Preview text:

lOMoAR cPSD| 49431889

TIẾẾNG ANH CHUYẾN NGÀNH 2 UNIT 16

1. Concept/ Functions/ Objectives of corporate finance?

a. Concept: Corporate finance refers to financial

decisions of companies: how to best raise and spend the company funds.

b. Functions and Objectives: - Functions:

+ Develop / Raise a sufficient operating budgets.

+ Ensure effective use of financial resources available to the Co.

+ Supervise (in coordination with other departments) all financial activities. - Objectives:

+ Ensure smooth daily operation and future investment plans.

+ Maximize revenue and benefits.

+ Minimize costs and expenses.

+ Timely track income and expense arisen from business dealings.

+ Promote the wise use of all financial resources.

2. Two major ways of raising funds for corporation? a. Equity financing:

The way companies raise funds by issuing and selling stocks to investors, using

retained earnings or mobilizing venture funds. b. Debt financing:

Company funds can be raised by borrowing from creditors or by issuing bonds for debentures.

3. The tasks of finance managers in the monitoring the finance? a. Activities:

- Supervising, controlling financial activities and conditions. lOMoAR cPSD| 49431889

- Evaluating effects caused by financial decisions.

- Suggesting necessary solutions and adjustments for business improvements. b. Objectives:

- Minimize the costs wastage and misuse of finance, the risks of investments.

- Maximize the financial efficiency, the return on finance and profitability. UNIT 17

1. What is the gearing? When is it high/low? (over-leverage/ under-leverage)

- Gearing: It is the relationship between the company’s

equity capital and longterm debts.

- High when: borrowing/ issuing bonds - Low when: issuing/ selling stocks.

2. How are 4 types of equity capital? How are they generated?

- Owner’s capital is the money invested by the owners of the company.

- Venture capital is provided by the venture firms.

- Besides, companies can issue and sell stocks on listed or unlisted securities markets.

3. What are advantages and disadvantages or owner’s capital/ venture

capital/ listed security market? a. Venture capital: - Advantages:

+ It is great chance to raise big funds.

+ The venture firms do not usually interfere in the company operation. - Disadvantages:

+ Venture firms demand high profit and fast growth.

