Preview text:

GROUP EVALUATION FINAL REPORT (50%) Name Position Tasks Status Discription Chương II, Lê Minh Quốc Việt Leader 100% III,IV Nguyễn Đăng Huy Member Chương II,IV 100%

Nguyễn Thị Huệ Mẩn Member Chương III,IV 100% Đoàn Thị Yến Nhi Member Chương I,IV 100%

Dương Nguyễn Mỹ Ngọc Member Chương I,IV 100% Nguyễn Xuân Ngọc Member Chương III,IV 100% THE PLEDGE The team member includes:

Lê Minh Quốc Việt – Student Code: 195012541

Nguyễn Đăng Huy – Student Code: 195012565

Nguyễn Thị Huệ Mẩn – Student Code: 195013252

Đoàn Thị Yến Nhi – Student Code: 195040468

Dương Nguyễn Mỹ Ngọc – Student Code: 205220984

Nguyễn Xuân Ngọc – Student Code: 195011412

All team members hereby commit that this project is completely built and

completed by the team members themselves. Never copied anyone. All documents

that the group refer to are clearly and transparently annotated.

Ho Chi Minh city, June 2022 The Team ACKNOWLEDGMENTS

At the beginning of this list, I would like to thank all members of the group.

Thank you for all the efforts and contributions of everyone during the construction

and completion of the project. This is a relatively complex project, without

everyone's contribution, this project could not reach the final step. So thank you for

their dedication, and it's also an honor to be in such a group.

Next, the group would like to send their most sincere thanks to the lecturer of

Sales Management, who is Le Ngoc Hai. Thank you for leading and imparting

knowledge related to the subject to the whole group. As well as listening and

giving comments to help the project can be completed in the best way Sincerely thank you !

Ho Chi Minh city, June 2022 The Team ABSTRACT

According to statistics of the World Instant Noodles Association (WINA),

Vietnam's instant noodle demand is ranked 3rd in the world with more than 7

billion packages of noodles consumed in 2020. If calculated on a per capita basis

Vietnam ranks in the top 2 in the world, each person consumes more than 72

packages of noodles per year on average. As for the growth rate in 2020, Vietnam

ranks first in the world in the percentage of people eating noodles, nearly 30%.

With a population of approximately 100 million people and a developing country

with a middle income. Vietnam is a promising market for any instant noodle

producer. Currently, in the Vietnamese instant noodle market, there are more than

50 manufacturers, but most of the market share belongs to big players such as Acecook, Masan, and Uniben.

Acecook Vietnam is a long-standing instant noodle manufacturing company in

Vietnam, a company originating from Japan that has invested in Vietnam right after

the reopening of the economy. Currently, Acecook is leading and holding the most

market share in the domestic instant noodle market. Hao Hao noodle brand is a

familiar name to all Vietnamese people, not only expressed in numbers but also in

the fact that this product appears in all parts of the country, it is not difficult for

consumers. Users can find a package of noodles named Hao Hao on the shelf. It

can be seen that, in order for Acecook to achieve such an almost 100% coverage

level, the company must have a team of professional sales staff.

In the current situation, the issue of inflation is becoming a topic of global

concern and will at least last for the next 3 to 4 years. The prices of many goods

have skyrocketed, so this is an opportunity for instant noodles to flourish.

Realizing that opportunity, the team chose Acecook to use the theories learned to

build a sales organization project to expand the market. LIST OF TABLE

Table 2. 1: SWOT......................................................................................................................................12 Y

Table 3. 1: Salary and allowance structure of Acecook (2022)..................................................................18

Table 3. 2: Acecook's Commission Policy (2022)......................................................................................18

Table 3. 3: Reward policy (2022)..............................................................................................................19

Table 3. 4: Vacation policy........................................................................................................................20 LIST OF FIGUR

Figure 1. 1: Acecook Vietnam Founder Mr. Kajiwara Junichi.....................................................................3

