Preview text:

VIETNAM NATIONAL UNIVERSITY HO CHI MINH CITY

INTERNATIONAL UNIVERSITY SCHOOL OF BUSINESS

Workshop 2 on Financial FINAL REPORT

Name of student: Le Duc Hieu Student ID:

BABAIU21396 Lecturer: Mr. Vo Khanh Thien

Semester 2nd of 2023 - 2024 Ho Chi Minh City, May 2024 1 TABLE OF CONTENTS

I. QUESTIONS: ................................................................................................................... 2

II. ANSWER: ......................................................................................................................... 3

Question 1: ......................................................................................................................... 3

Question 2.1: ...................................................................................................................... 6

Question 2.2: ...................................................................................................................... 7

Question 2.3: ...................................................................................................................... 8

Question 3.1: ...................................................................................................................... 8

Question 3.2: ...................................................................................................................... 9

III. REFERENCES ............................................................................................................ 10 I. QUESTIONS: 1. Credit rating:

- Why is credit rating applied but bad debts continue to increase in commercial banks? 2. IPO:

- Analyze the role of Special Purpose Acquisition Companies (SPACs) in IPO. What are

the potential risks associated with using this structure. Is an IPO a way to make a company wealthy?

3. CBDC and stable coin:

- Central Bank Digital Currency is a regulatory solution to the threats posed by private

stablecoin? Is stablecoin an essential element in cryptocurrency transactions? 2 II. ANSWER: Question 1: -

Credit ratings are assessments of a borrower's creditworthiness. Commercial banks

and lenders use this tool to assess the risk of lending to a certain individual or business.

The CIC tool is used by banks and financial organizations to assess consumers'

reputation and ability to repay debt through loan history. It collects, stores, analyzes, and

forecasts Vietnamese citizens" and businesses' credit information. From there, CIC helps

banks and credit institutions reduce loan and credit management risks. -

Bad debts, also known as non-performing loans, are loans in which the borrower has

fallen behind on payments or is unlikely to repay the entire amount own.

Despite the usage of credit ratings, bad debts continue to rise in many commercial

banks due to the following reasons:

Firstly, economic fluctuations is reason that significantly impact borrowers’

ability to repay loans. In Vietnam, periods of economic slowdown or external economic

shocks, such as the global financial crisis of 2008-2009 and the COVID-19 pandemic,

have led to increased unemployment and reduced business activity. These conditions

can make it difficult for even creditworthy borrowers to meet their debt obligations,

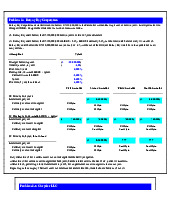

leading to a rise in bad debts. Image: 1 – Source: VnDirect

Image 1 suggested that, with a significant increase in bad debt ratios and the combined ratio of

bad debts and debts more than 90 days old following the COVID-19 pandemic. Prior to the pandemic, 3

these ratios hovered around 2-3%, but starting from Q1 2020, they began to rise sharply, reaching a peak

of over 4.5% for the combined ratio in Q2 2022.

Secondly, fraud and misrepresentating of business financial health with the

bank usually happens when borrowers may intentionally misrepresent their financial

situation or engage in dishonest activities to obtain loans they cannot repay. Credit

ratings and bank due diligence may not uncover such fraudulent activities.

The case of SCB bank illegally lending to Van Thinh Phat Group is also notable. Using

sophisticated techniques such as falsifying loan documents and including inadequate legal collateral,

Van Thinh Phat's group made more than 1,284 loans, with an outstanding debt at SCB of more than 677

trillion VND (nearly 484 trillion VND in principle, more than 193 trillion VND in interest), which cannot be recovered.

Also, commercial banks may compromise lending regulations to boost loan

portfolios and credit growth rates. This can involve lowering the minimum requirements

for factors like borrower creditworthiness, collateral coverage, debt service capacity,

and other risk metrics typically used to evaluate loan applications. Extending loans to

