Preview text:

lOMoAR cPSD| 47206071 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4

RECOMMENDATIONS OF LECTURER 1 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4 CITATION

This final report was written with the purpose of describing the information

that your team has learned and analyzed during the time of the research against.

During this time, I took advantage of the work of observing, researching and

reviewing the actual business situation of HEINEKEN enterprise and from

that, I selected topics for research, development, and product sales planning. tiger beer.

In addition to the specialized theories that I have accumulated through my

studies, I also use journals, books, reference materials and some other relevant

information about the industry that I research on the Internet. I collect the range

and include it in the report as a secondary data source.

Based on all the data and information that I have gathered, I present the following report in 6 parts:

• PART 1: IN TRODUCTION OF BUSINESS AND PRODUCT

• PART 2: ANALYSIS OF THE MICRO & MACRO SITUATION • PART 3: SWOT ANALYSIS • PART. 4: SER SALES GOALS • PART 5: SALES EXECUTION

• PART 6: MONITOR SALES ACTIVITIES • PART 7: BUDGET • PART 8: FINAL CONCLUSION 2 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4 ACKNOWLEDGEMENT

First of all, we would like to express our sincere thanks and respect to Hoa

Sen University, which has taught and created good conditions for us to study,

and especially the lecturers who guide us. Teacher Phan Minh Tuấn has

facilitated and supported us in the process of completing the report.

Due to limited knowledge, it is inevitable that there will be shortcomings in

understanding and clarifying the assigned problem. We look forward to

receiving the comments and guidance of you and your friends. 3 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4 TABLE OF CONTENTS

RECOMMENDATIONS OF LECTURER.................................................................................1

CITATION.....................................................................................................................................2

ACKNOWLEDGEMENT............................................................................................................3

TABLE OF CONTENTS..............................................................................................................4

LIST OF IMAGES SMALL.........................................................................................................5

INTRODUCTION.........................................................................................................................6

PART 1: INTRODUCTION OF BUSINESS AND PRODUCT................................................8

PART 2: ANALYSIS OF THE MICRO & MACRO SITUATION.......................................12

2.1 MICRO ENVIRONMENT....................................................................................................................................12 2.1.1

COMPETITOR..............................................................................................................................................12

2.1.2 INTERMEDIARY AGENT..............................................................................................................................13

2.1.3 CUSTOMERS...............................................................................................................................................13

2.2 MACRO ENVIROMENT.....................................................................................................................................14

2.2.1 ECONOMIC ENVIROMENT..........................................................................................................................14 2.2.2 POLITICAL

ENVIROMENT............................................................................................................................14

PART 3: SWOT ANALYSIS......................................................................................................16

3.1 STRENGTHS.....................................................................................................................................................16

3.2 WEAKNESSES...................................................................................................................................................18

3.3 OPPORTUNITIES..............................................................................................................................................19

3.4 THREATS..........................................................................................................................................................20

PART 4: SET SALES GOALS...................................................................................................21

4.1 BASES FOR BUILDING GOALS..........................................................................................................................21

4.1.1 CURRENT MARKET SITUATION..................................................................................................................21

4.1.2 ACTUAL RESOURCES OF THE BUSINESS.....................................................................................................22

4.1.3 PAST SALES RESULTS..................................................................................................................................24

4.1.4 FUTURE SALES GOALS................................................................................................................................25

4.2 STRATEGY DEVELOPMENT...............................................................................................................................26

4.2.1 PRODUCT STRATEGY ( PRODUCT)..............................................................................................................26

4.2.2 PRICE STRATEGY (PRICE)............................................................................................................................27

4.2.3 DISTRIBUTION STRATEGY (PLACE).............................................................................................................28

4.2.4 PROMOTION STRATEGY (PROMOTION).....................................................................................................30

4.2.5 B2C.............................................................................................................................................................33

4.2.6 B2B.............................................................................................................................................................34

PART 5: SALES EXECUTION.................................................................................................36

5.1 SALES FORCE...................................................................................................................................................36

5.2 AGENTS, WHOLESALERS AND RETAILERS........................................................................................................39

