Preview text:

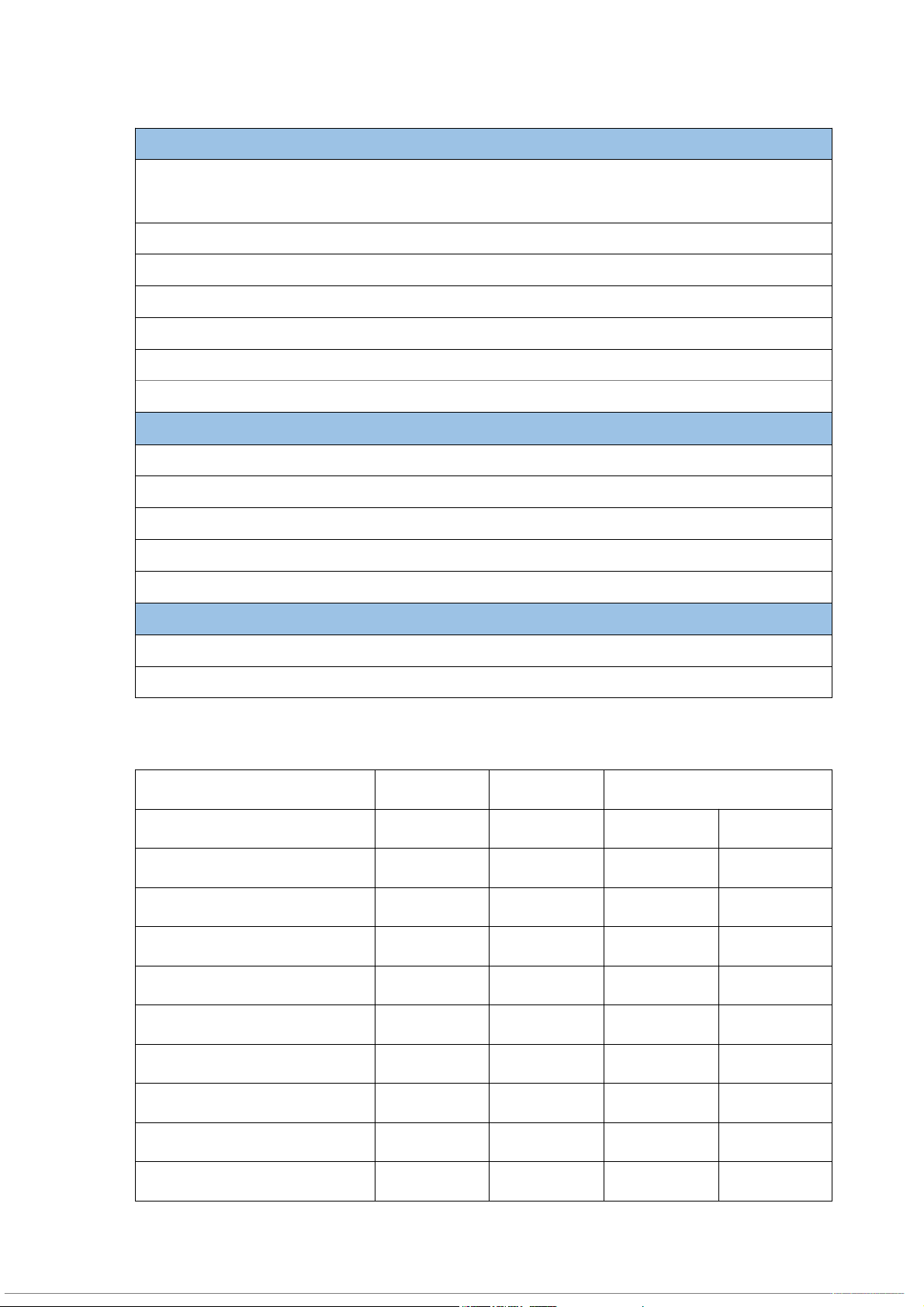

ANALYSIS FINANCIAL STATEMENT Profitability ratio

ROCE = EBIT / Equity + LTD = EBIT / Revenue * Revenue / Capital employed

= Operating profit margin * Asset turnover

ROE = Profit after tax / Equity

Asset turnover = Revenue / Capital employed

Gross profit margin = Gross profit / Revenue

Operating profit margin = Operating profit / Revenue

% Operating cost / Revenue = Operating expense / Revenue

Net profit margin = Net profit / Revenue Liquidity

Current ratio = Current asset / Current liability

Quick ratio = (Current asset – Inventory) / Current liability

Inventory day = Inventory / Cost of sale * 365

Receivable day = Receivable / Revenue * 365

Payable day = Payable / Cost of sale * 365 Financial risk

Gearing ratio = LTD / (LTD + Equity)

