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 =

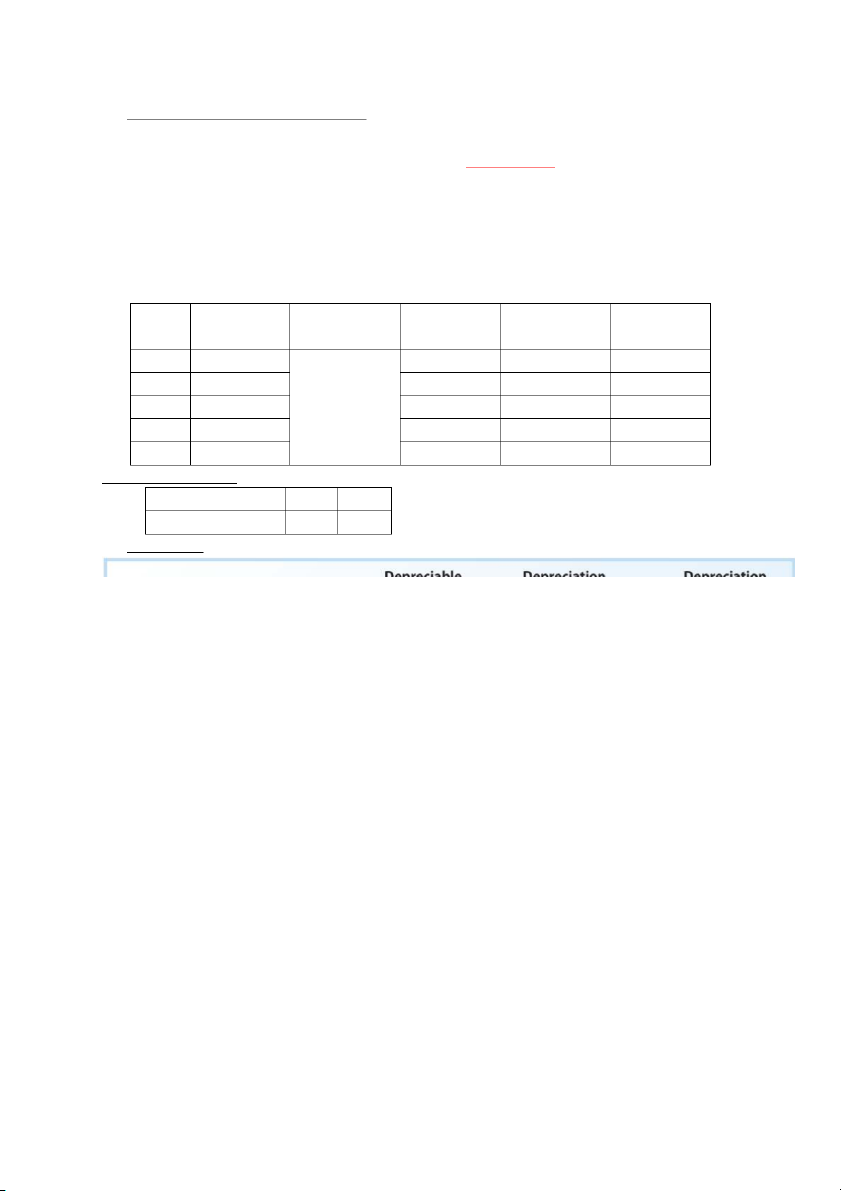

𝑈𝑠𝑒𝑓𝑢𝑙 𝐿𝑖𝑓𝑒 Dep. Annual Partial Current Accum. Book Year Rate Cost Exp. Year Year Exp. Dep. Value 2015 5 $2,400 $10,600 2016 4 4,800 8,200 2017 $12,000 20% $2,400 3 $2,400 7,200 5,800 2018 2 9,600 3,400 2019 1 12,000 1,000 2015 Journal Entry: Depreciation Exp. 2,400 Accum. Dep. 2,400 b) Unit-of-Activity

- Step 1: Determine the depreciation per unit

𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑏𝑙𝑒 𝐶𝑜𝑠𝑡

𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 𝐶𝑜𝑠𝑡 𝑝𝑒𝑟 𝑈𝑛𝑖𝑡 =

𝑇𝑜𝑡𝑎𝑙 𝑈𝑛𝑖𝑡𝑠 𝑜𝑓 𝐴𝑐𝑡𝑖𝑣𝑖𝑡𝑦

- Step 2: Compute the depreciation expense

𝐴𝑛𝑛𝑢𝑎𝑙 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 𝐸𝑥𝑝𝑒𝑛𝑠𝑒 = 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 𝐶𝑜𝑠𝑡 𝑝𝑒𝑟 𝑈𝑛𝑖𝑡 × 𝑈𝑛𝑖𝑡𝑠 𝑜𝑓 𝐴𝑐𝑡𝑖𝑣𝑖𝑡𝑦 Year Miles Used Cost per Unit Annual Exp. Accum. Dep. Book Value 2015 15,000 1,800 1,800 11,200 2016 30,000 3,600 5,400 7,600 2017 20,000 0.12 2,400 7,800 5,200 2018 25,000 3,000 10,800 2,200 2019 10,000 1,200 12,000 1,000 2015 Journal Entry: Depreciation Exp. 1,800 Accum. Dep. 1,800

