Preview text:

lOMoAR cPSD| 58950985 A. Intel overview 1. History

Intel Corporation is an American multinational corporation and technology company

headquartered in Santa Clara, California. Intel designs, manufactures, and sells computer

components and related products for business and consumer markets. It is considered one of

the world's largest semiconductor chip manufacturers by revenue until 2016.

In 1968, Gordon Moore suggested to Bob Noyce that semiconductor memory, an emerging

technology, might form the basis of a new company. Shortly after, on July 18, 1968, the two

men incorporated a venture that would later be called Intel. Almost immediately, Andy Grove

joined them, and the three men together formed the leadership of the company that has

produced technological innovations that have created new industries. 2. Products

Intel provides processors to major computer system makers, including Lenovo, HP, Dell and

Apple. The company is best known for CPUs based on its x86 architecture, which was created

in the 1980s and has been continuously modified, revised and modernized. Intel also offers

graphics processing units (GPUs), networking accelerators, programmable processors, AI

accelerators, and communications and security products. In addition to processors, the

company produces various components such as motherboard chipsets, network interface

controllers, integrated circuits, flash memory, graphics chips, embedded processors, and other

technology related to communications and computing. Its business divisions encompass the

computer client segment, data center operations, IoT ecosystem, programmable solutions, non-

volatile memory solutions, and more. Intel also invests heavily in R&D to strengthen its

competitive position and accelerate its growth in the era of artificial intelligence (AI) and smart computing.

Intel has broadly classified its business as:

● Data-Centric – It includes memory and storage products, programmable

semiconductors, products for machine learning-based sensing, data analysis, and

mapping. It also includes platforms and related products for cloud service and

communication service providers.

● PC-Centric – It includes a platform designed for end-users and targets the commercial,

gaming, and graphics market segment. lOMoAR cPSD| 58950985 Product Target Customer Segment Market Segment Consumers and Client Computing Intel Core OEMs, Enterprises Group Consumer Computing, Processors (i3, i5, OEMs, Gaming, i7, i9) Enterprise PCs Intel Xeon Data Centers,

Data Center and Data Centers, Cloud Processors Enterprises, Telecom AI Infrastructure, AI, Enterprise Intel Atom & Mobile Devices, IoT Network and Consumer PCs, Pentium Processors Devices Edge Embedded Devices, IoT Data Center and Intel Optane Data Centers, AI Data Storage, Memory and Enterprises, AI Enterprise, Cloud, Storage Companies HPC Mobileye Mobileye (EyeQ Automotive OEMs, Automotive, SoCs, ADAS Tier-1 Suppliers, Tech Autonomous Vehicles, Solutions) Firms ADAS

Intel Core Processors are by far the most significant contributor to Intel's overall revenue,

primarily driven by the consumer market. While Intel Xeon Processors continue to be a

dominant force in the data center and AI markets, they are essential for cloud providers and

enterprises. In the IoT and mobile sectors with Intel Atom Processors, has a major focus on

embedded systems. Intel Optane & AI Accelerators serve the data center and AI

infrastructure markets. Intel is making significant investments in this area, particularly in

memory solutions and accelerators for AI workloads. lOMoAR cPSD| 58950985 3. Market share

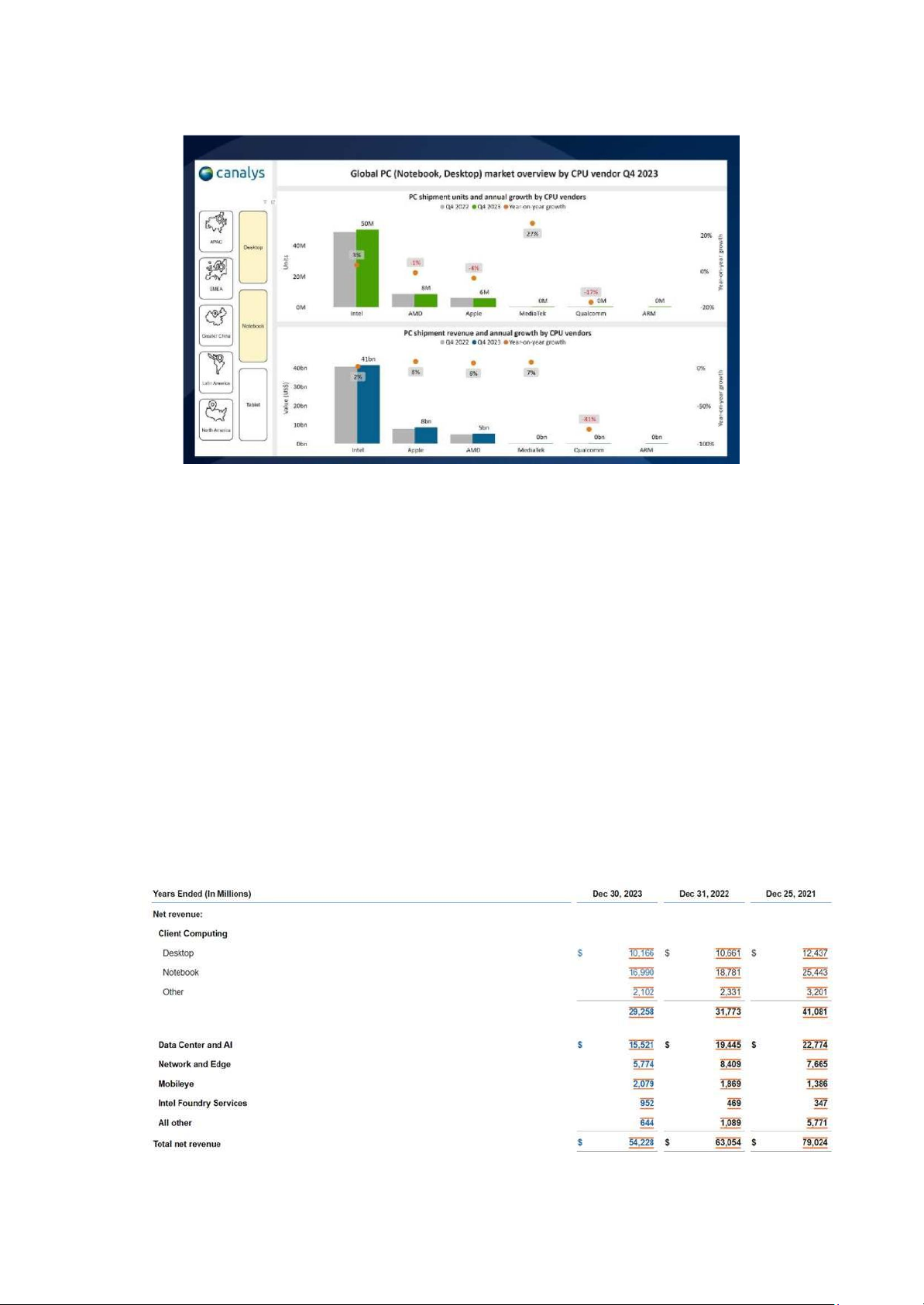

In Q4 2023, Intel Corporation maintained its leading position in PC (excluding tablets)

processor shipments, with a market share of 78%, showing a stable performance; AMD with

13% of the market share and 9% of the market, which it is assumed belongs to Apple, Qualcomm, Arm, and MediaTek.