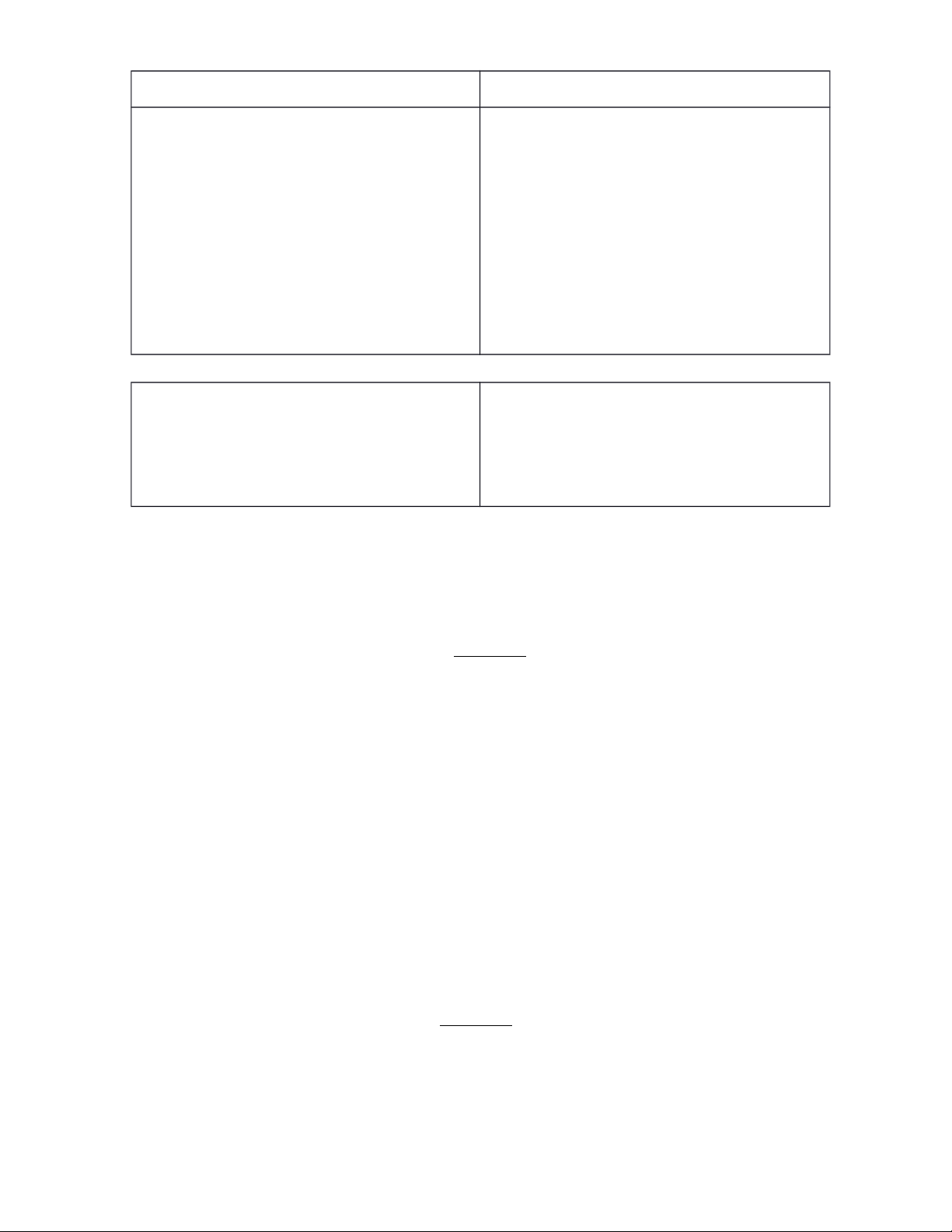

+ There is low percentage of the fund gainers. lOMoAR cPSD| 49431889 b. Stocks vs. Bonds STOCKS BONDS

- Stocks represent the company’s -

Bonds represent the company’s partial ownership debt

- The stockholders are the -

The bondholders are company’s owners creditors/lenders

They are entitled to receive dividends,

They have no right to interfere in the

to have voting right, to control &

Co. management but receive regular

supervise the Co. operation and join

fixed interest and get back principal at AGM maturity.

4. What are long-term debts? What are their advantages and disadvantages?

Long-term debt consists of loans and financial obligations lasting over one year.

Longterm debt for a company would include any financing or leasing obligations that are

to come due after a 12-month period. Long-term debt also applies to governments as

nations can also have long-term debt. - Advantages:

Long-term debts satisfy the demand for capital for expenses and investments. In

times of prosperity they can raise net profits and owners’ funds. - Disadvantages:

Borrowers must secure the debts over the fixed assets (collateral), bear high interest,

so in difficult times this may soak up all profits, cause loss or bankruptcy. UNIT 18

1. What is working (current/ floating/ circulating) capital? How is it classified?

a. Concept: Working capital consists of inventories and liquid resources

needed by a company to carry out trading or production. lOMoAR cPSD| 49431889

b. 2 types of working capital:

