Preview text:

MINISTRY OF PLANNING AND INVESTMENT FOREIGN INVESTMENT AGENCY DOING BUSINESS IN VIETNAM 2020

Investing in Vietnam, Engaging the world Abbreviation 3

II. Customs Duty and Procedures 52 Introduction 5 III. Land Rental Incentives 56 A. Country Profile 6

E. Human Resources and Employment 58 B. Trade and Investment 12 F. Foreign Exchange Control 65 I. Trade Agreement 13 Useful websites 68 II. Foreign Direct Investment 13 Deloitte Vietnam 71

C. Setting up an investment in Vietnam 17 Foreign Investment Agency 72 D. Taxation and Customs 25 I. Taxation 26 2

Doing business in Vietnam 2020. Investing in Vietnam, Engaging the world ABBREVIATION APA Advance Pricing Agreement FTA Free Trade Agreement APEC

Asia-Pacific Economic Cooperation GDP Gross Domestic Product ASEAN

Association of Southeast Asian GSO General Statistics Office Nations BCC Business Cooperation Contract IMF International Monetary Fund BLT Build-Lease-Transfer IRC Investment Registration Certificate BOO Build-Own-Operate IP Industrial Park BOT Build-Operate-Transfer M&A Mergers & Acquisitions BT Build-Transfer O&M Operate & Manage BTL Build-Transfer-Lease OECD Organization for Economic Cooperation and Development BTO Build-Transfer-Operate PIT Personal Income Tax CIT Corporate Income Tax PPP Public-Private Partnership CPTPP Comprehensive and Progressive RCEP Regional Comprehensive Agreement for Trans-Pacific Economic Partnership Partnership DTA

Double Taxation Avoidance SST Special Sales Tax Agreement EPE Export Processing Enterprise USD US Dol ar EPZ Export Processing Zone VAS

Vietnamese Accounting Standards ERC

Enterprise Registration Certificate VAT Value Added Tax EZ Economic Zone VND Vietnamese Dong FCWT

Foreign Contractor Withholding Tax WTO World Trade Organization FDI Foreign Direct Investment 3 4

Doing business in Vietnam 2020. Investing in Vietnam, Engaging the world INTRODUCTION

In more than 30 years of social-

a centralized to a market oriented

economy and its 96.92 million-strong Vietnam has moved from being

population, which features a large

one of the poorest nations in the world

and young workforce as well as

to a lower middle-income country

an increase in disposable income

with a number of convincing social-

in recent years. The Vietnamese

economic achievements. Joining the

Government has done an excellent job

Association of Southeast Asian Nations (ASEAN) in 1995

Economic Cooperation (APEC) in 1998 2.79 percent (2019).

and the World Trade Organisation

(WTO) in 2007; expanding gross

This guidebook was prepared by the

domestic product (GDP); improving Foreign Investment Agency of

infrastructure; and a steady increase

Vietnam in cooperation with Deloitte

in foreign direct investment (FDI)

Vietnam to provide readers with an

suggest that Vietnam has transformed

overview of the investment climate, into an attractive investment

forms of business organization, destination.

taxation, and business and accounting

practices in Vietnam. Although we do

Vietnam has been enjoying strong

our best to ensure that information economic growth. Since 1990,

contained in this book is current at

the time of writing, the rapid changes

Vietnam’s GDP per capita growth has in Vietnam mean that laws and

been among the fastest in the world,

regulations may change to reflect the

averaging 6.4 per cent a year in the

new conditions. We hope that you

2000s. Despite crisis and uncertainties

find this book useful in your endeavour

in the global environment, Vietnam’s

to expand your business in Vietnam.

economy continues to grow, with GDP

expanding by 7.02 per cent in 2019, Ministry of Planning and

and is expected to continue on this path. Investment of Vietnam Foreign Investment Agency

