Preview text:

lOMoAR cPSD| 58605085

1. Firms in competitive market

- Many buyers and many sellers

- The goods offered for sale are largely the same. - Firms can freely enter or exit the market.

⇨ Buyers and sellers are PRICE TAKER

● MR, MC bằng ạo hàm của TR hoặc TC theo Q

- A competitive firm can keep increasing its output without affecting the market price.

- So, each one-unit increase in Q causes revenue to rise by P, i.e., MR = P.

- MR = P is only true for firms in competitive markets.

- If MR > MC, then increase Q to raise profit. If MR < MC, then reduce Q to raise profit. - MR =

MC at the profit-maximizing Q.

- Shutdown: A short-run decision not to produce anything because of market conditions. Firms will

shut down if revenue falls by TR, costs fall by VC => P < AVC

+ Sunk cost: a cost that has already been committed and cannot be recovered +

So, FC should not matter in the decision to shut down.

- Exit: A long-run decision to leave the market. Firms exit when P < ATC

- Enter (in the long-run): Firms will enter the market if P > ATC. If existing firms earn positive

economic profit, new firms enter the market, SR market supply curve shifts right, P falls, reducing

firms’ profits. Entry stops when firms’ economic profits have been driven to zero.

- If existing firms incur losses, some will exit the market, SR market supply curve shifts left, P rises,

reducing remaining firms’ losses. Exit stops when firms’ economic losses have been driven to zero. 2. MONOPOLY

- A monopoly is a firm that is the sole seller of a product without close substitutes.

- A monopoly firm has market power, the ability to influence the market price of the product it sells.

A competitive firm has no market power.

- The main cause of monopolies is barriers to entry – other firms cannot enter the market. + A

single firm owns a key resource.

+ The govt gives a single firm the exclusive right to produce the good. (Patents, copyright laws,…)

+ Natural monopoly: a single firm can produce the entire market Q at lower ATC than could

several firms. Exp: 1000 homes need electricity. ATC is lower if one firm services all 1000 homes

than if two firms each service 500 homes.

- Increasing Q has two effects on revenue:

+ The output effect: More output is sold, which raises revenue

+ The price effect: The price falls, which lowers revenue

- To sell a larger Q, the monopolist must reduce the price on all the units it sells => MR

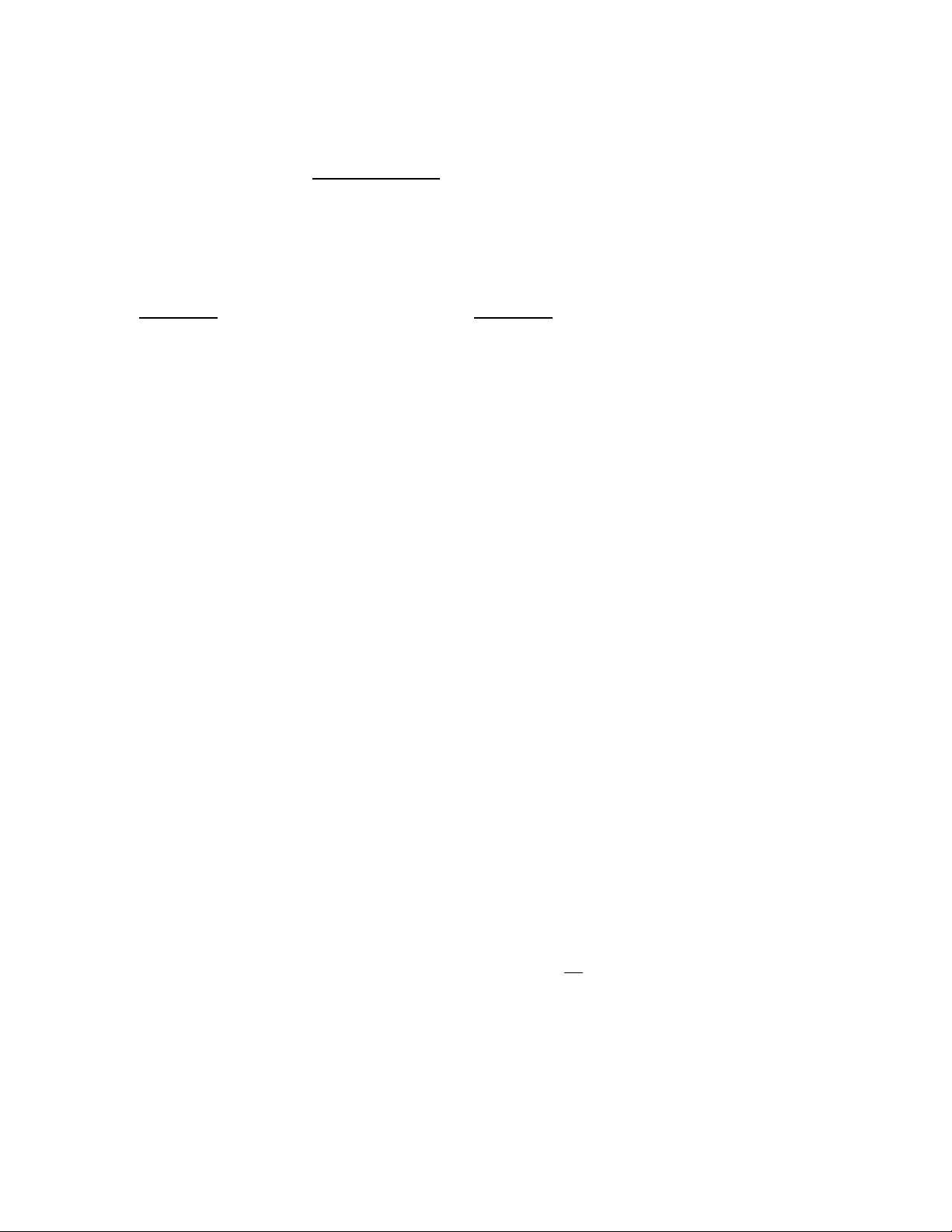

- A monopolist maximizes profit by producing the quantity where MR = MC. Once the monopolist

identifies this quantity, it sets the highest price consumers are willing to pay for that quantity. x lOMoAR cPSD| 58605085

