Preview text:

BỘ GIÁO DỤC VÀ ĐÀO TẠO

TRƯỜNG ĐẠI HỌC HOA SEN

------&------ GROUP REPORT

Course: Introduction to Management Topic

Lay’s Vietnam Analysis Lecturer : TRƯƠNG QUANG VINH Semester : 2233 Group : 02 Class : 0200 Contribute Student Full Name % (0% - Sign ID 100%) 2210314 1 PHẠM NGỌC MỸ KIM 100% 0 2212297 2 LÊ MINH KHOA 100% 9 2212287 3 NGUYỄN ANH THƯ 100% 9 4

22112729 VŨ PHÙNG ĐỖ QUYÊN 100% 5 22114119 NGUYỄN MINH LUÂN 100% i TP. HCM, Tháng 05/2023 Table of contents

Table of contents.............................................................................................ii

Appendices......................................................................................................iv

Task allocation.................................................................................................v

Contents...........................................................................................................1

1. Introduction......................................................................................................1

1.1. Company description................................................................................1

1.2. The company’s mission.............................................................................1

1.3. The company’s vision................................................................................1

2. Body..................................................................................................................1

2.1. Macro Environment..................................................................................1

2.1.1. Demographic.......................................................................................1

2.1.2. Economic.............................................................................................2

2.1.3. Natural.................................................................................................3

2.1.4. Technological.......................................................................................3

2.1.5. Political/Legal.....................................................................................4

2.1.6. Cultural...............................................................................................4

2.2. Micro Environment...................................................................................5

2.2.1. Marketing Environment.....................................................................5

a) Company.................................................................................................5

b) Suppliers.................................................................................................5

2.2.2. Marketing Intermediaries..................................................................6

a) Resellers..................................................................................................6 ii

b) Marketing service agencies....................................................................7

2.2.3. Customers............................................................................................7

2.2.4. Competitors.........................................................................................8

a) Direct Competitors.................................................................................8

b) Indirect Competitors............................................................................10

2.3. Marketing Strategies...............................................................................11

2.3.1. Segmentation.....................................................................................11

2.3.2. Targeting............................................................................................14

2.3.3. Differentiation...................................................................................15

2.3.4. Positioning.........................................................................................16

2.3.5. Value Proposition..............................................................................17

2.4. Marketing Mix (4Ps)...............................................................................18

2.4.1. Product..............................................................................................18

2.4.2. Pricing................................................................................................18

2.4.3. Place/Distribution.............................................................................19

2.4.4. Promotion..........................................................................................19

3. SWOT & Conclusion.....................................................................................20

3.1. SWOT.......................................................................................................20

3.2. Conclusion................................................................................................22

4. References.......................................................................................................23 iii Appendices