c) Double-Declining-Balance Method

- Step 1: Determine the straight-line rate 100%

𝑆𝑡𝑟𝑎𝑖𝑔ℎ𝑡 − 𝐿𝑖𝑛𝑒 𝑅𝑎𝑡𝑒 =

𝑈𝑠𝑒𝑓𝑢𝑙 𝐿𝑖𝑓𝑒

- Step 2: Determine the double-declining-balance rate

𝐷𝑜𝑢𝑏𝑙𝑒 − 𝐷𝑒𝑐𝑙𝑖𝑛𝑖𝑛𝑔 − 𝐵𝑎𝑙𝑎𝑛𝑐𝑒 𝑅𝑎𝑡𝑒 = 𝑆𝑡𝑟𝑎𝑖𝑔ℎ𝑡 − 𝐿𝑖𝑛𝑒 𝑅𝑎𝑡𝑒 × 2

- Step 3: Determine the depreciation expense

𝐴𝑛𝑛𝑢𝑎𝑙 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 𝐸𝑥𝑝𝑒𝑛𝑠𝑒

= 𝐷𝑒𝑐𝑙𝑖𝑛𝑖𝑛𝑔 − 𝐵𝑎𝑙𝑎𝑛𝑐𝑒 𝑅𝑎𝑡𝑒 × 𝐵𝑜𝑜𝑘 𝑉𝑎𝑙𝑢𝑒 𝑎𝑡 𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 𝑜𝑓 𝑌𝑒𝑎𝑟 Beginning Declining Year

Annual Exp. Accum. Dep. Book Value Book value Balance Rate 2015 13,000.00 5,200.00 5,200.00 7,800.00 2016 7,800.00 3,120.00 8,320.00 4,680.00 2017 4,680.00 40% 1,872.00 10,192.00 2,808.00 2018 2,808.00 1,123.20 11,315.20 1,684.80 2019 1,684.80 673.92 11,989.12 1,010.88 2015 Journal Entry: Depreciation Exp. 5,200 Accum. Dep. 5,200 d) Comparing

6. Depreciation for Income Tax

- Internal Revenue Service (IRS) does not require to use the same method on the tax

return that is used in preparing financial statements.

- IRS requires straight-line method or accelerated-depreciation method, called Modified

Accelerated Cost Recovery System (MACRS). - MASCRS has:

o 5-year class: automobiles & light-duty trucks

o 7-year class: most machinery & equipment

- Using MACRS, residual value is ignored.