5.3 SUPPORT MARKETING ACTIVITIES...................................................................................................................39

PART 6: MONITOR SALES ACTIVITIES.............................................................................41 4 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4

6.1 SALES STAFF MANAGEMENT...........................................................................................................................41

6.2 INVENTORY MANAGEMENT............................................................................................................................42

PART 7: BUDGET......................................................................................................................43

PART 8: FINAL CONCLUSION...............................................................................................44

RESOURCE.................................................................................................................................45

TURNITIN...................................................................................................................................46 5 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4 LIST OF IMAGES SMALL

Figure 1 Office complex of Heineken Vietnam Brewery - Vung Tau.............9

Figure 2 Tiger beer product lines...................................................................10

Figure 3 Market share of beer manufacturing companies in Vietnam 2021

(Heineken includes 2 main brands: Heineken beer and Tiger beer)..............11

Figure 4 Global beer consumption by country..............................................13

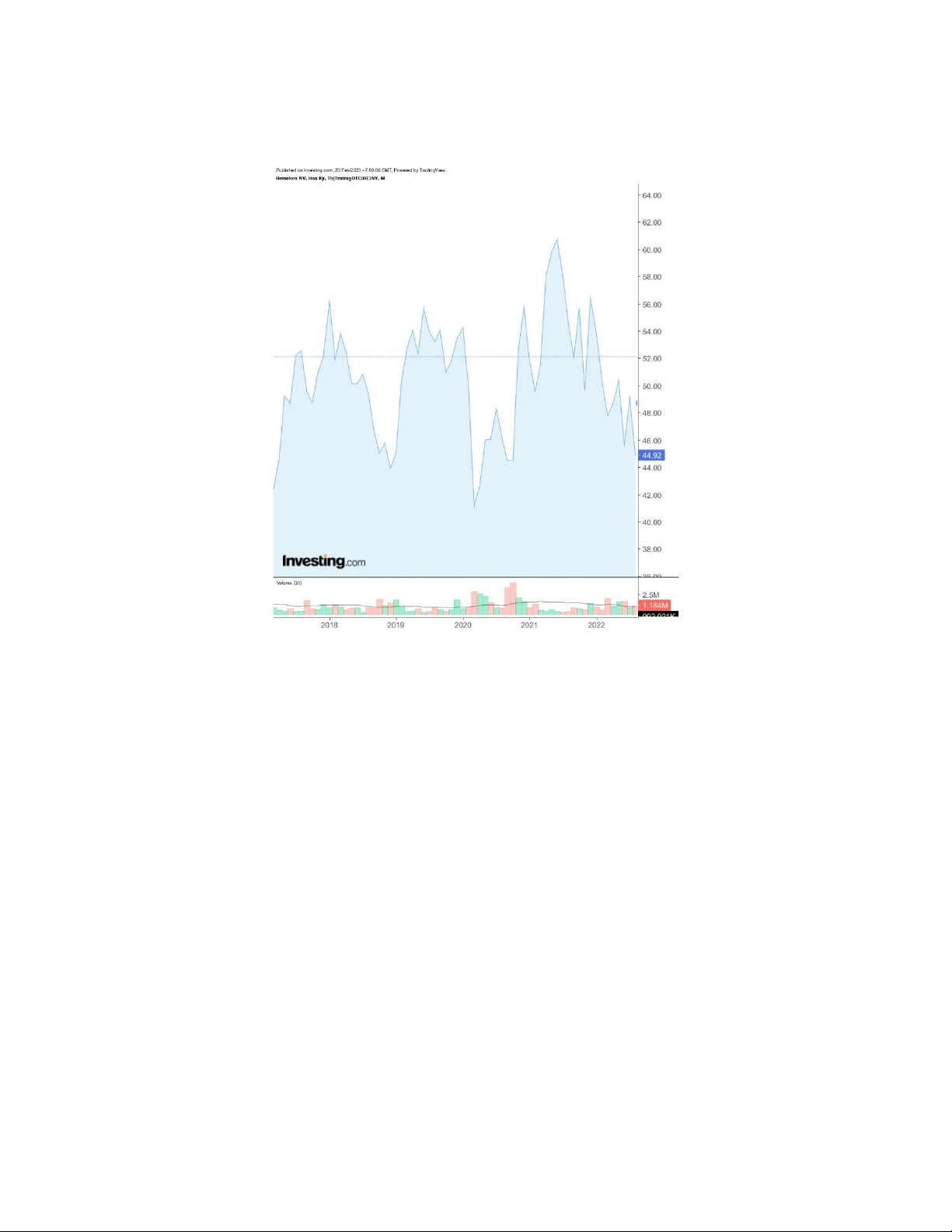

Figure 5 Stock situation of 2018-2022..........................................................14

Figure 6 Tiger monthly growth around 2022.................................................21

Figure 7 Heineken staff’s..............................................................................23

Figure 8 APB's revenue and profit have grown steadily over the years.........24

Figure 9 Tiger's customer..............................................................................25

Figure 10 Price segment statistics..................................................................27

Figure 11 Music event : virtual reality concert tiger remix............................32

Figure 12 Son Heung-Min Teams Up With Tiger Beer to Encourage

Everyone to Pursue Ambitions......................................................................33

Figure 13 Music event : virtual reality concert tiger remix............................33 INTRODUCTION

Reason for choosing the topic

The reason for choosing the topic Distribution is one of the important stages

in business activities of enterprises.Besides product strategy, advertising,

promotion, distribution strategy is an important marketing tool to help

businesses create and maintain a long-term competitive advantage in the

market. Researching and developing a wide distribution system and

approaching the target market not only creates a great competitive advantage