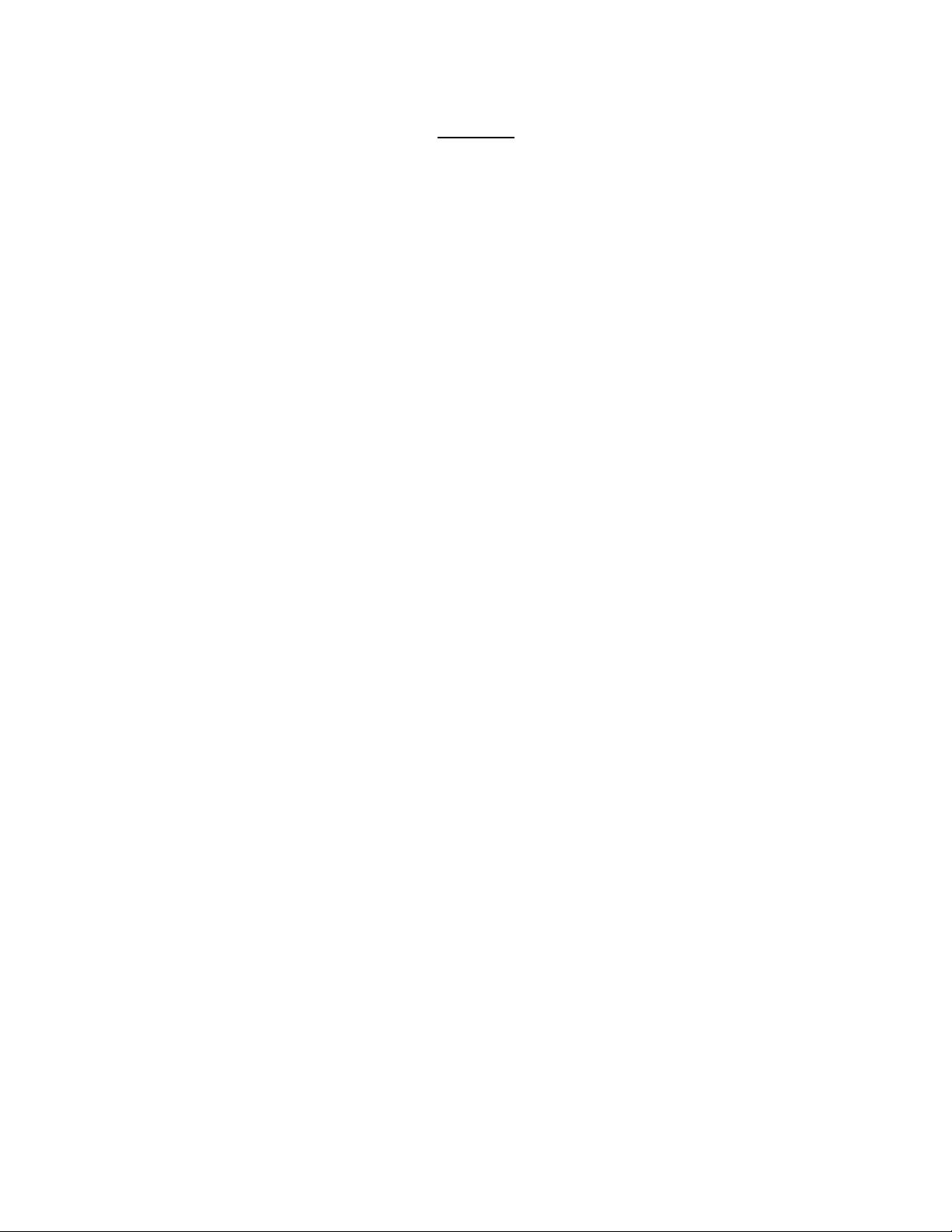

Permanent working capital

Temporary working capital

Is tied up in keeping the business

Is needed from time to time to deal flowing throughout the year

with seasonal, cyclical or unexpected fluctuations in the business

Both type of working capital have 3 major applications: inventories, debtors, cash.

+ Inventories include raw materials, work in progress, finished goods

+ Debtors include payment due to suppliers (accounts payable), payment owed

by customers (accounts receivable) + Cash

2. What are the tasks of the CFO in managing inventories/ debtors? a. Inventories:

- Provide the correct amount of working capital at the right time, in the right place

to realize the greatest return on investment

- Ensure enough inventories to meet the demand for production & sales, and to

save funds, raise investment opportunities

- Reduce the inventories costs, wastes and risks to the stocks - Apply just-in-time (JIT) b. Debtors:

Payment owed by customers

Payment due to suppliers (Accounts receivable) (Accounts payable)