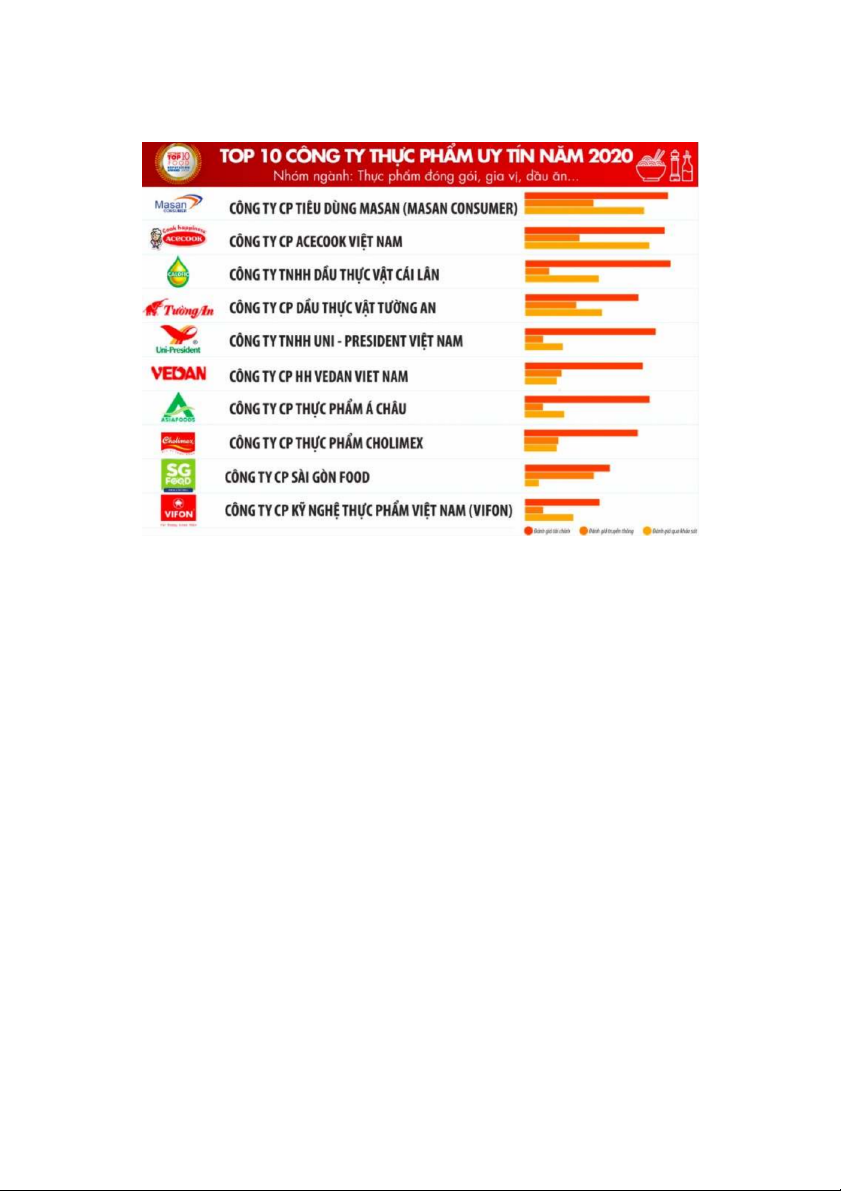

Figure 1. 2: Top 10 reputable food companies (2020).................................................................................4