in the market but also achieves a long-term advantage. However, in order to 6 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4

build a highly strategic distribution channel, businesses must invest a lot of

money, effort and time, because this is both a science and art work. As a long-

standing beer brand in Vietnam, Tiger beer brand has built its own wide

distribution channel system to help easily bring products to

consumers.Branded products are present on the market from North to South,

distributed through distributors, agents, and retailers. With fierce competition

from competitors in the market, the Tiger beer brand still maintains its

momentum, capturing the minds of target customers by developing a strong

distribution channel system and knowing how to coordinate effectively.

distribution channel strategy with other variables in marketing strategy.

Therefore, the group has chosen the topic "ANALYSIS OF THE

DISTRIBUTION CHANNEL SYSTEM OF BIATIGER BRAND IN

VIETNAM MARKET" to find out how the brand builds its distribution

channel system and gives some comments for the strategy. distribution channel strategy

Objectives of the thesis

The purpose of the essay is to collect basic information about Tiger beer

brands and products in Vietnam market, learn and analyze the distribution

channels of Tiger beer products, evaluate the advantages, disadvantages for

distribution channel strategy and propose some solutions in the future. In order

to complete the purpose of the topic set out above, the task of the topic focuses

on solving the following basic problems: Research, Synthesize and analyze the

distribution channel system of the Tiger beer brand. Assess the current situation

and propose solutions for the distribution system of the Tiger beer brand. 7 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4 Tiger outline

The marketing strategy of Tiger beer has partly confirmed the terrible power

of the "strong tiger" of the Asian beer village. With the pride of a famous Asian

beer brand in the world, Tiger is constantly reinventing itself in all aspects. At

the same time, presenting a strong and modern new image. However, it still

retains the quintessential taste, integrity and class. Thereby, increasingly

affirming the leading position in the choice of young Asians. Digital

Restaurant, a useful and reputable website with the latest updates in the case study section

PART 1: INTRODUCTION OF BUSINESS AND PRODUCT

History of formation and development

Tiger was born in 1930 in Singapore. In 1931, Heineken entered into a joint

venture with Singapore's Neave and Farser beverage companies to form

Malayan Breweries Limited (MBL). This cooperation helps to increase

Heineken international's dominant ratio when it holds 95.3% of the shares.

In October 1932, Singapore had its first beer brand, Tiger Beer, belonging to

Heineken Asia Pacific. In 1990, MBL changed its name to Asia Pacific

Breweries (APB). The aim is to dominate the Asian market. Thanks to the

exploitation and understanding of the Asian market and culture, Tiger beer has

successfully made a good impression on customers.