- Offer minimum credit to

Negotiate the generous credit terms customers

with suppliers (lower price, high

- Avoid risks of bad debts discount, long term of repayment…) lOMoAR cPSD| 49431889

- Achieve the balance between getting and giving good credit terms to attract

customers, keep good relation with suppliers, minimize cash outlay

3. How should the CFO/ a company manage the working capital?

- Manage procurement and inventory - Pay vendors on time

- Improve the receivables process

- Manage debtors effectively

- Make informed financing decisions UNIT 19

1. What is the difference between selling and marketing concept (classical

marketing and modern marketing)? Classical marketing Modern marketing

Focuses on selling: The producers make

Focuses on satisfying customers’ needs

products and then try to persuade and wants. Producers provide the things

customers to buy the available ones that best fill customers’ demand

Selling takes place after the

Marketing is performed before production

production and throughout the company’s operation

2. What are 4Ps in marketing mix? What are included in each element of marketing mix?

Marketing mix is all the various elements of a marketing program, their

integration, and the amount of effort that a company can expend on them in

order to influence the target market. The best-known classification of these elements is the 4Ps.

a. Products: What customers need & want?

Include quality, features (standard and optional), style, brand name, size,

packaging, services and guarantee.

b. Price: How much customers are willing to pay for the goods? lOMoAR cPSD| 49431889

Includes the basic list price, discounts, the length of the payment period,

possible credit terms, and so on.

c. Place: Where and when goods must be available for sales?

Includes such factors as distribution channels, locations of points of sale,

transport, inventory size, etc.

d. Promotion: How to create rising demand for the items?

Promotion groups together advertising, publicity, sales promotion and personal selling.

4Ps are flexible and interrelated

Customers’ satisfaction

Company’s profitability UNIT 20

1. What are prices? Their roles / importance?

a. Concept: Prices are measure of goods/ service value in terms of money. b. Roles:

- Determine consumer choice, guide customers to maximize their utility.

- Assist producers to choose profitable investments, determine company

profitability & market share.

- Facilitate trade, goods and money circulate. etc

2. What are the common mistakes in setting prices?

- Pricing is too cost oriented

- Price is set independently of the rest of the marketing mix

- Price is not revised often enough to capitalize on market changes - Price is not

varied enough for different product items and market segments

3. How to handle pricing well?

- Pricing is not too cost oriented

- Price is not set independently of the rest of the marketing mix lOMoAR cPSD| 49431889

- Price is revised often enough to capitalize on market changes - Price is

varied enough for different product items and market segments

4. How are product prices set in different types of companies?

- In small companies: Prices are often set by top management rather than by the marketing or sales department

- In large companies: pricing is typically handled by divisional and product-line

managers. Even here, top management sets the general pricing objectives and

policies and often approves the prices proposed by lower levels of management. UNIT 21

1. What is accounting? What are the tasks of accountants?

- Accounting provides financial information about an economic entity over a period of time.

Accounting refers to the design, maintenance and interpretation of the information in the accounts book.

- The tasks of accountants are:

+ Prepares asset, liability, and capital account entries by compiling and analyzing account information.

+ Documents financial transactions by entering account information.

+ Recommends financial actions by analyzing accounting options.

2. What are 3 types of accounting information? Their purposes?

- Financial accounting:

+ Describe detailed financial picture of the business, provide information about

financial resources, obligation and activities of the entity. lOMoAR cPSD| 49431889

+ Used for different purposes: assisting investors and creditors in deciding where to

place investment resources, reporting on company condition to managers, making

tax return… so it is called general-purpose accounting.

- Management accounting:

+ Develop and interpret accounting information to assist the internal control system

and managers in running the business, setting the company overall goals, evaluating

its performance and making all management decisions

+ Used by management, decision-makers - Tax accounting:

+ Adjust and reorganize accounting information to conform with income tax reporting requirement

+ Used to design tax returns and tax planning

3. What is financial accounting information? For what purpose is it used?

Financial accounting refers to information describing the financial resources,

obligations, and activities of an economic entity (either an organization or an individual).