riskier borrowers may increase bad debt levels. 4

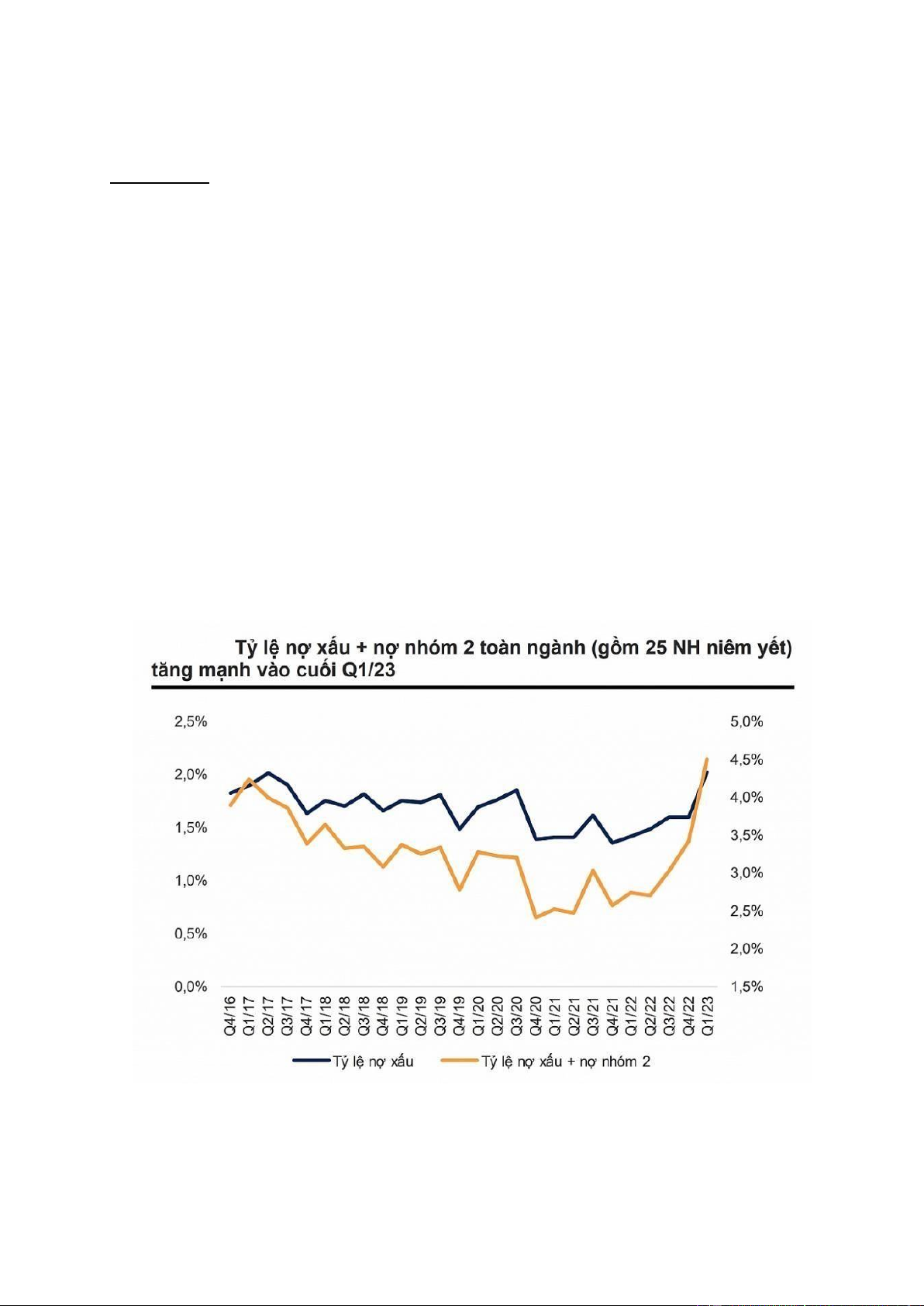

Image 2: - Source: VietstockFinance

It can be seen that all banks have very high positive credit growth. The strongest credit growth

is MB (MBB, +33%), followed by HDBank (HDB, +30%), VPBank (VPB, +29%) and Vietbank (VBB,

+27%). Along with that, we can see that 26/28 banks have a bad debt ratio above 1%.

Furthermore, credit rating models sometimes fail to predict defaults accurately.

In Vietnam, the credit rating system might not fully account for the informal economy,

which constitutes a significant part of the national economy. Many small and

mediumsized enterprises (SMEs) operate with informal financial practices, making it

challenging for credit models to assess their true creditworthiness. Consequently, these

models may overestimate the repayment capacity of certain borrowers, leading to unexpected defaults.