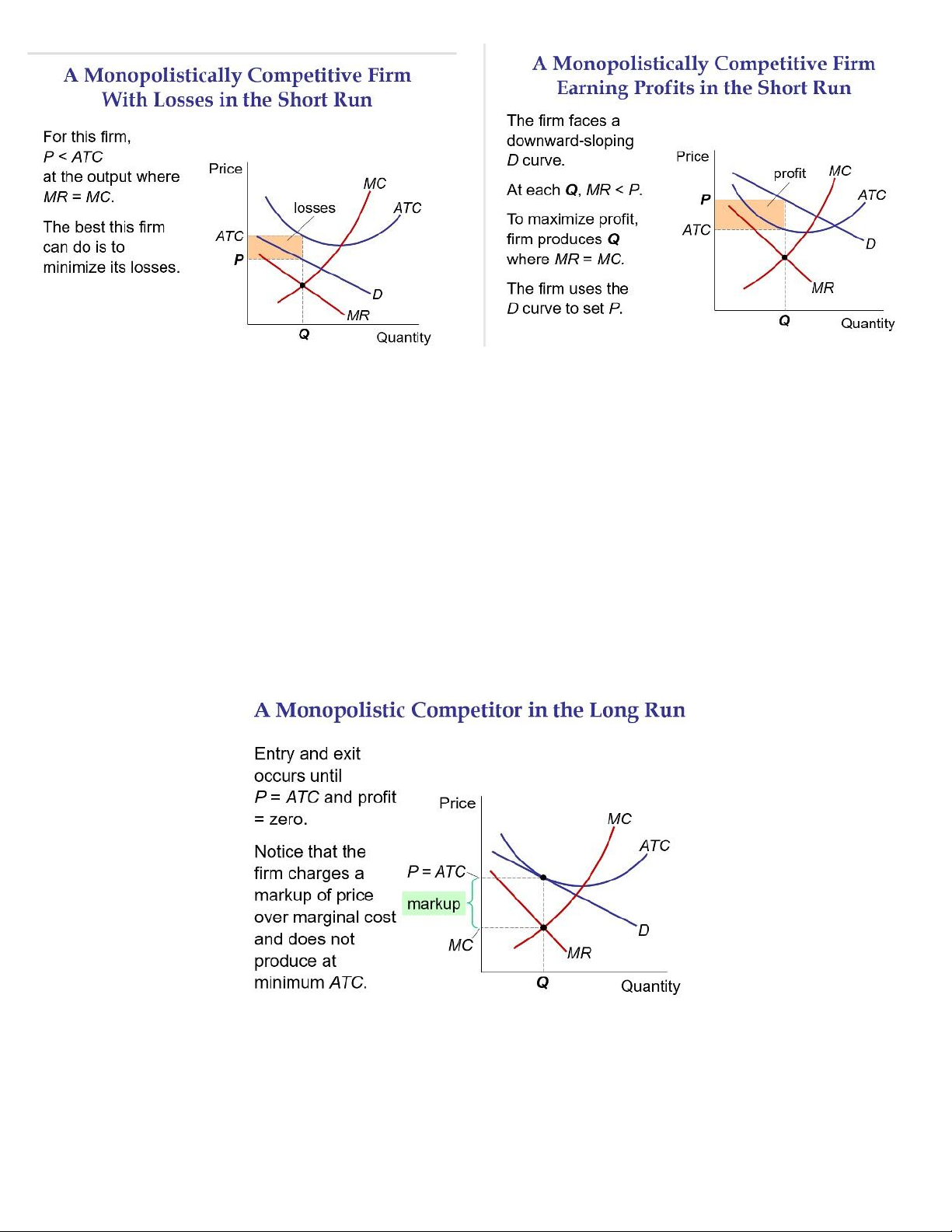

- Graph 2 shows that firm in a monopolistically competitive market earning economic profits in the short run. - A competitive firm

+ takes P as given

+ has a supply curve that shows how its Q depends on P - A monopoly firm

+ is a “price-maker,” not a “price-taker”

+ Q does not depend on P; rather, Q and P are jointly determined by MC, MR, and the demand

curve => So there is no supply curve for monopoly.

- Public Policy Toward Monopolies

+ Increasing competition with antitrust laws

● Examples: Sherman Antitrust Act (1890), Clayton Act (1914)

● Antitrust laws ban certain anticompetitive practices, allow govt to break up monopolies + Regulation

Govt agencies set the monopolist’s price

For natural monopolies, MC < ATC at all Q, so

marginal cost pricing would result in losses.

If so, regulators might subsidize the monopolist or set P = ATC for zero economic profit. + Public ownership lOMoAR cPSD| 58605085 Example: U.S. Postal Service

Problem: Public ownership is usually less efficient since no profit motive to minimize costs + Doing nothing

The foregoing policies all have drawbacks, so the best policy may be no policy.