Purpose: is designed primarily to assist investors and creditors in deciding where

to place their scarce investment resources.

4. What is management accounting information? For what purpose is it used?

Management accounting involves the development and interpretation of accounting

information intended specifically

Purposes: to assist management in running the business.

5. What are differences between financial accounting and management accounting? Financial accounting Management accounting lOMoAR cPSD| 49431889

+ Describe detailed financial picture of

+ Develop and interpret accounting

the business, provide information about

information to assist the internal

control financial resources, obligation and system and managers in running the

activities of the entity. business, setting the company overall

goals, evaluating its performance and +

Used for different purposes: assisting making all management decisions investors and creditors in deciding

where to place investment resources, + Used by management,

decisionreporting on company condition to makers managers, making tax return… so it is

called general-purpose accounting.

+ Used by managers and in income tax returns. UNIT 22

1. What are 3 important financial statements? What information do they provide?

- The balance sheet (based on accounting equation: Assets = Liabilities + Owners’

Equity) shows a company’s financial situation on a particular date, generally the

last day of the financial year or accounting period.

- The income statement (the profit and loss statement) shows earnings and

expenditure, gives figures for total turnover and costs…

- The statement of cash flows (the source and application of funds statements/ the

statement of changes in financial position) shows the flows of cash in and out of

the business (cash inflows and outflows) between balance sheet dates. UNIT 25

1.What is financial analysis? For what purposes are its results used internally and externally? lOMoAR cPSD| 49431889

Financial analysis is the selection, evaluation, and interpretation of financial data, along

with other pertinent information, to assist in investment and financial decision-making.

- Financial analysis may be used internally to evaluate issues such as employee

performance, the efficiency of operations, and credit policies, and externally to

evaluate potential investments and the credit-worthiness of borrowers, among other things.

2. What are the sources of data available for financial analysis?

4 sources: financial statement data, economic data, market data, current events.

- Financial statement data:

+ Include: profit & loss, efficiency/risks…

+ Come from: financial statements, other disclosures… - Market data:

+ Include: stock prices, price indexes…

+ Come from: financial press, daily electronic media… - Economic data:

+ Include: GDP & CPI, consumption, production… +

Come from: Government sources, private sources… - Current events:

+ Include: Co. expansion, restructuring…

+ Come from: Reports, mass media…

3. What are financial ratios? How are they classified by construction?

A financial ratio is a comparison between one bit of financial information and another.

They are classified as a coverage ratio, a return ratio, a turnover ratio, a component percentage.

- A coverage ratio is a measure of a company’s ability to satisfy (meet) particular obligations.

- A return ratio is a measure of the net benefit, relative to the resources expended.

- A turnover ratio is a measure of the gross benefit, relative to the resources expended.

- A component percentage is the ratio of a component of an item to the item.

4. What are aspects of the company operation can we evaluate from financial ratios? lOMoAR cPSD| 49431889

There are 6 aspects of operating performance and financial condition we can

evaluate from financial ratios:

- A liquidity ratio: provides information on a company’s ability to meet its

shortterm, immediate obligations.

- A profitability ratio: provides information on the amount of income from each dollar of sales.

- An activity ratio: relates information on a company’s ability to manage its

resources (that is, its assets) efficiently.

- A financial leverage ratio: provides information on the degree of a company’s

fixed financing obligations and its ability to satisfy these financing obligations.

- A shareholder ratio: describes the company’s financial condition in terms of amounts per share of stock.

- A return on investment ratio: provides information on the amount of profit,

relative to the assets employed to produce that profit.

5. How are financial ratios classified?

Financial ratios are classified according to construction and important aspects of company operation.

By construction, ratios can be classified as a coverage ratio, a return ratio, a turnover

ratio, or a component percentage.

The important aspects of company operation include a liquidity ratio, a profitability

ratio, an activity ratio, a financial leverage ratio, a shareholder ratio, a return on investment ratio. UNIT 26

1.What are the tasks of auditors?