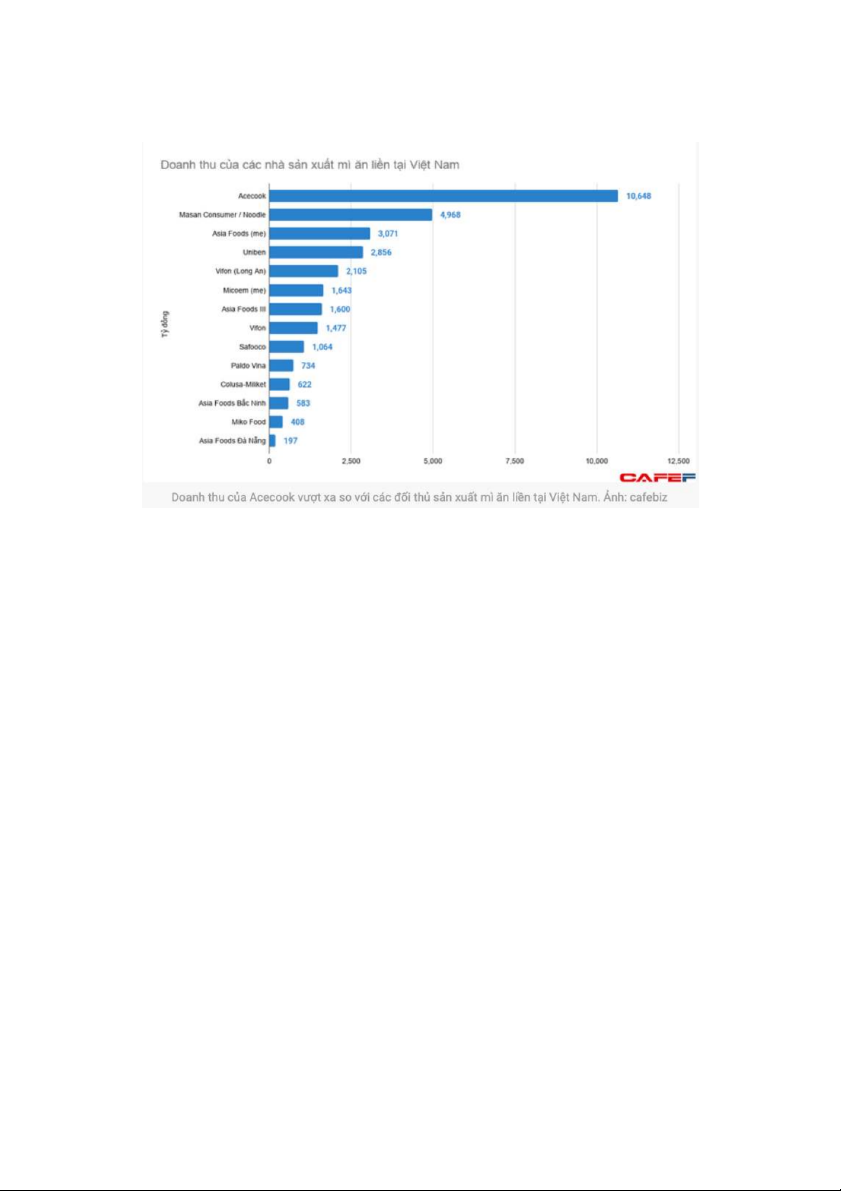

Figure 1. 3: Revenue of instant noodle manufacturers in Vietnam..............................................................5

Figure 1. 4: Hảo Hảo orginal......................................................................................................................6 Y

Figure 2. 1: Market share of instant noodles production in Vietnam...........................................................9

Figure 2. 2: Masan's Omachi Noodle Brand..............................................................................................10

Figure 2. 3: 3 Miền noodles.......................................................................................................................11

Figure 2. 4: Gấu Đỏ noodles......................................................................................................................11

Figure 3. 1: Organization chart of Acecook sales team..............................................................................13 TABLE OF CONTENTS

GROUP EVALUATION..........................................................................................i

THE PLEDGE.........................................................................................................ii

ACKNOWLEDGMENTS.....................................................................................iii

ABSTRACT............................................................................................................iv

LIST OF FIGURES................................................................................................vi

Chapter I: Introduction to Acecook.......................................................................2

1.1 Quickview........................................................................................................2

1.2. History of formation and development...........................................................4

1.3. Mission and vision..........................................................................................5

1.4. Acecook's products..........................................................................................5

Chapter II: Business Environment Analysis.........................................................7

2.1. Macro environment analysis...........................................................................7

2.1.1. Politics.......................................................................................................7

2.1.2. Economy...................................................................................................7

2.1.3. Society.......................................................................................................8

2.1.4. Environment..............................................................................................8

2.1.5. Technology................................................................................................8

2.2. Microenvironment analysis.............................................................................9

2.2.1. Industry status...........................................................................................9

2.2.2. Competitors.............................................................................................10

Chapter III: Organizing Sales Activities.............................................................13