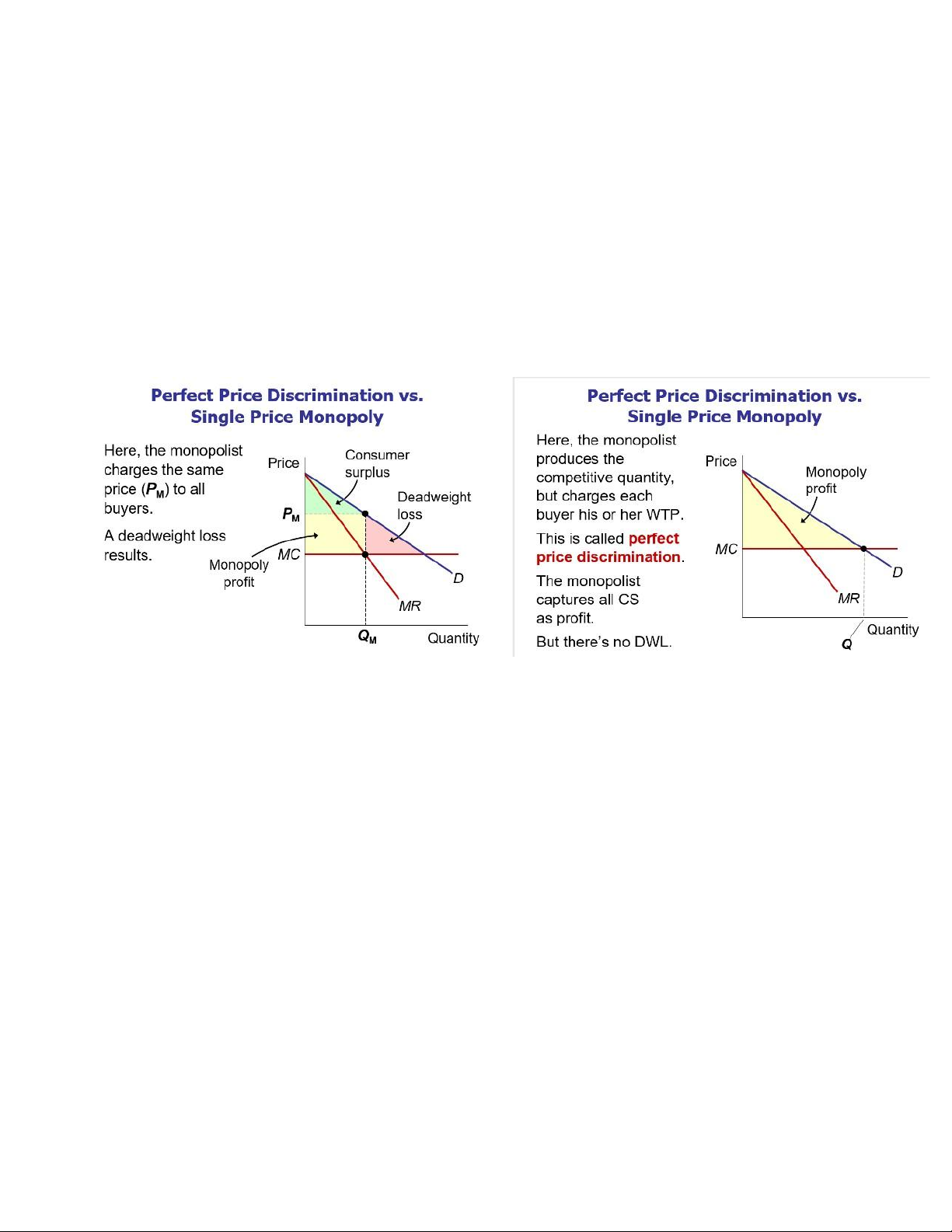

- Price Discrimination: is the business practice of selling the same good at different prices to

different buyers. The characteristic used in price discrimination is willingness to pay (WTP): A firm

can increase profit by charging a higher price to buyers with higher WTP.

- In the real world, perfect price discrimination is not possible:

- So, firms divide customers into groups based on some observable trait that is likely related to WTP,

such as age. Ex: movie ticket, airline prices, discount coupons, need-based financial aids,… -

In the real world, pure monopoly is rare.

- Yet, many firms have market power, due to selling a unique variety of a product; having a large

market share and few significant competitors

- In many such cases, most of the results from this chapter apply, including markup of price over

marginal cost and the deadweight loss

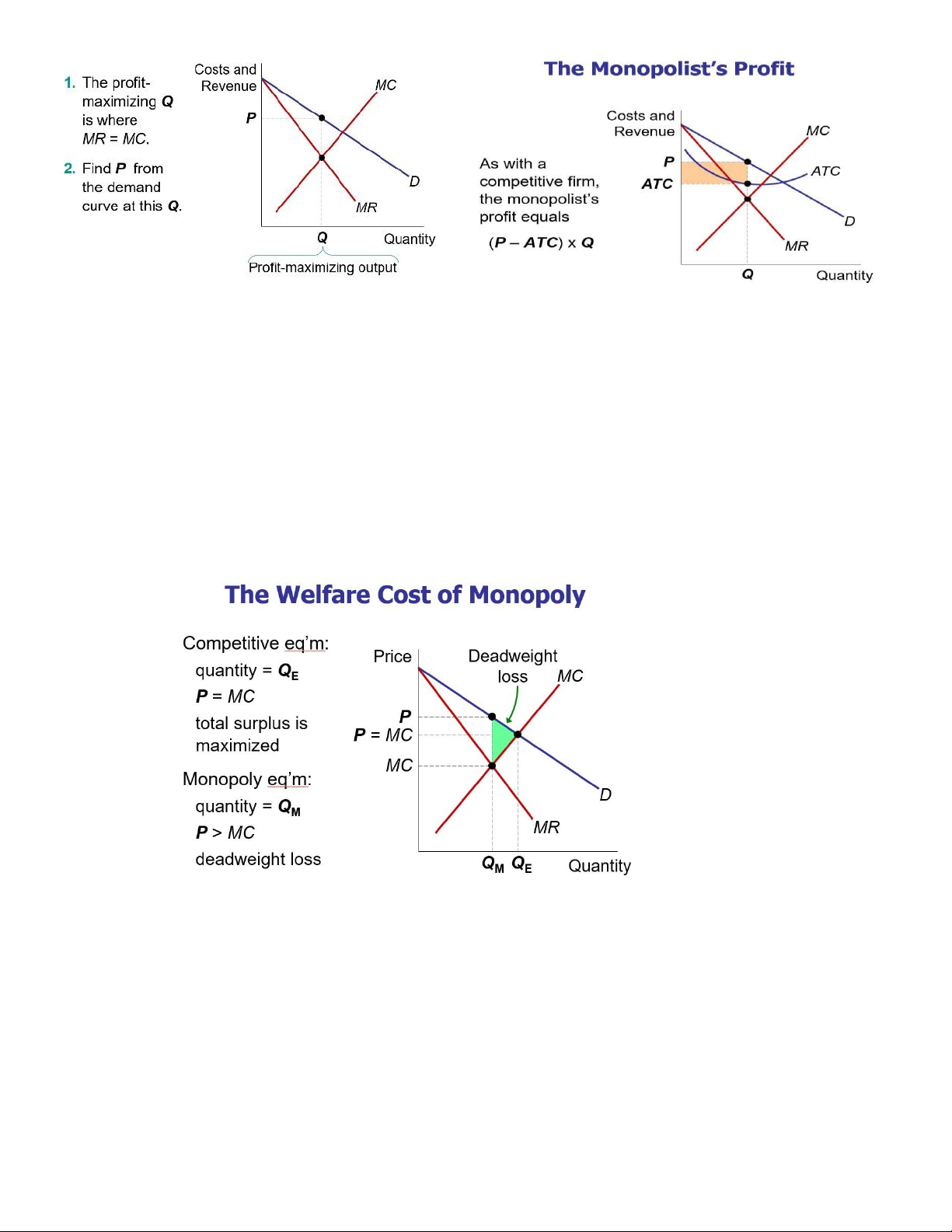

- Marginal revenue is less than price, the monopoly price will be greater than marginal cost, leading to a deadweight loss. 3.

Monopolistic Competition - Characteristics: + Many sellers + Product differentiation + Free entry and exit

- Examples: apartments, books, bottled water, clothing, fast food, night clubs,… lOMoAR cPSD| 58605085

- Short run: Under monopolistic competition, firm behavior is very similar to monopoly.

- Long run: In monopolistic competition, entry and exit drive economic profit to zero.

+ If profits in the short run: New firms enter the market, taking some demand away from existing

firms, prices and profits fall.

+ If losses in the short run: Some firms exit the market, remaining firms enjoy higher demand and prices.