Auditing is review and examination of accounting records and financial

statements to ensure that they are true and reliable. - The auditors:

+ Review and evaluate financial records and statements. Ensure their accuracy, reliability.

+ Correct errors and irregularities.

+ Provide accounting control against errors.

+ Suggest division of accounting duties to reduce possibility of misappropriation lOMoAR cPSD| 49431889

2.What is internal auditing? What are advantages and disadvantages

(strength and weakness) of internal auditing?

Internal auditing is regular examinations of accounting documents and financial

statements by the company’s own accountants.

- Advantages: The work plays an important role in the company’s internal control

and financial management, limits accounting errors, loss of funds. - Disadvantages:

+ The audit results may be inaccurate because of the internal auditor’s lack of qualification.

+ The audit reports may not be shown to the right managing staff for necessary

adjustment and solution, so reducing audit effectiveness. UNIT 27

1.What factors would contribute to efficient production in some certain countries?

Factors leading to efficient production in some certain countries include: - Climate - Natural resources

- Geographical location - Working population

- Technological development

- Economic administration Mechanism & policies.

Effective production of certain goods: Low costs, high productivity, high output, good quality

2.What do countries benefit from the world trade? Its disadvantages?

- Advantages of world trade:

+ Increase producers’ supply of goods and profits, improve competitiveness lOMoAR cPSD| 49431889

+ Enable consumers to benefit from wider choices, higher quality and lower prices +

Assist countries to exploit comparative advantages, create wealth, push up economic growth

+ Raise opportunities for market expansion and specialization

+ Promote the world’s economic efficiency

- Disadvantages of world trade: + Language barriers + Cultural differences

3.Why/How do the Gov. encourage exports and restrict imports? * Why: - Encourage exports:

+ Reach the balance of trade, expand markets

+ Gain benefit from trade surplus, raise national wealth and Gov. budget revenue - Limit imports:

+ Support & protect infant or important domestic industries from foreign competition

+ Avoid unemployment in important industries, maintain national basic skills

+ Ensure national security and independence *How: Gov. control methods - Export encouragement:

+ Offer subsidies to producers & exporters

+ Set tax incentives, low export duty

+ Organize trade promotion missions

+ Provide marketing information

+ Sign common trade expansion agreements

+ Apply for preferential trade clauses

+ Join international trade organizations and treaties: ASEAN, AFTA, APEC, WTO, …

- Import restriction or protectionism

+ Tariff barriers: import duties (specific or ad valorem)

+ Non-tariff barriers: Complicated procedures, cultural and social difference, legal and

political difference, foreign exchange control, embargo policy, subsidies, quotas. lOMoAR cPSD| 49431889 UNIT 29

1.What are 4 common trade barriers? The reasons for imposing them?

- Tariff on imports: Tariff is a tax imposed on imported goods and services + Raise Gov. Budget revenue

+ Increase price of imports, limit imports & luxury consumption

+ Improve competitiveness of domestic products, support national industry

- Quotas on imports: A quota is a government-imposed trade restriction that limits

the number or monetary value of goods that a country can import or export

during a particular period.

+ Restrict imports and their supply + Raise imported goods price + Ensure the balance of trade

- Subsidies: Subsidies are economic benefits or financial aid which are provided by

the Gov. to support certain national economic branches.

+ Protect domestic industries and support the national citizens to afford important goods

+ Make imports less competitive than domestic products

- Embargoes: Embargo is a form of punishment to prohibit the imports or exports with another country.

+ Weaken the economic state of the targeted country

+ Put economic and political pressure on other countries

2.What are the benefits of developing multinational corporations?

Multinational corporation is a company that designs, produces and markets products in many countries

*The advantages of development of multinational firms include: - For the firm:

+ Expand business opportunities, production and market scales

+ Exploit comparative advantages to improve production efficiency +

Develop global philosophy of management, marketing and production - For the local country:

+ Promote technology transfer, new skill training, investments and job creation

+ Raise the local residents’ living standard and working skills