3.1. Organizational structure of the sales team....................................................13

3.2 Training sales force........................................................................................13

3.3. Individual sales targets for each channel.......................................................15

3.3.1 Distribution channel level diagram..........................................................15

3.3.2. Monthly personal evaluation...................................................................17

3.4. Salary policies/ bonus structure.....................................................................18

3.5 Motivated policies.........................................................................................19

CHAPTER IV: SALES PLANNING...................................................................22

4.1. Introduce Idea................................................................................................22

4.1.1 Origin of formation..................................................................................22

4.1.2 Present ideas.............................................................................................22

4.2. Plan analysis..................................................................................................23

4.2.1. Overview of the idea...............................................................................23

4.2.2. Pros and Cons..........................................................................................23

Chapter I: Introduction to Acecook 1.1 Quickview

Acecook is a company specializing in packaged foods such as noodles, pho, vermicelli, etc.,

especially Hao Hao instant noodles, is a company specializing in packaged foods with Japanese

production technology. Kajiwara Junichi (representative of Acecook Japan) brought to Vietnam

in 1992 when the Vietnamese economy was still in difficulty. However, he believes that if the

Japanese business philosophy can be combined, it is the spirit of "Omoyari - think for others",

the Japanese production technology combined with the Vietnamese labor spirit. then the people

here will benefit from quality products.

Figure 1. 1: Acecook Vietnam Founder Mr. Kajiwara Junichi

(Source: Acecook Vietnam)

Up to now, Acecook Vietnam Joint Stock Company is considered a leading name in the field of

packaged food: 2nd position in the Top 10 prestigious food companies in 2020 - group of

packaged foods, spices, cooking oil (Vietnam Report). Currently, there are more than 50

enterprises producing instant noodles in Vietnam with 70% market share belonging to Acecook

Vietnam, Masan and Asia Food. In which, Acecook Vietnam has always led the market share,

accounting for about 50% in urban areas and 43% in the whole country.

Figure 1. 2: Top 10 reputable food companies (2020)

(Source: Vietnam Report)

1.2. History of formation and development

- Established on December 15, 1993 and officially put into operation in 1995.

- Year 2000: was the birth of Hao Hao noodle product, a leap of the company in the market.

- 2003: Expanding export markets: Australia, USA, Russia, China, Southeast Asia, etc.

Established a new factory in Binh Duong, bringing the total production line to 12 lines.

- In 2018: set the record of "The most consumed instant noodles in Vietnam for 18 years" since

2000. Acecook's profit increased at an average rate of about 20%/year to more than 1,300 billion

in and this year, Acecook's revenue is double that of Masan (VND4,636 billion).

- In 2020 and 2021: in the context of the Covid-19 pandemic, the business situation in these 2

years is a 'bumper' year, the increase rate of instant noodle consumption in the context of Covid- 19 is 67%.

Figure 1. 3: Revenue of instant noodle manufacturers in Vietnam (Source: Cafebiz) 1.3. Mission and vision

- Acecook company's mission: "Providing high quality products/services to Health - Safety - Peace of mind"

Based on this mission, Acecook Vietnam always puts the top priority on product quality, while

supporting the communication of correct and scientific information about instant noodle products

to create safety and peace of mind for customers. client. In recent years, Acecook has focused on

products for health, both to meet the new needs of consumers and to increase the value of instant noodles.

- Acecook's vision: "To become a leading food producer in Vietnam with sufficient management

capacity to adapt to the globalization process" 1.4. Acecook's products

Acecook is a long-standing food company in Vietnam. After more than 20 years of development,

the company has always researched and developed new products with a variety of flavors. Not

only focuses on producing instant noodles, but the company also produces many other products

such as pho, vermicelli, noodle soup, etc. But in this project, the authors will only focus on

researching the Hao instant noodle brand. Hao of Acecook

- Hao Hao noodles: appeared in the early 2000s, although originating from Japan, Acecook has

launched a product called Hao Hao with spicy and sour shrimp, inspired by Vietnam's sour soup.

After more than 21 years of development, Hao Hao noodles have gradually become a part of

Vietnamese culinary culture, also a part of life, especially for students. In 2018, Hao Hao

achieved a record of being the most consumed instant noodle in Vietnam with more than 20

billion packages sold, the title of No. Hao Hao has 100% coverage throughout the country, which

consumers can find it in any location

Figure 1. 4: Hảo Hảo orginal

(Source: Acecook Vietnam)

- Current products: Hao Hao spicy shrimp, lemongrass, purple onion, yellow chicken, fried garlic pork ribs, ... - Price: 3,500 VND/pack

- Weight: 1 box of Hao Hao noodles contains 30 packs of 75g noodles

Chapter II: Business Environment Analysis

2.1. Macro environment analysis 2.1.1. Politics

- Russia and Ukraine are two sources of wheat for the world, accounting for 30% of the world.