Lastly, interest rate fluctuations can also impact borrowers' ability to repay

loans. In Vietnam, fluctuations in interest rates have sometimes made it harder for

businesses and individuals to service their debts. For instance, when the State Bank of

Vietnam adjusts interest rates to control inflation or stabilize the currency, borrowers

with variable-rate loans may face increased repayment burdens, leading to higher default rates. 5 Question 2.1: -

IPO: A corporation can go public by issuing shares in an initial public offering

(IPO), following which its shares typically trade on an exchange. After being listed on an

exchange, shareholders can sell their shares and new investors can purchase shares

without having direct interaction with the company. -

SPAC: A special purpose acquisition company (SPAC) is a corporate entity

established to purchase a private company in the future. The Special Purpose Acquisition

Company (SPAC) generates funds through an Initial Public Offering (IPO) and places the

money in a trust, which it is obligated to use for acquiring a company within a specified

timeframe. There is no requirement to disclose the identity of the acquired firm during the

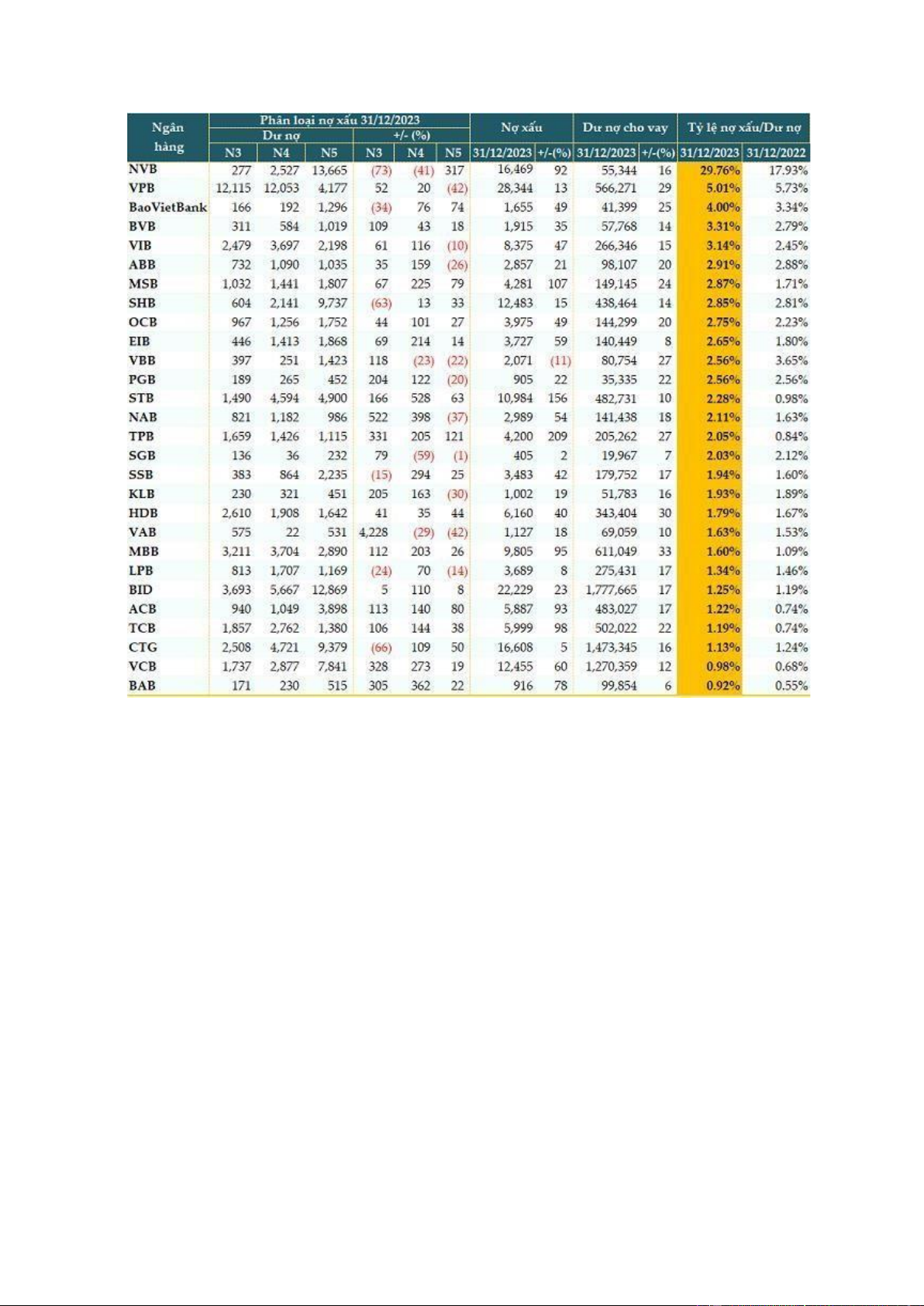

IPO. SPACs are also referred to as blank check companies for this reason. Diagram 1 – Self-draw

At the beginning, the sponsor, usually an experienced executive/investor or team,

launches a SPAC. A SPAC's investment strategy is usually a sector and geographyfocused

one, like North American education technology business acquisition.