With Desktop PC, Mobile, Client revenue share, AMD lost 1% of market share to Intel in

desktop PCs in the second quarter of 2024 and now controls 23%, leaving 77% to Intel at 50

million CPUs globally in 2023.

With Server revenue, Intel now controls 24.1% of the data center CPU market with its EPYC

CPUs. When compared to the second quarter of 2024, AMD's gained even more, as the

company grabbed 5.6% from Intel. Moreover, Intel earned $3.0 billion selling 75.9% of data

center CPUs (units), $0.2 billion more than AMD with $2.8 billion earned by selling 24.1% of server CPUs (units).

However, with the Add-in-board (AIB) market, Intel recently registered at zero percent. Since

Intel introduced its first dedicated AIB – or graphics card – via the Arc Alchemist

microarchitecture in March 2022, the company has seemingly failed to capture meaningful

market share from either Nvidia or AMD. 4. Revenue lOMoAR cPSD| 58950985

In 2023, Intel annual revenue was $54.2 billion, down $8.8 billion, or 14%, from 2022. CCG

revenue decreased 8% due to lower notebook and desktop volume from lower demand across

market segments, partially offset by increased volume in the second half of the year as customer

inventory levels normalized compared to higher levels in the first half.

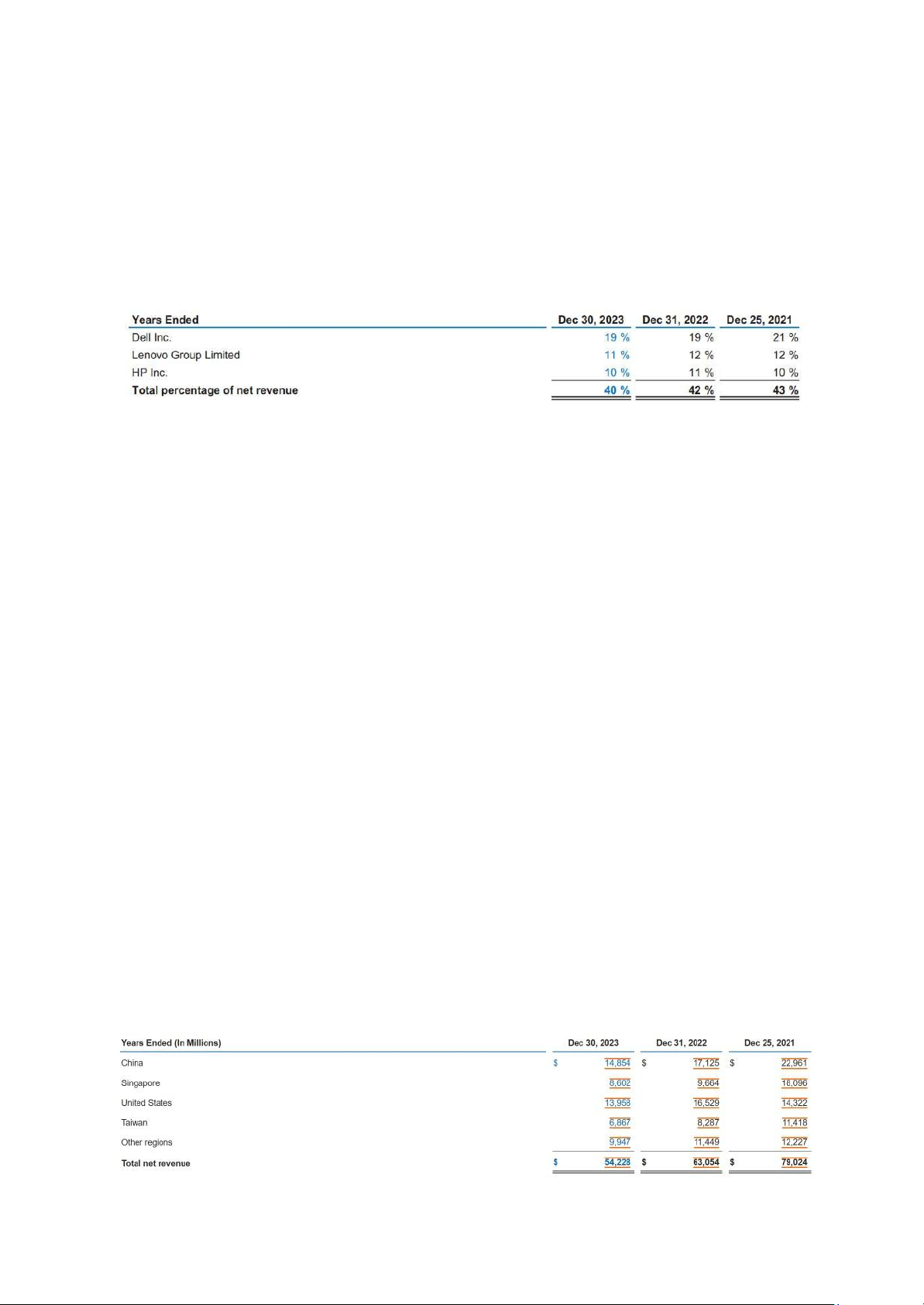

As of 2023, 40% of Intel’s net revenue came from three main customers: Dell, Lenovo Group,

and HP. In 2020, a key long-term partnership for the company came to an end when Apple Inc.

announced that its Macs would no longer use Intel processors.

Compared to their revenue in 2020, 2023 was $24 billion lower, yet the company's workforce

is 10% larger today. To reduce its head count, Intel plans to roll out a retirement offering for

eligible employees and offer an application for voluntary departures.

4.1. Core Revenue: PC-Centric Business

The Client Computing Group (CCG), Intel’s core revenue generator, represents 54% of

Intel’s total revenue in 2023, which amounts to approximately $29.3 billion. This segment

includes products like Intel Core processors (i3, i5, i7, i9), Intel Atom processors, and other consumer-related devices.

4.2. Non-Core Revenue: Data-Centric Businesses

Intel’s Data-Centric Businesses encompass several key areas: Data Center Group (DCAI),

Network and Edge (NEX), Mobileye, and Intel Foundry Services (IFS). Collectively, these

contribute 46% of Intel’s total revenue (~ $24.9 billion).

DCAI takes up about 28% of total revenue (~$15.2 billion). Moreover, its revenue decreased

by 20%, primarily due to lower server volume in the data center market. This was a result of a

softening demand for CPUs from data centers, which impacted Intel’s ability to maintain growth in this area.

NEX contributes about 10% of total revenue (~$5.4 billion). However, customers are reducing

purchases to adjust to lower demand and inventory levels which can affect this field.