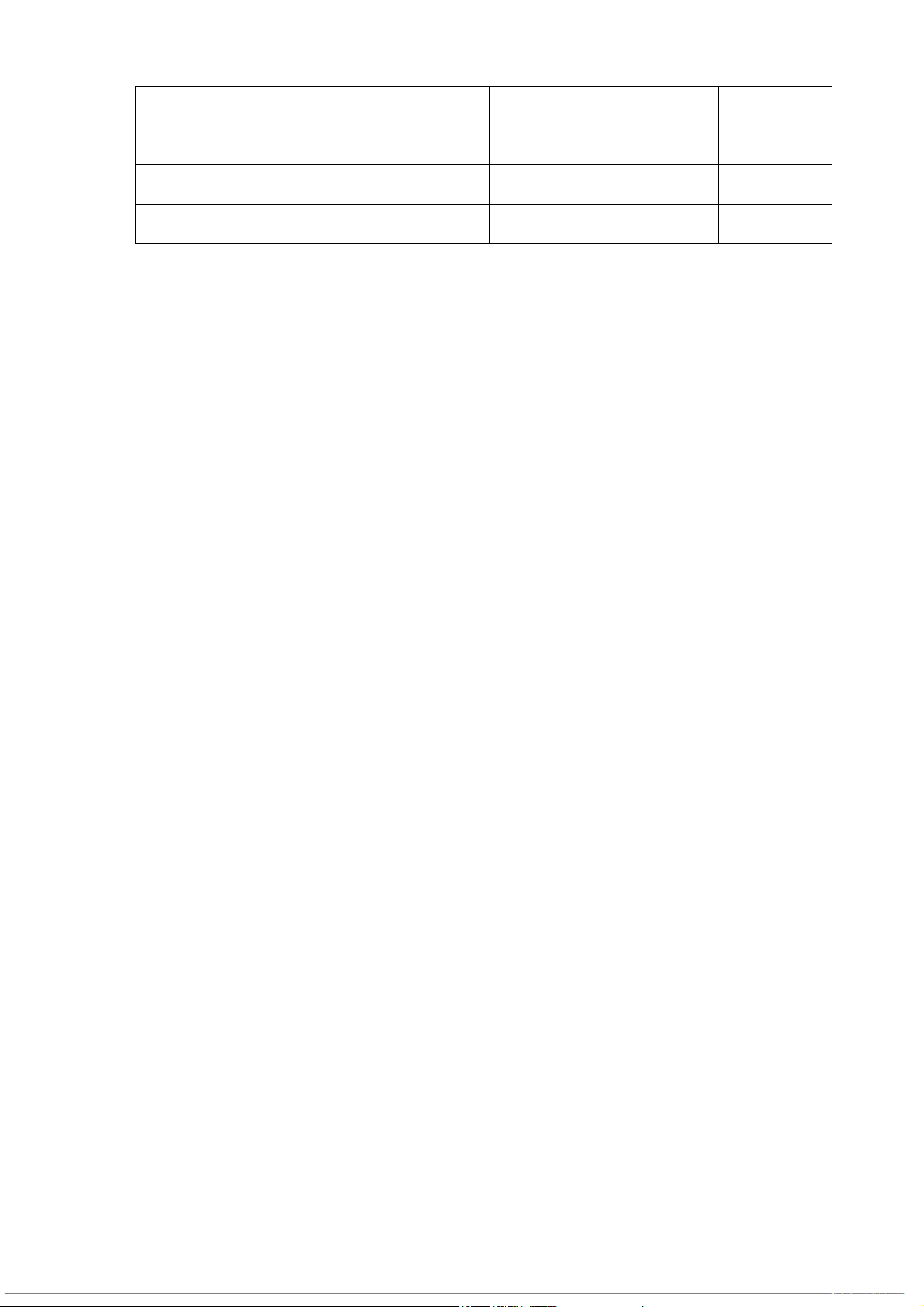

Interest cover = EBIT / Interest expense Question 1: 20X1 20X0 Difference ROCE 31.89% 38.92% -7.03% 18.06% ROE 31.58% 34.48% -2.9% 8.41% Asset turnover 1.38 times 1.86 times -0.48 times 25.81% Gross profit margin 41.96% 40% 1.96% 4.9% Operating profit margin 23.14% 20.87% 2.27% 10.88% % Operating cost / Revenue 18.82% 19.13% -0.31% 1.62% Net profit margin 11.76% 14.49% -2.73% 18.84% Current ratio 1.54 times 2.15 times -0.61 times 28.37% Quick ratio 0.85 times 1.61 times -0.76 times 47.2% Inventory day 89 days 63 days Receivable day 34 days 30 days Payable day 54 days 42 days Gearing ratio 48.65% 21.62% 27.03% 125.02% Interest cover 9.08 times 36 times -26.92 times 74.78% Change in ROCE

ROCE of the entity reduced significantly by 18.06% change => Reduction in investment efficiency.

This is due to change in operating profit margins and asset turnover

+ Operating profit margin increase, hence reasons of reducing in ROCE is reduce in asset turnover. Change in asset turnover

Asset turnover of the entity reduced significantly by 25.81% change.

This is due to change in asset turnover is more than change in revenue

+ Revenue increased by (25500-17250)/17250 = 47.83%

+ Asset turnover reduced by (18500-9250)/9250 = 100%

Reason asset increase rate is more than revenue increase rate

+ Investment in asset need tiem to realize and impact on revenue on revenue (related lead time of investment).

+ The enity in period of expanding and investing in asset (proved by increase in

NCA from 5.4m to 15.7m, 3 times in 1 year).

+ This expansion positively impact on financial performance of the entity (revenue

increased significantly approximately 50% change).

Change in operating profit margin

Operating profit margin increased by 10.88% change. Reason

+ Gross profit margin increased by 1.96%.

+ Operating expenses/Revenue is unchanged.