Second, they form a holding company and IPO. The sponsor then conducts a

roadshow to attract institutional investors.

The sponsor invests nominal capital, often resulting in ~20% founder shares in the

SPAC. The remaining ~80% interest is held by public stockholders through SPAC share

“units” offered in an IPO.

After an IPO, profits are placed in a trust account and the SPAC has 18–24 months

to find and merge with a target firm, known as de-SPACing.

After a target business is chosen and a merger disclosed, SPAC public shareholders can

vote against the deal and redeem their shares. After shareholder approval and regulatory

clearance, the SPAC transaction will close, and the target company will go public.

However, if the SPAC fails to combine within that timeframe, it will liquidate and

return the IPO proceeds to public shareholders. 6

The role of SPAC in IPO process:

In short, a SPAC is a shell business formed by investors only for the aim of

obtaining funds via an IPO in order to eventually acquire another company.

To begin, an IPO through SPAC saves business time: This faster IPO process

appeals to many companies since it avoids the time-consuming. A private company can

complete the SPAC business combination procedure in as little as 2 months, whereas a

standard IPO can take up to 9-12 months.

Second, corporations can avoid the uncertainty and volatility that occurred

throughout the IPO approval stage. For example, during unpredictable and volatile times,

like the COVID-19 pandemic, the typical IPO process may expose private enterprises to

unfavorable market conditions, resulting in lower IPO pricing and less money raised.

SPACs, on the other hand, have already raised the requisite money and frequently have

access to more funds (via warrants and other stock), therefore the SPAC process may be

less affected by overall investor sentiment and market conditions.

Finally, SPAC acts as a lifeline for businesses that want to IPO on the US stock

exchange. Companies that are not attractive enough to investors or unicorns that want to

avoid strict rules on profits and capital regulations of stock exchanges. Question 2.2:

Despite offering a more efficient route to public markets, SPACs still carry a set of

risks that investors should be aware of:

Looseness of strict regulations during the post-IPO process of a stock: such as

lack of post-IPO price stabilization can cause the price of shares to go public through a

SPAC to increase steeply in the first 4-5 days and decreased miserably after that time.

For example: the most recent and typical case is the case of Vinfast stock. After going

public by SPAC, this stock increased its value 8 times and peaked at the price range of $93/1 share

after turned around and dropped to the price range of $2.66/share (-92%)

Rapid and significant price changes require particular caution due to SPACs' lack

of information. Until a merger is finalized, price activity cannot be related to

fundamentals like earnings streams because they are cash aggregators. This is one reason

some SPACs have underperformed, and it emphasizes the need of sponsor and industry due diligence.

Failure to find a merger target could force a SPAC to collapse. If SPACs fail to

merge within two years, they liquidate, and investors receive their pro-rata part of the

SPAC's worth. Along with the inability of new SPACs to enter flooded markets, this risk

is rising. According to Bloomberg, $4 billion in deals were canceled in January 2022. 7

Finally, the future regulatory environment may cause new challenges. Over the

past year, speculative trading has increased, thus the SEC has focused more on SPACs.

SEC Chairman Gary Gensler has advocated for rule and disclosure changes that may

require existing corporations to undertake structural changes and change future deal

procedures. Some of this has affected the SPAC market. The SEC hinted at treating

warrants as liabilities rather than equities in an April 2021 report. That alone forced over

100 SPACs to restate financial accounts and halted new issuance. Question 2.3:

YES, in terms of cash flow, an IPO is a way to make a company wealthy in cash

temporalily. But IPO is not a direct means of making a company "rich" in the conventional

sense of generating profits or revenue. The following are some arguments on this issue:

IPO fundraising allows a company to raise a substantial amount of cash by selling

shares to the public. This capital flow can be used for a variety of purposes, including

growing operations, investing in R&D, repaying debt, and funding other strategic initiatives.

Value and greater exposure: IPOs increase a company's public valuation and

market reputation. This higher pricing may help merger and acquisitions negotiation or

supplier and partner agreements. IPOs can also increase a company's visibility and product sales.

Access to capital markets: Once public, a company has easier access to capital

markets to raise funds in the future through secondary placement, debt issuance or other financial instruments.

