Preview text:

lOMoARcPSD|46958826 lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships True/False Questions

One way to compute the total contribution margin is to add total fixed expenses to net operating income. Ans: True AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting LO: 1 Level: Medium

23 On a CVP graph for a profitable company, the total revenue line will be steeper than the total cost line. Ans: True AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 2 Level: Easy

23 In two companies making the same product and with the same total sales and total

expenses, the contribution margin ratio will be lower in the company with a

higher proportion of fixed expenses in its cost structure. Ans: False AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 3 Level: Medium

23 If the variable expense per unit increases, and all other factors remain constant,

the contribution margin ratio will increase. Ans: False AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 3 Level: Medium

23 The impact on net operating income of any given dollar change in total sales can

be estimated by multiplying the CM ratio by the dollar change in total sales. Ans: True AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting LO: 3 Level: Easy

23 A company with sales of $70,000 and variable expenses of $40,000 should spend

$10,000 on increased advertising if the increased advertising will increase sales by $20,000. Ans: False AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 4 Level: Medium

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 6-7 lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

23 The formula for the break-even point is the same as the formula to attain a given

target profit for the special case where the target profit is zero. Ans: True AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting LO: 5; 6 Level: Medium

23 An increase in total fixed expenses will not affect the break-even point so long as

the contribution margin ratio remains unchanged. Ans: False AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 5 Level: Medium

23 All other things the same, a reduction in the variable expense per unit will cause the break-even point to rise. Ans: False AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 5 Level: Medium

23 The unit sales volume necessary to reach a target profit is determined by dividing

the target profit by the contribution margin per unit. Ans: False AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting LO: 6 Level: Medium

23 All other things the same, the margin of safety in dollars at a given level of sales

will tend to be lower for a capital-intensive company than for a labor-intensive

company with high variable expenses. Ans: True AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 7 Level: Medium

23 The margin of safety in dollars equals the excess of budgeted (or actual) sales over

the break-even volume of sales. Ans: True AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting LO: 7 Level: Easy

23 A company with high operating leverage will experience a lower reduction in

net operating income in a period of declining sales than will a company with low operating leverage. Ans: False AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 8 Level: Medium 6-8

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

23 If Q is the quantity of a product sold, P is the price per unit, V is the variable expense

per unit, and F is the total fixed expense, then the degree of operating leverage is

equal to: [Q(P-V)] ÷ [Q(P-V)-F] Ans: True AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 8 Level: Hard

23 A shift in the sales mix from products with high contribution margin ratios toward

products with low contribution margin ratios will raise the break-even point. Ans: True AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 9 Level: Medium

Multiple Choice Questions

23 Contribution margin can be defined as:

the amount of sales revenue necessary to cover variable expenses.

sales revenue minus fixed expenses.

the amount of sales revenue necessary to cover fixed and variable expenses.

sales revenue minus variable expenses. Ans: D AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting LO: 1 Level: Easy

23 Which of the following statements is correct with regard to a CVP graph?

A CVP graph shows the maximum possible profit.

A CVP graph shows the break-even point as the intersection of the total sales

revenue line and the total expense line.

A CVP graph assumes that total expense varies in direct proportion to unit sales.

A CVP graph shows the operating leverage as the gap between total sales

revenue and total expense at the actual level of sales. Ans: B AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting LO: 2 Level: Easy

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 6-9 lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

23 If both the fixed and variable expenses associated with a product decrease, what will be

the effect on the contribution margin ratio and the break-even point, respectively? Contribution margin ratio Break-even point A) Decrease Increase B) Increase Decrease C) Decrease Decrease D) Increase Increase Ans: B AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 3; 5 Level: Medium Source: CMA; adapted

Which of the following is true regarding the contribution margin ratio of a single product company? 0

As fixed expenses decrease, the contribution margin ratio increases. 1

The contribution margin ratio multiplied by the selling price per unit equals

the contribution margin per unit. 2

The contribution margin ratio will decline as unit sales decline. 3

The contribution margin ratio equals the selling price per unit less the variable expense ratio. Ans: B AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 3 Level: Medium