But since the war between these two countries broke out, the important port cities of Ukraine in

exporting goods such as Mariupol, Kherson, .. blockade. Making it impossible for the country to

export 20 million tons of its food, causing a supply shortage because Ukraine is considered the

breadbasket of the world. Besides, Russia also has to face export sanctions from international,

which limit exports, which is the main reason for pushing up prices of wheat and vegetable oil on the world market.

- Also the impact of this war caused many countries around the world to strengthen protection

measures for their agricultural industries. Including restricting food exports, India on May 14

issued a ban on wheat exports, making the price of this product even more expensive, Inodesia,

which accounts for more than half of the country's palm oil exports. The world has banned the

export of this item. To date, more than 30 countries have imposed export or ban bans on food

items. The purpose of this ban or restriction is not to keep prices at an appropriate level in the

country. However, it caused the world price situation to escalate

- 14.6 Tổng Thống Joe Biden phát biểu rằng ông sẽ hợp tác với các đối tác phương Tây của mình

để tiến hành xây dựng các kho chứa Silo lương thực dọc theo biên giới giữa Ba Lan và Ukraine

mục đích đưa 20 triệu tấn lương thực của nước này ra thị trường thế giới bằng đường sắt nhầm

hạ giá lương thực. Nhưng sẽ phải mất nhiều thời gian

- Liên Hợp Quốc và Thổ Nhĩ Kỹ đang thúc đẩy một thõa thuận giữa Nga và Ukraine nhầm tạo

một hành lang trên Biển Đen để nối lại các hoạt động xuất cảng ngũ cốc từ các cảng của Ukraine

=> Các sản phẩm của Acecook như mì Hảo Hảo được làm chủ yếu bằng 2 nguyên liệu chính đó

chính là lúa mì và dầu cọ. Việc nguồn cung lúa mì và dầu cọ trên thế giới đang bị gián đoạn,

khiến cho Acecook phải tốn thêm chi phí nguyên liệu đầu vào. 2.1.2. Economy

- Supply chain disruption: International integration helps promote trade between countries, but in

the context that the global economy is in need of recovery after the post-Covid-19 impact,

geopolitical conflicts occurred recently, such as the war between Russia and Ukraine, China's

zero Covid policy, or the confrontation between the US and China in many fields, causing the

supply chain to be broken on a large scale in the context of the world. The world is a flat world

where all countries are interconnected and interdependent, such a supply chain disruption makes

the supply of raw materials low, leading to an increase in input costs, which makes the cost of

goods and services more expensive. goods of increased accordingly. Vietnam cannot stay out of

this impact, although Vietnam is a country that produces a lot of essential consumer goods, but

Vietnam also has to import a lot of raw materials from abroad for production.

- Inflation rate: Currently, inflation is the top concern. In recent years, in order to promote

exports, our country has always tried to keep the inflation rate below 2%. But in the context of

the current unstable world since the pandemic and tensions in Asia, EU. Causing the price of oil

to increase sharply, the price of gasoline in Vietnam nearly touched the threshold of 33,000 VND

/ liter, causing the transportation fee to increase sharply, along with the price of essential goods

also increasing. Make consumers spend carefully during this time

- GDP: At the beginning of 2022, Vietnam is predicted by the World Bank to have a growth rate

of 5.5% this year. But with the rough sea situation in the world just a few months later, this

organization lowered our country's growth forecast to 4%. As of 2021, Vietnam's per capita

income is about 3,000 USD/person. However, with the current situation of inflation, the daily

cost of living is so high that the salary of workers has been adjusted to match the real life. It can

be clearly seen that after the blockade orders, Vietnam's economy is currently very weak, people

and businesses are exhausted. People need time to save and it will take a long time for spending to return to normal 2.1.3. Society

- Population: On average, in 2021, Vietnam will have more than 98 million people, in which

population density is concentrated in large coastal plains such as the Red River Delta and the

Mekong River Delta. The urbanization rate of our country is also high, currently the urban

population is 36.57 million people, accounting for 37%, while the rural population accounts for

63%. The population is mainly in big cities like Saigon, Hanoi, ... and there is a big disparity in

income. Where there are people there is a market, with a population about to reach the milestone

of 100 million people, Vietnam is a potential development market.