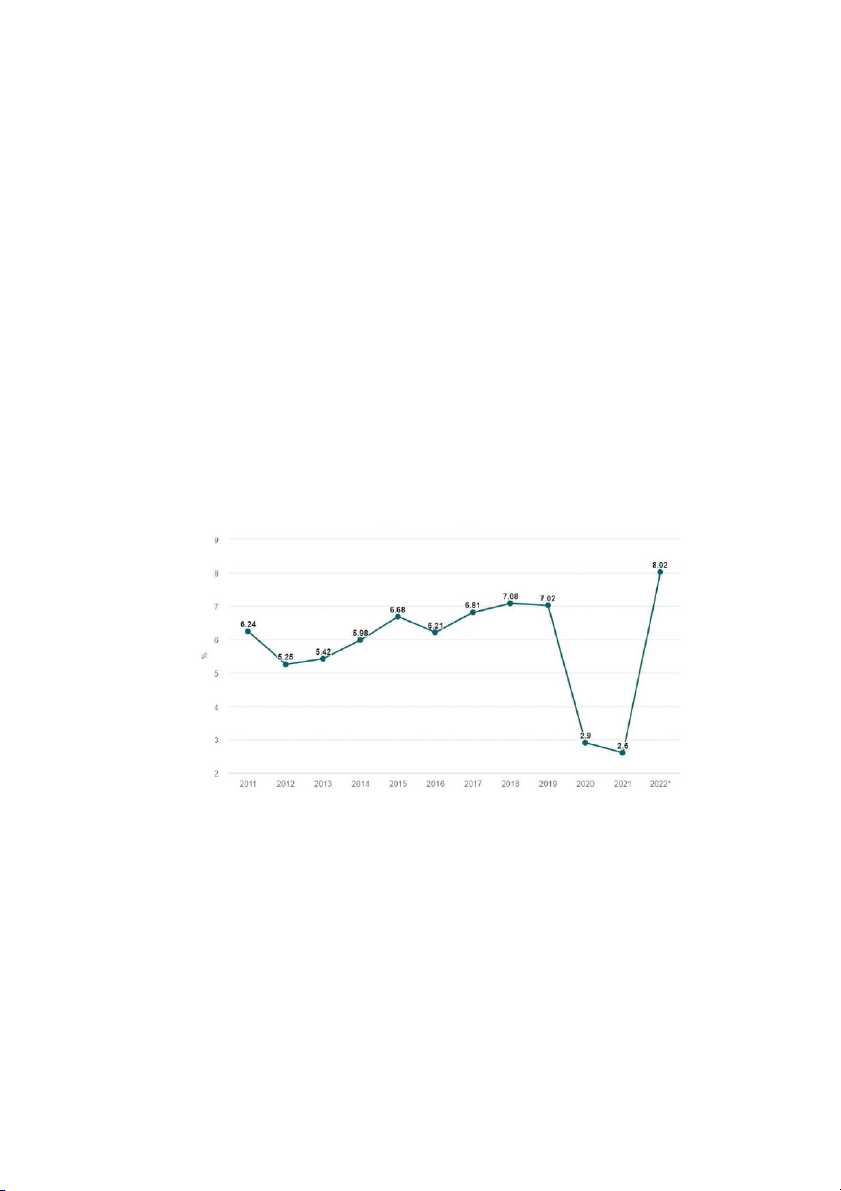

Figure 1: Vietnam’s GDP Growth 2011-2022 from the General Statistics Office....2

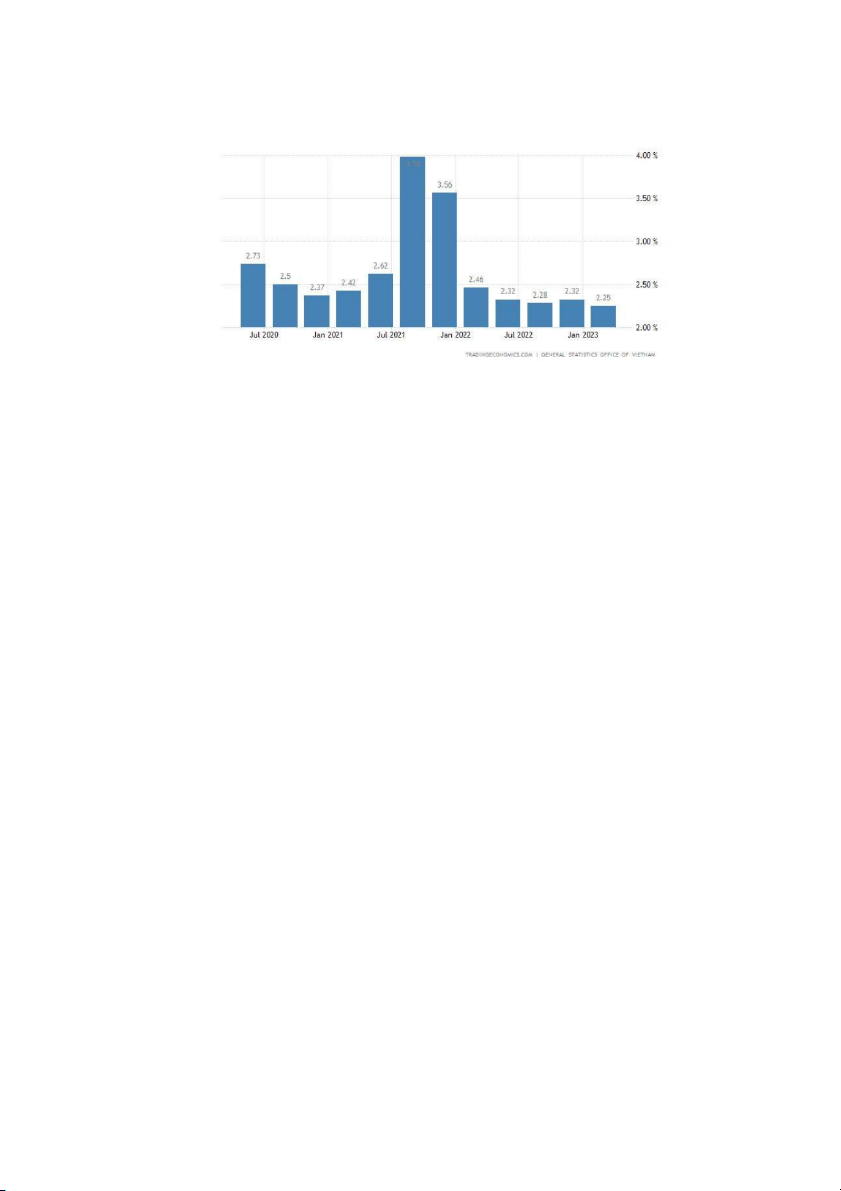

Figure 2: Vietnam's Unemployment rate 2020-2023 from Trading Economics.......3

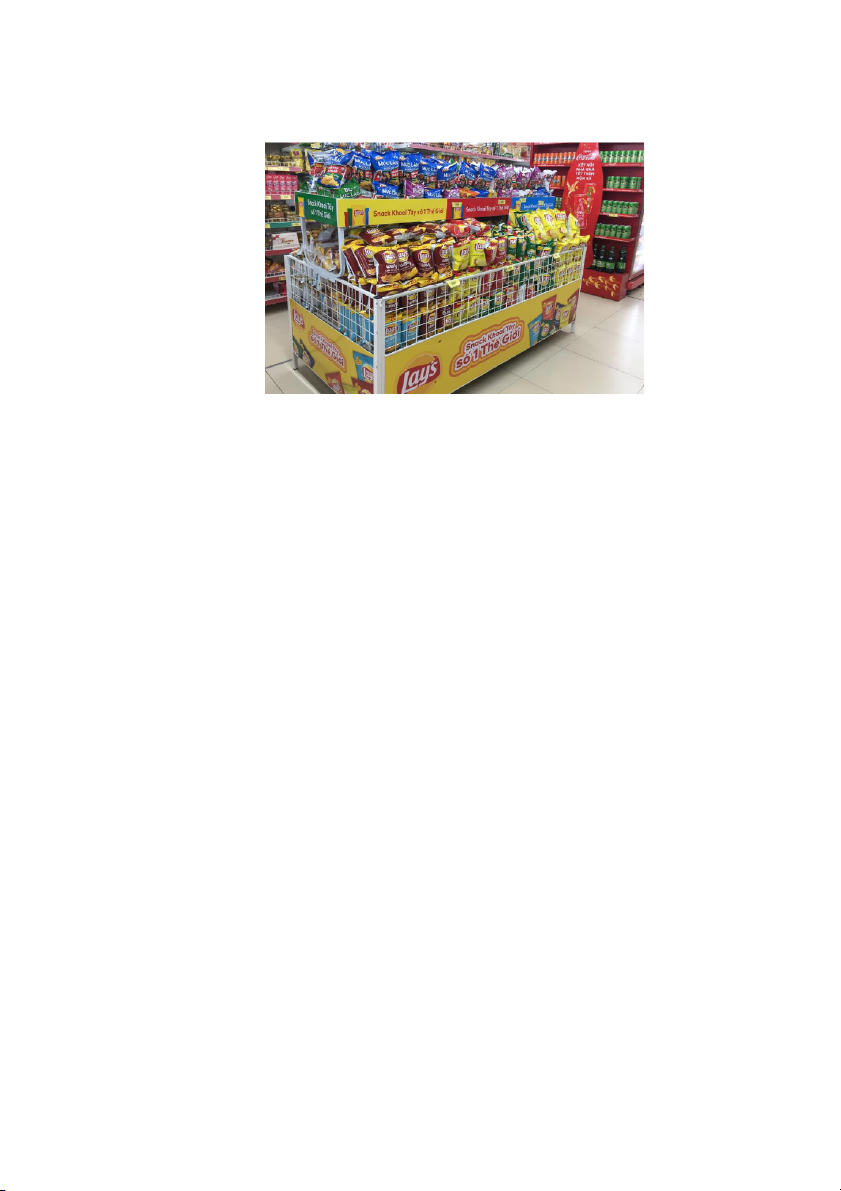

Figure 3: Vietnamese supermarkets sell Lay's products...........................................6

Figure 4: Lay's Crispy Subtitles Campaign..............................................................7

Figure 5: Brand Shares of Savoury Snacks adapted from Passport (2020)..............9

Figure 6: Snack Companies Prices comparision....................................................19 iv Task allocation

1. Introduction: Lê Minh Khoa

2. Body: 2.1. Macro Environment: Nguyễn Minh Luân

2.2. Micro Environment: Vũ Phùng Đỗ Quyên (2.2.2., 2.2.3.), Nguyễn

a Anh Thư (2.2.1., 2.2.4.)

2.3. Marketing Strategies: Nguyễn Anh Thư

2.4. Marketing Mix: Phạm Ngọc Mỹ Kim

3. SWOT & Conclusion: Phạm Ngọc Mỹ Kim v Contents 1. Introduction

1.1. Company description

PepsiCo Inc. (PEP) is an American Food and Beverage company that is

available in more than 200 countries. The Pepsi-Cola Company and Frito-Lay,