- Why Monopolistic Competition Is Less Efficient than Perfect Competition

+ Excess capacity

▪ The monopolistic competitor operates on the downward-sloping part of its ATC curve,

produces less than the cost-minimizing output.

▪ Under perfect competition, firms produce the quantity that minimizes ATC. lOMoAR cPSD| 58605085

+ Markup over marginal cost

▪ Under monopolistic competition, P > MC.

▪ Under perfect competition, P = MC.

- Number of firms in the market may not be optimal, due to external effects from the entry of new firms:

+ The product-variety externality: surplus consumers get from the introduction of new products +

The business-stealing externality: losses incurred by existing firms when new firms enter market

- The inefficiencies of monopolistic competition are subtle and hard to measure. No easy way for

policymakers to improve the market outcome - Critics of advertising believe: + Society is wasting

the resources it devotes to advertising.

+ Firms advertise to manipulate people’s tastes.

+ Advertising impedes competition – it creates the perception that products are more differentiated

than they really are, allowing higher markups.

- Defenders of advertising believe:

+ It provides useful information to buyers.

+ Informed buyers can more easily find and exploit price differences.

+ Thus, advertising promotes competition and reduces market power.

- Results of a prominent study: Eyeglasses were more expensive in states that prohibited advertising

by eyeglass makers than in states that did not restrict such advertising.

- The theory of monopolistic competition describes many markets in the economy, yet offers little

guidance to policymakers looking to improve the market’s allocation of resources.

- A monopolistically competitive market has many firms, differentiated products, and free entry.

- Each firm in a monopolistically competitive market has excess capacity – produces less than

the quantity that minimizes ATC. Each firm charges a price above marginal cost.

- Monopolistic competition does not have all of the desirable welfare properties of perfect

competition. There is a deadweight loss caused by the markup of price over marginal cost.

Also, the number of firms (and thus varieties) can be too large or too small. There is no clear way

for policymakers to improve the market outcome. 4. OLIGOPOLY

- Concentration ratio: the percentage of the market’s total output supplied by its four largest firms.

- The higher the concentration ratio, the less competition.

- Oligopoly: a market structure in which only a few sellers offer similar or identical products

- Collusion: an agreement among firms in a market about quantities to produce or prices to charge

- Cartel: a group of firms acting in unison, e.g., T-Mobile and Verizon in the outcome with collusion

- Nash equilibrium: a situation in which economic participants interacting with one another each

choose their best strategy given the strategies that all the others have chosen - oligopoly Q is

greater than monopoly Q but smaller than competitive Q.

- oligopoly P is greater than competitive P but less than monopoly P.

- Increasing output has two effects on a firm’s profits:

+ Output effect: If P > MC, selling more output raises profits.

+ Price effect: Raising production increases market quantity, which reduces market price and

reduces profit on all units sold.

- If output effect > price effect, the firm increases production. lOMoAR cPSD| 58605085

- If price effect > output effect, the firm reduces production.

- Another benefit of international trade: Trade increases the number of firms competing, increases Q,

brings P closer to marginal cost

- Dominant strategy: a strategy that is best for a player in a game regardless of the strategies chosen by the other players

- Oligopolists can maximize profits if they form a cartel and act like a monopolist.

- Yet, self-interest leads each oligopolist to a higher quantity and lower price than under the monopoly outcome.

- The larger the number of firms, the closer will be the quantity and price to the levels that would prevail under competition

- The prisoners’ dilemma shows that self-interest can prevent people from cooperating, even when

cooperation is in their mutual interest. The logic of the prisoners’ dilemma applies in many situations.

- Policymakers use the antitrust laws to prevent oligopolies from engaging in anticompetitive

behavior such as price-fixing. But the application of these laws is sometimes controversial. OTHER MATERIALS The cost of production

▪ Explicit costs – require an outlay of money, e.g. paying wages to workers

▪ Implicit costs – do not require a cash outlay, e.g. the opportunity cost of the owner’s time

▪ Accounting profit =total revenue minus total explicit costs lOMoAR cPSD| 58605085

▪ Economic profit =total revenue minus total costs (including explicit and implicit costs)

▪ A production function shows the relationship between the quantity of inputs used to produce a

good, and the quantity of output of that good.

▪ The marginal product of any input is the increase in output arising from an additional unit of that

input, holding all other inputs constant.