If a company is operating at the break-even point: 0

its contribution margin will be equal to its variable expenses. 1

its margin of safety will be equal to zero. 2

its fixed expenses will be equal to its variable expenses. 3

its selling price will be equal to its variable expense per unit. Ans: B AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 5; 7 Level: Medium At the break-even point: 0

sales would be equal to contribution margin. 1

contribution margin would be equal to fixed expenses. 2

contribution margin would be equal to net operating income. 3

sales would be equal to fixed expenses. Ans: B AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 5 Level: Medium 6-10

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

The break-even point would be increased by: 0

a decrease in total fixed expenses. 1

a decrease in the ratio of variable expenses to sales. 2

an increase in the contribution margin ratio. 3 none of these. Ans: D AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 5 Level: Medium

23. Which of the following strategies could be used to reduce the break-even point? Fixed expenses Contribution margin A) Increase Increase B) Decrease Decrease C) Decrease Increase D) Increase Decrease Ans: C

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 5 Level: Easy

Break-even analysis assumes that: 0 Total revenue is constant. 1

Unit variable expense is constant. 2

Unit fixed expense is constant. 3

Selling prices must fall in order to generate more revenue. Ans: B AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting LO: 5 Level: Easy

Target profit analysis is used to answer which of the following questions? 0

What sales volume is needed to cover all expenses? 1

What sales volume is needed to cover fixed expenses? 2

What sales volume is needed to earn a specific amount of net operating income? 3

What sales volume is needed to avoid a loss? Ans: C AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting LO: 6 Level: Easy

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 6-11 lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

The margin of safety can be calculated by: 0

Sales − (Fixed expenses/Contribution margin ratio). 1

Sales − (Fixed expenses/Variable expense per unit). 2

Sales − (Fixed expenses + Variable expenses). 3

Sales − Net operating income. Ans: A AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting LO: 7 Level: Medium

If the degree of operating leverage is 4, then a one percent change in quantity sold

should result in a four percent change in: 0 unit contribution margin. 1 revenue. 2 variable expense. 3 net operating income. Ans: D AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 8 Level: Easy Source: CMA; adapted

Which of the following is the correct calculation for the degree of operating leverage? 0

net operating income divided by total expenses. 1

net operating income divided by total contribution margin. 2

total contribution margin divided by net operating income. 3

variable expense divided by total contribution margin. Ans: C AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting LO: 8 Level: Easy

Which of the following is an assumption underlying standard CVP analysis? 0

In multiproduct companies, the sales mix is constant. 1

In manufacturing companies, inventories always change. 2

The price of a product or service is expected to change as volume changes. 3

Fixed expenses will change as volume increases. Ans: A AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting LO: 9 Level: Easy 6-12

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

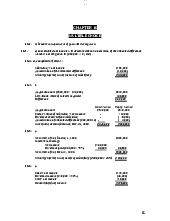

30. Hopi Corporation expects the following operating results for next year:

Sales...........................................................................$400,000

Margin of safety.....................................................$100,000

Contribution margin ratio...................................75%

Degree of operating leverage.............................4

What is Hopi expecting total fixed expenses to be next year? $75,000 $100,000 $200,000 $225,000 Ans: D AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 1; 3; 8 Level: Hard Solution:

Current sales - Breakeven sales = Margin of safety

Substituting the given information into the above equation, we will have:

$400,000 − Breakeven sales = $100,000 Breakeven sales = $300,000

Breakeven sales = Fixed expenses ÷ Contribution margin ratio

Substituting the given information into the above equation, we will have:

$300,000 = Fixed expenses ÷ 0.75 Fixed expenses = $225,000

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 6-13 lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

Escareno Corporation has provided its contribution format income statement for June.

The company produces and sells a single product.

Sales (8,400 units).......................... $764,400

Variable expenses........................... 445,200

Contribution margin....................... 319,200

Fixed expenses............................... 250,900

Net operating income..................... $ 68,300

If the company sells 8,200 units, its total contribution margin should be closest to: $301,000 $311,600 $319,200 $66,674 Ans: B AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 1 Level: Easy Solution:

Current contribution margin ÷ Current sales in units = Contribution margin per

unit $319,200 ÷ 8,400 = $38 contribution margin per unit

If 8,200 units are sold, the total contribution margin will be 8,200 × $38, or $311,600.