Overseas businesses are increasingly

attracted by the country’s move from 5 A COUNTRY PROFILE COUNTRY PROFILE

Vietnam’s economy continues its fast growth driven by free trade

agreements (FTAs) with major developed countries and increasingly

deregulated business environment. VIETNAM

Strategically located at the centre of Southeast Asia with convenient

access to commodity and cultural exchange. A stable political

A youthful and vibrant environment, and an country with digitally-savvy attractive business and well-educated workforce, environment with high incentives for a developing culture of foreign investors. entrepreneurship, and openness to new ideas. Competitive production cost compared to Fast growing economy with neighboring countries. GDP growth projected to be between 6% to 7% during 2016-2019 period. 16 FTAs with major developed markets. 6

Doing business in Vietnam 2020. Investing in Vietnam, Engaging the world COUNTRY SNAPSHOT LOCATION

POPULATION AND WORKFORCE Southeast Asia

Population: was estimated at 96.92 mil ion people

The country borders with China, Laos, Cambodia,

Ranked 15th in the list of most populated countries

Pacific Ocean and Gulf of Thailand

People of working age in employment: 48.7 mil ion

people (51.2% of total population) Unemployment rate: 2% LAND AREA 330,967 sq. km ECONOMY

Nominal GDP ( 2019): USD 261.9 billion GDP in 2019 increase by 7.02%, the highest growth since 2011 COASTLINE

GDP per capita (2019): USD 2739.82 3,260 km

5 MUNICIPALITIES & 58 PROVINCES LANGUAGE North: Hanoi – the capital Vietnamese (official language) Centre: Da Nang City

English (taught widely at school as a second language)

South: Ho Chi Minh City – the largest city BUSINESS HOURS CLIMATE AND WEATHER

Under the Vietnamese Labor Code, normal working

The climate varies from North to South with three

hours should be 8 hours/day, or 40 - 48 hours/week.

distinctive climate zones: tropical in the South (rainy

season from April to September; dry season from

October to March); monsoonal with hot and rainy

season in the Centre and North (May to September);

cold and damp in the highlands and the North

(October to March). It is also blessed with plenty of CURRENCY sun throughout the year. Vietnamese Dong (VND)

Source: General Statistics Office (GSO), Economist Intelligence Unit 7 POLITICAL STRUCTURE