Mobileye contributes 4% of total revenue (~$2.17 billion), and has a less significant decline relative to other segments. lOMoAR cPSD| 58950985

China is the major market for Intel as it contributes ~27% to the total revenue. It is also the

largest importer of semiconductors globally. And it is highly dependent on US companies for

semiconductors because of a huge demand by PC and Over Equipment Manufacturer (OEM).

Singapore, the US, and Taiwan are other primary markets for Intel. These are the major markets

for smart computing and devices and hence have a high demand for semiconductors.

B. Intel’s Global business strategy I. Business strategy

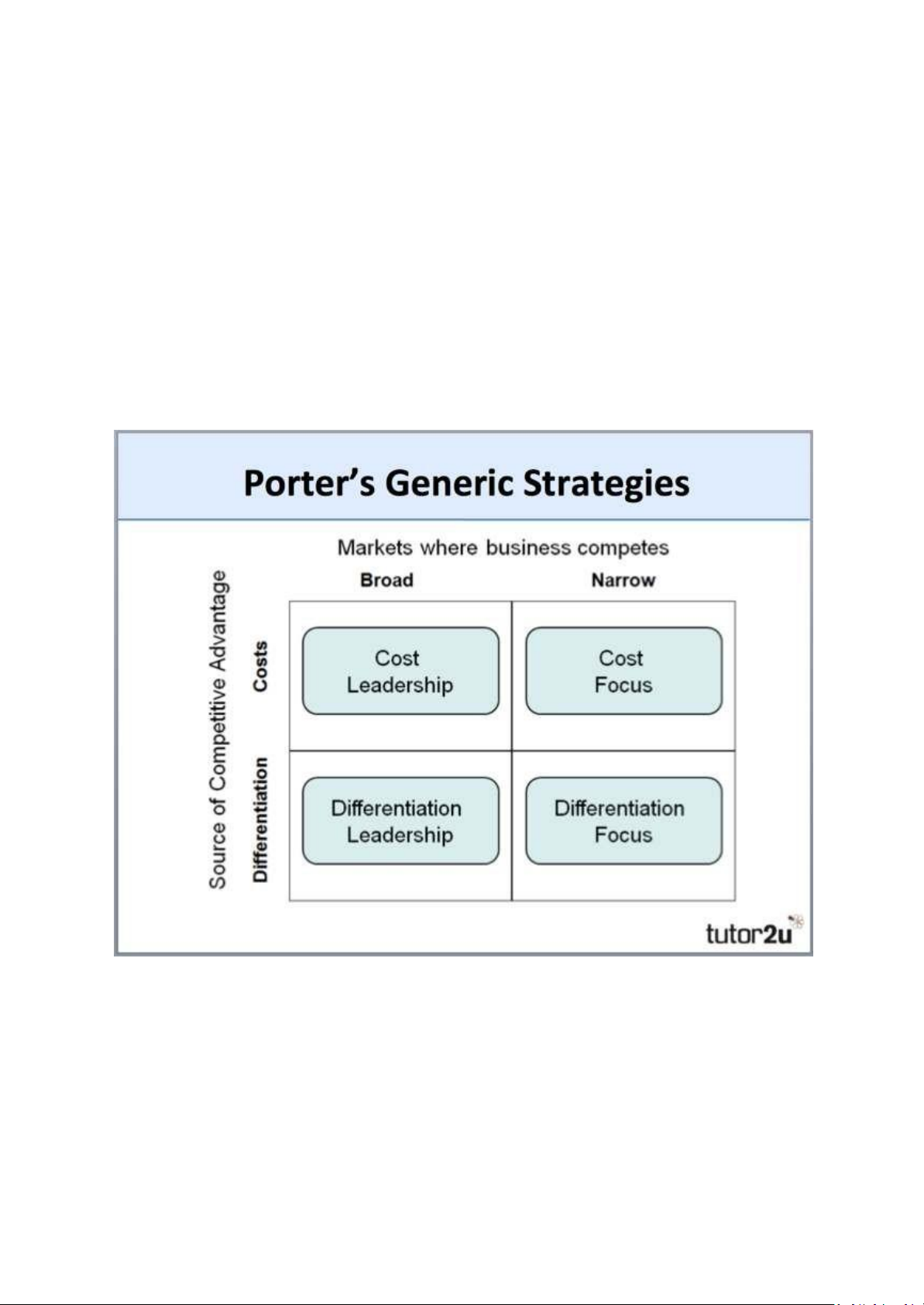

Intel Corporation’s generic competitive strategy is di

erentiation leadership. In Porter’s model,

this generic strategy builds competitive advantage based on product quality or features, customer

service, and brand image management. In Intel’s case, di erentiation is applied through product

quality and features. For example, the company invests in rapid innovation to produce cutting-edge

microprocessors and related technological products. The advanced features of these products ensure

leadership in the global market, helping fulfill Intel’s mission statement and vision statement. The implementation of the di

erentiation generic strategy helps Intel maintain its competitive

advantage despite strong competitors like AMD. lOMoAR cPSD| 58950985 Di

erentiation requires key strategic objectives that make Intel an industry leader. One of these

strategic objectives is to rapidly innovate to develop new or enhanced products that competitors

cannot easily match. For example, developing faster and more energy-e cient processors for mobile

products can strengthen Intel’s industry position, especially with regard to the mobile device market. In relation, based on the di

erentiation generic strategy, another strategic objective is to increase

the company’s competitive advantage and aggressiveness in the mobile device market. This objective

is based on the fact that Intel is a minor player in the mobile device market. (Rowland, 2018). II. Intensive growth strategy

1. ProductDevelopment(Primary)

Intel Corporation keeps product development as its primary intensive growth strategy. In the Anso

Matrix, product development supports business growth through new products that increase revenues.

For example, Intel’s operations management supports business growth and global market dominance

through the e ective development and introduction of new processors. This intensive growth

strategy makes the company’s new products attractive and profitable, thereby ensuring business

growth. Product development and Intel’s di erentiation generic strategy both support

competitive advantage based on product quality and features. A strategic objective based on product

development is to grow the company through rapid innovation. A related strategic objective based on

this intensive growth strategy is to increase Intel’s R&D investment for new product development.

2. MarketPenetration(Secondary)

The market penetration intensive growth strategy involves selling more products to current customers.

Intel implements market penetration as a secondary intensive strategy through business partnerships

and aggressive deals that favor growth and a strong market presence. For example, the company has

special agreements with computer developers and manufacturers to use Intel microprocessors in their

products, as in the case of Microsoft’s Surface devices. The generic competitive strategy of di

erentiation pushes the company to develop competitive advantages based on advanced features and

high quality in product development. Such features and quality support the e ective

implementation of market penetration as an intensive strategy for the company’s growth in the

semiconductor and microprocessor market. A strategic objective based on market penetration is to

grow the business through aggressive marketing strategies and corresponding tactics in Intel’s marketing mix or 4Ps.