Rovinsky Corporation, a company that produces and sells a single product, has

provided its contribution format income statement for November.

Sales (5,700 units).............. $319,200

Variable expenses............... 188,100 Contribution margin........... 131,100

Fixed expenses................... 106,500 Net operating income......... $ 24,600

If the company sells 5,300 units, its net operating income should be closest to: $24,600 $2,200 $22,874 $15,400 Ans: D AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 1 Level: Easy 6-14

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships Solution:

Current sales dollars ÷ Current sales in units = Sales price per

unit $319,200 ÷ 5,700 = $56 sales price per unit

Current variable expenses ÷ Current sales in units = Variable expense per

unit $188,100 ÷ 5,700 = $33 variable expense per unit

Sales (5,300 units × $56)....................... $ 296,800

Variable expenses (5,300 units × $33)... 174,900

Contribution margin.............................. 121,900

Fixed expenses....................................... 106,500

Net operating income............................ $ 15,400

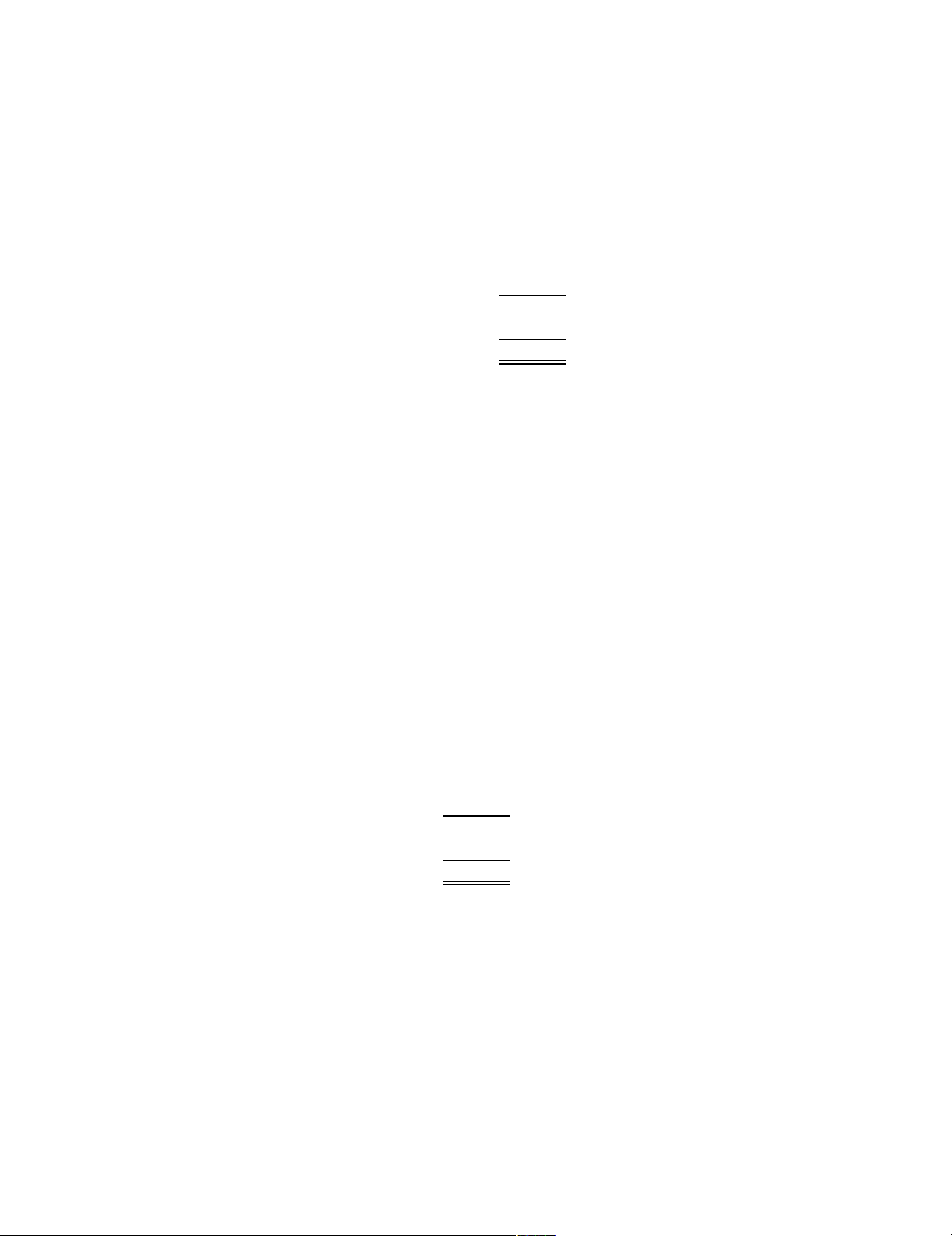

Sorin Inc., a company that produces and sells a single product, has provided its

contribution format income statement for January.

Sales (4,200 units).......................... $155,400

Variable expenses........................... 100,800

Contribution margin....................... 54,600

Fixed expenses............................... 42,400

Net operating income..................... $ 12,200

If the company sells 4,600 units, its total contribution margin should be closest to: $54,600 $59,800 $69,400 $13,362 Ans: B AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 1 Level: Easy Solution:

Current contribution margin ÷ Current sales in units = Contribution margin per

unit $54,600 ÷ 4,200 = $13 contribution margin per unit

If 4,600 units are sold, the total contribution margin will be 4,600 × $13, or $59,800.

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 6-15 lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

Decaprio Inc. produces and sells a single product. The company has provided its

contribution format income statement for June.

Sales (8,800 units).......................... $528,000

Variable expenses........................... 290,400

Contribution margin....................... 237,600

Fixed expenses............................... 211,700

Net operating income..................... $ 25,900

If the company sells 9,200 units, its net operating income should be closest to: $27,077 $49,900 $36,700 $25,900 Ans: C AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 1 Level: Easy Solution:

Current sales dollars ÷ Current sales in units = Sales price per

unit $528,000 ÷ 8,800 = $60 sales price per unit

Current variable expenses ÷ Current sales in units = Variable expense per

unit $290,400 ÷ 8,800 = $33 variable expense per unit

Sales (9,200 units × $60 ).......................... $552,000

Variable expenses (9,200 units × $33)....... 303,600

Contribution margin................................... 248,400

Fixed expenses........................................... 211,700

Net operating income................................. $ 36,700 6-16

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

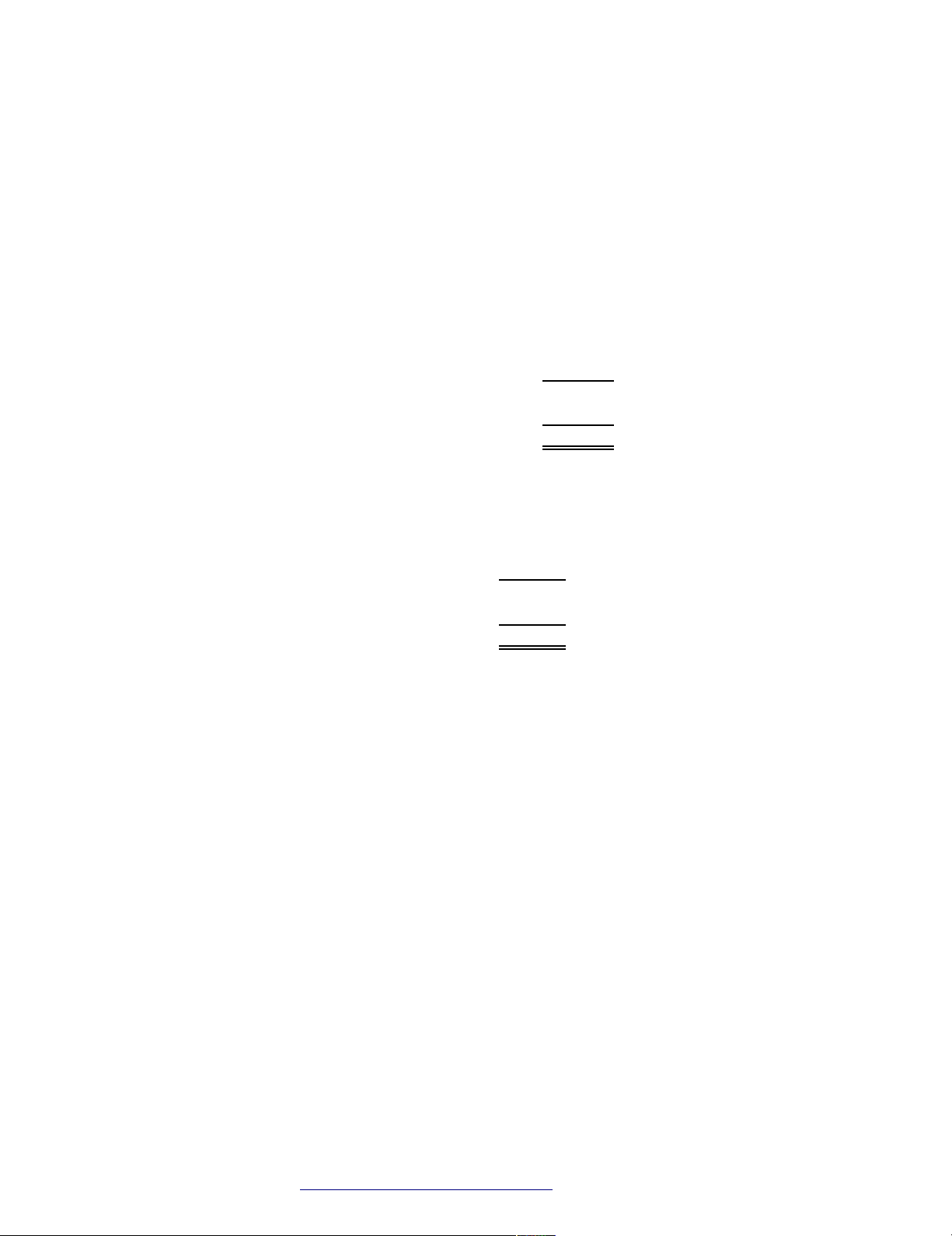

35. The Bronco Birdfeed Company reported the following information:

Sales (400 cases)............................ $100,000

Variable expenses........................... 60,000

Contribution margin....................... 40,000

Fixed expenses............................... 35,000

Net operating income..................... $5,000

How much will the sale of one additional case add to Bronco's net operating income? $250.00 $100.00 $150.00 $12.50 Ans: B AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 1 Level: Easy Solution:

Current contribution margin ÷ Current sales in cases = Contribution margin per

case $40,000 ÷ 400 = $100 contribution margin per case

If one additional case is sold, net operating income will increase by $100.

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 6-17 lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

The margin of safety in the Flaherty Company is $24,000. If the company's sales are

$120,000 and its variable expenses are $80,000, its fixed expenses must be: 0 $8,000 1 $32,000 2 $24,000 3 $16,000 Ans: B AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 3; 5; 7 Level: Hard Solution:

Current sales - Breakeven sales = Margin of safety

Substituting the given information into the above equation, we will have:

$120,000 - Breakeven sales = $24,000 Breakeven sales = $96,000

Sales - Variable expenses = Contribution margin $120,000 - $80,000 = $40,000

Contribution margin ratio = Contribution margin ÷

Sales Contribution margin ratio = $ 40,000 ÷ $120,000

Contribution margin ratio = 0.33333

Breakeven sales = Fixed costs ÷ Contribution margin ratio

Substituting the given information into the above equation, we will have:

$96,000 = Fixed costs ÷ 0.33333 Fixed costs = $32,000 6-18

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

Dodero Company produces a single product which sells for $100 per unit. Fixed

expenses total $12,000 per month, and variable expenses are $60 per unit. The

company's sales average 500 units per month. Which of the following statements is correct? 0

The company's break-even point is $12,000 per month. 1

The fixed expenses remain constant at $24 per unit for any activity level within the relevant range. 2

The company's contribution margin ratio is 40%. 3

Responses A, B, and C are all correct. Ans: C AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 3; 5 Level: Medium Solution:

Answer A is not correct because:

Sales = Variable expenses + Fixed expenses +

Profit $100Q = $60Q + $12,000 + $0 $40Q = $12,000

Q = $12,000 ÷ $40 per unit = 300 units

300 units × $100 selling price per unit = $30,000 breakeven sales in dollars

Answer B is not correct because fixed costs change as activity level

changes Answer C is correct because:

Contribution margin per unit = Selling price per unit - Variable expenses per unit = $100 - $60 = $40

Contribution margin ratio = Contribution margin per unit ÷ Selling price per unit

Contribution margin ratio = $40 ÷ $100

Contribution margin ratio = 40%

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 6-19 lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

Holt Company's variable expenses are 70% of sales. At a $300,000 sales level, the

degree of operating leverage is 10. If sales increase by $60,000, the degree of operating leverage will be: 0 12 1 10 2 6 3 4 Ans: D AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 3; 8 Level: Hard Solution:

Sales.......................................................... $300,000

Variable expenses ($300,000 × 70%)....... 210,000

Contribution margin................................. 90,000

Fixed expenses.......................................... ?

Net operating income............................... $ ?

Current degree of operating leverage = Current contribution margin ÷ Current net operating income

10 = $90,000 ÷ Current net operating income

Current net operating income = $90,000 ÷ 10 = $9,000

Contribution margin = Fixed expenses - Net operating

income $90,000 = Fixed expenses - $9,000

Fixed expenses = $90,000 - $9,000 = $81,000

Sales ($300,000 + $60,000)...................... $360,000

Variable expenses ($360,000 × 70%)....... 252,000

Contribution margin................................. 108,000

Fixed expenses.......................................... 81,000

Net operating income............................... $ 27,000

Degree of operating leverage = Contribution margin ÷ Net operating

income = $108,000/$27,000 = 4.0 6-20

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

Gayne Corporation's contribution margin ratio is 12% and its fixed monthly expenses are

$84,000. If the company's sales for a month are $738,000, what is the best estimate of

the company's net operating income? Assume that the fixed monthly expenses do not change. 0 $565,440 1 $654,000 2 $88,560 3 $4,560 Ans: D AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 3 Level: Easy Solution:

Sales.......................................................... $738,000

Variable expenses ($738,000 × 88%)....... 649,440

Contribution margin ($738,000 × 12%)... 88,560

Fixed expenses.......................................... 84,000

Net operating income............................... $ 4,560

Jilk Inc.'s contribution margin ratio is 58% and its fixed monthly expenses are $36,000.

Assuming that the fixed monthly expenses do not change, what is the best estimate of

the company's net operating income in a month when sales are $103,000? 0 $23,740 1 $59,740 2 $67,000 3 $7,260 Ans: A AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 3 Level: Easy Solution:

Sales........................................................... $103,000

Variable expenses ($103,000 × 42%)........ 43,260

Contribution margin ($103,000 × 58%).... 59,740

Fixed expenses........................................... 36,000

Net operating income................................. $ 23,740

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 6-21 lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

Creswell Corporation's fixed monthly expenses are $29,000 and its contribution margin

ratio is 56%. Assuming that the fixed monthly expenses do not change, what is the

best estimate of the company's net operating income in a month when sales are $95,000? 0 $12,800 1 $24,200 2 $53,200 3 $66,000 Ans: B AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 3 Level: Easy Solution:

Sales........................................................... $95,000

Variable expenses ($95,000 × 44%)........... 41,800

Contribution margin ($95,000 × 56%)....... 53,200

Fixed expenses........................................... 29,000

Net operating income................................. $24,200

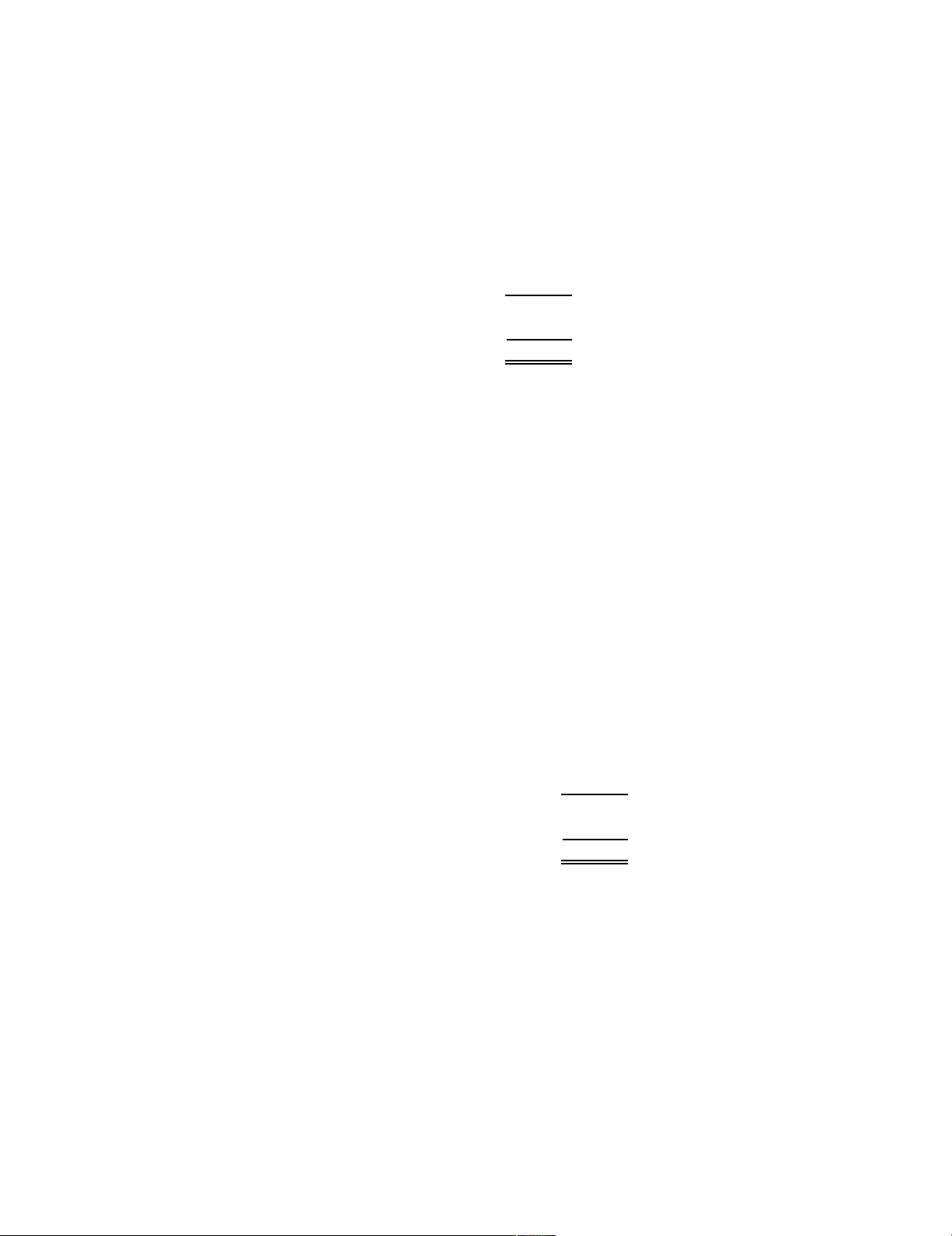

Wilson Company prepared the following preliminary budget assuming no advertising expenditures:

Selling price....................... $10 per unit

Unit sales............................ 100,000

Variable expenses............... $600,000

Fixed expenses................... $300,000

Based on a market study, the company estimated that it could increase the unit

selling price by 15% and increase the unit sales volume by 10% if $100,000 were

spent on advertising. Assuming that these changes are incorporated in its budget,

what should be the budgeted net operating income? $175,000 $190,000 $205,000 $365,000 Ans: C AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 4 Level: Medium Source: CPA; adapted 6-22

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships Solution:

Sales (110,000 units × $11.50)..................... $ 1,265,000

Variable expenses (110,000 units × $6*)...... 660,000

Contribution margin...................................... 605,000

Fixed expenses ($300,000 + $100,000)........ 400,000

Net operating income.................................... $ 205,000

0 Current variable expenses ÷ Current sales in units = Variable expense per

unit $600,000 ÷ 100,000 = $6 variable expense per unit

Data concerning Kardas Corporation's single product appear below: Per Unit Percent of Sales