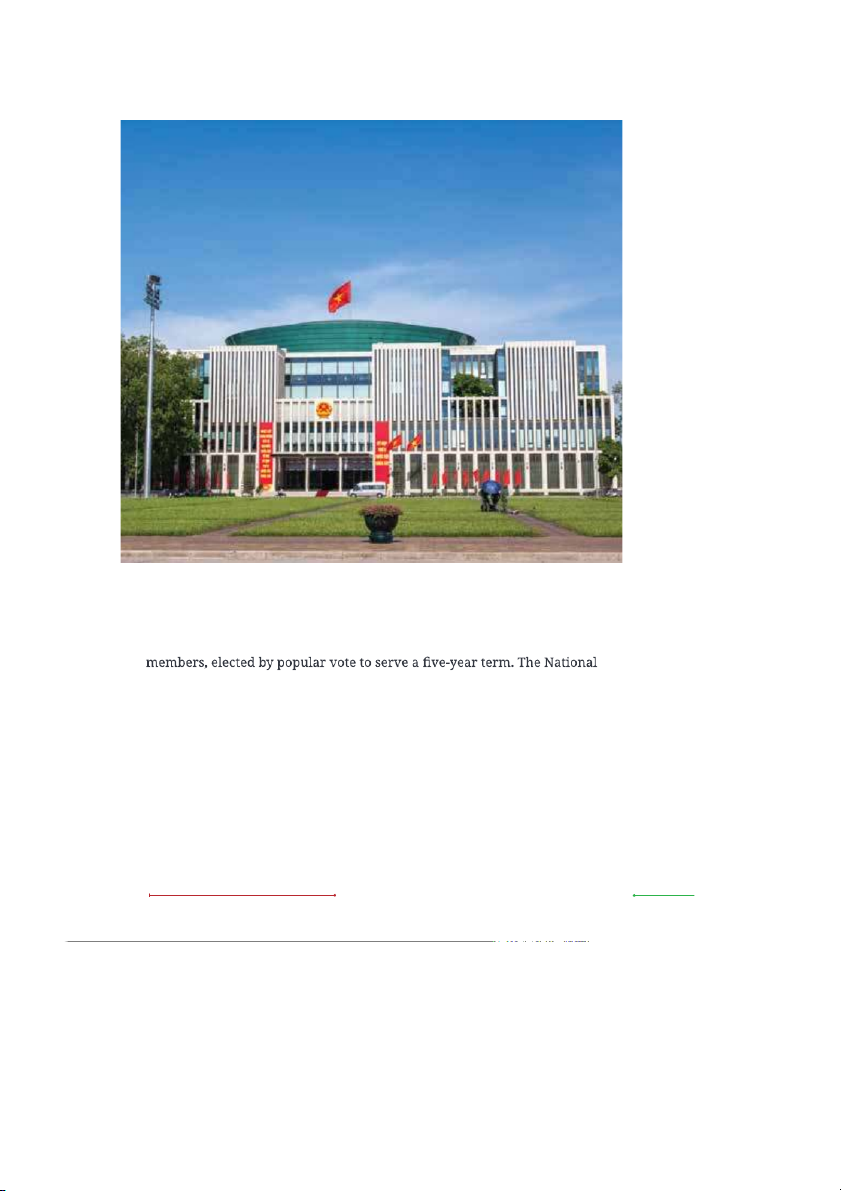

Vietnam is a socialist country under the leadership of the Communist Party

of Vietnam. The 14th National Assembly of Vietnam (term 2016-2021) has 489

Assembly, which is the highest-level representative body of Vietnamese people,

has the power to exercise constitutional and legislative rights and to decide on

critical issues of the country. 8

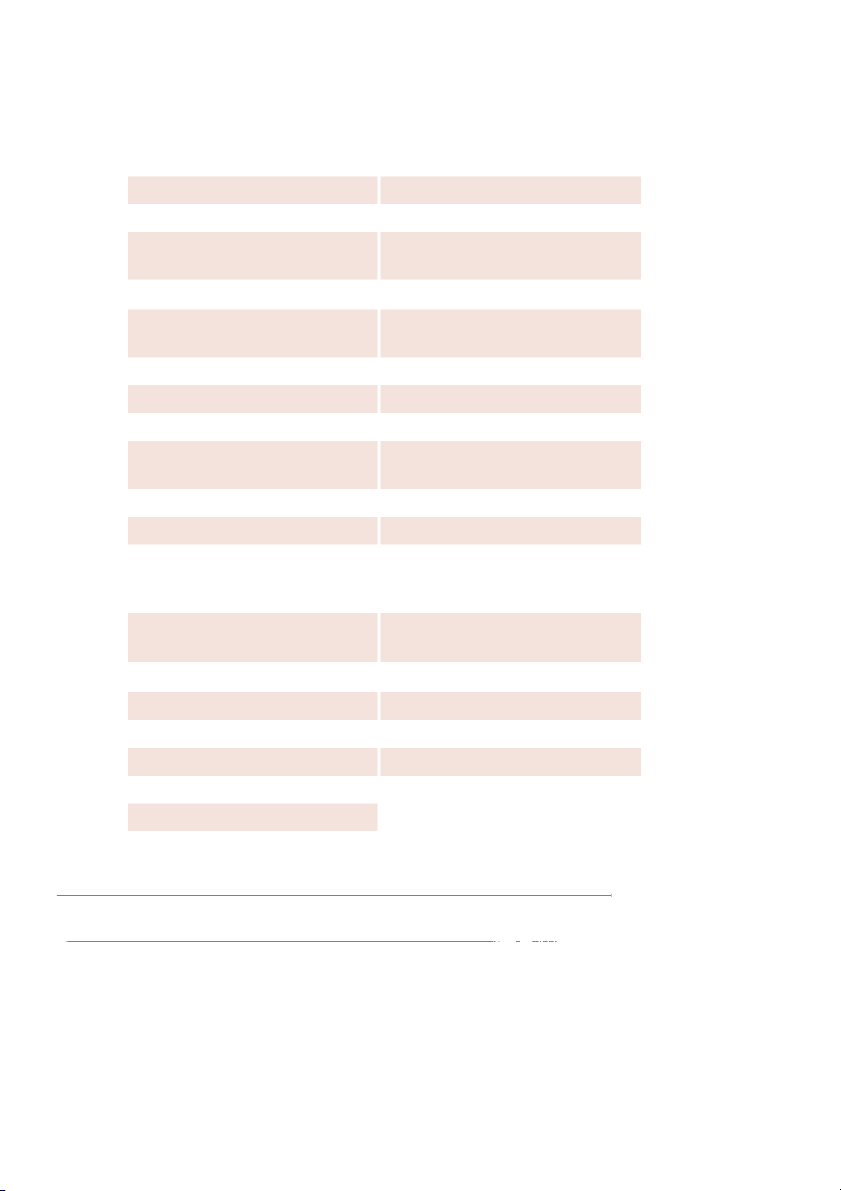

Doing business in Vietnam 2020. Investing in Vietnam, Engaging the world GDP BY SECTOR, 2018 8.0% 7.5% Product tax (net) 7.08% 7.0% 10% Agriculture, 7.02% Forestry and 6.5% 6.81% 15% Fishery 6.68% 41% 6.0% 6.21% 5.98% Services 5.5% 34% 5.42% 5.0% 4.5% Industry & Construction 4.0% 2018 2019 RETAIL SALES (billion USD) 6.60% 250 195 168 173 154 4.09% 200 140 125 3.53% 3.54% 111 2.79% 150 2.66% 100 50 0.63% 0 2018 2019 2018 2018

MAIN EXPORT PARTNERS, 2018 (share of total) Germany 11% US 46% South Korea 16% 243 237 214 211 180173 150 162166 148 132131 Japan 18% China 40% 2018 Source: GSO 9 A COUNTRY PROFILE