3. MarketDevelopment(Supporting)

Market development is an intensive growth strategy that serves a supporting role in Intel Corporation’s

progress. In implementing this intensive strategy, growth is achieved by entering new markets or

market segments, or by creating new markets for novel products. In this case, Intel applies market

development when it creates entirely new product lines. For example, the introduction of new mobile

chips developed the company’s presence in the mobile device market. The generic strategy of di

erentiation creates a competitive advantage that increases Intel’s potential success in new markets or

market segments when implementing market development as an intensive growth strategy. A strategic

objective based on this intensive strategy is to grow Intel through novel products to enter new markets,

such as the market for smart home systems. lOMoAR cPSD| 58950985

4. Diversification(Supporting)

Intel uses diversification as a supporting intensive growth strategy. This intensive strategy facilitates

the company’s growth through new business. For example, the 2016 acquisition of the German

company, Ascending Technologies, which develops unmanned aerial vehicles, contributed to the

diversification of Intel’s business. The generic competitive strategy of di erentiation, when applied

within the context of diversification, ensures the company’s competitive advantage through products

that attract target customers. A strategic objective based on diversification as an intensive strategy is

to grow Intel’s business through more acquisitions in other industries. III. Sustainable strategy

The Intel portfolio of hardware solutions for industry, built for demanding environments, is making it

faster and easier to develop and deploy intelligence at the edge in the pursuit of sustainability. These

solutions are powering gains in e

ciency, reducing carbon footprints, and helping businesses

cut waste in their operations and supply chains.

Intel’s global network of innovators o

ers a wide variety of intelligent edge and industrial solutions

on the Intel Solutions Marketplace. Intel also provides powerful software tools to speed the

development of sustainable factory solutions. Intel Edge Insights for Industrial and the Intel

Distribution of OpenVINO toolkit are helping bring AI, machine vision, and other smart factory

technologies to a broader range of businesses. Their RISE 2030 strategy and goals raise the bar for

commitment to corporate responsibility and ambitions to overcome global challenges. By 2030, their

goal is to achieve net positive water use, 100 percent renewable power, zero total waste to landfill,

and additional absolute carbon emissions reductions.

C. Intel’s global supply chain I. Sourcing 1. Raw Material Sourcing

Intel is one of the world's leading semiconductor manufacturers, and raw materials are

a critical component of the company's supply chain. Over 90% of Intel's raw materials

used for the production of microprocessors and electronic components primarily consist

of copper, silicon, tantalum, tin, tungsten, and gold. Intel is committed to sourcing

materials responsibly and sustainably. The company has established strict standards for

supplier selection, prioritizing partners that meet ethical and environmental criteria.

Intel has developed a global sourcing strategy that emphasizes responsible sourcing,

transparency, and collaboration across industries.

To manage the environmental and ethical impacts of its supply chain, Intel collaborates

with the Responsible Minerals Initiative (RMI), ensuring that 98% of its smelters are

certified as conflict-free. Intel also participates in programs like the Conflict-Free

Smelter Program to ensure that all materials used do not contribute to conflicts in

mining regions. With approximately 70% of raw materials traced, Intel not only

enhances product quality but also contributes to the sustainable development of the global electronics industry. lOMoAR cPSD| 58950985

This effort aligns with Intel's commitment to traceability, aiming to track raw materials

from the mine through the smelting process, which helps Intel meet regulatory and

ethical standards in sourcing minerals from conflict-free sources. Additionally, To

ensure a stable and high-quality supply, Intel collaborates with numerous suppliers

worldwide, including major companies like Mitsubishi Materials and KGHM Polska

Miedź, which specialize in copper and precious metals because they provide high-purity

materials and advanced equipment essential for Intel’s precise manufacturing

requirements. High-quality silicon wafers, for instance, ensure fewer defects in chips,

which is crucial for Intel’s high-performance standards. Raw material prices often

fluctuate with the market, but Intel has invested in long-term contracts with suppliers to mitigate price risks.

2. Supplier Selection & Evaluation

More than 9,000 tier 11 suppliers in 89 countries provide direct materials for our

production processes, intellectual property, tools and machines for our factories,

logistics and packaging services, software, office materials, and travel services for Intel.

We also rely on others to manufacture, assemble, and test some of our components and products.

According to statistics in 2023, the largest supplier is Taiwan accounting for

Approximately 60% of Intel's semiconductor manufacturing is handled by TSMC

(Taiwan Semiconductor Manufacturing Company), which is the largest foundry

globally, followed by South Korea with Samsung is another significant supplier,

contributing around 12.4% of the semiconductor market. The third supplier is the

United States: Companies like GlobalFoundries and Intel's own manufacturing facilities

also play a crucial role, with GlobalFoundries accounting for about 6% of the

market.And then is China with SMIC (Semiconductor Manufacturing International

Corporation) is a notable supplier from China, contributing roughly 5% to the global semiconductor supply.

Intel operates 10 manufacturing sites worldwide, which include both wafer fabrication

facilities and assembly/test plants lOMoAR cPSD| 58950985 Intel in Oregon, US Intel Arizona, US lOMoAR cPSD| 58950985 Intel New Mexico, US Intel Dalian , China lOMoAR cPSD| 58950985

Intel Ho Chi Minh, Vietnam

Many suppliers are strategically located near Intel's fabrication plants, particularly in

the U.S. and Asia. This proximity reduces transportation costs and lead times for

components. Besides, countries like Taiwan and South Korea have invested heavily in

their semiconductor ecosystems, creating a robust infrastructure that supports all stages

of semiconductor production, from design to fabrication and testing. And suppliers such

as China offer competitive labor costs, which help Intel manage its production expenses

while maintaining quality standards.

Criteria for Evaluating Potential Suppliers

Furthermore, Intel considers many characteristics and business principles in evaluating

potential suppliers. Suppliers who have been successful at Intel can be assured that they

have met some of the most stringent requirements in the industry. Successful sourcing

at Intel is not achieved solely on the basis of securing competitive bids. Intel is not

looking for the lowest prices, but for the best value on a total cost basis. Intel strives to

work with suppliers who are not only capable of, but also motivated to share Intel's

standards for total quality and continuous improvement. Companies under

consideration as potential suppliers are evaluated in a process using the following criteria: ● Total Quality

To achieve excellence and customer satisfaction worldwide, our focus must be on

continuous improvement within the processes and services on which we rely. Intel and

its suppliers must strive to examine and improve all of the systems by which our

businesses are run. Our suppliers are an integral part of our overall quality process,

working together toward improvement we can build better products right from the start.

To improve product cost and performance, Intel and its suppliers must consider all

factors, which combined make up the true value of the materials, equipment and

services being procured. Joint efforts to identify value and maximize results are the

basis for intelligent buying decisions and will ensure higher quality at lower total cost. ● Collaboration lOMoAR cPSD| 58950985

Intel’s success in achieving Total Quality depends on viewing suppliers as a valuable

extension of our own business. Our goal in purchasing is to build long-term business

relationships with a select group of suppliers who share our total quality vision by

consistently delivering the highest quality products and services. Ultimately, this focus

means selecting fewer, higher quality suppliers. ● Availability

Suppliers must be responsive to the rapid changes in design and manufacturing

strategies. Reducing the time it takes to deliver materials and services to our

manufacturing facilities helps to bring Intel products to market sooner and to reduce

inventory exposure for both Intel and our suppliers. The speed of technological changes

drives our need for reduced cycle times, shorter lead-times, 100% defect-free materials, and on-time delivery.