The strong, masculine Asian tiger and animal symbol further affirms the

brand image of true Asian beer. Not only firmly in this market, it is also

exported to many parts of the world. At the same time, becoming the exclusive 8 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4

leading brand of APB. It can be said that this is one of the biggest beer brands in the world.

Brief i ntroduction of the Company :

• Produced by Heineken Asia Pacific, forerunner

• Tiger Beer is a Singaporean beer brand that was first launched as Asia Pacific Brewery.

• The company is a joint venture between Heineken N.V. and Singapore

multinational food and beverage company Fraser and Neave.

• Tiger is one of the biggest beer brands in the world, and Vietnam is one

of Tiger's most beloved markets.

Figure 1 Office complex of Heineken Vietnam Brewery - Vung Tau

Brief introduction of the P roduct : 9 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4

Currently, in the Vietnamese market, Tiger Beer mainly provides this market with beer lines such as:

• Tiger Original beer (Tiger brown): is one of the most popular and

consumed beers in huge quantities. From restaurants to street eateries, everyone loves this beer.

• Tiger Platinum Wheat Lager Beer: Is a new line of Tiger beer with many

improvements both inside and out, bringing a new wave to attract consumers' attention.

• Tiger Crystal Beer (Silver Tiger): is a new product of Tiger beer, using

the unique cold fermentation technology Cold Suspension, deeply

cooled by Crystal Cold technology

Figure 2 Tiger beer product lines

In particular, the Tiger Beer brand recognizes that today's light beer market

is increasingly growing, with many young urban drinkers demanding a smooth

yet full - flavoured wine selection for every social occasion be it at a party or

at a company dinner after a long day at work, so now Tiger Beer has turned its 10 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4

Tiger Crystal beer into a development spearhead and an iconic product of Tiger

in the future. At the 2010 World Beer Cup, Crystal Silver Tiger beer took the

lead, beating 19 entries in the Australian, Latin American or Tropical Light

Lager category and was rated 87 points by www.tastings.com, the website of

the Beverage Testing Institute.