Reason for change in operating profit margin is changing in gross profit margin

+ Gross profit margin of the entity increased

+ Gross profit average => current product and new product

Entity invest in new product, this types of product has gross profit

significantly higher than current product. This leads gross profit margin increased.

This proved by change in strcuture of the asset:

Entity decided to sell current PPE, some PPE move to NCA held for sale ($2m).

PPE and intangible assets increased significantly

New product is different from current product

New investment in intangible asset which not existed with current product

+ Operating expenses/Revenue unchanged => operating expense is under control of the entity. Risk associated with profit Liquidity risk

Current ratio reduced from 2.15 to 1.54, entity liquidity issue.

Reason for change in current ratio

+ Receivable day increased from 30 days to 34 days, this means that the entity

expand credit policy to its customers.

+ Inventory day increased from 63 days to 89 days, this means that it is more

difficult for the enity to sell new product

+ Payable day increased form 42 days to 54 days, this means that the entity received

better policy from suppliers (because of increasing in volume of purchase)

+ Cash balance from $4m to overdraft $200,000 => positive to negative position =>

invest in new product => need cash to payment for purchase of asset Financial risk

Gearing ratio increased 21.62% to 48.65%, significantly more than 100%

+ Financial risk increase => Borrowing rate increase

Borrowing rate (10.5%) = Risk free rate (5.5%) + Credit risk premium (5%)

Borrowing rate increased from 6% to 10% => creditor assess financial risk of the entity increased significantly

Interest cover reduced significantly from 36 times to 9 times => financial risk increased IN CONCLUSION

Expand to new product, this increase risk of the entity.