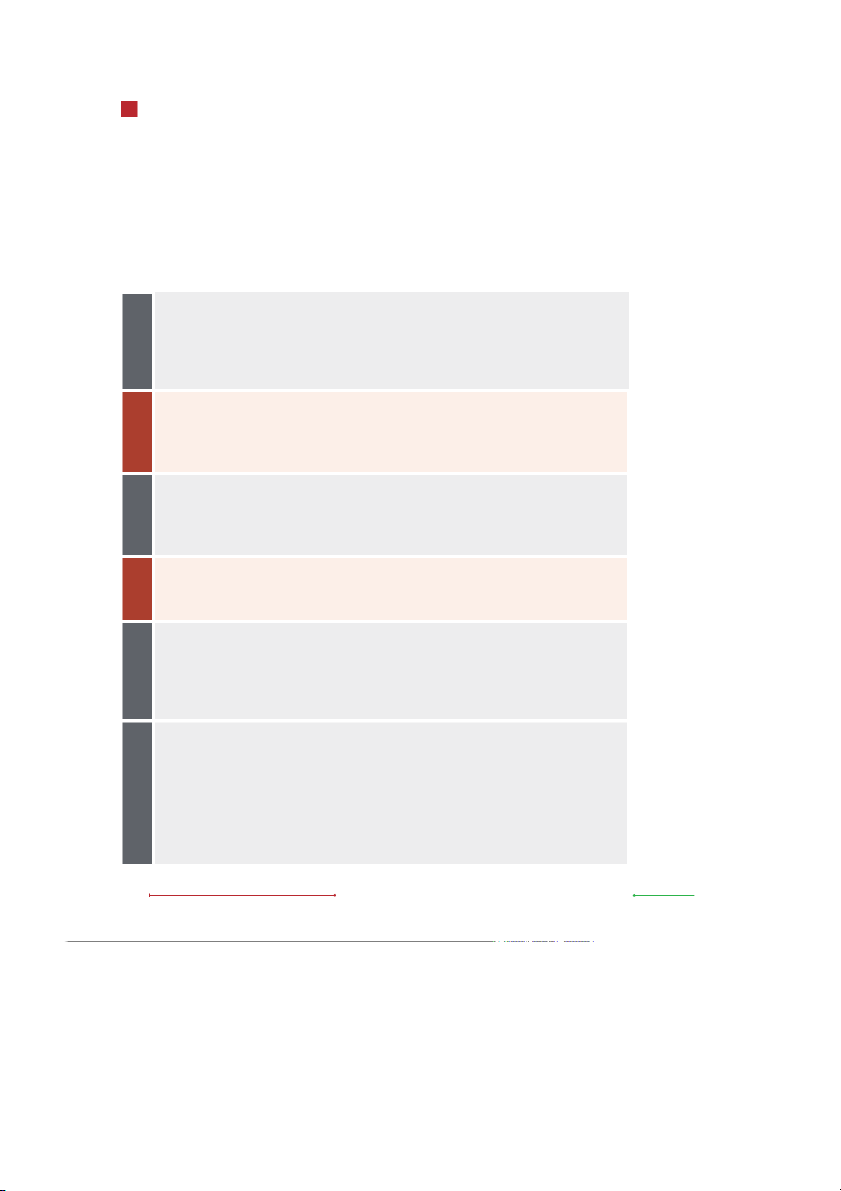

REGULATORY REFORM TO IMPROVE INVESTMENT CLIMATE

The regulatory framework has been constantly revised to incorporate more

favorable regulations for businesses to invest and operate in Vietnam. Since the

new Law on Investment and the new Law on Enterprises were passed in 2014,

many other laws, decrees and circulars have been put in place to provide

guidelines for better market access.

VIETNAMESE GOVERNMENT’S EFFORTS TO IMPROVE INVESTMENT CLIMATE

- Law No. 67/2014/QH13 on Investment

- Law No. 68/2014/QH13 on Enterprises

- Decree No. 46/2014/ND-CP provides regulations on col ection of land rent and water surface rent

2014 - Circular No. 78/2014/TT-BTC guides the implementation of the Law on CIT

- Circular No. 103/2014/TT-BTC provides guidelines for fulfil ment of tax liability of foreign entities doing business

in Vietnam or earning income in Vietnam

- Decree No. 118/2015/ND-CP provides guidelines for some articles of the Law on Investment

- Decree No. 96/2015/ND-CP provides guidelines for some articles of the Law on Enterprises

- Decree No. 15/2015/ND-CP on investment in the form of public-private partnership

2015 - Circular No. 38/2015/TT-BTC on customs procedures, customs supervision and inspection, export tax, import tax, and tax administration

- Law No. 107/2016/QH13 on Export and Import Duties

- Decree No. 134/2016/ND-CP provides guidelines for the Law on Export and Import Duties

- Circular No. 83/2016/TT-BTC guides the implementation of investment incentive programs

2016 - Circular No. 130/2016/TT-BTC on guidelines on some articles of the Law on Value Added Tax, and the Law on Special Sales Tax

- Law No. 04/2017/QH14 about provision of assistance for smal and medium-sized enterprises (coming into force from January 1st, 2018)

2017 - Decree No.32/2017/ND-CP on state investment credit

- Decision No. 3610A/QD-BCT slashes 675 conditions on business and investment under state management

- Decree No. 119/2018/ND-CP on electronic invoices for sale of goods and provision of services

- Decree No. 09/2018/ND-CP on trading activities of foreign investors

- Decree No. 08/2018/ND-CP on business conditions under State management of the Ministry of Industry and 2018 Trade

- Circular No. 25/2018/TT-BTC on amendments of some articles of Circular 78/2014/TT-BTC and Circular 111/2013/TT-BTC

- Resolution No. 50/NQ-TW on the direction of completing institutions and policies, improving the quality and

efficiency of foreign investment cooperation by 2030

- Resolution 23-NQ/TW on the national industry development strategy during 2018-2030

- Amended Law on Tax Administration No. 38/2019/QH14 (effective from 1 July 2020)

- Decree No. 14/2019/ND-CP providing guidelines for the law on special sales tax

2019 - Decree No. 05/2019/ND-CP provides a legal framework for the establishment and implementation of Internal Audit

- Circular No. 48/2019/TT-BTC on the making and settlement of provisions for devaluation of inventory, losses of

financial investments, bad debts and warranty at enterprises

- Draft amended Laws on Investment/Enterprises/Securities 10

Doing business in Vietnam 2020. Investing in Vietnam, Engaging the world