Inc. amalgamated and formed Pepsico in 1965. PepsiCo and 7Up were the

company's two brands when it entered Vietnam in 1994. And Pepsico Vietnam

has held the greatest market share in Vietnam's beverage business since 2004.

1.2. The company’s mission

Offering savory, reasonably priced, practical, complementing foods and

beverages to the entire world, ranging from healthy breakfasts to snacks and

beverages for social gatherings in the evening. This implies that despite the many

cultural backgrounds of its customers, the business makes an effort to offer goods

that appeal to everyone. It succeeds in integrating the value proposition with a

social marketing perspective while focusing on the value proposition that will

ultimately lead to customer satisfaction.

1.3. The company’s vision

Ensuring financial prospects, this claim demonstrates Lays' primary driving

force for continuous development, which focuses on upholding its obligations to society and consumers. 2. Body 2.1. Macro Environment 2.1.1. Demographic

According to a report by market researcher Decision Lab, In Vietnam, Gen Z

holds the largest market share for packaged foods. Nguyen Chi Dung, the

minister of planning and investment. Permanent Deputy Chair of the Central

Steering Committee for the Housing and Population Census noted that in 2019,

Vietnam is a country at a time when the population's gold structure,

comprising those aged 15 to 24, makes up 68% of the total. A wide pool of 1

potential customers means that snack companies, particularly Lay's, will sell

more packaged goods. In 2020, there will be 7.4 million senior persons in

Vietnam, or 7.7% of the entire population. By 2050, there will be 22.3 million

senior persons in Vietnam or 20.4% of the total population. One of the nations

in the world that is aging the fastest is Vietnam. Additionally, as older

customers care more about their health, an aging population could pose a

threat to Lay's packaged food businesses in the future. 2.1.2. Economic

The GDP surpassed 400 billion USD for the first time in 2022. The General

Statistics Office estimates that the GDP per capita in 2022 would be 95,6

million VND per person, which is equal to 4,110 USD, a rise of 393 USD from

2021. Vietnam's GDP in particular had a significant boost in 2022. in the past

12 years with an increase of 8.02% over the previous year.