- Trend: Our country's economy is currently an open economy, so it also depends a lot on the

global economy. The war in Ukraine, or political upheavals in the region, make gasoline prices

fluctuate sharply, rising prices make domestic consumers exhausted after the pandemic. Due to

the inflation situation, many items have also skyrocketed, goods in supermarkets such as a

package of noodles have increased from 3,500 VND to 4,000 VND, or a bowl of pho has the

lowest price from 35,000 to 40,000 VND. Prices increase but wages do not, especially for low-

income workers, they will tend to tighten their spending, only buying essential products for the family 2.1.4. Environment

- Vietnam is a country with tropical monsoon climate. The temperature is year round, especially

in the central provinces, every year, there are many storms that cause large-scale floods. This

helps to make instant noodles strong because it is a convenient product with low cost.

- But the hot climate can also be a reason for consumers to cut back on instant noodles. 2.1.5. Technology

- In the world e-commerce has appeared for a long time and has become familiar, such as

Amazon in the US. But in Vietnam, it has only really developed in the last few years and it is

known that during the time of the pandemic, people who are blocked and cannot go out of the

market can buy things on Shoppe, Lazada, Tiki, ... Besides e-commerce, carriers are also racing

to develop such as Grab, Gojek, etc., making buying and selling more convenient for businesses and consumers.

- The development of the Internet, social networking sites are widely used by Vietnamese people

such as Facebook, Youtube, etc. Also become a means to help businesses promote their brands,

reach out, and survey. Or implement your Marketing strategies

2.2. Microenvironment analysis 2.2.1. Industry status

- According to statistics of the World Instant Noodles Association (WINA), Vietnam's instant

noodle demand is ranked third in the world with the consumption amount of up to 7 billion

packages of instant noodles in 2020, an increase of 29.5% compared to that of the world. with

2019. If calculated per capita, Vietnam ranks in the top 2, average consumption of 72 packages

of noodles/year, while in 2019 it is 57 packs/year. As for the growth rate in 2020, Vietnam ranks

first in the world with the percentage of people consuming instant noodles, increasing by nearly 30%.

According to the latest survey by market research company Nielsen Vietnam, during the

pandemic, the rate of domestic consumption of instant food increased by 67%. Currently on the

market there are about 50 companies producing instant noodles in Vietnam. The instant noodle

industry, including cup and instant noodles, achieved a revenue of VND 28,000 billion, of which

instant noodles accounted for 85% and the rest was from instant noodles.

- Although there are about 50 manufacturers in the instant noodle market, most of the market

share belongs to 4 big players, these are the names that we are very familiar with including:

Acecook Vietnam, Masan, Uniben, Asia Foods. These are the 4 names that are dominating the