In short, while an IPO does not directly make a company rich in terms of profits, it

does provide important capital and strategic advantages that can contribute to the

company's growth and long-term financial health of the company. Question 3.1:

- Stablecoins are cryptocurrencies attached to a stable asset, usually a fiat currency like

the US dollar, to reduce price volatility. Stablecoins aim to provide digital currency

benefits without the price volatility of Bitcoin and Ethereum.

Based on the definitions provided above, it can be seen that private stable coins will be

collateralized by an asset (usually USD). However, risks often occur when:

Over-collateralization risk: If stablecoin collateral lowers dramatically, it may

not cover the value of the outstanding stablecoins, causing a confidence crisis.

Trust and centralization: USDT and USDC stablecoins guarantee to back each

token with a genuine US dollar. These reserves are generally maintained centrally, raising

questions regarding transparency and verifiability. 8

Regulatory risks: Currently, the transparency of stable coins is still noteworthy,

so the strict legal environment in the future will somewhat threaten the 1:1 ratio.

Smart contract failures: Smart contracts determine algorithmic stablecoin

efficiency and security. Exploiting a smart contract issue could compromise the stability mechanism and the peg.

- CBDCs are issued and regulated by a nation's central bank. CBDCs are centralized and

operate on a permissioned blockchain, meaning the central bank controls access, unlike

cryptocurrencies like Bitcoin (BTC) and Ether (ETH).

Based on the recent analysis, we can see that central banks researching and using

CBDC will be a potential solution to risks associated with private stable coins for the following reasons:

Issuer and supervisory authority: the fact that CBDC is issued at the Central

Bank demonstrates transparency and is highly legally binding.

Stable mechanism, solid collateral: unlike private stable coins, which are backed

up by fiat assets or USD coins deposited in banks (centralized management). The safety

of CBDC can be said to be very high, because they are backed by the sovereign and issuing government.

Regulation and compliance: Unlike stable coins that are not clearly regulated and

bound by law, CBDCs are directly governed by Government monetary policies and are

subject to the same laws and restrictions. Question 3.2:

YES, stablecoins play a crucial role in the cryptocurrency ecosystem due to their

stability. Although they were born after other cryptocurrencies such as BTC, ETH, etc.,

the importance of stable coins is increasing as they provide stability in cryptocurrency transactions. 9