PART 2: ANALYSIS OF THE MICRO & MACRO SITUATION 2.1 MICRO ENVIRONMENT 2.1.1 COMPETITOR

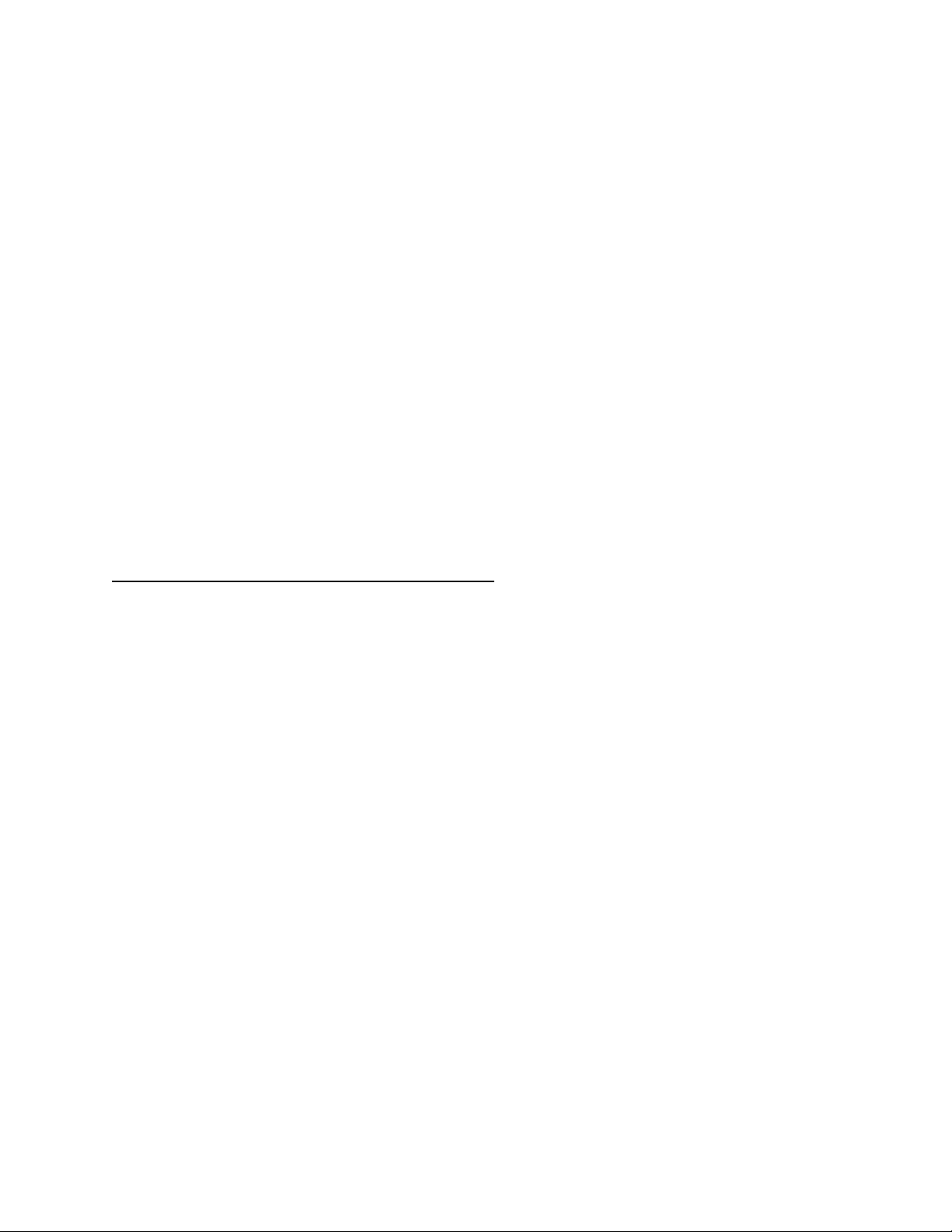

Figure 3 Market share of beer manufacturing companies in Vietnam 2021

(Heineken includes 2 main brands: Heineken beer and Tiger beer)

Tiger beer belongs to the premium beer segment in Vietnam market

(Premium segment > 15,000 VND/can, bottle) with retail price from 16,000

VND or more depending on distribution location

Substitute products of 3 main competitors (Sabeco, Habeco, Carlsberg) 11 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4

• Saigon Chill Beer of SABECO company

• Budweiser beer from Anheuser-Busch company.

• Beck's beer line of Anheuser-Busch company (Beck's, Beck's Ice)

• Sapporo Beer by Seibei Nakagawa Company

• Zorok Lager Beer of Sabmiller Vietnam Company

• brand or reputation of corporate governance to investors and consumers.

• Carlsberg beer of the company Carlsberg Indochina 2.1.2 INTERMEDIARY AGENT

Tiger Beer has retail and wholesale agents spread across the country from

pubs, grocery stores, convenience stores, supermarkets, .. 2.1.3 CUSTOMERS

According to the Ministry of Health. The average alcohol consumption in

Vietnam per liter of pure alcohol per capita (over 15 years old) per year is 8.3

liters, equivalent to 1 person drinking 170 liters of beer per year. In a survey

conducted in 2021 in Vietnam within 30 days, up to 64% of men and 10% of women drank alcohol. 12 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4

Figure 4 Global beer consumption by country 2.2 MACRO ENVIROMENT

2.2.1 ECONOMIC ENVIROMENT

General Statistics Office -> beer production in the first 6 months of 2022 => 2.6 billion liters 14.2% increase over last year

increased by 9.1% over the same period in 2019 (before the epidemic

broke out and Decree No. 100/2019/ND-CP took effect).