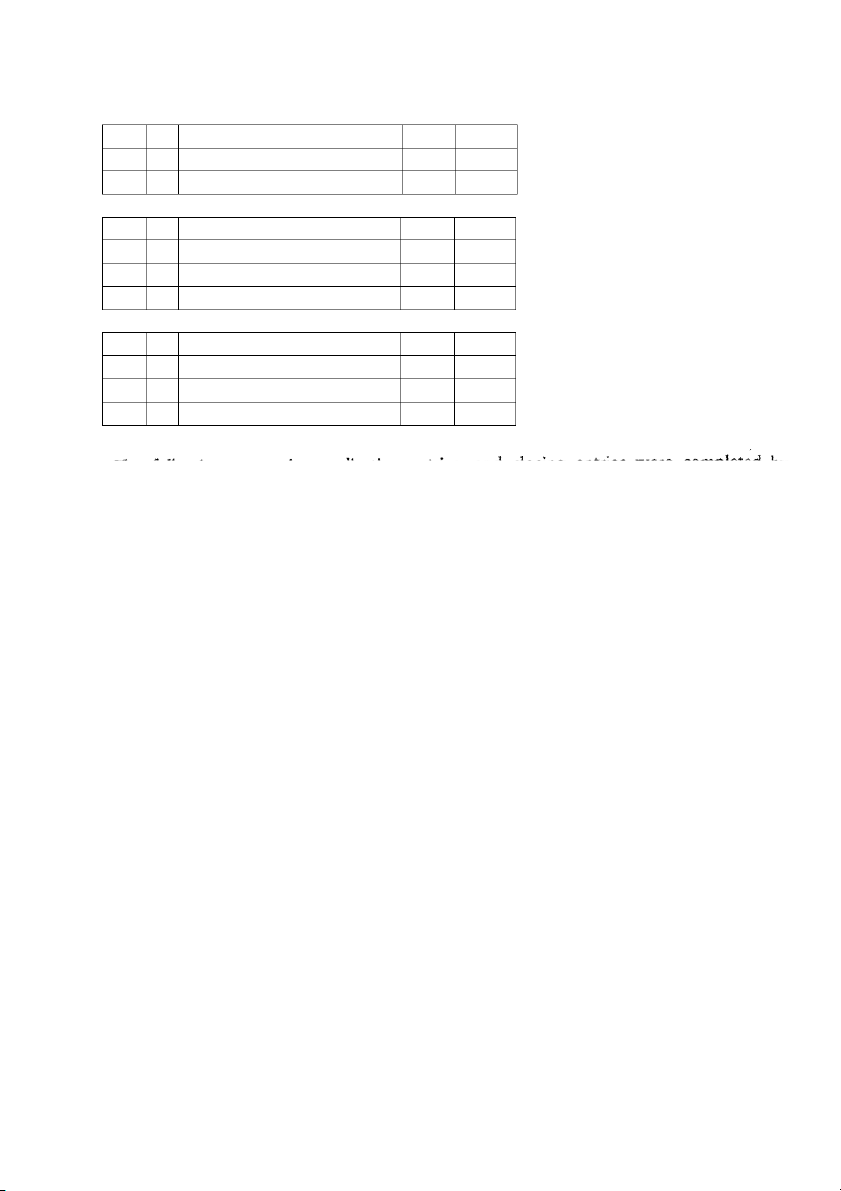

7. Disposals of Fixed Assets - In 3 ways:

o Retirement: be scrapped or discarded

o Sale: be sold to another party

o Exchange: be traded for new one

- MUST record depreciation up to the date of disposal

- Debit Accum. Dep. for the full amount of depreciation taken over the life

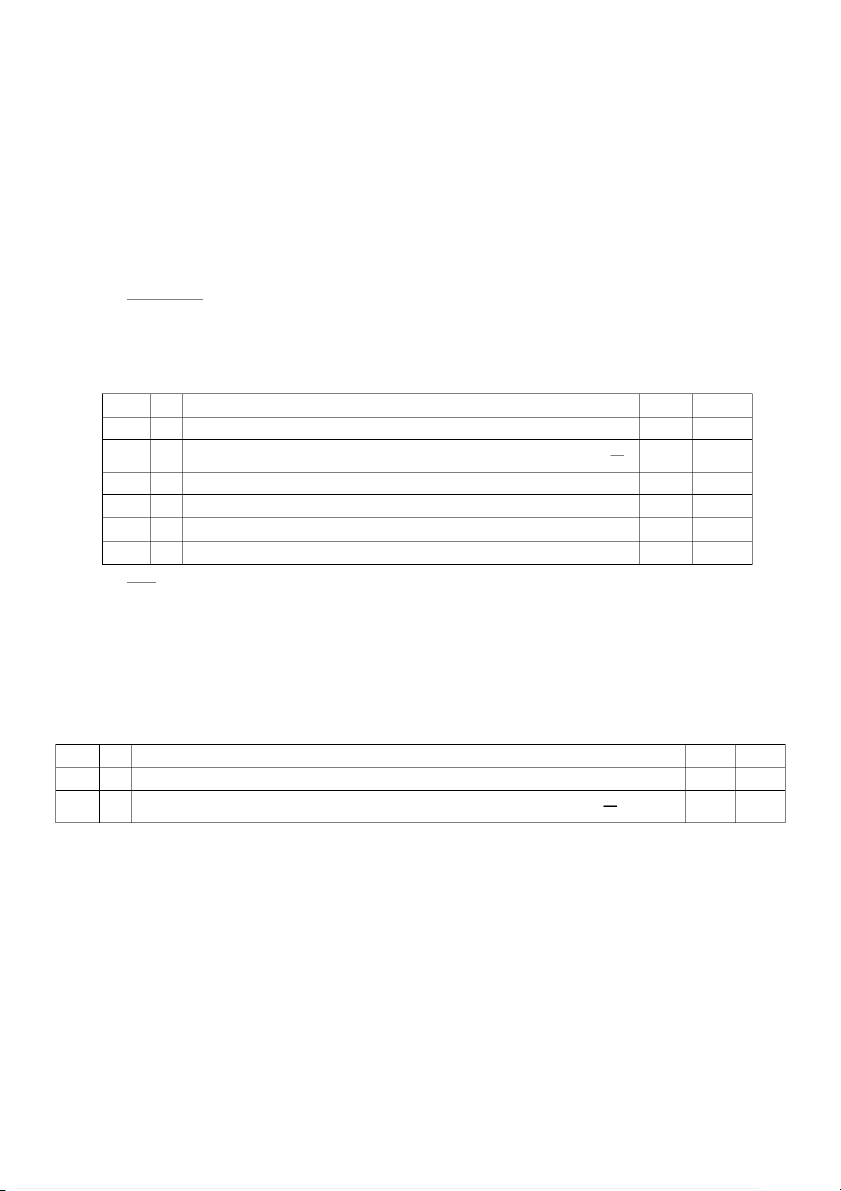

- Credit Asset Account for the original cost a) Retirement

Ex: Equipment costing $6,000 with no estimated residual value is depreciated at straight-line rate of 10%

Dec. 31 Accum. Dep. balance is $4,650 Mar. 24 Equipment is discarded

Mar. 24 Dep. Exp. – Equipment 150 Accum. Dep. E – quipment 150

To record current dep. on equipment discarded ($600 × 3 ) 12 24 Accum. Dep. E – quipment 4,800 Loss on Disposal of Equipment 1,200 Equipment 6,000

To write off equipment discarded b) Sale

- Compare book value with selling price:

o If selling price > book value → Gain on Sales

o If selling price < book value → Loss on Sales

Ex: Equipment costing $10,000 with no estimated residual value is depreciated at straight-line rate of 10% Dec. 31 Accum. Dep. balance is $7,000 Oct. 12

Equipment is sold for cash of the eight year of its use Oct. 12 Dep. Exp. E – quipment 750 Accum. Dep. E – quipment 750

To record current depreciation on equipment sold ($10,000 × 9 × 10%) 12 ➔ Book value = $2,250

Sold at book value, for $2,250 → No gain or loss Oct. 12 Cash 2,250 Accum. Dep. – Equipment 7,750 Equipment 10,000