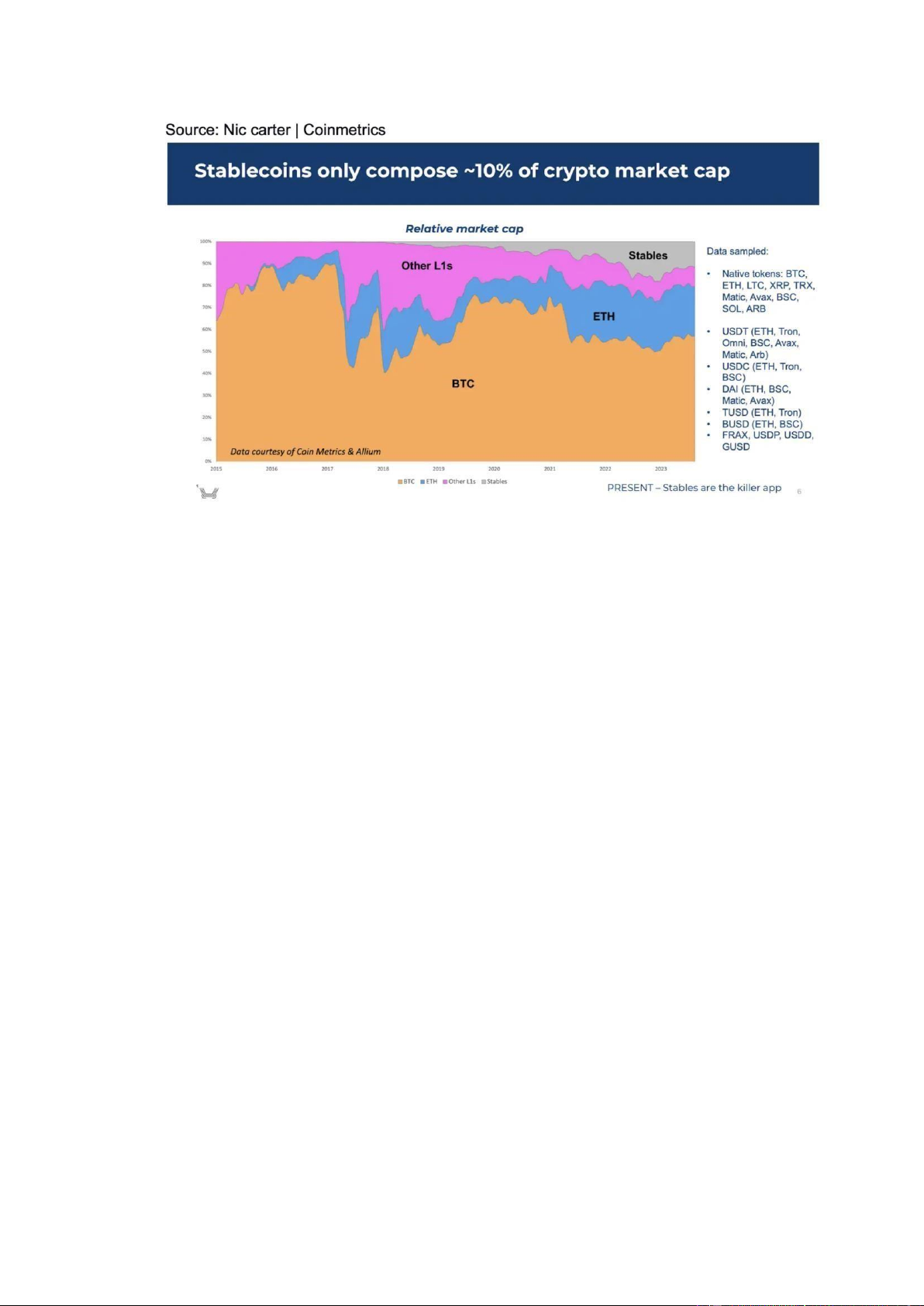

Image 3 – Source: Nic carter | Coinmetrics

There are five main viewpoints given to discuss the importance of stable coins in

cryptocurrency trading, these viewpoints are all based on the stability that this currency

brings to crypto traders in a volatile environment.

Firstly, its Stability and Reduced Volatility, cryptocurrencies like Bitcoin and

Ethereum are known for their price volatility. Stablecoins, anchored to stable assets like

the US dollar, provide a stable medium of exchange, which helps in mitigating the risk

associated with price fluctuations.

Efficient Trading is another reason, on cryptocurrency exchanges, stablecoins

serve as a stable trading partner against other volatile cryptocurrencies. This facilitates

smoother and more predictable trading experiences.

Cross-Border Transactions: stablecoins enable quicker and affordable

crossborder transactions compared to traditional banking systems. This is particularly

beneficial for remittances and international trade.

Finally, stablecoins function as an intermediary between fiat currencies and

cryptocurrencies for many consumers. Users can convert their fiat money to stablecoins,

which can then be used to trade other cryptocurrencies, and vice versa.

Through the 5 reasons mentioned above, I once again reaffirm the importance of

stable coins in crypto transactions. Although cryptocurrencies can still be traded without

the presence of a stable coin, the advantages it brings include: stability, efficiency, and

usability which are extremely important in crypto trading. III. REFERENCES Ways to improve stream water quality | NIWA. (n.d.).

https://niwa.co.nz/freshwater/waysimprove-stream-water-quality 10

Anh, T. (2024, May 14). Nợ xấu ngân hàng ồng loạt tăng. Báo Kinh Tế Đô Thị - Đọc Tin Tức

Thời Sự Kinh Tế 24h Mới Nhất. https://kinhtedothi.vn/no-xau-ngan-hang-dong-loattang.html

V. (2023, December 27). Bad debt remains big concern for banking system in 2024. Vietnam+ (VietnamPlus).

https://en.vietnamplus.vn/bad-debt-remains-big-concern-for-banking- systemin2024-post275457.vnp

V. (2024, February 26). | Vietstock. Vietstock. https://vietstock.vn/2024/02/ty-le-no-xau-ngan-

hang-lap-dinh-moi-lam-the-nao-xuly757-1157500.htm

How SPAC mergers work. (n.d.). https://www.holoniq.com/notes/how-spac-mergers-work SPACs: Risks to keep in mind | Vanguard. (n.d.).

https://investor.vanguard.com/investorresources-education/article/spacs-risks-to-keep-in-mind

Treasurer, G. (2024, May 7). Are Cryptoinvestments, Cryptocurrencies and Stablecoin About to

Change the Way we do Payments? - The Global Treasurer. The Global Treasurer.

https://www.theglobaltreasurer.com/2024/05/07/are-cryptoinvestments-

cryptocurrenciesandstablecoin-about-to-change-the-way-we-do-payments/ 11