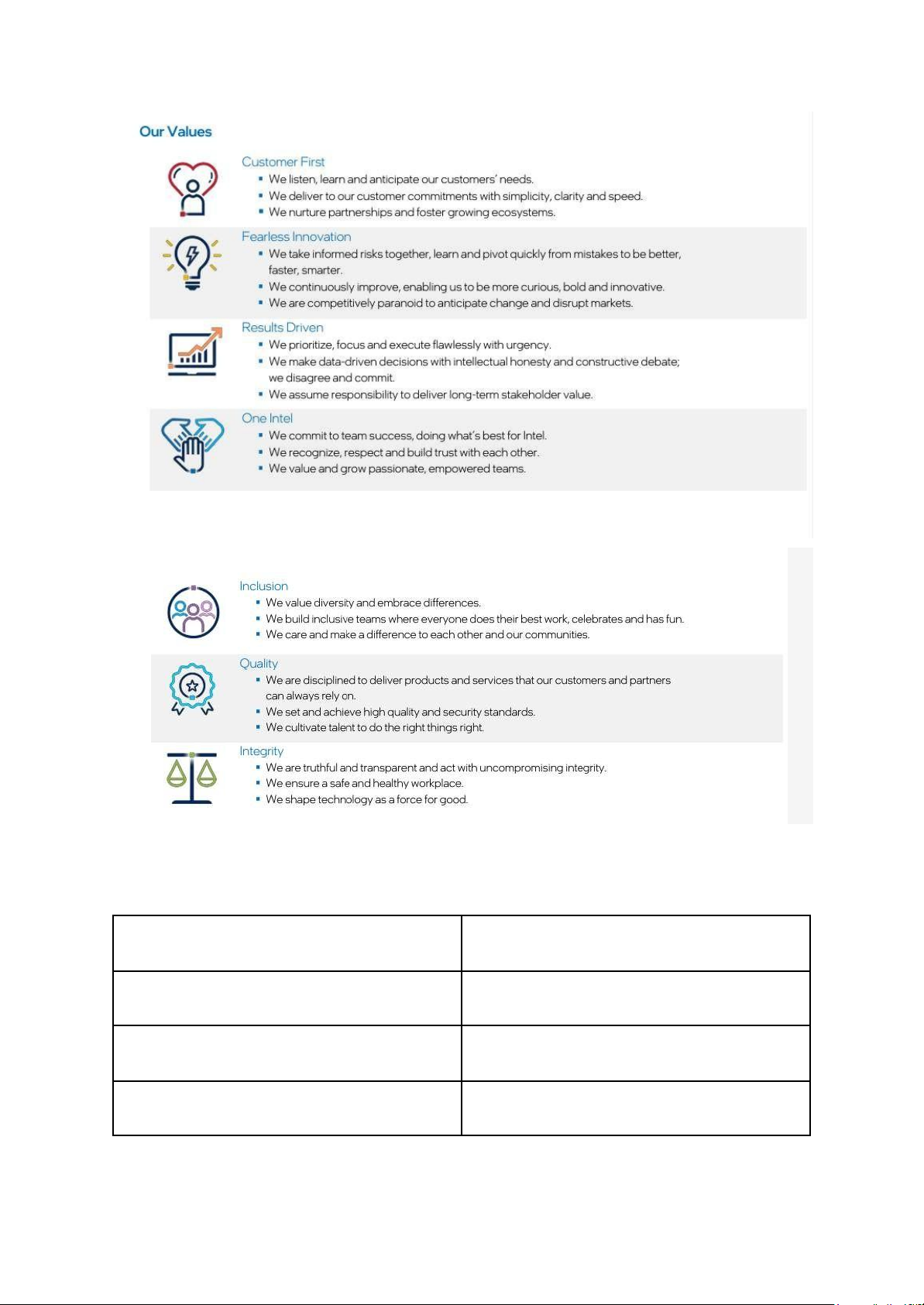

Intel's rapid growth has come principally from the technical innovations that have

opened new markets and from the efforts of our employees. Some of the philosophies

that have driven Intel have evolved into a distinct result-driven culture guided by our Corporate Values. lOMoAR cPSD| 58950985

In short, Intel is not looking for the lowest prices, but for the best value across multiple

factors. Companies under consideration as potential suppliers are evaluated in a process using the following criteria: ● Quality ● Sustainability ● Technology ● Financial Stability ● Productivity

● Delivery Predictability/Reliability ● Process Control ● Service lOMoAR cPSD| 58950985 ● World-wide Cost ● Diversity Competitiveness ● Environmental, Social & ● Management Philosophy Governance ● Innovation/New Ideas ● Training Programs

Intel expects to establish long-term relationships with capable suppliers and work

closely with them over time to achieve high levels of quality and productivity. This

process involves communicating intentions and expectations clearly, defining measures

of success, obtaining regular feedback, and implementing corrective action plans to improve performance.

3. Supplier Relationship Management.

Diversity and Inclusion Commitment: Intel has set clear goals to enhance diversity within its

supply chain, including doubling its spending with suppliers from the current $1 billion to $2 billion by 2030.

2030 Goal Program: Intel has rolled out this program in 26 countries and territories, focusing

on partnering with suppliers who are women of color, minority-owned businesses, and Black-

owned businesses in the United States.

Geographic Expansion: Intel is not only diversifying its supplier base geographically but also

emphasizing equitable development across different groups, creating opportunities for

underrepresented communities globally.

Government Partnerships: Intel is also collaborating with governments to drive the

development of more sustainable and efficient supply chains.

Intel collaborates with approximately 19,000 suppliers across the globe, forming a

diverse network essential for its operations in the semiconductor industry. The

average duration of partnerships with these suppliers is significant, often exceeding

10 years, which underscores Intel's commitment to fostering long-term relationships.

Intel emphasizes strong collaboration and mutual growth within its supply chain

ecosystem. The company employs a robust Supplier Relationship Management (SRM)

framework that integrates advanced technologies, such as data analytics and artificial

intelligence, to continuously evaluate supplier performance and ensure adherence to quality standards.

To facilitate effective management of supplier relationships, Intel operates multiple

regional offices worldwide, enabling localized support and oversight. This lOMoAR cPSD| 58950985

decentralized approach allows Intel to quickly adapt to regional market demands

while ensuring compliance with corporate sustainability and social responsibility goals. II. Operations management

Production and operation - Production scheduling:

Intel's real-time offering consists of a comprehensive set of optimizations throughout the

complete platform stack from Intel silicon to the application layer. These optimizations are

designed to make Intel platforms with real-time support achieve high determinism in the

presence of best-effort workloads running on the same system. Edge real-time offerings from

Intel support new solutions that deliver both high compute and real-time performance by:

+ Prioritizing real-time workloads access to cache, memory, and networking: When

specific real-time workloads must be completed within a set deadline to avoid critical

system failure, the ability to prioritize some workloads over others is crucial. Some, but

not all, real-time systems have this capability for workload or task prioritization. +

Minimizing disruption from other workloads: Through technologies like Intel® Time

Coordinated Computing (Intel® TCC), real-time tasks are isolated from less critical

processes. This ensures that high-priority applications are not disrupted by background

operations, crucial for maintaining performance in systems like real-time analytics and financial trading platforms.