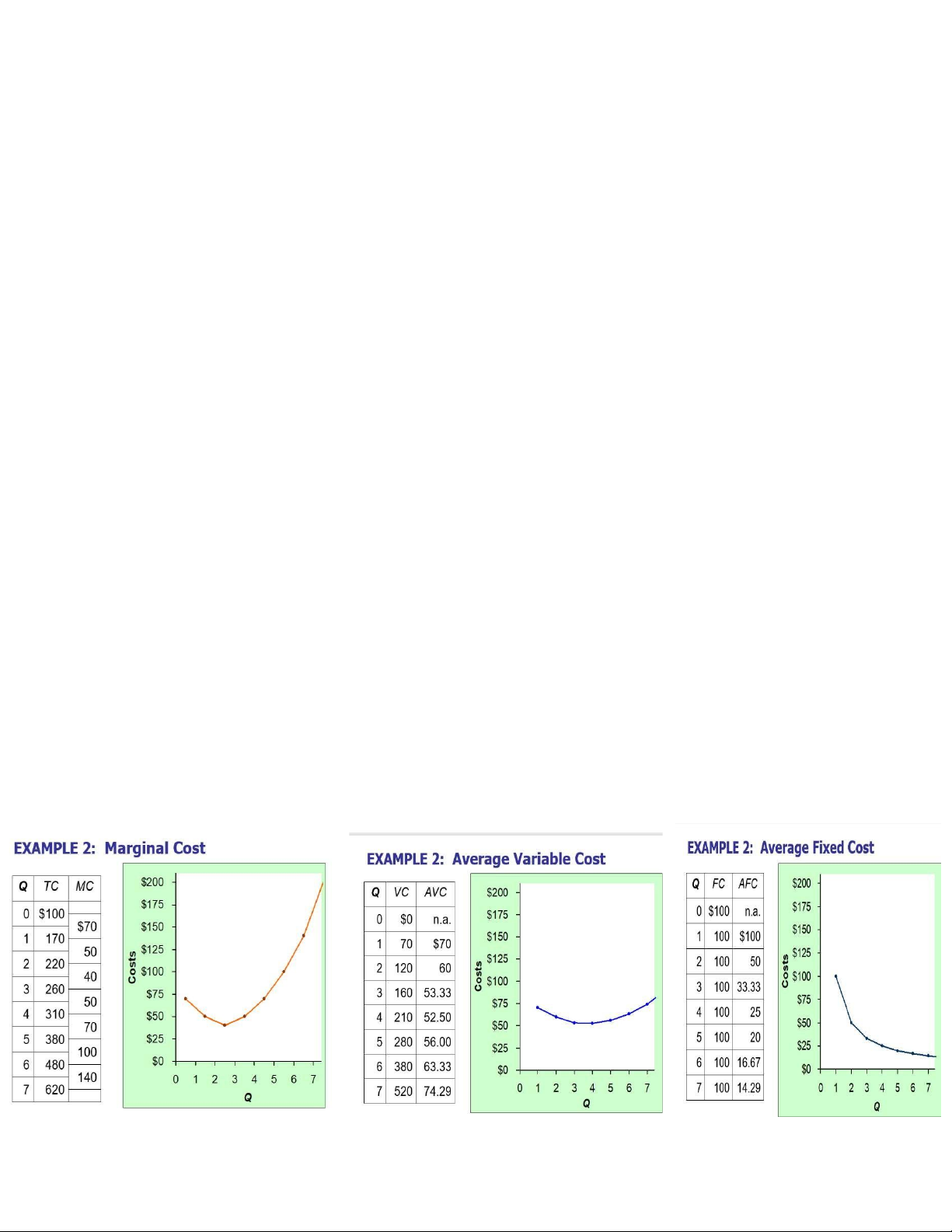

▪ Marginal Cost (MC) is the increase in Total Cost from producing one more unit:

▪ Fixed costs (FC) – do not vary with the quantity of output produced. EX: cost of equipment, loan payments, rent

▪ Variable costs (VC) – vary with the quantity produced. EX: cost of materials

Economies of scale: ATC falls as Q increases.

Constant returns to scale: ATC stays the same as Q increases.

Diseconomies of scale: ATC rises as Q increases. lOMoAR cPSD| 58605085

▪ Economies of scale occur when increasing production allows greater specialization: workers

are more efficient when focusing on a narrow task. More common when Q is low.

▪ Diseconomies of scale are due to coordination problems in large organizations.

E.g., management becomes stretched, can’t control costs. More common when Q is high. lOMoAR cPSD| 58605085

PRACTICE MULTIPLE CHOICE QUESTIONS 17/06/2024 Topic covered :

- Consumer & Producer Surplus

- The cost of production

- Firms in the perfect competitive market - Oligopoly

1.XYZ corporation produced 300 units of output but sold only 275 of the units it produced. The

average cost of production for each unit of output produced was $100. Each of the 275 units

sold were sold for a price of $95. Total revenue for the XYZ corporation would be a. $30,000. b. $28,500. c. $26,125. d. -$3,875.

AVC = $100; Q = 275 , P = $95. => TR = P x Q = 95 x 275 =26125$

2.Which of the following is an implicit cost of owning a business?

(i) forgone savings account interest when personal money is invested in the business.

(ii) interest expense on existing business loans => explicit cost (iii) damaged or

lost inventory. => explicit cost a. (i) only b. (ii) only c. (i) and (ii) d. all of the above

implicit cost = opportunity cost

3.Joe wants to start his own business. The business he wants to start will require that he purchase

a factory that costs $300,000. He is planning to use $100,000 of his own money, and borrow an

additional $200,000 to finance the factory purchase. Assume the relevant interest rate is 10 percent.

What is the explicit cost of purchasing the factory for the first year of operation?

=> explicit cost = the interest rate that you need to pay back when you borrow 200,000$ =>

loan interest rate = 200,000 x 10%= 20,000$ a. $10,000 b. $20,000 c. $30,000 d. $40,000

What is the opportunity cost of purchasing the factory for the first year of operation? a. $10,000 b. $20,000 c. $30,000 d. $40,000

=> an opportunity cost of purchasing the factory = forgone saving interest rate 10% of 300,000 $ lOMoAR cPSD| 58605085

4. Economic profit is equal to

a. total revenue minus the opportunity cost of producing goods and services.

b. total revenue minus the accounting cost of producing goods and services.

c. total revenue minus the explicit cost of producing goods and services.

d. average revenue minus the average cost of producing the last unit of a good or service.

Tony is a wheat farmer, but also spends part of his day teaching guitar lessons. Due to the

popularity of his local country western band, Farmer Tony has more students requesting lessons

than he has time for if he is to also maintain his farming business. Farmer Tony charges $25 an

hour for his guitar lessons. One spring day, he spends 10 hours in his fields planting $130 worth of

seeds on his farm. He expects that the seeds he planted will yield $300 worth of wheat.

=> explicit cost ( accounting cost) = $130

=> implicit cost = $25 x 10 = $250

5. What is the total opportunity cost Farmer Tony incurred for his spring day in the field planting wheat? a. 130 b. 250 c. 300 d. 380

6. Tony’s accountant would most likely figure the total cost of his wheat planting to equal a. 130. b. 250. c. 300. d. 380.

7. Tony’s accounting profit equals a. -80. b. 130. c. 170. d. 300.

Accounting profit = TR - explicit cost = $300 ( worth of wheat) - $130 ( worth of seeds) = $170

8. Tony’s economic profit equals a. -80. b. 130. c. 170. d. 300.

Economic profit = TR - ( explicit cost + implicit cost) = 300 - 380 =-80

9. Teacher's Helper is a small company that has a subcontract to produce instructional materials

for disabled children in public school districts. The owner rents several small rooms in an lOMoAR cPSD| 58605085

office building in the suburbs for $600 a month and has leased computer equipment that costs $480 a month. Output (Instructional

Average Average Average Marginal

Modules per Fixed Variable Cost Total Fixed Variable Total Cost month) Cost Cost Cost Cost Cost 0 1,080 0 1,080 FC/Q VC/Q =TC/Q =Change =AFC + in TC / AVC change in Q = N/A 1 1,080 400 1,480 =1080 =400/1 =1080+4 400 00 2 1,080 =TC-FC =ATC = 1080/2 = 850/2 965 450 =1930108=850 x Q = 1930 3 1,080 1,350 2,430 4 1,080 1,900 475 5 1,080 2,500 216 6 1,080 4,280 700 7 1,080 4,100 8 1,080 5,400 135 9 1,080 7,300 10 1,080 10,880 980

Use the information in the table below to answer questions 10 through 12. Quantity Price 1 13 2 13 3 13 4 13 5 13 6 13 7 13 8 13 9 13

10. The price and quantity relationship in the table is most likely that faced by a firm in a a. monopoly. b. concentrated market. c. strategic market. lOMoAR cPSD| 58605085

d. competitive market. => price based on market given, single firm will not have impact on the market price

11. Over which range of output is average revenue equal to price? a. 1 to 5 b. 3 to 7 c. 5 to 9

d. average revenue is equal to price over the whole range of output. In perfect competition : P = MR = AR = MC

12. Over what range of output is marginal revenue declining?

a. None; marginal revenue is constant over the whole range of output. b. 1 to 6 c. 3 to 7 d. 7 to 9

13. Use the information for a competitive firm in the table below to answer questions 13 through 18. Quantity Total Revenue Total Cost 0 $ 0 $ 10 1 9 14 2 18 19 3 27 25 4 36 32 5 45 40 6 54 49 7 63 59 8 72 70 9 81 82

At a production level of 3 units which of the following is true? a. Fixed cost is zero. b. Marginal cost is $6.

c. Total revenue is less than variable cost.

d. Marginal revenue is less than marginal cost.