Although the Fed increased lending rates, causing a series of Vietnamese

banks to increase, it did not reduce the level of beer consumption. 2.2.2 POLITICAL ENVIROMENT

Article 5 Law on Alcohol Prevention and Control 2019 => 18 years old can drink beer

Decree No. 100/2019 => raise the penalty level 13 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4

• General Statistics Office 2020

• Decree 100 along with the covid 19 epidemic => decrease in beer sales

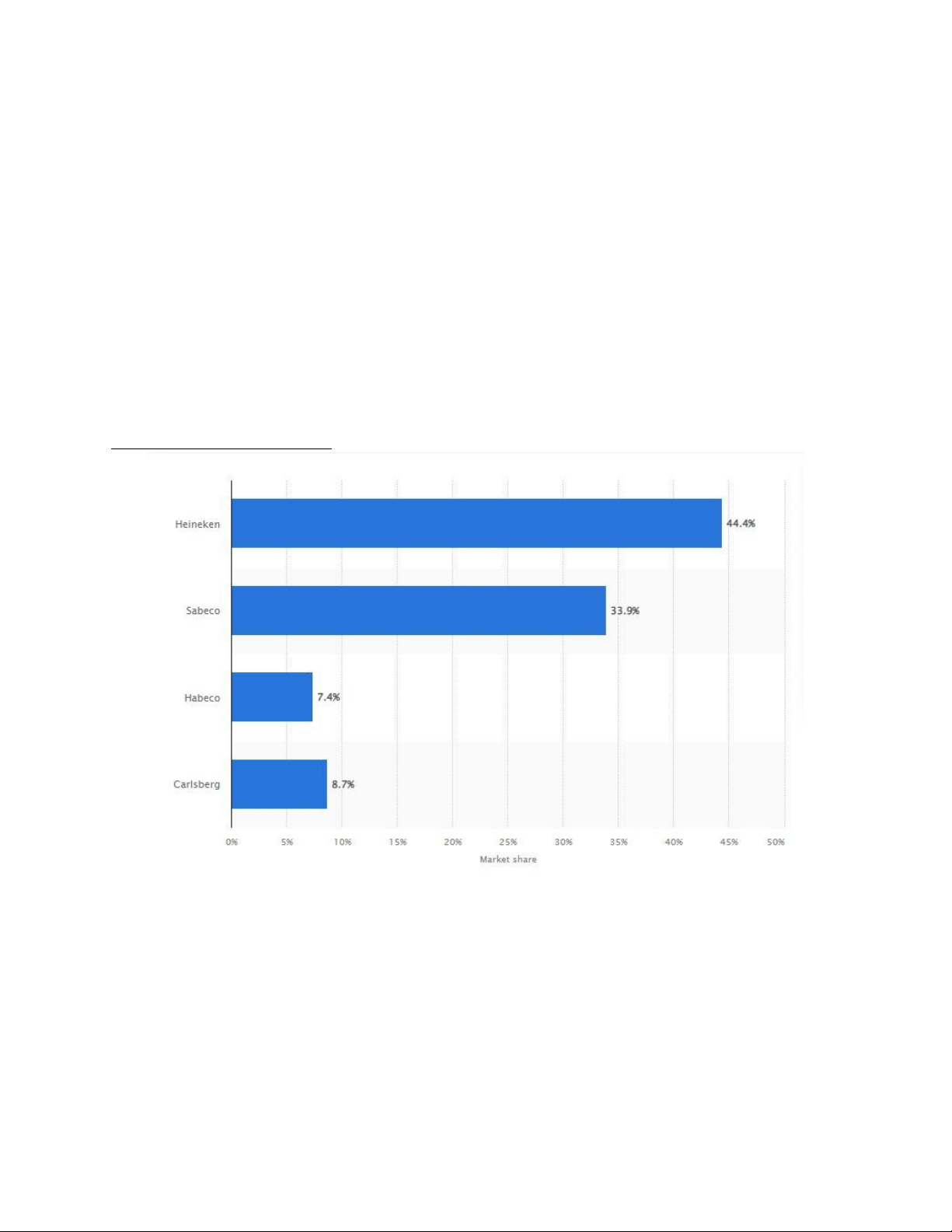

Figure 5 Stock situation of 2018-2022

Shares of Heineken company of Tiger beer 2019 2020 decreased and then

increased again from 2021 to present

=> Vietnamese people's consumption habits have not been affected much

after the Decree because => penalties are available but little enforcement PART 3: SWOT ANALYSIS 3.1 STRENGTHS Brand reputation:

• Originating from the streets of Asia in the 1930s, until now, Tiger Beer

has been present in more than 60 countries and has become a beer

brand loved by many consumers with its distinctive beer taste. 14 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4

• Tiger Beer is one of the most successful brands in Singapore and in

the world. Currently, the Tiger beer brand is valued at S$820 million. Many prestigious awards:

• More than 40 prestigious international awards that Tiger has achieved

has become the pride of the "Asian tiger" during 9 decades of conquest worldwide.