If success, the financial performance of the entity signicant better.

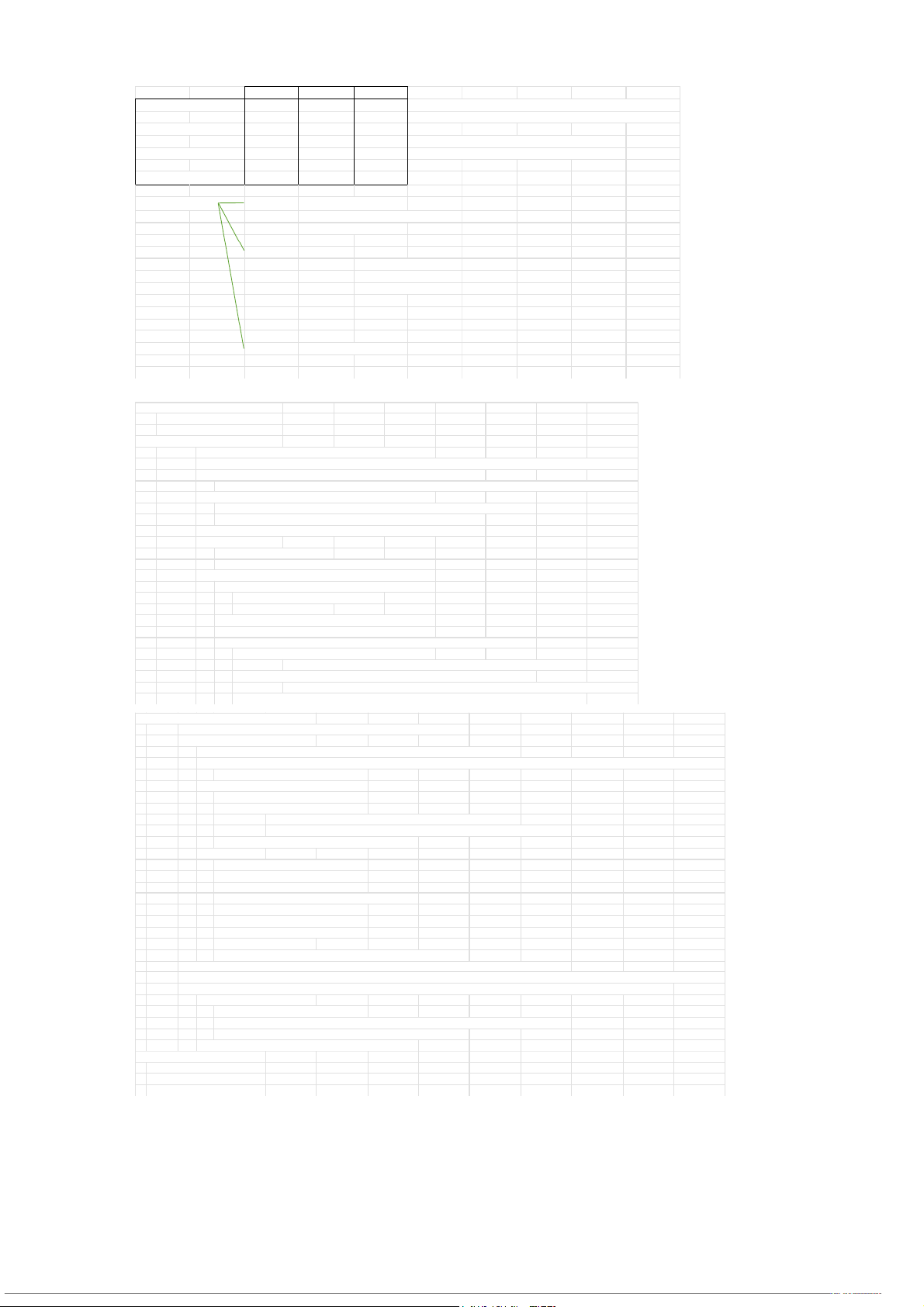

Entity need focus on risk management to ensure liquidity position. Question 4: 20x7 20x6 differ operating profit margin 8% 12%