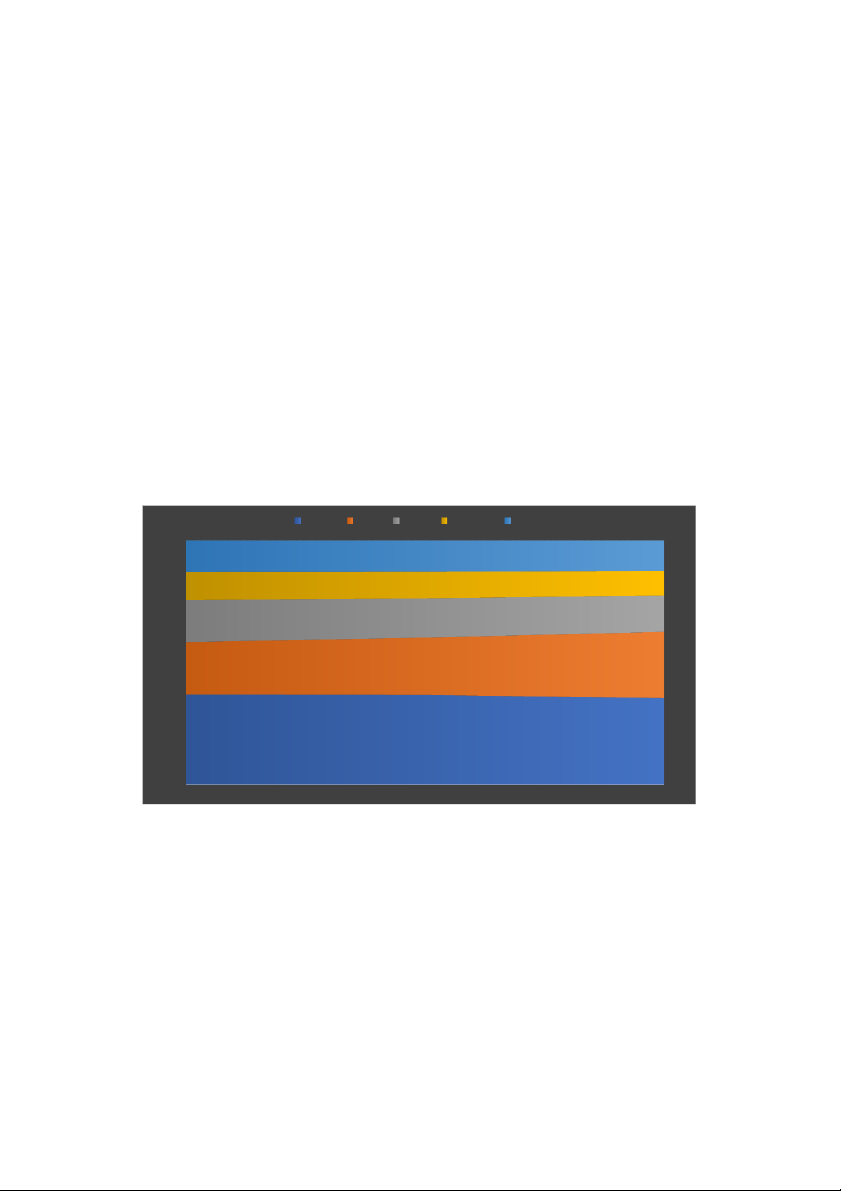

instant noodle market with 84% of sales in the first 9 months of 2020 Acecook Masan Uniben Asia Foods Others 0.13 0.13 0.12 100% 90%0.12 0.11 0.1 80%0.17 0.16 0.15 70% 0.27 60%0.22 0.24 50% 40%0.37 0.37 0.35 30% 20% 10% 0% 30/12/2020 30/12/2020 1/9/2020

Figure 2. 1: Market share of instant noodles production in Vietnam

- In addition to familiar brands, the Vietnamese market of nearly 100 million people has also

become an attractive piece of cake for many international brands that are penetrating the country,

taking advantage of incentives from FTAs, and competing with other international brands. domestic enterprises.

- With the variety of products, the Vietnamese market has many types and prices from low to

high. Ranging from 3,000 VND to 30,000 VND for consumers to choose from 2.2.2. Competitors - Masan: This group is considered the main competitor

and has the potential to take the top 1 position in the market share of Acecook. Competitors are now rising strongly when their market share increases from 21.6% (2018), to 27.2%

(2020). Masan's strategy in the instant noodle industry is to

target the high-end segment led by Omachi instant noodle brand, Masan's goal is to

Hình 2. 1: Thương hiệu mì Omachi của Masan

Figure 2. 2: Masan's Omachi Noodle Brand dominate this segment.

According to a survey by Kantar Worldpanel, About 98% of Vietnamese household use at least

Masan products. In which, Omachi instant noodles belong to high-end segment with 45% market

share, is the best – selling brand in supermarkets, convenience stores and the best-selling bowl of

noodles in the country. Not only in the high-end segment, but also in the mid-end segment,

Masan also has a famous brand that is the best selling Kokomi in the North market with 41.5%

To achieve such a strong advance in the instant noodle market, Masan has hired a team of

experts from Korea to research and release new products continuously. Besides an effective

marketing strategy, since 2011 Omachi noodles have appeared on television in association with

famous stars such as My Linh, Ngoc Trinh, Bao Anh, Ninh Duong Lan Ngoc,... to help the

brand. This brand of Masan builds an image. And to be able to bring the image of its instant

noodle brand to the market, in the hands of Masan Group, Masan Group also owns an arm that

connects the modern store system VinMart and Vinmart Plus. Merged from the end of 2019, with

a large number of stores, this is a beneficial tool in distributing products to consumers. Masan's

products are displayed in beautiful locations on store shelves, where it is easy to attract consumers