• In particular, it is worth mentioning twice winning the Gold Medal at

the International Beer Industry Awards taking place in the UK - the

award is likened to the Oscars of the beer industry - in 1954 and 1998. Local customers: 15 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4

In every country where Tiger beer is located, the brand strives to create

familiar local customer networks.

• In addition, the unique and distinctive taste of Tiger beer is also a

factor that is chosen by local customers because of its suitability with

hot and humid weather as well as the taste suitable for delicious Asian dishes. Wide distribution network:

• Another strength of the Tiger beer brand lies in its wide distribution

network and market share through the association of two shareholders,

Fraser and Neave, Limited (F&N) and Heineken International.

• Heineken International is a longstanding and well-known brand

among brewers through its global network of distributors and 115

breweries in over 65 countries. Powerful Marketing Strategy

• Exploiting Asian culture, Asian heritage and Far Eastern

characteristics, Tiger Beer has attracted many target customers of

Tiger - especially young people.

• Tiger Beer's global brand platform, "Uncage" is not only a descriptive

metaphor for how the brand brings bravery to the whole of Asia, but

also the first step in the marketing strategy of Tiger Beer. 16 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4

Tiger beer attracts customers in these Asian countries.

Through a big idea, Tiger wants to convey to young Asians that no

matter who they are, in any position in society, live to the fullest,

beyond the barriers of self and society. 3.2 WEAKNESSES Innovation trend:

• Young people in recent years often prefer strong alcohol to beer

because of the new strong feeling from alcohol.

• In addition, in a market as competitive as beer production, advances

in technology from the innovation of other beer brands are factors that

put Tiger beer under constant threat. Health:

• Many health related diseases including liver disease, heart disease are

related to the consumption of alcoholic stimulants such as beer and wine. 17 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4

• Moderate intake of these stimulants can have many health benefits,

but in reality, people who regularly drink alcohol consume more than recommended.

Alcohol use is increasing at an alarming rate, especially among young

people, not only creating a burden on health, causing economic losses

but also increasing social problems.

• Alcohol is the 5th leading risk factor for disability and death in

Vietnam. The WHO's Global Status of Alcohol Report shows that

alcohol is a direct cause of at least 30 diseases and an indirect cause

of at least 200 diseases and injuries.

Traffic accidents and violence issues

• Not only in Vietnam, in many Southeast Asian countries, the death

rate due to drinking while driving is increasing.

• In Vietnam, alcohol is also the biggest cause of 30% of social disorder

cases and 33.7% of domestic violence cases. Alcohol use has been

causing a heavy burden on health, economy and increasing social problems. 18 lOMoAR cPSD| 47206071 FINAL REPORT – GROUP 4 3.3 OPPORTUNITIES

Increase in personal income: Removing the negative factors in recent times,

the beer market is still considered to be a very active development, especially

with the increase in the personal income of consumers. Population Increasing:

Population and beer may sound unrelated, but in reality, population

growth in developing countries like Vietnam is actually a huge

opportunity for brewers like APB.

• More people corresponds to an increase in beer consumption. This

increases the demand for Tiger beer products.

Potential beer market in Vietnam

• According to the World Health Organization (WHO) in Vietnam, our

country ranks second among Southeast Asian countries and third in

Asia in terms of average alcohol consumption per person.

• According to WHO's 2018 global report, Vietnam is only behind Laos

and South Korea in terms of pure alcohol consumption in Asia.

• Notably, the rate of dangerous alcohol consumption has increased over

the years, especially among men. The results of a survey by the

Ministry of Health showed that 1 in 3 men drank at dangerous levels. 3.4 THREATS Product diversification: 19