=> MC at the 3rd unit = (25-19)/(3-2) =6

MR at the 3rd unit = ( 27-18) / ( 3-2) = 9 => MR > MC at 3rd unit.

14. At which level of production is average revenue equal to marginal cost? a. 1 b. 3 c. 6 d. 8

15. If this firm chooses to maximize profit ( MC = MR) it will choose a level of output where marginal cost is equal to lOMoAR cPSD| 58605085 a. 5. b. 7. c. 9. d. 11.

16. The maximum profit available to this firm is a. $2. b. $3. c. $4. d. $5. Profit = TR- TC

17. If the firm finds that its marginal cost is $11, it should

a. increase production to maximize profit.

b. decrease production to maximize profit.

c. maintain its current level of production to maximize profit.

d. advertise to find additional buyers. MR = $9 < MC = $11 => decrease production MR = MC => maximize profit

MR > MC => increase production

18. If the firm finds that its marginal cost is $5, it should

a. increase production to maximize profit.

b. decrease production to maximize profit.

c. maintain its current level of production to maximize profit.

d. reduce fixed costs by lowering production.

MC = $5 < MR = $9 => increase production

19. Comparing marginal revenue to marginal cost

(i) reveals the contribution of the last unit of production to total profit.

(ii) is helpful in making profit maximizing production decisions.

(iii) always reveals whether a firm is making an economic profit.

(iv) tells a firm whether its fixed costs are too high. a. (i) and (ii) only b. (iii) only c. (ii) and (iii) only d. all of the above lOMoAR cPSD| 58605085

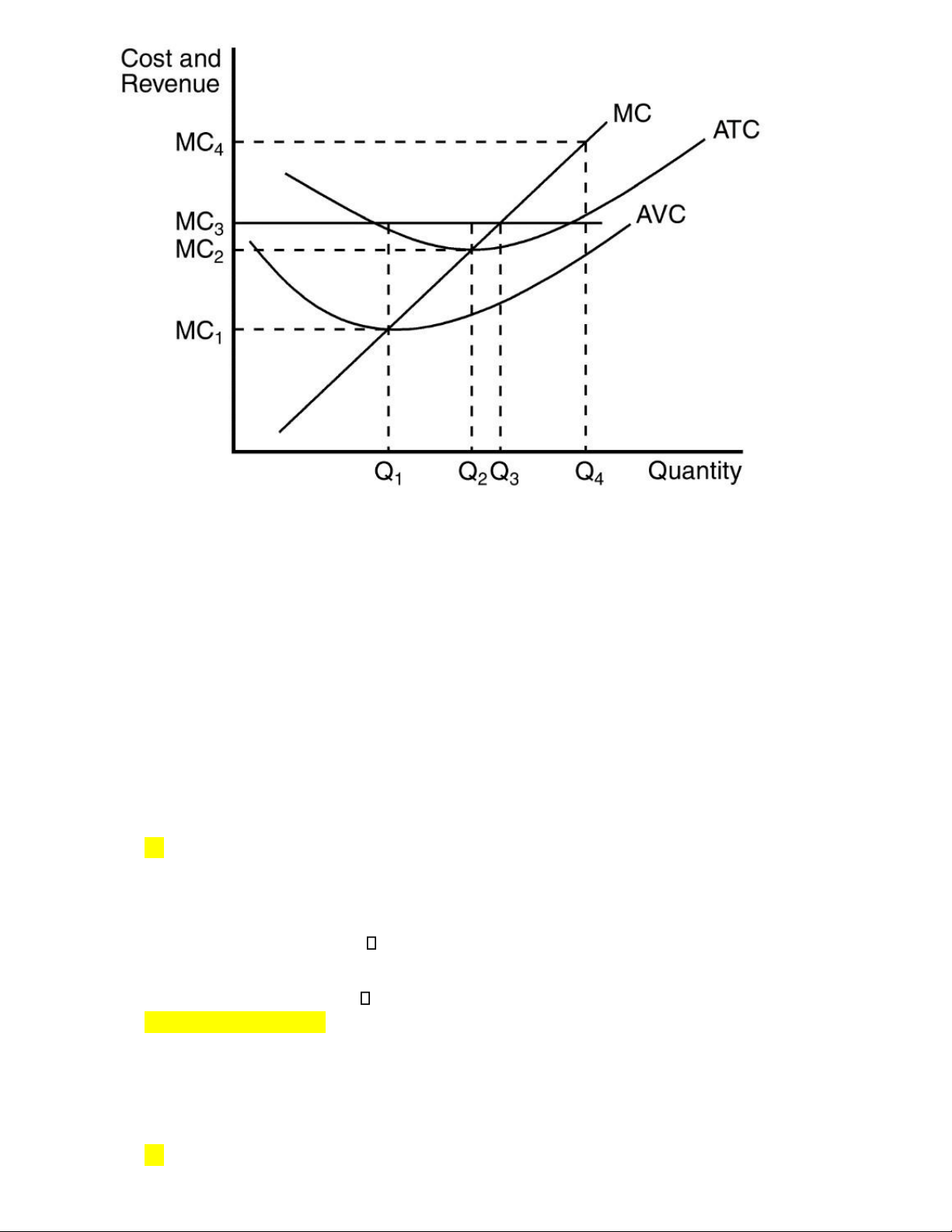

20. When marginal revenue is equal to MC3, the profit maximizing firm will produce what level of output? a. Q1 b. Q2 c. Q3 d. Q4

21. When market price is at MC2, a firm producing output level Q1 would experience

a. profits equal to (MC2 - MC1) Q1. b. zero profits.

c. losses equal to (MC2 - MC1) Q1. d. losses because P < ATC.