+ Optimizing performance for both real-time and non-real-time workloads: Intel’s

solutions dynamically balance computational resources between real-time and non-

real-time workloads, using technologies like Intel® Resource Director Technology

(Intel® RDT) to monitor and manage cache, memory bandwidth, and CPU utilization.

+ Supporting availability in both native and virtualized environments: Intel supports real-

time performance in both traditional native environments and virtualized setups

through technologies like Intel® Virtualization Technology (Intel® VT). This flexibility

allows enterprises to deploy real-time solutions across cloud, on-premises, and edge

environments without sacrificing performance.

* Contribution to implement Intel’s global business strategy:

Intel's production scheduling plays a crucial role in supporting its global business strategy by

enhancing precision, predictability, and prioritization in operations.

+ More precise timing: Real-time systems are designed to perform tasks that must be

executed within precise cycle deadlines (down to microseconds).

+ Higher predictability and reliability: Because real-time systems process data in defined,

predictable time frames, execution of tasks or workloads is practically guaranteed, thus

improving the reliability of critical systems for business.

+ Prioritization of real-time workloads: When specific real-time workloads must be

completed within the set deadline to avoid critical system failure, the ability to prioritize

some workloads over others is paramount. Some, but not all, real-time systems have

this capability for workload or task prioritization.

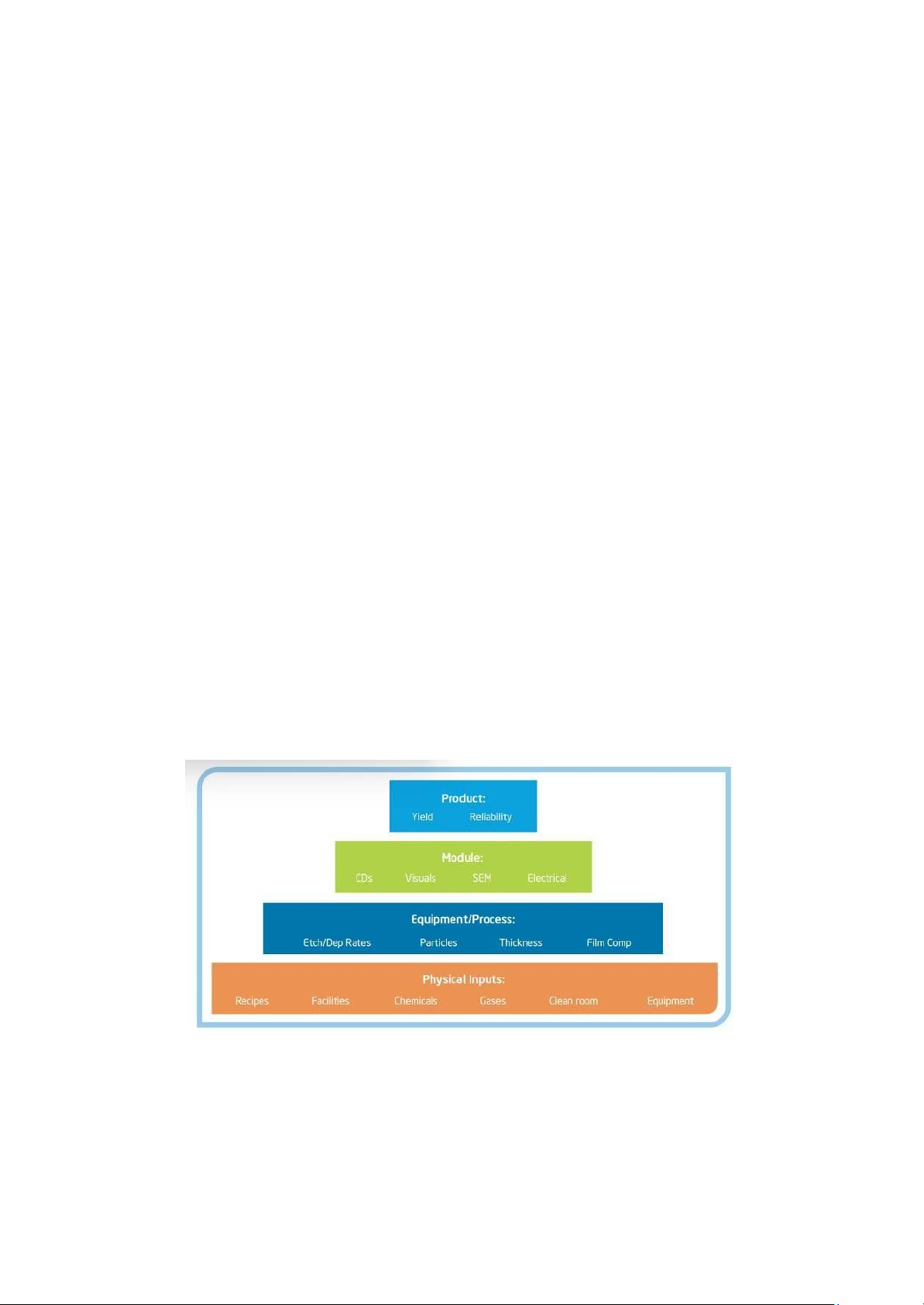

- Manufacturing process: lOMoAR cPSD| 58950985

Intel’s manufacturing organization follows a Copy Exactly (CE!) philosophy. Copy Exactly!

enables delivery of product from multiple production sites, which operate as a virtual factory

that performs consistently and independently of the manufacturing source site. The Copy

Exactly! Methodology focuses on matching the manufacturing site to the development site.

Matching occurs at all levels for physical inputs and statistical y matched responses (outputs).

This process enables continuous matching over time by using coordinated changes, audits,

process control systems, and joint Fab management structures.

Firstly, the physical inputs have to be matched. These are the energies and materials supplied

to the process chambers: for example, gas flows, temperatures, pressures, RF power, and so

forth. These might be supplied to the equipment by external sources or be generated within

the equipment itself. Everything about the equipment and its installation must be an exact

copy down to the diameters of piping and the number of bends, board revisions, software, etc.

The settings for these parameters and anything that might affect them are copied. Standards

are generated to allow measurement and comparison, and the values are measured and matched.

Early in the transfer, Process Technology Development (Process TD) selects process and

product parameters for statistical control and documents detailed control plans. Process TD

continues working with the factory location to achieve process control and yield targets in high

volume manufacturing. Throughout the transfer, factory personnel are responsible for quality

and statistical control of all key parameters.