Figure 1: Vietnam’s GDP Growth 2011-2022 from the General Statistics Office

Regarding GDP use in 2022, final consumption increased by 7.18%

compared to 2021, contributing 49.32% to the overall growth rate. In 2022, the

country's labor force will consist of 51.7 million individuals, up 1.1 million

from the previous year. The country's overall unemployment rate for working-

age people will be 2.32% in 2022. This could be a chance for a product to

boost productivity while also raising the caliber of a brand-new product. 2

Figure 2: Vietnam's Unemployment rate 2020-2023 from Trading Economics

The predicted total retail sales of products and services for consumers in

2022 will be VND 5,679 trillion, 19.8% increase from the current year. Despite

a gain of at least 5.7% per person, salaries here remain lower than in other

Asian nations, Many people in the nation are eager to work for the $260

federal minimum wage. Products like Lay's, which low-income customers can

use as an affordable snack at work or school, so there's still another opportunity. 2.1.3. Natural

Due to natural conditions along with climate change, environmental pollution

has brought disadvantages to people, especially in the food production

industry. Along with climate change, the area and production of potatoes are

decreasing in many parts of the world. According to information, with each

product, Lay's introduces a new recipe for french fries. Thereby attracting and

meeting the diverse consumption needs of customers. With the main

ingredient being fresh potatoes, potato snack companies, in which Lay's is no

exception, have encountered many inadequacies in terms of production process

and quantity. If the potato is not of good quality, it will not be able to make

delicious chips to meet the needs of consumers. 2.1.4. Technological

In 2022, the e-commerce industry will reach 16.4 billion USD, an increase of

20% compared to 2021. Along with that, about 57-60 million Vietnamese

people participate in online shopping with average shopping value. Therefore, 3

products with market share like Lay's should pay more attention to this

growing industry, as the industry is in its infancy and has great potential. As

mentioned, Lay's also focuses on improving technology in potato farming in

Vietnam. The company has also continuously invested in researching potato

varieties suitable for Vietnam's climate for many years in order to bring high

quality potato products according to international standards in Vietnam. 2.1.5. Political/Legal

Since 2018, the Vietnamese government has fulfilled its promise, based on

the signing of ATIGA, to reduce import duties on special products, including

confectionery, from ASEAN countries to almost zero. In addition, after

signing the EVFTA in 2019, EU countries will enjoy similar incentives for

these specific items. This increases competition in Vietnam's already crowded

packaged food market, with established brands like Lay's looking to indirectly

avoid losing market share to rivals in the packaged food sector, package.

In 2022, the Government signed and promulgated 17 decrees on the

Preferential Export Tariff and the Special Preferential Import Tariff of

Vietnam. These decrees aim to implement 17 agreements for 2022-2027, per

the List of export and import goods of Vietnam under AHTN 2022 as provided

for in Circular No.31/2022/TT-BTC dated 08/08/13. June 2022 of the Ministry of Finance. 2.1.6. Cultural

Food quality is of great importance to Vietnamese people. They consciously

maintain a healthy diet and avoid consuming junk and unhealthy products like

Lay's, which can lead to a drop in potential sales. In addition, during the

holidays, and cultural events, the foreign confectionery market in Vietnam

grew steadily. However, big names such as Kinh Do, Hai Ha, Bibica, Huu

Nghi, Orion Vietnam dominate the confectionery market with an estimated 75-

80% market share, the remaining 20-25% are imported confectionery. Recent

surveys show that Vietnam is home to the fastest-growing snack market in the

world. Younger generations in the country have changed from the traditional

three-meal-a-day routine, opting for six smaller meals instead. They tend to 4

consume more junk food, about eight times a week on average, and spend

about $0.7 each time. While 86% of consumers prioritize portion control and

have clear ingredient information when choosing junk food, a Nielsen report

shows that Vietnamese young people still spend up to VND 13,000 billion on junk food every month.