32% operating profit margin = (finance cost + profit before tax)/revenue ROCE (PBIT) 4% 10%

60% ROCE (PBIT) = Operating profit margin x Asset turnover net asset turnover 0 ,48 0 ,81 0 ,41 current ratio 0 ,53 1 ,22 0 ,56

current ratio = current asset/ current liability receivable day 1 4,46 1 4,46 0 ,00

Receivable day = receivable/revenue x 365 gearing ratio 41% 77% 47% interest cover 1 ,34 1 ,82 0 ,27 total operating cost variable cost - fuel cost 30%

- landing fee 10% & airport charge - maintainace 10% fixed cost - staffs 30% + pilot + flight attendance + maintainance crew + administrator - air craft 15% + buy + lease - administrati + office rent sale - passenger 80% - cergo 20% - ticket + tax & fee an ROCE reduce significant - 60% operating profit margin reduce asset turnover reduce

operating profit margin reduce because

reason 1: - licence fee of major airport increase => operating cost increase

- this cost take account 10% total cost of airline, hence increasing in this cost lead to significant increase in operating costs

- license of 5 airport increased from 5/20x7 => impact for 8 months

+ this year, this cost will impact on financial performance over 12 months => increase operating cost next year

- 10 another major airport are due to expire in 12/20x7

+ there is high possibility that license fees for these airports increase next year

(the airline has accepted increased license fees for another airports)

- in conclusion, license fees of airport will increase significantly next year reason 2: - revenue of airline + number of flights x

+ number of passengers per flights x ticket price

- revenue reduce + note 1: no differ change in number of flight

+ number of passengers per flights x ticket price => reduce

- number passengers per flight reduce - ticket price reduce

+ indicate: more copetition in current flight routes of airline

+ reduce value of core assets in the industry (aircrafts)

+ however, value of asset PPE (aircraft) increased from $174m to $317m => more 200%

- reason for increasing in PPE: buy => buy increase loan

=> however loan of the entity reduce => no additional purchse of aircraft

- reason for increasing in PPE: revaluation => revaluation surplus: 145m

=> double value of asset => not reasonable => financial statements might be material misstated

- the airline overstated its non - current asset => improve financial position of the entity

current ratio of the entity reduce significantly

reason: - cash & cash equivalent reduce significantly => by 22.1 to 9m => $13m

- how the entity use this cash:

+ purchase intangible asset => from 16m to 20m => 4m (without amortization)

=> license fee for 5 airport => next year need renew for another 10 major airport => entity need at least $8m for renewal license next year

- put pressure on cash flow of the entity

+ repayment of loan note: $20m

- opening 10% loan note: 150 + 19

- closing 10% loan note: 131 + 19

+ why loan note classified as current and non - current liability

+ the loan note pay equal installments over loan period => annual payment

- next year cumulated cash outflow 8 + 20 = 28 + paid dividend:

opening RE + profit - dividend = closing RE 41.8 + 18.48 - divident = 44.1

dividend = 41.8 + 18.48 - 44.1 = 16.18

- profit for the year: 18m/dividend paid 16m

- % dividend/profit = 16/18 = 90%

- enhance creditability with shareholder - % dividend paid 16/3 = 533% - need next year dividend

- next year cumulated cash outflow 8 + 20 = 28 28m + 16m = 44m

- current year cash outflow: 4m (intangible asset) + 20 (loan note) + 16 (dividend) = 24 + 16 = 40m

- cash inflow: reduce cash balance: 22 - 9 = 13 + profit (in cash) 18 = 18 + 13 = 31 + increase short term liability (trade and other payable) 6 = 37m

- next year => cash balnce 9m + expectect profit 18m = 27m => shortage cash: 13m => additional new loan to repayment current loan + conditions for new loan:

- profit business => YES: airline

- "security for loan" asset => YES => aircraft => more value asset = more loan => revaluaton of asset

- acceptable financial risk => gearing ratio = reduce significantly

+ increase the chance the entity obtain new loan

how to analysis financial statement understand business (industry) objectives of managerment trend in the market