Once matched, changes are coordinated through joint engineering teams. Intel performs cross

site audits of equipment configuration and in-line process and equipment monitor results using

a common process control system. Fabs execute high-level tactical and strategic changes

under the auspices of the joint engineering and strategic management structure. As each

factory begins to build a new technology, it starts at the same yield and improves at the same rate as the other factories.

Formal statistical tests are used at each level. If the match passes these tests, then we

proceed to the next level and so on. If the match does not pass the tests, the root cause must

be found and eliminated. If it can’t be found, troubleshooting occurs to find out which of the

previous level inputs is responsible because, despite best efforts, something may have been

overlooked. It is vitally important to avoid the temptation to make a compensating adjustment. lOMoAR cPSD| 58950985

Due to the complexities involved, an adjustment may result in an interacting parameter,

possibly something not measured, being mismatched.

Intel applies the Copy EXACTLY! model to ensure uniformity and consistency across its global

manufacturing facilities. This methodology involves replicating every aspect of the production

process, from equipment to procedures, across all Intel fabs.

A change control system: Most factories have some kind of approval process for making

changes to a production process, either in the form of a sign-off list or a formal change control

committee. Generally, there is some kind of record of the data showing the benefits of the

change. Intel’s R&D line continues to make improvements to finish off the technology

development and, in many cases, may also run some level of samples and production output.

With Intel's Copy EXACTLY! methodology, change control is started before technology

transfer, and all changes are implemented directly into both the R&D and production lines

within one week, or according to an approved schedule. The pace of R&D work is not allowed

to slow, so careful planning is required to ensure the new line is ready to accept the changes

in real time. Any engineer from the manufacturing line at Intel who has a good idea for

improvement is encouraged to pursue it. The only difference from the traditional approach is

that the idea must be implemented simultaneously at all Intel sites. The change control board

at Intel is responsible for the smooth operation of the system, which includes ensuring that the

additional requirements do not slow down the rate of improvement.

Equipment difference form: In Intel's Copy EXACTLY! system, each first piece of equipment

in the new factory or on the new process flow in the existing factory is treated as a change,

subject to change control. Audits are conducted, and an Equipment Difference Form is

prepared from each. This form documents the actual difference, what risks it might pose, and

the corrective action plan. This is formally reviewed by Intel's management.

Supplier education: Equipment and materials suppliers are constantly improving their products

in response to demands from the semiconductor industry for improvement. These changes

are stil desirable; however, with Intel's Copy EXACTLY! system, they are first introduced into

the R&D line and from there transferred to production. The suppliers are a vital part of Intel's

technology transfer and need to be thoroughly educated on the new concept and systems.

Audits: An audit is a formal procedure whereby engineers from Intel's R&D and production

audit both lines. These audits are required and scheduled as part of Intel's technology transfer

and are ongoing for a period thereafter. A report is written for each audit, detailing plans to

correct all differences found.

Joint specifications: Since the equipment, process recipes, and procedures are all the same

at Intel, there is no reason why the documents provided for training and manufacturing

operations cannot be the same. These are not copies; they are the same documents, either paper or electronic.

* Contribution to implement Intel’s global business strategy:

Intel's "Copy EXACTLY!" model supports the company’s global business strategy by ensuring

uniformity in design, materials, and quality control across all production sites, which enhances

global efficiency and product availability. This consistency builds customer trust through the

reliable delivery of high-quality products and minimizes re-engineering costs. By standardizing lOMoAR cPSD| 58950985

processes, the model streamlines production, strengthens supply chain reliability, and ensures

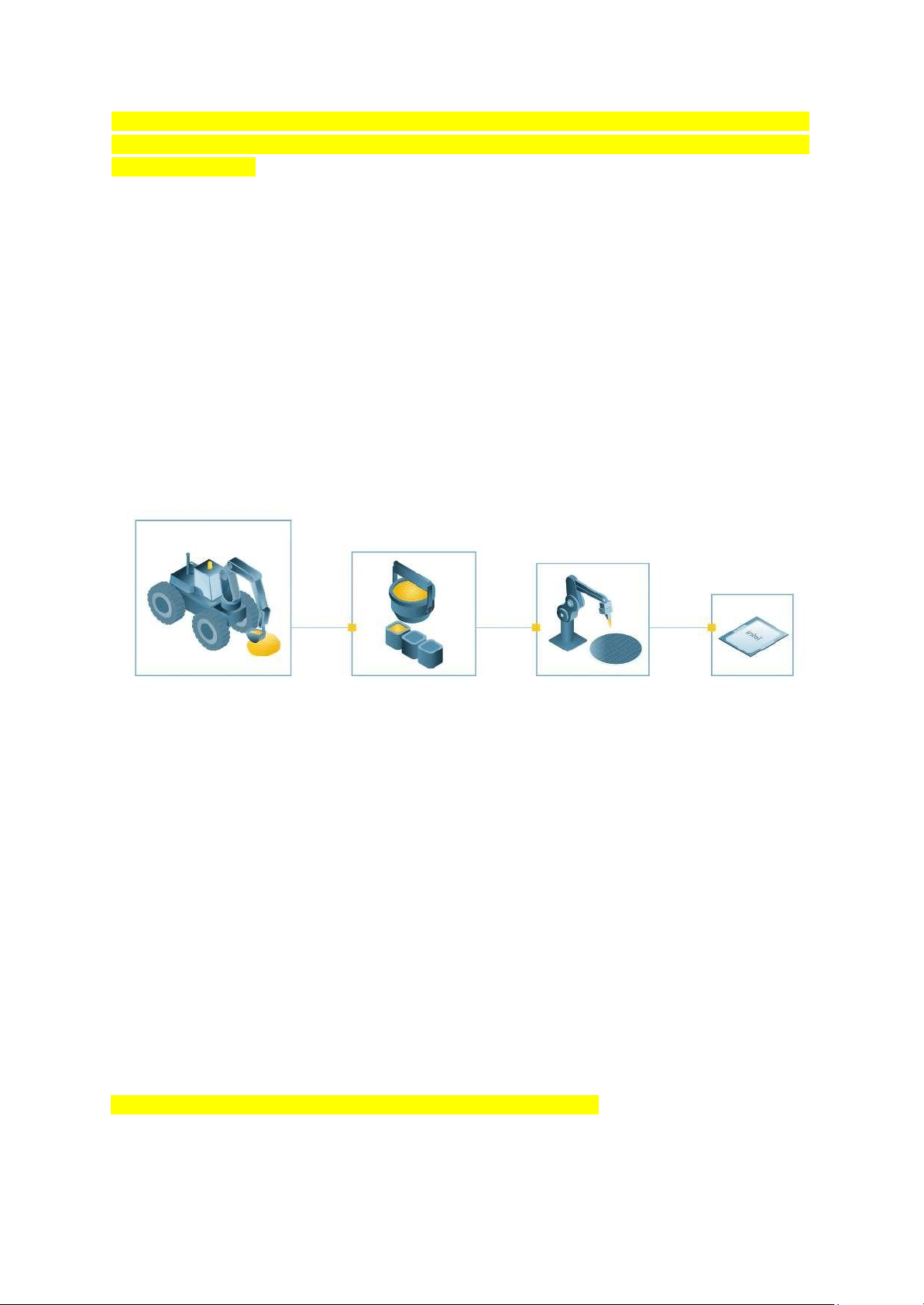

that all suppliers adhere to the same rigorous standards, reinforcing Intel’s competitive position worldwide. - Production line: + Converting Raw Materials:

Semiconductor manufacturing at Intel evolves every few years and, as predicted by Moore’s

Law, delivers ever-more functionality and performance, improved energy efficiency and lower

cost per transistor with each generation. With wafer fabrication sites and assembly/test

manufacturing locations worldwide, Intel’s manufacturing facilities operate with exceptional

flexibility on a global network.