Sold below book value, for $1,000 → Loss of $1,250 Oct. 12 Cash 1,000 Accum. Dep. – Equipment 7,750 Loss on Sale of Equipment 1,250 Equipment 10,000

Sold above book value, for $2,800 → Gain of $550 Oct. 12 Cash 2,800 Accum. Dep.- Equipment 7,750 Equipment 10,000 Gain on Sale of Equipment 550 8. Example

9. Natural Resources

- Cost of Natural Resources: price needed to acquire & prepare for intended use - Depletion:

o Accumulated Depletion is a contra-asset account

o Generally use units-of-activity method

- Step 1: Determine the depletion rate

𝐶𝑜𝑠𝑡 𝑜𝑓 𝑅𝑒𝑠𝑜𝑢𝑟𝑐𝑒

𝐷𝑒𝑝𝑙𝑒𝑡𝑖𝑜𝑛 𝑅𝑎𝑡𝑒 =

𝐸𝑠𝑡𝑖𝑚𝑎𝑡𝑒𝑑 𝑇𝑜𝑡𝑎𝑙 𝑈𝑛𝑖𝑡𝑠 𝑜𝑓 𝑅𝑒𝑠𝑜𝑢𝑟𝑐𝑒

- Step 2: Determine the depletion rate

𝐷𝑒𝑝𝑙𝑒𝑡𝑖𝑜𝑛 𝐸𝑥𝑝𝑒𝑛𝑠𝑒 = 𝐷𝑒𝑝𝑙𝑒𝑡𝑖𝑜𝑛 𝑅𝑎𝑡𝑒 × 𝑄𝑢𝑎𝑛𝑡𝑖𝑡𝑦 𝑅𝑒𝑚𝑜𝑣𝑒𝑑 Ex: Dec. 31 Depletion Exp. 36,000 Accum. Depl. 36,000

10. Intangible Assets - Credit asset account

- Limited-life intangibles → Amortization

- Indefinite-life intangibles → No amortization - Major issues: o Determine the initial cost o Determine the amortization t

– he amount of cost to transfer to expense

Ex: At the beginning of fiscal year, company acquires patent rights for $100,000

The remaining useful life is estimated as 5 years. Dec. 31 Amortization Exp. P – atents 20,000 Patents 20,000 ($100,000/5)

Ex: $250,000 of the goodwill created from the purchase of Electronic Systems is impaired

Dec. 31 Loss from Impaired Goodwill 250,000 Goodwill 250,000 Impaired goodwill