22. When market price is at MC4, a profit maximizing firm will produce what level of output? a. Q1 b. Q2 c. Q3 d. Q4 lOMoAR cPSD| 58605085

23. What price level will leave the profit maximizing firm with zero profits? a. MC1 b. MC2 c. MC3 d. MC4

Zero profit is when P = ATC

24. Which of the following is a reason why a competitive firm might choose to set its price below the market price?

a. Because this would result in higher profits.

b. Because this would result in lower total costs.

c. Because this would result in higher average revenue. d. none of the above

25 Of the following characteristics of competitive markets, which are necessary for firms to be price takers? (i) Many sellers.

(ii) Goods offered for sale are largely the same.

(iii) Firms can freely enter or exit the market. a. (i) and (ii) only b. (iii) only c. (ii) and (iii) only d. All are necessary.

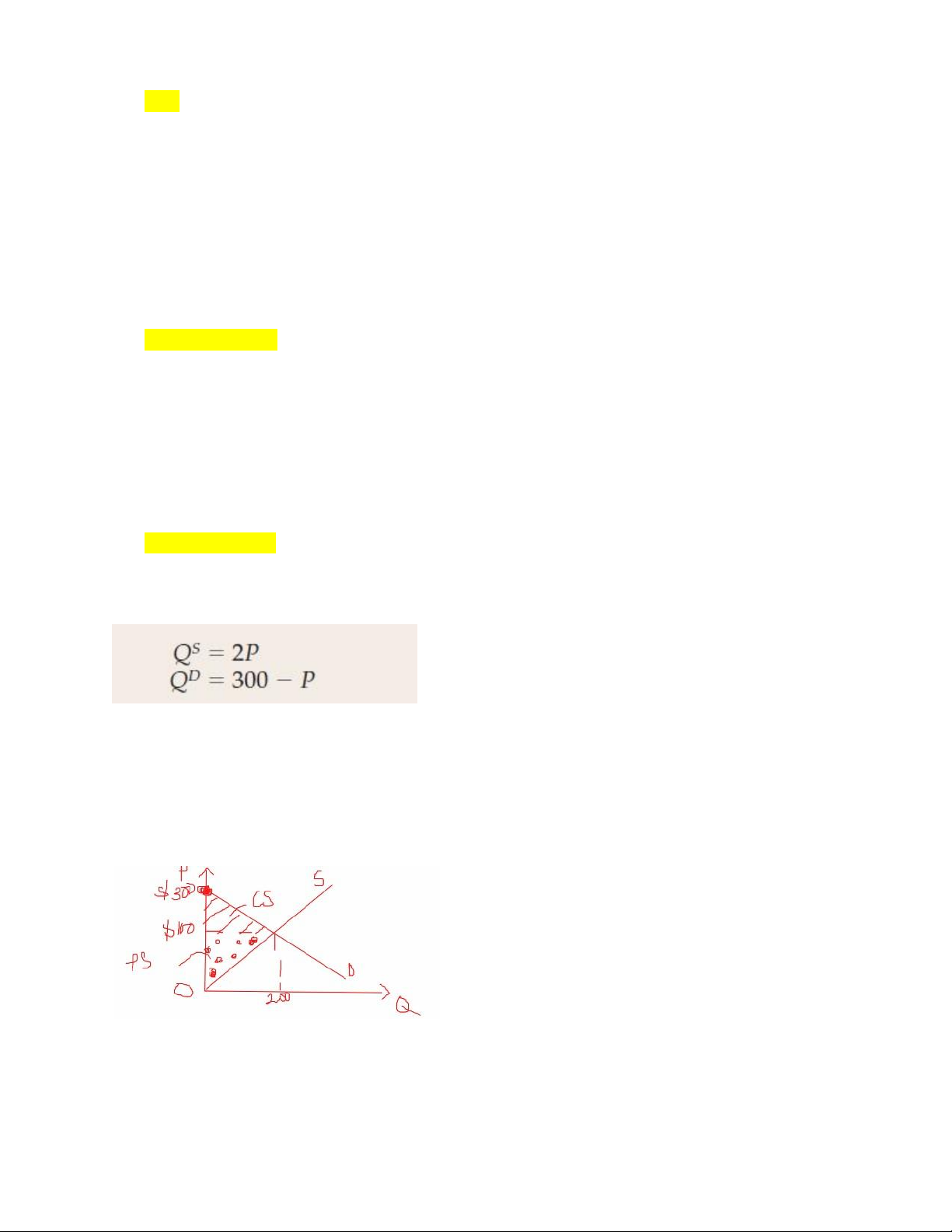

26. Calculate consumer surplus & producer surplus.

Calculate equilibrium price & equilibrium quantity

Qs = Qd => 2P = 300-P => P* = 100$, replace P* into (D) or (S) => Q* = 200.

= ½ x (300-100) x 200 =20000$ PS = ½ x 100 x 200 =10000$ 27. Market failure is

a. the inability of some unregulated markets to allocate resources efficiently. lOMoAR cPSD| 58605085

b. the inability of a market to establish an equilibrium price.

c. the inability of buyers to place a value on the good or service.

d. the inability of buyers to interact harmoniously with sellers in the market.

28. Billy and Andy sell lemonade on the corner for $0.10 per glass. Their producer surplus is

$0.06 per glass. Their willingness to sell is a. $0.16. b. $0.10. c. $0.06. d. $0.04.

PS = P - cost => 0.06 = $0.1 - cost

29. Ben sells investment advice for $100 per hour. His cost is $10 per hour. Ben’s producer surplus is a. $10. b. $90. c. $100. d. $110.

30. A situation in which economic actors interacting with one another each choose their best

strategy given the strategies the others have chosen is called a a. socially optimal solution. b. Nash equilibrium. c. competitive equilibrium. d. open market solution.

31. If an oligopolist is part of a cartel that is collectively producing at the monopoly level of

output, then the oligopolist, being self-interested, will

a. lower production and drive up prices.

b. increase production and push prices down.

c. do nothing thus allowing the cartel to realize monopoly profits. d. none of the above

Cartel : follow the agreement on output produced and price => monopoly profit will divide equally.

Self- interest : want to have higher profits than other competitors.

32. When strategic interactions are important to pricing and production decisions, a firm will

a. assume that competing firms are already maximizing profit.

b. consider exiting the market.

c. consider how competing firms might respond to its actions.

d. generally operate as if it is a monopolist.