Exploiting distribution network and pricing strategy is the most effective way to increase sales

of Noodles. And Masan has two important tools in his hand and has extensive coverage

- Uniben: different from Masan entering the high-end

Hình 2. 2: Mì 3 miền của Uniben Figure 2. 2: 3 Miền noodles

segment in the instant noodle ma

areas will be limited and gradually move to rural areas because rural areas account for 70% of

the country's population. Therefore, Uniben entered the mid-range segment with the famous

brand of 3 Mien noodles with the price of only 3,500 VND. There was a time when the 3 Mien

noodle brand was a direct competitor Next to Acecook's Hao Hao in rural areas, when the market

share of this brand is equal to or just behind Hao Hao. But with the strong rise from Masan,

Uniben has also gradually lost its market share in recent years, in 2018 accounted for 17.2%, down to 14.9% (2020).

- Asia Foods: This company is famous for its brand of Red Bear noodles. The company's strategy also targets the mid- range segment and focuses on

rural areas. As one of the four giants of the instant noodle industry, Asia Foods has manufacturers distributed

across three regions. In addition to targeting rural areas, Asia Foods also has a source of revenue when the company says it is holding more than 50% of the market share of instant

Hình 2. 3: Mì Gấu Đỏ của Asia Foods

Figure 2. 4: Gấu Đỏ noodles

noodles in Cambodia with the Red Bear brand. Currently Asia Foods currently accounting for

about 10.1% of the instant noodle market (2020), Asia Foods' gross profit margin is quite good at

26%. Compared to Acecook or Masan, Asia Foods is somewhat silent on the media front.

However, the data shows that this company does not seem to be out of breath and still maintains

its position in the countryside.

- Other brands: besides the big players in the market, there are other instant noodle brands with

legendary names that most of us know as Colusa – Milike

+ Miliket: is a brand that appeared the earliest in Vietnam, once dominated the domestic instant

noodle market. But now it makes many people regret the legend of two shrimp noodles Miliket

holding 90% of the market share, now only retains a market share of 4%, once famous, but now

this company's products are lacking. absent from the kitchen counter of Vietnamese people,

making room for those who come later. However, Miliket still aims to be the cheapest product on

supermarket shelves, targeting popular stores and rural areas. This helps Miliket find a small

niche in the market, "nesting" in the race of big players like Acecook and Masan.

+ Vifon: Another name that shares the same fate with Miliket is Vifon, which is also struggling

to gain 2-3% of the meager market share with small businesses in the industry. In order to reduce

competition with domestic brands, this company has another strategy that is to divert production

of rice-based products such as pho and vermicelli instead of focusing on producing traditional noodles. Table 2. 1: SWOT SWOT Opportunities (O) Threats (T)

O1: The economy after the pandemic is T1: War between Russia and Ukraine. Leaves

difficult. The price of many consumer Ukraine with 20 million tons of food that

products has increased, consumers can choose cannot be exported. Russia is subject to cheap products instead

export-restricting sanctions, causing food

O2: Vietnam returns to a new normal, lifting prices, especially wheat and palm oil, to soar

the blockade orders. Allow production to T2: More than 30 countries concerned about return to normal

the war in Ukraine should ban or restrict food.

O3: The US and Western countries are trying However, it causes world prices to increase.

to bring Ukraine's food to the world market to T3: Supply chain disruption on a large scale, lower global wheat prices

global inflation. The high price of gasoline

causes the cost of input materials to increase,

many products are forced to increase in price to make a profit. Strengths (S)

S1: Acecook is a long-standing instant noodle company in Vietnam, with a reputable brand

trusted by many people. Hao Hao products are known to all ages

S2: Using Japanese production technology lines. High safety standards

S3: Diverse products with many flavors, cheap price

S4: Extensive distribution system, consumers can easily find Acecook's products

S5: Is the company that is leading in the market share of instant noodles

S6: There are 7 modern factories nationwide. Using automatic production line system can produce large quantity Weakness (W)

W1: Not focused on developing nutritional value yet

W2: Packaging design is not as attractive as other products in the same industry