In the past few years, due to the impact of the epidemic, Vietnamese

consumers are gradually turning to healthy snack products. This suggests that

there are more indirect competitors to Lay's who should Lay’s has more

indirect competitors more aware of threats not from isolated market share, but

as a possible synergistic force. some market share. 2.2. Micro Environment

2.2.1. Marketing Environment a) Company

With Pepsi-Cola as its flagship product, Pepsico is one of the leading

companies in the food and beverage industries. As a result, Lay's could

potentially have a huge opportunities for taking advantage of the halo effect

in their advertising. Pepsico may exploit the positive reputation it has built

over the years to diversify into savory snacks like potato chips. Lay's could

benefit from the name recognition of its parent firm to cut costs on

marketing and increase consumer loyalty. b) Suppliers

As the stated best potato chip in the world, Lay's needs to maintain a

sufficient supply of sustainable suppliers to meet the country of Vietnam's

rising demand for savory snacks. Potatoes are effectively produced in 28

countries worldwide using regenerative agriculture techniques and

innovative farming equipment to assure consistent and high-quality output.

The three potato farms in Da Lat, Dak Lak, and Gia Lai have demonstrated

promise for effective and increasing yields as well as crops that match

international standards through training and technical assistance from Pepsico Foods Vietnam. 5

Potatoes are imported from all over the world in addition to the primary

raw material, but the supplier prefers that potato products be offered locally

to customers. As a result, finding potato types that thrive in a climate like

Vietnam is always challenging, and suppliers must make sure that their

goods live up to brand standards and are safe. on conformity and quality.

PepsiCo gives every adjustment maximum importance.

In order to meet 75% of domestic demand, Vietnam's farms can produce

more than 200,000 tons of potatoes annually. As a result, this may have a

significant effect on the farmer's quality of life and their personal finances

also the development of a sustainable supply chain for the item.

In 2020, PepsiCo decided to expand its potato growing program to a

province with a climate and soil more suitable for this crop, which is

expected to expand during the initial phase of the program to provide

additional produce. quantity. By 2023, production is expected to double in the producing provinces.

2.2.2. Marketing Intermediaries a) Resellers

In addition to the popularity of Lay’s potato chips in foreign countries,

there are also all over Vietnam. Their resellers are diverse, ranging from

supermarkets like Coopmart, Aeon, Lottemart, and Megamall,… and

convenience stores like Circle K, Family Mart, Ministop,… to e-commerce

platforms: Shopee, LazaLa, Tiki,… Not only do these retailers sell Lay’s,

but many traditional grocery stores also sell Lays. Also, as a reason for

globalization, there has been a recent trend of online shopping in Vietnam. 6

Figure 3: Vietnamese supermarkets sell Lay's products

b) Marketing service agencies

Lay's has noticed that the most potential customers are those of Gen Z –

accounting for 25% of the workforce in Vietnam and has promoted products

through various entertainment media such as Youtube, Facebook, and

Instagram,... to get closer. A typical example is the Lay's Crispy Subtitles

campaign run by Happiness Saigon won the grand prize - the most

important award in the broadcast/audio category of the festival on August 2021.

This campaign created a huge buzz in the Vietnamese media industry, used

by more than 80 countries, Lay's crispy topic was shared around the world

and became the hottest topic on Google and all over the world. social

networking site at that time. This includes major publications like Gizmodo, Yahoo News, and Virgin Radio! 7