33. The prisoners' dilemma is an important game to study because

a. it identifies the fundamental difficulty in maintaining cooperative agreements.

b. most games present zero-sum alternatives.

c. strategic decisions faced by prisoners are identical to those faced by firms engaged in competitive agreements. d. all of the above lOMoAR cPSD| 58605085

Two cigarette manufacturers (Firm A and Firm B) are faced with lawsuits from states to recover

the health care related expenses associated with cigarette smoking. Both cigarette firms have

evidence that indicates that cigarette smoke causes lung cancer (and other related illness). State

prosecutors do not have access to the same data used by cigarette manufacturers and thus will

have difficulty recovering full costs without the help of at least one cigarette firm study. Each firm

has been presented with an opportunity to lower their liability in the suit if they cooperate with

attorneys representing the states. Firm A Concede that Argue that there is no cigarette smoke evidence that smoke

causes lung cancer causes cancer Firm B Concede that Firm A profit = - Firm A profit = -$50 b cigarette smoke $20 b Firm B profit = -$5 b causes lung Firm B profit = $15 cancer b

Argue that there is Firm A profit = -$5 Firm A profit = -$10 b no evidence that b Firm B profit = -$10 b smoke causes Firm B profit = $50 cancer b

Firm A if choose concede that cigarette smoke causes lung cancer, then B will choose concede

that cigarette smoke causes lung cancer.

Firm A choose no evidence that smoke causes cancer , then firm B will concede that cigarette smoke causes lung cancer

=> Firm B dominant strategy will be concede that cigarette smoke causes lung cancer

Firm B choose concede that cigarette smoke causes lung cancer, then firm A will choose concede

that cigarette smoke causes lung cancer

Firm B choose no evidence, then firm A will choose concede that cigarette smoke causes lung cancer

=> Firm A dominant strategy will be concede that cigarette smoke causes lung cancer.

NASH EQUILIBRIUM FOR 2 FIRMS WILL BE :concede that cigarette smoke causes lung cancer

34. If both firms follow a dominant strategy, Firm A's profits (losses) will be a. -$5 b. b. -$10 b. c. -$20 b. d. -$50 b.

35. If both firms follow a dominant strategy, Firm B's profits (losses) will be a. -$5 b. b. -$10 b. c. -$15 b. lOMoAR cPSD| 58605085 d. -$50 b.

36. When this game reaches a Nash equilibrium, profits for firm A and firm B will be

a. -$20 b and -$15 b, respectively.

b. -$50 b and -$5 b, respectively.

c. -$5 b and -$50 b, respectively.

d. -$10 band -$10 b, respectively.

Two discount superstores (Ultimate Saver and SuperDuper Saver) in a growing urban area are

interested in expanding their market share. Both are interested in expanding the size of their store and

parking lot to accommodate potential growth in their customer base. The following game depicts the

strategic outcomes that result from the game. Growth related profits of the two discount superstores

under two scenarios are reflected in the table below. SuperDuper Saver Increase the size of store Do not increase the size and parking lot of store and parking lot

Ultimate Increase the size SuperDuper Saver = $50 SuperDuper Saver = $25 Saver of store and Ultimate Saver = $65 Ultimate Saver = $275 parking lot Do not increase

SuperDuper Saver = $250 SuperDuper Saver = $85 the size of store Ultimate Saver = $35 Ultimate Saver = $135 and parking lot

If superduper choose increase the size of store of parking lot, then Ultimate Saver will choose

increase the size of store of parking lot.

If SuperDuper choose do not increase the size of store and parking lot, then Utimate Saver will

choose increase the size of store of parking lot

=> increase the size of store of parking lot will be dominant strategy of Utimate Saver and SuperDuper.

=> Nash equilibrium : Superduer saver = $50 ; Ultimate Saver = $65.

37. If both stores follow a dominant strategy, Ultimate Saver's growth related profits will be a. $35. b. $135. c. $275. d. $65.

38. If both stores follow a dominant strategy, SuperDuper Saver's growth related profits will be a. $85. b. $250. c. $50. d. $25.

39. When this game reaches a Nash equilibrium, the dollar value of growth related profits will be

a. Ultimate Saver $275 and SuperDuper Saver $25.

b. Ultimate Saver $65 and SuperDuper Saver $50. lOMoAR cPSD| 58605085

c. Ultimate Saver $35 and SuperDuper Saver $250.

d. Ultimate Saver $135 and SuperDuper Saver $85.

40. Antitrust laws in general are used to

a. encourage oligopolists to pursue cooperative-interest at the expense of self-interest.

b. prevent oligopolists from acting in ways that make markets less competitive.

c. encourage frivolous lawsuits among competitive firms. d. all of the above

Antitrust Act restricted the ability of competitors to engage in cooperative agreements.

--------------------------------------------------------------------------------------------------------------------- lOMoAR cPSD| 58605085

MONOPOLY MULTIPLE CHOICE PRACTICE 20/06/2024

1. When a firm operates under conditions of a monopoly, its price is a. constrained by marginal cost. b. constrained by demand. c.

constrained only by its social agenda. d. not constrained.

Identify the profit maximizing quantity by MR = MC

Then look at demand curve to figure out the price of monopolists.

2. A natural monopoly occurs when a.

the monopolist product is sold in its natural state (such as water or diamonds). b.

firms are characterized by rising marginal cost curves. c.

a monopoly firm requires the use of free natural resources (such as water or air) to produce its product. d.

average total cost of production decreases as more output is produced.

Three reasons lead to monopoly : - Firm owns key resources -

Goverment created monopoly policies ( copyright, intellectual property….) -

Natural monopolies ( Increase in level of production => reduce in ATC / economic of scale)

3. An industry is a natural monopoly when (i)

a single firm will supply a good or service at a socially optimal quantity. (ii)

a single firm can supply a fixed number of goods or services at a smaller cost than could two or more firms. (iii)

a single firm can produce additional units at a smaller marginal cost. a. (i) and (ii) b. (ii) only c. (ii) and (iii) d. (iii) only

4. Patent and copyright laws are major sources of a. resource monopolies. b. natural monopolies. c.

government-created monopolies. d. none of the above

5. The key difference between a competitive firm and a monopoly firm is the ability to select a. the price of its output. b.

the level of competition in the market. c. the level of production. d.

inputs in the production process

6. If a monopolist faces a downward sloping market demand curve, its a.

average revenue is always less than marginal revenue. b.

marginal revenue is greater than the price of the units it sells. c.

average revenue is less than the price of its product. d.

marginal revenue is always less than the price of the units it sells.

In perfect competition, P = MR = AR, maximize profit quantity : MR = MC => P = MC = MC = AR IN

Monopoly: P =AR; P > MR , maximize profit quantity : MR = MC.

7. What is the monopolist's profit under the following conditions? The profit-maximizing price charged for

goods produced is $16. The intersection of the marginal revenue and marginal cost curves occurs where

output is 10 units and marginal cost is $8. Average cost for 10 units of output is $6. a. $80 b. $100 c. $160 d. $10.