By taking sand and heating it with magnesium powder, a manufacturer converts that raw

material into silicon. This process creates the key ingredient found in every computer

processor. If we didn’t convert raw materials into more complex goods, we wouldn’t have the

electronics, appliances, transportation and other things that make life today more efficient, safe and productive. + Assembly Line

By breaking down the steps and putting them in a pre-defined order, an assembly line allows

companies to create parts that can be used interchangeably and allows a finished product to

be made faster. This is most common in mass production, where unskil ed workers can be

trained to perform a single specific task rather than build an entire product themselves, which reduces labor costs.

The skil s required to operate machines and develop manufacturing processes have drastical y

changed over time. Many low-skil manufacturing jobs have shifted from developed to

developing countries, where labor tends to be less expensive. High-end products that require

precision and skil ed manufacturing are typically produced in developed economies.

Computers and precision electronic equipment allow companies to pioneer high-tech

manufacturing methods. Products made using these methods require more specialized labor

and higher capital investment, typically leading to a higher price tag.

* Contribution to implement Intel’s global business strategy: lOMoAR cPSD| 58950985

Intel’s production line plays a pivotal role in implementing the company’s global business

strategy by converting raw materials into high-value semiconductor products and optimizing

production through assembly line efficiencies.

Intel’s semiconductor manufacturing is continuously refined with each new generation,

aligning with Moore’s Law to enhance functionality, performance, and energy efficiency while

reducing costs. This capacity to transform basic materials (such as silicon from sand) into

sophisticated chips enables Intel to produce the advanced processors required by the tech

industry, supporting its leadership in innovation and global market presence.

Intel’s structured assembly line approach enables efficient mass production with

interchangeable parts, reducing labor costs and supporting Intel’s cost-effective production

goals. This system’s emphasis on high-tech precision, supported by skil ed labor and cutting-

edge machinery, allows Intel to maintain the high quality and reliability expected of its products.

In summary, Intel’s production line enables the company to deliver on its global business

strategy by maintaining a stronghold in innovation, ensuring efficient and flexible global

production, and supporting high-quality manufacturing standards. This approach enables Intel

to meet the demands of a competitive and technologically advanced global market.

- Production technology:

Manufacturing and industrial business operations are being transformed through the

convergence of information technology (IT) and operational technology (OT) systems onto

shared, intelligent, industrial-optimized compute platforms. This consolidation creates a

responsive, interconnected system that eliminates data silos and provides access to deeper

insights—powered by edge computing—and more flexibility and control. + AI in Manufacturing:

IIoT devices and connected factories generate immense amounts of data. AI and high-

performance computing (HPC) make it possible to quickly and effectively process and analyze

everything, resulting in improved efficiency and productivity. For example, connected factory

data can generate near-real-time production insights that help enhance your organization’s

decision-making. In structural and product design, AI approaches can help engineers define

the problem and estimate the resources required to solve it. Physics-based AI enables

engineers to project a solution design from a knowledge base of solutions.

Because the manufacturing market encompasses a wide range of operations, solutions

designed for AI workloads in this sector must accommodate varying requirements for

performance, power, size, form factor, and cost. + Real-Time Computing:

In Industrial Automation, certain real-time tasks must be completed within strict deadlines to

prevent critical system failures. This necessitates systems executing these tasks operating

within predictable and specific time limits, ensuring they can perform operations and respond

to events promptly. The ongoing Industrial transformation involves supporting real-time tasks

alongside best-effort workloads on the same system by implementing workload or task

prioritization for time-sensitive applications. lOMoAR cPSD| 58950985

In addition to real-time operation, the network traffic within the manufacturing environment

needs to meet latency requirements. Providing support for Industry standards such as IEEE

802 TSN specification to support time-sensitive applications enables ultra-reliable and low-

latency communication and provides an open ecosystem for device inter-operability.

Intel® Time Coordinated Computing (TCC) provides platform optimizations to better support

real-time workloads running alongside best-effort workloads. Intel TCC is comprised of silicon

and software optimizations that include support for IEEE TSN that reduces latencies and

improves clock synchronization to better support real-time workloads. + Virtualization:

Virtualization Technology is a key enabler of Workload Consolidation, which involves creating

distinct, isolated environments, each with its own operating system, on a single, robust

platform. This approach replaces multiple purpose-built hardware machines with a smaller set

of general-purpose computing platforms, reducing the overall hardware infrastructure.

Organizations can optimize their operations and reduce costs by maximizing the utilization of

existing resources. In the manufacturing and Industrial Automation sectors, Virtualization

solutions must support the consolidation of both real-time and non-real-time workloads. + Functional Safety:

As human-machine interactions become increasingly integral to manufacturing, the

importance of Functional Safety has also grown. Functional safety requires implementing

automated protection systems capable of detecting and mitigating malfunctions in machine

systems, such as robots, to ensure human safety. Adhering to international standards like IEC

61508 (for industrial applications) and ISO 13849 (for robotic controllers) accelerates the

development of safety-critical applications.

* Contribution to implement Intel’s global business strategy:

Intel’s production technology plays a crucial role in executing its global business strategy by

integrating IT and OT, employing AI, supporting real-time computing, using virtualization, and

prioritizing functional safety. The convergence of IT and OT onto shared platforms enables

Intel to eliminate data silos, enhance flexibility, and provide real-time insights across its global

operations. This interconnected system supports Intel’s goal of operational efficiency and

strengthens its ability to meet diverse production needs in a dynamic, global market.

Intel leverages AI and high-performance computing to process large volumes of data from

connected factories, generating insights that improve decision-making and productivity. Real-

time computing technologies, like Intel® Time Coordinated Computing (TCC), support precise,

time-sensitive tasks essential for critical manufacturing processes. Additionally, Intel’s

virtualization technology enables workload consolidation, maximizing resource use and

reducing infrastructure costs. These technological advancements support Intel’s commitment

to operational efficiency, cost-effectiveness, and reliable product delivery.

Intel’s adherence to international functional safety standards, such as IEC 61508 and ISO

13849, is vital for safe human-machine interactions, particularly in automated and robotics-

driven environments. This focus on safety and reliability underpins Intel’s reputation as a

trusted leader in high-tech manufacturing. Together, these technologies align Intel’s production