Selling price....................... $140 100%

Variable expenses............... 28 20% Contribution margin........... $112 80%

The company is currently selling 8,000 units per month. Fixed expenses are $719,000

per month. The marketing manager believes that a $20,000 increase in the monthly

advertising budget would result in a 180 unit increase in monthly sales. What should be

the overall effect on the company's monthly net operating income of this change? decrease of $160 increase of $20,160 decrease of $20,000 increase of $160 Ans: D AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 4 Level: Easy Solution: 8,000 units 8,180 units

Sales (8,000 units, 8,180 units × $140).......... $ 1,120,000 $ 1,145,200 Variable expenses

($1,120,000, $1,145,200 × 20%)................ 224,000 229,040

Contribution margin....................................... 896,000 916,160

Fixed expenses................................................ 719,000 739,000

Net operating income..................................... $ 177,000 $ 177,160

Increase in net operating income: $177,160 - $177,000 = $160

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 6-23 lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

Kuzio Corporation produces and sells a single product. Data concerning that product appear below: Per Unit Percent of Sales

Selling price....................... $130 100%

Variable expenses............... 78 60% Contribution margin........... $ 52 40%

The company is currently selling 6,000 units per month. Fixed expenses are $263,000

per month. The marketing manager believes that a $5,000 increase in the monthly

advertising budget would result in a 140 unit increase in monthly sales. What should be

the overall effect on the company's monthly net operating income of this change? increase of $2,280 increase of $7,280 decrease of $5,000 decrease of $2,280 Ans: A AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 4 Level: Easy Solution: 6,000 units 6,140 units

Sales (6,000 units, 6,140 units × $130)......... $780,000 $ 798,200 Variable expenses

($780,000, $798,200 × 60%)..................... 468,000 478,920

Contribution margin...................................... 312,000 319,280

Fixed expenses.............................................. 263,000 268,000

Net operating income.................................... $ 49,000 $ 51,280

Increase in net operating income: $51,280 - $49,000 = $2,280 6-24

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

45. Data concerning Dorazio Corporation's single product appear below: Per Unit Percent of Sales

Selling price................................... $160 100%

Variable expenses........................... 48 30%

Contribution margin....................... $112 70%

Fixed expenses are $87,000 per month. The company is currently selling 1,000 units

per month. Management is considering using a new component that would increase

the unit variable cost by $28. Since the new component would increase the features of

the company's product, the marketing manager predicts that monthly sales would

increase by 400 units. What should be the overall effect on the company's monthly

net operating income of this change? increase of $5,600 increase of $33,600 decrease of $5,600 decrease of $33,600 Ans: A AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 4 Level: Easy Solution: 1,000 units 1,400 units

Sales (1,000 units, 1,400 units × $160).............. $160,000 $ 224,000 Variable expenses

(1,000 units × $48, 1,400 units × $76)............ 48,000 106,400

Contribution margin............................................ 112,000 117,600

Fixed expenses.................................................... 87,000 87,000

Net operating income.......................................... $ 25,000 $ 30,600

Increase in net operating income: $30,600 - $25,000 = $5,600

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 6-25 lOMoARcPSD|46958826

Chapter 6 Cost-Volume-Profit Relationships

Chovanec Corporation produces and sells a single product. Data concerning that product appear below: Per Unit Percent of Sales

Selling price....................... $170 100%

Variable expenses............... 68 40% Contribution margin........... $102 60%

Fixed expenses are $521,000 per month. The company is currently selling 7,000 units

per month. Management is considering using a new component that would increase

the unit variable cost by $6. Since the new component would increase the features of

the company's product, the marketing manager predicts that monthly sales would

increase by 500 units. What should be the overall effect on the company's monthly

net operating income of this change? decrease of $48,000 decrease of $6,000 increase of $48,000 increase of $6,000 Ans: D AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting LO: 4 Level: Easy Solution: 7,000 units 7,500 units

Sales (7,000 units, 7,500 units × $170)............ $ 1,190,000 $1,275,000 Variable expenses

(7,000 units × $68, 7,500 units × $74)......... 476,000 555,000

Contribution margin......................................... 714,000 720,000

Fixed expenses................................................. 521,000 521,000

Net operating income....................................... $ 193,000 $ 199,000

Increase in net operating income: $199,000 - $193,000 = $6,000 6-26

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition